|

|

市場調査レポート

商品コード

1394052

北米の衛星光地上局市場の2028年までの予測- 地域別分析- 運用別、装置別、用途別、エンドユーザー別North America Satellite Optical Ground Station Market Forecast to 2028 - Regional Analysis - by Operation, Equipment, Application, and End User |

||||||

|

|||||||

| 北米の衛星光地上局市場の2028年までの予測- 地域別分析- 運用別、装置別、用途別、エンドユーザー別 |

|

出版日: 2023年09月29日

発行: The Insight Partners

ページ情報: 英文 129 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

北米の衛星光地上局市場は、2023年の231億7,727万米ドルから2028年には407億7,636万米ドルに成長すると予測されています。2023年から2028年までのCAGRは12.0%と推定されています。

スペースデブリの増加で北米の衛星光地上局市場が活性化

異なる高度で地球を周回する機能しない人工物はすべてスペースデブリと呼ぶことができます。デブリには、ロケット本体部品、破片、有人ミッション中に発生したゴミ、ロケットからの排気物、廃衛星などが含まれます。このようなデブリのほとんどは、低軌道(LEO)において平均時速26,000km以上で地球を周回しており、機能的な宇宙資産にとって衝突の深刻な脅威となっています。このような脅威は、LEOや深宇宙に向けてロケットを打ち上げるたびに増大しています。宇宙物体の衝突の脅威の増大は、宇宙空間の安全で持続可能な利用にとって根強い問題です。こうした脅威は宇宙への自由なアクセスを制限し、関係者にリスクを軽減するために必要な措置を取るよう促します。2021年11月、ロシア軍は対衛星実験(ASAT)を実施し、ヌードル・ミサイルで廃衛星コスモス1408(1982年打ち上げ)を爆破しました。この爆発の直後、国際宇宙ステーションに滞在していたアメリカとロシアの宇宙飛行士は、国際宇宙ステーションが衛星にかなり接近していたため、衛星の破片に当たらないように予防措置を取らなければならなかっています。

北米の衛星光地上局市場概要

北米の衛星光地上局市場は米国とカナダに区分されます。先進的な衛星光地上局技術は、米国とカナダで防衛能力向上のために広く採用されています。2020年8月、米国宇宙センタは、ユナイテッド・ローンチ・アライアンス(ULA)が米国宇宙軍の重要な国家安全保障宇宙ミッションの打ち上げを受注したと発表しました。ミッションは2027年度にフロリダのケープカナベラル空軍基地から展開される予定です。このような衛星の打ち上げは、地上局技術の導入に役立ちます。

さらに、北米全域での新しい衛星地上局の打ち上げと既存の地上局の拡張も、北米全域での衛星光地上局の成長を促進する主要因です。

2022年、BlueHaloは米国宇宙軍から14億米ドル相当の契約を獲得し、同国内の12の軍用地上局をアップグレードしました。BlueHaloは、軍用地上局全体で古いパラボラ衛星アンテナを電子フェーズドアレイアンテナに置き換えます。

2023年2月、衛星通信事業者のKSATが、南極大陸に新しい地上局アンテナを設置してネットワークを拡大し、ハワイ、アラスカ、米国南東部に複数のアンテナを設置して米国内の容量を拡大すると発表しました。

2023年1月、スペースXのスターリンクは第2世代衛星の打ち上げと米国全域での地上局インフラの拡大を発表しました。

2019年5月、ウルトラエレクトロニクスコミュニケーションズ&インテグレーテッドシステムズ(CIS)傘下のギガサットは、インマルサットと提携して、カナダの国防省(DND)に衛星マルチバンド地上局端末16台を納入しました。

北米の衛星光地上局市場の収益と2028年までの予測(金額)

北米の衛星光地上局市場セグメンテーション

北米の衛星光地上局市場は、運用、アプリケーション、エンドユーザー、装置、国に区分されます。

運用に基づいて、北米の衛星光地上局市場は、レーザサットコムと光学運用にセグメント化されます。2023年には、光運用セグメントがより大きな市場シェアを握る。レーザサットコムセグメントは、OISL、ダイレクトツアース、フィーダリンクにサブセグメント化されています。

アプリケーションベースでは、北米の衛星光地上局市場は、レーザ運用、デブリ識別、地球観測、宇宙状況認識に区分されます。地球観測セグメントは、2023年に最大市場シェアを記録しました。レーザ運用セグメントは、さらに測距と通信に細分されます。

エンドユーザベースでは、北米の衛星光地上局市場は、政府&軍用と商用企業に区分されます。2023年は、政府&軍事セグメントが大きな市場シェアを占めています。

機器ベースでは、北米の衛星光地上局市場は民生機器とネットワーク機器に区分されます。ネットワーク機器セグメントが、2023年に大きな市場シェアを占めています。

国別では、北米の衛星光地上局市場は米国とカナダに分類されています。米国は、2023年に北米の衛星光地上局市場を独占しました。

AAC Clyde Space AB、Ball Corp、Comtech Telecomm Corp、General Atomics Aeronautical Systems Inc、Hensoldt AG、Mynaric AG、Thales SAは、北米の衛星光地上局市場で事業展開している大手企業の一部。

目次

第1章 イントロダクション

第2章 主要なポイント

第3章 調査手法

- カバー範囲

- 2次調査

- 1次調査

第4章 北米の衛星光地上局の市場情勢

- 市場概要

- 北米ポーターのファイブフォース分析

- エコシステム分析

- 北米の専門家の見解

第5章 北米の衛星光地上局市場力学

- 市場促進要因

- 衛星打ち上げ数の増加

- スペースデブリの増加

- 市場抑制要因

- 光運用の信号遮断

- 市場機会

- 戦略的提携の増加

- 今後の動向

- レーザーベースの衛星通信に対する需要の高まり

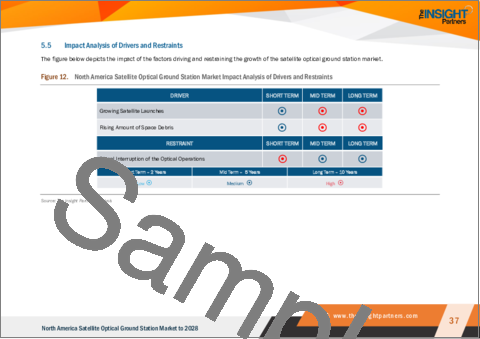

- 促進要因と抑制要因の影響分析

第6章 衛星光地上局市場-北米分析

第7章 北米の衛星光地上局市場分析:運用別

- 北米の衛星光地上局市場:運用別(2022年、2028年)

- レーザー衛星通信

- 光学操作

第8章 北米の衛星光地上局市場分析:用途別

- 北米の衛星光地上局市場:用途別(2022年、2028年)

- レーザー運用

- デブリ識別

- 地球観測

- 宇宙状況認識

第9章 北米の衛星光地上局市場分析:エンドユーザー別

- 北米の衛星光地上局市場:エンドユーザー別(2022年、2028年)

- 政府および軍事

- 民間企業

第10章 北米の衛星光地上局市場分析:装置別

- 北米の衛星光地上局市場:機器別(2022年、2028年)

- 民生機器

- ネットワーク機器

第11章 北米の衛星光地上局市場:国別分析

- 北米:衛星光地上局市場

- 北米:衛星光地上局の市場:主要国別

第12章 業界情勢

- 市場への取り組み

- 製品開発

- 合併と買収

第13章 企業プロファイル

- Thales SA

- Ball Corp

- AAC Clyde Space AB

- Hensoldt AG

- General Atomics Aeronautical Systems Inc

- Mynaric AG

- Comtech Telecomm Corp

第14章 付録

List Of Tables

- Table 1. North America Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

- Table 2. US: Satellite Optical Ground Station Market, By Operation- Revenue and Forecast to 2028 (US$ Million)

- Table 3. US: Satellite Optical Ground Station Market, By Laser SATCOM- Revenue and Forecast to 2028 (US$ Million)

- Table 4. US: Satellite Optical Ground Station Market, by Application - Revenue and Forecast to 2028 (US$ Million)

- Table 5. US: Satellite Optical Ground Station Market, by Laser Operation - Revenue and Forecast to 2028 (US$ Million)

- Table 6. US: Satellite Optical Ground Station Market, by End User - Revenue and Forecast to 2028 (US$ Million)

- Table 7. US: Satellite Optical Ground Station Market, by Equipment - Revenue and Forecast to 2028 (US$ Million)

- Table 8. Canada: Satellite Optical Ground Station Market, By Operation- Revenue and Forecast to 2028 (US$ Million)

- Table 9. Canada: Satellite Optical Ground Station Market, By Laser SATCOM- Revenue and Forecast to 2028 (US$ Million)

- Table 10. Canada: Satellite Optical Ground Station Market, by Application - Revenue and Forecast to 2028 (US$ Million)

- Table 11. Canada: Satellite Optical Ground Station Market, by Laser Operation - Revenue and Forecast to 2028 (US$ Million)

- Table 12. Canada: Satellite Optical Ground Station Market, by End User - Revenue and Forecast to 2028 (US$ Million)

- Table 13. Canada: Satellite Optical Ground Station Market, by Equipment - Revenue and Forecast to 2028 (US$ Million)

- Table 14. Canada Satellite Optical Ground Station Market, by Equipment - Revenue and Forecast to 2028 (USD Million)

- Table 15. List of Abbreviation

List Of Figures

- Figure 1. North America Satellite Optical Ground Station Market Segmentation

- Figure 2. North America Satellite Optical Ground Station Market Segmentation - By Country

- Figure 3. North America Satellite Optical Ground Station Market Overview

- Figure 4. Optical Operations Contributed the Largest Market Share in 2022

- Figure 5. Earth Observation Held the Largest Market Share in 2022

- Figure 6. Network Equipment Segment held the Largest Share in 2022

- Figure 7. Government & Military Segment held the Largest Share in 2022

- Figure 8. The US to Show Great Traction During Forecast Period of 2023 to 2028

- Figure 9. North America Porter's Five Forces Analysis

- Figure 10. North America Satellite Optical Ground Station Market- Ecosystem Analysis

- Figure 11. North America Expert Opinion

- Figure 12. North America Satellite Optical Ground Station Market Impact Analysis of Drivers and Restraints

- Figure 13. North America Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 14. North America Satellite Optical Ground Station Market, by Operation (2022 and 2028)

- Figure 15. Laser Satcom: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 16. OISL: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 17. Direct to Earth: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 18. Feeder Links: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 19. Optical Operations: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 20. North America Satellite Optical Ground Station Market, by Application (2022 and 2028)

- Figure 21. Laser Operations: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 22. Ranging: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 23. Communication: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 24. Debris Identification: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 25. Earth Observation: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 26. Space Situational Awareness: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 27. North America Satellite Optical Ground Station Market, by End User (2022 and 2028)

- Figure 28. Government And Military: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 29. Commercial Enterprises: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 30. North America Satellite Optical Ground Station Market, by Equipment (2022 and 2028)

- Figure 31. Consumer Equipment: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 32. Network Equipment: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- Figure 33. North America: Satellite Optical Ground Station Market Revenue, by Key Country (2022)(US$ Million)

- Figure 34. North America: Satellite Optical Ground Station Market Revenue Share, by Key Country (2022 & 2028)

- Figure 35. US: Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

- Figure 36. Canada: Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

The North America satellite optical ground station market is expected to grow from US$ 23,177.27 million in 2023 to US$ 40,776.36 million by 2028. It is estimated to grow at a CAGR of 12.0% from 2023 to 2028.

Rising Amount of Space Debris Fuels North America Satellite Optical Ground Station Market

All non-functional artificial materials orbiting the Earth at different altitudes can be termed space debris. Debris includes rocket body parts, fragmentation debris, refuse created during crewed missions, exhaust products from rockets, and defunct satellites. Most of such debris orbit the Earth at an average speed above 26,000 km per hour in Low Earth Orbits (LEO), posing a severe threat of collision for functional space assets. Such threats increase with each rocket launch for LEO and deep space. Growing collision threats of space objects are a persistent problem for the safe and sustainable use of outer space. These threats restrict unhindered access to space and prompt relevant parties to take necessary steps to mitigate risk. In November 2021, the Russian military conducted an anti-satellite test (ASAT) and blew up its defunct Cosmos 1408 satellite (which was launched in 1982) with a Nudol missile. Immediately after the blast, American and Russian astronauts aboard the International Space Station had to take preventive measures to avoid being struck by debris from the satellite, as the International Space Station was supposedly reasonably close to the satellite.

North America Satellite Optical Ground Station Market Overview

The North American satellite optical ground station market is segmented into US and Canada. Advanced satellite optical ground station technologies are being widely adopted in the US and Canada to improve defense capabilities. In August 2020, the US Space Center announced that United Launch Alliance (ULA) was awarded to launch its critical national security space missions for the US Space Force. The missions are planned to be deployed from Cape Canaveral Air Force Station in Florida in FY2027. These types of satellite launch help in the adoption of the ground station technologies.

Moreover, the launch of new satellite ground stations across the region and the expansion of existing ground stations is another major factor driving the growth of satellite optical ground stations across the North America region. For instance:

In 2022, BlueHalo won a contract worth US$ 1.4 billion from the US Space Force for the upgrade of 12 military ground stations across the country wherein BlueHalo will replace the old parabolic satellite dishes with electronic phased array antennas across the military ground stations.

In February 2023, Satellite operator KSAT announced that it is expanding its network with the installation of new ground station antennas across Antarctica and expanding its capacity in the US through multiple antennas in Hawaii, Alaska, and the Southeast US.

In January 2023, SpaceX's Starlink announced the launch of its fleet of second-generation satellites and expansion of its ground station infrastructure across the US.

In May 2019, GigaSat, part of Ultra Electronics Communications & Integrated Systems (CIS), in partnership with Inmarsat, delivered 16 satellite multiband earth ground station terminals to Canada's Department of National Defence (DND).

North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

North America Satellite Optical Ground Station Market Segmentation

The North America satellite optical ground station market is segmented into operation, application, end user, equipment, and country.

Based on operation, the North America satellite optical ground station market is segmented into laser satcom and optical operations. The optical operations segment held a larger market share in 2023. The laser satcom segment is sub-segmented into OISL, direct-to-earth, and feeder links.

Based on application, the North America satellite optical ground station market is segmented into laser operation, debris identification, earth observation, and space situational awareness. The earth observation segment registered the largest market share in 2023. The laser operation segment is further sub-segmented into ranging and communication.

Based on end user, North America satellite optical ground station market is segmented into government & military and commercial enterprises. The government & military segment held a larger market share in 2023.

Based on equipment, the North America satellite optical ground station market is segmented into consumer equipment and network equipment. The network equipment segment held a larger market share in 2023.

Based on country, the North America satellite optical ground station market has been categorized into US and Canada. The US dominated the North America satellite optical ground station market in 2023.

AAC Clyde Space AB; Ball Corp; Comtech Telecomm Corp; General Atomics Aeronautical Systems Inc; Hensoldt AG; Mynaric AG; and Thales SA are some of the leading companies operating in the North America satellite optical ground station market.

Reasons to Buy:

- Save and reduce time carrying out entry-level research by identifying the growth, size, leading players, and segments in the North America satellite optical ground station market

- Highlights key business priorities in order to assist companies to realign their business strategies

- The key findings and recommendations highlight crucial progressive industry trends in the North America satellite optical ground station market, thereby allowing players across the value chain to develop effective long-term strategies

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets

- Scrutinize in-depth North America market trends and outlook coupled with the factors driving the satellite optical ground station market as well as those hindering it

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to client products, segmentation, pricing, and distribution

Table Of Contents

1. Introduction

- 1.1 Study Scope

- 1.2 The Insight Partners Research Report Guidance

- 1.3 Market Segmentation

2. Key Takeaways

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. North America Satellite Optical Ground Station Market Landscape

- 4.1 Market Overview

- 4.2 North America Porter's Five Forces Analysis

- 4.3 Ecosystem Analysis

- 4.4 North America Expert Opinion

5. North America Satellite Optical Ground Station -Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Growing Number of Satellite Launches

- 5.1.2 Rising Amount of Space Debris

- 5.2 Market Restraint

- 5.2.1 Signal Interruption of the Optical Operations

- 5.3 Market Opportunities

- 5.3.1 Increasing Number of Strategic Alliances

- 5.4 Future Trends

- 5.4.1 Rising Demand for Laser-Based Satellite Communications

- 5.5 Impact Analysis of Drivers and Restraints

6. Satellite Optical Ground Station Market - North America Analysis

- 6.1 North America Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

7. North America Satellite Optical Ground Station Market Analysis - by Operation

- 7.1 Overview

- 7.2 North America Satellite Optical Ground Station Market, by Operation (2022 and 2028)

- 7.3 Laser Satcom

- 7.3.1 Overview

- 7.3.2 Laser Satcom: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 7.3.2.1 OISL

- 7.3.2.1.1 Overview

- 7.3.2.1.2 OISL: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 7.3.2.2 Direct to Earth

- 7.3.2.2.1 Overview

- 7.3.2.2.2 Direct to Earth: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 7.3.2.3 Feeder Links

- 7.3.2.3.1 Overview

- 7.3.2.3.2 Feeder Links: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 7.3.2.1 OISL

- 7.4 Optical Operations

- 7.4.1 Overview

- 7.4.2 Optical Operations: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

8. North America Satellite Optical Ground Station Market Analysis - by Application

- 8.1 Overview

- 8.2 North America Satellite Optical Ground Station Market, by Application (2022 and 2028)

- 8.3 Laser Operations

- 8.3.1 Overview

- 8.3.2 Laser Operations: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 8.3.3 Ranging

- 8.3.3.1 Overview

- 8.3.4 Communication

- 8.3.4.1 Overview

- 8.3.4.2 Communication: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 8.4 Debris Identification

- 8.4.1 Overview

- 8.4.2 Debris Identification: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 8.5 Earth Observation

- 8.5.1 Overview

- 8.5.2 Earth Observation: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 8.6 Space Situational Awareness

- 8.6.1 Overview

- 8.6.2 Space Situational Awareness: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

9. North America Satellite Optical Ground Station Market Analysis - by End User

- 9.1 Overview

- 9.2 North America Satellite Optical Ground Station Market, by End User (2022 and 2028)

- 9.3 Government And Military

- 9.3.1 Overview

- 9.3.2 Government And Military: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 9.4 Commercial Enterprises

- 9.4.1 Overview

- 9.4.2 Commercial Enterprises: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

10. North America Satellite Optical Ground Station Market Analysis - by Equipment

- 10.1 Overview

- 10.2 North America Satellite Optical Ground Station Market, by Equipment (2022 and 2028)

- 10.3 Consumer Equipment

- 10.3.1 Overview

- 10.3.2 Consumer Equipment: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

- 10.4 Network Equipment

- 10.4.1 Overview

- 10.4.2 Network Equipment: North America Satellite Optical Ground Station Market Revenue and Forecast to 2028 (US$ Million)

11. North America Satellite Optical Ground Station Market -Country Analysis

- 11.1 North America: Satellite Optical Ground Station Market

- 11.1.1 North America: Satellite Optical Ground Station Market, by Key Country

- 11.1.1.1 US: Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

- 11.1.1.1.1 US: Satellite Optical Ground Station Market, By Operation

- 11.1.1.1.1.1 US: Satellite Optical Ground Station Market, By Laser SATCOM

- 11.1.1.1.2 US: Satellite Optical Ground Station Market, by Application

- 11.1.1.1.2.1 US: Satellite Optical Ground Station Market, by Laser Operation

- 11.1.1.1.3 US: Satellite Optical Ground Station Market, by End User

- 11.1.1.1.4 US: Satellite Optical Ground Station Market, by Equipment

- 11.1.1.2 Canada: Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

- 11.1.1.2.1 Canada: Satellite Optical Ground Station Market, By Operation

- 11.1.1.2.1.1 Canada: Satellite Optical Ground Station Market, By Laser SATCOM

- 11.1.1.2.2 Canada: Satellite Optical Ground Station Market, by Application

- 11.1.1.2.2.1 Canada: Satellite Optical Ground Station Market, by Laser Operation

- 11.1.1.2.3 Canada: Satellite Optical Ground Station Market, by End User

- 11.1.1.2.4 Canada: Satellite Optical Ground Station Market, by Equipment

- 11.1.1.2.5 Canada Satellite Optical Ground Station Market Revenue Share, by End User (2022 and 2028)

- 11.1.1.1 US: Satellite Optical Ground Station Market - Revenue and Forecast to 2028 (US$ Million)

- 11.1.1 North America: Satellite Optical Ground Station Market, by Key Country

12. Industry Landscape

- 12.1 Overview

- 12.2 Market Initiative

- 12.3 Product Development

- 12.4 Mergers & Acquisitions

13. Company Profiles

- 13.1 Thales SA

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Ball Corp

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 AAC Clyde Space AB

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Hensoldt AG

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Financial Overview

- 13.4.4 SWOT Analysis

- 13.4.5 Key Developments

- 13.5 General Atomics Aeronautical Systems Inc

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 Mynaric AG

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Comtech Telecomm Corp

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

14. Appendix

- 14.1 About The Insight Partners

- 14.2 Word Index