|

|

市場調査レポート

商品コード

1426509

LED照明の世界市場分析 (2024年)2024 Global LED Lighting Market Analysis |

||||||

|

|||||||

| LED照明の世界市場分析 (2024年) |

|

出版日: 2024年02月01日

発行: TrendForce

ページ情報: 英文

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

世界のLED照明の市場規模は、2024年には4%増加して、609億米ドルに達する見通し

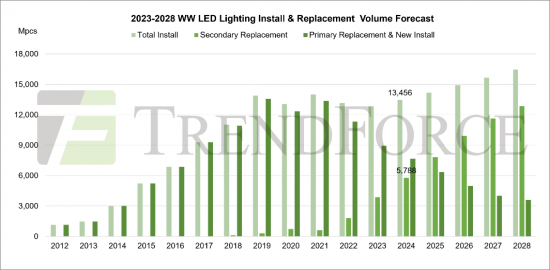

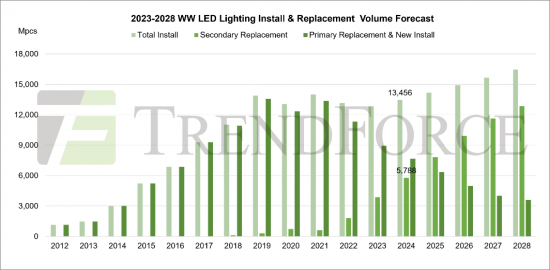

2023年の照明の市場需要は、多くの要因から期待された回復には至りませんでした。2023年のLED照明の市場規模は585億米ドル (前年比5%減) に再度下方修正しました。2024年には、約57億8,800万個のLEDランプと照明器具が寿命に達し、段階的に使用されなくなります。これにより、LED照明市場の減少傾向が逆転し、市場規模は609億米ドル (前年比4%増) に達すると予想されます。

農業用照明市場

照明メーカーは当面の業界の課題を受けて積極的な拡大計画を修正し、植物工場部門への投資意欲を減退させています。このような保守的な姿勢は、園芸用LED照明の普及プロセスを予想より遅らせることは間違いありません。一方、中国メーカーが園芸用照明の中流から上流のサプライチェーンに参入し始めると、照明供給の重要な障壁である光学式の専門知識がより広まります。これが業界チェーン内での競争を激化させ、価格引き下げを加速させます。しかし、最終市場の園芸用照明製品の価格と需要は一般照明ほど柔軟ではないため、価格引き下げによって大幅な需要拡大を刺激することは難しいです。また、価格の低下は、この業界の期待市場価値を一時的に低下させます。

照明メーカーの収益と発展戦略

2023年の照明メーカーの収益上位5社は、Signify、Acuity Brands、Panasonic、LEDVANCE (MLS Lightingが買収)、Zumtobelとなっています。2023年の照明需要は引き続き低迷しており、主要20社の総収入は4.5%減となりました。輸出が例年より低調であったため、中国メーカーは年間を通じて国内市場に注力しています。スマート調光、調色、発光効率の向上は、欧米企業の多くが新製品で強調している主要機能です。「天井用電球のない家庭用照明」というコンセプトがますます一般化していることを受け、各社は高品質のダウンライト、スポットライト、ストリップライトの開発に力を入れています。

LED照明パッケージ市場

下流工程セグメントの最終製品メーカーに比べ、照明用LED市場は2023年に価格引き下げ圧力が強まり、業界が復帰した2021年に追加された生産能力が解放されます。2023年の最終市場の需要は望ましい回復には至らず、むしろ縮小し、照明用LED分野の需給不均衡を悪化させました。TrendForceは、2023年の一般照明、建築照明、農業照明用LEDの市場規模は、2023年には42億3,600万米ドル (前年比17%減) に落ち込むと予測しています。

当レポートでは、世界のLED照明市場について分析し、LED照明市場全体の市場規模の推移と予測、製品別・電力別・地域別の詳細動向、園芸用・農業用LED照明の市場動向、主要企業のランキングと業績・戦略、照明用LEDパッケージの市場動向などを調査しております。

目次

第1章 世界の照明市場の動向

- 調査手法

- 製品の定義

- 製品定義:ランプ

- 製品定義:照明器具

- 世界のLED照明市場規模:製品別 (2024~2028年)

- 世界のLED照明市場規模:地域別 (2024~2028年)

- 世界のLED照明市場予測:製品別 (2024~2028年)

- 世界のLED照明市場予測:用途別 (2024~2028年)

- 世界のLED照明の市場規模 (金額ベース):地域別・製品別 (2023年)

- 世界のLED照明の市場規模 (数量ベース):地域別・製品別 (2023年)

- 世界のLED照明の市場規模 (金額ベース):地域別・製品別 (2024年)

- 世界のLED照明の市場規模 (数量ベース):地域別・製品別 (2024年)

- 世界のLED照明の市場規模 (金額ベース):地域別・製品別 (2028年)

- 世界のLED照明の市場規模 (数量ベース):地域別・製品別 (2028年)

第2章 園芸用照明・LED市場の動向

- 園芸用LED照明の市場需要

- 園芸用照明市場:主要な促進・抑制要因

- 園芸用LED照明の市場規模 - LED照明器具 (2024~2028年)

- 園芸用LED照明の市場規模:用途別 (2024~2028年)

- 園芸用LED照明の市場規模:地域別 (2024~2028年)

- 農業用LED照明の概要

- 農業用LED照明の市場規模 - LEDパッケージ (2024~2028年)

- 農業用LED照明の市場規模:電力別 (2024~2028年)

- 園芸用LED照明市場のサプライチェーン:最新情報

第3章 照明企業の収益ランキングと戦略

- 世界の主要照明メーカーの一覧

- 照明企業の収益ランキング上位20社:照明全体 (2021~2023年)

- 照明企業の収益ランキング上位20社:LED照明 (2021~2023年)

- 照明企業の収益と製品戦略

- Signify

- Zumtobel

- Fagerhult

- Acuity Brands

- Current Lighting Solutions

- Panasonic

- Endo Lighting

- 照明企業の収益と製品戦略

- 中国の照明企業の収益ランキング上位10社 (2022~2023年)

- 中国の照明企業の収益と製品戦略

- LEDVANCE/MLS

- Opple Lighting

- NVC Lighting

- Leedarson

- Foshan Lighting

- Yankon Group

- 中国の照明企業の収益と製品戦略

第4章 照明用LEDの市場規模

- 一般照明用LEDの市場価値:用途別 (2024~2028年)

- 一般照明用LEDの市場価値:パッケージの種類別 (2024~2028年)

- 一般照明用LEDの市場規模:電力別 (2024~2028年)

- LEDパッケージメーカー:照明市場全体での収益ランキング (2022~2023年)

- LEDパッケージメーカー:照明市場全体での市場シェア (2022~2023年)

付録:照明市場の規制と基準

TrendForce: Global LED Lighting Market Value Likely to Increase 4% To USD 60.9 Billion in 2024

According to TrendForce's latest market research report "TrendForce 2024 Global LED Lighting Market Analysis-1H24", the lighting market demand in 2023 did not experience the expected rebound due to numerous factors. TrendForce once again revised down the LED lighting market value for 2023 to USD 58.5 billion (-5% YoY). In 2024, about 5.788 billion LED lamps and luminaires will reach their service life limits and be phased out, leading to a considerable demand for second-time replacements. This is expected to reverse the declining trend in the LED lighting market, and the market value will reach USD 60.9 billion (+4% YoY).

Agricultural Lighting Market

On the one hand, lighting manufacturers have modified their aggressive expansion plans in response to the immediate industry challenges, which have in fact decreased the desire to invest in the plant factory sector. This conservative posture will undoubtedly slow down the penetration process of LED horticultural lighting compared to expectations. On the other hand, as Chinese manufacturers begin to enter the mid-to-upstream supply chain of horticultural lighting, optical formula expertise, the key barrier to lighting supply, becomes more widespread. This intensifies competition within the industry chain and accelerates price reductions. However, the prices and demand for end-market horticultural lighting products are not as flexible as those for general lighting, making it difficult to stimulate significant demand growth through price reduction. The decrease in prices will also temporarily lower the expected market value for this industry.

Governments around the world are increasing policy support to promote the development of smart agriculture for local food security concerns. For example, Israel, Dubai, and North Africa continue to invest in vertical farms. In 2023, China imported 160 million tons of grain, an increase of 11.7% compared to the previous year. The Chinese government will increase agricultural investments in the next five years, which is beneficial to the agricultural lighting market. Additionally, the acceleration of urbanization, the decrease in per capita arable land, the aging population, and a sharp decline in the number of newborns are significant social issues that drive breakthroughs and development in agricultural technology. In 2024, the agricultural lighting industry will combine AI, sensors, drones, and other technologies to further promote the maturity of smart agriculture. By 2025, some regions will achieve large-scale smart agriculture monitoring and management. This will bring new opportunities to the agricultural lighting market, including horticultural lighting, livestock lighting, aquaculture lighting, fishery lighting, and microalgae growth. LED agricultural lighting technology can not only improve quality and growth speed but also prevent pests and diseases to increase yield. With an improved standard of living, humans seek higher levels of spiritual and material enjoyment, leading to a segmented market for agricultural lighting that offers diverse flavors, high-tech, and a transparent cultivation process.

Lighting Manufacturer Revenues and Development Strategies

According to the data compiled by TrendForce, the top five lighting manufacturers by revenue for 2023 were Signify, Acuity Brands, Panasonic, LEDVANCE (acquired by MLS Lighting), and Zumtobel. The lighting demand for 2023 remained sluggish, with a 4.5% slump in total revenue posted by the top twenty players. As export performance was weaker than previous years, Chinese manufacturers turned to focus on the domestic market throughout the year. Smart dimming and color tuning as well as light efficacy improvement are major features emphasized by most European and US businesses for new products. Following the increasingly popular concept of "household lighting without overhead lights", companies have been striving to develop high-quality downlights, spotlights, and strip lights.

In 2023, the entire lighting industry suffered lower profits due to energy crisis, frequent supply chain woes, and high inventory levels, all of which hampered the progress of inventory depletion.

Regarding industry chain development, integration will be a dominant trend for leading lighting firms in the next three years, with economies of scale being the main tool for profitability. Enterprises without core technology or prominent self-owned brands are expected to be taken over or be eliminated. The challenging global economic conditions and political uncertainty have prompted governments worldwide to cut infrastructure spending. As 2024 will be a crucial year for governments to validate climate efforts, they are likely to allocate higher budget for fixture replacement, giving rise to the LED lighting replacement market.

LED Lighting Package Market

Compared to final product manufacturers in the downstream segment, those producing lighting LED market faced increased pressure on price reductions in 2023, with the production capacity added in 2021-where the industry returned-being released. The end-market demand for 2023 did not recover desirably and even shrank, exacerbating the supply-demand imbalance within the lighting LED sector. TrendForce estimated the market value of LEDs for general, architectural, and agricultural lighting to slump to USD 4.236 billion in 2023 (-17% YoY).

Despite the slower decline in demand for 2023, the long-term unprofitability prompted some companies to withdraw from the market, including multinational players intending to reduce losses. In the long run, the 2835/3030 LED will be the top two components for lighting, while other products could barely threaten their dominance. As miniaturization has never been the focus of lighting LEDs, the 3014/4014 package structures will not become a mainstream. Regardless of the long-term competition between COB and discrete components, the two are clearly differentiated in most applications. A TrendForce survey revealed that the market demand for LED commercial lighting returned in 2023, and that for agricultural (horticultural) lighting also recovered starting in 3Q23. However, the overall economic downturn still led to an increase in the market shares of low-end lighting LEDs. TrendForce estimated the global lighting LED market size (General Lighting) will reach USD 3.686 billion in 2024.

Table of Contents

Chapter 1. Global Lighting Market Trend

- TrendForce LED Lighting Market Scale- Methodology

- TrendForce LED Lighting Market- Product Definition

- TrendForce LED Lighting Market Product Definition- Lamps

- TrendForce LED Lighting Market Product Definition- Luminaires

- 2024-2028 Global LED Lighting Market Scale- by Product

- 2024-2028 Global LED Lighting Market Scale- by Region

- 2023-2024 Global LED Lighting Market Forecast- by Product

- 2024-2028 Global LED Lighting Market Forecast- by Application

- 2023 Global LED Lighting Market - Value Based: by Region vs. Product

- 2023 Global LED Lighting Market - Volume Based: by Region vs. Product

- 2024 Global LED Lighting Market - Value Based: by Region vs. Product

- 2024 Global LED Lighting Market - Volume Based: by Region vs. Product

- 2028 Global LED Lighting Market - Value Based: by Region vs. Product

- 2028 Global LED Lighting Market - Volume Based: by Region vs. Product

Chapter 2. Horticultural Lighting and LED Market Trend

- 2.1. LED Horticultural Lighting Market Demand

- Horticultural Lighting Market Key Forces & Restraining Forces

- 2024-2028 LED Horticultural Lighting Market Scale- LED Luminaires

- 2024-2028 LED Horticultural Lighting Market Scale by Application

- 2024-2028 LED Horticultural Lighting Market Scale by Region

- 2.2. Overview of LED Agriculture Lighting

- 2024-2028 Agricultural Lighting LED Market Scale- LED Package

- 2024-2028 Agricultural Lighting LED Market Scale- by Power

- Horticultural LED Lighting Market Supply Chain Update

Chapter 3. Lighting Player Revenue Ranking and Strategies

- Global Major Lighting Manufacturer List

- 2021-2023(E) Top 20 Lighting Player Revenue Ranking: Total Lighting

- 2021-2023(E) Top 20 Lighting Player Revenue Ranking: LED Lighting

- Lighting Player Revenue and Product Strategies

- Signify

- Zumtobel

- Fagerhult

- Acuity Brands

- Current Lighting Solutions

- Panasonic

- Endo Lighting

- Lighting Player Revenue and Product Strategies

- 2022-2023(E) Top 10 Chinese Lighting Player Revenue Ranking

- Chinese Lighting Player Revenue and Product Strategies

- LEDVANCE/MLS

- Opple Lighting

- NVC Lighting

- Leedarson

- Foshan Lighting

- Yankon Group

- Chinese Lighting Player Revenue and Product Strategies

Chapter 4. Lighting LED Market Scale

- 2024-2028 General Lighting LED Market Value- by Application

- 2024-2028 General Lighting LED Market Value - by Package Type

- 2024-2024 General Lighting LED Market Scale- by Power

- 2022-2023(E) LED Package Makers' Revenue Ranking in Total Lighting

- 2022-2023(E) LED Package Makers' Market Share in Total Lighting

Appendix. Lighting Market Regulations and Standards

- Policies and Regulations on the General Lighting Market- Abstract

- Policies and Regulations on the General Lighting Market - North America

- Policies and Regulations on the General Lighting Market - DLC for Horticultural Lighting

- Policies and Regulations on the General Lighting Market - Europe

- Policies and Regulations on the General Lighting Market - Africa

- Policies and Regulations on the General Lighting Market - Asia Pacific

- Policies and Regulations on the General Lighting Market - Greater Middle East

- Policies and Regulations on the General Lighting Market - Latin America and the Caribbean

- Policies and Regulations on the General Lighting Market - International Bodies

- Policies and Regulations on the General Lighting Market - Corporation