|

|

市場調査レポート

商品コード

1636635

スマート食品包装の世界市場 (~2029年):タイプ (アクティブ包装・インテリジェント包装・ガス置換包装・エディブル包装)・用途・機能・素材・地域別Smart Food Packaging Market by Type (Active Packaging, Intelligent Packaging, Modified Atmosphere Packaging, Edible Packaging), Application, Functionality, Material and Region - Global Forecast to 2029 |

||||||

カスタマイズ可能

|

|||||||

| スマート食品包装の世界市場 (~2029年):タイプ (アクティブ包装・インテリジェント包装・ガス置換包装・エディブル包装)・用途・機能・素材・地域別 |

|

出版日: 2025年01月10日

発行: MarketsandMarkets

ページ情報: 英文 305 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

スマート食品包装の市場規模は、2024年の264億2,000万米ドルから、予測期間中は6.2%のCAGRで推移し、2029年には356億9,000万米ドルの規模に成長すると予測されています。

Mondi (英国) の2023年版レポートによると、世界の包装市場は年間約1兆米ドルと評価されており、欧州と北米がこの需要の半分近くを占めています。紙ベースとプラスチックベースの包装がそれぞれ世界市場の約40%を占め、金属とガラスが残りを占めています。食品・飲料、ヘルスケア、化粧品などの消費者用途が世界の包装需要の約60%を占め、工業用途と輸送用途が40%を占めています。包装市場の成長は、GDP、消費動向の変化、持続可能な製品やeコマースの拡大に対する需要の高まりに牽引され、経済サイクルを通じて構造的に2~4%と推定されています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2024-2029年 |

| 基準年 | 2023年 |

| 予測期間 | 2024-2029年 |

| 検討単位 | 金額 (米ドル) |

| セグメント別 | タイプ・用途・機能・素材・地域別 |

| 対象地域 | 北米・欧州・アジア太平洋・南米・その他の地域 |

世界の包装市場のこの一貫した成長は、特に食品の安全性、貯蔵寿命の延長、持続可能性をサポートするソリューションへの需要に基づいており、スマート食品包装業界を大きく牽引しています。この業界における主要な事業機会のいくつかは、インテリジェントでアクティブな包装技術、ガス置換包装 (MAP)、ナノテクノロジー、生分解性ソリューションに対するニーズの高まりにあります。また、世界の食品サプライチェーンの複雑さ、都市化の進展、食品廃棄物削減の推進も、革新的な包装に対する高い需要の一因となっています。さらに、持続可能性目標に関連したグリーン包装ソリューションの推進も、スマート包装の世界的採用を支援する見通しです。

当レポートでは、世界のスマート食品包装の市場を調査し、市場概要、市場成長への各種影響因子の分析、技術・特許の動向、法規制環境、ケーススタディ、市場規模の推移・予測、各種区分・地域別の詳細分析、競合環境、主要企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- マクロ経済見通し

- 市場力学

- 促進要因

- 抑制要因

- 機会

- 課題

- スマート食品包装における生成AIの影響

第6章 業界の動向

- バリューチェーン

- サプライチェーン

- 顧客の事業に影響を与える動向

- 価格分析

- スマート食品包装の市場マッピングとエコシステム

- 取引データ

- ポーターのファイブフォース分析

- 技術分析

- 特許分析

- 関税と規制状況

- ケーススタディ

- 主な会議とイベント

- 主なステークホルダーと購入基準

第7章 スマート食品包装市場:用途別

- 飲料

- 果物・野菜

- 肉・鶏肉・魚介類

- 焼き菓子・菓子類製品

- 牛乳・乳製品

- 加工食品

- その他

第8章 スマート食品包装市場:機能別

- バリア保護

- 水分・ガス制御

- 温度調節

- 食品安全監視

- 賞味期限延長

- 消費者との交流・エンゲージメント

- 製品認証

第9章 スマート食品包装市場:素材別

- プラスチック

- 紙・板紙

- 金属

- ガラス

- その他

第10章 スマート食品包装市場:包装タイプ別

- アクティブ包装

- 抗菌

- ガス除去

- 水分コントロール (湿度調節器) および温度コントロール

- インテリジェント包装

- インジケーター・バイオセンサー

- RFID・NFC

- 認証・追跡技術

- ガス置換包装 (MAP)

- 真空包装

- ガス充填包装

- エディブル包装

- その他

第11章 スマート食品包装市場:技術別

- RFID・NFC

- センサー・バイオセンサー

- 環境条件の監視

- 品質保証のためのバイオセンサー

- 腐敗検知用ガスセンサー

- 品質管理・消費者エンゲージメント

- ブロックチェーン技術

- IoP (INTERNET OF PACKAGING)

- 高度3Dプリント

- その他

第12章 スマート食品包装市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- イタリア

- その他

- アジア太平洋

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- その他

- 南米

- ブラジル

- アルゼンチン

- その他

- その他の地域

- 中東

- アフリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み

- 収益分析

- 市場シェア分析

- 企業評価マトリックス:主要企業

- 企業評価マトリックス:スタートアップ/中小企業

- 企業価値評価と財務指標

- ブランド/製品比較

- 競合シナリオと動向

第14章 企業プロファイル

- 主要企業

- AMCOR PLC

- SEALED AIR

- BERRY GLOBAL INC.

- THE TETRA LAVAL GROUP

- MONDI

- TOYO SEIKAN GROUP HOLDINGS, LTD.

- CROWN

- 3M

- MITSUBISHI GAS CHEMICAL COMPANY, INC.

- MULTISORB

- HUHTAMAKI OYJ

- STEPAC

- CHECKPOINT SYSTEMS, INC.

- NOVIPAX BUYER, LLC

- TIMESTRIP UK LTD

- その他の企業

- INSIGNIA TECHNOLOGIES LTD.

- VARCODE

- TIPA LTD

- FLEXIBLE PACKAGING SOLUTIONS

- NOTPLA

- VITSAB INTERNATIONAL AB

- TEMPIX AB

- BIOWRAP

- IT'S FRESH LIMITED

- KELP INDUSTRIES LTD

第15章 隣接市場と関連市場

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES CONSIDERED, 2020-2023

- TABLE 2 SMART FOOD PACKAGING MARKET, 2024 VS. 2029

- TABLE 3 US FOOD & DRUG ADMINISTRATION (FDA): RECALLS, MARKET WITHDRAWALS, AND SAFETY ALERTS, DECEMBER 2024

- TABLE 4 BLOCKCHAIN APPLICATIONS IN SUPPLY CHAIN MANAGEMENT

- TABLE 5 SMART FOOD PACKAGING MARKET: INDICATIVE SELLING PRICE, BY INTELLIGENT PACKAGING, 2020-2022 (USD/PIECE)

- TABLE 6 SMART FOOD PACKAGING MARKET: SUPPLY CHAIN (ECOSYSTEM)

- TABLE 7 IMPORT DATA OF PLASTIC-BASED PACKAGES, BY COUNTRY, 2021-2023 (IN KGS)

- TABLE 8 EXPORT DATA OF PLASTIC-BASED PACKAGES, BY COUNTRY, 2021-2023 (IN KGS)

- TABLE 9 SMART FOOD PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- TABLE 10 PATENTS PERTAINING TO SMART FOOD PACKAGING, 2020-2024

- TABLE 11 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 CASE STUDY: CRYOVAC SHRINK EQUIPMENT DELIVERS SUPERIOR PERFORMANCE FOR LEADING MEAT PROCESSOR

- TABLE 15 CASE STUDY: TETRA PAK'S CONNECTED PACKAGE PLATFORM POWERS CONSUMER ENGAGEMENT AND BOOSTS SALES FOR DAIRY PRODUCERS

- TABLE 16 SMART FOOD PACKAGING MARKET: KEY CONFERENCES AND EVENTS

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN SMART FOOD PACKAGING TYPES (%)

- TABLE 18 KEY BUYING CRITERIA FOR TOP THREE APPLICATION INDUSTRIES OF SMART FOOD PACKAGING

- TABLE 19 SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 20 SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 21 BEVERAGES: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 22 BEVERAGES: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 23 FRUITS & VEGETABLES: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 24 FRUITS & VEGETABLES: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 25 MEAT, POULTRY & SEAFOOD: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 26 MEAT, POULTRY & SEAFOOD: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 27 BAKED & CONFECTIONERY PRODUCTS: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 28 BAKED & CONFECTIONERY PRODUCTS: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 29 MILK & DAIRY PRODUCTS: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 30 MILK & DAIRY PRODUCTS: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 31 PROCESSED FOODS: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 32 PROCESSED FOODS: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 33 OTHER APPLICATIONS: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 34 OTHER APPLICATIONS: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 35 SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2019-2023 (USD MILLION)

- TABLE 36 SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

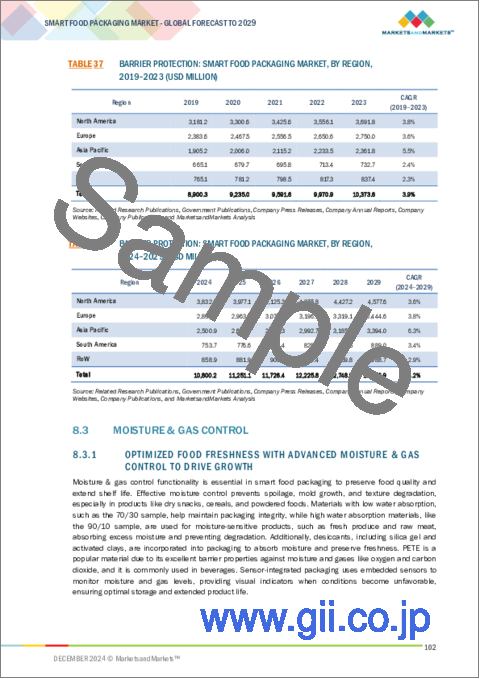

- TABLE 37 BARRIER PROTECTION: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 38 BARRIER PROTECTION: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 39 MOISTURE & GAS CONTROL: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 40 MOISTURE & GAS CONTROL: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 41 TEMPERATURE REGULATION: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 42 TEMPERATURE REGULATION: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 43 FOOD SAFETY MONITORING: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 44 FOOD SAFETY MONITORING: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 45 SHELF-LIFE EXTENSION: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 46 SHELF-LIFE EXTENSION: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 47 CONSUMER INTERACTION AND ENGAGEMENT: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 48 CONSUMER INTERACTION AND ENGAGEMENT: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 49 PRODUCT AUTHENTICATION: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 50 PRODUCT AUTHENTICATION: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 51 SMART FOOD PACKAGING MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 52 SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 53 PLASTIC: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 54 PLASTIC: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 55 PAPER & PAPERBOARD: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 56 PAPER & PAPERBOARD: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 57 METAL: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 58 METAL: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 59 GLASS: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 60 GLASS: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 61 OTHER MATERIAL TYPES: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 62 OTHER MATERIAL TYPES: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 63 SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 64 SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 65 ACTIVE PACKAGING: SMART FOOD PACKAGING MARKET, BY SUB-PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 66 ACTIVE PACKAGING: SMART FOOD PACKAGING MARKET, BY SUB-PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 67 ACTIVE PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 68 ACTIVE PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 69 INTELLIGENT PACKAGING: SMART FOOD PACKAGING MARKET, BY SUB-PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 70 INTELLIGENT PACKAGING: SMART FOOD PACKAGING MARKET, BY SUB-PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 71 INTELLIGENT PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 72 INTELLIGENT PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 73 MODIFIED ATMOSPHERE PACKAGING: SMART FOOD PACKAGING MARKET, BY SUB-PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 74 MODIFIED ATMOSPHERE PACKAGING: SMART FOOD PACKAGING MARKET, BY SUB-PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 75 MODIFIED ATMOSPHERE PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 76 MODIFIED ATMOSPHERE PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 77 EDIBLE PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 78 EDIBLE PACKAGING: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 79 OTHER PACKAGING TYPES: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 80 OTHER PACKAGING TYPES: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 81 SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 82 SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 83 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 84 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 85 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 86 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 87 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 88 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 89 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 90 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 91 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2019-2023 (USD MILLION)

- TABLE 92 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 93 US: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 94 US: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 95 CANADA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 96 CANADA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 97 MEXICO: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 98 MEXICO: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 99 EUROPE: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 100 EUROPE: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 101 EUROPE: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 102 EUROPE: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 103 EUROPE: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 104 EUROPE: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 105 EUROPE: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 106 EUROPE: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 107 EUROPE: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2019-2023 (USD MILLION)

- TABLE 108 EUROPE: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 109 GERMANY: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 110 GERMANY: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 111 UK: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 112 UK: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 113 FRANCE: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 114 FRANCE: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 115 SPAIN: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 116 SPAIN: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 117 ITALY: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 118 ITALY: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 119 REST OF EUROPE: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 120 REST OF EUROPE: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 121 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 122 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 123 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 124 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 125 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 126 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 127 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 128 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 129 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2019-2023 (USD MILLION)

- TABLE 130 ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 131 CHINA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 132 CHINA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 133 INDIA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 134 INDIA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 135 JAPAN: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 136 JAPAN: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 137 AUSTRALIA & NEW ZEALAND: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 138 AUSTRALIA & NEW ZEALAND: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 139 REST OF ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 140 REST OF ASIA PACIFIC: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 141 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2019-2023 (USD MILLION)

- TABLE 142 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY COUNTRY, 2024-2029 (USD MILLION)

- TABLE 143 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 144 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 145 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 146 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 147 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 148 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 149 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2019-2023 (USD MILLION)

- TABLE 150 SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 151 BRAZIL: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 152 BRAZIL: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 153 ARGENTINA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 154 ARGENTINA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 155 REST OF SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 156 REST OF SOUTH AMERICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 157 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 158 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 159 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2019-2023 (USD MILLION)

- TABLE 160 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024-2029 (USD MILLION)

- TABLE 161 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 162 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 163 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2019-2023 (USD MILLION)

- TABLE 164 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024-2029 (USD MILLION)

- TABLE 165 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2019-2023 (USD MILLION)

- TABLE 166 REST OF THE WORLD: SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024-2029 (USD MILLION)

- TABLE 167 MIDDLE EAST: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 168 MIDDLE EAST: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 169 AFRICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2019-2023 (USD MILLION)

- TABLE 170 AFRICA: SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024-2029 (USD MILLION)

- TABLE 171 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN SMART FOOD PACKAGING MARKET

- TABLE 172 SMART FOOD PACKAGING MARKET: DEGREE OF COMPETITION

- TABLE 173 SMART FOOD PACKAGING MARKET: REGIONAL FOOTPRINT

- TABLE 174 SMART FOOD PACKAGING MARKET: TYPE FOOTPRINT

- TABLE 175 SMART FOOD PACKAGING MARKET: APPLICATION FOOTPRINT

- TABLE 176 SMART FOOD PACKAGING MARKET: KEY START-UPS/SMES

- TABLE 177 SMART FOOD PACKAGING MARKET: COMPETITIVE BENCHMARKING OF KEY START-UPS/SMES, 2023

- TABLE 178 SMART FOOD PACKAGING MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, JANUARY 2020-AUGUST 2024

- TABLE 179 SMART FOOD PACKAGING MARKET: DEALS, JANUARY 2020-OCTOBER 2024

- TABLE 180 SMART FOOD PACKAGING MARKET: EXPANSIONS, MARCH 2020-NOVEMBER 2024

- TABLE 181 AMCOR PLC: COMPANY OVERVIEW

- TABLE 182 AMCOR PLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 183 AMCOR PLC: PRODUCT LAUNCHES

- TABLE 184 AMCOR PLC: EXPANSIONS

- TABLE 185 AMCOR PLC: DEALS

- TABLE 186 AMCOR PLC: OTHER DEALS/DEVELOPMENTS

- TABLE 187 SEALED AIR: COMPANY OVERVIEW

- TABLE 188 SEALED AIR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 189 SEALED AIR: PRODUCT LAUNCHES

- TABLE 190 SEALED AIR: EXPANSIONS

- TABLE 191 SEALED AIR: DEALS

- TABLE 192 BERRY GLOBAL INC.: COMPANY OVERVIEW

- TABLE 193 BERRY GLOBAL INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 194 BERRY GLOBAL INC.: EXPANSIONS

- TABLE 195 BERRY GLOBAL INC.: DEALS

- TABLE 196 THE TETRA LAVAL GROUP: COMPANY OVERVIEW

- TABLE 197 THE TETRA LAVAL GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 198 THE TETRA LAVAL GROUP: DEALS

- TABLE 199 MONDI: COMPANY OVERVIEW

- TABLE 200 MONDI: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 201 MONDI: EXPANSIONS

- TABLE 202 MONDI: DEALS

- TABLE 203 TOYO SEIKAN GROUP HOLDINGS, LTD.: COMPANY OVERVIEW

- TABLE 204 TOYO SEIKAN GROUP HOLDINGS, LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 205 CROWN: COMPANY OVERVIEW

- TABLE 206 CROWN: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 207 3M: COMPANY OVERVIEW

- TABLE 208 3M: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 209 MITSUBISHI GAS CHEMICAL COMPANY, INC.: COMPANY OVERVIEW

- TABLE 210 MITSUBISHI GAS CHEMICAL COMPANY, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 211 MITSUBISHI GAS CHEMICAL COMPANY, INC.: PRODUCT LAUNCHES

- TABLE 212 MULTISORB: COMPANY OVERVIEW

- TABLE 213 MULTISORB: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 214 HUHTAMAKI OYJ: COMPANY OVERVIEW

- TABLE 215 HUHTAMAKI OYJ: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 216 HUHTAMAKI OYJ: PRODUCT LAUNCHES

- TABLE 217 STEPAC: COMPANY OVERVIEW

- TABLE 218 STEPAC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 219 STEPAC: PRODUCT LAUNCHES

- TABLE 220 STEPAC: DEALS

- TABLE 221 CHECKPOINT SYSTEMS, INC.: COMPANY OVERVIEW

- TABLE 222 CHECKPOINT SYSTEMS, INC.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 223 CHECKPOINT SYSTEMS, INC.: DEALS

- TABLE 224 NOVIPAX BUYER, LLC: COMPANY OVERVIEW

- TABLE 225 NOVIPAX BUYER, LLC: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 226 NOVIPAX BUYER, LLC: PRODUCT LAUNCHES

- TABLE 227 NOVIPAX BUYER, LLC: EXPANSIONS

- TABLE 228 TIMESTRIP UK LTD: COMPANY OVERVIEW

- TABLE 229 TIMESTRIP UK LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 230 TIMESTRIP UK LTD: PRODUCT LAUNCHES

- TABLE 231 TIMESTRIP UK LTD: DEALS

- TABLE 232 INSIGNIA TECHNOLOGIES LTD.: COMPANY OVERVIEW

- TABLE 233 INSIGNIA TECHNOLOGIES LTD.: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 234 INSIGNIA TECHNOLOGIES LTD.: PRODUCT LAUNCHES

- TABLE 235 VARCODE: COMPANY OVERVIEW

- TABLE 236 VARCODE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 237 VARCODE: DEALS

- TABLE 238 TIPA LTD: COMPANY OVERVIEW

- TABLE 239 TIPA LTD: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 240 TIPA LTD: PRODUCT LAUNCHES

- TABLE 241 TIPA LTD: DEALS

- TABLE 242 FLEXIBLE PACKAGING SOLUTIONS: COMPANY OVERVIEW

- TABLE 243 FLEXIBLE PACKAGING SOLUTIONS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 244 FLEXIBLE PACKAGING SOLUTIONS: EXPANSIONS

- TABLE 245 NOTPLA: COMPANY OVERVIEW

- TABLE 246 NOTPLA: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 247 ADJACENT MARKETS

- TABLE 248 FOOD PACKAGING FILMS MARKET, BY TYPE, 2020-2027 (USD MILLION)

- TABLE 249 FOOD PACKAGING FILMS MARKET, BY TYPE, 2020-2027 (KILOTONS)

- TABLE 250 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2020-2023 (USD BILLION)

- TABLE 251 FOOD & BEVERAGE METAL CANS MARKET, BY FABRICATION TYPE, 2024-2029 (USD BILLION)

List of Figures

- FIGURE 1 MARKET SEGMENTATION

- FIGURE 2 SMART FOOD PACKAGING MARKET: RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS: BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 1 (SUPPLY SIDE)-COLLECTIVE SHARE OF KEY PLAYERS

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 2 (SUPPLY SIDE)-COLLECTIVE REVENUE OF ALL PRODUCTS

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 3 (DEMAND SIDE)-PRODUCTS SOLD

- FIGURE 7 MARKET SIZE ESTIMATION METHODOLOGY: APPROACH 4-TOP-DOWN APPROACH

- FIGURE 8 DATA TRIANGULATION METHODOLOGY

- FIGURE 9 SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 10 SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024 VS. 2029 (USD MILLION)

- FIGURE 11 SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024 VS. 2029 (USD MILLION)

- FIGURE 12 SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 13 SMART FOOD PACKAGING MARKET SHARE, BY REGION, 2024

- FIGURE 14 INCREASE IN DEMAND FOR ENHANCED FOOD SAFETY, EXTENDED SHELF LIFE, AND SUSTAINABLE PACKAGING SOLUTIONS

- FIGURE 15 US AND ACTIVE PACKAGING TO ACCOUNT FOR LARGEST SHARES IN 2024

- FIGURE 16 US TO ACCOUNT FOR LARGEST SHARE IN 2024

- FIGURE 17 PLASTIC PACKAGING MATERIAL TO DOMINATE SMART FOOD PACKAGING MARKET DURING FORECAST PERIOD

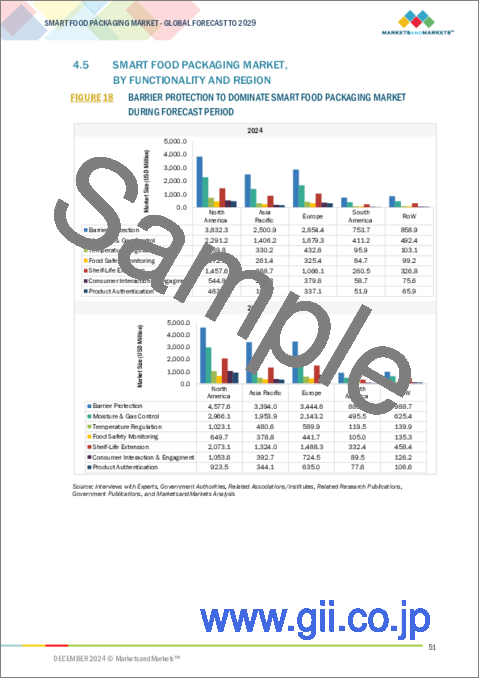

- FIGURE 18 BARRIER PROTECTION TO DOMINATE SMART FOOD PACKAGING MARKET DURING FORECAST PERIOD

- FIGURE 19 PROCESSED FOOD PRODUCTS TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 20 MARKET DYNAMICS: SMART FOOD PACKAGING MARKET

- FIGURE 21 VALUE CHAIN ANALYSIS OF SMART FOOD PACKAGING MARKET

- FIGURE 22 SUPPLY CHAIN ANALYSIS OF SMART FOOD PACKAGING MARKET

- FIGURE 23 REVENUE SHIFT FOR SMART FOOD PACKAGING MARKET

- FIGURE 24 SMART FOOD PACKAGING: MARKET MAP

- FIGURE 25 SMART FOOD PACKAGING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 26 NUMBER OF PATENTS GRANTED BETWEEN 2014 AND 2024

- FIGURE 27 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS IN SMART FOOD PACKAGING TYPES

- FIGURE 28 KEY BUYING CRITERIA FOR TOP THREE APPLICATION INDUSTRIES OF SMART FOOD PACKAGING

- FIGURE 29 SMART FOOD PACKAGING MARKET, BY APPLICATION, 2024 VS. 2029 (USD MILLION)

- FIGURE 30 SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY, 2024 VS. 2029 (USD MILLION)

- FIGURE 31 SMART FOOD PACKAGING MARKET, BY MATERIAL, 2024 VS. 2029 (USD MILLION)

- FIGURE 32 SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE, 2024 VS. 2029 (USD MILLION)

- FIGURE 33 JAPAN TO BE FASTEST-GROWING MARKET IN SMART FOOD PACKAGING DURING FORECAST PERIOD

- FIGURE 34 NORTH AMERICA: SMART FOOD PACKAGING MARKET SNAPSHOT

- FIGURE 35 ASIA PACIFIC: SMART FOOD PACKAGING MARKET SNAPSHOT

- FIGURE 36 TOP FIVE PLAYERS DOMINATE MARKET, 2021-2023 (USD BILLION)

- FIGURE 37 RANKING OF TOP FIVE PLAYERS IN SMART FOOD PACKAGING MARKET, 2023

- FIGURE 38 SMART FOOD PACKAGING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2023

- FIGURE 39 SMART FOOD PACKAGING MARKET: COMPANY FOOTPRINT

- FIGURE 40 SMART FOOD PACKAGING MARKET: COMPANY EVALUATION MATRIX (START-UPS/SMES), 2023

- FIGURE 41 COMPANY VALUATION OF FEW MAJOR PLAYERS (USD BILLION)

- FIGURE 42 EV/EBITDA OF KEY COMPANIES

- FIGURE 43 BRAND/PRODUCT COMPARISON

- FIGURE 44 AMCOR PLC: COMPANY SNAPSHOT

- FIGURE 45 SEALED AIR: COMPANY SNAPSHOT

- FIGURE 46 BERRY GLOBAL INC.: COMPANY SNAPSHOT

- FIGURE 47 THE TETRA LAVAL GROUP: COMPANY SNAPSHOT

- FIGURE 48 MONDI: COMPANY SNAPSHOT

- FIGURE 49 TOYO SEIKAN GROUP HOLDINGS, LTD.: COMPANY SNAPSHOT

- FIGURE 50 CROWN: COMPANY SNAPSHOT

- FIGURE 51 3M: COMPANY SNAPSHOT

- FIGURE 52 MITSUBISHI GAS CHEMICAL COMPANY, INC.: COMPANY SNAPSHOT

- FIGURE 53 HUHTAMAKI OYJ: COMPANY SNAPSHOT

The global smart food packaging market size is estimated to be valued at USD 26.42 billion in 2024 and is projected to reach USD 35.69 billion by 2029 at a CAGR of 6.2%. According to Mondi (UK) 2023 report, the global packaging market is valued at approximately USD 1 trillion annually, with Europe and North America accounting for nearly half of this demand. Paper-based and plastic-based packaging each comprise about 40% of the global market, while metal and glass constitute the remainder. Consumer applications, such as food, beverages, health care, and cosmetics, account for about 60% of global packaging demand, while industrial and transport uses account for 40%. The growth of the packaging market is estimated to be 2-4% structurally through economic cycles, driven by GDP, changes in consumption trends, and a growing demand for sustainable products and eCommerce expansion.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2029 |

| Base Year | 2023 |

| Forecast Period | 2024-2029 |

| Units Considered | Value (USD) |

| Segments | By Type, Application, Functionality, Material, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

This consistent growth of the global packaging market highly drives the smart food packaging industry, which is particularly based on a demand for solutions that support food safety, extended shelf life, and sustainability. Some of the major opportunities in the industry result from the growing need for intelligent and active packaging technologies, Modified Atmosphere Packaging (MAP), nanotechnology, and biodegradable solutions. The complexities of the global food supply chain, increasing urbanization, and a drive to reduce food waste contribute to a high demand for innovative packaging. In addition, the thrust to green packaging solutions in relation to sustainability objectives supports smart packaging adoption globally, hence setting it for strong growth.

Disruptions in Smart Food Packaging Market:

- Integration of IoT and Smart Sensors: The Internet of Things (IoT) and digital technologies such as QR codes, NFC tags, and RFID sensors enable real-time tracking and traceability and interaction with the consumer, are changing the face of smart food packaging. IoT-enabled smart labels monitor temperature, humidity, and food freshness for safety and reduced food waste. These technologies also involve consumers by providing them with detailed product information and transparency via smartphones. This disruption brings about growth in connected packaging solutions that assist brands to improve customer experience, guarantee quality control, and increase trust in the supply chain.

- Growth of Biodegradable and Edible Packaging: The growth of biodegradable and edible packaging mirrors the growing demand for sustainable alternatives in the packaging industry. With plastic pollution concerns increasing, these innovations provide an environmentally friendly solution that maintains food safety and prolongs shelf life. Biodegradable packaging is made from natural materials such as seaweed, starch, and proteins and breaks down safely. Edible packaging enhances convenience by providing consumers with the option of having waste-free consumption. This disruptive trend, therefore, aligns with the regulatory pressure and consumer preferences for sustainability, positioning brands to capitalize on growing opportunities in the market for innovation and environmental responsibility.

"Intelligent packaging is expected to have highest CAGR in the packaging type segment throughout the forecast period."

Rapid expansion in the intelligent packaging market is influenced by advancements in technology, increasing demand from consumers for convenience, and awareness regarding food safety. Some key technologies are sensors, RFID, and temperature indicators. These enable real-time monitoring that ensures freshness and minimizes the risk of spoilage. It caters to the interests of both consumers and businesses, thus promoting market growth furthered by the growing trend of e-commerce and efficient management of the supply chain. The adoption of this product is very high in North America and Europe because of strict food safety norms and demand for sustainable packaging solutions. On the other hand, Asia-Pacific has been growing rapidly because of the rate of urbanization, consumer preference changes, and an increase in retail businesses. Prominent players like Amcor plc (Switzerland), Sealed Air (US), and THE TETRA LAVAL GROUP (Switzerland) have capitalized on these opportunities.

"Plastic holds largest market share by material segment in the smart food packaging market."

Plastic is the leader of the market in terms of material in the smart food packaging market because of the characteristics such as versatility, low price, and durability. Plastics can be molded into different forms; besides, they are also known for their lightweight properties. In active and intelligent packaging applications, plastics are highly ideal due to these properties. Polyethylene, polypropylene, and PET are used widely due to their barrier properties, with pliable characteristics, preventing any contamination risks and ensuring food safety, and longer shelf life. Advancements in recyclable and biodegradable plastics are gaining momentum along with the increase in environmental concerns, hence driving demand for sustainable packaging solutions. North America and Asia-Pacific are the significant adopters of plastic-based smart packaging, which is further fueling the growth of the market.

"The North America accounts for largest market share in the region in the smart food packaging market."

The North American smart food packaging market is set to experience growth with increasing factors like food sales and demand for sustainable, convenient, and safe packaging solutions. As reported by the USDA in November 2023, in 2019, the retail food stores in the U.S. sold USD 717 billion of food and nonfood products, with grocery stores selling 92.1% of these. This strong market serves to illustrate the demand for packaging that will serve the needs of large food retailers.

The USDA, in its report of November 2024, further mentioned that agriculture, food, and related industries contributed approximately USD 1.530 trillion in 2023 to the U.S. GDP. This totals 5.6 percent of the economy. This demonstrates the food industry's importance in the economy and further calls for effective packaging solutions for efficiency and sustainability.

As the North American food sector continues to expand, particularly in grocery and specialty stores, the need for advanced food packaging solutions is expected to rise. Technologies like active packaging, modified atmosphere packaging, and intelligent packaging are meeting consumer demands for extended shelf life, food safety, and traceability. Moreover, heightened awareness around food and plastic waste is creating opportunities for developing more sustainable packaging alternatives. The growth of this market is fueled by technological innovations and a shift in consumer preference toward environmentally friendly packaging options.

The break-up of the profile of primary participants in the smart food packaging market:

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 15%, Managers- 25% and Others - 60%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and Rest of the World - 5%

Prominent companies include Amcor plc (Switzerland), Mondi (UK), Sealed Air (US), Berry Global Inc. (US), Toyo Seikan Group Holdings, Ltd. (Japan), THE TETRA LAVAL GROUP (Switzerland), Crown (US), 3M (US), MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan), Multisorb (US), Huhtamaki Oyj (Finland), Timestrip UK LTD (UK), Stepac (Israel), Checkpoint Systems, Inc. (US), and Novipax Buyer, LLC (US) among others.

Research Coverage:

This research report categorizes the smart food packaging market by Packaging Type (Active Packaging, Intelligent Packaging, Modified Atmosphere Packaging, Bioactive Packaging and Other Packaging Type), Application (Beverages, Fruits & Vegetables, Meat, Poultry & Seafood, Baked & Confectionary Products, Milk & Dairy Products, Processed Foods and Other Applications), Functionality (Barrier Protection, Moisture and Gas Control, Temperature Regulation, Food Safety Monitoring, Shelf-Life Extension, Consumer Interaction and Engagement and Product Authentication), Material (Plastic, Paper & Paperboard, Metal, Glass and Other Material Types), and Region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report covers information about the key factors, such as drivers, restraints, opportunities, and challenges impacting the growth of the smart food packaging market. It also provides a detailed analysis of the major players in the market, including their business overview, products offered; key strategies; partnerships, new product launches, expansions, and acquisitions. Competitive benchmarking of upcoming startups in the smart food packaging market is covered in this report.

Reasons to buy this report:

The report will help the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall smart food packaging market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Technological advancements enabling smart features like temperature sensors and freshness indicators, and Rising consumer preference for convenience and extended shelf life of packaged food), restraints (Limited infrastructure for recycling smart packaging materials globally, and Consumer resistance to adopting new packaging solutions due to unfamiliarity), opportunities (Development of biodegradable and edible packaging to replace traditional plastic packaging, Expansion of e-commerce driving demand for smart packaging in food deliveries, and Increasing regulatory pressure encouraging the adoption of sustainable food packaging solutions), and challenges (Ensuring cost-effective production while maintaining high-tech features in smart packaging) influencing the growth of the smart food packaging market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the smart food packaging market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart food packaging market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the smart food packaging market.

Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading smart food packaging market players such as Amcor plc (Switzerland), Mondi (UK), Sealed Air (US), Berry Global Inc. (US), Toyo Seikan Group Holdings, Ltd. (Japan), THE TETRA LAVAL GROUP (Switzerland), Crown (US), 3M (US), MITSUBISHI GAS CHEMICAL COMPANY, INC. (Japan), Multisorb (US), Huhtamaki Oyj (Finland), Timestrip UK LTD (UK), Stepac (Israel), Checkpoint Systems, Inc. (US), and Novipax Buyer, LLC (US) among others. The report also helps stakeholders understand the smart food packaging market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART FOOD PACKAGING MARKET

- 4.2 NORTH AMERICA: SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE AND COUNTRY

- 4.3 SMART FOOD PACKAGING MARKET: REGIONAL SNAPSHOT

- 4.4 SMART FOOD PACKAGING, BY MATERIAL AND REGION

- 4.5 SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY AND REGION

- 4.6 SMART FOOD PACKAGING MARKET, BY APPLICATION AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC OUTLOOK

- 5.2.1 RISING REGULATORY PRESSURES AND FOOD SAFETY STANDARDS

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Advancements in IoT and sensor technology

- 5.3.1.2 Blockchain technology revolutionizing food supply chains

- 5.3.1.3 Companies' adoption of RFID technology in food safety and supply chain management

- 5.3.1.4 Growing awareness of plastic waste driving demand for biodegradable edible packaging from natural polymers like seaweed and starch

- 5.3.2 RESTRAINTS

- 5.3.2.1 Lack of consumer awareness in developing markets

- 5.3.2.2 Consumer privacy concerns

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Increased demand for cold chain monitoring

- 5.3.3.2 Food authentication and anti-counterfeiting

- 5.3.4 CHALLENGES

- 5.3.4.1 High initial costs

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON SMART FOOD PACKAGING

- 5.4.1 INTRODUCTION

- 5.4.2 APPLICATIONS OF AI IN SMART PACKAGING

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN

- 6.2.1 RAW MATERIAL SOURCING

- 6.2.2 MANUFACTURING OF PACKAGING COMPONENTS

- 6.2.3 QUALITY CONTROL AND TESTING

- 6.2.4 PACKAGING ASSEMBLY

- 6.2.5 DISTRIBUTION AND LOGISTICS

- 6.2.6 END-USER INTERACTION AND DISPOSAL

- 6.2.7 DATA INTEGRATION AND ANALYSIS (DIGITAL SUPPLY CHAIN)

- 6.3 SUPPLY CHAIN

- 6.4 TRENDS IMPACTING CUSTOMER BUSINESS

- 6.5 PRICING ANALYSIS

- 6.5.1 AVERAGE SELLING PRICE TREND ANALYSIS

- 6.6 MARKET MAPPING AND ECOSYSTEM OF SMART FOOD PACKAGING

- 6.6.1 DEMAND SIDE

- 6.6.2 SUPPLY SIDE

- 6.7 TRADE DATA

- 6.8 PORTER'S FIVE FORCES ANALYSIS

- 6.8.1 INTENSITY OF COMPETITIVE RIVALRY

- 6.8.2 BARGAINING POWER OF SUPPLIERS

- 6.8.3 BARGAINING POWER OF BUYERS

- 6.8.4 THREAT OF SUBSTITUTES

- 6.8.5 THREAT OF NEW ENTRANTS

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGY

- 6.9.1.1 Nanotechnology

- 6.9.1.2 Self-healing packaging

- 6.9.2 COMPLEMENTARY TECHNOLOGY

- 6.9.2.1 Augmented reality (AR)

- 6.9.2.2 AI & machine learning

- 6.9.3 ADJACENT TECHNOLOGY

- 6.9.3.1 Recycling & circular economy innovation

- 6.9.1 KEY TECHNOLOGY

- 6.10 PATENT ANALYSIS

- 6.11 TARIFF AND REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 SMART FOOD PACKAGING REGULATIONS IN NORTH AMERICA

- 6.11.2.1 US

- 6.11.2.2 Canada

- 6.11.3 SMART FOOD PACKAGING REGULATIONS IN EUROPEAN UNION

- 6.11.4 SMART FOOD PACKAGING REGULATIONS IN ASIA PACIFIC

- 6.11.4.1 China

- 6.11.4.2 India

- 6.12 CASE STUDIES

- 6.13 KEY CONFERENCES AND EVENTS

- 6.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.14.2 BUYING CRITERIA

7 SMART FOOD PACKAGING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 BEVERAGES

- 7.2.1 IMPROVED QUALITY, FRESHNESS, AND SUSTAINABILITY TO DRIVE MARKET

- 7.3 FRUITS & VEGETABLES

- 7.3.1 ENHANCED FRESHNESS AND REDUCED WASTE TO DRIVE GROWTH

- 7.4 MEAT, POULTRY & SEAFOOD

- 7.4.1 FOOD QUALITY AND SAFETY IN MEAT, POULTRY, AND SEAFOOD MARKETS TO DRIVE GROWTH

- 7.5 BAKED & CONFECTIONERY PRODUCTS

- 7.5.1 ENHANCED FOOD FRESHNESS AND SHELF-LIFE EXTENSION TO DRIVE MARKET

- 7.6 MILK & DAIRY PRODUCTS

- 7.6.1 ENHANCED FOOD SAFETY AND SUSTAINABILITY TO DRIVE GROWTH

- 7.7 PROCESSED FOODS

- 7.7.1 INCREASED PRODUCTION AND CONSUMPTION OF PROCESSED FOODS TO DRIVE DEMAND

- 7.8 OTHER APPLICATIONS

8 SMART FOOD PACKAGING MARKET, BY FUNCTIONALITY

- 8.1 INTRODUCTION

- 8.2 BARRIER PROTECTION

- 8.2.1 ENHANCED FOOD QUALITY AND SAFETY THROUGH ADVANCED BARRIER PROTECTION TO DRIVE DEMAND

- 8.3 MOISTURE & GAS CONTROL

- 8.3.1 OPTIMIZED FOOD FRESHNESS WITH ADVANCED MOISTURE & GAS CONTROL TO DRIVE GROWTH

- 8.4 TEMPERATURE REGULATION

- 8.4.1 ENHANCED COLD CHAIN EFFICIENCY WITH ADVANCED TEMPERATURE REGULATION TO DRIVE MARKET

- 8.5 FOOD SAFETY MONITORING

- 8.5.1 ADVANCING FOOD SAFETY WITH REAL-TIME MONITORING TO DRIVE DEMAND

- 8.6 SHELF-LIFE EXTENSION

- 8.6.1 ENHANCED FOOD QUALITY AND REDUCED WASTAGE TO DRIVE MARKET

- 8.7 CONSUMER INTERACTION AND ENGAGEMENT

- 8.7.1 EVOLVING RETAIL AND CONSUMER EXPERIENCE TO DRIVE RFID AND NFC PACKAGING

- 8.8 PRODUCT AUTHENTICATION

- 8.8.1 ENHANCED PRODUCT INTEGRITY WITH ADVANCED AUTHENTICITY AND TRACEABILITY PACKAGING TECHNOLOGIES TO DRIVE DEMAND

9 SMART FOOD PACKAGING MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 PLASTIC

- 9.2.1 COST-EFFECTIVENESS AND EASY AVAILABILITY TO DRIVE MARKET

- 9.3 PAPER & PAPERBOARD

- 9.3.1 ECO-FRIENDLY INNOVATION AND SUSTAINABILITY TO DRIVE GROWTH

- 9.4 METAL

- 9.4.1 DURABILITY AND INNOVATION TO DRIVE GROWTH OF METAL IN SMART FOOD PACKAGING

- 9.5 GLASS

- 9.5.1 PREMIUM LOOK AND NON-REACTIVE NATURE OF GLASS TO DRIVE DEMAND

- 9.6 OTHER MATERIAL TYPES

10 SMART FOOD PACKAGING MARKET, BY PACKAGING TYPE

- 10.1 INTRODUCTION

- 10.2 ACTIVE PACKAGING

- 10.2.1 ANTIMICROBIAL AGENTS

- 10.2.1.1 Enhanced food safety and shelf life to drive market

- 10.2.2 GAS SCAVENGERS

- 10.2.2.1 Extended shelf life and quality preservation to drive growth

- 10.2.3 MOISTURE CONTROL (HUMIDITY REGULATORS) & TEMPERATURE CONTROL PACKAGING

- 10.2.3.1 Enhanced food freshness and sustainability with moisture and temperature control packaging to drive demand

- 10.2.1 ANTIMICROBIAL AGENTS

- 10.3 INTELLIGENT PACKAGING

- 10.3.1 INDICATORS AND BIOSENSORS

- 10.3.1.1 Enhanced food safety and freshness with advanced oxygen indicators and sensors in packaging to drive market

- 10.3.2 RFID (RADIO-FREQUENCY IDENTIFICATION) & NFC (NEAR FIELD COMMUNICATION)

- 10.3.2.1 Evolving retail and consumer experience to drive RFID and NFC packaging

- 10.3.3 AUTHENTICATION AND TRACEABILITY TECHNOLOGIES

- 10.3.3.1 Enhanced product integrity with advanced authenticity and traceability packaging technologies to drive demand

- 10.3.1 INDICATORS AND BIOSENSORS

- 10.4 MODIFIED ATMOSPHERE PACKAGING (MAP)

- 10.4.1 VACUUM PACKAGING

- 10.4.1.1 Maximizing freshness and efficiency with vacuum packaging for extended shelf life to drive market

- 10.4.2 GAS-FLUSHED PACKAGING

- 10.4.2.1 Flavor, texture, and color enhancing qualities to drive market growth in snacks and meat industry

- 10.4.1 VACUUM PACKAGING

- 10.5 EDIBLE PACKAGING

- 10.5.1 SUSTAINABILITY AND ECO-FRIENDLY SOLUTIONS TO DRIVE GROWTH

- 10.6 OTHER PACKAGING TYPES

11 SMART FOOD PACKAGING MARKET, BY TECHNOLOGY

- 11.1 INTRODUCTION

- 11.2 RFID & NFC

- 11.2.1 CASE STUDIES OF RFID APPLICATIONS IN FOOD MANUFACTURING INDUSTRY

- 11.3 SENSORS AND BIOSENSORS

- 11.3.1 MONITORING ENVIRONMENTAL CONDITIONS

- 11.3.2 BIOSENSORS FOR QUALITY ASSURANCE

- 11.3.3 GAS SENSORS FOR SPOILAGE DETECTION

- 11.3.4 QUALITY CONTROL AND CONSUMER ENGAGEMENT

- 11.4 BLOCKCHAIN TECHNOLOGY

- 11.5 INTERNET OF PACKAGING (IOP)

- 11.5.1 INTERNET OF PACKAGING IN FOOD INDUSTRY

- 11.5.2 BENEFITS OF INTERNET OF PACKAGING

- 11.6 ADVANCED 3D PRINTING

- 11.7 OTHER TECHNOLOGIES

12 SMART FOOD PACKAGING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Rise in consumption and sales of food products to drive demand

- 12.2.2 CANADA

- 12.2.2.1 Increased consumption of baked and confectionary products to drive market

- 12.2.3 MEXICO

- 12.2.3.1 Growth of meat and poultry industry to drive market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Increased growth in German food processing industry to drive market

- 12.3.2 UK

- 12.3.2.1 Growth in food industry to drive demand for innovative and sustainable smart packaging solutions

- 12.3.3 FRANCE

- 12.3.3.1 Demand for baked goods to drive market

- 12.3.4 SPAIN

- 12.3.4.1 High growth of food industry to drive market

- 12.3.5 ITALY

- 12.3.5.1 Increased demand and production of processed food to drive market

- 12.3.6 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Increased import & production of meat & seafood to drive market

- 12.4.2 INDIA

- 12.4.2.1 Increased trade of food items to drive MAP and active food packaging market

- 12.4.3 JAPAN

- 12.4.3.1 Increased demand from food industry to drive smart food packaging market

- 12.4.4 AUSTRALIA & NEW ZEALAND

- 12.4.4.1 Growth of food industry and sustainability concerns in packaging to drive market

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.5.1.1 Growth of retail food industry to drive market

- 12.5.2 ARGENTINA

- 12.5.2.1 Increased meat and poultry production to drive smart food packaging market

- 12.5.3 REST OF SOUTH AMERICA

- 12.5.1 BRAZIL

- 12.6 REST OF THE WORLD

- 12.6.1 MIDDLE EAST

- 12.6.1.1 Rising demand for processed foods and meat to drive market

- 12.6.2 AFRICA

- 12.6.2.1 Increased demand for food and meat to drive market

- 12.6.1 MIDDLE EAST

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 13.3 REVENUE ANALYSIS

- 13.4 MARKET SHARE ANALYSIS, 2023

- 13.4.1 MARKET RANKING ANALYSIS

- 13.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 13.5.1 STARS

- 13.5.2 EMERGING LEADERS

- 13.5.3 PERVASIVE PLAYERS

- 13.5.4 PARTICIPANTS

- 13.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2023

- 13.5.5.1 Company footprint

- 13.5.5.2 Regional footprint

- 13.5.5.3 Type footprint

- 13.5.5.4 Application footprint

- 13.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2023

- 13.6.1 PROGRESSIVE COMPANIES

- 13.6.2 RESPONSIVE COMPANIES

- 13.6.3 DYNAMIC COMPANIES

- 13.6.4 STARTING BLOCKS

- 13.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2023

- 13.6.5.1 Key start-ups/SMEs

- 13.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 13.7 COMPANY VALUATION AND FINANCIAL METRICS

- 13.8 BRAND/PRODUCT COMPARISON

- 13.9 COMPETITIVE SCENARIO AND TRENDS

- 13.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 AMCOR PLC

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.3.2 Expansions

- 14.1.1.3.3 Deals

- 14.1.1.3.4 Other deals/developments

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 SEALED AIR

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Expansions

- 14.1.2.3.3 Deals

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 BERRY GLOBAL INC.

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Expansions

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 THE TETRA LAVAL GROUP

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 MONDI

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Expansions

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 TOYO SEIKAN GROUP HOLDINGS, LTD.

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 MnM view

- 14.1.7 CROWN

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 MnM view

- 14.1.8 3M

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 MnM view

- 14.1.9 MITSUBISHI GAS CHEMICAL COMPANY, INC.

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.9.4 MnM view

- 14.1.10 MULTISORB

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.11 HUHTAMAKI OYJ

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.11.3 Recent developments

- 14.1.11.3.1 Product launches

- 14.1.11.4 MnM view

- 14.1.12 STEPAC

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Solutions/Services offered

- 14.1.12.3 Recent developments

- 14.1.12.3.1 Product launches

- 14.1.12.3.2 Deals

- 14.1.12.4 MnM view

- 14.1.13 CHECKPOINT SYSTEMS, INC.

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Solutions/Services offered

- 14.1.13.3 Recent developments

- 14.1.13.3.1 Deals

- 14.1.13.4 MnM view

- 14.1.14 NOVIPAX BUYER, LLC

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Solutions/Services offered

- 14.1.14.3 Recent developments

- 14.1.14.3.1 Product launches

- 14.1.14.3.2 Expansions

- 14.1.14.4 MnM view

- 14.1.15 TIMESTRIP UK LTD

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Solutions/Services offered

- 14.1.15.3 Recent developments

- 14.1.15.3.1 Product launches

- 14.1.15.3.2 Deals

- 14.1.15.4 MnM view

- 14.1.1 AMCOR PLC

- 14.2 OTHER PLAYERS

- 14.2.1 INSIGNIA TECHNOLOGIES LTD.

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product launches

- 14.2.1.4 MnM view

- 14.2.2 VARCODE

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Deals

- 14.2.2.4 MnM view

- 14.2.3 TIPA LTD

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.4 MnM view

- 14.2.4 FLEXIBLE PACKAGING SOLUTIONS

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Expansions

- 14.2.4.4 MnM view

- 14.2.5 NOTPLA

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 MnM view

- 14.2.6 VITSAB INTERNATIONAL AB

- 14.2.7 TEMPIX AB

- 14.2.8 BIOWRAP

- 14.2.9 IT'S FRESH LIMITED

- 14.2.10 KELP INDUSTRIES LTD

- 14.2.1 INSIGNIA TECHNOLOGIES LTD.

15 ADJACENT & RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LIMITATIONS

- 15.3 FOOD PACKAGING FILMS MARKET

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.4 FOOD & BEVERAGE METAL CANS MARKET

- 15.4.1 MARKET DEFINITION

- 15.4.2 MARKET OVERVIEW

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS