|

|

市場調査レポート

商品コード

1452549

北米のバイオプラスチックとバイオポリマー:2030年までの市場予測 - 地域別分析 - 製品タイプ別、最終用途産業別North America Bioplastics and Biopolymers Market Forecast to 2030 - Regional Analysis - by Product Type and End-Use Industry |

||||||

| 北米のバイオプラスチックとバイオポリマー:2030年までの市場予測 - 地域別分析 - 製品タイプ別、最終用途産業別 |

|

出版日: 2024年01月03日

発行: The Insight Partners

ページ情報: 英文 120 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米のバイオプラスチックとバイオポリマー市場は、2023年の15億1,309万米ドルから2030年には30億4,020万米ドルに成長すると予測されています。2023年から2030年までのCAGRは10.5%と推定されます。

従来型プラスチックに対する規制と政策の増加が北米のバイオプラスチックとバイオポリマー市場を動かす

政府の規制と政策がバイオプラスチックとバイオポリマー市場を形成しています。従来のプラスチックが環境に与える影響を認識し、世界中の多くの政府が持続可能な代替品の生産と使用を促進するために厳しい措置を実施しています。いくつかの国では、レジ袋、ストロー、カトラリーなどの使い捨てプラスチックの使用禁止や制限を導入しています。これらの政策は、プラスチック廃棄物を削減し、生分解性で環境フットプリントの少ないバイオプラスチックやバイオポリマーの採用を奨励することを目的としています。禁止措置に加え、各国政府はバイオプラスチック産業の成長を促進するため、税制優遇措置、補助金、助成金、研究資金などの様々なインセンティブを提供し、支援体制を整えています。こうした優遇措置は、バイオプラスチックのコスト削減に役立ち、従来のプラスチックとの競争力を高めています。このようなメリットは、市場に参入する企業が研究開発に投資し、生産規模を拡大し、革新的なバイオプラスチック製品を市場に投入することを後押ししています。

各国政府は、バイオプラスチックやバイオポリマーを含むバイオベース材料の使用を政府出資のプロジェクトに優先させることで、持続可能性の基準を公共調達政策に取り入れる傾向を強めており、その結果、これらの材料に対する大きな需要が生まれています。さらに、バイオプラスチックの品質と安全基準を確保するための規制枠組みも確立されつつあります。各国政府は業界団体や規制機関と協力し、生分解性、堆肥化性、環境性能に関する認証制度や基準を設けています。これらの基準は、消費者、企業、産業界が使用するプラスチックが一定の基準を満たしていることを保証し、市場の成長を促進します。

北米のバイオプラスチックとバイオポリマー市場概要

米国、カナダ、メキシコは北米の主要経済国です。北米では、バイオプラスチックとバイオポリマーはペットボトルや袋などの包装分野で広く消費されています。バイオプラスチックとバイオポリマーの生産と消費は、主に食品包装用途で、この地域で成長すると予想されています。従来のプラスチックとは異なり、バイオプラスチックやバイオポリマーは再生可能な資源から得られます。第一世代のバイオプラスチックは、トウモロコシ、小麦、サトウキビ、大豆などのデンプンや糖類から得られます。第二世代のバイオプラスチックは、サトウキビのバガスやおがくず、乳清などの産業残渣など、農作物や工業プロセスから得られるセルロースを原料としています。

バイオプラスチックとバイオポリマーの他の最終用途産業には、消費者製品、自動車、農業、繊維、建築・建設、医薬品などがあります。これらの最終用途産業の成長が、北米のバイオプラスチックとバイオポリマー市場をさらに牽引しています。北米の建設業界は、好調な経済と公共事業や施設建築物に対する連邦政府や州政府の助成金の増加により、驚異的に拡大しています。さらに、この地域では、エクステンデッド・キャブのような大排気量車の需要と生産が増加しており、市場の成長を後押ししています。この地域の自動車市場は、天候の変化やオフロードでの走行性能に優れていることから、小型トラックやSUVに傾斜しています。北米では小型商用車(LCV)の生産も増加しています。この地域の自動車産業は、インフラストラクチャー、研究開発活動、新しい生産設備への多額の投資により、世界的に最も進んだ産業のひとつとなっています。バイオポリアミド(バイオPA)、ポリ乳酸(PLA)、バイオベースポリプロピレン(バイオPP)は、自動車製造に使用されるバイオプラスチックです。これらの要因がバイオプラスチックとバイオポリマー市場の成長を牽引しています。

北米のバイオプラスチックとバイオポリマー市場の収益と2030年までの予測

北米のバイオプラスチックとバイオポリマー市場セグメンテーション

北米のバイオプラスチックとバイオポリマー市場は、製品タイプ、最終用途産業、国に区分されます。

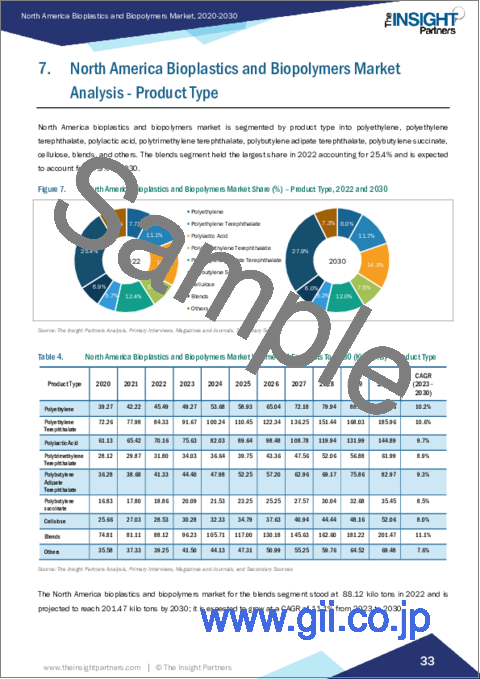

製品タイプ別では、北米のバイオプラスチックとバイオポリマー市場は、ポリエチレン、ポリエチレンテレフタレート、ポリ乳酸、ポリトリメチレンテレフタレート、ポリブチレンアジペートテレフタレート、ポリブチレンサクシネート、セルロース、ブレンド、その他に区分されます。2023年の北米バイオプラスチック/バイオポリマー市場では、ブレンド分野が最大のシェアを占めています。

北米のバイオプラスチックとバイオポリマー市場は、最終用途産業に基づいて、包装、消費財、自動車、繊維、建築・建設、医療、農業、その他に分けられます。2023年の北米バイオプラスチック・バイオポリマー市場では、包装分野が最大のシェアを占めています。

国別では、北米のバイオプラスチックとバイオポリマー市場は米国、カナダ、メキシコに区分されます。2023年の北米バイオプラスチック・バイオポリマー市場は米国が支配的です。

Arkema SA、BASF SE、Braskem SA、Cardia Bioplastics Australia Pty Ltd、Corbion NV、Eastman Chemical Co、Mitsubishi Chemical Holdings Corp、Mitsui Chemicals Inc、Novamont SpA、Saudi Basic Industries Corpは、北米のバイオプラスチックとバイオポリマー市場で事業を展開している大手企業の一部です。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 北米のバイオプラスチックとバイオポリマー市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- 流通業者または供給業者

- エンドユーザー

第5章 北米のバイオプラスチックとバイオポリマー市場:主要市場力学

- 市場促進要因

- 従来のプラスチックに対する規制と政策の増加

- 包装業界における環境に優しいプラスチックへの需要の高まり

- 市場抑制要因

- バイオプラスチックとバイオポリマーのインフラとリサイクル施設の不足

- 市場機会

- バイオ医療用途における生分解性プラスチックの採用拡大

- 今後の動向

- イノベーションと技術進歩への注目の高まり

- 影響分析

第6章 バイオプラスチックとバイオポリマー市場-北米市場分析

- 北米のバイオプラスチックとバイオポリマーの市場収益(数量)

- 北米のバイオプラスチックとバイオポリマーの市場収益

- 北米のバイオプラスチックとバイオポリマーの市場予測と分析

第7章 北米のバイオプラスチックとバイオポリマーの市場分析:製品タイプ

- ポリエチレン

- ポリエチレンテレフタレート

- ポリ乳酸

- ポリトリメチレンテレフタレート

- ポリブチレンアジペートテレフタレート

- ポリブチレンサクシネート

- セルロース

- ブレンド

- その他

第8章 北米のバイオプラスチックとバイオポリマー市場分析:最終用途産業

- 包装

- 消費財

- 自動車

- 繊維

- 建築・建設

- 医療

- 農業

- その他

第9章 北米のバイオプラスチックとバイオポリマー市場:国別分析

- 米国

- カナダ

- メキシコ

第10章 競合情勢

- 主要プレーヤー別ヒートマップ分析

- 企業のポジショニングと集中度

第11章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第12章 企業プロファイル

- Arkema SA

- BASF SE

- Mitsui Chemicals Inc

- Cardia Bioplastics Australia Pty Ltd

- Braskem SA

- Saudi Basic Industries Corp

- Corbion NV

- Mitsubishi Chemical Holdings Corp

- Novamont SpA

- Eastman Chemical Co

第13章 付録

List Of Tables

- Table 1. North America Bioplastics and Biopolymers Market Segmentation

- Table 2. North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons)

- Table 3. North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million)

- Table 4. North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - Product Type

- Table 5. North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - Product Type

- Table 6. North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - End-Use Industry

- Table 7. North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - End-Use Industry

- Table 8. US: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - By Product Type

- Table 9. US: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - By Product Type

- Table 10. US: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - By End-Use Industry

- Table 11. US: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use Industry

- Table 12. Canada: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - By Product Type

- Table 13. Canada: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - By Product Type

- Table 14. Canada: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - By End-Use Industry

- Table 15. Canada: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use Industry

- Table 16. Mexico: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - By Product Type

- Table 17. Mexico: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - By Product Type

- Table 18. Mexico: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons) - By End-Use Industry

- Table 19. Mexico: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million) - By End-Use Industry

- Table 20. Company Positioning & Concentration

List Of Figures

- Figure 1. North America Bioplastics and Biopolymers Market Segmentation, By Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: North America Bioplastics and Biopolymers Market

- Figure 4. North America Bioplastics and Biopolymers Market Impact Analysis of Drivers and Restraints

- Figure 5. North America Bioplastics and Biopolymers Market Revenue (Kilo Tons), 2020 - 2030

- Figure 6. North America Bioplastics and Biopolymers Market Revenue (US$ Million), 2020 - 2030

- Figure 7. North America Bioplastics and Biopolymers Market Share (%) - Product Type, 2022 and 2030

- Figure 8. Polyethylene Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 9. Polyethylene Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 10. Polyethylene Terephthalate Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 11. Polyethylene Terephthalate Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 12. Polylactic Acid Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 13. Polylactic Acid Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 14. Polytrimethylene Terephthalate Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 15. Polytrimethylene Terephthalate Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 16. Polybutylene Adipate Terephthalate Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 17. Polybutylene Adipate Terephthalate Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 18. Polybutylene Succinate Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 19. Polybutylene Succinate Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 20. Cellulose Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 21. Cellulose Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Blends Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 23. Blends Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Others Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 25. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. North America Bioplastics and Biopolymers Market Share (%) - End-Use Industry, 2022 and 2030

- Figure 27. Packaging Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 28. Packaging Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 29. Consumer Goods Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 30. Consumer Goods Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 31. Automotive Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 32. Automotive Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 33. Textile Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 34. Textile Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 35. Building and Construction Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 36. Building and Construction Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 37. Medical Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 38. Medical Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 39. Agriculture Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 40. Agriculture Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 41. Others Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 42. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 43. North America Bioplastics and Biopolymers Market, by Key Country- Revenue (2022) (US$ Million)

- Figure 44. North America Bioplastics and Biopolymers Market Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 45. US: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 46. US: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 47. Canada: North America Bioplastics and Biopolymers Market Volume and Forecasts To 2030 (Kilo Tons)

- Figure 48. Canada: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 49. Mexico: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (Kilo Tons)

- Figure 50. Mexico: North America Bioplastics and Biopolymers Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 51. Heat Map Analysis By Key Players

The North America bioplastics and biopolymers market is expected to grow from US$ 1,513.09 million in 2023 to US$ 3,040.20 million by 2030. It is estimated to grow at a CAGR of 10.5% from 2023 to 2030.

Increasing Regulations and Policies Against Traditional Plastic Fuel North America Bioplastics and Biopolymers Market

Government regulations and policies have shaped the bioplastics and biopolymers market. Recognizing the environmental impact of conventional plastics, many governments worldwide have implemented stringent measures to promote the production and use of sustainable alternatives. Several countries have introduced bans or restrictions on single-use plastics, such as plastic bags, straws, and cutlery. These policies aim to reduce plastic waste and encourage the adoption of bioplastics and biopolymers that are biodegradable and have a lower environmental footprint. In addition to bans, governments offer various incentives such as tax breaks, subsidies, grants, and research funding, as well as support mechanisms to promote the growth of the bioplastics industry. These incentives help reduce the cost of bioplastics, making them more competitive with conventional plastics. Thus, all these benefits have encouraged companies operating in the market to invest in research and development, scale up production, and bring innovative bioplastic products to the market.

Governments are increasingly incorporating sustainability criteria into public procurement policies by prioritizing the use of biobased materials, including bioplastics and biopolymers, in government-funded projects, thus creating a significant demand for these materials. Further, regulatory frameworks are being established to ensure the quality and safety standards of bioplastics. Governments collaborate with industry associations and regulatory bodies to establish certification systems and standards for biodegradability, compostability, and environmental performance. These standards guarantee consumers, businesses, and industries that the plastics they use meet a certain criteria, fostering market growth.

North America Bioplastics and Biopolymers Market Overview

The US, Canada, and Mexico are the key economies in North America. In North America, bioplastics and biopolymers are widely consumed in the packaging sector in the form of plastic bottles and bags. Production and consumption of bioplastics and biopolymers are expected to grow in the region, primarily in food packaging applications. Unlike traditional plastics, bioplastics, and biopolymers are obtained from renewable sources. First-generation bioplastics are obtained from starches or sugars, such as corn, wheat, sugarcane, or soy. Second-generation bioplastics use cellulose from crops or industrial processes as raw materials, including sugarcane bagasse or sawdust, and other industrial residues, such as whey.

Other end-use industries for bioplastics and biopolymers include consumer products, automotive, agriculture, textiles, building & construction, and pharmaceuticals. The growth of these end-use industries is further driving the bioplastics and biopolymers market in North America. The construction industry in North America is expanding tremendously due to a strong economy, combined with an increase in federal and state funding for public works and institutional buildings. Further, the higher demand for and production of large engine capacity vehicles, such as extended cabs, in this region is bolstering the market growth. The automotive market is inclined toward light trucks and SUVs in this region owing to their better traction in changing weather conditions and off-road capabilities. Light commercial vehicle (LCV) production is also increasing in North America. The automotive industry in this region is one of the most advanced industries globally due to substantial investments in infrastructure, R&D activities, and new production facilities. Bio-polyamides (Bio-PA), polylactic acid (PLA), and bio-based polypropylene (Bio-PP) are bioplastics used in automotive manufacturing. These factors are driving the bioplastics and biopolymers market growth.

North America Bioplastics and Biopolymers Market Revenue and Forecast to 2030 (US$ Million)

North America Bioplastics and Biopolymers Market Segmentation

The North America bioplastics and biopolymers market is segmented into product type , end-use industry, and country.

Based on product type, the North America bioplastics and biopolymers market is segmented into polyethylene, polyethylene terephthalate, polylactic acid, polytrimethylene terephthalate, polybutylene adipate terephthalate, polybutylene succinate, cellulose, blends, and others. The blends segment accounted the largest share of the North America bioplastics and biopolymers market in 2023.

Based o n end-use industry, the North America bioplastics and biopolymers market is divided into packaging, consumer goods, automotive, textile, building and construction, medical, agriculture, and others. The packaging segment held the largest share of the North America bioplastics and biopolymers market in 2023.

Based on country, the North America bioplastics and biopolymers market is segmented int o the US, Canada, and Mexico. The US dominated the North America bioplastics and biopolymers market in 2023.

Arkema SA, BASF SE, Braskem SA, Cardia Bioplastics Australia Pty Ltd, Corbion NV, Eastman Chemical Co, Mitsubishi Chemical Holdings Corp, Mitsui Chemicals Inc, Novamont SpA, and Saudi Basic Industries Corp are some of the leading companies operating in the North America bioplastics and biopolymers market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Bioplastics and Biopolymers Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers:

- 4.3.2 Manufacturers:

- 4.3.3 Distributors or Suppliers:

- 4.3.4 End Users:

5. North America Bioplastics and Biopolymers Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Increasing Regulations and Policies Against Traditional Plastic

- 5.1.2 Rising Demand for Eco-Friendly Plastics in Packaging Industry

- 5.2 Market Restraints

- 5.2.1 Lack of Infrastructure and Recycling Facilities for Bioplastics and Biopolymers

- 5.3 Market Opportunities

- 5.3.1 Growing Incorporation of Biodegradable Plastics in Biomedical Applications

- 5.4 Future Trends

- 5.4.1 Increasing Focus on Innovations and Technological Advancement

- 5.5 Impact Analysis

6. Bioplastics and Biopolymers Market- North America Market Analysis

- 6.1 North America Bioplastics and Biopolymers Market Revenue (Kilo Tons)

- 6.2 North America Bioplastics and Biopolymers Market Revenue (US$ Million)

- 6.3 North America Bioplastics and Biopolymers Market Forecast and Analysis

7. North America Bioplastics and Biopolymers Market Analysis - Product Type

- 7.1 Polyethylene

- 7.1.1 Overview

- 7.1.2 Polyethylene Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.2 Polyethylene Terephthalate

- 7.2.1 Overview

- 7.2.2 Polyethylene Terephthalate Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.3 Polylactic Acid

- 7.3.1 Overview

- 7.3.2 Polylactic Acid Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.4 Polytrimethylene Terephthalate

- 7.4.1 Overview

- 7.4.2 Polytrimethylene Terephthalate Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.5 Polybutylene Adipate Terephthalate

- 7.5.1 Overview

- 7.5.2 Polybutylene Adipate Terephthalate Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.6 Polybutylene Succinate

- 7.6.1 Overview

- 7.6.2 Polybutylene Succinate Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.7 Cellulose

- 7.7.1 Overview

- 7.7.2 Cellulose Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.8 Blends

- 7.8.1 Overview

- 7.8.2 Blends Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 7.9 Others

- 7.9.1 Overview

- 7.9.2 Others Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

8. North America Bioplastics and Biopolymers Market Analysis - End-Use Industry

- 8.1 Packaging

- 8.1.1 Overview

- 8.1.2 Packaging Market Volume, Revenue, and Forecast to 2030 (Kilo Tons) (US$ Million)

- 8.2 Consumer Goods

- 8.2.1 Overview

- 8.2.2 Consumer Goods Market Volume, Revenue, and Forecast to 2030 (Kilo Tons) (US$ Million)

- 8.3 Automotive

- 8.3.1 Overview

- 8.3.2 Automotive Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 8.4 Textile

- 8.4.1 Overview

- 8.4.2 Textile Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 8.5 Building and Construction

- 8.5.1 Overview

- 8.5.2 Building and Construction Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 8.6 Medical

- 8.6.1 Overview

- 8.6.2 Medical Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 8.7 Agriculture

- 8.7.1 Overview

- 8.7.2 Agriculture Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

- 8.8 Others

- 8.8.1 Overview

- 8.8.2 Others Market Volume, Revenue and Forecast to 2030 (Kilo Tons) (US$ Million)

9. North America Bioplastics and Biopolymers Market - Country Analysis

- 9.1 Overview

- 9.1.1 North America Bioplastics and Biopolymers Market, by Key Country- Revenue (2022) (US$ Million)

- 9.1.2 North America Bioplastics and Biopolymers Market Revenue and Forecasts and Analysis - By Countries

- 9.1.2.1 North America Bioplastics and Biopolymers Market Breakdown by Country

- 9.1.2.2 US: North America Bioplastics and Biopolymers Market Volume and Forecasts to 2030 (Kilo Tons)

- 9.1.2.3 US: North America Bioplastics and Biopolymers Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.2.3.1 US: North America Bioplastics and Biopolymers Market Breakdown by Product Type

- 9.1.2.3.2 US: North America Bioplastics and Biopolymers Market Breakdown by Product Type

- 9.1.2.3.3 US: North America Bioplastics and Biopolymers Market Breakdown by End-Use Industry

- 9.1.2.3.4 US: North America Bioplastics and Biopolymers Market Breakdown by End-Use Industry

- 9.1.2.4 Canada: North America Bioplastics and Biopolymers Market Volume and Forecasts to 2030 (Kilo Tons)

- 9.1.2.5 Canada: North America Bioplastics and Biopolymers Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.2.5.1 Canada: North America Bioplastics and Biopolymers Market Breakdown by Product Type

- 9.1.2.5.2 Canada: North America Bioplastics and Biopolymers Market Breakdown by Product Type

- 9.1.2.5.3 Canada: North America Bioplastics and Biopolymers Market Breakdown by End-Use Industry

- 9.1.2.5.4 Canada: North America Bioplastics and Biopolymers Market Breakdown by End-Use Industry

- 9.1.2.6 Mexico: North America Bioplastics and Biopolymers Market Volume and Forecasts to 2030 (Kilo Tons)

- 9.1.2.7 Mexico: North America Bioplastics and Biopolymers Market Revenue and Forecasts to 2030 (US$ Million)

- 9.1.2.7.1 Mexico: North America Bioplastics and Biopolymers Market Breakdown by Product Type

- 9.1.2.7.2 Mexico: North America Bioplastics and Biopolymers Market Breakdown by Product Type

- 9.1.2.7.3 Mexico: North America Bioplastics and Biopolymers Market Breakdown by End-Use Industry

- 9.1.2.7.4 Mexico: North America Bioplastics and Biopolymers Market Breakdown by End-Use Industry

10. Competitive Landscape

- 10.1 Heat Map Analysis By Key Players

- 10.2 Company Positioning & Concentration

11. Industry Landscape

- 11.1 Overview

- 11.2 Market Initiative

- 11.3 New Product Development

- 11.4 Merger and Acquisition

12. Company Profiles

- 12.1 Arkema SA

- 12.1.1 Key Facts

- 12.1.2 Business Description

- 12.1.3 Products and Services

- 12.1.4 Financial Overview

- 12.1.5 SWOT Analysis

- 12.1.6 Key Developments

- 12.2 BASF SE

- 12.2.1 Key Facts

- 12.2.2 Business Description

- 12.2.3 Products and Services

- 12.2.4 Financial Overview

- 12.2.5 SWOT Analysis

- 12.2.6 Key Developments

- 12.3 Mitsui Chemicals Inc

- 12.3.1 Key Facts

- 12.3.2 Business Description

- 12.3.3 Products and Services

- 12.3.4 Financial Overview

- 12.3.5 SWOT Analysis

- 12.3.6 Key Developments

- 12.4 Cardia Bioplastics Australia Pty Ltd

- 12.4.1 Key Facts

- 12.4.2 Business Description

- 12.4.3 Products and Services

- 12.4.4 Financial Overview

- 12.4.5 SWOT Analysis

- 12.4.6 Key Developments

- 12.5 Braskem SA

- 12.5.1 Key Facts

- 12.5.2 Business Description

- 12.5.3 Products and Services

- 12.5.4 Financial Overview

- 12.5.5 SWOT Analysis

- 12.5.6 Key Developments

- 12.6 Saudi Basic Industries Corp

- 12.6.1 Key Facts

- 12.6.2 Business Description

- 12.6.3 Products and Services

- 12.6.4 Financial Overview

- 12.6.5 SWOT Analysis

- 12.6.6 Key Developments

- 12.7 Corbion NV

- 12.7.1 Key Facts

- 12.7.2 Business Description

- 12.7.3 Products and Services

- 12.7.4 Financial Overview

- 12.7.5 SWOT Analysis

- 12.7.6 Key Developments

- 12.8 Mitsubishi Chemical Holdings Corp

- 12.8.1 Key Facts

- 12.8.2 Business Description

- 12.8.3 Products and Services

- 12.8.4 Financial Overview

- 12.8.5 SWOT Analysis

- 12.8.6 Key Developments

- 12.9 Novamont SpA

- 12.9.1 Key Facts

- 12.9.2 Business Description

- 12.9.3 Products and Services

- 12.9.4 Financial Overview

- 12.9.5 SWOT Analysis

- 12.9.6 Key Developments

- 12.10 Eastman Chemical Co

- 12.10.1 Key Facts

- 12.10.2 Business Description

- 12.10.3 Products and Services

- 12.10.4 Financial Overview

- 12.10.5 SWOT Analysis

- 12.10.6 Key Developments