|

|

市場調査レポート

商品コード

1623671

データセンター用変圧器の市場規模、シェア、成長分析、電圧別、冷却別、構造別、用途別、フェーズ別、地域別 - 産業予測、2025~2032年Data Center Transformer Market Size, Share, Growth Analysis, By Voltage (Low Voltage Transformers, Medium Voltage Transformers ), By Cooling, By Construction, By Application, By Phase, By Region - Industry Forecast 2025-2032 |

||||||

|

|||||||

| データセンター用変圧器の市場規模、シェア、成長分析、電圧別、冷却別、構造別、用途別、フェーズ別、地域別 - 産業予測、2025~2032年 |

|

出版日: 2024年12月25日

発行: SkyQuest

ページ情報: 英文 165 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

データセンター用変圧器2023年の市場規模は110億7,000万米ドルで、予測期間(2025~2032年)のCAGRは6.2%で、2024年の120億2,000万米ドルから2032年には153億7,000万米ドルに成長する見通しです。

データセンターにおける変圧器の需要は、作業量の増加と電力供給品質向上の必要性から急増しています。国際エネルギー機関(IEA)によると、データセンターの作業量指数は2023年の3.2から2019年には7.5に上昇すると予測されており、効率的な配電の緊急ニーズが浮き彫りになっています。企業がデータ・ストレージと運用効率を高めるためにIT支出を拡大する中、世界のデータセンター市場は拡大を続けています。この成長は、データトラフィックの増加やエネルギー消費の増大と相まって、信頼性の高い電力供給を確保する上で変圧器が果たす重要な役割を浮き彫りにしています。これらの要因が相まって、データセンターにおける変圧器の重要な存在が強調され、この分野の市場成長が促進されています。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次データと一次データの方法

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーターの分析

主な市場の考察

- 重要成功要因

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2024年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

- 特許分析

- 原材料の分析

データセンター用変圧器市場規模:電圧別

- 市場概要

- 低電圧変圧器(2.5 KV)

- 中電圧変圧器(2.5-36 KV)

- 高電圧変圧器(>36 KV)

データセンター用変圧器市場規模:冷却別

- 市場概要

- 油変圧器

- ガス変圧器

- 乾式変圧器

データセンター用変圧器市場規模:建設業

- 市場概要

- コアタイプ

- シェルタイプ

- アモルファスコア

データセンター用変圧器市場規模:用途別

- 市場概要

- 電力分配

- 電力変換

- 無停電電源装置(UPS)

データセンター用変圧器市場規模:フェーズ別

- 市場概要

- 単相変圧器

- 三相変圧器

データセンター用変圧器市場規模

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ地域

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2024年)

- 主な市場企業が採用した戦略

- 市場の最近の動向

- 企業の市場シェア分析(2024年)

- 主要企業の企業プロファイル

- 会社概要

- 製品ポートフォリオ分析

- セグメント別シェア分析

- 収益の前年比比較(2022-2024)

主要企業プロファイル

- ABB(Switzerland)

- Eaton Corporation(Ireland)

- General Electric(USA)

- Hitachi Energy(Switzerland)

- Hyosung Heavy Industries(South Korea)

- Legrand(France)

- Mitsubishi Electric Corporation(Japan)

- Schneider Electric(France)

- SGB-SMIT Group(Germany)

- Siemens AG(Germany)

- Toshiba Corporation(Japan)

- Vertiv Group Corp.(USA)

- Virginia Transformer Corp.(USA)

- WEG Industries(Brazil)

- Crompton Greaves(India)

- Bharat Heavy Electricals Limited(BHEL)(India)

- Voltamp Transformers Ltd(India)

- Transformers and Rectifiers(India)Ltd(India)

- TBEA Co., Ltd.(China)

- Xian XD Transformer Co., Ltd.(China)

結論と推奨事項

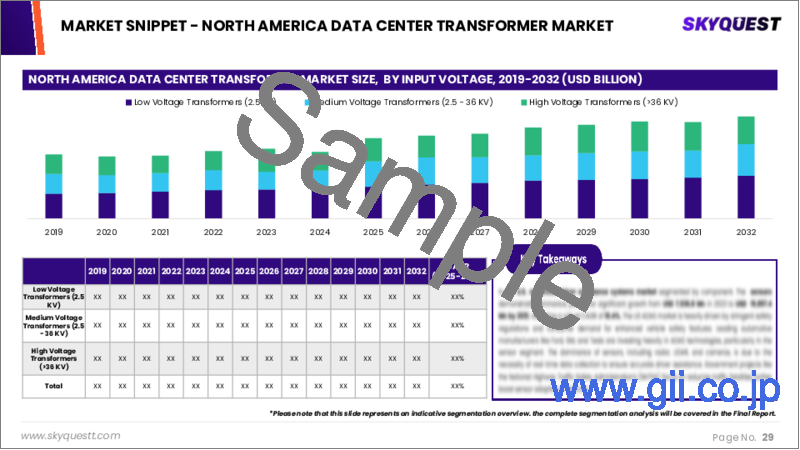

Data Center Transformer Market size was valued at USD 11.07 Billion in 2023 and is poised to grow from USD 12.02 Billion in 2024 to USD 15.37 Billion by 2032, growing at a CAGR of 6.2% during the forecast period (2025-2032).

The demand for transformers in data centers is surging due to the increasing workload and the necessity for improved power supply quality. According to the International Energy Agency (IEA), the data center workload index is projected to rise from 3.2 in 2023 to 7.5 in 2019, highlighting the urgent need for efficient power distribution. As organizations ramp up IT spending to enhance data storage and operational efficiency, the global data center market continues to expand. This growth, coupled with rising data traffic and heightened energy consumption, underscores the vital role of transformers in ensuring reliable power delivery. Collectively, these factors accentuate the transformers' critical presence in data centers and drive market growth in this sector.

Top-down and bottom-up approaches were used to estimate and validate the size of the Data Center Transformer market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Data Center Transformer Market Segmental Analysis

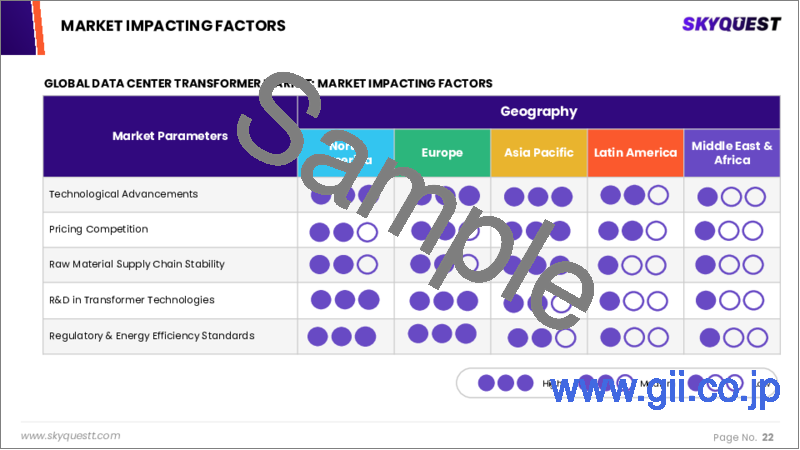

Global Data Center Transformer Market is segmented by voltage, cooling, construction, application, phase and region. Based on voltage, the market is segmented into low voltage transformers (2.5 kV), medium voltage transformers (2.5 - 36 kV) and high voltage transformers (>36 kV). Based on cooling, the market is segmented into oil transformers, gas transformers and dry transformers. Based on construction, the market is segmented into core type, shell type and amorphous core. Based on application, the market is segmented into power distribution, power conversion and uninterruptible power supply (UPS). Based on phase, the market is segmented into single phase transformer and three phase transformer. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Data Center Transformer Market

The Data Center Transformer market is witnessing significant growth due to several driving factors. In recent years, advancements in technology and services within data centers have prompted organizations to increase their IT investments for enhanced process efficiency and greater data storage capabilities. This surge in demand stems from a remarkable rise in data traffic, which has directly bolstered the global need for data center transformers. As data centers expand and power consumption intensifies, the necessity for high-quality power supplies becomes crucial to support their growing workloads. To enhance energy efficiency and meet U.S. Department of Energy (DOE) standards established in 2016, industry players are focused on innovating transformer designs, optimizing impedance, in-rush current, and short-circuit current to mitigate energy losses. Consequently, these developments are anticipated to further escalate the adoption of advanced transformers in the foreseeable future.

Restraints in the Data Center Transformer Market

The Data Center Transformer market faces a notable restraint stemming from the substantial initial investment required for transitioning to contemporary data center power systems. Businesses are often hindered by the high upfront costs associated with upgrading from outdated infrastructure to advanced components. This financial burden becomes particularly challenging for many enterprises, including small and medium-sized businesses (SMEs) with constrained budgets, as they struggle to afford the necessary modernization of their data centers. Consequently, this reluctance to invest in modernization hampers the overall growth and development of the data center power market, limiting the adoption of more efficient and effective solutions.

Market Trends of the Data Center Transformer Market

The Data Center Transformer market is witnessing significant growth driven by the trend of data center consolidation. Businesses are increasingly looking to streamline operations by merging or reducing their data center footprints, which not only lowers operational expenses but also enhances IT asset management. Recent data from the Data Center Alliance reveals that 62% of data centers are actively pursuing consolidation strategies. This trend is fueled by the escalating global IP traffic and an urgent need for more efficient functionality. As suppliers respond with innovative solutions-such as integrating physical assets and optimizing software with hardware-the demand for data center transformation services will continue to surge, reshaping the market landscape.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Drivers & Opportunities

- Restraints & Challenges

- Porters Analysis

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2024

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

- Patent Analysis

- Raw Material Analysis

Global Data Center Transformer Market Size by Voltage & CAGR (2024-2032)

- Market Overview

- Low Voltage Transformers (2.5 KV)

- Medium Voltage Transformers (2.5 - 36 KV)

- High Voltage Transformers (>36 KV)

Global Data Center Transformer Market Size by Cooling & CAGR (2024-2032)

- Market Overview

- Oil Transformers

- Gas Transformers

- Dry Transformers

Global Data Center Transformer Market Size by Construction & CAGR (2024-2032)

- Market Overview

- Core Type

- Shell Type

- Amorphous Core

Global Data Center Transformer Market Size by Application & CAGR (2024-2032)

- Market Overview

- Power Distribution

- Power Conversion

- Uninterruptible Power Supply (UPS)

Global Data Center Transformer Market Size by Phase & CAGR (2024-2032)

- Market Overview

- Single Phase Transformer

- Three Phase Transformer

Global Data Center Transformer Market Size & CAGR (2024-2032)

- North America (Voltage, Cooling, Construction, Application, Phase)

- US

- Canada

- Europe (Voltage, Cooling, Construction, Application, Phase)

- Germany

- Spain

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific (Voltage, Cooling, Construction, Application, Phase)

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America (Voltage, Cooling, Construction, Application, Phase)

- Brazil

- Rest of Latin America

- Middle East & Africa (Voltage, Cooling, Construction, Application, Phase)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2024

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2024

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2022-2024)

Key Company Profiles

- ABB (Switzerland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Eaton Corporation (Ireland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- General Electric (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Hitachi Energy (Switzerland)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Hyosung Heavy Industries (South Korea)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Legrand (France)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Mitsubishi Electric Corporation (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Schneider Electric (France)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- SGB-SMIT Group (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Siemens AG (Germany)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Toshiba Corporation (Japan)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Vertiv Group Corp. (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Virginia Transformer Corp. (USA)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- WEG Industries (Brazil)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Crompton Greaves (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Bharat Heavy Electricals Limited (BHEL) (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Voltamp Transformers Ltd (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Transformers and Rectifiers (India) Ltd (India)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- TBEA Co., Ltd. (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Xian XD Transformer Co., Ltd. (China)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments