|

|

市場調査レポート

商品コード

1503313

生物製剤受託開発製造機関(CDMO)市場の2030年までの予測: 製品別、サービス別、タイプ別、エンドユーザー別、地域別の世界分析Biologics Contract Development and Manufacturing Organization Market Forecasts to 2030 - Global Analysis By Product, Service (Contract Manufacturing Organization and Contract Research Organization ), Type, End User and By Geography |

||||||

カスタマイズ可能

|

|||||||

| 生物製剤受託開発製造機関(CDMO)市場の2030年までの予測: 製品別、サービス別、タイプ別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2024年06月06日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界の生物製剤受託開発製造機関(CDMO)市場は、2024年に145億4,000万米ドルを占め、予測期間中のCAGRは14.9%で成長し、2030年には334億5,000万米ドルに達すると予測されています。

モノクローナル抗体、ワクチン、細胞・遺伝子治療、組換えタンパク質などの生物学的製品は、生物製剤受託開発製造機関(CDMO)として知られる専門サービス・プロバイダーの支援を受けて開発・製造されます。CDMOは、細胞株開発、プロセス最適化、分析試験、大規模生産などの分野で経験を積んでいるため、これらの組織はバイオ医薬品部門にとって不可欠です。さらに、バイオ医薬品企業はCDMOと協力することで、コストを削減し、製品開発を迅速化し、複雑な規制環境をより巧みに乗り切ることができます。

国際製薬技術協会(ISPE)によると、生物製剤開発製造受託機関(CDMO)は製薬業界にとって不可欠であり、複雑な生物学的製剤の開発、スケールアップ、商業化を可能にする不可欠なサービスを提供しています。

高まる生物製剤への関心

糖尿病、がん、自己免疫疾患などの慢性疾患の世界の増加により、より効率的で集中的な治療が求められています。生物製剤は、その高い特異性と有効性から、治療の選択肢として好まれています。生物学的製剤に対する需要の増加により、製薬会社は効率的な方法で生産ニーズを満たす専門知識を持つCDMOに注目するようになった。さらに、高齢化社会とバイオテクノロジーの発展がCDMO市場の着実な成長に拍車をかけています。

過剰な運営コスト

生物製剤の生産にかかる高い運営コストは、生物製剤受託開発製造機関(CDMO)市場が直面する主な障害の1つです。生物製剤の製造には、高度な細胞培養技術、精製技術、厳格な品質管理措置など、複雑でコストのかかる手順が伴う。専門施設、高度な資格を持つ労働者、最先端技術の必要性により、コストはさらに増大します。さらに、規制や業界標準に準拠するため、CDMOは設備やインフラに多額の設備投資を行わなければならず、非常に高額になります。

最先端の製造技術の活用

自動化、連続バイオプロセス、シングルユースシステムといった最新の製造技術は、CDMOに生産物の品質と業務効率の両方を向上させる大きなチャンスを提供します。生産コストを下げ、拡張性を高めることで、これらの技術は汚染のリスクも下げることができます。さらに、CDMOはこれらのイノベーションを活用することで、競争優位性を強化し、優れた生物製剤を求める市場の拡大に対応することができます。

不十分な熟練労働力

生物製剤業界では、細胞生物学、バイオプロセス工学、薬事などの専門家を含む、高度に熟練した専門人材が必要とされています。それにもかかわらず、生物製剤の創製と生産を支援するために必要な知識と経験を持つ専門家が世界中に不足しています。CDMOが熟練したスタッフを惹きつけ、維持することができないことは、CDMOが拡大し、より効率的に運営する能力を阻害する可能性があります。さらに、優秀な人材を惹きつけ、維持するために、CDMOは競争力のある給与、研修プログラム、キャリア開発の機会を提供しなければならないです。なぜなら、熟練した労働者をめぐっては熾烈な競争が繰り広げられているからです。

COVID-19の影響:

生物製剤受託開発製造機関(CDMO)の市場は、COVID-19の大流行の結果、驚異的な成長と変化を遂げました。ワクチン、治療、診断ツールの差し迫った必要性から、CDMOサービスに対するかつてない需要が生じ、生産スケジュールが早まり、製造能力が高まった。さらに、COVID-19ワクチンと治療法の迅速な開発と広範な製造は、CDMOによって可能になった部分が多く、バイオ医薬品のサプライチェーンにおけるCDMOの重要性が浮き彫りになった。

予測期間中、生物製剤分野が最大となる見込み

生物製剤受託開発製造機関(CDMO)市場では、生物製剤分野が最大の市場シェアを占めています。生物製剤は、組換えタンパク質、細胞・遺伝子治療、ワクチン、モノクローナル抗体など、複雑な医薬品を幅広く含んでいます。生物学的製剤の市場は、慢性疾患の罹患率の上昇と個別化された標的治療に対するニーズの高まりにより拡大しています。さらに、製薬会社は、従来の低分子医薬品よりも治療上の利点が大きいことから、生物製剤の開発と商業化に多額の投資を行っています。

受託製造機関(CMO)分野は予測期間中に最も高いCAGRが見込まれる

生物製剤受託開発製造機関(CDMO)市場では、通常、製造受託機関(CMO)分野が最も高いCAGRを示します。CMOは、プロセス開発、スケールアップ、商業生産を含むエンドツーエンドの製造サービスをバイオ医薬品に提供する専門家です。さらに、製薬会社は、生物製剤の需要の増加、複雑な製造プロセス、専門的な専門知識の必要性から、CMOに製造を委託しています。

最もシェアの高い地域:

生物製剤受託開発製造機関(CDMO)市場では、北米が一般的に最大のシェアを占めています。この地域の優位性には、盛んなバイオ医薬品セクター、最先端のヘルスケア施設、強固な規制環境、高度に有能な労働力など、数多くの要素が寄与しています。さらに、北米には多数のバイオテクノロジー企業や製薬企業、著名な学術・研究機関が存在するため、生物製剤の開発・製造のための活発なエコシステムが形成されています。

CAGRが最も高い地域:

生物製剤受託開発製造機関(CDO)の市場では、通常アジア太平洋地域が最も高いCAGRを示しています。バイオ医薬品企業によるアウトソーシングの増加、医療インフラへの投資の増加、中国、インド、韓国などの国々におけるバイオ医薬品製造能力の向上が、この成長を後押しする要因のひとつです。さらに、この地域のCDMOに対する魅力は、有利な政府政策、規制改革、バイオ技術革新を支援するイニシアチブによってさらに高まっています。

無料カスタマイズサービス:

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレーヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査情報源

- 1次調査情報源

- 2次調査情報源

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 製品分析

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競争企業間の敵対関係

第5章 世界の生物製剤受託開発製造機関(CDMO)市場:製品別

- バイオシミラー

- 生物学的製剤

- アンチセンスおよび分子療法

- 組み換えタンパク質

- ワクチン

- モノクローナル

- タンパク質ベース

- 診断

- 治療的

- その他の製品

第6章 世界の生物製剤受託開発製造機関(CDMO)市場:サービス別

- 受託製造組織(CMO)

- 研究機関(CRO)

第7章 世界の生物製剤受託開発製造機関(CDMO)市場:タイプ別

- 哺乳類

- 非哺乳類(微生物)

- ウイルスベクター

- その他のタイプ

第8章 世界の生物製剤受託開発製造機関(CDMO)市場:エンドユーザー別

- バイオテクノロジー企業

- バイオ医薬品企業

- その他のエンドユーザー

第9章 世界の生物製剤受託開発製造機関(CDMO)市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第10章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品発売

- 事業拡大

- その他の主要戦略

第11章 企業プロファイリング

- Samsung Biologics

- Boehringer Ingelheim Group

- Sandoz Biopharmaceuticals(Novartis AG)

- Parexel International Corporation

- Fujifilm Diosynth Biotechnologies USA Inc.

- AbbVie Contract Manufacturing

- Lonza Group

- Binex Co. Limited

- Rentschler Biotechnologies

- Toyobo Co. Limited

- AGC Biologics

- PRA Health Sciences

- Catalent Inc

- Wuxi Biologics

- JRS Pharma

List of Tables

- Table 1 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Region (2022-2030) ($MN)

- Table 2 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Product (2022-2030) ($MN)

- Table 3 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biosimilars (2022-2030) ($MN)

- Table 4 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biologics (2022-2030) ($MN)

- Table 5 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Antisense and Molecular Therapy (2022-2030) ($MN)

- Table 6 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Recombinant Proteins (2022-2030) ($MN)

- Table 7 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Vaccines (2022-2030) ($MN)

- Table 8 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Monoclonal (2022-2030) ($MN)

- Table 9 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Products (2022-2030) ($MN)

- Table 10 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Service (2022-2030) ($MN)

- Table 11 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Manufacturing Organization (CMO) (2022-2030) ($MN)

- Table 12 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Research Organization (CRO) (2022-2030) ($MN)

- Table 13 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Type (2022-2030) ($MN)

- Table 14 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Mammalian (2022-2030) ($MN)

- Table 15 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Non-Mammalian (Microbial) (2022-2030) ($MN)

- Table 16 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Viral Vector (2022-2030) ($MN)

- Table 17 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Types (2022-2030) ($MN)

- Table 18 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By End User (2022-2030) ($MN)

- Table 19 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biotechnology Companies (2022-2030) ($MN)

- Table 20 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biopharmaceutical Companies (2022-2030) ($MN)

- Table 21 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 22 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Country (2022-2030) ($MN)

- Table 23 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Product (2022-2030) ($MN)

- Table 24 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biosimilars (2022-2030) ($MN)

- Table 25 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biologics (2022-2030) ($MN)

- Table 26 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Antisense and Molecular Therapy (2022-2030) ($MN)

- Table 27 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Recombinant Proteins (2022-2030) ($MN)

- Table 28 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Vaccines (2022-2030) ($MN)

- Table 29 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Monoclonal (2022-2030) ($MN)

- Table 30 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Products (2022-2030) ($MN)

- Table 31 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Service (2022-2030) ($MN)

- Table 32 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Manufacturing Organization (CMO) (2022-2030) ($MN)

- Table 33 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Research Organization (CRO) (2022-2030) ($MN)

- Table 34 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Type (2022-2030) ($MN)

- Table 35 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Mammalian (2022-2030) ($MN)

- Table 36 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Non-Mammalian (Microbial) (2022-2030) ($MN)

- Table 37 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Viral Vector (2022-2030) ($MN)

- Table 38 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Types (2022-2030) ($MN)

- Table 39 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By End User (2022-2030) ($MN)

- Table 40 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biotechnology Companies (2022-2030) ($MN)

- Table 41 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biopharmaceutical Companies (2022-2030) ($MN)

- Table 42 North America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 43 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Country (2022-2030) ($MN)

- Table 44 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Product (2022-2030) ($MN)

- Table 45 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biosimilars (2022-2030) ($MN)

- Table 46 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biologics (2022-2030) ($MN)

- Table 47 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Antisense and Molecular Therapy (2022-2030) ($MN)

- Table 48 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Recombinant Proteins (2022-2030) ($MN)

- Table 49 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Vaccines (2022-2030) ($MN)

- Table 50 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Monoclonal (2022-2030) ($MN)

- Table 51 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Products (2022-2030) ($MN)

- Table 52 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Service (2022-2030) ($MN)

- Table 53 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Manufacturing Organization (CMO) (2022-2030) ($MN)

- Table 54 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Research Organization (CRO) (2022-2030) ($MN)

- Table 55 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Type (2022-2030) ($MN)

- Table 56 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Mammalian (2022-2030) ($MN)

- Table 57 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Non-Mammalian (Microbial) (2022-2030) ($MN)

- Table 58 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Viral Vector (2022-2030) ($MN)

- Table 59 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Types (2022-2030) ($MN)

- Table 60 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By End User (2022-2030) ($MN)

- Table 61 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biotechnology Companies (2022-2030) ($MN)

- Table 62 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biopharmaceutical Companies (2022-2030) ($MN)

- Table 63 Europe Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 64 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Country (2022-2030) ($MN)

- Table 65 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Product (2022-2030) ($MN)

- Table 66 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biosimilars (2022-2030) ($MN)

- Table 67 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biologics (2022-2030) ($MN)

- Table 68 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Antisense and Molecular Therapy (2022-2030) ($MN)

- Table 69 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Recombinant Proteins (2022-2030) ($MN)

- Table 70 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Vaccines (2022-2030) ($MN)

- Table 71 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Monoclonal (2022-2030) ($MN)

- Table 72 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Products (2022-2030) ($MN)

- Table 73 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Service (2022-2030) ($MN)

- Table 74 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Manufacturing Organization (CMO) (2022-2030) ($MN)

- Table 75 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Research Organization (CRO) (2022-2030) ($MN)

- Table 76 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Type (2022-2030) ($MN)

- Table 77 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Mammalian (2022-2030) ($MN)

- Table 78 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Non-Mammalian (Microbial) (2022-2030) ($MN)

- Table 79 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Viral Vector (2022-2030) ($MN)

- Table 80 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Types (2022-2030) ($MN)

- Table 81 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By End User (2022-2030) ($MN)

- Table 82 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biotechnology Companies (2022-2030) ($MN)

- Table 83 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biopharmaceutical Companies (2022-2030) ($MN)

- Table 84 Asia Pacific Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 85 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Country (2022-2030) ($MN)

- Table 86 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Product (2022-2030) ($MN)

- Table 87 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biosimilars (2022-2030) ($MN)

- Table 88 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biologics (2022-2030) ($MN)

- Table 89 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Antisense and Molecular Therapy (2022-2030) ($MN)

- Table 90 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Recombinant Proteins (2022-2030) ($MN)

- Table 91 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Vaccines (2022-2030) ($MN)

- Table 92 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Monoclonal (2022-2030) ($MN)

- Table 93 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Products (2022-2030) ($MN)

- Table 94 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Service (2022-2030) ($MN)

- Table 95 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Manufacturing Organization (CMO) (2022-2030) ($MN)

- Table 96 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Research Organization (CRO) (2022-2030) ($MN)

- Table 97 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Type (2022-2030) ($MN)

- Table 98 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Mammalian (2022-2030) ($MN)

- Table 99 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Non-Mammalian (Microbial) (2022-2030) ($MN)

- Table 100 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Viral Vector (2022-2030) ($MN)

- Table 101 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Types (2022-2030) ($MN)

- Table 102 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By End User (2022-2030) ($MN)

- Table 103 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biotechnology Companies (2022-2030) ($MN)

- Table 104 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biopharmaceutical Companies (2022-2030) ($MN)

- Table 105 South America Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other End Users (2022-2030) ($MN)

- Table 106 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Country (2022-2030) ($MN)

- Table 107 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Product (2022-2030) ($MN)

- Table 108 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biosimilars (2022-2030) ($MN)

- Table 109 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biologics (2022-2030) ($MN)

- Table 110 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Antisense and Molecular Therapy (2022-2030) ($MN)

- Table 111 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Recombinant Proteins (2022-2030) ($MN)

- Table 112 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Vaccines (2022-2030) ($MN)

- Table 113 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Monoclonal (2022-2030) ($MN)

- Table 114 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Products (2022-2030) ($MN)

- Table 115 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Service (2022-2030) ($MN)

- Table 116 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Manufacturing Organization (CMO) (2022-2030) ($MN)

- Table 117 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Contract Research Organization (CRO) (2022-2030) ($MN)

- Table 118 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Type (2022-2030) ($MN)

- Table 119 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Mammalian (2022-2030) ($MN)

- Table 120 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Non-Mammalian (Microbial) (2022-2030) ($MN)

- Table 121 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Viral Vector (2022-2030) ($MN)

- Table 122 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other Types (2022-2030) ($MN)

- Table 123 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By End User (2022-2030) ($MN)

- Table 124 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biotechnology Companies (2022-2030) ($MN)

- Table 125 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Biopharmaceutical Companies (2022-2030) ($MN)

- Table 126 Middle East & Africa Biologics Contract Development and Manufacturing Organization (CDMO) Market Outlook, By Other End Users (2022-2030) ($MN)

According to Stratistics MRC, the Global Biologics Contract Development and Manufacturing Organization (CDMO) Market is accounted for $14.54 billion in 2024 and is expected to reach $33.45 billion by 2030 growing at a CAGR of 14.9% during the forecast period. Biological products, such as monoclonal antibodies, vaccines, cell and gene therapies, and recombinant proteins, are developed and manufactured with the assistance of specialized service providers known as biologics contract development and manufacturing organizations, or CDMOs. Because they offer experience in fields like cell line development, process optimization, analytical testing, and large-scale production, these organizations are vital to the biopharmaceutical sector. Moreover, biopharma companies can cut costs, expedite product development, and more skillfully navigate complex regulatory environments by collaborating with CDMOs.

According to the International Society for Pharmaceutical Engineering (ISPE), Biologics Contract Development and Manufacturing Organizations (CDMOs) are vital to the pharmaceutical industry, providing essential services that enable the development, scale-up, and commercialization of complex biological products.

Market Dynamics:

Driver:

Growing interest in biologics

The need for more efficient and focused treatments is being driven by the rising global burden of chronic diseases like diabetes, cancer, and autoimmune disorders. Biologics are a preferred option for treatment because of their high specificity and efficacy. The increasing demand for biologics has led pharmaceutical companies to turn to CDMOs for their expertise in meeting production needs in an efficient manner. Additionally, this demand is further fueled by the aging population and biotechnology developments, which are driving the CDMO market's steady growth.

Restraint:

Excessive costs of operations

The high operating costs of producing biologics are one of the main obstacles facing the biologics Contract Development and Manufacturing Organization (CDMO) market. Complex and costly procedures, such as advanced cell culture techniques, purification techniques, and strict quality control measures, are involved in the manufacturing of biologics. Costs are further increased by the requirement for specialized facilities, highly qualified workers, and cutting-edge technologies. Furthermore, to comply with regulations and industry standards, CDMOs have to make large capital expenditures on equipment and infrastructure, which can be very expensive.

Opportunity:

Utilizing cutting-edge manufacturing technologies

Modern manufacturing techniques like automation, continuous bioprocessing, and single-use systems offer CDMOs great chances to improve both the quality of their output and operational efficiency. By lowering production costs and increasing scalability, these technologies can also lower the risk of contamination. Moreover, CDMOs can reinforce their competitive advantage and satisfy the increasing market for superior biologics by putting these innovations to use.

Threat:

Insufficiently skilled workforce

A highly skilled and specialized workforce is needed in the biologics industry, including experts in cell biology, bioprocess engineering, and regulatory affairs. Nonetheless, there is a dearth of professionals with the knowledge and experience needed to assist in the creation and production of biologics throughout the world. The inability of CDMOs to attract and retain skilled staff may impede their ability to expand and operate more efficiently. Additionally, in order to attract and retain top talent, CDMOs must provide competitive salaries, training programs, and opportunities for career development. This is because there is fierce competition for skilled workers.

Covid-19 Impact:

The market for biologics contract development and manufacturing organizations (or CDMOs) has seen tremendous growth and change as a result of the COVID-19 pandemic. An unprecedented demand for CDMO services resulted from the pressing need for vaccines, treatments, and diagnostic tools, which sped up production schedules and increased manufacturing capacity. Furthermore, the rapid development and widespread manufacturing of COVID-19 vaccines and treatments were made possible in large part by CDMOs, underscoring the significance of these organizations in the biopharmaceutical supply chain.

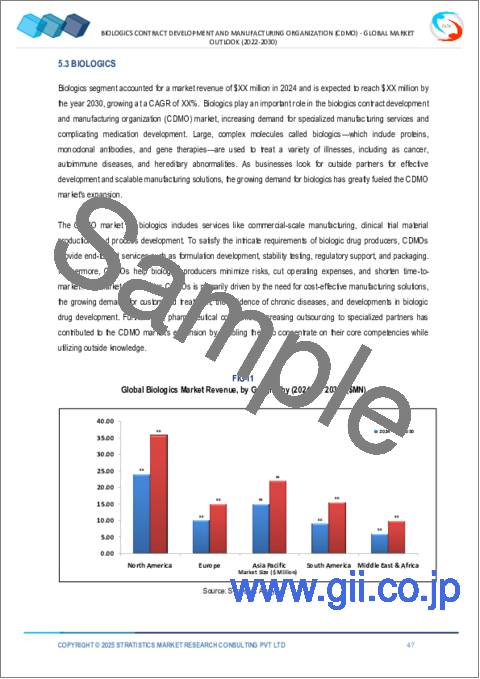

The Biologics segment is expected to be the largest during the forecast period

In the biologics contract development and manufacturing organization (CDMO) market, the biologics segment has the largest market share. Biologics comprise a broad spectrum of intricate medicinal items, such as recombinant proteins, cell and gene therapies, vaccines, and monoclonal antibodies. The market for biologics has expanded due to the rising incidence of chronic illnesses and the rising need for individualized and targeted treatments. Moreover, pharmaceutical companies have made significant investments in the development and commercialization of biologics due to their significant therapeutic advantages over traditional small-molecule drugs.

The Contract Manufacturing Organization (CMO) segment is expected to have the highest CAGR during the forecast period

In the biologics contract development and manufacturing organization (CDMO) market, the contract manufacturing organization (CMO) segment usually shows the highest CAGR. CMOs are experts in offering biopharmaceutical products end-to-end manufacturing services, encompassing process development, scaling up, and commercial production. Additionally, pharmaceutical companies outsource manufacturing to CMOs due to the growing demand for biologics, complex manufacturing processes, and the requirement for specialized expertise.

Region with largest share:

In the biologics contract development and manufacturing organization (CDMO) market, North America typically holds the largest share. Numerous elements contribute to the region's dominance, such as a thriving biopharmaceutical sector, state-of0-the-art healthcare facilities, a solid regulatory environment, and a highly qualified labour force. Furthermore, a thriving ecosystem for the development and production of biologics is fostered by the large number of biotech and pharmaceutical companies, as well as eminent academic and research institutions located in North America.

Region with highest CAGR:

In the market for biologics contract development and manufacturing organizations (CDOs), the Asia-Pacific region usually shows the highest CAGR. Increasing outsourcing among biopharmaceutical companies, growing investments in healthcare infrastructure and growing biopharmaceutical manufacturing capabilities in nations like China, India, and South Korea are some of the factors driving this growth. Moreover, the region's appeal to CDMOs is further enhanced by advantageous government policies, regulatory reforms, and initiatives to support biotech innovation.

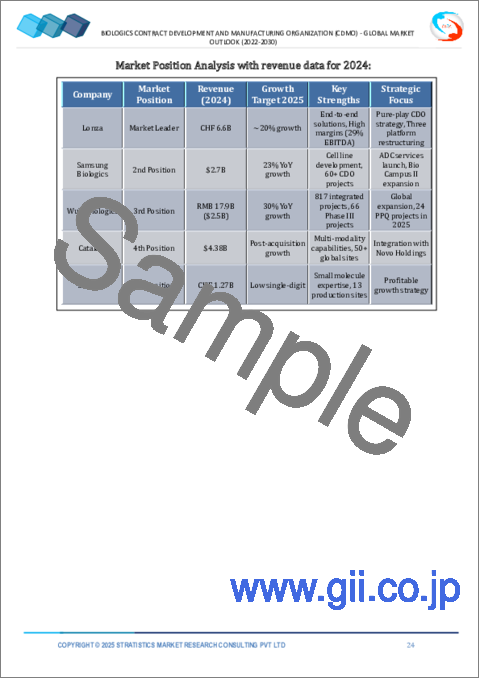

Key players in the market

Some of the key players in Biologics Contract Development and Manufacturing Organization (CDMO) market include Samsung Biologics, Boehringer Ingelheim Group, Sandoz Biopharmaceuticals (Novartis AG), Parexel International Corporation, Fujifilm Diosynth Biotechnologies USA Inc., AbbVie Contract Manufacturing, Lonza Group, Binex Co. Limited, Rentschler Biotechnologies, Toyobo Co. Limited, AGC Biologics, PRA Health Sciences, Catalent Inc, Wuxi Biologics and JRS Pharma.

Key Developments:

In May 2024, AbbVie and Gilgamesh Pharmaceuticals have announced a collaboration and option-to-license agreement to develop next-generation therapies for psychiatric disorders. This collaboration will leverage AbbVie's expertise in psychiatry and Gilgamesh's innovative research platform to discover novel neuroplastogens.

In April 2024, FUJIFILM Diosynth Biotechnologies, a global leading contract development and manufacturing organization (CDMO), announced that it will expand its large-scale cell culture manufacturing facility currently under construction with a $1.2 billion investment from FUJIFILM Corporation.

In February 2024, Samsung Biologics, a global contract development and manufacturing organization (CDMO), has signed a partnership agreement with LegoChem Biosciences, a biotech company pioneering the research and development of antibody-drug conjugate (ADC) programs.

Products Covered:

- Biosimilars

- Biologics

- Other Products

Services Covered:

- Contract Manufacturing Organization (CMO)

- Contract Research Organization (CRO)

Types Covered:

- Mammalian

- Non-Mammalian (Microbial)

- Viral Vector

- Other Types

End Users Covered:

- Biotechnology Companies

- Biopharmaceutical Companies

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2022, 2023, 2024, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Product Analysis

- 3.7 End User Analysis

- 3.8 Emerging Markets

- 3.9 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market, By Product

- 5.1 Introduction

- 5.2 Biosimilars

- 5.3 Biologics

- 5.3.1 Antisense and Molecular Therapy

- 5.3.2 Recombinant Proteins

- 5.3.3 Vaccines

- 5.3.4 Monoclonal

- 5.3.4.1 Protein-Based

- 5.3.4.2 Diagnostic

- 5.3.4.3 Therapeutic

- 5.4 Other Products

6 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market, By Service

- 6.1 Introduction

- 6.2 Contract Manufacturing Organization (CMO)

- 6.3 Contract Research Organization (CRO)

7 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market, By Type

- 7.1 Introduction

- 7.2 Mammalian

- 7.3 Non-Mammalian (Microbial)

- 7.4 Viral Vector

- 7.5 Other Types

8 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market, By End User

- 8.1 Introduction

- 8.2 Biotechnology Companies

- 8.3 Biopharmaceutical Companies

- 8.4 Other End Users

9 Global Biologics Contract Development and Manufacturing Organization (CDMO) Market, By Geography

- 9.1 Introduction

- 9.2 North America

- 9.2.1 US

- 9.2.2 Canada

- 9.2.3 Mexico

- 9.3 Europe

- 9.3.1 Germany

- 9.3.2 UK

- 9.3.3 Italy

- 9.3.4 France

- 9.3.5 Spain

- 9.3.6 Rest of Europe

- 9.4 Asia Pacific

- 9.4.1 Japan

- 9.4.2 China

- 9.4.3 India

- 9.4.4 Australia

- 9.4.5 New Zealand

- 9.4.6 South Korea

- 9.4.7 Rest of Asia Pacific

- 9.5 South America

- 9.5.1 Argentina

- 9.5.2 Brazil

- 9.5.3 Chile

- 9.5.4 Rest of South America

- 9.6 Middle East & Africa

- 9.6.1 Saudi Arabia

- 9.6.2 UAE

- 9.6.3 Qatar

- 9.6.4 South Africa

- 9.6.5 Rest of Middle East & Africa

10 Key Developments

- 10.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 10.2 Acquisitions & Mergers

- 10.3 New Product Launch

- 10.4 Expansions

- 10.5 Other Key Strategies

11 Company Profiling

- 11.1 Samsung Biologics

- 11.2 Boehringer Ingelheim Group

- 11.3 Sandoz Biopharmaceuticals (Novartis AG)

- 11.4 Parexel International Corporation

- 11.5 Fujifilm Diosynth Biotechnologies USA Inc.

- 11.6 AbbVie Contract Manufacturing

- 11.7 Lonza Group

- 11.8 Binex Co. Limited

- 11.9 Rentschler Biotechnologies

- 11.10 Toyobo Co. Limited

- 11.11 AGC Biologics

- 11.12 PRA Health Sciences

- 11.13 Catalent Inc

- 11.14 Wuxi Biologics

- 11.15 JRS Pharma