|

|

市場調査レポート

商品コード

1729645

日本のジェネリック医薬品市場:産業動向、シェア、規模、成長、機会、2025年~2033年予測Japan Generic Drug Market: Industry Trends, Share, Size, Growth, Opportunity and Forecast 2025-2033 |

||||||

カスタマイズ可能

|

|||||||

| 日本のジェネリック医薬品市場:産業動向、シェア、規模、成長、機会、2025年~2033年予測 |

|

出版日: 2025年05月01日

発行: IMARC

ページ情報: 英文 118 Pages

納期: 5~7営業日

|

全表示

- 概要

- 図表

- 目次

日本のジェネリック医薬品の市場規模は2024年に123億米ドルに達しました。今後、IMARC Groupは、2033年までに同市場が225億米ドルに達し、2025年から2033年の成長率(CAGR)は6.55%になると予測しています。費用対効果が高く手ごろな価格のヘルスケアを推進する政府政策の拡大、高齢化人口の増加、医療費の高騰、医療従事者や患者の間でジェネリック医薬品が受け入れられつつあることなどが、市場の成長を後押しする主な要因となっています。

本レポートで扱う主な質問

- 日本のジェネリック医薬品市場はこれまでどのように推移してきたか?

- 日本のジェネリック医薬品市場にCOVID-19が与えた影響は?

- 日本のジェネリック医薬品市場のバリューチェーンにはどのような段階があるのか?

- 日本のジェネリック医薬品市場の主な促進要因と課題は?

- 日本のジェネリック医薬品市場の構造と主要企業は?

- 市場の競合構造は?

- 日本のジェネリック医薬品市場の主要プレイヤー/企業は?

目次

第1章 序文

第2章 調査範囲と調査手法

- 調査の目的

- ステークホルダー

- データソース

- 市場推定

- 調査手法

第3章 エグゼクティブサマリー

第4章 日本のジェネリック医薬品市場-イントロダクション

- ジェネリック医薬品とは何ですか?

- ノーブランド・ブランドジェネリック医薬品

- 認可されたジェネリック医薬品

第5章 日本のジェネリック医薬品市場がなぜこれほど収益性が高いのか

- 特許切れを迎えるブロックバスター医薬品

- ヘルスケア費の高騰と人口の高齢化

- 日本はジェネリック医薬品の普及率が最も低い国の一つ

- ジェネリック医薬品調剤のインセンティブ

- 支払者と提供者にとって大きな節約

- バイオシミラー

第6章 世界のジェネリック医薬品市場

- 市場実績

- 市場内訳:国別

- 市場予測

- 最も処方されているジェネリック医薬品とブランド医薬品

第7章 日本のジェネリック医薬品市場

- 日本の医薬品市場実績

- 日本のジェネリック医薬品市場実績

第8章 SWOT分析

- 概要

- 強み

- 弱み

- 機会

- 脅威

第9章 サプライチェーンのさまざまなレベルにおける価格決定メカニズムと利益率

第10章 ポーターのファイブフォース分析

- 概要

- 買い手の交渉力

- 供給企業の交渉力

- 競合の程度

- 新規参入業者の脅威

- 代替品の脅威

第11章 日本のジェネリック医薬品市場:競合情勢

- 日本のジェネリック医薬品市場 - 競争構造

- 日本のジェネリック医薬品市場 - 内訳、主要企業別

- 日本のジェネリック医薬品市場 - 内訳、流通チャネル別

第12章 日本のジェネリック医薬品市場:バリューチェーン分析

- 研究開発

- 製造

- マーケティング

- 流通

第13章 日本のジェネリック医薬品業界における規制

- 日本におけるジェネリック医薬品の承認手続き

- 認定資格

第14章 日本のジェネリック医薬品市場:成功の鍵となる要素

第15章 日本のジェネリック医薬品市場:障害

第16章 ジェネリック医薬品製造工場の設立要件

- 製造プロセス

- 原材料の要件

- 原材料の写真

- 土地と建設の要件

- 機械とインフラの要件

- 機械写真

- 工場レイアウト

- 梱包要件

- ユーティリティ要件

- 人員要件

第17章 日本のジェネリック医薬品市場:主要企業プロファイル

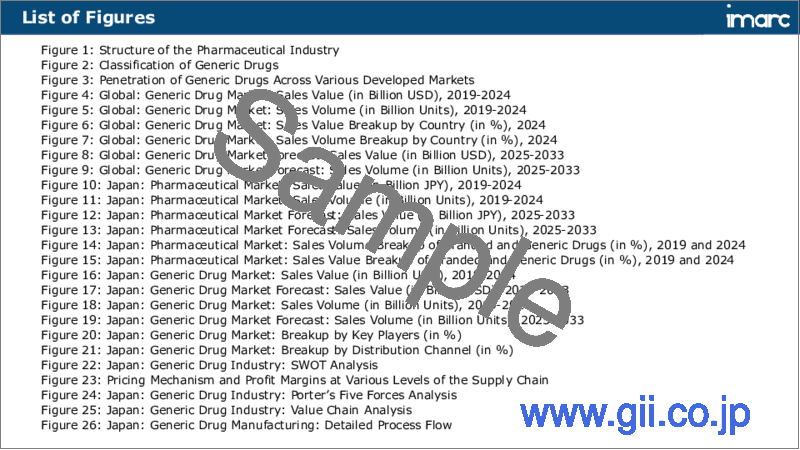

List of Figures

- Figure 1: Structure of the Pharmaceutical Industry

- Figure 2: Classification of Generic Drugs

- Figure 3: Penetration of Generic Drugs Across Various Developed Markets

- Figure 4: Global: Generic Drug Market: Sales Value (in Billion USD), 2019-2024

- Figure 5: Global: Generic Drug Market: Sales Volume (in Billion Units), 2019-2024

- Figure 6: Global: Generic Drug Market: Sales Value Breakup by Country (in %), 2024

- Figure 7: Global: Generic Drug Market: Sales Volume Breakup by Country (in %), 2024

- Figure 8: Global: Generic Drug Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 9: Global: Generic Drug Market Forecast: Sales Volume (in Billion Units), 2025-2033

- Figure 10: Japan: Pharmaceutical Market: Sales Value (in Billion JPY), 2019-2024

- Figure 11: Japan: Pharmaceutical Market: Sales Volume (in Billion Units), 2019-2024

- Figure 12: Japan: Pharmaceutical Market Forecast: Sales Value (in Billion JPY), 2025-2033

- Figure 13: Japan: Pharmaceutical Market Forecast: Sales Volume (in Billion Units), 2025-2033

- Figure 14: Japan: Pharmaceutical Market: Sales Volume Breakup of Branded and Generic Drugs (in %), 2019 and 2024

- Figure 15: Japan: Pharmaceutical Market: Sales Value Breakup of Branded and Generic Drugs (in %), 2019 and 2024

- Figure 16: Japan: Generic Drug Market: Sales Value (in Billion USD), 2019-2024

- Figure 17: Japan: Generic Drug Market Forecast: Sales Value (in Billion USD), 2025-2033

- Figure 18: Japan: Generic Drug Market: Sales Volume (in Billion Units), 2019-2024

- Figure 19: Japan: Generic Drug Market Forecast: Sales Volume (in Billion Units), 2025-2033

- Figure 20: Japan: Generic Drug Market: Breakup by Key Players (in %)

- Figure 21: Japan: Generic Drug Market: Breakup by Distribution Channel (in %)

- Figure 22: Japan: Generic Drug Industry: SWOT Analysis

- Figure 23: Pricing Mechanism and Profit Margins at Various Levels of the Supply Chain

- Figure 24: Japan: Generic Drug Industry: Porter's Five Forces Analysis

- Figure 25: Japan: Generic Drug Industry: Value Chain Analysis

- Figure 26: Japan: Generic Drug Manufacturing: Detailed Process Flow

- Figure 27: Japan: Generic Drug Manufacturing: Raw Material Requirements

- Figure 28: Japan: Generic Drug Manufacturing Plant: Proposed Plant Layout

- Figure 29: Japan: Generic Drug Manufacturing: Packaging Requirements

- Figure 30: Japan: Approval Pathway for a Generic Drug

List of Tables

- Table 1: Japan: Sales (in Billion USD) and Patent Expiry of Major Drugs Expected to Lose Patent Protection (in Billion USD)

- Table 2: Japan: History of Major Policies to Encourage the Use of Generic Drugs

- Table 3: Japan: Expenses of Generic and Branded Drug Manufacturers (in %)

- Table 4: Major Biosimilar Product Under Development as of March 2023

- Table 5: Japan: Generic Drug Market: Key Industry Highlights, 2024 and 2033

- Table 6: Global: Generics Market: Volume Performance of Top Molecules (in Million Prescriptions)

- Table 7: Global: Branded Drug market: Volume Performance of Top Branded Drugs (in Million Prescriptions)

- Table 8: Japan: Generic Drug Industry: Market Structure

- Table 9: Generic Drug Manufacturing Plant: Machinery Costs (in USD)

- Table 10: Generic Oncology Drug Manufacturing Plant: Costs Related to Salaries and Wages (in USD)

- Table 11: Japan: Data Requirements for a New Generic Drug Application

- Table 12: Japan: Various Bioequivalence Guidelines for Generic Drugs

- Table 13: Japan: Timeline for New Generic Drug Approval

- Table 14: Japan: Review Time of the Application for Partial Change Approval

- Table 15: Nichi-Iko Pharmaceutical Co., Ltd: Key Financials (in USD Million)

- Table 16: Sawai Pharmaceutical Co., Ltd: Key Financials (in USD Million)

- Table 17: Towa Pharmaceutical: Key Financials (in USD Million)

- Table 18: Teva Pharmaceutical Ltd: Key Financials (in USD Million)

- Table 19: Fuji Pharma Co Ltd: Key Financials (in USD Million)

The Japan generic drug market size reached USD 12.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 22.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.55% during 2025-2033. The growing government policies promoting cost-effective and affordable healthcare, the increasing ageing population, the rising healthcare costs, and the growing acceptance of generics among healthcare providers and patients are some of the major factors propelling the growth of the market.

Japan Generic Drug Market Analysis:

- Major Market Drivers: The rising government policies aimed at reducing healthcare costs represent the major drivers of the market. the government actively promotes the use of generic drugs through incentives and favorable, regulations, making them a cost-effective alternative to branded medications. The rising healthcare expenditures further propel the market in Japan.

- Key Market Trends: The increasing collaboration between domestic and international pharmaceutical companies represents the key Japan generic drug market trends. These partnerships aim to enhance the development and distribution of generic medications, leveraging global expertise and resources. Another notable trend is the technological advancement in generic drug manufacturing.

- Competitive Landscape: The report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

- Challenges and Opportunities: The market faces several challenges including strict regulatory requirements, which can delay the approval and launch of generic medications. However, the market also faces various opportunities including an aging population and rising healthcare costs driving demand for affordable medications.

Japan Generic Drug Market Trends:

Growing Government Policies and Initiatives

The Japanese government actively promotes the use of generic drugs to reduce healthcare costs. Incentives, favorable regulations, and public awareness campaigns encourage the adoption of generics, making them a key component of the national healthcare strategy. According to an article published by the Japan Times in 2024, a health ministry panel is urging small drugmakers to merge with their bigger counterparts to ensure a stable supply of generic drugs in Japan amid an ongoing shortage. At present, around a quarter of the companies in the industry that primarily manufacture generic drugs, each produce more than 51 products. This is boosting the Japan generic drug market growth significantly.

Increasing Aging Population

Japan's rapidly aging population increases the demand for affordable medications. Elderly patients often require long-term treatment for chronic conditions, driving the need for cost-effective generic drugs to manage the financial burden on the healthcare system. According to the industry report, Japan has one of the lowest birth rates in the world and has long struggled with how to provide for its aging population. It has the world's oldest population, measured by the proportion of people aged 65 or up, as per the United Nations report. In Japan, those aged over 65 years are expected to account for 34.8% of the population by 2040, according to the National Institute of Population and Social Security Research. This is likely to fuel the Japan generic drug market forecast over the coming years.

Rising Healthcare Costs

As healthcare expenditures continue to rise, both patients and healthcare providers seek more economical treatment options. According to Ubie Health, Japan's healthcare expenses have been on a steady rise since the past 30 years with the government estimates predicting healthcare expenses to be approximately 445 billion dollars in the year 2040. Since generic drugs offer a cost-effective alternative to branded medications without compromising efficacy, they are increasing gaining traction among both the patients and healthcare providers, making them an attractive choice in managing healthcare budgets. According to an article published by Meiji, at present, about 80% of the prescribed drugs available at pharmacies in Japan are generic drugs, which is expected to only witness a rise to cope with the increasing healthcare costs in the country.

Competitive Landscape:

Key players in the Japan generic drug market are driven by factors such as government incentives promoting the use of generics to reduce healthcare costs and providing a favorable regulatory environment. The aging population in Japan significantly boosts demand for affordable, long-term medication options, encouraging pharmaceutical companies to expand their generic drug portfolios. Additionally, rising healthcare costs push both providers and patients towards more economical treatment alternatives, increasing the adoption of generic drugs. Technological advancements in drug manufacturing and formulation also enable key players to produce high-quality generics, ensuring market competitiveness and compliance with stringent regulatory standards.

Japan Generic Drug Market News:

- In June 2024, Sawai Pharmaceutical Co., Ltd. announced the listing of two generic drugs with three strengths in the National Health Insurance (NHI) drug price list. Sawai's product line now includes 327 compounds with 776 strengths.

- In August 2023, Asahi Kasei Pharma announced that Empaveli(R) Subcutaneous Injection 1080 mg (generic name: pegcetacoplan), a complement protein C3 inhibitor, for which it obtained exclusive distribution rights in Japan from Swedish Orphan Biovitrum Japan Co., Ltd. (Sobi Japan), has been listed on Japan's National Health Insurance (NHI) drug price standard. The product was finally launched in September 4, 2023.

Key Questions Answered in This Report:

- How has the Japan generic drug market performed so far, and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Japan generic drug market?

- What are the various stages in the value chain of the Japan generic drug market?

- What are the key driving factors and challenges in the Japan generic drug market?

- What is the structure of the Japan generic drug market, and who are the key players?

- What is the competitive structure of the market?

- Who are the key players/companies in the Japan generic drug market?

Table of Contents

1 Preface

2 Scope and Methodology

- 2.1 Objectives of the Study

- 2.2 Stakeholders

- 2.3 Data Sources

- 2.3.1 Primary Sources

- 2.3.2 Secondary Sources

- 2.4 Market Estimation

- 2.4.1 Bottom-Up Approach

- 2.4.2 Top-Down Approach

- 2.5 Forecasting Methodology

3 Executive Summary

4 Japan Generic Drug Market - Introduction

- 4.1 What are Generic Drugs?

- 4.2 Unbranded and Branded Generic Drugs

- 4.3 Authorized Generic Drugs

5 Why is the Japanese Generic Drug Market So Lucrative

- 5.1 Blockbuster Drugs Going Off-Patent

- 5.2 Rising Healthcare Costs Coupled with an Increasing Ageing Population

- 5.3 Japan Has One of the Lowest Penetration of Generics

- 5.4 Incentives for Dispensing Generics

- 5.5 Significant Savings for Payers and Providers

- 5.6 Biosimilars

6 Global Generic Drug Market

- 6.1 Market Performance

- 6.1.1 Value Trends

- 6.1.2 Volume Trends

- 6.2 Market Breakup by Country

- 6.2.1 Market Breakup by Volume

- 6.2.2 Market Breakup by Value

- 6.3 Market Forecast

- 6.4 Most Prescribed Generic and Branded Drugs

7 Japan Generic Drug Market

- 7.1 Japan Pharmaceutical Market Performance

- 7.1.1 Value Trends

- 7.1.2 Volume Trends

- 7.1.3 Market Breakup by Type

- 7.1.4 Market Forecast

- 7.2 Japan Generic Drug Market Performance

- 7.2.1 Value Trends

- 7.2.2 Volume Trends

- 7.2.3 Impact of COVID-19

- 7.2.4 Market Forecast

8 SWOT Analysis

- 8.1 Overview

- 8.2 Strength

- 8.3 Weakness

- 8.4 Opportunities

- 8.5 Threats

9 Pricing Mechanism and Profit Margins at Various Levels of Supply Chain

10 Porter's Five Forces Analysis

- 10.1 Overview

- 10.2 Bargaining Power of Buyers

- 10.3 Bargaining Power of Suppliers

- 10.4 Degree of Competition

- 10.5 Threat of New Entrants

- 10.6 Threat of Substitutes

11 Japan Generic Drug Market- Competitive Landscape

- 11.1 Japan Generic Drug Market - Competitive Structure

- 11.2 Japan Generic Drug Market - Breakup by Key Players

- 11.3 Japan Generic Drug Market - Breakup by Distribution Channel

12 Japan Generic Drug Market- Value Chain Analysis

- 12.1 Research and Development

- 12.2 Manufacturing

- 12.3 Marketing

- 12.4 Distribution

13 Regulations in Japan Generics Industry

- 13.1 Approval Pathway of a Generic Drug in Japan

- 13.1.1 Master File Scheme for Active Ingredients

- 13.1.2 Equivalency Review

- 13.1.3 Conformity Audit

- 13.2 Certifications

- 13.2.1 MAH (Market Authorization Holder) License for Product Approval

- 13.2.2 FMA (Foreign Manufacturer Accredited) Certification for Product Approval

- 13.2.3 DMF (Drug Master File) Registration

- 13.2.4 GMP (Good Manufacturing Practices) Certification

- 13.2.5 Manufacturer's License

14 Japan Generic Drug Market: Key Success Factors

15 Japan Generic Drug Market: Road Blocks

16 Requirements for Setting up a Generic Drug Manufacturing Plant

- 16.1 Manufacturing Process

- 16.2 Raw Material Requirements

- 16.3 Raw Material Pictures

- 16.4 Land and Construction Requirements

- 16.5 Machinery and Infrastructure Requirements

- 16.6 Machinery Pictures

- 16.7 Plant Layout

- 16.8 Packaging Requirements

- 16.9 Utility Requirements

- 16.10 Manpower Requirements