|

|

市場調査レポート

商品コード

1614881

再生プラスチックの世界市場規模、シェア、成長分析、:製品タイプ別、供給源別、用途別、エンドユーザー別、地域別 - 産業予測(2024年~2031年)Recycled Plastic Market Size, Share, Growth Analysis, By Product Type (Polyethylene, Polyethylene Terephthalate), By Source, By Application, By End User, By Region - Industry Forecast 2024-2031 |

||||||

|

|||||||

| 再生プラスチックの世界市場規模、シェア、成長分析、:製品タイプ別、供給源別、用途別、エンドユーザー別、地域別 - 産業予測(2024年~2031年) |

|

出版日: 2024年12月14日

発行: SkyQuest

ページ情報: 英文 165 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

世界の再生プラスチックの市場規模は、2022年に476億米ドルと評価され、予測期間(2024年~2031年)のCAGRは6.1%で、2023年の505億米ドルから2031年には811億米ドルに成長する見通しです。

プラスチック廃棄物は海洋ゴミの80%を占め、全大陸の海洋の健康と生態系に大きな影響を与えており、特に観光客のホットスポットや人口の多い地域の近くに多く見られます。この環境課題は、海洋生物の多様性、食の安全、人間の福利にリスクをもたらすと同時に、気候変動を悪化させます。これに対し、政府、メーカー、消費者を含む利害関係者は、廃棄物排出量の削減、リサイクルの強化、使用後の処理を容易にする製品設計の革新によって、プラスチックの消費習慣を積極的に再構築しています。包装材や使い捨て品から大量のプラスチック廃棄物を排出する飲食品セクターは、リサイクルイニシアチブを採用し、持続可能性目標を達成しなければならないという強い圧力に直面しています。その結果、このセクターはより効率的なリサイクルプロセスの開発に成功し、2019年には60%を超える圧倒的な収益シェアに貢献しています。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次・一次情報源

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーターの分析と影響

- 競争企業間の敵対関係

- 代替品の脅威

- 買い手の交渉力

- 新規参入業者の脅威

- 供給企業の交渉力

主な市場の考察

- 重要成功要因

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2023年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

- 規制情勢

- 特許分析

- ケーススタディ

再生プラスチック市場規模:製品タイプ別、CAGR(2024年~2031年)

- 市場概要

- ポリエチレン(PE)

- 高密度ポリエチレン(HDPE)

- 低密度ポリエチレン(LDPE)

- ポリエチレンテレフタレート(PET)

- ポリプロピレン(PP)

- ポリ塩化ビニル(PVC)

- ポリスチレン(PS)

- その他

再生プラスチック市場規模:供給源別、CAGR(2024年~2031年)

- 市場概要

- ボトル

- フィルム

- 繊維

- フォーム

- その他

再生プラスチック市場規模:用途別、CAGR(2024年~2031年)

- 市場概要

- 包装

- 飲食品包装

- 消費財包装

- 工業用包装

- 建築・建設

- 自動車

- 電気・電子

- 繊維

- その他

再生プラスチック市場規模:エンドユーザー別、CAGR(2024年~2031年)

- 市場概要

- メーカー

- 小売業者

- 政府機関

- リサイクル会社

- その他

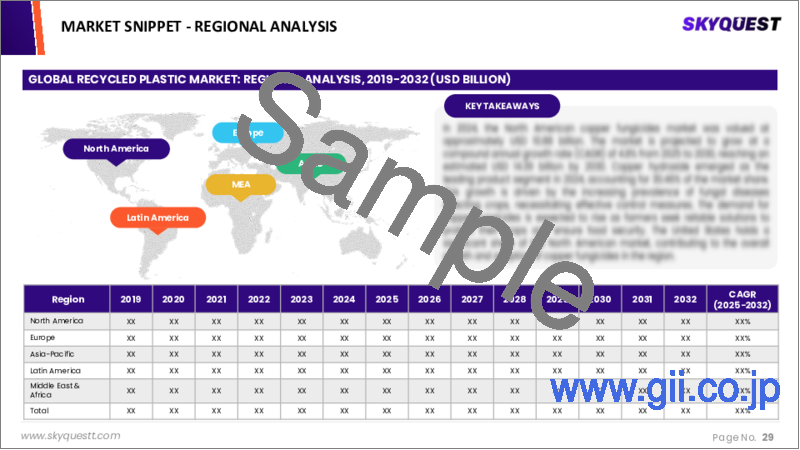

再生プラスチック市場規模、CAGR(2024年~2031年)

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- スペイン

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2023年)

- 主な市場企業が採用した戦略

- 市場の最近の動向

- 企業の市場シェア分析(2023年)

- 主要企業プロファイル

- 会社概要

- 製品ポートフォリオ分析

- セグメント別シェア分析

- 収益の前年比の比較(2021年~2023年)

主要企業プロファイル

- REMONDIS SE & Co. KG

- Biffa

- Stericycle

- Republic Services, Inc.

- Waste Management, Inc.(WM)

- Veolia Environnement S.A.

- SUEZ

- Plastipak Holdings, Inc.

- KW Plastics

- Custom Polymers, Inc.

- MBA Polymers, Inc.

- Envision Plastics

- Clear Path Recycling

- Green Line Polymers

- UltrePET, LLC

- Evergreen Plastics, Inc.

- Indorama Ventures Public Company Limited

- CarbonLITE Industries

- Phoenix Technologies International, LLC

- Avangard Innovative

結論と推奨事項

Global Recycled Plastic Market size was valued at USD 47.60 billion in 2022 and is poised to grow from USD 50.50 billion in 2023 to USD 81.10 billion by 2031, growing at a CAGR of 6.1% during the forecast period (2024-2031).

Plastic waste constitutes 80% of all marine debris, significantly impacting ocean health and ecosystems across all continents, particularly near tourist hotspots and populous areas. This environmental challenge poses risks to marine biodiversity, food safety, and human well-being while also exacerbating climate change. In response, stakeholders - including governments, manufacturers, and consumers - are actively reshaping plastic consumption habits by reducing waste output, enhancing recycling practices, and innovating product designs for easier post-use processing. The food and beverage sector, which generates substantial plastic waste through packaging and disposables, faces mounting pressure to adopt recycling initiatives and meet sustainability targets. Consequently, this sector has successfully developed more efficient recycling processes, contributing to its dominant revenue share of over 60% in 2019.

Top-down and bottom-up approaches were used to estimate and validate the size of the Global Recycled Plastic market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Global Recycled Plastic Market Segmental Analysis

Global Recycled Plastic Market is segmented by product type, source, application, end user and region. Based on product type, the market is segmented into polyethylene (PE) (high-density polyethylene (HDPE), low-density polyethylene (LDPE)), polyethylene terephthalate (PET), polypropylene (PP), polyvinyl chloride (PVC), polystyrene (PS) and others. Based on source, the market is segmented into bottles, films, fibers, foams and others. Based on application, the market is segmented into packaging (food & beverage packaging, consumer goods packaging, industrial packaging), building & construction, automotive, electrical & electronics, textiles and others. Based on end user, the market is segmented into manufacturers, retailers, government bodies, recycling companies and others. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Global Recycled Plastic Market

The global recycled plastic market is driven by the increasing need for sustainable waste management solutions due to the rising production and consumption of plastic materials over the years. The versatility, lightweight nature, and cost-effectiveness of plastics have contributed significantly to their widespread use, resulting in an alarming accumulation of plastic waste that poses severe environmental challenges. Traditional waste disposal methods, such as landfills, are becoming increasingly inadequate as available space diminishes in many regions. This approach may offer short-term relief but carries long-term risks, including potential soil and groundwater contamination, ultimately highlighting the urgent necessity for recycling initiatives as a viable alternative.

Restraints in the Global Recycled Plastic Market

The global market for recycled plastics faces significant constraints primarily due to intense competition with virgin plastics, which excel in terms of quality and versatility. Virgin plastics can be utilized in a broad range of applications, including food-grade packaging, where direct contact with food is a crucial factor. In contrast, recycled plastics often fall short of meeting safety standards, as concerns linger about the potential presence of impurities from their previous uses. Although some regulations permit the combination of recycled and virgin resins for food-grade containers, the recycled materials may not reach the stringent quality necessary for such applications. Consequently, high-end products that demand precise chemical compositions are typically manufactured solely from virgin materials.

Market Trends of the Global Recycled Plastic Market

The Global Recycled Plastic market is witnessing a robust growth trend, primarily fueled by the increasing volume of recovered plastics stemming from bottles. Bottles represent the largest and fastest-growing segment due to their efficient collection and sorting systems, making them the most recycled post-consumer plastics. The predominance of PET resin in these bottles also contributes positively, as it boasts the highest recycling rates among plastics. As developing nations enter the recycling sector, they are increasingly leaning on bottles as a key resource for recovered plastics, driving both demand and innovation in recycling processes and sustainable product development.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Driver & Opportunities

- Restraints & Challenges

- Porters Analysis & Impact

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2023

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

- Regulatory Landscape

- Patent Analysis

- Case Studies

Global Recycled Plastic Market Size by Product Type & CAGR (2024-2031)

- Market Overview

- Polyethylene (PE)

- High-Density Polyethylene (HDPE)

- Low-Density Polyethylene (LDPE)

- Polyethylene Terephthalate (PET)

- Polypropylene (PP)

- Polyvinyl Chloride (PVC)

- Polystyrene (PS)

- Others

Global Recycled Plastic Market Size by Source & CAGR (2024-2031)

- Market Overview

- Bottles

- Films

- Fibers

- Foams

- Others

Global Recycled Plastic Market Size by Application & CAGR (2024-2031)

- Market Overview

- Packaging

- Food & Beverage Packaging

- Consumer Goods Packaging

- Industrial Packaging

- Building & Construction

- Automotive

- Electrical & Electronics

- Textiles

- Others

Global Recycled Plastic Market Size by End User & CAGR (2024-2031)

- Market Overview

- Manufacturers

- Retailers

- Government Bodies

- Recycling Companies

- Others

Global Recycled Plastic Market Size & CAGR (2024-2031)

- North America (Product Type, Source, Application, End User)

- US

- Canada

- Europe (Product Type, Source, Application, End User)

- UK

- Germany

- Spain

- France

- Italy

- Rest of Europe

- Asia-Pacific (Product Type, Source, Application, End User)

- China

- India

- Japan

- South Korea

- Rest of Asia Pacific

- Latin America (Product Type, Source, Application, End User)

- Brazil

- Rest of Latin America

- Middle East & Africa (Product Type, Source, Application, End User)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2023

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2023

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2021-2023)

Key Company Profiles

- REMONDIS SE & Co. KG

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Biffa

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Stericycle

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Republic Services, Inc.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Waste Management, Inc. (WM)

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Veolia Environnement S.A.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- SUEZ

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Plastipak Holdings, Inc.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- KW Plastics

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Custom Polymers, Inc.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- MBA Polymers, Inc.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Envision Plastics

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Clear Path Recycling

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Green Line Polymers

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- UltrePET, LLC

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Evergreen Plastics, Inc.

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Indorama Ventures Public Company Limited

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- CarbonLITE Industries

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Phoenix Technologies International, LLC

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Avangard Innovative

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments