|

市場調査レポート

商品コード

1498830

電子材料ガス (Ne・Xeを含む) の世界市場(重要材料):2024~2025年 (Critical Materials Report)Electronic Gases including Ne & Xe Market Report 2024-2025 (Critical Materials Report) |

||||||

|

|||||||

| 電子材料ガス (Ne・Xeを含む) の世界市場(重要材料):2024~2025年 (Critical Materials Report) |

|

出版日: 2024年06月01日

発行: TECHCET

ページ情報: 英文 311 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

概要

当レポートでは、半導体デバイス製造に使用される電子材料ガスの市場環境とサプライチェーンを網羅しています。また、主要サプライヤーの情報、材料サプライチェーンの課題や動向、サプライヤーの市場シェアの推計・予測、材料セグメント別の市場予測などを掲載しています。

サンプルビュー

目次

第1章 エグゼクティブサマリー

第2章 調査範囲・目的・手法

第3章 半導体産業:市場の現状と展望

- 世界経済と展望

- 半導体産業と世界経済のつながり

- 半導体の売上高成長

- 台湾のアウトソーシングメーカーの月間売上動向

- チップの販売動向:電子製品セグメント別

- エレクトロニクスの展望

- 自動車産業の展望

- スマートフォンの展望

- PCの展望

- サーバー/IT市場

- 半導体製造の成長と拡大

- チップ拡張への巨額投資の真っ只中

- 米国の新しい工場

- 世界各地での工場の拡大が成長を牽引

- 設備投資の動向

- 高度ロジックの技術ロードマップ

- 工場投資の評価

- 政策と貿易の動向と影響

- 半導体材料の概要

- ウエハーの投入枚数:将来予測(~2028年)

- 材料市場の予測(~2028年)

第4章 電子材料ガス市場の動向

- 電子材料ガス市場の動向:概要

- 電子材料ガス市場の動向:2023~2024年

- 電子材料ガス市場の見通し

- 電子材料ガスの収益予測 (5年間分):セグメント別

- 電子材料ガスの収益予測 (5年間分):セグメント別 - 主要材料別の概略

- 電子材料ガスの供給能力・需要:概要

- 電子材料ガスの供給能力・需要、投資

- 電子材料ガスの生産量:地域別

- 電子材料ガスの生産能力の拡大

- 投資発表の概要

- 投資活動に関する追加コメント

- 希ガス (Xe、Kr、Ne):供給と需要のバラン:-概要

- ヘリウムの供給と需要

- 供給と需要のバランス:NF3、三フッ化窒素

- 供給と需要のバランス:WF6、六フッ化タングステン

- 価格動向

- 価格動向:ネオン

- 価格動向:キセノン

- 価格動向:クリプトン

- ヘリウム価格の動向と予測

- 技術動向/技術の促進要因:概要

- 電子材料ガス技術全般:概要

- 電子材料ガス技術の動向

- 特殊/新興材料とその用途

- WF6の市場需要:モリブデンによる潜在的な置き換え

- ALE (原子層) エッチングガスの一覧

- 技術動向と機会の概要

- 地域ごとの考慮事項

- EHS (環境・健康・安全) と貿易/物流の問題

- ロシアのウクライナ侵攻

- イエメンのフーシ派による紅海とアデン湾での攻撃が世界の海運を混乱させる

- 新たな中東紛争は、世界の技術サプライチェーンとIntelの拡張計画を混乱させる可能性がある

- パナマ運河の歴史的な干ばつ

- EHS問題

- EHS問題

- 貿易/物流問題

- 電子材料ガス市場の動向に関するアナリストの評価

第5章 供給サイドの市場情勢

- 電子材料ガスの市場シェア

- 産業用ガスの市場シェア

- 世界の大手電子材料ガス・サプライヤー上位5社:今四半期の活動と報告収益

- 米国のサプライヤーのランキング

- LINDE PLC (2023年通期および第4四半期): 売上高減少にもかかわらず堅調な利益成長、引き続き好調な業績を予測

- AIR LIQUIDE (2023年第4四半期および通年):2023年の収益はエネルギー価格の低下により圧迫されるもの、指標は良好

- Lerckのエレクトロニクス部門は、半導体の減速と市場の圧力の影響で、2023年第3四半期に4%の有機的売上高の減少に直面

- TAIYO NIPPON SANSO:第3四半期の売上高

- 地域別動向:韓国

- 地域別動向:日本

- 地域別動向:中国

- 地域別動向:ロシア

- 地域別動向:米国

- 地域別動向:欧州

- 企業合併・買収 (M&A) 活動とと事業協力 (パートナーシップ)

- 工場閉鎖/売却

- 新規参入企業

- 製造中止の恐れがあるサプライヤーまたは部品/製品ライン

- 電子材料ガスサプライヤー:アナリストによる評価

第6章 下層のサプライチェーン:電子材料ガス

- 下層 (サブティア) サプライチェーン:供給元と市場の概要

- バルクガスとその発生源

- 蛍石の供給

- 臭素の供給

- 下層のサプライチェーン:EHSと物流の問題

- 下層のサプライチェーン:アナリストによる評価

第7章 サプライヤーのプロファイル

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- その他20件以上

第8章 付録

- 複数の産業で使用されるガス

- 特殊ガス産業マトリックス

- 半導体デバイス製造に使用されるガス

- ディスプレイ業界で使用されるガス

- サプライヤー一覧:ガスの種類別

- 水素化物

- シリコン前駆体 (シラン)

- エッチング剤/チャンバー洗浄

- 蒸着/その他

- バルクガス

- エッチングガスのロードマップ

図表

LIST OF FIGURES

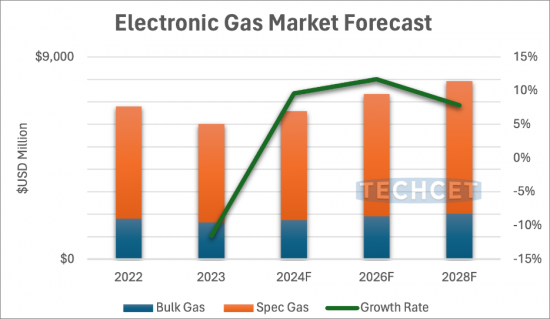

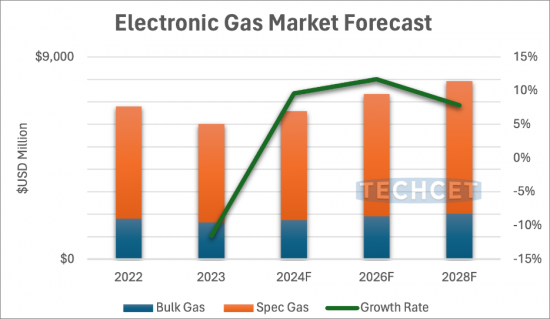

- FIGURE 1.1: ELECTRONIC GAS MARKET

- FIGURE 1.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 1.3: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 1.4: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104B

- FIGURE 1.5: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 3.1: GLOBAL ECONOMY AND THE ELECTRONICS SUPPLY CHAIN (2023)

- FIGURE 3.2: WORLDWIDE SEMICONDUCTOR SALES

- FIGURE 3.3: TECHCET'S TAIWAN SEMICONDUCTOR INDUSTRY INDEX (TTSI)

- FIGURE 3.4: 2023 SEMICONDUCTOR CHIP APPLICATIONS

- FIGURE 3.5: GLOBAL LIGHT VEHICLE UNIT SALES (IN MILLIONS OF UNITS)

- FIGURE 3.5: ELECTRIFICATION TREND BY WORLD REGION

- FIGURE 3.6: AUTOMOTIVE SEMICONDUCTOR PRODUCTION

- FIGURE 3.7: MOBILE PHONE SHIPMENTS, WW ESTIMATES

- FIGURE 3.8: WORLDWIDE PC AND TABLET FORECAST

- FIGURE 3.9: TSMC PHOENIX CAMPUS WITH THE 2ND FAB VISIBLE IN THE BACKGROUND

- FIGURE 3.10: ESTIMATED GLOBAL FAB SPENDING 2022-2027

- FIGURE 3.11: FAB EXPANSIONS WITHIN THE US

- FIGURE 3.12: SEMICONDUCTOR CHIP MANUFACTURING REGIONS OF THE WORLD

- FIGURE 3.13: GLOBAL TOTAL EQUIPMENT SPENDING (US$ M) AND Y-O-Y CHANGE

- FIGURE 3.14: ADVANCED LOGIC DEVICE TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.15: DRAM TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.16: 3D NAND TECHNOLOGY ROADMAP OVERVIEW

- FIGURE 3.17: INTEL OHIO PLANT SITE AS OF FEB. 2024

- FIGURE 3.18: TECHCET WAFER START FORECAST BY NODE SEGMENTS

- FIGURE 3.19: TECHCET WORLDWIDE MATERIALS FORECAST ($M USD)

- FIGURE 4.1: ELECTRONIC GAS MARKET

- FIGURE 4.2: HELIUM DEMAND 2023 - 7.4 BCF

- FIGURE 4.3: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- FIGURE 4.4: NEON SUPPLY/DEMAND FORECAST

- FIGURE 4.5: GLOBAL NEON REVENUES

- FIGURE 4.6: XENON SUPPLY/DEMAND FORECAST

- FIGURE 4.7: GLOBAL XENON REVENUES

- FIGURE 4.8: KRYPTON SUPPLY/DEMAND FORECAST

- FIGURE 4.9: GLOBAL KRYPTON REVENUES

- FIGURE 4.10: HELIUM SUPPLY & DEMAND (BCF)

- FIGURE 4.11: HELIUM DEMAND BY APPLICATION 2023 - 5.9 BCF

- FIGURE 4.12: WW HELIUM CAPACITY BY REGION 2023 VS. 2028 (BCF)

- FIGURE 4.13: HELIUM SUPPLY RISK BY COUNTRY 2030

- FIGURE 4.14: NF3 SUPPLY/DEMAND FORECAST

- FIGURE 4.15: WF6 SUPPLY/DEMAND FORECAST

- FIGURE 4.16: WORLDWIDE NOBLE GASES ASP TREND

- FIGURE 4.17: MO PRECURSORS

- FIGURE 4.18: PLASMA AND THERMAL ALE PROCESSES

- FIGURE 4.19: 2023 SEMICONDUCTOR ELECTRONIC GASES REVENUE SHARE BY REGION

- FIGURE 4.20: GREENHOUSE GAS PROTOCOL, DETAILED CATEGORIES

- FIGURE 4.21: SCOPE 3 EMISSIONS FOR SEMICONDUCTOR COMPANIES

- FIGURE 4.22: CO2-EQUIVALENT EMISSIONS FOR TYPICAL FAB

- FIGURE 5.1: TOTAL ELECTRONIC GAS MARKET SHARE 2023, US$6.01B

- FIGURE 5.2: TOTAL INDUSTRIAL GAS MARKET SHARE 2023, US$104 B

- FIGURE 5.3: TOP-5 ELECTRONIC GASES MAKERS' QUARTERLY COMBINED SALES (LINDE, AL, AP, RESONAC, TNSC)

- FIGURE 5.4: AIR LIQUIDE'S Q4 AND 2023 REVENUES

- FIGURE 5.5: MERCK'S 2023 REVENUES

- FIGURE 5.6: TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- FIGURE 5.7: KOREA SEMICONDUCTOR DEVELOPMENT PLAN

- FIGURE 6.1: LEADING COUNTRIES BASED ON MINE PRODUCTION OF FLUORSPAR WORLDWIDE IN 2023

- FIGURE 6.2: WW RESERVES OF FLUORSPAR IN 2023, BY COUNTRY (US$/KILOTONNE)

- FIGURE 6.3: FLUORSPAR PRICE IN US 2014-2023 (US$/KILOTONNE)

- FIGURE 6.4: WW BROMINE SUPPLY 2023 (KILOTONNES)

- FIGURE 8.1: ELECTRONIC SPECIALTY GASES

- FIGURE 8.2: BULK GASES

LIST OF TABLES

- TABLE 1.1: ELECTRONIC GASES(S) GROWTH OVERVIEW

- TABLE 1.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 1.3: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 3.1: GLOBAL GDP AND SEMICONDUCTOR REVENUES

- TABLE 3.2: WORLD BANK ECONOMIC OUTLOOK (JANUARY 2024)

- TABLE 3.3: BATTERY ELECTRIC VEHICLE (BEV) REGIONAL TRENDS

- TABLE 3.4: DATA CENTER SYSTEMS AND COMMUNICATION SERVICES MARKET SPENDING 2023

- TABLE 4.1: ELECTRONIC GASES SUPPLIER MANUFACTURING LOCATIONS

- TABLE 4.2: OVERVIEW OF ANNOUNCED 2023/2024 ELECTRONIC GASES SUPPLIER INVESTMENTS

- TABLE 4.3: REGIONAL SUMMARY OF GAS MARKET

- TABLE 4.4: 5-YEAR SPECIALTY GAS SUPPLY & DEMAND

- TABLE 4.5: SUPPLIERS WITH LOCATIONS IN AREAS OF HIGH RISK

- TABLE 4.6: GAS TRENDS AND OPPORTUNITIES BY DEVICE TYPE

- TABLE 5.1: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.2: ESTIMATED MARKET SHARE BY SUPPLIER

- TABLE 5.3: ESTIMATED SUPPLY CHAIN SUPPLIER RANKING

- TABLE 6.1: BULK AND INERT GAS APPLICATION AND SOURCE DESCRIPTION

- TABLE 8.1: SPECIALTY GAS INDUSTRY MATRIX

- TABLE 8.2: GASES USED IN FPD MANUFACTURING

- TABLE 8.3: HYDRIDE GAS SUPPLIERS

- TABLE 8.4: SILICON PRECURSOR SUPPLIERS

- TABLE 8.5: ETCHANT GAS SUPPLIERS

- TABLE 8.6: DEPOSITION/MISC. GAS SUPPLIERS

- TABLE 8.7: BULK GAS SUPPLIERS

- TABLE 8.8: ETCH ROADMAPS

- TABLE 8.9: ETCH ROADMAPS

- TABLE 8.10: ETCH ROADMAPS

目次

This report covers the market landscape and supply-chain for Electronic Gases used in semiconductor device fabrication. It includes information about key suppliers, issues/trends in the material supply chain, estimates on supplier market share, and forecast for the material segments.

SAMPLE VIEW

TABLE OF CONTENTS

1 EXECUTIVE SUMMARY

- 1.1 ELECTRONIC GASES BUSINESS - MARKET OVERVIEW

- 1.2 MARKET TRENDS IMPACTING 2024 OUTLOOK

- 1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 1.5 ELECTRONIC GASES SEGMENT TRENDS

- 1.6 TECHNOLOGY TRENDS

- 1.7 COMPETITIVE LANDSCAPE - ELECTRONIC GASES

- 1.7.1 COMPETITIVE LANDSCAPE - INDUSTRIAL GASES

- 1.8 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 1.9 EHS, TRADE, AND/OR LOGISTICS ISSUES/CONCERNS

- 1.10 ANALYST ASSESSMENT OF ELECTRONIC GASES

2 SCOPE, PURPOSE AND METHODOLOGY

- 2.1 SCOPE

- 2.2 METHODOLOGY

- 2.3 OVERVIEW OF OTHER TECHCET CMR(TM) OFFERINGS

3 SEMICONDUCTOR INDUSTRY MARKET STATUS & OUTLOOK

- 3.1 WORLDWIDE ECONOMY AND OUTLOOK

- 3.1.1 SEMICONDUCTOR INDUSTRIES TIES TO THE GLOBAL ECONOMY

- 3.1.2 SEMICONDUCTOR SALES GROWTH

- 3.1.3 TAIWAN OUTSOURCE MANUFACTURER MONTHLY SALES TRENDS

- 3.2 CHIPS SALES BY ELECTRONIC GOODS SEGMENT

- 3.2.1 ELECTRONICS OUTLOOK

- 3.2.2 AUTOMOTIVE INDUSTRY OUTLOOK

- 3.2.2.1 ELECTRIC VEHICLE (EV) MARKET TRENDS

- 3.2.2.2 INCREASE IN SEMICONDUCTOR CONTENT FOR AUTOS

- 3.2.3 SMARTPHONE OUTLOOK

- 3.2.4 PC OUTLOOK

- 3.2.5 SERVERS / IT MARKET

- 3.3 SEMICONDUCTOR FABRICATION GROWTH & EXPANSION

- 3.3.1 IN THE MIDST OF HUGE INVESTMENT IN CHIP EXPANSIONS

- 3.3.2 NEW FABS IN THE US

- 3.3.3 WW FAB EXPANSION DRIVING GROWTH

- 3.3.4 EQUIPMENT SPENDING TRENDS

- 3.3.5 ADVANCED LOGIC TECHNOLOGY ROADMAPS

- 3.3.5.1 DRAM TECHNOLOGY ROADMAPS

- 3.3.5.2 3D NAND TECHNOLOGY ROADMAPS

- 3.3.6 FAB INVESTMENT ASSESSMENT

- 3.4 POLICY & TRADE TRENDS AND IMPACT

- 3.5 SEMICONDUCTOR MATERIALS OVERVIEW

- 3.5.1 TECHCET WAFER STARTS FORECAST THROUGH 2028

- 3.5.2 TECHCET MATERIALS MARKET FORECAST THROUGH 2028

4 ELECTRONIC GASES MARKET TRENDS

- 4.1 ELECTRONIC GASES MARKET TRENDS - OUTLINE

- 4.1.1 2023 ELECTRONIC GASES MARKET LEADING INTO 2024

- 4.1.2 ELECTRONIC GASES MARKET OUTLOOK

- 4.1.3 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT

- 4.1.4 ELECTRONIC GASES 5-YEAR REVENUE FORECAST BY SEGMENT-HIGHLIGHT KEY MATERIALS

- 4.2 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, OVERVIEW

- 4.2.1 ELECTRONIC GASES SUPPLY CAPACITY AND DEMAND, INVESTMENTS

- 4.2.2 ELECTRONIC GASES PRODUCTION BY REGION

- 4.2.3 ELECTRONIC GASES PRODUCTION CAPACITY EXPANSIONS

- 4.2.4 INVESTMENT ANNOUNCEMENTS OVERVIEW

- 4.2.4.1 REGIONAL ACTIVITY SPECIALTY GAS INVESTMENTS

- 4.2.5 INVESTMENT ACTIVITY ADDITIONAL COMMENTS

- 4.2.6 RARE GASES - XE, KR, NE - SUPPLY VS. DEMAND BALANCE - OVERVIEW

- 4.2.6.1 SPECIALTY GAS MARKET: 5-YEAR SUPPLY & DEMAND, SELECT GASES

- 4.2.6.2 SUPPLY VS. DEMAND BALANCE - NEON

- 4.2.6.3 SUPPLY VS. DEMAND BALANCE - NEON (CONTINUED)

- 4.2.6.4 SUPPLY VS. DEMAND BALANCE - XENON

- 4.2.6.5 SUPPLY VS. DEMAND BALANCE - KRYPTON

- 4.2.7 HELIUM SUPPLY V. DEMAND

- 4.2.7.1 SUPPLY VS. DEMAND BALANCE - HELIUM

- 4.2.7.2 SUPPLY VS. DEMAND BALANCE - REGIONAL HELIUM SUPPLY

- 4.2.7.3 HELIUM SUPPLY RISK BY COUNTRY 2030

- 4.2.7.4 KEY PLAYERS IN THE HELIUM SUPPLY CHAIN

- 4.2.8 SUPPLY VS. DEMAND BALANCE - NF3, NITROGEN TRIFLUORIDE

- 4.2.8.1 ELECTRONIC GASES MARKET OUTLOOK - NF3

- 4.2.9 SUPPLY VS. DEMAND BALANCE - WF6, TUNGSTEN HEXAFLUORIDE

- 4.3 PRICING TRENDS

- 4.3.1 PRICING TRENDS - NEON

- 4.3.2 PRICING TRENDS - XENON

- 4.3.3 PRICING TRENDS - KRYPTON

- 4.3.4 HELIUM PRICE TREND & FORECAST

- 4.4 TECHNOLOGY TRENDS/TECHNICAL DRIVERS - OUTLINE

- 4.4.1 ELECTRONIC GASES GENERAL TECHNOLOGY OVERVIEW

- 4.4.2 ELECTRONIC GASES TECHNOLOGY TRENDS

- 4.4.3 SPECIALTY/EMERGING MATERIAL AND APPLICATIONS

- 4.4.4 WF6 MARKET DEMAND, POTENTIAL DISPLACEMENT BY MOLYBDENUM

- 4.4.5 ALE ETCH GAS LISTING

- 4.4.6 SUMMARY OF TECHNICAL TRENDS AND OPPORTUNITIES

- 4.5 REGIONAL CONSIDERATIONS

- 4.6 EHS AND TRADE/LOGISTIC ISSUES

- 4.6.1 RUSSIA INVASION OF UKRAINE

- 4.6.2 YEMEN'S HOUTHI ATTACKS IN THE RED SEA AND GULF OF ADEN DISRUPT GLOBAL SHIPPING

- 4.6.3 NEW MIDDLE EAST CONFLICT COULD DISRUPT GLOBAL TECH SUPPLY CHAIN AND INTEL'S EXPANSION PLANS

- 4.6.4 PANAMA CANAL HISTORIC DROUGHT

- 4.6.5 EHS ISSUES

- 4.6.6 EHS ISSUES

- 4.6.7 TRADE/LOGISTICS ISSUES

- 4.7 ANALYST ASSESSMENT OF ELECTRONIC GASES MARKET TRENDS

5 SUPPLY-SIDE MARKET LANDSCAPE

- 5.1 ELECTRONIC GASES MARKET SHARE

- 5.1.1 INDUSTRIAL GASES MARKET SHARE

- 5.2 CURRENT QUARTER TOP-5 GLOBAL ELECTRONIC GASES SUPPLIERS' ACTIVITIES & REPORTED REVENUES

- 5.2.1 US SUPPLIER RANKING

- 5.3 LINDE PLC FULL YEAR 2023 AND Q4 - ROBUST EARNINGS GROWTH DESPITE SALES DECLINE, FORECASTS CONTINUED STRONG PERFORMANCE

- 5.3.1 AIR LIQUIDE'S Q4 AND 2023 REVENUES WEIGHED BY DECLINING ENERGY PRICES, BUT SHOWING POSITIVE METRICS

- 5.3.2 MERCK'S ELECTRONICS SECTOR FACES 4% ORGANIC SALES DECLINE IN Q3 2023, IMPACTED BY SEMICONDUCTOR SLOWDOWN AND MARKET PRESSURES

- 5.3.3 TAIYO NIPPON SANSO REVENUES Q3 RESULTS

- 5.4 REGIONAL TRENDS- KOREA

- 5.4.1 REGIONAL TRENDS- JAPAN

- 5.4.2 REGIONAL TRENDS- CHINA

- 5.4.3 REGIONAL TRENDS - RUSSIA

- 5.4.4 REGIONAL TRENDS- USA

- 5.4.5 REGIONAL TRENDS- EU

- 5.5 M&A ACTIVITY AND PARTNERSHIPS

- 5.5.1 M&A ACTIVITY AND PARTNERSHIPS

- 5.6 PLANT CLOSURES / DIVESTITURES

- 5.7 NEW ENTRANTS

- 5.8 SUPPLIERS OR PARTS/PRODUCT LINES THAT ARE AT RISK OF DISCONTINUATIONS

- 5.9 TECHCET ANALYST ASSESSMENT OF ELECTRONIC GAS SUPPLIERS

6 SUB-TIER SUPPLY CHAIN, ELECTRONIC GASES

- 6.1 SUB-TIER SUPPLY CHAIN: SOURCES & MARKETS OVERVIEW

- 6.1.1 BULK GASES AND THEIR SOURCES

- 6.1.2 FLUORSPAR SUPPLY

- 6.1.2.1 FLUORSPAR WORLD RESERVES

- 6.1.2.2 FLUORSPAR SUPPLY, DEMAND AND PRICING IMPACTS

- 6.1.3 BROMINE SUPPLY

- 6.2 SUB-TIER SUPPLY-CHAIN EHS AND LOGISTICS ISSUES

- 6.3 SUB-TIER SUPPLY-CHAIN TECHCET ANALYST ASSESSMENT

7 SUPPLIER PROFILES

- Air Liquide

- Air Products

- Air Water

- Cryoin Engineering

- DuPont

- ...AND 20+ MORE

8 APPENDIX

- 8.1 GASES USED BY MULTIPLE INDUSTRIES

- 8.1.1 SPECIALTY GAS INDUSTRY MATRIX

- 8.1.2 GASES USED FOR SEMICONDUCTOR DEVICE MANUFACTURING

- 8.1.3 GASES USED IN THE DISPLAY INDUSTRY

- 8.2 SUPPLIER LISTING BY GAS TYPE

- 8.2.1 HYDRIDES

- 8.2.2 SILICON PRECURSORS (SILANES)

- 8.2.3 ETCHANTS/CHAMBER CLEAN

- 8.2.4 DEPOSITION/MISC

- 8.2.5 BULK GASES

- 8.3 ETCH GAS ROADMAPS

- 8.3.1 ETCH ROADMAPS 1 OF 3

- 8.3.2 ETCH ROADMAPS 2 OF 3

- 8.3.3 ETCH ROADMAPS 3 OF 3