|

|

市場調査レポート

商品コード

1581325

LIB製造装置の開発状況と中長期の見通し(~2035年)<2024> LIB Manufacturing Equipment Development Status and Mid/Long-term Outlook (~2035) |

||||||

|

|||||||

| LIB製造装置の開発状況と中長期の見通し(~2035年) |

|

出版日: 2024年10月08日

発行: SNE Research

ページ情報: 英文 412 Pages

納期: お問合せ

|

全表示

- 概要

- 目次

昨今、世界のリチウムイオン二次電池市場が徐々に拡大する中、二次電池メーカーの生産拡大状況が急速に高まっており、二次電池製造装置の需要も増加しています。爆発的に拡大するリチウムイオン二次電池市場での成功は、タイムリーな製品供給によるシェア確保と判断されます。リチウムイオン二次電池市場、電気自動車市場、ESS市場は、今後の成長が確実視される新たな成長エンジンとして、二次電池製造装置パートナーも共に成長する魅力的な市場として浮上しています。

しかし、2023年の二次電池製造装置市場も電気自動車のキャズム(一時的な需要停滞)により苦戦を強いられ、韓国、中国、日本の製造装置メーカーの競合により二次電池工場の稼働率が上昇し、各社の明暗が分かれる結果となっています。今後、二次電池製造装置市場では、安定した品質管理と量産力を維持し対応できる企業、次世代プロセスや新技術で主導権を握る企業が主要企業としての地位を確立していくことが予測されます。

当レポートでは、LIB市場について調査分析し、パウチ型、円筒型、角型の製造プロセスや装置の特徴、主要二次電池メーカーの生産拡大の見通し、各プロセスの製造装置の市場規模、装置メーカーの状況、次世代プロセス(乾式プロセス)の開発状況、主要二次電池メーカーの生産能力拡大計画、装置メーカーのSCMと特徴などの情報を提供しています。

目次

第1章 LIB二次電池のイントロダクション

第2章 製造プロセス:二次電池タイプ別

- 電極構造のタイプ

- パウチ型電池

- 円筒型電池

- 角型電池

- 二次電池タイプ:メーカー別

第3章 電極プロセス(パウチ型、円筒型、角型共通)

- 混合

- コーティング

- プレス

- スリット

- 真空乾燥

第4章 組み立てプロセス

パウチ型

- ノッチング

- 巻き取り

- ジグザグスタッキング

- ラミネート・折りたたみ/スタッキング

- タブ溶接

- パッケージング

円筒型

- 巻き取り

- 組み立て

角型

- 巻き取り

- 組み立て

第5章 化成プロセス(パウチ型、円筒型、角型共通)

- エージング

- 化成

- 脱ガス

- 折りたたみ

- IR/OCV

第6章 新技術の開発動向

- 新しい電極(プレート)プロセス技術の動向

- 新しい組み立てプロセス技術の動向

- 新しい化成プロセス技術の動向

- ビジョンアプリケーション

- セルトラッキング

- デジタルトランスフォーメーション

- 電極プロセスと乾式プロセス技術

- 次世代(固体)プロセス技術

- 次世代プロセスの研究開発動向:技術別

- 次世代プロセスの研究開発動向:企業別

第7章 二次電池製造装置メーカー

- 電極プロセス

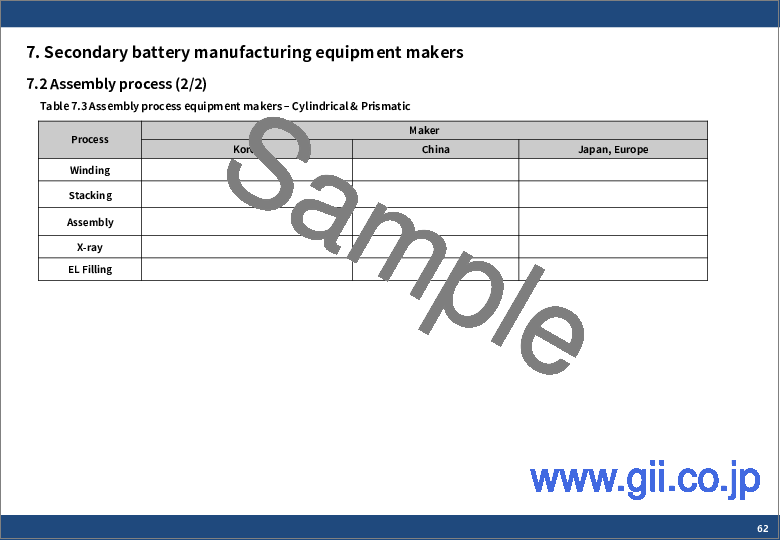

- 組み立てプロセス

- 化成プロセス

- その他の装置、輸送・検査

- 世界の装置市場、売上とM/S:メーカー別

- 世界の装置市場、売上:メーカー別(2022年)

- 世界の装置市場、情勢:国別

- 世界の装置市場、ピアグループ:プロセス別

第8章 製造装置の市場見通し

- 二次電池、世界の需要の見通し

- 二次電池、世界の生産能力の見通し

- 二次電池、世界の生産能力の見通し:地域別

- 二次電池、新規生産能力の見通し

- 二次電池装置、投資と規模

- 二次電池装置、市場見通し

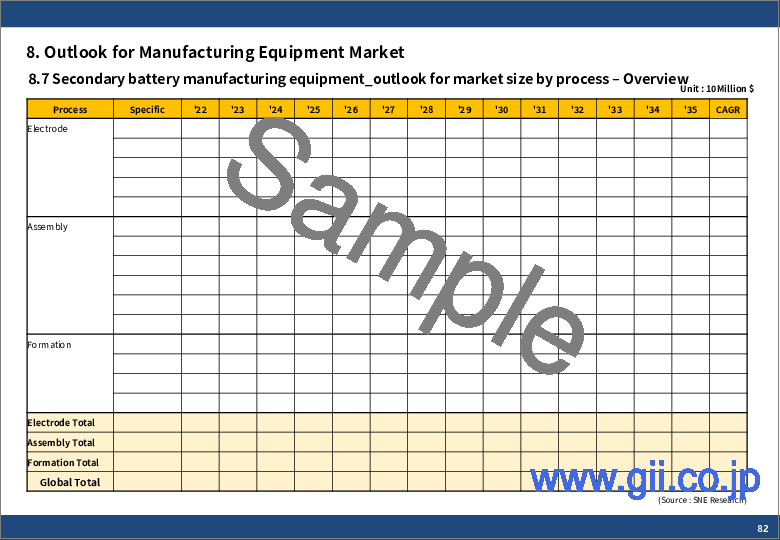

- 二次電池装置、市場見通し:プロセス別

- 二次電池装置、市場見通し:装置別

- 二次電池装置、市場見通し:地域別

- 二次電池装置、市場見通し:企業別

第9章 装置メーカー

- メーカーとステータスのリスト

- 韓国企業(上場)

- 韓国企業(非上場)、国外企業

- 韓国企業 - 電極プロセス

- Yunsung F&C

- TSI

- Jeil M&S

- PNT

- CIS

- 韓国企業 - 組立プロセス

- Hana Technology

- Phil Optics

- Mplus

- Nain Tech

- DA Technology

- Youil Energy Tech

- DE&T

- DSK

- System R&D

- Koem

- Woowon Technology

- Shinjin Mtech

- DH

- Bestech

- Dongjin

- NS

- Techland

- KGA

- MOT

- 韓国企業 - 化成プロセス

- Wonik PNE

- APRO

- Kapjin

- YTS

- 韓国企業 - その他のプロセス

- Hanwha/Momentum

- SFA

- Toptec

- Cowintech

- Avaco

- Daebo Magnetic

- Innometry

- V-one Tech

- Xavis

- Nsys

- EID

- 国外企業 - 中国

- Wuxi Lead Intelligent Equipment, Lead China

- Yinghe Technology

- Lyric Robot

- Hymson

- CHR Hanke

- Colibri

- United Winners Laser

- Priority Technology

- Katop (Jiatuo Intelligent)

- Super Components

- Geesun Intelligence

- Nebula Electronics

- 国外企業 - 日本

- Toray

- Hirano Tecseed

- Primix

- Inoue

- Hitachi HighTech

- Nishimura

- Nagano Automation

- CKD Corp

- 国外企業 - その他

- Manz

第10章 装置メーカーの比較:二次電池プロセス別

- 電極(電極板)プロセス

- 電極プロセス装置メーカー

- 組み立てプロセス

- 円筒型、角型メーカー

- ノッチング、スタッキング装置メーカー

- 化成とその他のプロセス

- 化成・検査装置メーカー

第11章 主要二次電池メーカーの生産能力拡大計画 - 装置のSCMとその特徴

- LGES

- SamsungSDI

- SK Innovation

- CATL

- NorthVolt

- Tesla

Recently, as the global lithium-ion secondary battery market is gradually expanding, the production expansion status of secondary battery manufacturers is rapidly increasing, and the demand for secondary battery manufacturing equipment is also increasing. Success in the explosively growing lithium-ion secondary battery market is judged to be securing market share by supplying products in a timely manner. The lithium-ion secondary battery, electric vehicle, and ESS markets are emerging as attractive markets where secondary battery manufacturing equipment partners are also growing together as new growth engines with certain future growth.

However, in 2023, the secondary battery manufacturing equipment market also suffered due to the electric vehicle chasm (temporary stagnation in demand), and the operating rates of secondary battery factories increased due to competition among Korean, Chinese, and Japanese manufacturing equipment companies, resulting in mixed fortunes among companies. In the future, companies that can maintain and respond to stable quality management and mass production capabilities, and companies that take the lead in next-generation processes and new technologies are expected to establish themselves as the main companies in the secondary battery manufacturing equipment market.

This report examines the manufacturing process and equipment features by secondary battery type, such as pouch type, cylindrical type, and prismatic type. It also introduces the production expansion prospects of each major secondary battery manufacturer, the manufacturing equipment market size by process, the status of equipment manufacturers, the development status of the next-generation process (dry process), the production capacity expansion plans of major secondary battery manufacturers, and the equipment company SCM and features, thereby providing a forecast of how the manufacturing equipment flow of lithium-ion secondary batteries is changing and how it will change in the future.

In addition, through a competitiveness comparison of the major equipment companies representing Korea, China, and Japan through the process-based peer group, the performance and market share status of each major company in the secondary battery equipment market and the future market structure outlook through expansion plans were provided.

The major equipment companies being investigated are approximately 120 companies, including 30 electrode process companies, 50 assembly process companies, 20 formation process companies, and 20 inspection and other equipment companies.

- Chapter 1: explains principle and types of secondary batteries,

- Chapter 2: summarizes manufacturing process by secondary battery type.

- Chapter 3: describes electrode process and features of the electrode equipment,

- Chapter 4: describes assembly process and features of the assembly equipment,

- Chapter 5: describes formation process and features of the formation equipment,

- Chapter 6: shows trend of new technology development of manufacturing equipment,

- Chapter 7: examines secondary battery equipment manufacturers by process,

- Chapter 8: presents manufacturing equipment market trend and outlook,

- Chapter 9: introduces current status of major equipment companies,

- Chapter 10: compares in detail equipment manufacturers by secondary battery process,

- Chapter 11: examines expansion outlook of major secondary battery companies and equipment SCM

This SNE Research report on the development status of manufacturing equipment and the market outlook can be hopefully of help for manufacturing equipment companies, the related component companies, and customers who use secondary batteries.

Table of Contents

1. Introduction to LIB secondary batteries

- 1.1. Principle of secondary batteries

- 1.2. Advantage of secondary batteries

- 1.3. Types of secondary batteries

2. Manufacturing process by secondary battery type

- 2.1. Types of electrode structure

- 2.2. Pouch type batteries

- 2.3. Cylindrical type batteries

- 2.4. Prismatic type batteries

- 2.5. Secondary battery type by manufacturer

3. Electrode process (common in pouch, cylindrical and prismatic)

- 3.1. Mixing

- 3.1.1. Electrode Components

- 3.1.2. Comparison of Mixing Process

- 3.1.3. Mixing Equipment

- 3.2. Coating

- 3.2.1. Continuous Coating & Intermittent Coating

- 3.2.2. Coating Equipment

- 3.3. Pressing

- 3.3.1. Pressing Equipment

- 3.4. Slitting

- 3.4.1. Slitting Equipment

- 3.5. Vacuum Dry

- 3.5.1. Vacuum Dry Equipment

- 3.5.2. Equipment and process procedure by electrode structure

4. Assembly process

Pouch type

- 4.1. Notching

- 4.1.1. Notching equipment

- 4.1.2. Laser Notching & Blanking

- 4.2. Winding

- 4.2.1. Winding equipment

- 4.3. Zigzag Stacking

- 4.3.1. Zigzag Stacking equipment

- 4.4. Lamination & Folding/ Stacking

- 4.4.1. Lamination & Folding/ Stacking equipment

- 4.5. Tab Welding

- 4.5.1. Tab Welding equipment

- 4.6. Packaging

- 4.6.1. Packaging equipment

Cylindrical type

- 4.7. Winding

- 4.7.1. Winding equipment

- 4.8. Assembly

- 4.8.1. Driving part and transporting

- 4.8.2. Assembly equipment

Prismatic type

- 4.9. Winding

- 4.9.1. Winding equipment

- 4.10. Assembly

- 4.10.1. Assembly equipment

5. Formation process (common in pouch, cylindrical and prismatic)

- 5.1. Aging

- 5.1.1. Aging type

- 5.1.2. Aging equipment

- 5.2. Formation

- 5.2.1. Formation equipment

- 5.2.2. Formation electrical component

- 5.2.3. Jig Formation

- 5.3. Degassing

- 5.3.1. Degassing equipment

- 5.4. Folding

- 5.4.1. Folding equipment

- 5.5. IR/OCV

- 5.5.1. IR/OCV equipment

6. New Technology Development Trends

- 6.1. New electrode (plate) process technology trends

- 6.2. New assembly process technology trends

- 6.3. New formation process technology trends

- 6.4. Vision Application

- 6.5. Cell Tracking

- 6.6. Digital Transformation

- 6.7. Electrode process and Dry process technology

- 6.8. Next generation (solid state) process technology

- 6.9. Next generation process R&D trends (by technology)

- 6.10. Next generation process R&D trends (by company)

7. Secondary battery manufacturing equipment maker

- 7.1. Electrode process

- 7.2. Assembly process

- 7.3. Formation process

- 7.4. Other equipment, Transport & Inspection

- 7.5. Global equipment market_sales & M/S by maker

- 7.6. Global equipment market_sales in 2022 by maker

- 7.7. Global equipment market_status by country

- 7.8. Global equipment market_Peer Group by process

8. Market outlook for the manufacturing equipment

- 8.1. Secondary batteries_global demand outlook

- 8.2. Secondary batteries_global capacity outlook

- 8.3. Secondary batteries_global capacity outlook by region

- 8.4. Secondary batteries_new capacity outlook

- 8.5. Secondary battery equipment_investment & its scale

- 8.6. Secondary battery equipment_Market outlook

- 8.7. Secondary battery equipment_Market outlook by process

- 8.8. Secondary battery equipment_Market outlook by equipment

- 8.9. Secondary battery equipment_Market outlook by region

- 8.10. Secondary battery equipment_Market outlook by company

9. Equipment manufacturers

- 9.1. List of manufacturers and status

- 9.1.1. Korean companies (public-listed)

- 9.1.2. Korean companies (private) and overseas companies

- 9.2. Korean companies_Electrode process

- 9.2.1. Yunsung F&C

- 9.2.2. TSI

- 9.2.3. Jeil M&S

- 9.2.4. PNT

- 9.2.5. CIS

- 9.3. Korean companies_Assembly process

- 9.3.1. Hana Technology

- 9.3.2. Phil Optics

- 9.3.3. Mplus

- 9.3.4. Nain Tech

- 9.3.5. DA Technology

- 9.3.6. Youil Energy Tech

- 9.3.7. DE&T

- 9.3.8. DSK

- 9.3.9. System R&D

- 9.3.10. Koem

- 9.3.11. Woowon Technology

- 9.3.12. Shinjin Mtech

- 9.3.13. DH

- 9.3.14. Bestech

- 9.3.15. Dongjin

- 9.3.16. NS

- 9.3.17. Techland

- 9.3.18. KGA

- 9.3.19. MOT

- 9.4. Korean companies_Formation process

- 9.4.1. Wonik PNE

- 9.4.2. APRO

- 9.4.3. Kapjin

- 9.4.4. YTS

- 9.5. Korean companies_other process

- 9.5.1. Hanwha/Momentum

- 9.5.2. SFA

- 9.5.3. Toptec

- 9.5.4. Cowintech

- 9.5.5. Avaco

- 9.5.6. Daebo Magnetic

- 9.5.7. Innometry

- 9.5.8. V-one Tech

- 9.5.9. Xavis

- 9.5.10. Nsys

- 9.5.11. EID

- 9.6. Overseas companies_China

- 9.6.1. Wuxi Lead Intelligent Equipment, Lead China

- 9.6.2. Yinghe Technology

- 9.6.3. Lyric Robot

- 9.6.4. Hymson

- 9.6.5. CHR Hanke

- 9.6.6. Colibri

- 9.6.7. United Winners Laser

- 9.6.8. Priority Technology

- 9.6.9. Katop (Jiatuo Intelligent)

- 9.6.10. Super Components

- 9.6.11. Geesun Intelligence

- 9.6.12. Nebula Electronics

- 9.7. Overseas companies - Japan

- 9.7.1. Toray

- 9.7.2. Hirano Tecseed

- 9.7.3. Primix

- 9.7.4. Inoue

- 9.7.5. Hitachi HighTech

- 9.7.6. Nishimura

- 9.7.7. Nagano Automation

- 9.7.8. CKD Corp

- 9.8. Overseas company_Others

- 9.8.1. Manz

10. Comparison of equipment manufacturers by secondary battery process

- 10.1. Electrode (electrode plate) process

- 10.1.1. Electrode process equipment manufacturer

- 10.2. Assembly process

- 10.2.1. Cylindrical, prismatic manufacturer

- 10.2.2. Notching, stacking equipment manufacturer

- 10.3. Formation and other process

- 10.3.1. Formation & inspection equipment manufacturer

11. Capacity expansion plan of major secondary battery companies - equipment SCM and its character

- 11.1. LGES

- 11.2. SamsungSDI

- 11.3. SK Innovation

- 11.4. CATL

- 11.5. NorthVolt

- 11.6. Tesla