|

|

市場調査レポート

商品コード

1424164

欧州の宝飾品と身の回り品用の電気メッキ市場の規模と予測、地域シェア、動向、成長機会分析:金属別、タイプ別、用途別Europe Electroplating Market for Jewellery and Personal Goods Application Size and Forecasts, Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Metal, Type, and Application |

||||||

|

|||||||

| 欧州の宝飾品と身の回り品用の電気メッキ市場の規模と予測、地域シェア、動向、成長機会分析:金属別、タイプ別、用途別 |

|

出版日: 2023年12月29日

発行: The Insight Partners

ページ情報: 英文 103 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

欧州の宝飾品と身の回り品用の電気メッキ市場は、2022年に34億5,000万米ドルを占め、2030年には50億3,000万米ドルに達すると予想され、2022年から2030年までのCAGRは4.8%と推定されます。

電気メッキは、直流電流を印加することによって、金属または金属物体を別の金属の非常に薄い層でコーティングするプロセスです。電気メッキは、厚みを作り、基材を保護し、表面特性を向上させ、外観を改善するために使用されます。電気メッキは、宝飾品や身の回り品産業で多く使用されています。個人用品産業では、電気メッキはバックル、カラビナ、台所用品、眼鏡フレーム、食器などに使用されます。

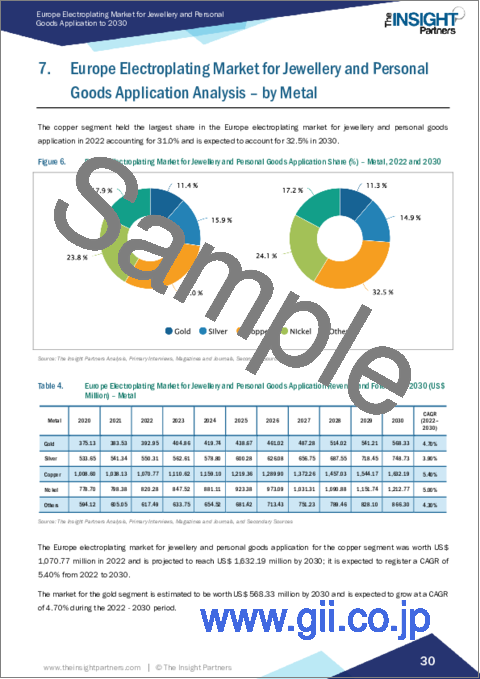

金属に基づき、欧州の宝飾品と身の回り品用の電気メッキ市場は、金、銀、銅、ニッケル、その他に区分されます。銅セグメントは2022年に最大の市場シェアを占めました。銅メッキは基板の導電性を高めるが、銅は極めて導電性が高いだけです。柔らかい金属である銅は、しばしば可鍛性であるため、接着を維持するための固有の柔軟性を持っています。銅は、その可鍛性、高い導電性、耐腐食性で知られる赤橙色の金属材料です。これらの特性により、銅は多くの産業で部品のコーティングによく使われます。シアン化銅メッキは、多くのメッキ作業でストライクとして一般的に使用されています。シアン化銅メッキでは、シアン化第一銅をカリウムやナトリウムと錯体化させ、水溶液中で可溶性の銅化合物を形成させる必要があります。プラスチックやプリント基板へのメッキに使用されるピロリン酸銅メッキは、シアン化銅メッキよりもメッキ浴の監視とメンテナンスが必要です。

国別に見ると、市場はドイツ、フランス、イタリア、英国、ロシア、その他欧州に区分されます。ドイツは2022年、欧州の宝飾品と身の回り品用の電気メッキ市場で最大のシェアを占めました。最終用途産業の力強い成長、急速な工業化、技術開拓が欧州の電気メッキ市場を牽引しています。電気メッキは宝飾品と身の回り品産業で高度に使用されています。欧州では、流行に敏感な若い消費者から、動向のあるファッショナブルな宝飾品への需要が高いです。働く女性の増加、消費者の可処分所得の増加、ミニマリスト・ジュエリーへの傾倒の高まりが、宝飾品の需要を押し上げています。また、オンライン販売プラットフォームの急速な拡大や、さまざまなブランドによるマーケティングやブランディング・キャンペーンが、さまざまなタイプの宝飾品の需要を煽っています。欧州の様々な宝飾品ブランドは、広く多様な消費者層を引き付けるために、強力なマーケティング・キャンペーンや、有名人の推薦やデジタル広告などのプロモーション活動に投資しています。電気メッキは、宝飾品の全体的な美しさとデザインを高めるために、宝飾品製造に大いに利用されています。

ELIX Polymers SL、Dr Hesse GmbH &Cie KG、PRV Engineering Ltd、SAXONIA Galvanik GmbH、Karas Plating Ltd、Dr Ing Max Schlotter GmbH and Co KG、Atotech Deutschland GmbH &Co KG、Allenchrome Electroplating Ltd、Frost Electroplating Ltd、UK Metal Finishing Ltd.は、欧州の宝飾品と身の回り品用の電気メッキ市場で活動している主要企業の一つです。市場企業は、顧客の要求を満たすために、高品質で革新的な製品の開発に非常に注力しています。同市場で活動する企業は、研究開発活動への投資やその他の活動など、様々な戦略の採用に注力しています。例えば、MKSインスツルメンツは2023年7月、アルカリ亜鉛ニッケルメッキ用のアトテックCMAクローズドループシステムの発売を発表しました。この技術はTUVラインランドの認証を受けており、廃棄物の発生を最小限に抑え、二酸化炭素排出量を削減しながら、実質的に排水のない操業を可能にします。この技術は、コンパクトなメンブレンアノード、特注の化学添加剤、真空蒸発器、冷凍ユニットを特徴としています。その結果、環境への影響が大幅に削減され、寿命が延び、電気メッキラインの製品品質が向上します。2023年11月、高度なステンレス鋼と特殊合金の高付加価値製品の世界的メーカーであるAlleima ABは、メッキ部品の需要増に対応するため、スイスでの事業拡大計画を発表しました。

欧州の宝飾品と身の回り品用の電気メッキ市場全体の市場規模は、一次情報と二次情報の両方を用いて導き出されました。調査プロセスを開始するにあたり、市場に関する質的・量的情報を入手するため、社内外の情報源を用いて徹底的な二次調査を実施しました。また、データを検証し、トピックに関するより分析的な洞察を得るために、業界関係者に複数の一次インタビューを実施しました。この調査プロセスには、副社長、市場開拓マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家、および欧州の宝飾品と身の回り品用の電気メッキ市場を専門とする評価専門家、研究アナリスト、キーオピニオンリーダーなどの外部コンサルタントが参加しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 欧州の宝飾品と身の回り品用の電気メッキ市場情勢

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係の強さ

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- 電気メッキ企業

- 最終用途

- バリューチェーンのベンダー一覧

第5章 欧州の宝飾品と身の回り品用の電気メッキ市場:主要市場力学

- 欧州の宝飾品と身の回り品用の電気メッキ市場:主要市場力学

- 市場促進要因

- 最終用途産業からの需要増加

- 工業化の進展

- 市場抑制要因

- 電気メッキに関する各種当局による規制

- 市場機会

- 革新的で環境に優しい技術の導入

- 今後の動向

- ナノテクノロジーの利用

- 促進要因と抑制要因の影響

第6章 欧州の宝飾品と身の回り品用の電気メッキ市場分析

- 欧州の宝飾品と身の回り品用の電気メッキ市場売上実績、2022年~2030年

- 欧州の宝飾品と身の回り品用の電気メッキ市場の予測と分析

第7章 欧州の宝飾品と身の回り品用の電気メッキ市場分析:金属別

- 金

- 銀

- 銅

- ニッケル

- その他

第8章 欧州の宝飾品と身の回り品用の電気メッキ市場の用途分析:タイプ別

- バレルメッキ

- ラックメッキ

- 連続メッキ

- ラインメッキ

第9章 欧州の宝飾品と身の回り品用の電気メッキ市場分析:用途別

- 宝飾品

- パーソナルグッズ

第10章 欧州の宝飾品と身の回り品用の電気メッキ市場:国別分析

- 欧州

- ドイツ

- フランス

- 英国

- イタリア

- ロシア

- その他欧州

第11章 欧州の宝飾品と身の回り品用の電気メッキ市場:COVID-19パンデミックの影響

- COVID-19前後の影響

第12章 競合情勢

- 主要企業別ヒートマップ分析

- 企業のポジショニングと集中度

第13章 業界情勢

- 市場イニシアティブ

- 合併と買収

第14章 企業プロファイル

- ELIX Polymers SL

- Dr Hesse GmbH & Cie KG

- PRV Engineering Ltd

- SAXONIA Galvanik GmbH

- Karas Plating Ltd

- Dr Ing Max Schlotter GmbH and Co KG

- Atotech Deutschland GmbH & Co KG

- Allenchrome Electroplating Ltd

- Frost Electroplating Ltd

- UK Metal Finishing Ltd

第15章 企業プロファイル付録

List Of Tables

- Table 1. Europe Electroplating Market for Jewellery and Personal Goods Application Segmentation

- Table 2. List of Vendors

- Table 3. Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million)

- Table 4. Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million) - Metal

- Table 5. Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million) - Type

- Table 6. Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million) - Application

- Table 7. Germany Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Metal

- Table 8. Germany Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 9. Germany Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 10. France Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Metal

- Table 11. France Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 12. France Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 13. UK Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Metal

- Table 14. UK Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 15. UK Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 16. Italy Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Metal

- Table 17. Italy Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 18. Italy Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 19. Russia Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Metal

- Table 20. Russia Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 21. Russia Electroplating Market Revenue and Forecast to 2030 (US$ Million) - by Application

- Table 22. Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million) - by Metal

- Table 23. Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million) - by Type

- Table 24. Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million) - by Application

List Of Figures

- Figure 1. Europe Electroplating Market for Jewellery and Personal Goods Application Segmentation, by Country

- Figure 2. Porter's Five Forces Analysis

- Figure 3. Ecosystem: Electroplating Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Europe Electroplating Market for Jewellery and Personal Goods Application Revenue (US$ Million), 2022 - 2030

- Figure 6. Europe Electroplating Market for Jewellery and Personal Goods Application Share (%) - Metal, 2022 and 2030

- Figure 7. Gold Market Revenue and Forecast to 2030 (US$ Million)

- Figure 8. Silver Market Revenue and Forecast to 2030 (US$ Million)

- Figure 9. Copper Market Revenue and Forecast to 2030 (US$ Million)

- Figure 10. Nickel Market Revenue and Forecast to 2030 (US$ Million)

- Figure 11. Others Market Revenue and Forecast to 2030 (US$ Million)

- Figure 12. Europe Electroplating Market for Jewellery and Personal Goods Application Share (%) - Type, 2022 and 2030

- Figure 13. Barrel Plating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 14. Rack Plating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 15. Continuous Plating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 16. Line Plating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 17. Europe Electroplating Market for Jewellery and Personal Goods Application Share (%) - Application, 2022 and 2030

- Figure 18. Jewellery Market Revenue and Forecast to 2030 (US$ Million)

- Figure 19. Personal Goods Market Revenue and Forecast to 2030 (US$ Million)

- Figure 20. Buckles Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 21. Carabiners Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 22. Kitchenware Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 23. Eyeglass Frames Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 24. Tableware Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 25. Others Market Revenue and Forecasts To 2030 (US$ Million)

- Figure 26. Europe Electroplating Market for Jewellery and Personal Goods Application Breakdown by Key Countries, 2022 and 2030 (%)

- Figure 27. Germany Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 28. France Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 29. UK Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 30. Italy Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 31. Russia Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- Figure 32. Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million)

- Figure 33. Heat Map Analysis By Key Players

- Figure 34. Company Positioning & Concentration

The Europe electroplating market for jewellery and personal goods application accounted for US$ 3.45 billion in 2022 and is expected to reach US$ 5.03 billion by 2030; the market is estimated to record a CAGR of 4.8% from 2022 to 2030.

Electroplating is the process of coating metal or metal objects with a very thin layer of another metal by applying a direct electric current. Electroplating is used to build thickness, protect the substrate, lend surface properties, and improve appearance. Electroplating is highly used in the jewellery and personal goods industries. In the personal goods industry, electroplating is used for buckles, carabiners, kitchenware, eyeglass frames, tableware, and others.

Based on metal, the Europe electroplating market for jewellery and personal goods application is segmented into gold, silver, copper, nickel, and others. The copper segment accounted for the largest market share in 2022. Copper plating increases the conductivity of a substrate, though copper is extremely conductive only. As a soft metal, copper is often malleable and thus has the inherent flexibility to maintain adhesion. Copper is a metallic material with a red-orange color known for its malleability, high electrical conductivity, and resistance to corrosion. These properties make copper a common choice for coating components in numerous industries. Copper cyanide plating is commonly used as a strike in many plating operations. For copper cyanide plating, cuprous cyanide must be complexed with potassium or sodium to form soluble copper compounds in aqueous solutions. Copper pyrophosphate plating, which is used for plating on plastics and printed circuit boards, requires more monitoring and maintenance of the plating baths than copper cyanide plating does.

Based on country, the market is segmented into countries such as Germany, France, Italy, the UK, Russia, and the Rest of Europe. Germany accounted for the largest Europe electroplating market for jewellery and personal goods application share in 2022. Strong growth of the end-use industries, rapid industrialization, and technological developments drive the electroplating market in Europe. Electroplating is highly used in the jewellery and personal goods industries. In Europe, there is a high demand for on-trend and fashionable pieces of jewellery from young and fashion-conscious consumers. The growing number of working women, increasing disposable income of consumers, and rising inclination toward minimalist jewellery boost the demand for jewellery. Also, the rapid expansion of online sales platforms and the marketing and branding campaigns by different brands fuel the demand for different types of jewellery. Various European jewellery brands are investing in strong marketing campaigns and promotional activities such as celebrity endorsements and digital advertising to attract a wide and diverse consumer base. Electroplating is highly used in jewellery making to enhance the overall aesthetic of the jewellery and design.

ELIX Polymers SL, Dr Hesse GmbH & Cie KG, PRV Engineering Ltd, SAXONIA Galvanik GmbH, Karas Plating Ltd, Dr Ing Max Schlotter GmbH and Co KG, Atotech Deutschland GmbH & Co KG, Allenchrome Electroplating Ltd, Frost Electroplating Ltd, and UK Metal Finishing Ltd. are among the major players operating in the Europe electroplating market for jewellery and personal goods application. Market players are highly focused on developing high-quality and innovative products to fulfill customers' requirements. Players operating in the market focus on adopting various strategies such as investment in research and development activities and others. For instance, in July 2023, MKS Instruments announced the release of the Atotech CMA Closed-Loop System for alkaline zinc nickel plating. This technology is certified by TUV Rheinland, which enables virtually wastewater-free operations while minimizing waste generation and reducing carbon footprint. This technology features compact membrane anodes, custom chemical additives, a vacuum evaporator, and a freezing unit. This results in a significantly reduced environmental impact, a longer lifespan, and enhanced product quality for the electroplating line. In November 2023, Alleima AB, a global manufacturer of high-value-added products in advanced stainless steel and special alloys, announced a plan to expand its operations in Switzerland to meet the growing demand for plated components.

The overall Europe electroplating market for jewellery and personal goods application size has been derived using both primary and secondary sources. To begin the research process, exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants such as valuation experts, research analysts, and key opinion leaders-specializing in the Europe electroplating market for jewellery and personal goods application.

Reasons to Buy:

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe electroplating market for jewellery and personal goods application, thereby allowing players to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Electroplating Market for Jewellery and Personal Goods Application Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Electroplating Companies

- 4.3.3 End Use

- 4.4 List of Vendors in the Value Chain

5. Europe Electroplating Market for Jewellery and Personal Goods Application - Key Market Dynamics

- 5.1 Europe Electroplating Market for Jewellery and Personal Goods Application - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Increasing Demand from End-Use Industries

- 5.2.2 On-Going Industrialization

- 5.3 Market Restraints

- 5.3.1 Regulations by Various Authorities upon Electroplating

- 5.4 Market Opportunities

- 5.4.1 Implementation of Innovative and Environment-friendly Techniques

- 5.5 Future Trends

- 5.5.1 Use of Nanotechnology

- 5.6 Impact of Drivers and Restraints:

6. Europe Electroplating Market for Jewellery and Personal Goods Application Analysis

- 6.1 Europe Electroplating Market for Jewellery and Personal Goods Application Revenue (US$ Million), 2022 - 2030

- 6.2 Europe Electroplating Market for Jewellery and Personal Goods Application Forecast and Analysis

7. Europe Electroplating Market for Jewellery and Personal Goods Application Analysis - by Metal

- 7.1 Gold

- 7.1.1 Overview

- 7.1.2 Gold Market, Revenue and Forecast to 2030 (US$ Million)

- 7.2 Silver

- 7.2.1 Overview

- 7.2.2 Silver Market, Revenue and Forecast to 2030 (US$ Million)

- 7.3 Copper

- 7.3.1 Overview

- 7.3.2 Copper Market, Revenue and Forecast to 2030 (US$ Million)

- 7.4 Nickel

- 7.4.1 Overview

- 7.4.2 Nickel Market, Revenue and Forecast to 2030 (US$ Million)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market, Revenue and Forecast to 2030 (US$ Million)

8. Europe Electroplating Market for Jewellery and Personal Goods Application Analysis -by Type

- 8.1 Barrel Plating

- 8.1.1 Overview

- 8.1.2 Barrel Plating Market, Revenue and Forecast to 2030 (US$ Million)

- 8.2 Rack Plating

- 8.2.1 Overview

- 8.2.2 Rack Plating Market, Revenue and Forecast to 2030 (US$ Million)

- 8.3 Continuous Plating

- 8.3.1 Overview

- 8.3.2 Continuous Plating Market, Revenue and Forecast to 2030 (US$ Million)

- 8.4 Line Plating

- 8.4.1 Overview

- 8.4.2 Line Plating Market, Revenue and Forecast to 2030 (US$ Million)

9. Europe Electroplating Market for Jewellery and Personal Goods Application Analysis - by Application

- 9.1 Jewellery

- 9.1.1 Overview

- 9.1.2 Jewellery Market, Revenue and Forecast to 2030 (US$ Million)

- 9.2 Personal Goods

- 9.2.1 Overview

- 9.2.2 Personal Goods Market, Revenue and Forecast to 2030 (US$ Million)

- 9.2.3 Buckles

- 9.2.3.1 Buckles: Europe Electroplating Market for Jewellery and Personal Goods Application - Revenue and Forecast to 2028 (US$ Million)

- 9.2.4 Carabiners

- 9.2.4.1 Carabiners: Europe Electroplating Market for Jewellery and Personal Goods Application - Revenue and Forecast to 2028 (US$ Million)

- 9.2.5 Kitchenware

- 9.2.5.1 Kitchenware: Europe Electroplating Market for Jewellery and Personal Goods Application - Revenue and Forecast to 2028 (US$ Million)

- 9.2.6 Eyeglass Frames

- 9.2.6.1 Eyeglass Frames: Europe Electroplating Market for Jewellery and Personal Goods Application - Revenue and Forecast to 2028 (US$ Million)

- 9.2.7 Tableware

- 9.2.7.1 Tableware: Europe Electroplating Market for Jewellery and Personal Goods Application - Revenue and Forecast to 2028 (US$ Million)

- 9.2.8 Others

- 9.2.8.1 Others: Europe Electroplating Market for Jewellery and Personal Goods Application - Revenue and Forecast to 2028 (US$ Million)

10. Europe Electroplating Market for Jewellery and Personal Goods Application - Country Analysis

- 10.1 Europe

- 10.1.1 Europe Electroplating Market for Jewellery and Personal Goods Application Breakdown by Countries

- 10.1.2 Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast and Analysis - by Country

- 10.1.2.1 Germany Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.1.1 Germany Electroplating Market Breakdown by Metal

- 10.1.2.1.2 Germany Electroplating Market Breakdown by Type

- 10.1.2.1.3 Germany Electroplating Market Breakdown by Application

- 10.1.2.2 France Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.2.1 France Electroplating Market Breakdown by Metal

- 10.1.2.2.2 France Electroplating Market Breakdown by Type

- 10.1.2.2.3 France Electroplating Market Breakdown by Application

- 10.1.2.3 UK Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.3.1 UK Electroplating Market Breakdown by Metal

- 10.1.2.3.2 UK Electroplating Market Breakdown by Type

- 10.1.2.3.3 UK Electroplating Market Breakdown by Application

- 10.1.2.4 Italy Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.4.1 Italy Electroplating Market Breakdown by Metal

- 10.1.2.4.2 Italy Electroplating Market Breakdown by Type

- 10.1.2.4.3 Italy Electroplating Market Breakdown by Application

- 10.1.2.5 Russia Electroplating Market Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.5.1 Russia Electroplating Market Breakdown by Metal

- 10.1.2.5.2 Russia Electroplating Market Breakdown by Type

- 10.1.2.5.3 Russia Electroplating Market Breakdown by Application

- 10.1.2.6 Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Revenue and Forecast to 2030 (US$ Million)

- 10.1.2.6.1 Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Breakdown by Metal

- 10.1.2.6.2 Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Breakdown by Type

- 10.1.2.6.3 Rest of Europe Electroplating Market for Jewellery and Personal Goods Application Breakdown by Application

- 10.1.2.1 Germany Electroplating Market Revenue and Forecast to 2030 (US$ Million)

11. Europe Electroplating Market for Jewellery and Personal Goods Application - Impact of COVID-19 Pandemic

- 11.1 Pre & Post COVID-19 Impact

12. Competitive Landscape

- 12.1 Heat Map Analysis By Key Players

- 12.2 Company Positioning & Concentration

13. Industry Landscape

- 13.1 Overview

- 13.2 Market Initiative

- 13.3 Merger and Acquisition

14. Company Profiles

- 14.1 ELIX Polymers SL

- 14.1.1 Key Facts

- 14.1.2 Business Description

- 14.1.3 Products and Services

- 14.1.4 Financial Overview

- 14.1.5 SWOT Analysis

- 14.1.6 Key Developments

- 14.2 Dr Hesse GmbH & Cie KG

- 14.2.1 Key Facts

- 14.2.2 Business Description

- 14.2.3 Products and Services

- 14.2.4 Financial Overview

- 14.2.5 SWOT Analysis

- 14.2.6 Key Developments

- 14.3 PRV Engineering Ltd

- 14.3.1 Key Facts

- 14.3.2 Business Description

- 14.3.3 Products and Services

- 14.3.4 Financial Overview

- 14.3.5 SWOT Analysis

- 14.3.6 Key Developments

- 14.4 SAXONIA Galvanik GmbH

- 14.4.1 Key Facts

- 14.4.2 Business Description

- 14.4.3 Products and Services

- 14.4.4 Financial Overview

- 14.4.5 SWOT Analysis

- 14.4.6 Key Developments

- 14.5 Karas Plating Ltd

- 14.5.1 Key Facts

- 14.5.2 Business Description

- 14.5.3 Products and Services

- 14.5.4 Financial Overview

- 14.5.5 SWOT Analysis

- 14.5.6 Key Developments

- 14.6 Dr Ing Max Schlotter GmbH and Co KG

- 14.6.1 Key Facts

- 14.6.2 Business Description

- 14.6.3 Products and Services

- 14.6.4 Financial Overview

- 14.6.5 SWOT Analysis

- 14.6.6 Key Developments

- 14.7 Atotech Deutschland GmbH & Co KG

- 14.7.1 Key Facts

- 14.7.2 Business Description

- 14.7.3 Products and Services

- 14.7.4 Financial Overview

- 14.7.5 SWOT Analysis

- 14.7.6 Key Developments

- 14.8 Allenchrome Electroplating Ltd

- 14.8.1 Key Facts

- 14.8.2 Business Description

- 14.8.3 Products and Services

- 14.8.4 Financial Overview

- 14.8.5 SWOT Analysis

- 14.8.6 Key Developments

- 14.9 Frost Electroplating Ltd

- 14.9.1 Key Facts

- 14.9.2 Business Description

- 14.9.3 Products and Services

- 14.9.4 Financial Overview

- 14.9.5 SWOT Analysis

- 14.9.6 Key Developments

- 14.10 UK Metal Finishing Ltd

- 14.10.1 Key Facts

- 14.10.2 Business Description

- 14.10.3 Products and Services

- 14.10.4 Financial Overview

- 14.10.5 SWOT Analysis

- 14.10.6 Key Developments

15. Appendix

- 15.1 About The Insight Partners