|

|

市場調査レポート

商品コード

1691632

高温用半導体デバイス:市場機会Semiconductor Devices for High-Temperature Applications: Market Opportunities |

||||||

|

|||||||

| 高温用半導体デバイス:市場機会 |

|

出版日: 2025年03月28日

発行: BCC Research

ページ情報: 英文 141 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界の高温用半導体デバイスの市場規模は、2024年の118億米ドルから、予測期間中はCAGR 9.4%で推移し、2029年には185億米ドルに達すると予測されています。

シリコン市場は、2024年の84億米ドルから、予測期間中はCAGR 8.9%で推移し、2029年には128億米ドルに達すると予測されています。III-V族材料の市場は、2024年の34億米ドルから、予測期間中はCAGR 10.6%で推移し、2029年には57億米ドルに達すると予測されています。

当レポートでは、世界の高温用半導体デバイスの市場を調査し、市場概要、市場影響因子および市場機会の分析、法規制環境、新興技術および技術開発の動向、市場規模の推移・予測、各種区分・地域別の詳細分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 エグゼクティブサマリー

- 市場見通し

- 調査範囲

- 市場サマリー

- 市場力学と成長要因

- 新興技術

- セグメント分析

- 地域別洞察と新興市場

- 総論

第2章 市場概要

- 現在の市場シナリオと将来の期待

- マクロ経済要因分析

- インフレ上昇と労働力不足の影響

- 為替レートの変動

- 地政学的緊張と貿易動向

- ポーターのファイブフォース分析

- バリューチェーン分析

- 規制状況

第3章 市場力学

- 重要ポイント

- 市場促進要因

- UWBG材料の出現

- 高温電子機器の需要の増加

- 電気航空機とEVの需要の増加

- 市場抑制要因

- 半導体デバイスの設計、テスト、製造の複雑さ

- 特殊材料のコスト上昇

- パッケージングの制限と標準化されたテストの欠如

- 市場機会

- 政府の取り組みと協力の拡大

- 超高温エレクトロニクスの進歩

- 世界の宇宙探査の増加

第4章 新たな動向と技術

- 概要

- 新たな動向

- 高温SiC技術と製造の進歩

- シリコンを超える超高温半導体材料への注目の高まり

- 新興技術

- 信頼性の高い高温半導体動作を可能にするパッケージングの革新

- 強誘電体不揮発性メモリ (NVM) と熱管理のイノベーション

- 特許分析

- 地理的パターン

- 主な調査結果

第5章 市場セグメンテーション分析

- セグメンテーションの内訳

- 市場内訳:材料別

- 重要ポイント

- シリコン

- III-V族材料

- ガリウムヒ素 (GaAs)

- 窒化ガリウム (GaN)

- シリコンカーバイド (SiC)

- その他

- 市場内訳:デバイスタイプ別

- 重要ポイント

- マイクロコントローラ&プロセシング

- パワー半導体

- 電力管理・制御

- その他

- 市場内訳:動作温度別

- 重要ポイント

- 126°C~250°C

- 250°C超

- 市場内訳:産業別

- 重要ポイント

- 産業・計測機器

- 自動車

- 航空宇宙・防衛

- エネルギー・電力

- その他

- 地理的内訳

- 市場内訳:地域別

- 重要ポイント

- 北米

- 欧州

- アジア太平洋

- その他の地域

第6章 競合情報

- 重要ポイント

- 市場エコシステム分析

- 主要企業の分析

- Infineon Technologies AG

- NXP Semiconductors

- TDK Corp.

- 戦略分析

第7章 高温用半導体デバイス産業における持続可能性:ESGの観点

- 重要ポイント

- 高温用半導体デバイス市場における主要なESG問題

- 高温用半導体デバイスにおける主要な環境問題

- 高温用半導体デバイスにおける社会的責任

- 高温用半導体デバイスのガバナンス

- ESGパフォーマンス分析

- 環境パフォーマンス

- 社会的パフォーマンス

- ガバナンスパフォーマンス

- 高温用半導体デバイス市場におけるESGの現状

- BCCからの総論

第8章 付録

- 調査手法

- 略語

- 企業プロファイル

- ALLEGRO MICROSYSTEMS INC.

- ANALOG DEVICES INC.

- CISSOID

- FUJITSU

- GENERAL ELECTRIC CO.

- HONEYWELL INTERNATIONAL INC.

- INFINEON TECHNOLOGIES AG

- LATTICE SEMICONDUCTOR

- MITSUBISHI ELECTRIC CORP.

- NXP SEMICONDUCTORS

- QORVO INC.

- RENESAS ELECTRONICS CORP.

- RTX

- TDK CORP.

- TEXAS INSTRUMENTS INC.

- TOSHIBA CORP.

- WOLFSPEED INC.

List of Tables

- Summary Table : Global Market for Semiconductor Devices for High-Temperature Applications, by Materials, Through 2029

- Table 1 : Semiconductor Devices for High-Temperature Applications: Regulatory Bodies, Standards Organizations and Government Agencies, by Region

- Table 2 : Published Patents on Semiconductor Devices for High-Temperature Applications, January 2024-September 2024

- Table 3 : Global Market for Semiconductor Devices for High-Temperature Applications, by Materials, Through 2029

- Table 4 : Global Market for Silicon in Semiconductor Devices for High-Temperature Applications, by Region, Through 2029

- Table 5 : Global Market for III-V materials in Semiconductor Devices for High-Temperature Applications, by Region, Through 2029

- Table 6 : Global Market for Semiconductor Devices for High-Temperature Applications, by III-V Materials, Through 2029

- Table 7 : Global Market for Gallium Arsenide (GaAs) in Semiconductor Devices for High-Temperature Applications, by Region, Through 2029

- Table 8 : Global Market for GaN in Semiconductor Devices for High-Temperature Applications, by Region, Through 2029

- Table 9 : Global Market for III-SiC in Semiconductor Devices for High-Temperature Applications, by Region, Through 2029

- Table 10 : Global Market for Other III-V Materials in Semiconductor Devices for High-Temperature Applications, by Region, Through 2029

- Table 11 : Global Market for Semiconductor Devices for High-Temperature Applications, by Device Type, Through 2029

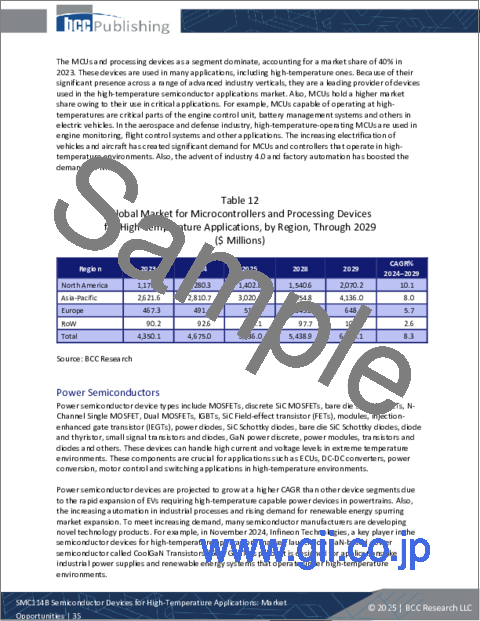

- Table 12 : Global Market for Microcontrollers and Processing Devices for High-Temperature Applications, by Region, Through 2029

- Table 13 : Global Market for Power Semiconductors for High-Temperature Applications, by Region, Through 2029

- Table 14 : Global Market for Power Management and Control for High-Temperature Applications, by Region, Through 2029

- Table 15 : Global Market for Other Device Types for High-Temperature Applications, by Region, Through 2029

- Table 16 : Global Market for Semiconductor Devices for High-Temperature Applications, by Operating Temperature, Through 2029

- Table 17 : Global Market for Semiconductor Devices for Temperatures Between 126°C and 250°C, by Region, Through 2029

- Table 18 : Global Market for Semiconductor Devices for Temperatures Exceeding 250°C, by Region, Through 2029

- Table 19 : Global Market for Semiconductor Devices for High-Temperature Applications, by Industry, Through 2029

- Table 20 : Global Market for Semiconductor Devices for High-Temperature Applications in Industrial and Instrumentation, by Region, Through 2029

- Table 21 : Global Market for Semiconductor Devices for High-Temperature Applications in the Automotive Industry, by Region, Through 2029

- Table 22 : Global Market for Semiconductor Devices for High-Temperature Applications in Aerospace and Defense Industry, by Region, Through 2029

- Table 23 : Global Market for Semiconductor Devices for High-Temperature Applications in Energy and Power Industries, by Region, Through 2029

- Table 24 : Global Market for Semiconductor Devices for High-Temperature Applications in Other Industries, by Region, Through 2029

- Table 25 : Global Market for Semiconductor Devices for High-Temperature Applications, by Region, Through 2029

- Table 26 : North American Market for Semiconductor Devices for High-Temperature Applications, by Country, Through 2029

- Table 27 : North American Market for Semiconductor Devices for High-Temperature Applications, by Materials, Through 2029

- Table 28 : North American Market for Semiconductor Devices for High-Temperature Applications, by Device Type, Through 2029

- Table 29 : North American Market for Semiconductor Devices for High-Temperature Applications, by Operating Temperature, Through 2029

- Table 30 : North American Market for Semiconductor Devices for High-Temperature Applications, by Industry, Through 2029

- Table 31 : European Market for Semiconductor Devices for High-Temperature Applications, by Country, Through 2029

- Table 32 : European Market for Semiconductor Devices for High-Temperature Applications, by Materials, Through 2029

- Table 33 : European Market for Semiconductor Devices for High-Temperature Applications, by Device Type, Through 2029

- Table 34 : European Market for Semiconductor Devices for High-Temperature Applications, by Operating Temperature, Through 2029

- Table 35 : European Market for Semiconductor Devices for High-Temperature Applications, by Industry, Through 2029

- Table 36 : Asia-Pacific Market for Semiconductor Devices for High-Temperature Applications, by Country, Through 2029

- Table 37 : Asia-Pacific Market for Semiconductor Devices for High-Temperature Applications, by Materials, Through 2029

- Table 38 : Asia-Pacific Market for Semiconductor Devices for High-Temperature Applications, by Device Type, Through 2029

- Table 39 : Asia-Pacific Market for Semiconductor Devices for High-Temperature Applications, by Operating Temperature, Through 2029

- Table 40 : Asia-Pacific Market for Semiconductor Devices for High-Temperature Applications, by Industry, Through 2029

- Table 41 : RoW Market for Semiconductor Devices for High-Temperature Applications, by Materials, Through 2029

- Table 42 : RoW Market for Semiconductor Devices for High-Temperature Applications, by Device Type, Through 2029

- Table 43 : RoW Market for Semiconductor Devices for High-Temperature Applications, by Operating Temperature, Through 2029

- Table 44 : RoW Market for Semiconductor Devices for High-Temperature Applications, by Industry, Through 2029

- Table 45 : Ranking of Key Players in the Global Semiconductor Devices Market for High-Temperature Applications, 2023

- Table 46 : Global Semiconductor Devices for High-Temperature Applications Market: Key Recent Developments, January 2022- November 2024

- Table 47 : Global Semiconductor Devices Market for High-Temperature Applications: Environmental Impact

- Table 48 : Global Semiconductor Devices Market for High-Temperature Applications: Social Impact

- Table 49 : Global Semiconductor Devices Market for High-Temperature Applications: Governance Impact

- Table 50 : Global Semiconductor Devices for High-Temperature Applications Market: ESG Risk Ratings Metric, 2023

- Table 51 : Abbreviations Used in the Report

- Table 52 : Allegro Microsystems Inc.: Company Snapshot

- Table 53 : Allegro Microsystems Inc.: Financial Performance, FY 2022 and 2023

- Table 54 : Allegro Microsystems Inc.: Product Portfolio

- Table 55 : Allegro Microsystems Inc.: News/Key Developments, 2024

- Table 56 : Analog Devices Inc.: Company Snapshot

- Table 57 : Analog Devices Inc.: Financial Performance, FY 2023 and 2024

- Table 58 : Analog Devices Inc.: Product Portfolio

- Table 59 : Analog Devices Inc.: News/Key Developments, 2023

- Table 60 : Cissoid: Company Snapshot

- Table 61 : Cissoid: Product Portfolio

- Table 62 : Fujitsu: Company Snapshot

- Table 63 : Fujitsu: Financial Performance, FY 2022 and 2023

- Table 64 : Fujitsu: Product Portfolio

- Table 65 : Fujitsu: Key Developments, 2022 and 2023

- Table 66 : General Electric Co.: Company Snapshot

- Table 67 : General Electric Co.: Financial Performance, FY 2022 and 2023

- Table 68 : General Electric Co.: Product Portfolio

- Table 69 : General Electric Co.: News/Key Developments, 2023

- Table 70 : Honeywell International Inc.: Company Snapshot

- Table 71 : Honeywell International Inc.: Financial Performance, FY 2022 and 2023

- Table 72 : Honeywell International Inc.: Product Portfolio

- Table 73 : Infineon Technologies AG: Company Snapshot

- Table 74 : Infineon Technologies AG: Financial Performance, FY 2023 and 2024

- Table 75 : Infineon Technologies AG: Product Portfolio

- Table 76 : Infineon Technologies AG: News/Key Developments, 2023

- Table 77 : Lattice Semiconductor: Company Snapshot

- Table 78 : Lattice Semiconductor: Financial Performance, FY 2022 and 2023

- Table 79 : Lattice Semiconductor: Product Portfolio

- Table 80 : Mitsubishi Electric Corp.: Company Snapshot

- Table 81 : Mitsubishi Electric Corp.: Financial Performance, FY 2022 and 2023

- Table 82 : Mitsubishi Electric Corp.: Product Portfolio

- Table 83 : NXP Semiconductors: Company Snapshot

- Table 84 : NXP Semiconductors: Financial Performance, FY 2022 and 2023

- Table 85 : NXP Semiconductors: Product Portfolio

- Table 86 : NXP Semiconductors: News/Key Developments, 2024

- Table 87 : Qorvo Inc.: Company Snapshot

- Table 88 : Qorvo Inc.: Financial Performance, FY 2022 and 2023

- Table 89 : Qorvo Inc.: Product Portfolio

- Table 90 : Renesas Electronics Corp.: Company Snapshot

- Table 91 : Renesas Electronics Corp.: Financial Performance, FY 2022 and 2023

- Table 92 : Renesas Electronics Corp.: Product Portfolio

- Table 93 : Renesas Electronics Corp.: News/Key Developments, 2023

- Table 94 : RTX: Company Snapshot

- Table 95 : RTX: Financial Performance, FY 2022 and 2023

- Table 96 : RTX: Product Portfolio

- Table 97 : RTX: News/Key Developments, 2024

- Table 98 : TDK Corp.: Company Snapshot

- Table 99 : TDK Corp.: Financial Performance, FY 2022 and 2023

- Table 100 : TDK Corp.: Product Portfolio

- Table 101 : TDK Corp.: News/Key Developments, 2024

- Table 102 : Texas Instruments Inc.: Company Snapshot

- Table 103 : Texas Instruments Inc.: Financial Performance, FY 2022 and 2023

- Table 104 : Texas Instruments Inc.: Product Portfolio

- Table 105 : Toshiba Corp.: Company Snapshot

- Table 106 : Toshiba Corp.: Financial Performance, FY 2022 and 2023

- Table 107 : Toshiba Corp.: Product Portfolio

- Table 108 : Toshiba Corp.: News/Key Developments, 2024

- Table 109 : Wolfspeed Inc.: Company Snapshot

- Table 110 : Wolfspeed Inc.: Financial Performance, FY 2022 and 2023

- Table 111 : Wolfspeed Inc.: Product Portfolio

- Table 112 : Wolfspeed Inc.: News/Key Developments, 2023

List of Figures

- Summary Figure : Global Market Shares of Semiconductor Devices for High-Temperature Applications, by Materials, 2023

- Figure 1 : Value Chain for Semiconductor Devices for High-Temperature Applications Market

- Figure 2 : Market Dynamics of Semiconductor Devices for High-Temperature Applications Market

- Figure 3 : Share of Published Patents and Patent Applications on Semiconductor Devices for High-Temperature Applications, by Applicants in Key Regions, July 2023-August 2024

- Figure 4 : Global Market Shares of Semiconductor Devices for High-Temperature Applications, by Materials, 2023

- Figure 5 : Global Market Shares of Semiconductor Devices for High-Temperature Applications, by III-V Materials, 2023

- Figure 6 : Global Market Shares of Semiconductor Devices for High-Temperature Applications, by Device Type, 2023

- Figure 7 : Global Market Shares of Semiconductor Devices for High-Temperature Applications, by Operating Temperature, 2023

- Figure 8 : Global Market Shares of Semiconductor Devices for High-Temperature Applications, by Industry, 2023

- Figure 9 : Global Market Shares of Semiconductor Devices for High-Temperature Applications Market, by Region, 2023

- Figure 10 : Global Semiconductor Devices Market for High-Temperature Applications Ecosystem

- Figure 11 : Allegro Microsystems Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 12 : Allegro Microsystems Inc.: Revenue Shares, by Region, FY 2023

- Figure 13 : Analog Devices Inc.: Revenue Shares, by Business Unit, FY 2024

- Figure 14 : Analog Devices Inc.: Revenue Shares, by Region, FY 2024

- Figure 15 : Fujitsu: Revenue Shares, by Business Unit, FY 2023

- Figure 16 : Fujitsu: Revenue Shares, by Region, FY 2023

- Figure 17 : General Electric Co.: Revenue Shares, by Business Unit, FY 2023

- Figure 18 : General Electric Co.: Revenue Shares, by Region, FY 2023

- Figure 19 : Honeywell International Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 20 : Honeywell International Inc.: Revenue Shares, by Region, FY 2023

- Figure 21 : Infineon Technologies AG: Revenue Shares, by Business Unit, FY 2024

- Figure 22 : Infineon Technologies AG: Revenue Shares, by Region, FY 2024

- Figure 23 : Lattice Semiconductor: Revenue Shares, by Business Unit, FY 2023

- Figure 24 : Lattice Semiconductor: Revenue Shares, by Region, FY 2023

- Figure 25 : Mitsubishi Electric Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 26 : Mitsubishi Electric Corp.: Revenue Shares, by Region, FY 2023

- Figure 27 : NXP Semiconductors: Revenue Shares, by Business Unit, FY 2023

- Figure 28 : NXP Semiconductors: Revenue Shares, by Region, FY 2023

- Figure 29 : Qorvo Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 30 : Qorvo Inc.: Revenue Shares, by Region, FY 2023

- Figure 31 : Renesas Electronics Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 32 : Renesas Electronics Corp.: Revenue Shares, by Region, FY 2023

- Figure 33 : RTX: Revenue Shares, by Business Unit, FY 2023

- Figure 34 : RTX: Revenue Shares, by Region, FY 2023

- Figure 35 : TDK Corp.: Revenue Shares, by Business Unit, FY 2023

- Figure 36 : TDK Corp.: Revenue Shares, by Region, FY 2023

- Figure 37 : Texas Instruments Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 38 : Texas Instruments Inc.: Revenue Shares, by Region, FY 2023

- Figure 39 : Wolfspeed Inc.: Revenue Shares, by Business Unit, FY 2023

- Figure 40 : Wolfspeed Inc.: Revenue Shares, by Region, FY 2023

The global market for semiconductor devices for high-temperature applications is estimated to increase from $11.8 billion in 2024 to reach $18.5 billion by 2029, at a compound annual growth rate (CAGR) of 9.4% from 2024 through 2029.

The silicon market for semiconductor devices for high-temperature applications is estimated to increase from $8.4 billion in 2024 to reach $12.8 billion by 2029, at a CAGR of 8.9% from 2024 through 2029.

The III-V materials market for semiconductor devices for high-temperature applications is estimated to increase from $3.4 billion in 2024 to reach $5.7 billion by 2029, at a CAGR of 10.6% from 2024 through 2029.

Report Scope

This report provides an overview of the global semiconductor devices for high-temperature applications market and analyzes market trends. It provides the global revenue (in $ millions) for segments and regions, considering 2023 as the base year, with estimated market data for 2024 through 2029. The market is based on materials, device types, operating temperatures, industries and regions. Geographical segments covered are North America (U.S., Canada, Mexico), Europe (U.K., Germany, France, Italy, Rest of Europe), Asia-Pacific (China, Japan, South Korea, Rest of Asia-Pacific) and the Rest of the World (RoW), which includes South America, Middle East and Africa. The report also focuses on emerging technologies and vendor landscape. It concludes with profiles of the major players in the market.

Report Includes

- 59 data tables and 54 additional tables

- An analysis of the global market for semiconductor devices for high-temperature applications

- Analyses of the global market trends, with data from 2023, estimates for 2024, forecasts for 2025 and 2026, and projections of compound annual growth rates (CAGRs) through 2029

- Evaluation of the market potential for semiconductor devices for high- temperature applications, industry growth drivers, and forecasts for this market's segments and sub-segments

- Estimates of the actual market size and revenue forecast for the global market for semiconductor devices for high-temperature applications, and a corresponding market share analysis by material type, device type, operating temperature, industry and region

- Description of gallium nitride (GaN), silicon carbide (SiC) and gallium arsenide (GaAs); their products and applications

- Discussion of the market dynamics and shifts, and the regulations, industry challenges, and macroeconomic factors affecting the demand for semiconductor devices for high-temperature applications

- Discussion on the industry's ESG challenges and practices

- Identification of the companies that are best positioned to meet this demand because of their proprietary technologies, strategic alliances or other advantages

- Insights into the industry structure for semiconductor devices for high-temperature applications, and the competitive landscape

- Company profiles of major players within the industry, including Infineon Technologies AG, NXP Semiconductors, TDK Corp., Wolfspeed Inc., and Allegro MicroSystems LLC.

Table of Contents

Chapter 1 Executive Summary

- Market Outlook

- Scope of Report

- Market Summary

- Market Dynamics and Growth Factors

- Emerging Technologies

- Segmental Analysis

- Regional Insights and Emerging Markets

- Conclusion

Chapter 2 Market Overview

- Current Market Scenario and Future Expectations

- Macro-Economic Factors Analysis

- Impact of Rising Inflation and Labor Shortages

- Currency Exchange Rate Fluctuations

- Geopolitical Tension and Trade Dynamics

- Porter's Five Force Analysis

- Value Chain Analysis

- Regulatory Landscape

Chapter 3 Market Dynamics

- Key Takeaways

- Market Drivers

- Emergence of UWBG Materials

- Growing Demand for High-Temperature Electronics

- Growing Demand for Electric Aircraft and EVs

- Market Restraints

- Complexity in Design, Testing and Manufacturing for Semiconductor Devices

- Higher Cost of Specialized Materials

- Packaging Limitations and Absence of Standardized Testing

- Market Opportunities

- Growing Government Initiatives and Collaborative Efforts

- Advancing Ultra-High-Temperature Electronics

- Increasing Global Space Exploration

Chapter 4 Emerging Trends and Technologies

- Overview

- Emerging Trends

- Advances in High-Temperature SiC Technologies and Manufacturing

- Rising Focus on Ultra-High-Temperature Semiconductors Materials Beyond Silicon

- Emerging Technologies

- Packaging Innovations Enabling Reliable High-Temperature Semiconductor Operation

- Ferroelectric Non-volatile Memory (NVM) and Thermal Management Innovations

- Patent Analysis

- Geographical Patterns

- Key Findings

Chapter 5 Market Segmentation Analysis

- Segmentation Breakdown

- Market Breakdown by Materials

- Key Takeaways

- Silicon

- III-V materials

- Gallium Arsenide (GaAs)

- Gallium Nitride (GaN)

- Silicon Carbide (SiC)

- Others

- Market Breakdown by Device Types

- Key Takeaways

- Microcontrollers and Processing

- Power Semiconductors

- Power Management and Control

- Others

- Market Breakdown by Operating Temperature

- Key Takeaways

- 126°C to 250°C

- Higher than 250°C

- Market Breakdown by Industry

- Key Takeaways

- Industrial and Instrumentation

- Automotive

- Aerospace and Defense

- Energy and Power

- Others

- Geographic Breakdown

- Market Breakdown by Region

- Key Takeaways

- North America

- Europe

- Asia-Pacific

- Rest of the World

Chapter 6 Competitive Intelligence

- Key Takeaways

- Market Ecosystem Analysis

- Analysis of Key Companies

- Infineon Technologies AG

- NXP Semiconductors

- TDK Corp.

- Strategic Analysis

Chapter 7 Sustainability in the Semiconductor Devices for High-Temperature Applications Industry: An ESG Perspective

- Key Takeaways

- Key ESG Issues in the Semiconductor Devices for High-Temperature Applications Market

- Key Environmental Issues in Semiconductor Devices for High-Temperature Applications

- Social Responsibility in Semiconductor Devices for High-Temperature Applications

- Governance in Semiconductor Devices for High-Temperature Applications

- ESG Performance Analysis

- Environmental Performance

- Social Performance

- Governance Performance

- Current Status of ESG in the Semiconductor Devices for High-Temperature Applications Market

- Concluding Remarks from BCC Research

Chapter 8 Appendix

- Methodology

- Abbreviations

- Company Profiles

- ALLEGRO MICROSYSTEMS INC.

- ANALOG DEVICES INC.

- CISSOID

- FUJITSU

- GENERAL ELECTRIC CO.

- HONEYWELL INTERNATIONAL INC.

- INFINEON TECHNOLOGIES AG

- LATTICE SEMICONDUCTOR

- MITSUBISHI ELECTRIC CORP.

- NXP SEMICONDUCTORS

- QORVO INC.

- RENESAS ELECTRONICS CORP.

- RTX

- TDK CORP.

- TEXAS INSTRUMENTS INC.

- TOSHIBA CORP.

- WOLFSPEED INC.