|

|

市場調査レポート

商品コード

1159502

バイオプラスチックの世界市場予測:製品別、用途別、地域別の分析(2028年まで)Bioplastics Market Forecasts to 2028 - Global Analysis By Product (I Non Biodegradable, Biodegradable), Application (Consumer goods, Packaging, Agriculture, Textile, Building & Construction, Automotive & Transportation) and Geography |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| バイオプラスチックの世界市場予測:製品別、用途別、地域別の分析(2028年まで) |

|

出版日: 2022年11月01日

発行: Stratistics Market Research Consulting

ページ情報: 英文 175+ Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

世界のバイオプラスチックの市場規模は、2022年の121億4,000万米ドルから、2028年までに346億7,000万米ドルに達し、予測期間中にCAGRで19.1%の成長が予測されています。

当レポートでは、世界のバイオプラスチック市場を調査し、市場の促進要因・抑制要因、市場機会、COVID-19の影響、セグメント別の市場分析、主要企業のプロファイルなどの情報を提供しています。

目次

第1章 エグゼクティブサマリー

第2章 序文

第3章 市場動向分析

- 促進要因

- 抑制要因

- 機会

- 脅威

- 製品分析

- 用途分析

- 新興市場

- COVID-19の影響

第4章 ポーターのファイブフォース分析

第5章 世界のバイオプラスチック市場:製品別

- 非生分解性

- ポリアミド

- ポリエチレンテレフタレート

- ポリトリメチレンテレフタレート

- ポリエチレン

- その他

- 生分解性

- 澱粉ブレンド

- ポリ乳酸

- ポリブチレンサクシネート(PBS)

- ポリブチレンアジペートテレフタレート(PBAT)

- その他

- その他

第6章 世界のバイオプラスチック市場:用途別

- 消費財

- 包装

- 軟質包装

- 硬質包装

- 農業

- 繊維

- 建築・建設

- 自動車・輸送

- その他

第7章 世界のバイオプラスチック市場:地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- イタリア

- フランス

- スペイン

- その他の欧州

- アジア太平洋

- 日本

- 中国

- インド

- オーストラリア

- ニュージーランド

- 韓国

- その他のアジア太平洋

- 南米

- アルゼンチン

- ブラジル

- チリ

- その他の南米

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- カタール

- 南アフリカ

- その他の中東・アフリカ

第8章 主な発展

- 契約、パートナーシップ、提携、合弁事業

- 買収・合併

- 新製品の発売

- 事業拡大

- その他の主要戦略

第9章 企業プロファイル

- Toyota Tsusho Corporation

- SABIC

- BASF SE

- Trinseo S.A.

- Total Corbion PLAIR

- Futerro

- Braskem

- Koninklijke DSM N.V.

- NatureWorks, LLC

- Dow Chemical Company

- Danimer Scientific

- Indorama Ventures Public Company Limited

- Novamont SpA

- M& G Chemicals

- Lyondellbase

- Succinity GmbH

List of Tables

- Table 1 Global Bioplastics Market Outlook, By Region (2020-2028) ($MN)

- Table 2 Global Bioplastics Market Outlook, By Product (2020-2028) ($MN)

- Table 3 Global Bioplastics Market Outlook, By Non Biodegradable (2020-2028) ($MN)

- Table 4 Global Bioplastics Market Outlook, By Polyamide (2020-2028) ($MN)

- Table 5 Global Bioplastics Market Outlook, By Polyethylene Terephthalate (2020-2028) ($MN)

- Table 6 Global Bioplastics Market Outlook, By Polytrimethylene Terephthalate (2020-2028) ($MN)

- Table 7 Global Bioplastics Market Outlook, By Polyethylene (2020-2028) ($MN)

- Table 8 Global Bioplastics Market Outlook, By Other Non Biodegradables (2020-2028) ($MN)

- Table 9 Global Bioplastics Market Outlook, By Biodegradable (2020-2028) ($MN)

- Table 10 Global Bioplastics Market Outlook, By Starch Blends (2020-2028) ($MN)

- Table 11 Global Bioplastics Market Outlook, By Polylactic Acid (2020-2028) ($MN)

- Table 12 Global Bioplastics Market Outlook, By Polybutylene Succinate (PBS) (2020-2028) ($MN)

- Table 13 Global Bioplastics Market Outlook, By Polybutylene Adipate Terephthalate (PBAT) (2020-2028) ($MN)

- Table 14 Global Bioplastics Market Outlook, By Other Biodegradables (2020-2028) ($MN)

- Table 15 Global Bioplastics Market Outlook, By Other Products (2020-2028) ($MN)

- Table 16 Global Bioplastics Market Outlook, By Application (2020-2028) ($MN)

- Table 17 Global Bioplastics Market Outlook, By Consumer goods (2020-2028) ($MN)

- Table 18 Global Bioplastics Market Outlook, By Packaging (2020-2028) ($MN)

- Table 19 Global Bioplastics Market Outlook, By Flexible Packaging (2020-2028) ($MN)

- Table 20 Global Bioplastics Market Outlook, By Shopping/Waste Bags (2020-2028) ($MN)

- Table 21 Global Bioplastics Market Outlook, By Pouches (2020-2028) ($MN)

- Table 22 Global Bioplastics Market Outlook, By Rigid Packaging (2020-2028) ($MN)

- Table 23 Global Bioplastics Market Outlook, By Trays (2020-2028) ($MN)

- Table 24 Global Bioplastics Market Outlook, By Bottle & Jar (2020-2028) ($MN)

- Table 25 Global Bioplastics Market Outlook, By Agriculture (2020-2028) ($MN)

- Table 26 Global Bioplastics Market Outlook, By Textile (2020-2028) ($MN)

- Table 27 Global Bioplastics Market Outlook, By Building & Construction (2020-2028) ($MN)

- Table 28 Global Bioplastics Market Outlook, By Automotive & Transportation (2020-2028) ($MN)

- Table 29 Global Bioplastics Market Outlook, By Other Applications (2020-2028) ($MN)

Note: Tables for North America, Europe, APAC, South America, and Middle East & Africa Regions are also represented in the same manner as above.

According to Stratistics MRC, the Global Bioplastics Market is accounted for $12.14 billion in 2022 and is expected to reach $34.67 billion by 2028 growing at a CAGR of 19.1% during the forecast period. A form of plastic known as "bioplastic" is produced from naturally biodegradable materials. It is a polymer that may be produced into a useful product using renewable or natural resources. There are numerous methods used to create bioplastics. Bioplastics' ability to degrade is determined by their molecular makeup rather than their origin.

According to European Bioplastics, one of the forthcoming applications of biodegradable polymers is in the automobile industry, which will increase their volume to roughly 170 KT by 2024.

Market Dynamics:

Driver:

Increasing demand for sustainable plastics

The qualities of biodegradable plastics are identical to those of traditional plastic. Additionally, during the anticipated period, the government's initiative and investment in the production of bioplastics will accelerate market growth. As a result, it is predicted that the market would be boosted by the rising use of bioplastics in important end-use sectors such packaging, textiles, consumer goods, automotive & transportation, and medical devices, among others.

Restraint:

High cost

Even though bioplastics are growing in popularity globally, their high cost relative to regular plastics is the key obstacle preventing the business from expanding. Due to the low cost of conventional plastics, it is now difficult for bioplastics to offer competitive pricing. In addition to being expensive, the lack of infrastructure for recycling and waste collection makes things challenging. People are becoming more willing to pay for the usage of bioplastics due to their value-adding advantages and environmental friendliness, despite the high costs associated with their production. Additionally, it is projected that in the next years, the supply of raw materials for bioplastics would be impacted by the growing population and worries about food shortages.

Opportunity:

Increasing Adoption in Agriculture & Horticulture

Due to reasons including the high consumer acceptance of bio-based products, the eco-friendliness of bioplastics, and the accessibility of renewable raw material sources, the demand for bioplastic products has increased in agriculture and horticultural applications. Its ability to reduce ecological plastic litter and the growing global trend for e-commerce are also two major factors in its uptake. Demand for products has increased as a result of greater crop protection against pests, weed control, and soil moisture and nutrient management. Thus, the market for bioplastics has chances to expand as a result of these factors.

Threat:

Risk of Contamination

When put in trash cans, biodegradable plastics shouldn't be mixed with non-biodegradable plastics. The issue here is that not everyone is aware of how to separate or identify bioplastics from other types of plastic. These bioplastics become polluted and unusable when these two types of plastic are combined. Because of this, more trash will accumulate in landfills from these polluted bioplastics. These days, more people are using biodegradable plastics as a result of growing environmental and global warming awareness.

COVID-19 Impact

Prices for conventional plastics have decreased as a result of the COVID-19 pandemic's effects on production, shipping, and other aspects of the supply chain. The fundamental cause of the decline in this market's growth is the use of crude oil for fuel, which has reached its lowest level since World War II and has resulted in reduced pricing for traditional plastics. Additionally, the pandemic delays legislation on single-use plastics and green investments announced by numerous countries and organisations, which lowers the demand for bio-based alternatives. Due to the rise in demand for food, pharmaceutical, and PPE packaging, sustainable plastics can prove to be a great substitute for traditional plastics, offering this market growth.

The non biodegradable segment is expected to be the largest during the forecast period

The non biodegradable segment is estimated to have a lucrative growth, due end-user demand and the growing desire to reduce dependence on petroleum-based products, key companies' tendency to produce sustainable products is developing. Non biodegradable plastics include those made of polyethylene, polyethylene terephthalate, polyamide, polytrimethylene terephthalate, polypropylene, polyethylene, furanoate, and polyvinyl chloride. These plastics are made from renewable resources like sugarcane, corn, castor oil, and others as their raw materials. Non biodegradable bioplastics are most frequently used in throwaway items like bottles, carry bags, shopping bags, films, consumer goods, electronics, and automobile interiors.

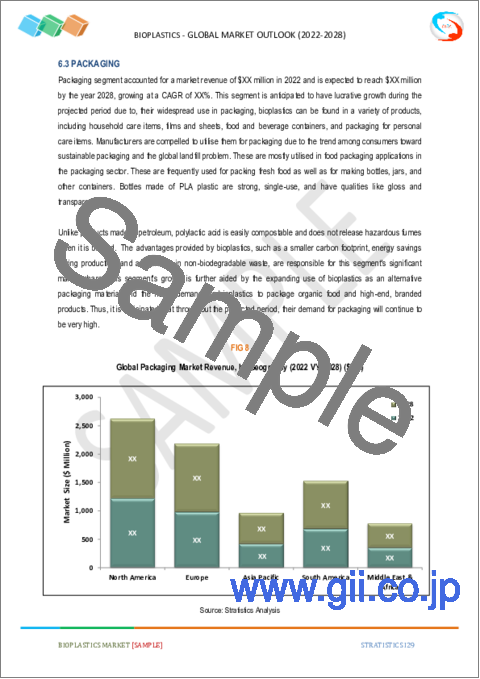

The packaging segment is expected to have the highest CAGR during the forecast period

The packaging segment is anticipated to witness the fastest CAGR growth during the forecast period. Bioplastics are frequently used in packaging, notably in films, sheets, home goods, packaging for food and beverages, and packaging for personal care products. Due to growing waste problems worldwide and consumer tendencies toward sustainable packaging, manufacturers are pushed to use bioplastics for packaging. In the packaging industry, bioplastics are largely used in applications for food packaging. Fresh food is regularly packaged in bioplastic bottles, jars, and other containers. Strong, single-use bottles manufactured of PLA plastic also have characteristics like gloss and clarity.

Region with highest share:

North America is projected to hold the largest market share during the forecast period owing to rising demand for bioplastics. Need for sustainability is prevalent in the local market, and this has sparked a significant demand for sustainable packaging. The U.S. Agriculture department's activities to promote ecologically friendly products are anticipated to increase demand for bioplastics across North America.

Region with highest CAGR:

Europe is projected to have the highest CAGR over the forecast period, owing to growing adoption of bioplastics in important end-use industries, including among others packaging, textiles, consumer goods, automotive & transportation, and medical devices. Bioplastics are widely employed in a variety of crucial applications, including bottles, shopping bags, loose packaging, and films for agricultural mulch. All over Europe, there is an increase in the general acceptance of bioplastics among consumers.

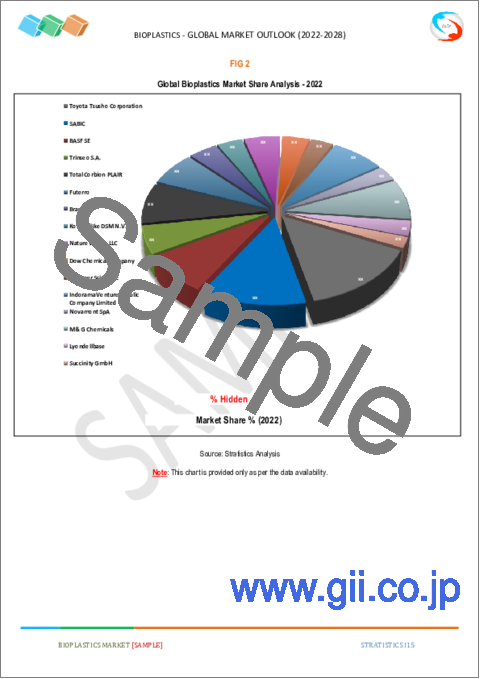

Key players in the market

Some of the key players profiled in the Bioplastics Market include Toyota Tsusho Corporation, SABIC, BASF SE, Trinseo S.A., Total Corbion PLAIR, Futerro, Braskem, Koninklijke DSM N.V., NatureWorks, LLC, Dow Chemical Company, Danimer Scientific, Indorama Ventures Public Company Limited, Novamont SpA, M& G Chemicals, Lyondellbase and Succinity GmbH.

Key Developments:

In June 2022, BASF SE launched Ultramida A3EM8 OP, an optimal grade for painting since it has an A-grade surface quality and a high bonding strength. The Ultramida A3EM8 OP maintains dimensional stability during the painting process and under diverse driving circumstances. It is resistant to high heat up to 180°C. The substance also offers excellent chemical resistance needed for external car parts.

In January 2021, Trinseo finalized the expansion of its thermoplastic elastomers (TPE) R&D Center in Mussolente, Italy. This expansion will allow the company to increase its leading bioplastics portfolio.

In January 2021, Novamont acquired the Biobag Group, a Norway based company producing low impact solutions for packaging. This acquisition will allow Novamont expand its packaging market and offer more suitable and wider range of packaging solutions in the market in untapped regions.

Products Covered:

- Non Biodegradable

- Biodegradable

- Other Products

Applications Covered:

- Consumer goods

- Packaging

- Agriculture

- Textile

- Building & Construction

- Automotive & Transportation

- Other Applications

Regions Covered:

- North America

- US

- Canada

- Mexico

- Europe

- Germany

- UK

- Italy

- France

- Spain

- Rest of Europe

- Asia Pacific

- Japan

- China

- India

- Australia

- New Zealand

- South Korea

- Rest of Asia Pacific

- South America

- Argentina

- Brazil

- Chile

- Rest of South America

- Middle East & Africa

- Saudi Arabia

- UAE

- Qatar

- South Africa

- Rest of Middle East & Africa

What our report offers:

- Market share assessments for the regional and country-level segments

- Strategic recommendations for the new entrants

- Covers Market data for the years 2020, 2021, 2022, 2025, and 2028

- Market Trends (Drivers, Constraints, Opportunities, Threats, Challenges, Investment Opportunities, and recommendations)

- Strategic recommendations in key business segments based on the market estimations

- Competitive landscaping mapping the key common trends

- Company profiling with detailed strategies, financials, and recent developments

- Supply chain trends mapping the latest technological advancements

Free Customization Offerings:

All the customers of this report will be entitled to receive one of the following free customization options:

- Company Profiling

- Comprehensive profiling of additional market players (up to 3)

- SWOT Analysis of key players (up to 3)

- Regional Segmentation

- Market estimations, Forecasts and CAGR of any prominent country as per the client's interest (Note: Depends on feasibility check)

- Competitive Benchmarking

- Benchmarking of key players based on product portfolio, geographical presence, and strategic alliances

Table of Contents

1 Executive Summary

2 Preface

- 2.1 Abstract

- 2.2 Stake Holders

- 2.3 Research Scope

- 2.4 Research Methodology

- 2.4.1 Data Mining

- 2.4.2 Data Analysis

- 2.4.3 Data Validation

- 2.4.4 Research Approach

- 2.5 Research Sources

- 2.5.1 Primary Research Sources

- 2.5.2 Secondary Research Sources

- 2.5.3 Assumptions

3 Market Trend Analysis

- 3.1 Introduction

- 3.2 Drivers

- 3.3 Restraints

- 3.4 Opportunities

- 3.5 Threats

- 3.6 Product Analysis

- 3.7 Application Analysis

- 3.8 Emerging Markets

- 3.9 Impact of Covid-19

4 Porters Five Force Analysis

- 4.1 Bargaining power of suppliers

- 4.2 Bargaining power of buyers

- 4.3 Threat of substitutes

- 4.4 Threat of new entrants

- 4.5 Competitive rivalry

5 Global Bioplastics Market, By Product

- 5.1 Introduction

- 5.2 Non Biodegradable

- 5.2.1 Polyamide

- 5.2.2 Polyethylene Terephthalate

- 5.2.3 Polytrimethylene Terephthalate

- 5.2.4 Polyethylene

- 5.2.5 Other Non Biodegradables

- 5.3 Biodegradable

- 5.3.1 Starch blends

- 5.3.2 Polylactic Acid

- 5.3.3 Polybutylene Succinate (PBS)

- 5.3.4 Polybutylene Adipate Terephthalate (PBAT)

- 5.3.5 Other Biodegradables

- 5.4 Other Products

6 Global Bioplastics Market, By Application

- 6.1 Introduction

- 6.2 Consumer goods

- 6.3 Packaging

- 6.3.1 Flexible Packaging

- 6.3.1.1 Shopping/Waste Bags

- 6.3.1.2 Pouches

- 6.3.2 Rigid Packaging

- 6.3.2.1 Trays

- 6.3.2.2 Bottle & Jar

- 6.3.1 Flexible Packaging

- 6.4 Agriculture

- 6.5 Textile

- 6.6 Building & Construction

- 6.6 Automotive & Transportation

- 6.8 Other Applications

7 Global Bioplastics Market, By Geography

- 7.1 Introduction

- 7.2 North America

- 7.2.1 US

- 7.2.2 Canada

- 7.2.3 Mexico

- 7.3 Europe

- 7.3.1 Germany

- 7.3.2 UK

- 7.3.3 Italy

- 7.3.4 France

- 7.3.5 Spain

- 7.3.6 Rest of Europe

- 7.4 Asia Pacific

- 7.4.1 Japan

- 7.4.2 China

- 7.4.3 India

- 7.4.4 Australia

- 7.4.5 New Zealand

- 7.4.6 South Korea

- 7.4.7 Rest of Asia Pacific

- 7.5 South America

- 7.5.1 Argentina

- 7.5.2 Brazil

- 7.5.3 Chile

- 7.5.4 Rest of South America

- 7.6 Middle East & Africa

- 7.6.1 Saudi Arabia

- 7.6.2 UAE

- 7.6.3 Qatar

- 7.6.4 South Africa

- 7.6.5 Rest of Middle East & Africa

8 Key Developments

- 8.1 Agreements, Partnerships, Collaborations and Joint Ventures

- 8.2 Acquisitions & Mergers

- 8.3 New Product Launch

- 8.4 Expansions

- 8.5 Other Key Strategies

9 Company Profiling

- 9.1 Toyota Tsusho Corporation

- 9.2 SABIC

- 9.3 BASF SE

- 9.4 Trinseo S.A.

- 9.5 Total Corbion PLAIR

- 9.6 Futerro

- 9.7 Braskem

- 9.8 Koninklijke DSM N.V.

- 9.9 NatureWorks, LLC

- 9.10 Dow Chemical Company

- 9.11 Danimer Scientific

- 9.12 Indorama Ventures Public Company Limited

- 9.13 Novamont SpA

- 9.14 M& G Chemicals

- 9.15 Lyondellbase

- 9.16 Succinity GmbH