|

|

市場調査レポート

商品コード

1754825

データセンターサーバーの世界市場:2034年までの機会と戦略Data Center Server Global Market Opportunities And Strategies To 2034 |

||||||

カスタマイズ可能

|

|||||||

| データセンターサーバーの世界市場:2034年までの機会と戦略 |

|

出版日: 2025年06月16日

発行: The Business Research Company

ページ情報: 英文 345 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

世界のデータセンターサーバー市場は、2019年に439億8,411万米ドルと評価され、2024年まで5.00%以上の複合年間成長率(CAGR)で成長しました。

クラウドコンピューティングの採用拡大

クラウドコンピューティングの採用拡大は、歴史的な期間におけるデータセンターサーバー市場の成長に貢献しました。クラウド・コンピューティングの採用拡大により、データセンターサーバーの需要が大幅に増加しています。クラウド・サービス・プロバイダーは、大規模なデータ・ストレージと処理機能をサポートする信頼性と拡張性の高いインフラストラクチャを必要としているためです。このような需要の急増により、データセンターへの投資が拡大し、大量のデータを効率的に管理し、最適なパフォーマンスでクラウドベースのサービスを提供できる高性能サーバーのニーズがさらに高まっています。例えば、ルクセンブルクを拠点とする欧州連合(EU)の統計局であるユーロスタットによると、2023年12月、欧州連合(EU)の企業の45.2%がクラウド・コンピューティング・サービスを購入しており、これは2021年と比較して4.2ポイント上昇したことになります。このため、クラウド・コンピューティングの普及がデータセンターサーバー市場の成長を牽引しました。

目次

第1章 エグゼクティブサマリー

- データセンターサーバー-市場の魅力とマクロ経済情勢

第2章 目次

第3章 表一覧

第4章 図一覧

第5章 レポート構成

第6章 市場の特徴

- 一般的な市場の定義

- 概要

- データセンターサーバー市場定義とセグメンテーション

- 市場セグメンテーション:製品別

- ラックサーバー

- ブレードサーバー

- マイクロサーバー

- タワーサーバー

- 市場セグメンテーション:用途別

- 産業用サーバー

- 商用サーバー

- 市場セグメンテーション:業界別

- BFSI(銀行、金融サービス、保険)

- ITと通信

- 政府

- 防衛

- その他の業界

第7章 主要な市場動向

- モジュラーサーバーソリューションによるAIとデータセンター開発の革新

- AIとクラウドインフラの拡張をサポートするローカライズされたスケーラブルなデータセンターソリューションのイントロダクション

- データセンターリソースを最適化する高密度コンピューティングサーバー

- 比類のないパフォーマンスと拡張性を実現する次世代ブレードサーバー

第8章 世界データセンターサーバー

- 世界: PESTEL分析

- 政治的

- 経済

- 社会

- 技術的

- 環境

- 法律上

- エンドユーザーB2B市場の分析

- 銀行金融サービスおよび保険(BFSI)

- 政府

- ITと通信

- 防衛

- その他のエンドユーザー

- 世界のデータセンターサーバー市場:成長率分析

- 市場成長実績, 2019-2024

- 市場促進要因2019年~2024年

- 市場抑制要因2019-2024年

- 市場成長予測, 2024-2029, 2034F

- 市場促進要因2024年~2029年

- 市場抑制要因2024年~2029年

- 成長予測の貢献要因

- 量的成長の貢献者

- 促進要因

- 抑制要因

- 世界のデータセンターサーバー総アドレス可能市場(TAM)

第9章 世界のデータセンターサーバー市場:セグメンテーション

- 世界のデータセンターサーバー市場:製品別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のデータセンターサーバー市場:用途別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のデータセンターサーバー市場:業界別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のデータセンターサーバー市場、ラックサーバー、タイプ別サブセグメンテーション:実績と予測, 2019-2024, 2029F, 2034F

- 世界のデータセンターサーバー市場、ブレードサーバー、タイプ別サブセグメンテーション:実績と予測, 2019-2024, 2029F, 2034F

- 世界のデータセンターサーバー市場、マイクロサーバー、タイプ別サブセグメンテーション:実績と予測, 2019-2024, 2029F, 2034F

- 世界のデータセンターサーバー市場、タワーサーバー、タイプ別サブセグメンテーション:実績と予測, 2019-2024, 2029F, 2034F

第10章 データセンターサーバー市場:地域・国別分析

- 世界のデータセンターサーバー市場:地域別、実績と予測, 2019-2024, 2029F, 2034F

- 世界のデータセンターサーバー市場:国別、実績と予測, 2019-2024, 2029F, 2034F

第11章 アジア太平洋市場

第12章 西欧市場

第13章 東欧市場

第14章 北米市場

第15章 南米市場

第16章 中東市場

第17章 アフリカ市場

第18章 競合情勢と企業プロファイル

- 企業プロファイル

- Dell Technologies Inc.

- Super Micro Computer, Inc.

- Asus

- Gigabyte Technology

- Microsoft Corp.

第19章 その他の大手企業と革新的企業

- Quanta Computer Incorporated(Quanta Cloud Technology)

- International Business Machines Corporation(IBM)

- Hewlett Packard Enterprise Company

- Cisco Systems Inc.

- NEC Corporation

- Lenovo

- Google LLC

- Atos(Bull Atos Technologies)

- Samsung Electronics Co., Ltd.

- Foxconn(Hon Hai Technology Group)

- Inspur Group

- Hitachi Ltd.

- Fujitsu

- Oracle Corporation

- Infortrend Technology Inc.

第20章 競合ベンチマーキング

第21章 競合ダッシュボード

第22章 主要な合併と買収

- AMD Acquired ZT Systems

- Redcentric Acquired 4D Data Centres

- Bit Digital, Inc. Acquired Enovum Data Centers

- Microsoft Corporation Acquired Fungible Inc.

第23章 最近の動向データセンターサーバー市場

第24章 機会と戦略

- 世界のデータセンターサーバー市場2029:新たな機会を提供する国

- 世界のデータセンターサーバー市場2029:新たな機会を提供するセグメント

- 世界のデータセンターサーバー市場2029:成長戦略

- 市場動向に基づく戦略

- 競合の戦略

第25章 データセンターサーバー市場:結論と提言

- 結論

- 提言

- 製品

- 場所

- 価格

- プロモーション

- 人々

第26章 付録

A data center server is a high-performance computing system designed to manage, store, and process data efficiently within data centers. These servers are essential components of modern IT infrastructure, enabling businesses, government organizations, and service providers to run applications, host websites, store vast amounts of data, and support cloud computing and virtualization.

The data center server market consists of sales, by entities (organizations, sole traders, or partnerships), of data center servers are primarily used by enterprises, cloud service providers, financial institutions, government agencies, and technology companies that require reliable and scalable computing power to handle large workloads and critical applications. They are utilized continuously, ensuring seamless operation of databases, enterprise applications, customer-facing services, and internal IT (Information Technology) systems.

The global data center server market was valued at $43,984.11 million in 2019 which grew till 2024 at a compound annual growth rate (CAGR) of more than 5.00%.

Growing Adoption of Cloud Computing

The growing adoption of cloud computing contributed to the growth of the data center server market in the historic period. The increasing adoption of cloud computing has substantially driven the demand for data center servers, as cloud service providers require reliable, scalable infrastructure to support extensive data storage and processing capabilities. This surge in demand has resulted in greater investments in data centers, further escalating the need for high-performance servers that can efficiently manage large volumes of data and deliver cloud-based services with optimal performance. For instance, in December 2023, according to Eurostat, a Luxembourg-based statistical office of the European Union, 45.2% of European Union (EU) enterprises purchased cloud computing services in 2023, which represents a 4.2 percentage point rise compared with 2021. Therefore, the growing adoption of cloud computing drove the growth of the data center server market.

Revolutionizing AI and Data Center Development with Modular Server Solutions

Major companies operating in the data center server market are focusing on revolutionizing AI and data center development with modular server solutions. This modular approach ensures that data centers and AI researchers can adapt the system to their specific requirements, such as adding or changing (Graphics Processing Units) GPUs, (Central Processing Units) CPUs, or DPUs (Data Processing Units), depending on the workload or task at hand. For instance, in December 2024, Chenbro, a Taiwan-based company that is involved in the design and manufacturing of rackmount servers and storage chassis for hyperscale data centers, launched its NVIDIA MGX server chassis solutions to support the growth of AI and data center infrastructure. Leveraging NVIDIA's MGX modular server architecture, these solutions offer enhanced flexibility and scalability for accelerated computing. Available in 1U, 2U and 4U configurations, the MGX system accommodates a variety of GPU, CPU and DPU options. The chassis solutions, which include both air-cooled and liquid-cooled models, are specifically engineered for AI training, high-performance computing (HPC) applications and big data processing, providing customized solutions to meet the diverse needs of various industries.

The global data center server markets are fairly fragmented, with a large number of small players operating in the market. The top 10 competitors in the market made up 16.10% of the total market in 2023.

Data Center Server Global Market Opportunities And Strategies To 2034 from The Business Research Company provides the strategists; marketers and senior management with the critical information they need to assess the global data center server market as it emerges from the COVID-19 shut down.

Reasons to Purchase

- Gain a truly global perspective with the most comprehensive report available on this market covering 15 geographies.

- Understand how the market is being affected by the coronavirus and how it is likely to emerge and grow as the impact of the virus abates.

- Create regional and country strategies on the basis of local data and analysis.

- Identify growth segments for investment.

- Outperform competitors using forecast data and the drivers and trends shaping the market.

- Understand customers based on the latest market research findings.

- Benchmark performance against key competitors.

- Utilize the relationships between key data sets for superior strategizing.

- Suitable for supporting your internal and external presentations with reliable high-quality data and analysis.

Where is the largest and fastest-growing market for data center server? How does the market relate to the overall economy; demography and other similar markets? What forces will shape the market going forward? The data center server market global report from The Business Research Company answers all these questions and many more.

The report covers market characteristics; size and growth; segmentation; regional and country breakdowns; competitive landscape; market shares; trends and strategies for this market. It traces the market's history and forecasts market growth by geography. It places the market within the context of the wider data center server market; and compares it with other markets.

The report covers the following chapters

- Introduction And Market Characteristics - Brief introduction to the segmentations covered in the market, definitions and explanations about the segment by equipment, by product, by applications and verticals.

- Key Trends - Highlights the major trends shaping the global market. This section also highlights likely future developments in the market.

- Growth Analysis And Strategic Analysis Framework - Analysis on PESTEL, end use industries, market growth rate, global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods, forecast growth contributors and total addressable market (TAM).

- Global Market Size And Growth - Global historic (2019-2024) and forecast (2024-2029, 2034F) market values and drivers and restraints that support and control the growth of the market in the historic and forecast periods.

- Regional And Country Analysis - Historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison by region and country.

- Market Segmentation - Contains the market values (2019-2024) (2024-2029, 2034F) and analysis for each segment by Product, segment product, by applications and verticals in the market. Historic (2019-2024) and forecast (2024-2029) and (2029-2034) market values and growth and market share comparison by region market.

- Regional Market Size And Growth - Regional market size (2024), historic (2019-2024) and forecast (2024-2029, 2034F) market values and growth and market share comparison of countries within the region. This report includes information on all the regions Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East and Africa and major countries within each region.

- Competitive Landscape - Details on the competitive landscape of the market, estimated market shares and company profiles of the leading players.

- Other Major And Innovative Companies - Details on the company profiles of other major and innovative companies in the market.

- Competitive Benchmarking - Briefs on the financials comparison between major players in the market.

- Competitive Dashboard- Briefs on competitive dashboard of major players.

- Key Mergers and Acquisitions- Information on recent mergers and acquisitions in the market is covered in the report. This section gives key financial details of mergers and acquisitions which have shaped the market in recent years.

- Recent Developments - Information on recent developments in the market covered in the report.

- Market Opportunities And Strategies- Describes market opportunities and strategies based on findings of the research, with information on growth opportunities across countries, segments and strategies to be followed in those markets.

- Conclusions And Recommendations- This section includes recommendations for data center server providers in terms of product/service offerings geographic expansion, marketing strategies and target groups

- Appendix- This section includes details on the NAICS codes covered, abbreviations and currencies codes used in this report.

Markets Covered:

- 1) By Product: Rack Servers; Blade Servers; Microservers; Tower Servers

- 2) By Application: Industrial Servers; Commercial Servers

- 3) By Verticals: BFSI (Banking, Financial Services And Insurance); IT And Telecom; Government; Defense; Other Verticals

- Companies Mentioned: Dell Technologies Inc.; Supermicro; Asus; Gigabyte Technology; Microsoft Corp.

- Countries: China; Australia; India; Indonesia; Japan; South Korea; USA; Canada; Brazil; France; Germany; UK; Italy; Spain; Russia

- Regions: Asia-Pacific; Western Europe; Eastern Europe; North America; South America; Middle East; Africa

- Time-series: Five years historic and ten years forecast.

- Data: Ratios of market size and growth to related markets; GDP proportions; expenditure per capita; data center server indicators comparison.

- Data segmentations: country and regional historic and forecast data; market share of competitors; market segments.

- Sourcing and Referencing: Data and analysis throughout the report is sourced using end notes.

Table of Contents

1 Executive Summary

- 1.1 Data Center Server - Market Attractiveness And Macro Economic Landscape

2 Table Of Contents

3 List Of Tables

4 List Of Figures

5 Report Structure

6 Market Characteristics

- 6.1 General Market Definition

- 6.2 Summary

- 6.3 Data Center Server Market Definition And Segmentations

- 6.4 Market Segmentation By Product

- 6.4.1 Rack Servers

- 6.4.2 Blade Servers

- 6.4.3 Microservers

- 6.4.4 Tower Servers

- 6.5 Market Segmentation By Application

- 6.5.1 Industrial Servers

- 6.5.2 Commercial Servers

- 6.6 Market Segmentation By Verticals

- 6.6.1 BFSI (Banking, Financial Services And Insurance)

- 6.6.2 IT And Telecom

- 6.6.3 Government

- 6.6.4 Defense

- 6.6.5 Other Verticals

7 Major Market Trends

- 7.1 Revolutionizing AI and Data Center Development with Modular Server Solutions

- 7.2 Introduction On Localized And Scalable Data Center Solutions To Support AI And Cloud Infrastructure Expansion

- 7.3 High-Density Computing Servers for Optimized Data Center Resources

- 7.4 Next-Generation Blade Server Delivers Unmatched Performance and Scalability

8 Global Data Center Server

- 8.1 Global: PESTEL Analysis

- 8.1.1 Political

- 8.1.2 Economic

- 8.1.3 Social

- 8.1.4 Technological

- 8.1.5 Environmental

- 8.1.6 Legal

- 8.2 Analysis Of End User B2B Market

- 8.2.1 Banking Financial Services And Insurance (BFSI)

- 8.2.2 Government

- 8.2.3 IT And Telecom

- 8.2.4 Defense

- 8.2.5 Other End Users

- 8.3 Global Data Center Server Market Growth Rate Analysis

- 8.4 Historic Market Growth, 2019 - 2024, Value ($ Million)

- 8.4.1 Market Drivers 2019 - 2024

- 8.4.2 Market Restraints 2019- 2024

- 8.5 Forecast Market Growth, 2024 - 2029, 2034F Value ($ Million)

- 8.5.1 Market Drivers 2024 - 2029

- 8.5.2 Market Restraints 2024 - 2029

- 8.6 Forecast Growth Contributors/Factors

- 8.6.1 Quantitative Growth Contributors

- 8.6.2 Drivers

- 8.6.3 Restraints

- 8.7 Global Data Center Server Total Addressable Market (TAM)

9 Global Data Center Server Market Segmentation

- 9.1 Global Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.2 Global Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.3 Global Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.4 Global Data Center Server Market, Sub-Segmentation Of Rack Servers, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.5 Global Data Center Server Market, Sub-Segmentation Of Blade Servers, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.6 Global Data Center Server Market, Sub-Segmentation By Microservers, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 9.7 Global Data Center Server Market, Sub-Segmentation By Tower Servers, By Type, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

10 Data Center Server Market, Regional and Country Analysis

- 10.1 Global Data Center Server Market, By Region, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 10.2 Global Data Center Server Market, By Country, Historic and Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

11 Asia-Pacific Market

- 11.1 Summary

- 11.2 Market Overview

- 11.2.1 Region Information

- 11.2.2 Market Information

- 11.2.3 Background Information

- 11.2.4 Government Initiatives

- 11.2.5 Regulations

- 11.2.6 Regulatory Bodies

- 11.2.7 Major Associations

- 11.2.8 Taxes Levied

- 11.2.9 Corporate Tax Structure

- 11.2.10 Investments

- 11.2.11 Major Companies

- 11.3 Asia-Pacific Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.4 Asia-Pacific Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

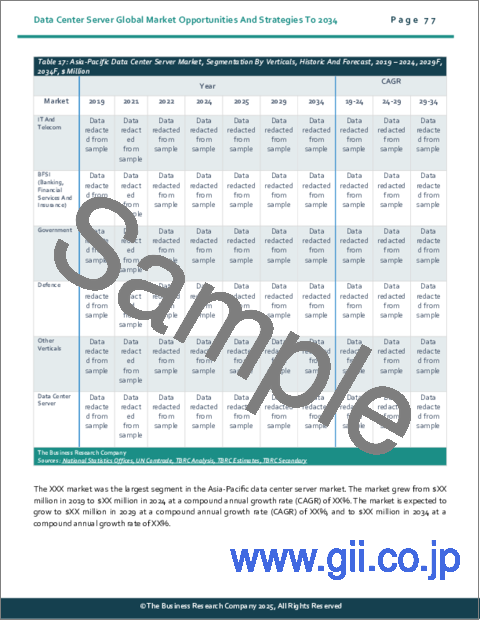

- 11.5 Asia-Pacific Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.6 Asia-Pacific Data Center Server Market: Country Analysis

- 11.7 China Market

- 11.8 Summary

- 11.9 Market Overview

- 11.9.1 Country Information

- 11.9.2 Market Information

- 11.9.3 Background Information

- 11.9.4 Government Initiatives

- 11.9.5 Regulations

- 11.9.6 Regulatory Bodies

- 11.9.7 Major Associations

- 11.9.8 Taxes Levied

- 11.9.9 Corporate Tax Structure

- 11.9.10 Investments

- 11.9.11 Major Companies

- 11.10 China Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.11 China Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.12 China Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.13 India Market

- 11.14 India Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.15 India Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.16 India Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.17 Japan Market

- 11.18 Summary

- 11.19 Market Overview

- 11.19.1 Country Information

- 11.19.2 Market Information

- 11.19.3 Background Information

- 11.19.4 Government Initiatives

- 11.19.5 Regulations

- 11.19.6 Regulatory Bodies

- 11.19.7 Major Associations

- 11.19.8 Taxes Levied

- 11.19.9 Corporate Tax Structure

- 11.19.10 Investments

- 11.19.11 Major Companies

- 11.20 Japan Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.21 Japan Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.22 Japan Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.23 South Korea Market

- 11.24 Summary

- 11.25 Market Overview

- 11.25.1 Country Information

- 11.25.2 Market Information

- 11.25.3 Background Information

- 11.25.4 Government Initiatives

- 11.25.5 Regulations

- 11.25.6 Regulatory Bodies

- 11.25.7 Major Associations

- 11.25.8 Taxes Levied

- 11.25.9 Corporate Tax Structure

- 11.25.10 Investments

- 11.25.11 Major Companies

- 11.26 South Korea Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.27 South Korea Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.28 South Korea Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.29 Australia Market

- 11.30 Australia Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.31 Australia Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.32 Australia Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.33 Indonesia Market

- 11.34 Indonesia Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.35 Indonesia Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 11.36 Indonesia Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

12 Western Europe Market

- 12.1 Summary

- 12.2 Market Overview

- 12.2.1 Region Information

- 12.2.2 Market Information

- 12.2.3 Background Information

- 12.2.4 Government Initiatives

- 12.2.5 Regulations

- 12.2.6 Regulatory Bodies

- 12.2.7 Major Associations

- 12.2.8 Taxes Levied

- 12.2.9 Corporate tax structure

- 12.2.10 Investments

- 12.2.11 Major Companies

- 12.3 Western Europe Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.4 Western Europe Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.5 Western Europe Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.6 Western Europe Data Center Server Market: Country Analysis

- 12.7 UK Market

- 12.8 UK Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.9 UK Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.10 UK Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.11 Germany Market

- 12.12 Germany Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.13 Germany Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.14 Germany Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.15 France Market

- 12.16 France Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.17 France Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.18 France Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.19 Italy Market

- 12.20 Italy Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.21 Italy Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.22 Italy Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.23 Spain Market

- 12.24 Spain Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.25 Spain Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 12.26 Spain Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

13 Eastern Europe Market

- 13.1 Summary

- 13.2 Market Overview

- 13.2.1 Region Information

- 13.2.2 Market Information

- 13.2.3 Background Information

- 13.2.4 Government Initiatives

- 13.2.5 Regulations

- 13.2.6 Regulatory Bodies

- 13.2.7 Major Associations

- 13.2.8 Taxes Levied

- 13.2.9 Corporate Tax Structure

- 13.2.10 Investments

- 13.2.11 Major Companies

- 13.3 Eastern Europe Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.4 Eastern Europe Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.5 Eastern Europe Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.6 Russia Market

- 13.7 Russia Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.8 Russia Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 13.9 Russia Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

14 North America Market

- 14.1 Summary

- 14.2 Market Overview

- 14.2.1 Region Information

- 14.2.2 Market Information

- 14.2.3 Background Information

- 14.2.4 Government Initiatives

- 14.2.5 Regulations

- 14.2.6 Regulatory Bodies

- 14.2.7 Major Associations

- 14.2.8 Taxes Levied

- 14.2.9 Corporate Tax Structure

- 14.2.10 Investments

- 14.2.11 Major Companies

- 14.3 North America Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.4 North America Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.5 North America Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.6 North America Data Center Server Market: Country Analysis

- 14.7 USA Market

- 14.8 Summary

- 14.9 Market Overview

- 14.9.1 Country Information

- 14.9.2 Market Information

- 14.9.3 Background Information

- 14.9.4 Government Initiatives

- 14.9.5 Regulations

- 14.9.6 Regulatory Bodies

- 14.9.7 Major Associations

- 14.9.8 Taxes Levied

- 14.9.9 Corporate Tax Structure

- 14.9.10 Investments

- 14.9.11 Major Companies

- 14.10 USA Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.11 USA Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.12 USA Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.13 Canada Market

- 14.14 Summary

- 14.15 Market Overview

- 14.15.1 Region Information

- 14.15.2 Market Information

- 14.15.3 Background Information

- 14.15.4 Government Initiatives

- 14.15.5 Regulations

- 14.15.6 Regulatory Bodies

- 14.15.7 Major Associations

- 14.15.8 Taxes Levied

- 14.15.9 Corporate Tax Structure

- 14.15.10 Investment

- 14.15.11 Major Companies

- 14.16 Canada Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.17 Canada Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 14.18 Canada Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

15 South America Market

- 15.1 Summary

- 15.2 Market Overview

- 15.2.1 Region Information

- 15.2.2 Market Information

- 15.2.3 Background Information

- 15.2.4 Government Initiatives

- 15.2.5 Regulations

- 15.2.1 Regulatory Bodies

- 15.2.2 Major Associations

- 15.2.3 Taxes Levied

- 15.2.4 Corporate Tax Structure

- 15.2.5 Investments

- 15.2.6 Major Companies

- 15.3 South America Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.4 South America Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.5 South America Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.6 Brazil Market

- 15.7 Brazil Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.8 Brazil Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 15.9 Brazil Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

16 Middle East Market

- 16.1 Summary

- 16.2 Market Overview

- 16.2.1 Region Information

- 16.2.2 Market Information

- 16.2.3 Background Information

- 16.2.4 Government Initiatives

- 16.2.5 Regulations

- 16.2.6 Regulatory Bodies

- 16.2.7 Major Associations

- 16.2.8 Taxes Levied

- 16.2.9 Corporate Tax Structure

- 16.2.10 Investments

- 16.2.11 Major Companies

- 16.3 Middle East Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.4 Middle East Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 16.5 Middle East Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

17 Africa Market

- 17.1 Summary

- 17.2 Market Overview

- 17.2.1 Region Information

- 17.2.2 Market Information

- 17.2.3 Background Information

- 17.2.4 Government Initiatives

- 17.2.5 Regulations

- 17.2.6 Regulatory Bodies

- 17.2.7 Major Associations

- 17.2.8 Taxes Levied

- 17.2.9 Corporate Tax Structure

- 17.2.10 Investments

- 17.2.11 Major Companies

- 17.3 Africa Data Center Server Market, Segmentation By Product, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.4 Africa Data Center Server Market, Segmentation By Application, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

- 17.5 Africa Data Center Server Market, Segmentation By Verticals, Historic And Forecast, 2019 - 2024, 2029F, 2034F, Value ($ Million)

18 Competitive Landscape And Company Profiles

- 18.1 Company Profiles

- 18.2 Dell Technologies Inc.

- 18.2.1 Company Overview

- 18.2.2 Products And Services

- 18.2.3 Business Strategy

- 18.2.4 Financial Overview

- 18.3 Super Micro Computer, Inc.

- 18.3.1 Company Overview

- 18.3.2 Products And Services

- 18.3.3 Business Strategy

- 18.3.4 Financial Overview

- 18.4 Asus

- 18.4.1 Company Overview

- 18.4.2 Products And Services

- 18.4.3 Financial Overview

- 18.5 Gigabyte Technology

- 18.5.1 Company Overview

- 18.5.2 Products And Services

- 18.5.3 Financial Overview

- 18.6 Microsoft Corp.

- 18.6.1 Company Overview

- 18.6.2 Products And Services

- 18.6.3 Business Strategy

- 18.6.4 Financial Overview

19 Other Major And Innovative Companies

- 19.1 Quanta Computer Incorporated (Quanta Cloud Technology)

- 19.1.1 Company Overview

- 19.1.2 Products And Services

- 19.2 International Business Machines Corporation (IBM)

- 19.2.1 Company Overview

- 19.2.2 Products And Services

- 19.3 Hewlett Packard Enterprise Company

- 19.3.1 Company Overview

- 19.3.2 Products And Services

- 19.4 Cisco Systems Inc.

- 19.4.1 Company Overview

- 19.4.2 Products And Services

- 19.5 NEC Corporation

- 19.5.1 Company Overview

- 19.5.2 Products And Services

- 19.6 Lenovo

- 19.6.1 Company Overview

- 19.6.2 Products And Services

- 19.7 Google LLC

- 19.7.1 Company Overview

- 19.7.2 products And Services

- 19.8 Atos (Bull Atos Technologies)

- 19.8.1 Company Overview

- 19.8.2 Products And Services

- 19.9 Samsung Electronics Co., Ltd.

- 19.9.1 Company Overview

- 19.9.2 Products And Services

- 19.10 Foxconn (Hon Hai Technology Group)

- 19.10.1 Company Overview

- 19.10.2 Products And Services

- 19.11 Inspur Group

- 19.11.1 Company Overview

- 19.11.2 Products And Services

- 19.12 Hitachi Ltd.

- 19.12.1 Company Overview

- 19.12.2 Products And Services

- 19.13 Fujitsu

- 19.13.1 Company Overview

- 19.13.2 Products And Services

- 19.14 Oracle Corporation

- 19.14.1 Company Overview

- 19.14.2 Products And Services

- 19.15 Infortrend Technology Inc.

- 19.15.1 Company Overview

- 19.15.2 Products And Services

20 Competitive Benchmarking

21 Competitive Dashboard

22 Key Mergers And Acquisitions

- 22.1 AMD Acquired ZT Systems

- 22.2 Redcentric Acquired 4D Data Centres

- 22.3 Bit Digital, Inc. Acquired Enovum Data Centers

- 22.4 Microsoft Corporation Acquired Fungible Inc.

23 Recent Developments In The Data Center Server Market

- 23.1 High-Performance AI Server with Scalable GPU Support

- 23.2 Next-Generation Servers with Enhanced Security and AI Insights

- 23.3 Next-Gen Rack Servers Enhance Performance with Latest Processor Integration

- 23.4 Innovative Servers for High-Performance Cloud and AI Workloads

- 23.5 High-Performance Server Hardware for Cutting-Edge Cloud Applications

24 Opportunities And Strategies

- 24.1 Global Data Center Server Market In 2029 - Countries Offering Most New Opportunities

- 24.2 Global Data Center Server Market In 2029 - Segments Offering Most New Opportunities

- 24.3 Global Data Center Server Market In 2029 - Growth Strategies

- 24.3.1 Market Trend Based Strategies

- 24.3.2 Competitor Strategies

25 Data Center Server Market, Conclusions And Recommendations

- 25.1 Conclusions

- 25.2 Recommendations

- 25.2.1 Product

- 25.2.2 Place

- 25.2.3 Price

- 25.2.4 Promotion

- 25.2.5 People

26 Appendix

- 26.1 Geographies Covered

- 26.2 Market Data Sources

- 26.3 Research Methodology

- 26.4 Currencies

- 26.5 The Business Research Company

- 26.6 Copyright and Disclaimer