|

|

市場調査レポート

商品コード

1701705

ジェネリック医薬品の市場規模、シェア、成長分析、投与経路別、治療用途別、剤形別、流通チャネル別、エンドユーザー別、地域別 - 産業予測 2025~2032年Generic Drugs Market Size, Share, and Growth Analysis, By Route of Administration, By Therapeutic Application, By Formulation, By Distribution Channel, By End User, By Region - Industry Forecast 2025-2032 |

||||||

|

|||||||

| ジェネリック医薬品の市場規模、シェア、成長分析、投与経路別、治療用途別、剤形別、流通チャネル別、エンドユーザー別、地域別 - 産業予測 2025~2032年 |

|

出版日: 2025年04月07日

発行: SkyQuest

ページ情報: 英文 157 Pages

納期: 3~5営業日

|

全表示

- 概要

- 目次

世界のジェネリック医薬品市場規模は2023年に4,872億1,000万米ドルと評価され、2024年の5,130億3,000万米ドルから2032年には7,754億8,000万米ドルに成長し、予測期間(2025-2032年)のCAGRは5.3%で成長する見通しです。

ジェネリック医薬品市場は、慢性疾患の有病率の上昇と費用対効果の高い投薬オプションの需要に牽引され、大きな成長を遂げています。ブランド薬と同じ化学組成を持ちながら低価格で入手できるジェネリック医薬品は、新興経済諸国と先進経済諸国の両方で人気を集めています。FDA(米国食品医薬品局)による特許保護は、先発医薬品開発者に一時的な独占権を与え、ジェネリック医薬品の競合を防ぐ。しかし、特許が切れると、ジェネリック医薬品は厳しい品質、安全性、効率基準を守りながら、迅速な承認プロセスを通じて迅速に市場に参入できるようになります。この動向は、高価値医薬品の特許切れによってさらに促進され、ジェネリック医薬品の開発と入手のしやすさを高め、市場拡大を後押ししています。

目次

イントロダクション

- 調査の目的

- 調査範囲

- 定義

調査手法

- 情報調達

- 二次と一次データの方法

- 市場規模予測

- 市場の前提条件と制限

エグゼクティブサマリー

- 世界市場の見通し

- 供給と需要の動向分析

- セグメント別機会分析

市場力学と見通し

- 市場概要

- 市場規模

- 市場力学

- 促進要因と機会

- 抑制要因と課題

- ポーターの分析

主な市場の考察

- 重要成功要因

- 競合の程度

- 主な投資機会

- 市場エコシステム

- 市場の魅力指数(2024年)

- PESTEL分析

- マクロ経済指標

- バリューチェーン分析

- 価格分析

- ケーススタディ

- 規制情勢

- 顧客と購買基準の分析

ジェネリック医薬品市場規模:投与経路別& CAGR(2025-2032)

- 市場概要

- 経口

- 非経口

- 局所

- 吸入

- 経皮

- 眼科

- その他

ジェネリック医薬品市場規模:治療用途別& CAGR(2025-2032)

- 市場概要

- 心血管疾患

- 中枢神経系(CNS)疾患

- 感染症

- 腫瘍学

- 呼吸器疾患

- 胃腸障害

- 内分泌疾患

- その他

ジェネリック医薬品市場規模:剤形別& CAGR(2025-2032)

- 市場概要

- 固形剤形

- 液体剤形

- 半固形形態

- 気体形態

ジェネリック医薬品市場規模:流通チャネル別& CAGR(2025-2032)

- 市場概要

- 病院薬局

- 小売薬局

- オンライン薬局

- ドラッグストア

- 卸売業者および販売業者

ジェネリック医薬品市場規模:エンドユーザー別& CAGR(2025-2032)

- 市場概要

- 病院

- クリニック

- 在宅ケア設定

- 外来手術センター(ASC)

- 小売消費者

ジェネリック医薬品市場規模:地域別& CAGR(2025-2032)

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- スペイン

- フランス

- 英国

- イタリア

- その他欧州地域

- アジア太平洋地域

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- その他ラテンアメリカ地域

- 中東・アフリカ

- GCC諸国

- 南アフリカ

- その他中東・アフリカ

競合情報

- 上位5社の比較

- 主要企業の市場ポジショニング(2024年)

- 主な市場企業が採用した戦略

- 最近の市場動向

- 企業の市場シェア分析(2024年)

- 主要企業の企業プロファイル

- 企業の詳細

- 製品ポートフォリオ分析

- 企業のセグメント別シェア分析

- 収益の前年比比較(2022-2024年)

主要企業プロファイル

- Sandoz-Switzerland

- Teva Pharmaceuticals-Israel

- Sun Pharmaceutical Industries Ltd.-India

- Viatris Inc.-USA

- Fresenius Kabi AG-Germany

- Cipla Ltd.-India

- Dr. Reddy's Laboratories Ltd.-India

- Lupin Limited-India

- Aspen Pharmacare Holdings Limited-South Africa

- Zydus Cadila-India

- KRKA d.d.-Slovenia

- Towa Pharmaceutical Co., Ltd.-Japan

- STADA Arzneimittel AG-Germany

- Glenmark Pharmaceuticals Ltd.-India

- Amneal Pharmaceuticals, Inc.-USA

- Biocon Limited-India

- Aurobindo Pharma Ltd.-India

- Sawai Pharmaceutical Co., Ltd.-Japan

- Torrent Pharmaceuticals Ltd.-India

- Hikma Pharmaceuticals PLC-UK

結論と提言

Global Generic Drugs Market size was valued at USD 487.21 billion in 2023 and is poised to grow from USD 513.03 billion in 2024 to USD 775.48 billion by 2032, growing at a CAGR of 5.3% during the forecast period (2025-2032).

The generic drug market is experiencing significant growth, driven by the rising prevalence of chronic diseases and the demand for cost-effective medication options. Generic drugs, which share the same chemical composition as their branded counterparts but are available at lower prices, are gaining traction in both developing and developed economies. The patent protection granted by the FDA gives branded drug developers a temporary monopoly, preventing generic competition. However, once patents expire, generic drugs can swiftly enter the market through expedited approval processes while adhering to stringent quality, safety, and efficiency standards. This trend is further fueled by the expiration of patents for high-value medications, leading to an increase in the development and accessibility of generic alternatives, bolstering market expansion.

Top-down and bottom-up approaches were used to estimate and validate the size of the Global Generic Drugs market and to estimate the size of various other dependent submarkets. The research methodology used to estimate the market size includes the following details: The key players in the market were identified through secondary research, and their market shares in the respective regions were determined through primary and secondary research. This entire procedure includes the study of the annual and financial reports of the top market players and extensive interviews for key insights from industry leaders such as CEOs, VPs, directors, and marketing executives. All percentage shares split, and breakdowns were determined using secondary sources and verified through Primary sources. All possible parameters that affect the markets covered in this research study have been accounted for, viewed in extensive detail, verified through primary research, and analyzed to get the final quantitative and qualitative data.

Global Generic Drugs Market Segments Analysis

Global Generic Drugs Market is segmented by Route of Administration, Therapeutic Application, Formulation, Distribution Channel, End User and region. Based on Route of Administration, the market is segmented into Oral, Parenteral, Topical, Inhalation, Transdermal, Ophthalmic and Others. Based on Therapeutic Application, the market is segmented into Cardiovascular Disorders, Central Nervous System (CNS) Disorders, Infectious Diseases, Oncology, Respiratory Diseases, Gastrointestinal Disorders, Endocrine Disorders and Others. Based on Formulation, the market is segmented into Solid Dosage Forms, Liquid Dosage Forms, Semi-solid Forms and Gaseous Forms. Based on Distribution Channel, the market is segmented into Hospital Pharmacies, Retail Pharmacies, Online Pharmacies, Drug Stores and Wholesalers & Distributors. Based on End User, the market is segmented into Hospitals, Clinics, Homecare Settings, Ambulatory Surgical Centers (ASCs) and Retail Consumers. Based on region, the market is segmented into North America, Europe, Asia Pacific, Latin America and Middle East & Africa.

Driver of the Global Generic Drugs Market

The Global Generic Drugs market is significantly driven by the rising prevalence of chronic illnesses, which continues to escalate with the growing aging population. As recorded in 2021, there were over 10.1 million cancer cases in men and 9.3 million in women, alongside more than 350 million individuals diagnosed with arthritis worldwide. This increasing burden of chronic diseases necessitates improved health services, thereby fueling the demand for affordable and accessible healthcare solutions. Consequently, the generic drugs market is anticipated to experience substantial growth throughout the forecast period, as healthcare systems strive to meet the evolving needs of patients.

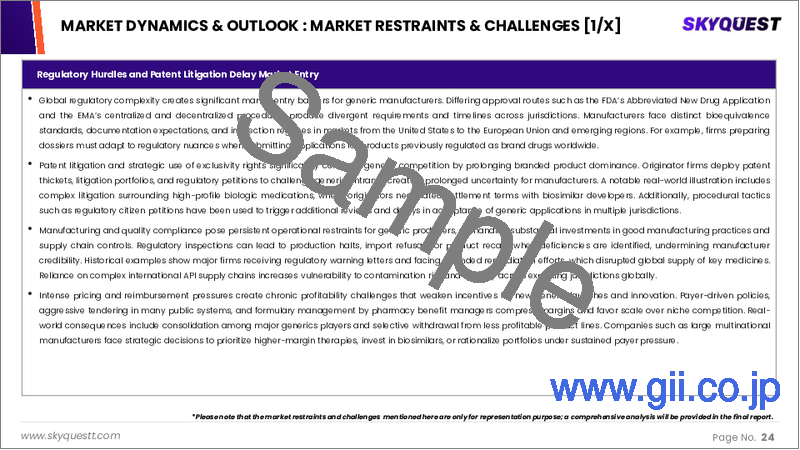

Restraints in the Global Generic Drugs Market

A significant obstacle hindering the expansion of the global generic drugs market is the stringent regulatory framework imposed by authorities such as the FDA. This agency meticulously assesses the accuracy, potential side effects, and compositional integrity of generic medications. Should manufacturers fail to adhere to these strict standards, they are compelled to withdraw their products from the market. Consequently, the necessity for regulatory approval for generic pharmaceuticals can create delays and complications, ultimately impacting market growth projections. This regulatory environment poses a challenge for manufacturers striving to introduce new generic drugs, thus limiting the overall development of the sector.

Market Trends of the Global Generic Drugs Market

The Global Generic Drugs market is witnessing significant growth, driven by the robust production and consumption of generics in India, which ranks as the third largest pharmaceutical market by volume and fourteenth by value. With over 3,000 pharmaceutical companies and more than 10,500 factories, India is a key player, offering a diverse range of generic drugs. The country is recognized for having the highest number of US-FDA approved manufacturing plants outside the United States, further bolstering its global position. This trend indicates a growing reliance on affordable medications, positioning India as a pivotal hub in the global pharmaceuticals landscape.

Table of Contents

Introduction

- Objectives of the Study

- Scope of the Report

- Definitions

Research Methodology

- Information Procurement

- Secondary & Primary Data Methods

- Market Size Estimation

- Market Assumptions & Limitations

Executive Summary

- Global Market Outlook

- Supply & Demand Trend Analysis

- Segmental Opportunity Analysis

Market Dynamics & Outlook

- Market Overview

- Market Size

- Market Dynamics

- Drivers & Opportunities

- Restraints & Challenges

- Porters Analysis

- Competitive rivalry

- Threat of substitute

- Bargaining power of buyers

- Threat of new entrants

- Bargaining power of suppliers

Key Market Insights

- Key Success Factors

- Degree of Competition

- Top Investment Pockets

- Market Ecosystem

- Market Attractiveness Index, 2024

- PESTEL Analysis

- Macro-Economic Indicators

- Value Chain Analysis

- Pricing Analysis

- Case Studies

- Regulatory Landscape

- Customer & Buying Criteria Analysis

Global Generic Drugs Market Size by Route of Administration & CAGR (2025-2032)

- Market Overview

- Oral

- Parenteral

- Topical

- Inhalation

- Transdermal

- Ophthalmic

- Others

Global Generic Drugs Market Size by Therapeutic Application & CAGR (2025-2032)

- Market Overview

- Cardiovascular Disorders

- Central Nervous System (CNS) Disorders

- Infectious Diseases

- Oncology

- Respiratory Diseases

- Gastrointestinal Disorders

- Endocrine Disorders

- Others

Global Generic Drugs Market Size by Formulation & CAGR (2025-2032)

- Market Overview

- Solid Dosage Forms

- Liquid Dosage Forms

- Semi-solid Forms

- Gaseous Forms

Global Generic Drugs Market Size by Distribution Channel & CAGR (2025-2032)

- Market Overview

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

- Drug Stores

- Wholesalers & Distributors

Global Generic Drugs Market Size by End User & CAGR (2025-2032)

- Market Overview

- Hospitals

- Clinics

- Homecare Settings

- Ambulatory Surgical Centers (ASCs)

- Retail Consumers

Global Generic Drugs Market Size & CAGR (2025-2032)

- North America (Route of Administration, Therapeutic Application, Formulation, Distribution Channel, End User)

- US

- Canada

- Europe (Route of Administration, Therapeutic Application, Formulation, Distribution Channel, End User)

- Germany

- Spain

- France

- UK

- Italy

- Rest of Europe

- Asia Pacific (Route of Administration, Therapeutic Application, Formulation, Distribution Channel, End User)

- China

- India

- Japan

- South Korea

- Rest of Asia-Pacific

- Latin America (Route of Administration, Therapeutic Application, Formulation, Distribution Channel, End User)

- Brazil

- Rest of Latin America

- Middle East & Africa (Route of Administration, Therapeutic Application, Formulation, Distribution Channel, End User)

- GCC Countries

- South Africa

- Rest of Middle East & Africa

Competitive Intelligence

- Top 5 Player Comparison

- Market Positioning of Key Players, 2024

- Strategies Adopted by Key Market Players

- Recent Developments in the Market

- Company Market Share Analysis, 2024

- Company Profiles of All Key Players

- Company Details

- Product Portfolio Analysis

- Company's Segmental Share Analysis

- Revenue Y-O-Y Comparison (2022-2024)

Key Company Profiles

- Sandoz - Switzerland

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Teva Pharmaceuticals - Israel

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Sun Pharmaceutical Industries Ltd. - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Viatris Inc. - USA

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Fresenius Kabi AG - Germany

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Cipla Ltd. - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Dr. Reddy's Laboratories Ltd. - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Lupin Limited - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Aspen Pharmacare Holdings Limited - South Africa

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Zydus Cadila - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- KRKA d.d. - Slovenia

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Towa Pharmaceutical Co., Ltd. - Japan

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- STADA Arzneimittel AG - Germany

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Glenmark Pharmaceuticals Ltd. - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Amneal Pharmaceuticals, Inc. - USA

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Biocon Limited - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Aurobindo Pharma Ltd. - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Sawai Pharmaceutical Co., Ltd. - Japan

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Torrent Pharmaceuticals Ltd. - India

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments

- Hikma Pharmaceuticals PLC - UK

- Company Overview

- Business Segment Overview

- Financial Updates

- Key Developments