|

|

市場調査レポート

商品コード

1438120

カーボンオフセット/カーボンクレジット市場の2030年までの予測: タイプ別、プロジェクトタイプ別、エンドユーザー別、地域別の世界分析Carbon Offset/Carbon Credit Market Forecasts to 2030 - Global Analysis By Type (Voluntary Market and Compliance Market), Project Type, End User and By Geography |

||||||

カスタマイズ可能

|

|||||||

| カーボンオフセット/カーボンクレジット市場の2030年までの予測: タイプ別、プロジェクトタイプ別、エンドユーザー別、地域別の世界分析 |

|

出版日: 2024年02月02日

発行: Stratistics Market Research Consulting

ページ情報: 英文 200+ Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

Stratistics MRCによると、世界のカーボンオフセット/カーボンクレジット市場は、2023年に4,148億米ドルを占め、予測期間中に33.0%のCAGRで成長し、2030年には3兆535億米ドルに達すると予想されています。

カーボンオフセットとは、温室効果ガス(GHG)排出量の削減、または大気中からのGHGの除去であり、他の場所で発生した排出量を補うものです。カーボンクレジットは、特定量の温室効果ガスを排出する権利を表す許可証または証明書です。1クレジットは通常、1トンのCO2eに相当します。これらのオフセットは通常、再生可能エネルギー発電、植林、メタン回収など、排出量を削減または回収するプロジェクトを通じて創出されます。

世界銀行によると、炭素価格はここ1年で急上昇しており、これは脱炭素化への取り組みが加速するにつれて需要が高まっていることが主な原因です。オフセット価格の急上昇は、価格上昇と企業バイヤーの需要増の両方を反映しており、オフセット取引量の増加につながった。

持続可能性目標の高まりとカーボンフットプリント削減への取り組み

野心的な環境目標の達成に努める企業は、炭素市場に積極的に参加し、避けられない排出をオフセットします。このような需要の高まりは、再生可能エネルギーへの取り組みから自然保護活動まで、多様なプロジェクトへの投資を刺激します。その結果、カーボンオフセット/クレジット市場は拡大し、企業の持続可能性目標を達成し、低炭素経済への移行を促進するための重要なメカニズムを提供しています。

変動しやすいカーボンクレジット価格

急激な変動は、企業の排出削減戦略の計画や予算を立てる能力を混乱させ、長期的な投資の意欲をそぎ、潜在的な投資家やプロジェクト開発者にためらいを生み、市場全体の安定性に影響を与える可能性があります。さらに、予測不可能な価格設定は、排出削減目標を達成するための信頼できる手段としての炭素クレジットの信頼性に影響を与え、市場の成長を妨げる可能性があります。

厳しい気候政策と政策規制

排出削減目標を課す世界各国の政府は、企業がその遵守を求める中で、炭素クレジットの旺盛な需要を生み出しています。このような規制環境は、企業が排出削減プロジェクトに投資し、やむを得ない排出を相殺するためにクレジットを購入する動機付けとなっています。市場は、その範囲を拡大し、持続可能な慣行におけるイノベーションを促進し、低炭素経済への移行を推進することで対応しています。全体として、厳しい気候政策がカーボンオフセット/クレジット市場の成長と有効性の触媒として機能しています。

カーボンオフセットに対する社会の認識と理解は限定的

認知度の低さは、カーボンオフセットへの個人や企業の自発的な参加を妨げています。この不十分な理解は、カーボンクレジットの需要を低下させ、市場への影響を制限します。これに対処するためには、一般市民の意識を高め、カーボンオフセット・プロジェクトの利点を明確にし、より広範な採用を促進するための教育イニシアティブとアウトリーチ・キャンペーンが極めて重要です。

COVID-19の影響

パンデミックは、再生可能エネルギー・プロジェクトやカーボンオフセット・イニシアチブに関連するものを含め、様々な業界のサプライ・チェーンを混乱させました。さらに、パンデミックは、政府の優先順位を一時的に環境問題からずらし、炭素市場の政策や規制の枠組みに影響を与えた可能性があります。しかし、一部の政府はこの機会を利用して、持続可能性対策を復興計画に組み入れ、市場の成長を促した可能性があります。

予測期間中、除去・分離プロジェクト分野が最大になる見込み

環境に優しい選択肢を求める消費者の意識と需要が市場競争を促進し、材料と製造プロセスの革新を促す可能性があるため、除去・隔離プロジェクトセグメントは有利な成長を遂げると予測されます。全体として、キャンプ用クーラー製品を炭素除去の取り組みに合わせることは、世界の環境目標に沿うものであり、肯定的なブランドイメージを醸成し、環境配慮型製品に対する消費者の嗜好の高まりに応えるものです。

エネルギー・電力分野は予測期間中に最も高いCAGRが見込まれる

クーラーのイノベーションは、冷却メカニズムにエネルギー効率の高い技術を活用することが多く、性能と携帯性に影響を与えるため、エネルギー&パワー分野は予測期間中に最も高いCAGR成長が見込まれます。効率的なエネルギー使用は、特にオフグリッドのキャンプシーンにおいて、クーラーの効果を高める。さらに、電源は製品コストにも影響するため、メーカーは性能とエネルギー効率のバランスをとり、信頼性が高く、便利で、環境に配慮したキャンプ用冷却ソリューションを求める多様な市場に対応する必要があります。

最大のシェアを占める地域

アジア太平洋地域は、カーボンオフセットとクレジットの需要により、予測期間中最大の市場シェアを占めると予測されています。太陽光、風力、その他のクリーンなエネルギー源への投資は、排出量の削減とカーボンクレジットの生成の両方に貢献する可能性があります。さらに、産業界や企業が炭素削減の取り組みに参加することも重要な原動力となります。企業は、環境責任を実証し、持続可能性の目標を達成するために、カーボンオフセット・プロジェクトや取引制度に自主的に参加することがあります。

CAGRが最も高い地域

北米では、気候変動と持続可能性に対する意識の高まりにより、カーボンオフセットとカーボンクレジットへの関心が高まっているため、予測期間中のCAGRは北米が最も高いと予測されます。企業や参入企業は、二酸化炭素排出量を削減し、炭素市場に参加する方法を模索しており、これが市場成長の促進要因となっています。

無料カスタマイズサービス

本レポートをご購読のお客様には、以下の無料カスタマイズオプションのいずれかをご利用いただけます:

- 企業プロファイル

- 追加市場プレイヤーの包括的プロファイリング(3社まで)

- 主要企業のSWOT分析(3社まで)

- 地域セグメンテーション

- 顧客の関心に応じた主要国の市場推計・予測・CAGR(注:フィージビリティチェックによる)

- 競合ベンチマーキング

- 製品ポートフォリオ、地理的プレゼンス、戦略的提携に基づく主要企業のベンチマーキング

目次

第1章 エグゼクティブサマリー

第2章 序文

- 概要

- ステークホルダー

- 調査範囲

- 調査手法

- データマイニング

- データ分析

- データ検証

- 調査アプローチ

- 調査ソース

- 1次調査ソース

- 2次調査ソース

- 前提条件

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- エンドユーザー分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 代替品の脅威

- 新規参入業者の脅威

- 競合企業間の敵対関係

第5章 世界のカーボンオフセット/カーボンクレジット市場:タイプ別

- 自主市場

- コンプライアンス市場

第6章 世界のカーボンオフセット/カーボンクレジット市場:プロジェクトタイプ別

- 除去/隔離プロジェクト

- 回避/削減プロジェクト

第7章 世界のカーボンオフセット/カーボンクレジット市場:エンドユーザー別

- エネルギーと電力

- 航空

- 産業用

- 建物

- 交通機関

- その他のエンドユーザー

第8章 世界のカーボンオフセット/カーボンクレジット市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他欧州

- アジア太平洋地域

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他アジア太平洋地域

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他南米

- 中東とアフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他中東とアフリカ

第9章 主な発展

- 契約、パートナーシップ、コラボレーション、合弁事業

- 買収と合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第10章 企業プロファイル

- 3Degrees

- Finite Carbon

- EKI Energy Services Ltd.

- WGL Holdings, Inc.

- NativeEnergy

- South Pole Group

- Carbon Care Asia Limited

- Natureoffice GmbH

- Carbon Credit Capital

- Enking International

- Cool Effect, Inc.

- TEM(Tasman Environmental Markets)

- Climate Impact Partners

- Carbonfund

- Green Mountain Energy

- ForestCarbon

- Bluesource LLC

- Moss.Earth

- Terrapass

List of Tables

- Table 1 Global Carbon Offset/Carbon Credit Market Outlook, By Region (2021-2030) ($MN)

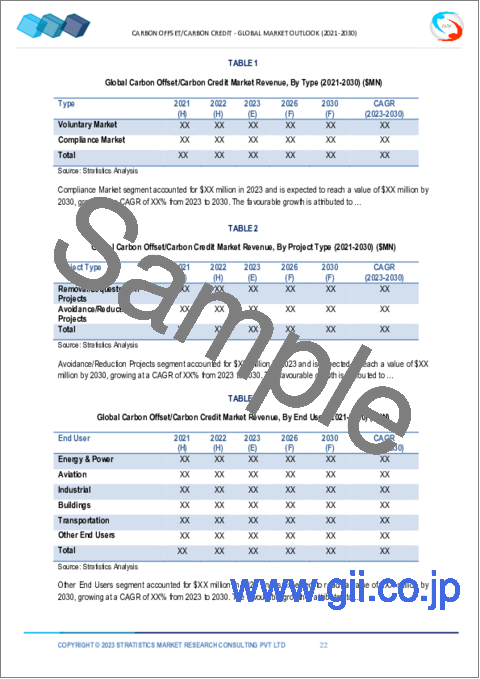

- Table 2 Global Carbon Offset/Carbon Credit Market Outlook, By Type (2021-2030) ($MN)

- Table 3 Global Carbon Offset/Carbon Credit Market Outlook, By Voluntary Market (2021-2030) ($MN)

- Table 4 Global Carbon Offset/Carbon Credit Market Outlook, By Compliance Market (2021-2030) ($MN)

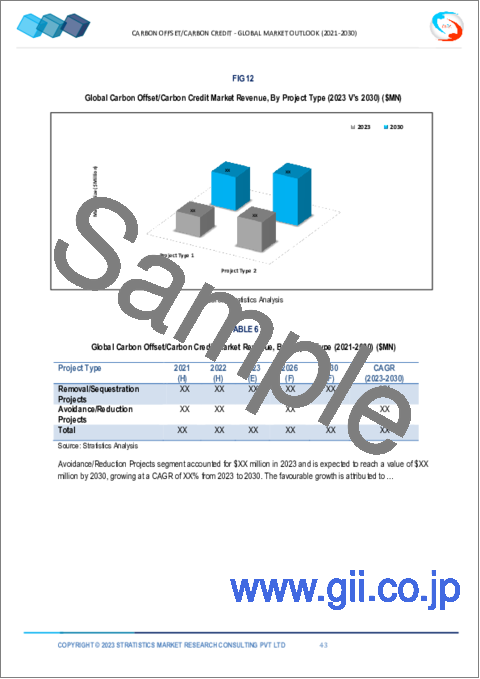

- Table 5 Global Carbon Offset/Carbon Credit Market Outlook, By Project Type (2021-2030) ($MN)

- Table 6 Global Carbon Offset/Carbon Credit Market Outlook, By Removal/Sequestration Projects (2021-2030) ($MN)

- Table 7 Global Carbon Offset/Carbon Credit Market Outlook, By Avoidance/Reduction Projects (2021-2030) ($MN)

- Table 8 Global Carbon Offset/Carbon Credit Market Outlook, By End User (2021-2030) ($MN)

- Table 9 Global Carbon Offset/Carbon Credit Market Outlook, By Energy & Power (2021-2030) ($MN)

- Table 10 Global Carbon Offset/Carbon Credit Market Outlook, By Aviation (2021-2030) ($MN)

- Table 11 Global Carbon Offset/Carbon Credit Market Outlook, By Industrial (2021-2030) ($MN)

- Table 12 Global Carbon Offset/Carbon Credit Market Outlook, By Buildings (2021-2030) ($MN)

- Table 13 Global Carbon Offset/Carbon Credit Market Outlook, By Transportation (2021-2030) ($MN)

- Table 14 Global Carbon Offset/Carbon Credit Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 15 North America Carbon Offset/Carbon Credit Market Outlook, By Country (2021-2030) ($MN)

- Table 16 North America Carbon Offset/Carbon Credit Market Outlook, By Type (2021-2030) ($MN)

- Table 17 North America Carbon Offset/Carbon Credit Market Outlook, By Voluntary Market (2021-2030) ($MN)

- Table 18 North America Carbon Offset/Carbon Credit Market Outlook, By Compliance Market (2021-2030) ($MN)

- Table 19 North America Carbon Offset/Carbon Credit Market Outlook, By Project Type (2021-2030) ($MN)

- Table 20 North America Carbon Offset/Carbon Credit Market Outlook, By Removal/Sequestration Projects (2021-2030) ($MN)

- Table 21 North America Carbon Offset/Carbon Credit Market Outlook, By Avoidance/Reduction Projects (2021-2030) ($MN)

- Table 22 North America Carbon Offset/Carbon Credit Market Outlook, By End User (2021-2030) ($MN)

- Table 23 North America Carbon Offset/Carbon Credit Market Outlook, By Energy & Power (2021-2030) ($MN)

- Table 24 North America Carbon Offset/Carbon Credit Market Outlook, By Aviation (2021-2030) ($MN)

- Table 25 North America Carbon Offset/Carbon Credit Market Outlook, By Industrial (2021-2030) ($MN)

- Table 26 North America Carbon Offset/Carbon Credit Market Outlook, By Buildings (2021-2030) ($MN)

- Table 27 North America Carbon Offset/Carbon Credit Market Outlook, By Transportation (2021-2030) ($MN)

- Table 28 North America Carbon Offset/Carbon Credit Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 29 Europe Carbon Offset/Carbon Credit Market Outlook, By Country (2021-2030) ($MN)

- Table 30 Europe Carbon Offset/Carbon Credit Market Outlook, By Type (2021-2030) ($MN)

- Table 31 Europe Carbon Offset/Carbon Credit Market Outlook, By Voluntary Market (2021-2030) ($MN)

- Table 32 Europe Carbon Offset/Carbon Credit Market Outlook, By Compliance Market (2021-2030) ($MN)

- Table 33 Europe Carbon Offset/Carbon Credit Market Outlook, By Project Type (2021-2030) ($MN)

- Table 34 Europe Carbon Offset/Carbon Credit Market Outlook, By Removal/Sequestration Projects (2021-2030) ($MN)

- Table 35 Europe Carbon Offset/Carbon Credit Market Outlook, By Avoidance/Reduction Projects (2021-2030) ($MN)

- Table 36 Europe Carbon Offset/Carbon Credit Market Outlook, By End User (2021-2030) ($MN)

- Table 37 Europe Carbon Offset/Carbon Credit Market Outlook, By Energy & Power (2021-2030) ($MN)

- Table 38 Europe Carbon Offset/Carbon Credit Market Outlook, By Aviation (2021-2030) ($MN)

- Table 39 Europe Carbon Offset/Carbon Credit Market Outlook, By Industrial (2021-2030) ($MN)

- Table 40 Europe Carbon Offset/Carbon Credit Market Outlook, By Buildings (2021-2030) ($MN)

- Table 41 Europe Carbon Offset/Carbon Credit Market Outlook, By Transportation (2021-2030) ($MN)

- Table 42 Europe Carbon Offset/Carbon Credit Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 43 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Country (2021-2030) ($MN)

- Table 44 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Type (2021-2030) ($MN)

- Table 45 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Voluntary Market (2021-2030) ($MN)

- Table 46 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Compliance Market (2021-2030) ($MN)

- Table 47 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Project Type (2021-2030) ($MN)

- Table 48 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Removal/Sequestration Projects (2021-2030) ($MN)

- Table 49 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Avoidance/Reduction Projects (2021-2030) ($MN)

- Table 50 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By End User (2021-2030) ($MN)

- Table 51 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Energy & Power (2021-2030) ($MN)

- Table 52 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Aviation (2021-2030) ($MN)

- Table 53 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Industrial (2021-2030) ($MN)

- Table 54 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Buildings (2021-2030) ($MN)

- Table 55 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Transportation (2021-2030) ($MN)

- Table 56 Asia Pacific Carbon Offset/Carbon Credit Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 57 South America Carbon Offset/Carbon Credit Market Outlook, By Country (2021-2030) ($MN)

- Table 58 South America Carbon Offset/Carbon Credit Market Outlook, By Type (2021-2030) ($MN)

- Table 59 South America Carbon Offset/Carbon Credit Market Outlook, By Voluntary Market (2021-2030) ($MN)

- Table 60 South America Carbon Offset/Carbon Credit Market Outlook, By Compliance Market (2021-2030) ($MN)

- Table 61 South America Carbon Offset/Carbon Credit Market Outlook, By Project Type (2021-2030) ($MN)

- Table 62 South America Carbon Offset/Carbon Credit Market Outlook, By Removal/Sequestration Projects (2021-2030) ($MN)

- Table 63 South America Carbon Offset/Carbon Credit Market Outlook, By Avoidance/Reduction Projects (2021-2030) ($MN)

- Table 64 South America Carbon Offset/Carbon Credit Market Outlook, By End User (2021-2030) ($MN)

- Table 65 South America Carbon Offset/Carbon Credit Market Outlook, By Energy & Power (2021-2030) ($MN)

- Table 66 South America Carbon Offset/Carbon Credit Market Outlook, By Aviation (2021-2030) ($MN)

- Table 67 South America Carbon Offset/Carbon Credit Market Outlook, By Industrial (2021-2030) ($MN)

- Table 68 South America Carbon Offset/Carbon Credit Market Outlook, By Buildings (2021-2030) ($MN)

- Table 69 South America Carbon Offset/Carbon Credit Market Outlook, By Transportation (2021-2030) ($MN)

- Table 70 South America Carbon Offset/Carbon Credit Market Outlook, By Other End Users (2021-2030) ($MN)

- Table 71 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Country (2021-2030) ($MN)

- Table 72 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Type (2021-2030) ($MN)

- Table 73 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Voluntary Market (2021-2030) ($MN)

- Table 74 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Compliance Market (2021-2030) ($MN)

- Table 75 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Project Type (2021-2030) ($MN)

- Table 76 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Removal/Sequestration Projects (2021-2030) ($MN)

- Table 77 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Avoidance/Reduction Projects (2021-2030) ($MN)

- Table 78 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By End User (2021-2030) ($MN)

- Table 79 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Energy & Power (2021-2030) ($MN)

- Table 80 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Aviation (2021-2030) ($MN)

- Table 81 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Industrial (2021-2030) ($MN)

- Table 82 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Buildings (2021-2030) ($MN)

- Table 83 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Transportation (2021-2030) ($MN)

- Table 84 Middle East & Africa Carbon Offset/Carbon Credit Market Outlook, By Other End Users (2021-2030) ($MN)

According to Stratistics MRC, the Global Carbon Offset/Carbon Credit Market is accounted for $414.8 billion in 2023 and is expected to reach $3053.5 billion by 2030 growing at a CAGR of 33.0% during the forecast period. A carbon offset is a reduction in greenhouse gas (GHG) emissions, or the removal of GHGs from the atmosphere, to compensate for emissions produced elsewhere. A carbon credit is a permit or certificate that represents the right to emit a specific amount of greenhouse gases. Each credit typically corresponds to one ton of CO2e. These offsets are typically generated through projects that reduce or capture emissions, such as renewable energy projects, afforestation, or methane capture.

According to the World Bank, carbon prices have risen sharply in the past year, and this is mostly due to the increased demand as decarbonization efforts accelerate. The rapid increase in the value of offsets reflects both the rising prices and the rising demand from corporate buyers leading to higher transacted offset volumes.

Market Dynamics:

Driver:

Increasing sustainability goals and commit to reducing their carbon footprint

Companies, striving to meet ambitious environmental targets, actively participate in carbon markets to offset unavoidable emissions. This heightened demand stimulates investment in diverse projects, ranging from renewable energy initiatives to conservation efforts. As a result, the carbon offset/credit market expands, offering a crucial mechanism for achieving corporate sustainability objectives and fostering a transition to a low-carbon economy.

Restraint:

Volatile carbon credit prices

Rapid fluctuations can disrupt businesses' ability to plan and budget for emission reduction strategies, discouraging long-term investments, may also create hesitancy among potential investors and project developers, impacting the market's overall stability. Additionally, unpredictable pricing may affect the credibility of carbon credits as a reliable tool for achieving emissions reduction targets hamper the market growth.

Opportunity:

Stringent climate policies and regulations

Governments globally imposing emission reduction targets create a robust demand for carbon credits as businesses seek compliance. This regulatory environment incentivizes companies to invest in emission reduction projects and purchase credits to offset unavoidable emissions. The market responds by expanding its scope, fostering innovation in sustainable practices, and driving the transition to a low-carbon economy. Overall, stringent climate policies serve as a catalyst for the growth and effectiveness of the carbon offset/credit market

Threat:

Limited public awareness and understanding of the carbon offset

The lack of awareness hampers voluntary participation from individuals and businesses in offsetting their carbon footprints. This insufficient understanding may result in lower demand for carbon credits, limiting their market impact. To address this, educational initiatives and outreach campaigns are crucial to enhance public awareness, clarify the benefits of carbon offset projects, and encourage broader adoption.

Covid-19 Impact

The pandemic has disrupted supply chains across various industries, including those related to renewable energy projects and carbon offset initiatives. Moreover, the pandemic may have shifted government priorities away from environmental issues temporarily, impacting policy and regulatory frameworks for carbon markets. However, some governments might have used the opportunity to integrate sustainability measures into their recovery plans encourage in the market growth.

The removal/sequestration projects segment is expected to be the largest during the forecast period

The removal/sequestration projects segment is estimated to have a lucrative growth, due to consumer awareness and demand for eco-friendly options could drive market competition, encouraging innovation in materials and manufacturing processes. Overall, aligning camping cooler products with carbon removal initiatives aligns with global environmental goals, fostering a positive brand image and meeting the increasing consumer preference for eco-conscious products.

The energy & power segment is expected to have the highest CAGR during the forecast period

The energy & power segment is anticipated to witness the highest CAGR growth during the forecast period, as cooler innovations often leverage energy-efficient technologies for cooling mechanisms, impacting performance and portability. Efficient energy usage enhances cooler effectiveness, especially in off-grid camping scenarios. Additionally, the power source also affects product costs, prompting manufacturers to balance performance and energy efficiency to cater to a diverse market seeking reliable, convenient, and environmentally conscious camping cooling solutions.

Region with largest share:

Asia Pacific is projected to hold the largest market share during the forecast period owing to the demand for carbon offsets and credits can be influenced by the growth of renewable energy projects in the region. Investments in solar, wind, and other clean energy sources may contribute to both reduced emissions and the generation of carbon credits. Additionally, the engagement of industries and businesses in carbon reduction initiatives is a significant driver. Companies may voluntarily participate in carbon offset projects or trading schemes to demonstrate environmental responsibility and meet sustainability goals.

Region with highest CAGR:

North America is projected to have the highest CAGR over the forecast period, owing to growing interest in carbon offsetting and carbon credits in North America, driven by increasing awareness of climate change and sustainability. Companies and individuals have been exploring ways to reduce their carbon footprint and participate in carbon markets which are driving the growth of the market.

Key players in the market

Some of the key players in the Carbon Offset/Carbon Credit Market include 3Degrees, Finite Carbon, EKI Energy Services Ltd., WGL Holdings, Inc., NativeEnergy, South Pole Group, Carbon Care Asia Limited, Natureoffice GmbH, Carbon Credit Capital Enking International, Cool Effect, Inc., TEM (Tasman Environmental Markets), Climate Impact Partners, Carbonfund, Green Mountain Energy, ForestCarbon, Bluesource LLC, Moss.Earth and Terrapass

Key Developments:

In October 2023, Solidia technologies to partner with 3degrees to issue high-integrity carbon credits, the resulting credits, which include carbon removal, will be purchased by organizations to reduce their scope 3 emissions from cement and concrete or to compensate for other greenhouse gas emissions.

In April 2023, LandYield and Finite Carbon Join Forces to Expand Landowner Access to Voluntary Carbon Market. Participating landowners also help maintain recreational values, protect water resources, and improve habitat quality on enrolled lands.

In March 2023, Sweep and 3Degrees Partner to Launch Groundbreaking Carbon Measurement and Reduction Solution. The two certified B Corporations will team up to provide a seamless experience for organizations looking to measure and take action on their operational and value chain emissions.

Types Covered:

- Voluntary Market

- Compliance Market

Project Types Covered:

- Removal/Sequestration Projects

- Avoidance/Reduction Projects

End Users Covered:

- Energy & Power

- Aviation

- Industrial

- Buildings

- Transportation

- Other End Users

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2021, 2022, 2023, 2026, and 2030

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 End User Analysis

- 3.7 Emerging Markets

- 3.8 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Carbon Offset/Carbon Credit Market, By Type

- 5.1 Introduction

- 5.2 Voluntary Market

- 5.3 Compliance Market

6 Global Carbon Offset/Carbon Credit Market, By Project Type

- 6.1 Introduction

- 6.2 Removal/Sequestration Projects

- 6.3 Avoidance/Reduction Projects

7 Global Carbon Offset/Carbon Credit Market, By End User

- 7.1 Introduction

- 7.2 Energy & Power

- 7.3 Aviation

- 7.4 Industrial

- 7.5 Buildings

- 7.6 Transportation

- 7.7 Other End Users

8 Global Carbon Offset/Carbon Credit Market, By Geography

- 8.1 Introduction

- 8.2 North America

- 8.2.1 US

- 8.2.2 Canada

- 8.2.3 Mexico

- 8.3 Europe

- 8.3.1 Germany

- 8.3.2 UK

- 8.3.3 Italy

- 8.3.4 France

- 8.3.5 Spain

- 8.3.6 Rest of Europe

- 8.4 Asia Pacific

- 8.4.1 Japan

- 8.4.2 China

- 8.4.3 India

- 8.4.4 Australia

- 8.4.5 New Zealand

- 8.4.6 South Korea

- 8.4.7 Rest of Asia Pacific

- 8.5 South America

- 8.5.1 Argentina

- 8.5.2 Brazil

- 8.5.3 Chile

- 8.5.4 Rest of South America

- 8.6 Middle East & Africa

- 8.6.1 Saudi Arabia

- 8.6.2 UAE

- 8.6.3 Qatar

- 8.6.4 South Africa

- 8.6.5 Rest of Middle East & Africa

9 Key Developments

- 9.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 9.2 Acquisitions & Mergers

- 9.3 New Product Launch

- 9.4 Expansions

- 9.5 Other Key Strategies

10 Company Profiling

- 10.1 3Degrees

- 10.2 Finite Carbon

- 10.3 EKI Energy Services Ltd.

- 10.4 WGL Holdings, Inc.

- 10.5 NativeEnergy

- 10.6 South Pole Group

- 10.7 Carbon Care Asia Limited

- 10.8 Natureoffice GmbH

- 10.9 Carbon Credit Capital

- 10.10 Enking International

- 10.11 Cool Effect, Inc.

- 10.12 TEM (Tasman Environmental Markets)

- 10.13 Climate Impact Partners

- 10.14 Carbonfund

- 10.15 Green Mountain Energy

- 10.16 ForestCarbon

- 10.17 Bluesource LLC

- 10.18 Moss.Earth

- 10.19 Terrapass