|

|

市場調査レポート

商品コード

1463559

北米の体外診断:2030年までの市場予測 - 地域分析 - 製品・サービス、技術、用途、エンドユーザー別North America In-Vitro Diagnostics Market Forecast to 2030 - Regional Analysis - by Product & Services, Technology, Application, and End User |

||||||

|

|||||||

| 北米の体外診断:2030年までの市場予測 - 地域分析 - 製品・サービス、技術、用途、エンドユーザー別 |

|

出版日: 2024年01月24日

発行: The Insight Partners

ページ情報: 英文 112 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の体外診断市場は、2022年の212億707万米ドルから2030年には331億8,341万米ドルに成長すると予測されています。2022年から2030年までのCAGRは5.8%と推定されます。

POC検査の成長とCOVID-19パンデミック時の体外診断需要の急増が北米体外診断市場を後押し

ポイントオブケア検査(POCT)は体外診断市場において極めて重要な機会であり、その実用的で迅速な診断能力によりヘルスケア提供に革命をもたらしています。これらの検査は、患者のいる場所またはその近くで実施され、即時に結果が得られるため、タイムリーな臨床判断が可能となります。POCTの成長を促す要因はいくつかあります。

第一に、救急外来、診療所、在宅医療などのヘルスケア現場において、便利で迅速な診断ソリューションが求められていることが、POCTの拡大を後押ししています。第二に、技術の進歩によりコンパクトで使いやすいPOCTデバイスが開発されています。

さらに、COVID-19の大流行は、迅速で利用しやすい診断の重要性を強調しました。このパンデミックは、POCTの世界的規模での感染症管理における関連性と可能性を示すものでした。この経験はPOCTの研究開発を加速させ、ポータブル検査ソリューションへの技術革新と投資をさらに促進しました。

感染症の診断に使用される体外診断用医薬品には、免疫測定法や分子測定法があります。診断薬企業もまた、COVID-19を管理するために提供する製品の迅速な進歩に注力しています。さらに、規制当局は、パンデミックの間、新しい体外診断用医薬品の発売に有利な基準の一時的な改正や修正を導入しました。このような政府の取り組みにより、分子診断薬やイムノアッセイの需要が急増しました。このように、COVID-19パンデミックは、ポイントオブケア(POC)診断薬や検査室での検査に対する需要の高まりにより、体外診断市場に恩恵をもたらしました。

北米の体外診断市場概要

北米には米国、カナダ、メキシコが含まれます。地域別では体外診断市場で最大のシェアを占めています。同地域の3カ国はいずれも、体外診断に対する大きな需要を目の当たりにしています。慢性疾患や感染症の増加、効率的な疾患診断の重視、高度なヘルスケアシステムに対するニーズの高まりなどの要因が、同地域における体外診断の採用を後押ししています。北米の体外診断市場では米国が最大のシェアを占めています。米国ではがんや心血管疾患などの慢性疾患が障害や死亡の主な原因となっています。National Center for Chronic Disease Prevention and Health Promotionによると、米国では10人に6人が少なくとも1つの慢性疾患を抱えています。米国疾病予防管理センター(CDC)によると、2021年、米国では20歳以上の成人1,820万人が冠動脈疾患(CAD)を患っています。心臓病は同国の人々の死亡原因の第1位です。さらに、米国病院協会の推計によると、1億3,300万人が少なくとも1つの慢性疾患を抱えており、その数は2030年までに1億7,000万人に達すると予想されています。慢性疾患の罹患率の高さは、診断処置に対する膨大な需要をもたらし、ひいては米国の体外診断市場を牽引しています。予防医療が重視されるようになり、ヘルスケア施設へのアクセスが向上していることも、今後数年間の市場成長をさらに後押しすると思われます。

患者数の増加に伴い体外診断ツールのニーズが急激に高まる中、市場開拓企業は迅速な検査を可能にする高度な診断システムの開発に注力しています。例えば、2019年2月、診断サービスにおける米国のプレーヤーであるGrailは、迅速ながん検出のための新技術を開発する目的で、マイクロソフトとアマゾンから15億米ドルの資金援助を受けた。さらに、発達したヘルスケアインフラと支出増による広範な技術進歩が、国内の体外診断市場の成長に有利な機会を生み出しています。例えば、2019年7月、体外診断市場の著名なプレーヤーの1つであるSysmex America, Inc.は、カリフォルニア州アナハイムで開催された第71回AACC Annual Scientific Meeting &Clinical Lab Expoにおいて、PS-10と名付けられた新しい統合体外診断を展示しました。同装置は複雑な検体検査、ルーチンサイトメトリー、血液学的評価を行うように設計されています。同様に2020年5月、バイオ・ラッド・ラボラトリーズ社は米国食品医薬品局(FDA)からSARS-CoV-2 Droplet Digital PCR(ddPCR)検査キットの緊急使用許可(EUA)を取得しました。SARS-CoV-2 ddPCR検査はBio-RadのQX200とQXDx ddPCRシステムで実行されます。

北米の体外診断市場の収益と2030年までの予測(金額)

北米の体外診断市場セグメンテーション

北米の体外診断市場は、製品・サービス、技術、用途、エンドユーザー、国に区分されます。

製品&サービス別に見ると、北米の体外診断市場は試薬&キット、機器、ソフトウェア&サービスに区分されます。2022年の北米の体外診断市場では、試薬&キット部門が最大のシェアを占めています。

技術別では、北米の体外診断市場は免疫測定/免疫化学、臨床化学、分子診断、微生物学、血糖自己測定、凝固・止血、血液学、尿検査、その他に区分されます。2022年の北米体外診断市場では、免疫測定/免疫化学分野が最大のシェアを占めました。

用途別では、北米の体外診断市場は感染症、糖尿病、腫瘍、循環器、自己免疫疾患、腎臓、その他に区分されます。2022年の北米体外診断市場では、感染症分野が最大のシェアを占めています。

エンドユーザー別に見ると、北米の体外診断市場は病院、検査室、在宅医療、その他に区分されます。2022年の北米体外診断市場では、病院セグメントが最大シェアを占めています。

国別では、北米の体外診断市場は米国、カナダ、メキシコに区分されます。2022年の北米体外診断市場は米国が支配的でした。

Abbott Laboratories、Becton Dickinson and Co、bioMerieux SA、Bio-Rad Laboratories Inc、Danaher Corp、F. Hoffmann-La Roche Ltd、Qiagen NV、Siemens AG、Sysmex Corp、Thermo Fisher Scientific Incは、北米の体外診断市場で事業を展開している大手企業です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要な洞察

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米の体外診断市場- 主要産業力学

- 主な市場促進要因

- 慢性疾患および感染症の有病率の増加

- ポイントオブケア検査の成長とCOVID-19パンデミック時の体外診断需要の急増

- 市場抑制要因

- 規制体制と償還政策の不備

- 市場機会

- IVDとデジタルヘルス技術の統合

- 今後の動向

- 個別化医療とゲノミクスへの需要の高まり

第5章 体外診断市場-北米市場分析

- 北米の体外診断市場収益、2022年~2030年

第6章 北米の体外診断市場:収益と2030年までの予測:製品・サービス別

- 市場収益シェア、2022年および2030年

- 試薬・キット

- ソフトウェアとサービス

- 検査機器

第7章 北米の体外診断市場:収益と2030年までの予測:技術別

- 市場収益シェア、2022年および2030年

- 免疫測定/免疫化学

- 臨床化学

- 分子診断学

- 微生物学

- 血糖自己測定

- 凝固および止血

- 血液学

- 尿検査

- その他

第8章 北米の体外診断市場:収益と2030年までの予測:用途別

- 市場収益シェア、2022年および2030年

- 感染症

- 糖尿病

- 腫瘍学

- 循環器

- 自己免疫疾患

- 腎臓内科

- その他

第9章 北米の体外診断市場:収益と2030年までの予測:エンドユーザー別

- 市場収益シェア、2022年および2030年

- 病院

- 研究所

- 在宅医療

- その他

第10章 北米の体外診断市場:2030年までの収益と予測:国別分析

- 米国

- カナダ

- メキシコ

第11章 業界情勢

- 有機的開発

- 無機的展開

第12章 企業プロファイル

- Abbott Laboratories

- F. Hoffmann-La Roche Ltd

- Danaher Corp

- Siemens AG

- Sysmex Corp

- Thermo Fisher Scientific Inc

- Becton Dickinson and Co

- bioMerieux SA

- Bio-Rad Laboratories Inc

- Qiagen NV

第13章 付録

List Of Tables

- Table 1. North America In-Vitro Diagnostics Market Segmentation

- Table 2. US North America In-Vitro Diagnostics Market, by Product and Services - Revenue and Forecast to 2030 (US$ Million)

- Table 3. US North America In-Vitro Diagnostics Market, by Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 4. US North America In-Vitro Diagnostics Market, by Application - Revenue and Forecast to 2030 (US$ Million)

- Table 5. US North America In-Vitro Diagnostics Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 6. Canada North America In-Vitro Diagnostics Market, by Product and Services - Revenue and Forecast to 2030 (US$ Million)

- Table 7. Canada North America In-Vitro Diagnostics Market, by Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 8. Canada North America In-Vitro Diagnostics Market, by Application - Revenue and Forecast to 2030 (US$ Million)

- Table 9. Canada North America In-Vitro Diagnostics Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 10. Mexico North America In-Vitro Diagnostics Market, by Product and Services - Revenue and Forecast to 2030 (US$ Million)

- Table 11. Mexico North America In-Vitro Diagnostics Market, by Technology - Revenue and Forecast to 2030 (US$ Million)

- Table 12. Mexico North America In-Vitro Diagnostics Market, by Application - Revenue and Forecast to 2030 (US$ Million)

- Table 13. Mexico North America In-Vitro Diagnostics Market, by End User - Revenue and Forecast to 2030 (US$ Million)

- Table 14. Organic Developments Done by Companies

- Table 15. Inorganic Developments Done by Companies

- Table 16. Glossary of Terms, North America In-Vitro Diagnostics Market

List Of Figures

- Figure 1. North America In-Vitro Diagnostics Market Segmentation, By Country

- Figure 2. North America In-Vitro Diagnostics Market: Key Industry Dynamics

- Figure 3. North America In-Vitro Diagnostics Market: Impact Analysis of Drivers and Restraints

- Figure 4. North America In-Vitro Diagnostics Market Revenue (US$ Mn), 2020 - 2030

- Figure 5. North America In-Vitro Diagnostics Market Revenue Share, by Product and Services 2022 & 2030 (%)

- Figure 6. Reagents and Kits: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 7. Software and Services: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Instruments: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 9. North America In-Vitro Diagnostics Market Revenue Share, by Technology 2022 & 2030 (%)

- Figure 10. Immunoassay/ Immunochemistry: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Clinical Chemistry: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Molecular Diagnostics: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

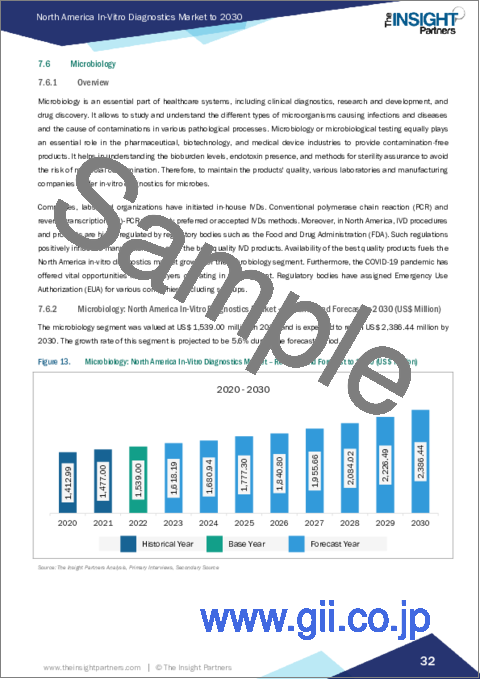

- Figure 13. Microbiology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Blood Glucose Self-Monitoring: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Coagulation and Hemostasis: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Hematology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Urinalysis: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 18. Others: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 19. North America In-Vitro Diagnostics Market Revenue Share, by Application 2022 & 2030 (%)

- Figure 20. Infectious Diseases: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 21. Diabetes: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 22. Oncology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 23. Cardiology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 24. Autoimmune Diseases: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 25. Nephrology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 26. Others: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 27. North America In-Vitro Diagnostics Market Revenue Share, by End User 2022 & 2030 (%)

- Figure 28. Hospitals: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 29. Laboratories: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 30. Homecare: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 31. Others: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 32. North America: North America In-Vitro Diagnostics Market, by Key Country - Revenue (2022) (US$ Million)

- Figure 33. North America In-Vitro Diagnostics Market, by Country, 2022 & 2030 (%)

- Figure 34. US: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 35. Canada: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- Figure 36. Mexico: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

The North America in-vitro diagnostics market is expected to grow from US$ 21,207.07 million in 2022 to US$ 33,183.41 million by 2030. It is estimated to grow at a CAGR of 5.8% from 2022 to 2030.

Growth in Point-of-Care Testing and Surge in Demand for IVD during COVID-19 Pandemic Fuels North America In-Vitro Diagnostics Market

Point-of-care testing (POCT) is a pivotal opportunity in the in vitro diagnostics market, revolutionizing healthcare delivery with its potable and rapid diagnostic capabilities. These tests, conducted at or near the patient's location, offer immediate results, enabling timely clinical decision-making. Several factors drive the growth of POCT.

Firstly, the demand for convenient and swift diagnostic solutions in healthcare settings, such as emergency rooms, clinics, and home care, propels the expansion of POCT. Secondly, technological advancements have led to the development of compact and user-friendly POCT devices.

Moreover, the COVID-19 pandemic underscored the significance of rapid and accessible diagnostics. The pandemic accelerated the deployment and utilization of point-of-care COVID-19 tests, showcasing the relevance and potential of POCT in managing infectious diseases on a global scale. This experience accelerated research and development on POCT, further driving innovation and investment in portable testing solutions.

IVDs that are used in the diagnosis of infectious diseases include immunoassays, and molecular assays. Diagnostics companies also focus on making rapid advancements in their offerings to manage COVID-19. Further, regulatory authorities introduced temporary amendments or modifications to their standards, which favored the launches of new IVDs during the pandemic. The demand for molecular diagnostics and immunoassays surged due to these government initiatives. Thus, the COVID-19 pandemic has benefitted the in-vitro diagnostics market due to the rising demand for point-of-care (POC) diagnostics and laboratory testing procedures.

North America In-Vitro Diagnostics Market Overview

North America region includes the US, Canada, and Mexico. It holds the largest share of the in-vitro diagnostics market by geography. All three countries in the region are witnessing considerable demand for in-vitro diagnostics. Certain factors, such as the increasing prevalence of chronic & infectious diseases, focus on efficient disease diagnosis, and a higher need for advanced healthcare systems are boosting the adoption of in-vitro diagnostics in the region. The US held the largest share of the North America in-vitro diagnostics market. Chronic diseases such as cancer and cardiovascular diseases are the major causes of disability and death in the US. Per the National Center for Chronic Disease Prevention and Health Promotion, 6 in 10 people in the country have at least one chronic disease. According to the Centers for Disease Control and Prevention (CDC), in 2021, ~18.2 million adults aged 20 and above had coronary artery disease (CAD) in the US. Heart disease is the leading cause of death among people in the country. Additionally, the American Hospital Association estimates ~133 million people have at least one chronic disease, and that number is expected to reach 170 million by 2030. The high incidence of chronic diseases results in a huge demand for diagnostic procedures, which, in turn, drives the in-vitro diagnostics market in the US. Growing emphasis on preventive care coupled with enhanced access to healthcare facilities would further boost the market growth in the coming years.

With the exponentially rising need for in-vitro diagnostics tools with the growing patient pool, the market players focus on developing advanced diagnostic systems enabling rapid examinations. For instance, in February 2019, Grail, a US-based player in diagnostic services, received financial aid of US$ 1.5 billion from Microsoft and Amazon with an aim to develop new technologies for rapid cancer detection. Additionally, extensive technological advancements due to developed healthcare infrastructure and rising expenditure are generating lucrative opportunities for the growth of the in-vitro diagnostics market in the country. For instance, in July 2019, Sysmex America, Inc., one of the prominent players in the in-vitro diagnostics market, showcased its new integrated in-vitro diagnostic machine named PS-10 at the 71st AACC Annual Scientific Meeting & Clinical Lab Expo organized in Anaheim, California. The machine is designed to perform complex laboratory tests, routine cytometry, and hematology assessments. Similarly, in May 2020, Bio-Rad Laboratories Inc. received Emergency Use Authorization (EUA) for its SARS-CoV-2 Droplet Digital PCR (ddPCR) test kit from the US Food and Drug Administration (FDA). The SARS-CoV-2 ddPCR test runs on Bio-Rad's QX200 and QXDx ddPCR systems.

North America In-Vitro Diagnostics Market Revenue and Forecast to 2030 (US$ Million)

North America In-Vitro Diagnostics Market Segmentation

The North America in-vitro diagnostics market is segmented into product & services, technology, application, end user, and country.

Based on product & services, the North America in-vitro diagnostics market is segmented into reagents & kits, instruments, and software & services. The reagents & kits segment held the largest share of the North America in-vitro diagnostics market in 2022.

Based on technology, the North America in-vitro diagnostics market is segmented into immunoassay/ immunochemistry, clinical chemistry, molecular diagnostics, microbiology, blood glucose self-monitoring, coagulation & hemostasis, hematology, urinalysis, and others. The immunoassay/ immunochemistry segment held the largest share of the North America in-vitro diagnostics market in 2022.

Based on application, the North America in-vitro diagnostics market is segmented into infectious diseases, diabetes, oncology, cardiology, autoimmune diseases, nephrology, and others. The infectious diseases segment held the largest share of the North America in-vitro diagnostics market in 2022.

Based on end user, the North America in-vitro diagnostics market is segmented into hospitals, laboratories, homecare, and others. The hospitals segment held the largest share of the North America in-vitro diagnostics market in 2022.

Based on country, the North America in-vitro diagnostics market is segmented int o the US, Canada, and Mexico. The US dominated the North America in-vitro diagnostics market in 2022.

Abbott Laboratories, Becton Dickinson and Co, bioMerieux SA, Bio-Rad Laboratories Inc, Danaher Corp, F. Hoffmann-La Roche Ltd, Qiagen NV, Siemens AG, Sysmex Corp, and Thermo Fisher Scientific Inc are some of the leading companies operating in the North America in-vitro diagnostics market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America In-Vitro Diagnostics Market - Key Industry Dynamics

- 4.1 Key Market Drivers

- 4.1.1 Increasing Prevalence of Chronic and Infectious Diseases

- 4.1.2 Growth in Point-of-Care Testing and Surge in Demand for IVD during COVID-19 Pandemic

- 4.2 Market Restraint

- 4.2.1 Insufficiency of Regulatory Frameworks and Reimbursement Policies

- 4.3 Market Opportunities

- 4.3.1 Integration of IVD with Digital Health Technologies

- 4.4 Future Trends

- 4.4.1 Increasing Demand for Personalized Medicine and Genomics

5. In-Vitro Diagnostics Market - North America Market Analysis

- 5.1 North America In-Vitro Diagnostics Market Revenue (US$ Mn), 2022 - 2030

6. North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by Product and Services

- 6.1 Overview

- 6.2 North America In-Vitro Diagnostics Market Revenue Share, by Product and Services 2022 & 2030 (%)

- 6.3 Reagents and Kits

- 6.3.1 Overview

- 6.3.2 Reagents and Kits: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 6.4 Software and Services

- 6.4.1 Overview

- 6.4.2 Software and Services: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 6.5 Instruments

- 6.5.1 Overview

- 6.5.2 Instruments: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

7. North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by Technology

- 7.1 Overview

- 7.2 North America In-Vitro Diagnostics Market Revenue Share, by Technology 2022 & 2030 (%)

- 7.3 Immunoassay/ Immunochemistry

- 7.3.1 Overview

- 7.3.2 Immunoassay/ Immunochemistry: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.4 Clinical Chemistry

- 7.4.1 Overview

- 7.4.2 Clinical Chemistry: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.5 Molecular Diagnostics

- 7.5.1 Overview

- 7.5.2 Molecular Diagnostics: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.6 Microbiology

- 7.6.1 Overview

- 7.6.2 Microbiology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.7 Blood Glucose Self-Monitoring

- 7.7.1 Overview

- 7.7.2 Blood Glucose Self-Monitoring: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.8 Coagulation and Hemostasis

- 7.8.1 Overview

- 7.8.2 Coagulation and Hemostasis: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.9 Hematology

- 7.9.1 Overview

- 7.9.2 Hematology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.10 Urinalysis

- 7.10.1 Overview

- 7.10.2 Urinalysis: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 7.11 Others

- 7.11.1 Overview

- 7.11.2 Others: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

8. North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by Application

- 8.1 Overview

- 8.2 North America In-Vitro Diagnostics Market Revenue Share, by Application 2022 & 2030 (%)

- 8.3 Infectious Disease

- 8.3.1 Overview

- 8.3.2 Infectious Diseases: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 8.4 Diabetes

- 8.4.1 Overview

- 8.4.2 Diabetes: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 8.5 Oncology

- 8.5.1 Overview

- 8.5.2 Oncology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 8.6 Cardiology

- 8.6.1 Overview

- 8.6.2 Cardiology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 8.7 Autoimmune Diseases

- 8.7.1 Overview

- 8.7.2 Autoimmune Diseases: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 8.8 Nephrology

- 8.8.1 Overview

- 8.8.2 Nephrology: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 8.9 Others

- 8.9.1 Overview

- 8.9.2 Others: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

9. North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - by End User

- 9.1 Overview

- 9.2 North America In-Vitro Diagnostics Market Revenue Share, by End User 2022 & 2030 (%)

- 9.3 Hospitals

- 9.3.1 Overview

- 9.3.2 Hospitals: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 9.4 Laboratories

- 9.4.1 Overview

- 9.4.2 Laboratories: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 9.5 Homecare

- 9.5.1 Overview

- 9.5.2 Homecare: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 9.6 Others

- 9.6.1 Overview

- 9.6.2 Others: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

10. North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 - Country Analysis

- 10.1 North America In-Vitro Diagnostics Market

- 10.1.1 Overview

- 10.1.2 North America In-Vitro Diagnostics Market, by Country

- 10.1.2.1 US: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.1.1 Overview

- 10.1.2.1.2 US: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.1.3 US: North America In-Vitro Diagnostics Market, by Product and Services, 2020-2030 (US$ Million)

- 10.1.2.1.4 US: North America In-Vitro Diagnostics Market, by Technology, 2020-2030 (US$ Million)

- 10.1.2.1.5 US: North America In-Vitro Diagnostics Market, by Application, 2020-2030 (US$ Million)

- 10.1.2.1.6 US: North America In-Vitro Diagnostics Market, by End User, 2020-2030 (US$ Million)

- 10.1.2.2 Canada: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.2.1 Overview

- 10.1.2.2.2 Canada: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.2.3 Canada: North America In-Vitro Diagnostics Market, by Product and Services, 2020-2030 (US$ Million)

- 10.1.2.2.4 Canada: North America In-Vitro Diagnostics Market, by Technology, 2020-2030 (US$ Million)

- 10.1.2.2.5 Canada: North America In-Vitro Diagnostics Market, by Application, 2020-2030 (US$ Million)

- 10.1.2.2.6 Canada: North America In-Vitro Diagnostics Market, by End User, 2020-2030 (US$ Million)

- 10.1.2.3 Mexico: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.3.1 Overview

- 10.1.2.3.2 Mexico: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.3.3 Mexico: North America In-Vitro Diagnostics Market, by Product and Services, 2020-2030 (US$ Million)

- 10.1.2.3.4 Mexico: North America In-Vitro Diagnostics Market, by Technology, 2020-2030 (US$ Million)

- 10.1.2.3.5 Mexico: North America In-Vitro Diagnostics Market, by Application, 2020-2030 (US$ Million)

- 10.1.2.3.6 Mexico: North America In-Vitro Diagnostics Market, by End User, 2020-2030 (US$ Million)

- 10.1.2.1 US: North America In-Vitro Diagnostics Market - Revenue and Forecast to 2030 (US$ Million)

11. Industry Landscape

- 11.1 Organic Developments

- 11.1.1 Overview

- 11.2 Inorganic Developments

- 11.2.1 Overview

12. Company Profiles

- 12.1 Abbott Laboratories

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 F. Hoffmann-La Roche Ltd

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Danaher Corp

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Siemens AG

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Sysmex Corp

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Thermo Fisher Scientific Inc

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Becton Dickinson and Co

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 bioMerieux SA

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Bio-Rad Laboratories Inc

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Qiagen NV

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments

13. Appendix

- 13.1 About Us

- 13.2 Glossary of Terms