|

|

市場調査レポート

商品コード

1591404

中米の潤滑油市場規模・予測、世界・地域別シェア、動向、成長機会分析レポート:基油別、製品タイプ別、最終用途別、国別Central America Lubricants Market Size and Forecast and Regional Share, Trend, and Growth Opportunity Analysis Report Coverage: By Base Oil, Product Type, End Use, and Country |

||||||

|

|||||||

| 中米の潤滑油市場規模・予測、世界・地域別シェア、動向、成長機会分析レポート:基油別、製品タイプ別、最終用途別、国別 |

|

出版日: 2024年10月31日

発行: The Insight Partners

ページ情報: 英文 151 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

中米の潤滑油市場は、2023年の18億2,000万米ドルから成長し、2031年には22億7,000万米ドルに達すると予測されており、2023年から2031年までのCAGRは2.8%と予測されています。

中米における鉱業からの需要の急増は、同地域の潤滑油市場を大きく押し上げています。鉱業部門が力強い成長を遂げるにつれて、潤滑油のニーズが高まっており、その主な要因は、鉱業作業における重機や装置の広範な使用です。鉱物の採掘と加工に不可欠なこれらの機械は、円滑な機能を確保し、摩耗や損傷を減らし、運転寿命を延ばすために、効率的な潤滑が要求されます。鉱業活動は、過酷な運転条件によって特徴付けられ、機器の部品に大きなストレスを与えます。潤滑剤は、摩擦を緩和し、温度を管理し、腐食を防止し、鉱業機械の全体的な性能と寿命を向上させる上で重要な役割を果たしています。鉱物や金属の需要が急増し、採掘作業が促進される中、採掘会社が設備のメンテナンスと最適化を優先させるため、潤滑油市場もそれに対応した上昇を経験しています。中米データによると、中米から米国への金輸出は2021年に387%増加し、ニカラグアが1兆5,343億米ドルで首位に立った。また、インド輸出入銀行によると、インドの対中米投資の77.8%は農業と鉱業部門です。

さらに、中米では先進的な技術と近代的な採掘方法が採用されており、高品質の潤滑剤の重要性が強調されています。これらの潤滑剤は、最先端の採掘機械のシームレスな稼働を促進するだけでなく、ダウンタイムとメンテナンスコストの最小化にも貢献します。鉱業が中米の主要な経済促進要因であり続ける中、潤滑油市場は、この地域の鉱業セクターがもたらす特有の課題に合わせた特殊な潤滑ソリューションに対する需要の高まりに対応し、成長する態勢を整えています。

中米の潤滑油市場で事業を展開している主な企業は、Shell Plc、Exxon Mobil Corp、TotalEnergies SE、BP Plc、Lukoil、PETRONAS Lubricants International Sdn Bhd、Fuchs SE、Valvoline Inc、Puma Energy Holdings Pte Ltd、Motul SA、Gulf Oil International Ltdなどです。同市場で事業を展開する企業は、顧客の要望を満たすため、高品質で革新的な製品の開発に注力しています。

中米の潤滑油市場全体の規模は、一次情報と二次情報の両方を用いて算出されています。徹底的な二次調査は、市場に関する質的・量的情報を得るために、社内外の情報源を用いて実施しました。また、データを検証し、より分析的な洞察を得るために、業界関係者に複数の一次インタビューを実施しました。このプロセスの参入企業には、副社長、市場開発マネージャー、マーケットインテリジェンスマネージャー、国内営業マネージャーなどの業界専門家と、中米潤滑油市場を専門とするバリュエーション専門家、調査アナリスト、キーオピニオンリーダーなどの外部コンサルタントが含まれます。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 2次調査

- 1次調査

- 仮説の策定

- マクロ経済要因分析

- 基礎数値の作成

- データの三角測量

- 国レベルのデータ

- 限界と前提

第4章 中米の潤滑油市場情勢

- PEST分析

- エコシステム分析

- 原材料サプライヤー

- 潤滑油メーカー

- ディストリビューター/サプライヤー

- 最終用途産業

- バリューチェーンのベンダー一覧

第5章 中米の潤滑油市場:主要市場力学

- 中米の潤滑油市場:主要市場力学

- 市場促進要因

- 成長する自動車部門

- 鉱業からの需要増加

- 市場抑制要因

- 潤滑油の輸入依存度の高さ

- 市場機会

- 風力エネルギーセクターからの潤滑油需要の増加

- 今後の動向

- 様々な産業におけるバイオベースおよび持続可能な潤滑油の需要急増

- 促進要因と抑制要因の影響

第6章 中米の潤滑油市場分析

- 中米の潤滑油市場規模、2021年~2031年

- 中米の潤滑油市場の数量予測・分析

- 中米の潤滑油市場収益:2023年~2031年

- 中米の潤滑油市場の予測・分析

第7章 中米の潤滑油市場の収益分析:基油別

- 鉱物油

- 合成油

- バイオベース

第8章 中米の潤滑油市場の収益分析:製品タイプ別

- エンジンオイル

- 油圧作動油

- 金属加工油

- 工業用オイル

- グリース

- 駆動系潤滑油

- その他

第9章 中米の潤滑油市場の収益分析:最終用途別

- 自動車

- 石油・ガス

- 鉱業・金属

- 海洋

- エネルギー・電力

- 建設

- その他

第10章 中米の潤滑油市場:国別分析

- 中米

- Honduras

- Nicaragua

- Guatemala

- Costa Rica

- El Salvador

- Panama

- Belize

- Rest of Central America

第11章 競合情勢

- 主要企業によるヒートマップ分析

- 企業のポジショニングと集中度

第12章 業界情勢

- 市場イニシアティブ

- 新製品開発

- 合併と買収

第13章 企業プロファイル

- Shell Plc

- Exxon Mobil Corp

- TotalEnergies SE

- BP Plc

- Lukoil

- PETRONAS Lubricants International Sdn Bhd

- Fuchs SE

- Valvoline Inc

- Puma Energy Holdings Pte Ltd

- Motul SA

- Gulf Oil International Ltd

第14章 付録

List Of Tables

- Table 1. Central America Lubricants Market Segmentation

- Table 2. List of Vendors in Value Chain

- Table 3. Central America Lubricants Market - Volume and Forecast to 2031 (Kilo Tons)

- Table 4. Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Table 5. Central America Lubricants Market - Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 6. Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 7. Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 8. Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 9. Central America Lubricants Market - Volume and Forecast to 2031 (Kilo Tons) - by Country

- Table 10. Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Country

- Table 11. Honduras: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 12. Honduras: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 13. Honduras: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 14. Honduras: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 15. Nicaragua: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 16. Nicaragua: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 17. Nicaragua: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 18. Nicaragua: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 19. Guatemala: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 20. Guatemala: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 21. Guatemala: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 22. Guatemala: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 23. Costa Rica: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 24. Costa Rica: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 25. Costa Rica: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 26. Costa Rica: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 27. El Salvador: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 28. El Salvador: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 29. El Salvador: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 30. El Salvador: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 31. Panama: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 32. Panama: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 33. Panama: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 34. Panama: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 35. Belize: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 36. Belize: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 37. Belize: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 38. Belize: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

- Table 39. Rest of Central America: Central America Lubricants Market -Volume and Forecast to 2031 (Kilo Tons) - by Base Oil

- Table 40. Rest of Central America: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Base Oil

- Table 41. Rest of Central America: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by Product Type

- Table 42. Rest of Central America: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million) - by End Use

List Of Figures

- Figure 1. Central America Lubricants Market Segmentation, by Geography

- Figure 2. PEST Analysis

- Figure 3. Ecosystem: Central America Lubricants Market

- Figure 4. Impact Analysis of Drivers and Restraints

- Figure 5. Central America Lubricants Market Volume (Kilo Tons), 2021-2031

- Figure 6. Central America Lubricants Market Revenue (US$ Million), 2023-2031

- Figure 7. Central America Lubricants Market Share (%) - Base Oil, 2023 and 2031

- Figure 8. Mineral Oil: Central America Lubricants Market - Volume and Forecast to 2031(Kilo Tons)

- Figure 9. Mineral Oil: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 10. Synthetic: Central America Lubricants Market - Volume and Forecast to 2031(Kilo Tons)

- Figure 11. Synthetic: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 12. Bio-based: Central America Lubricants Market - Volume and Forecast to 2031(Kilo Tons)

- Figure 13. Bio-based: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 14. Central America Lubricants Market Share (%) - Product Type, 2023 and 2031

- Figure 15. Engine Oil: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 16. Hydraulic Fluids: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 17. Metalworking Fluids: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 18. Industrial Oils: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 19. Grease: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 20. Driveline Lubricants: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 21. Others: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 22. Central America Lubricants Market Share (%) - End Use, 2023 and 2031

- Figure 23. Automotive: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 24. Passenger Vehicles: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 25. Light Commercial Vehicles: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 26. Heavy Commercial Vehicles: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 27. Others: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 28. Oil and Gas: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 29. Mining and Metals: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 30. Marine: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 31. Energy and Power: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 32. Construction: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 33. Others: Central America Lubricants Market - Revenue and Forecast to2031 (US$ Million)

- Figure 34. Central America Lubricants Market Breakdown by Key Countries, 2023 and 2031 (%)

- Figure 35. Honduras: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 36. Nicaragua: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 37. Guatemala: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 38. Costa Rica: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 39. El Salvador: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 40. Panama: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 41. Belize: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 42. Rest of Central America: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- Figure 43. Heat Map Analysis by Key Players

- Figure 44. Company Positioning & Concentration

The Central America lubricants market is expected to grow from US$ 1.82 billion in 2023 and is projected to reach US$ 2.27 billion by 2031; it is expected to register a CAGR of 2.8% from 2023 to 2031.

The surge in demand from the mining industry in Central America has significantly propelled the lubricants market within the region. As the mining sector experiences robust growth, the need for lubricants has intensified, primarily driven by the extensive use of heavy machinery and equipment in mining operations. These machines, integral to the extraction and processing of minerals, demand efficient lubrication to ensure smooth functioning, reduce wear and tear, and extend operational lifespan. Mining activities, characterized by harsh operating conditions, put substantial stress on equipment components. Lubricants play a crucial role in mitigating friction, managing temperatures, and preventing corrosion, thereby enhancing mining machinery's overall performance and longevity. With the burgeoning demand for minerals and metals driving the mining operations, the lubricants market experiences a corresponding uptick as mining companies prioritize the maintenance and optimization of their equipment. According to Central America Data, gold exports to the US from Central America increased 387% in 2021, and Nicaragua was in the lead with US$ 1,534.3 billion. In addition, according to the India Exim Bank, 77.8% of India's investments in Central America are in the agriculture and mining sectors.

Moreover, the adoption of advanced technologies and modern mining practices in Central America accentuates the importance of high-quality lubricants. These lubricants not only facilitate the seamless operation of cutting-edge mining machinery but also contribute to minimizing downtime and maintenance costs. As the mining industry continues to be a key economic driver in Central America, the lubricants market is poised to thrive, meeting the escalating demand for specialized lubrication solutions tailored to the unique challenges posed by the mining sector in the region.

A few key players operating in the Central America lubricants market are Shell Plc, Exxon Mobil Corp, TotalEnergies SE, BP Plc, Lukoil, PETRONAS Lubricants International Sdn Bhd, Fuchs SE, Valvoline Inc, Puma Energy Holdings Pte Ltd, Motul SA, and Gulf Oil International Ltd. Players operating in the market are highly focused on developing high-quality and innovative product offerings to fulfill customers' requirements.

The overall Central America lubricants market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants, such as valuation experts, research analysts, and key opinion leaders-specializing in the Central America lubricants market.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Secondary Research

- 3.2 Primary Research

- 3.2.1 Hypothesis formulation:

- 3.2.2 Macro-economic factor analysis:

- 3.2.3 Developing base number:

- 3.2.4 Data Triangulation:

- 3.2.5 Country level data:

- 3.3 Limitations and Assumptions

4. Central America Lubricants Market Landscape

- 4.1 Overview

- 4.2 PEST Analysis

- 4.3 Ecosystem Analysis

- 4.3.1 Raw Material Suppliers

- 4.3.2 Lubricants Manufacturers

- 4.3.3 Distributors/Suppliers

- 4.3.4 End-Use Industries

- 4.4 List of Vendors in the Value Chain

5. Central America Lubricants Market - Key Market Dynamics

- 5.1 Central America Lubricants Market - Key Market Dynamics

- 5.2 Market Drivers

- 5.2.1 Growing Automobile Sector

- 5.2.2 Rising Demand from Mining Industry

- 5.3 Market Restraints

- 5.3.1 High Reliance on Import of Lubricants

- 5.4 Market Opportunities

- 5.4.1 Increasing Demand for Lubricants from Wind Energy Sector

- 5.5 Future Trends

- 5.5.1 Surging Demand for Bio-Based and Sustainable Lubricants in Various Industries

- 5.6 Impact of Drivers and Restraints:

6. Central America Lubricants Market Analysis

- 6.1 Central America Lubricants Market Volume (Kilo Tons), 2021-2031

- 6.2 Central America Lubricants Market Volume Forecast and Analysis (Kilo Tons)

- 6.3 Central America Lubricants Market Revenue (US$ Million), 2023-2031

- 6.4 Central America Lubricants Market Forecast and Analysis

7. Central America Lubricants Market Volume and Revenue Analysis - by Base Oil

- 7.1 Mineral Oil

- 7.1.1 Overview

- 7.1.2 Mineral Oil: Central America Lubricants Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.1.3 Mineral Oil: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 7.2 Synthetic

- 7.2.1 Overview

- 7.2.2 Synthetic: Central America Lubricants Market - Volume and Forecast to 2031 (Kilo Tons)

- 7.2.3 Synthetic: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 7.3 Bio-based

- 7.3.1 Overview

- 7.3.2 Bio-based: Central America Lubricants Market - Volume and Forecast to 2031 (Kilo Tons)

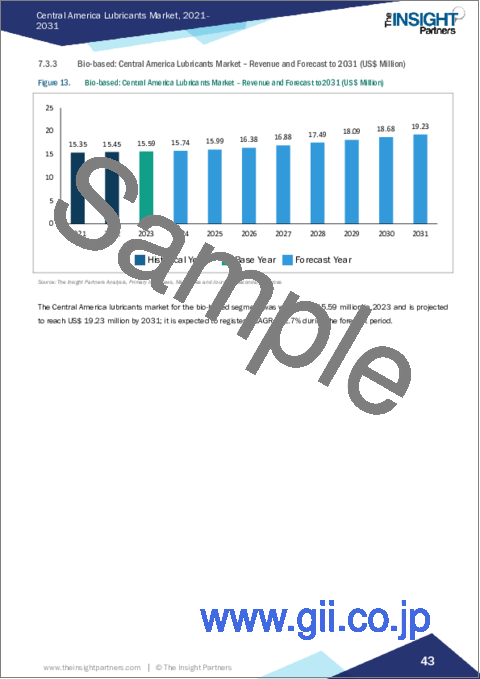

- 7.3.3 Bio-based: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

8. Central America Lubricants Market Revenue Analysis - by Product Type

- 8.1 Engine Oil

- 8.1.1 Overview

- 8.1.2 Engine Oil: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 8.2 Hydraulic Fluids

- 8.2.1 Overview

- 8.2.2 Hydraulic Fluids: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 8.3 Metalworking Fluids

- 8.3.1 Overview

- 8.3.2 Metalworking Fluids: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 8.4 Industrial Oils

- 8.4.1 Overview

- 8.4.2 Industrial Oils: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 8.5 Grease

- 8.5.1 Overview

- 8.5.2 Grease: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 8.6 Driveline Lubricants

- 8.6.1 Overview

- 8.6.2 Driveline Lubricants: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 8.7 Others

- 8.7.1 Overview

- 8.7.2 Others: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

9. Central America Lubricants Market Revenue Analysis - by End Use

- 9.1 Automotive

- 9.1.1 Overview

- 9.1.2 Automotive: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.3 Passenger Vehicles

- 9.1.3.1 Overview

- 9.1.3.2 Passenger Vehicles: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.4 Light Commercial Vehicles

- 9.1.4.1 Overview

- 9.1.4.2 Light Commercial Vehicles: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.5 Heavy Commercial Vehicles

- 9.1.5.1 Overview

- 9.1.5.2 Heavy Commercial Vehicles: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.1.6 Others

- 9.1.6.1 Overview

- 9.1.6.2 Others: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.2 Oil and Gas

- 9.2.1 Overview

- 9.2.2 Oil and Gas: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.3 Mining and Metals

- 9.3.1 Overview

- 9.3.2 Mining and Metals: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.4 Marine

- 9.4.1 Overview

- 9.4.2 Marine: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.5 Energy and Power

- 9.5.1 Overview

- 9.5.2 Energy and Power: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.6 Construction

- 9.6.1 Overview

- 9.6.2 Construction: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 9.7 Others

- 9.7.1 Overview

- 9.7.2 Others: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

10. Central America Lubricants Market - Country Analysis

- 10.1 Central America

- 10.1.1 Central America Lubricants Market Breakdown by Countries

- 10.1.2 Central America Lubricants Market Revenue and Forecast and Analysis - by Country

- 10.1.2.1 Central America Lubricants Market Volume and Forecast and Analysis - by Country

- 10.1.2.2 Central America Lubricants Market Revenue and Forecast and Analysis -by Country

- 10.1.2.3 Honduras: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.3.1 Honduras: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.3.2 Honduras: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.3.3 Honduras: Central America Lubricants Market Breakdown by End Use

- 10.1.2.4 Nicaragua: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.4.1 Nicaragua: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.4.2 Nicaragua: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.4.3 Nicaragua: Central America Lubricants Market Breakdown by End Use

- 10.1.2.5 Guatemala: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.5.1 Guatemala: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.5.2 Guatemala: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.5.3 Guatemala: Central America Lubricants Market Breakdown by End Use

- 10.1.2.6 Costa Rica: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.6.1 Costa Rica: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.6.2 Costa Rica: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.6.3 Costa Rica: Central America Lubricants Market Breakdown by End Use

- 10.1.2.7 El Salvador: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.7.1 El Salvador: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.7.2 El Salvador: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.7.3 El Salvador: Central America Lubricants Market Breakdown by End Use

- 10.1.2.8 Panama: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.8.1 Panama: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.8.2 Panama: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.8.3 Panama: Central America Lubricants Market Breakdown by End Use

- 10.1.2.9 Belize: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.9.1 Belize: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.9.2 Belize: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.9.3 Belize: Central America Lubricants Market Breakdown by End Use

- 10.1.2.10 Rest of Central America: Central America Lubricants Market - Revenue and Forecast to 2031 (US$ Million)

- 10.1.2.10.1 Rest of Central America: Central America Lubricants Market Breakdown by Base Oil

- 10.1.2.10.2 Rest of Central America: Central America Lubricants Market Breakdown by Product Type

- 10.1.2.10.3 Rest of Central America: Central America Lubricants Market Breakdown by End Use

11. Competitive Landscape

- 11.1 Heat Map Analysis by Key Players

- 11.2 Company Positioning & Concentration

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 New Product Development

- 12.4 Merger and Acquisition

13. Company Profiles

- 13.1 Shell Plc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Exxon Mobil Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 TotalEnergies SE

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 BP Plc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 Lukoil

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 PETRONAS Lubricants International Sdn Bhd

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Fuchs SE

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Valvoline Inc

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 Puma Energy Holdings Pte Ltd

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Motul SA

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments

- 13.11 Gulf Oil International Ltd

- 13.11.1 Key Facts

- 13.11.2 Business Description

- 13.11.3 Financial Overview

- 13.11.4 SWOT Analysis

- 13.11.5 Key Developments

14. Appendix

- 14.1 About The Insight Partners