|

|

市場調査レポート

商品コード

1389664

欧州の食品包装の市場規模・予測、地域のシェア、動向、成長機会分析:製品タイプ別、用途別Europe Food Packaging Market Size and Forecasts (2020 - 2030), Regional Share, Trends, and Growth Opportunity Analysis Report Coverage: By Product Type and Application (Commercial Catering, Food-to-Go, Ready-to-Eat Meals, and Others) |

||||||

|

|||||||

| 欧州の食品包装の市場規模・予測、地域のシェア、動向、成長機会分析:製品タイプ別、用途別 |

|

出版日: 2023年11月10日

発行: The Insight Partners

ページ情報: 英文 150 Pages

納期: 即納可能

|

- 全表示

- 概要

- 図表

- 目次

欧州の食品包装市場は、2022年の793億4,000万米ドルから2030年には1,152億5,000万米ドルに成長すると予測されており、2022年から2030年までのCAGRは4.9%と予測されています。

食品包装とは、輸送、保管、販売の過程で損傷、汚染、腐敗を引き起こす可能性のある環境要因から食品を保護する目的で食品を封入することです。食品包装製品は、プラスチック、アルミニウム、紙・板紙、ガラス、その他の添加物などの素材を用いて作られます。ポリエチレンテレフタレート(PET)、ポリプロピレン(PP)、発泡ポリスチレン(EPS)、ポリスチレン(PS)、高密度ポリエチレン(HDPE)などは、食品包装に最もよく使われるプラスチックのひとつです。アルミニウムなどの金属も食品包装によく使用されます。

調理済み食品(RTE)のような便利な食品は、消費者が食材の買い出し、食事の準備と調理、消費、食後活動に関連する時間と労力を節約することを可能にします。小規模世帯の増加や欧州全域でのミレニアル世代の人口増加といった数々の社会的変化が、高品質のコンビニエンスフードの消費を後押ししています。多忙な仕事のスケジュールのため、ミレニアル世代は退屈な仕事に時間を費やすよりも、時間を生産的に使うことを好みます。そのため、ミレニアル世代はコンビニエンスフードにお金を使う傾向が強く、それが焼き菓子、スナック菓子、乳製品などのパッケージ入りRTE製品の人気につながっています。調理済み食品は食品包装市場においてダイナミックに成長している分野であり、消費者のペースの速いライフスタイルや食習慣の変化に対応しています。これらの食事は完全に調理され、簡便に包装されており、サラダやサンドイッチからフルコースのディナーまで幅広い選択肢を提供しています。調理済み食品の包装の意義は、味や栄養を損なうことなく、消費者に手間のかからない食事を素早く提供できる点にあります。これらの食事は、鮮度、風味、食品の安全性を維持するために特殊な包装を必要とします。調理済み食品用の包装ソリューションには、真空密封容器、電子レンジ対応包装、食感や風味を保つために食品を分離しておく革新的な素材などがよく使われます。さらに、包装は賞味期限を延長する上で重要な役割を果たし、保存料を使わなくても長期保存が可能になります。近年、調理済み食品の包装市場では持続可能性が重視されるようになっています。環境に配慮した選択肢を求める消費者の需要に応えるため、メーカー各社は環境に優しい素材を使用し、包装廃棄物を最小限に抑えるようになってきています。さらに、調理済み食品の包装は機能的な目的だけでなく、製品の視覚的な魅力を高めるためにもデザインされており、重要なマーケティングツールとなっています。独創的なデザインとラベリングは、ブランドが製品を差別化し、競争の激しい市場で消費者を引きつけるのに役立ちます。このような利便性の高い食品への需要の高まりが、欧州の食品包装市場の成長を促進すると予想されます。

オンライン食品プラットフォームは消費者に比類のない利便性を提供します。数回クリックするかタップするだけで、消費者は多種多様な食品オプションを閲覧し、注文を行い、食事を玄関先まで配達してもらうことができます。これによって、移動、行列、時間のかかる食事プロセスが不要になります。組織化された小売業やeコマースは、消費者の需要を満たすために効率的なサプライチェーンに依存しています。食品包装は、輸送や配達中に生鮮食品の品質と鮮度を維持するために、これらのサービスにとって不可欠なものとなっています。断熱包装、温度管理ソリューション、漏れ防止容器は、食品を最適な状態で消費者に確実に届けるのに役立ちます。適切な包装は、製品の視認性、ブランド認知、消費者へのアピールを確保し、販売のチャンスを高める。専用棚、冷蔵コーナー、またはオンラインリスティングにより、eコマースプラットフォームや小売店は幅広い食品を展示しています。このように、組織化された小売&eコマース業界の拡大は、欧州の食品包装市場の成長を強化しています。さらに、業務用ケータリング包装の重要性は、業務効率を最適化しながら、食品の安全性、衛生性、利便性を確保する能力にあります。これらの包装ソリューションは、大規模な食品の準備、保管、輸送、およびサービングの厳しい要求を満たすように設計されています。バルクフーズ、使い捨てケータリングトレイ、断熱包装、デリケートなペストリーから熱々のメインディッシュまで対応する特殊包装などがあります。業務用ケータリング包装は、温度変化、輸送、迅速な組み立てとサービスの必要性など、フードサービス業界の課題に耐えるため、耐久性と機能性に優れていなければなりません。さらに、業務用ケータリング包装ソリューションは、二次汚染を防ぎ、準備からプレゼンテーションまでの全過程で食品の品質を維持するのに役立つため、食品安全規制を遵守するために不可欠です。この分野では持続可能性への関心も高まっており、生分解性調理器具、堆肥化可能な配膳トレイ、リサイクル可能な素材など、環境に優しいケータリング包装オプションの革新につながっています。これらの要因が欧州の食品包装市場の成長を牽引しています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

- 主要洞察

- 市場の魅力

第3章 調査手法

- 調査範囲

- 2次調査

- 1次調査

第4章 欧州の食品包装市場の情勢

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 供給企業の交渉力

- 買い手の交渉力

- 競争企業間の敵対関係

- 代替品の脅威

- エコシステム分析

- 原材料サプライヤー

- メーカー

- 流通業者または供給業者

- エンドユーザー

- バリューチェーンのベンダー一覧

第5章 欧州の食品包装市場:主要市場力学

- 市場促進要因

- 組織小売とeコマースの拡大

- コンビニエンス食品需要の増加

- 市場抑制要因

- 食品包装に関する政府の厳しい規制

- 市場機会

- 持続可能で環境に優しい包装への注目の高まり

- 今後の動向

- スマートでアクティブな包装の先進化

- 影響分析

第6章 食品包装市場:欧州の市場分析

- 欧州の食品包装市場の収益

- 欧州の食品包装市場の予測と分析

第7章 欧州の食品包装市場分析:製品タイプ別

- トレー

- 成形繊維

- プラスチック

- アルミニウム

- その他

- ボトル

- タブとカップ

- 箱

- その他

第8章 欧州の食品包装市場分析:用途別

- 業務用ケータリング

- 持ち帰り食品

- RTEミール

- その他

第9章 欧州の食品包装市場:地域別分析

第10章 COVID-19パンデミックの欧州の食品包装市場への影響

- COVID-19前後の影響

第11章 業界情勢

- 事業拡大

- 新製品開発

- 合併と買収

- パートナーシップ

- その他の事業戦略

第12章 競合情勢

- 主要プレーヤーによるヒートマップ分析

- 企業のポジショニングと集中度

第13章 企業プロファイル

- Amcor Plc

- Tetra Pak International SA

- Crown Holdings Inc

- Smurfit Kappa Group Plc

- International Paper Co

- DS Smith Plc

- Ardagh Group SA

- Huhtamaki Oyj

- WestRock Co

- Pactiv Evergreen Inc

第14章 付録

List Of Tables

- Table 1. Europe Food Packaging Market Segmentation

- Table 2. List of Raw Material Suppliers in Value Chain:

- Table 3. List of Manufacturers in Value Chain:

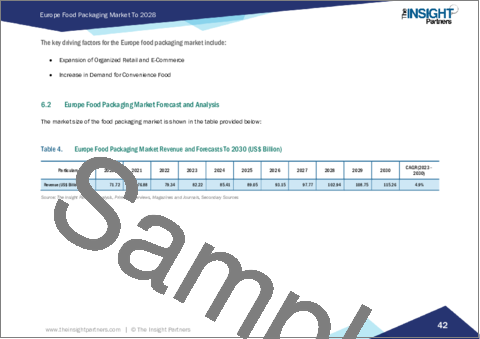

- Table 4. Europe Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- Table 5. Europe Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Product Type

- Table 6. Europe Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Application

- Table 7. Germany Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Product Type

- Table 8. Germany Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Application

- Table 9. France Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Product Type

- Table 10. France Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Application

- Table 11. Italy Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Product Type

- Table 12. Italy Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Application

- Table 13. UK Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Product Type

- Table 14. UK Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Application

- Table 15. Russia Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Product Type

- Table 16. Russia Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Application

- Table 17. Rest of Europe Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Product Type

- Table 18. Rest of Europe Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion) - Application

List Of Figures

- Figure 1. Europe Food Packaging Market Segmentation, By Country

- Figure 2. Europe Food Packaging Market - Porter's Analysis

- Figure 3. Ecosystem: Food Packaging Market

- Figure 4. Market Dynamics: Europe Food Packaging Market

- Figure 5. Europe Food Packaging Market Impact Analysis of Drivers and Restraints

- Figure 6. Europe Food Packaging Market Revenue (US$ Billion), 2020 - 2030

- Figure 7. Europe Food Packaging Market Share (%) - Product Type, 2022 and 2030

- Figure 8. Trays Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 9. Bottles Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 10. Tubs and Cups Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 11. Boxes Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 12. Others Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 13. Europe Food Packaging Market Share (%) -Application, 2022 and 2030

- Figure 14. Commercial Catering Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 15. Food-to-go Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 16. Ready to Eat Meals Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 17. Others Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 18. Europe Food Packaging Market Breakdown by Key Countries, 2022 And 2030 (%)

- Figure 19. Germany Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 20. France Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 21. Italy Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 22. UK Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 23. Russia Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 24. Rest of Europe Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- Figure 25. Company Positioning & Concentration

- Figure 26. Heat Map Analysis by Key Players

The Europe food packaging market is expected to grow from US$ 79.34 billion in 2022 to US$ 115.25 billion by 2030; it is expected to register a CAGR of 4.9% from 2022 to 2030.

Food packaging is the enclosing of food for the purpose of protecting against environmental factors that may cause damage, contamination, or decay in the process of transport, storage, or selling. Food packaging products are made by using materials such as plastic, aluminum, paper and paperboard, glass, and other additives. Polyethylene terephthalate (PET), polypropylene (PP), expanded polystyrene (EPS), polystyrene (PS), and high-density polyethylene (HDPE) are among the most commonly used plastics in food packaging. Metals such as aluminum are commonly used for food packaging.

Convenience foods such as ready-to-eat (RTE) products allow consumers to save time and effort associated with shopping for ingredients, meal preparation and cooking, consumption, and post-meal activities. Numerous social changes such as increasing number of smaller households and rising millennial population across the Europe boost the consumption of high-quality convenience food. Due to hectic work schedules, millennials prefer to be productive in their time rather than spend it on tedious tasks. Thus, they are more likely to spend their money on convenience foods, which dives into the popularity of packaged RTE products, such as baked products, snacks, and dairy products. Ready-to-eat meals are a dynamic and growing segment in the food packaging market, catering to the fast-paced lifestyles and changing eating habits of consumers. These meals are fully prepared and conveniently packaged, offering a wide variety of options from salads and sandwiches to full-course dinners. The significance of ready-to-eat meal packaging lies in its ability to provide consumers with a quick and hassle-free dining experience without compromising on taste or nutrition. These meals require specialized packaging to maintain freshness, flavor, and food safety. Packaging solutions for ready-to-eat meals often include vacuum-sealed containers, microwave-safe packaging, and innovative materials that keep food items separated to preserve their texture and flavor. Additionally, packaging plays a vital role in ensuring extended shelf life, allowing these meals to be stored for longer periods without the need for preservatives. In recent years, there has been a growing emphasis on sustainability in the ready-to-eat meal packaging market. Manufacturers are increasingly using eco-friendly materials and minimizing packaging waste to meet consumer demands for environmentally responsible options. Furthermore, the packaging of ready-to-eat meals is designed not only for functional purposes but also to enhance the visual appeal of the product, making it an important marketing tool. Creative designs and labeling help brands differentiate their products and attract consumers in a competitive market. This growing demand for convenience food is expected to drive the Europe food packaging market growth.

Online food platforms offer unparalleled convenience to consumers. With a few clicks or taps, consumers can browse a wide variety of food options, place orders, and have their meals delivered to their doorsteps. This eliminates the need for travel, waiting in lines, and time-consuming dining process. Organized retail and e-commerce rely on efficient supply chains to meet consumer demands. Food packaging becomes essential for these services to maintain the quality and freshness of perishable food items during transportation and delivery. Insulated packaging, temperature control solutions, and leak-resistant containers help ensure that food products are delivered to consumers in optimal condition. Proper packaging ensures product visibility, brand recognition, and consumer appeal, enhancing the chances of sales. With dedicated shelves, refrigerated sections, or an online listing, e-commerce platforms and retail stores showcase a wide range of food items. Thus, the expanding organized retail & e-commerce industry bolsters the Europe food packaging market growth. Furthermore, the significance of commercial catering packaging lies in its ability to ensure food safety, hygiene, and convenience while optimizing operational efficiency. These packaging solutions are designed to meet the rigorous demands of large-scale food preparation, storage, transportation, and serving. They include items such as bulk-sized food storage containers, disposable catering trays, insulated food carriers, and specialized packaging for everything from delicate pastries to hot entrees. Commercial catering packaging must excel in durability and functionality to withstand the challenges of the foodservice industry, such as temperature variations, transportation, and the need for rapid assembly and service. Moreover, commercial catering packaging solutions are essential for adhering to food safety regulations, as they help prevent cross-contamination and maintain food quality during the entire process, from preparation to presentation. Sustainability is also a growing concern in this sector, leading to innovations in eco-friendly catering packaging options, such as biodegradable utensils, compostable serving trays, and recyclable materials. These factors are driving the Europe food packaging market growth.

A few key players operating in the Europe food packaging market are Amcor Plc, Tetra Pak International SA, Crown Holdings Inc, Smurfit Kappa Group Plc, International Paper Co, DS Smith Plc, Ardagh Group SA, Huhtamaki Oyj, WestRock Co, and Pactiv Evergreen Inc. Players operating in the Europe food packaging market are highly focused on developing high-quality and innovative product offerings to fulfill customers' requirements.

The overall Europe food packaging market size has been derived using both primary and secondary sources. Exhaustive secondary research has been conducted using internal and external sources to obtain qualitative and quantitative information related to the Europe food packaging market. Also, multiple primary interviews have been conducted with industry participants to validate the data and gain more analytical insights into the topic. The participants of this process include industry experts, such as VPs, business development managers, market intelligence managers, and national sales managers-along with external consultants, such as valuation experts, research analysts, and key opinion leaders-specializing in the Europe food packaging market.

Reasons to Buy:

- Highlights key business priorities in order to assist companies to realign their business strategies.

- The key findings and recommendations highlight crucial progressive industry trends in the Europe food packaging market, thereby allowing players to develop effective long-term strategies.

- Develop/modify business expansion plans by using substantial growth offering developed and emerging markets.

- Scrutinize in-depth the market trends and outlook coupled with the factors driving the market, as well as those hindering it.

- Enhance the decision-making process by understanding the strategies that underpin commercial interest with respect to products, segmentation, and industry verticals.

Table Of Contents

1. Introduction

- 1.1 The Insight Partners Research Report Guidance

- 1.2 Market Segmentation

2. Executive Summary

- 2.1 Key Insights

- 2.2 Market Attractiveness

3. Research Methodology

- 3.1 Coverage

- 3.2 Secondary Research

- 3.3 Primary Research

4. Europe Food Packaging Market Landscape

- 4.1 Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants:

- 4.2.2 Bargaining Power of Suppliers:

- 4.2.3 Bargaining Power of Buyers:

- 4.2.4 Competitive Rivalry:

- 4.2.5 Threat of Substitutes:

- 4.3 Ecosystem Analysis

- 4.3.1 Overview:

- 4.3.2 Raw Material Suppliers:

- 4.3.3 Manufacturers

- 4.3.4 Distributors or Suppliers

- 4.3.5 End Users

- 4.4 List of Vendors in the Value Chain

5. Europe Food Packaging Market - Key Market Dynamics

- 5.1 Market Drivers

- 5.1.1 Expansion of Organized Retail and E-Commerce

- 5.1.2 Increase in Demand for Convenience Food

- 5.2 Market Restraints

- 5.2.1 Stringent Government Regulations Related to Food Packaging

- 5.3 Market Opportunities

- 5.3.1 Increasing Focus on Sustainable and Eco-Friendly Packaging

- 5.4 Future Trends

- 5.4.1 Advancements in Smart and Active Packaging

- 5.5 Impact Analysis

6. Food Packaging Market - Europe Market Analysis

- 6.1 Europe Food Packaging Market Revenue (US$ Billion)

- 6.2 Europe Food Packaging Market Forecast and Analysis

7. Europe Food Packaging Market Analysis - Product Type

- 7.1 Trays

- 7.1.1 Overview

- 7.1.2 Trays Market Revenue and Forecast to 2030 (US$ Billion)

- 7.1.3 Molded Fiber

- 7.1.4 Plastic

- 7.1.5 Aluminum

- 7.1.6 Others

- 7.2 Bottles

- 7.2.1 Overview

- 7.2.2 Bottles Market Revenue and Forecast to 2030 (US$ Billion)

- 7.3 Tubs and Cups

- 7.3.1 Overview

- 7.3.2 Tubs and Cups Market Revenue and Forecast to 2030 (US$ Billion)

- 7.4 Boxes

- 7.4.1 Overview

- 7.4.2 Boxes Market Revenue and Forecast to 2030 (US$ Billion)

- 7.5 Others

- 7.5.1 Overview

- 7.5.2 Others Market Revenue and Forecast to 2030 (US$ Billion)

8. Europe Food Packaging Market Analysis - Application

- 8.1 Commercial Catering

- 8.1.1 Overview

- 8.1.2 Commercial Catering Market Revenue, and Forecast to 2030 (US$ Billion)

- 8.2 Food-to-go

- 8.2.1 Overview

- 8.2.2 Food-to-go Market Revenue, and Forecast to 2030 (US$ Billion)

- 8.3 Ready to Eat Meals

- 8.3.1 Overview

- 8.3.2 Ready to Eat Meals Market Revenue and Forecast to 2030 (US$ Billion)

- 8.4 Others

- 8.4.1 Overview

- 8.4.2 Others Market Revenue and Forecast to 2030 (US$ Billion)

9. Europe Food Packaging Market - Geographical Analysis

- 9.1 Europe Food Packaging Market

- 9.1.1 Overview

- 9.1.2 Europe Food Packaging Market Breakdown by Country

- 9.1.2.1 Europe Food Packaging Market Breakdown by Country

- 9.1.2.2 Germany Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- 9.1.2.2.1 Germany Food Packaging Market Breakdown by Product Type

- 9.1.2.2.2 Germany Food Packaging Market Breakdown by Application

- 9.1.2.3 France Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- 9.1.2.3.1 France Food Packaging Market Breakdown by Product Type

- 9.1.2.3.2 France Food Packaging Market Breakdown by Application

- 9.1.2.4 Italy Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- 9.1.2.4.1 Italy Food Packaging Market Breakdown by Product Type

- 9.1.2.4.2 Italy Food Packaging Market Breakdown by Application

- 9.1.2.5 UK Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- 9.1.2.5.1 UK Food Packaging Market Breakdown by Product Type

- 9.1.2.5.2 UK Food Packaging Market Breakdown by Application

- 9.1.2.6 Russia Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- 9.1.2.6.1 Russia Food Packaging Market Breakdown by Product Type

- 9.1.2.6.2 Russia Food Packaging Market Breakdown by Application

- 9.1.2.7 Rest of Europe Food Packaging Market Revenue and Forecasts To 2030 (US$ Billion)

- 9.1.2.7.1 Rest of Europe Food Packaging Market Breakdown by Product Type

- 9.1.2.7.2 Rest of Europe Food Packaging Market Breakdown by Application

10. Impact of COVID-19 Pandemic on Europe Food Packaging Market

- 10.1 Pre & Post Covid-19 Impact

11. Industry Landscape

- 11.1 Overview

- 11.2 Expansion

- 11.3 New Product Development

- 11.4 Merger and Acquisition

- 11.5 Partnerships

- 11.6 Other Business Strategies

12. Competitive Landscape

- 12.1 Heat Map Analysis by Key Players

- 12.2 Company Positioning & Concentration

13. Company Profiles

- 13.1 Amcor Plc

- 13.1.1 Key Facts

- 13.1.2 Business Description

- 13.1.3 Products and Services

- 13.1.4 Financial Overview

- 13.1.5 SWOT Analysis

- 13.1.6 Key Developments

- 13.2 Tetra Pak International SA

- 13.2.1 Key Facts

- 13.2.2 Business Description

- 13.2.3 Products and Services

- 13.2.4 Financial Overview

- 13.2.5 SWOT Analysis

- 13.2.6 Key Developments

- 13.3 Crown Holdings Inc

- 13.3.1 Key Facts

- 13.3.2 Business Description

- 13.3.3 Products and Services

- 13.3.4 Financial Overview

- 13.3.5 SWOT Analysis

- 13.3.6 Key Developments

- 13.4 Smurfit Kappa Group Plc

- 13.4.1 Key Facts

- 13.4.2 Business Description

- 13.4.3 Products and Services

- 13.4.4 Financial Overview

- 13.4.5 SWOT Analysis

- 13.4.6 Key Developments

- 13.5 International Paper Co

- 13.5.1 Key Facts

- 13.5.2 Business Description

- 13.5.3 Products and Services

- 13.5.4 Financial Overview

- 13.5.5 SWOT Analysis

- 13.5.6 Key Developments

- 13.6 DS Smith Plc

- 13.6.1 Key Facts

- 13.6.2 Business Description

- 13.6.3 Products and Services

- 13.6.4 Financial Overview

- 13.6.5 SWOT Analysis

- 13.6.6 Key Developments

- 13.7 Ardagh Group SA

- 13.7.1 Key Facts

- 13.7.2 Business Description

- 13.7.3 Products and Services

- 13.7.4 Financial Overview

- 13.7.5 SWOT Analysis

- 13.7.6 Key Developments

- 13.8 Huhtamaki Oyj

- 13.8.1 Key Facts

- 13.8.2 Business Description

- 13.8.3 Products and Services

- 13.8.4 Financial Overview

- 13.8.5 SWOT Analysis

- 13.8.6 Key Developments

- 13.9 WestRock Co

- 13.9.1 Key Facts

- 13.9.2 Business Description

- 13.9.3 Products and Services

- 13.9.4 Financial Overview

- 13.9.5 SWOT Analysis

- 13.9.6 Key Developments

- 13.10 Pactiv Evergreen Inc

- 13.10.1 Key Facts

- 13.10.2 Business Description

- 13.10.3 Products and Services

- 13.10.4 Financial Overview

- 13.10.5 SWOT Analysis

- 13.10.6 Key Developments