|

市場調査レポート

商品コード

1787832

コンピュータービジョン向けAIの世界市場(~2035年):コンポーネントタイプ別、機能別、機械学習モデル別、展開別、応用分野別、製品別、エンドユーザー別、企業規模別、主要地域別、産業動向、予測AI in Computer Vision Market Till 2035; Distribution by Type of Component, Function, Machine Learning Models, Deployment, Areas of Application, Product, End Users, Company Size, and Key Geographical Regions: Industry Trends and Global Forecasts |

||||||

カスタマイズ可能

|

|||||||

| コンピュータービジョン向けAIの世界市場(~2035年):コンポーネントタイプ別、機能別、機械学習モデル別、展開別、応用分野別、製品別、エンドユーザー別、企業規模別、主要地域別、産業動向、予測 |

|

出版日: 2025年08月11日

発行: Roots Analysis

ページ情報: 英文 178 Pages

納期: 7~10営業日

|

全表示

- 概要

- 目次

コンピュータービジョン向けAI市場の概要

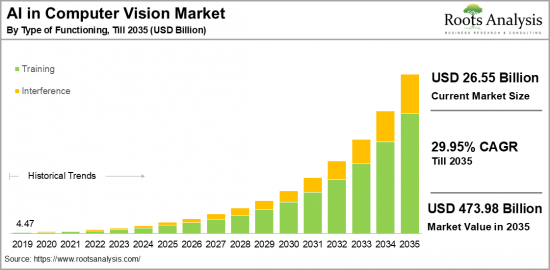

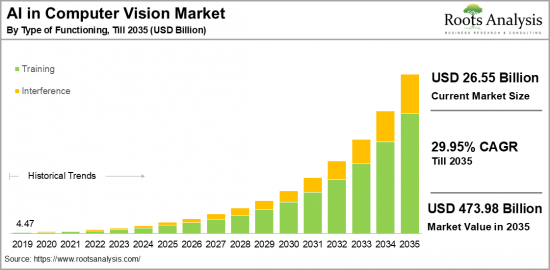

世界のコンピュータービジョンのAIの市場規模は、現在の265億5,000万米ドルから2035年までに4,739億8,000万米ドルに達すると予測され、2035年までの予測期間にCAGRで29.95%の成長が見込まれます。

コンピュータービジョン向けAI市場:成長と動向

世界的なデジタルトランスフォーメーションの進行により、さまざまな産業でAIの採用が進んでいます。特に、AIはコンピュータービジョンシステムに不可欠であり、コンピューターやその他のシステムがデジタル画像、動画、さまざまな視覚入力から重要な情報を抽出し、得られたデータに基づいて行動したり参照したりすることを可能にします。コンピュータービジョン技術は、AIと機械学習の手法に大きく依存しています。この分野は、視覚情報に関連する多様なプロセスと表現の自動化と統合に重点を置いています。画像処理(画像の符号化、変換、送信を含む)や統計的パターン分類などのさまざまな技術を包含します。

自動車用途におけるコンピュータービジョンシステムへのニーズの増加、感情認識AIへの関心の高まり、品質検査と自動化に対する需要の高まりが、AIビジョン技術の市場の拡大を後押ししていることは特筆に値します。さらに、ビジョンシステム内のAI技術の進歩を促進することを目的とした政府の積極的な取り組みが、コンピュータービジョン部門においてAIにさらなる機会を生み出しています。上記の要因から、世界のコンピュータービジョン向けAI市場は、予測期間に安定したペースで増大する見込みです。

当レポートでは、世界のコンピュータービジョン向けAI市場について調査分析し、市場規模の推計と機会の分析、競合情勢、企業プロファイル、メガトレンドなどの情報を提供しています。

目次

セクション1 レポートの概要

第1章 序文

第2章 調査手法

第3章 市場力学

第4章 マクロ経済指標

セクション2 定性的な知見

第5章 エグゼクティブサマリー

第6章 イントロダクション

第7章 規制シナリオ

セクション3 市場の概要

第8章 主要企業の包括的なデータベース

第9章 競合情勢

第10章 ホワイトスペース分析

第11章 企業の競争力の分析

第12章 コンピュータービジョン向けAI市場のスタートアップエコシステム

セクション4 企業プロファイル

第13章 企業プロファイル

- 章の概要

- Alphabet

- Advanced Micro Devices

- Amazon Web Services

- Apple

- Baumer Optronic

- Basler

- Baidu

- Cognex

- CEVA

- General Electric

- Honeywell

- Huawei

- IBM

- Intel

- JAI A/S

- KEYENCE

- Matterport

セクション5 市場動向

第14章 メガトレンドの分析

第15章 アンメットニーズの分析

第16章 特許分析

第17章 近年の発展

セクション6 市場機会の分析

第18章 世界のコンピュータービジョン向けAI市場

第19章 市場機会:コンポーネントタイプ別

第20章 市場機会:機能タイプ別

第21章 市場機会:機械学習モデルタイプ別

第22章 市場機会:展開タイプ別

第23章 市場機会:応用分野別

第24章 市場機会:製品タイプ別

第25章 市場機会:エンドユーザータイプ別

第26章 北米のコンピュータービジョン向けAI市場の機会

第27章 欧州のコンピュータービジョン向けAI市場の機会

第28章 アジアのコンピュータービジョン向けAI市場の機会

第29章 中東・北アフリカ(MENA)のコンピュータービジョン向けAI市場の機会

第30章 ラテンアメリカのコンピュータービジョン向けAI市場の機会

第31章 その他の地域のコンピュータービジョン向けAI市場の機会

第32章 市場集中分析:主要企業別

第33章 隣接市場の分析

セクション7 戦略ツール

第34章 勝利の鍵となる戦略

第35章 ポーターのファイブフォース分析

第36章 SWOT分析

第37章 バリューチェーン分析

第38章 Rootsの戦略的提言

セクション8 その他の独占的知見

第39章 1次調査からの知見

第40章 レポートの結論

セクション9 付録

AI in Computer Vision Market Overview

As per Roots Analysis, the global AI in computer vision market size is estimated to grow from USD 26.55 billion in current year to USD 473.98 billion by 2035, at a CAGR of 29.95% during the forecast period, till 2035.

The opportunity for AI in computer vision market has been distributed across the following segments:

Type of Component

- Hardware

- Software

- Service

Type of Function

- Training

- Interference

Type of Machine Learning Models

- Supervised Learning

- Unsupervised Learning

Type of Deployment

- Cloud-Based

- On-Premises

Areas of Application

- Facial Recognition

- Image Classification

- Object Detection

- Object Tracking

- Others

Type of Product

- PC-Based Computer Vision System

- Smart Camera-Based Computer Vision System

Type of End Users

- Automotive

- Consumer Electronics

- Healthcare

- Manufacturing

- Retail

- Security & Surveillance

- Sports & Entertainment

- Others

Company Size

- Large Enterprises

- Small and Medium Enterprises

Type of Business Model

- B2B

- B2C

- B2B2C

Geographical Regions

- North America

- US

- Canada

- Mexico

- Other North American countries

- Europe

- Austria

- Belgium

- Denmark

- France

- Germany

- Ireland

- Italy

- Netherlands

- Norway

- Russia

- Spain

- Sweden

- Switzerland

- UK

- Other European countries

- Asia

- China

- India

- Japan

- Singapore

- South Korea

- Other Asian countries

- Latin America

- Brazil

- Chile

- Colombia

- Venezuela

- Other Latin American countries

- Middle East and North Africa

- Egypt

- Iran

- Iraq

- Israel

- Kuwait

- Saudi Arabia

- UAE

- Other MENA countries

- Rest of the World

- Australia

- New Zealand

- Other countries

AI IN COMPUTER VISION MARKET: GROWTH AND TRENDS

Due to the ongoing global digital transformation, a variety of industries are adopting artificial intelligence (AI). Notably, AI is integral to computer vision systems, which allow computers and other systems to extract significant information from digital images, videos, and various visual inputs, enabling them to act or reference based on the obtained data. Computer vision technology heavily relies on artificial intelligence and machine learning methodologies. This field focuses on automating and integrating diverse processes and representations related to visual information. It encompasses various techniques such as image processing (including encoding, transforming, and transmitting images) and statistical pattern classification.

It is worth mentioning that an increased need for computer vision systems in automotive applications, a growing interest in emotion AI, and a heightened demand for quality inspection and automation, are propelling market expansion for AI vision technology. Further, active government initiatives aimed at promoting advancements in AI technology within vision systems are creating additional opportunities for the AI in computer vision sector. Owing to the abovementioned factors, the global AI in computer vision market is expected to increase at a steady pace during the forecast period.

AI IN COMPUTER VISION MARKET: KEY SEGMENTS

Market Share by Type of Component

Based on type of component, the global AI in computer vision market is segmented into hardware, software, and services. According to our estimates, currently, the software segment captures the majority share of the market. This can be attributed to the vital role of software in supplying essential tools for analyzing and visualizing data.

The software offers various applications, including AI frameworks, AI algorithms, video processing, and more, which further contributes to its market growth. However, the hardware segment is anticipated to grow at a relatively higher CAGR during the forecast period, owing to its crucial role in for data capture in computer vision applications.

Market Share by Type of Function

Based on type of function, the AI in computer vision market is segmented into training and interference. According to our estimates, currently, the training segment captures the majority of the market. This can be attributed to the growing need for training data and advancements in deep learning algorithms, which require targeted training to improve results.

Market Share by Type of Machine Learning Models

Based on type of machine learning models, the AI in computer vision market is segmented into supervised learning and unsupervised learning. According to our estimates, currently, the supervised learning segment captures the majority share of the market. This can be attributed to the model's efficiency in functions such as image classification and object detection, which typically require labeled datasets for training.

However, the unsupervised learning model is anticipated to grow at a relatively higher CAGR during the forecast period. This growth is likely due to its capacity to analyze and interpret data without relying on labeled inputs, making it especially useful in scenarios where obtaining labeled data poses challenges.

Market Share by Type of Deployment

Based on type of deployment, the AI in computer vision market is segmented into cloud-based and on-premises. According to our estimates, currently, the on-premises segment captures the majority share of the market. This can be attributed to its accessibility, flexibility, scalability, and cost-effectiveness provided by AI in computer vision systems. The growing emphasis on accessibility and efficiency by numerous companies is also driving the growth of this segment.

Market Share by Area of Application

Based on areas of application, the AI in computer vision market is segmented into facial recognition, image classification, object detection, object tracking and others. According to our estimates, currently, facial recognition segment captures the majority share of the market. This can be attributed to the fact that facial recognition is an effective tool for security and surveillance, as it can accurately identify individuals. Further, it can aid in locating missing individuals and apprehending criminals by comparing faces in video recordings and databases of known offenders and missing persons.

However, the object detection segment is anticipated to grow at a relatively higher CAGR during the forecast period, due to its essential function in security systems, facilitating real-time image analysis and the identification of intruders, suspicious items, and possible threats.

Market Share by Type of Product

Based on type of product, the AI in computer vision market is segmented into PC-based computer vision system, smart camera-based computer vision system. According to our estimates, currently, the smart camera-based computer vision system captures the majority share of the market. This can be attributed to its extensive use across various sectors such as security, automotive, and healthcare. Additionally, this segment gains from advancements in camera module technology and the integration of AI.

However, PC-based computer vision system is anticipated to grow at a relatively higher CAGR during the forecast period, owing to the rising demand for robust computing solutions capable of managing intricate algorithms and substantial datasets.

Market Share by Type of End-Users

Based on type of end-users, the AI in computer vision market is segmented into automotive, consumer electronics, healthcare, manufacturing, retail, security & surveillance, sports & entertainment and others. According to our estimates, currently, the manufacturing segment captures the majority share of the market.

This can be attributed to the rapid expansion the manufacturing industry is witnessing in the realm of AI-powered computer vision, resulting in the transformation of various processes and delivering significant advantages. Vision computing systems within manufacturing aid in product inspections with accuracy, identifying defects like scratches or cracks. They also contribute to image analysis and the anticipation of possible failures.

However, the healthcare sector is anticipated to grow at a relatively higher CAGR during the forecast period, owing to a range of benefits these systems offer to improve patient care and medical practices.

Market Share by Company Size

Based on company size, the AI in computer vision market is segmented into large and small and medium enterprise. According to our estimates, currently, large enterprise segment captures the majority share of the market. However, the small enterprise segment is anticipated to grow at a relatively higher CAGR during the forecast period.

This is attributed to their flexibility, innovative approaches, concentration on specialized markets, and capacity to adjust to evolving customer preferences and market dynamics.

Market Share by Geographical Regions

Based on geographical regions, the AI in computer vision market is segmented into North America, Europe, Asia, Latin America, Middle East and North Africa, and the rest of the world. According to our estimates, currently, Asia Pacific captures the majority share of the market. This can be attributed to the deployments of the internet of things (IoT) in the area. Further, the strong IT and telecom infrastructure in the region, along with the high number of cloud and edge deployments, are additional factors driving the growth of computer vision systems.

Example Players in AI in Computer Vision Market

- Airtel

- AT&T

- China Mobile

- China Unicorn

- Ciena

- Deepsig

- Deutsche Telekom

- Ericsson

- HPE

- Jio

- KDDI

- KT

- Media Tek

- National Instruments

- NTT DoCoMo

- Orange

- Qualcomm Technology

- Rakuten Mobile

- Singtel

- SK Telecom

- Telefonica

- T-Mobile

- Verizon

- Vodafone

AI IN COMPUTER VISION MARKET: RESEARCH COVERAGE

The report on the AI in computer vision market features insights on various sections, including:

- Market Sizing and Opportunity Analysis: An in-depth analysis of the AI in computer vision market, focusing on key market segments, including [A] type of component, [B] type of function, [C] type of machine learning models, [D] type of deployment, [E] areas of application, [F] type of product, [G] type of end users, [H] company size, and [I] key geographical regions.

- Competitive Landscape: A comprehensive analysis of the companies engaged in the AI in computer vision market, based on several relevant parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] ownership structure.

- Company Profiles: Elaborate profiles of prominent players engaged in the AI in computer vision market, providing details on [A] location of headquarters, [B]company size, [C] company mission, [D] company footprint, [E] management team, [F] contact details, [G] financial information, [H] operating business segments, [I] AI in computer vision portfolio, [J] moat analysis, [K] recent developments, and an informed future outlook.

- Megatrends: An evaluation of ongoing megatrends in AI in computer vision industry.

- Patent Analysis: An insightful analysis of patents filed / granted in the AI in computer vision domain, based on relevant parameters, including [A] type of patent, [B] patent publication year, [C] patent age and [D] leading players.

- Recent Developments: An overview of the recent developments made in the AI in computer vision market, along with analysis based on relevant parameters, including [A] year of initiative, [B] type of initiative, [C] geographical distribution and [D] most active players.

- Porter's Five Forces Analysis: An analysis of five competitive forces prevailing in the AI in computer vision market, including threats of new entrants, bargaining power of buyers, bargaining power of suppliers, threats of substitute products and rivalry among existing competitors.

- SWOT Analysis: An insightful SWOT framework, highlighting the strengths, weaknesses, opportunities and threats in the domain. Additionally, it provides Harvey ball analysis, highlighting the relative impact of each SWOT parameter.

- Value Chain Analysis: A comprehensive analysis of the value chain, providing information on the different phases and stakeholders involved in the AI in computer vision market.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in AI in computer vision market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

SECTION I: REPORT OVERVIEW

1. PREFACE

- 1.1. Introduction

- 1.2. Market Share Insights

- 1.3. Key Market Insights

- 1.4. Report Coverage

- 1.5. Key Questions Answered

- 1.6. Chapter Outlines

2. RESEARCH METHODOLOGY

- 2.1. Chapter Overview

- 2.2. Research Assumptions

- 2.3. Database Building

- 2.3.1. Data Collection

- 2.3.2. Data Validation

- 2.3.3. Data Analysis

- 2.4. Project Methodology

- 2.4.1. Secondary Research

- 2.4.1.1. Annual Reports

- 2.4.1.2. Academic Research Papers

- 2.4.1.3. Company Websites

- 2.4.1.4. Investor Presentations

- 2.4.1.5. Regulatory Filings

- 2.4.1.6. White Papers

- 2.4.1.7. Industry Publications

- 2.4.1.8. Conferences and Seminars

- 2.4.1.9. Government Portals

- 2.4.1.10. Media and Press Releases

- 2.4.1.11. Newsletters

- 2.4.1.12. Industry Databases

- 2.4.1.13. Roots Proprietary Databases

- 2.4.1.14. Paid Databases and Sources

- 2.4.1.15. Social Media Portals

- 2.4.1.16. Other Secondary Sources

- 2.4.2. Primary Research

- 2.4.2.1. Introduction

- 2.4.2.2. Types

- 2.4.2.2.1. Qualitative

- 2.4.2.2.2. Quantitative

- 2.4.2.3. Advantages

- 2.4.2.4. Techniques

- 2.4.2.4.1. Interviews

- 2.4.2.4.2. Surveys

- 2.4.2.4.3. Focus Groups

- 2.4.2.4.4. Observational Research

- 2.4.2.4.5. Social Media Interactions

- 2.4.2.5. Stakeholders

- 2.4.2.5.1. Company Executives (CXOs)

- 2.4.2.5.2. Board of Directors

- 2.4.2.5.3. Company Presidents and Vice Presidents

- 2.4.2.5.4. Key Opinion Leaders

- 2.4.2.5.5. Research and Development Heads

- 2.4.2.5.6. Technical Experts

- 2.4.2.5.7. Subject Matter Experts

- 2.4.2.5.8. Scientists

- 2.4.2.5.9. Doctors and Other Healthcare Providers

- 2.4.2.6. Ethics and Integrity

- 2.4.2.6.1. Research Ethics

- 2.4.2.6.2. Data Integrity

- 2.4.3. Analytical Tools and Databases

- 2.4.1. Secondary Research

3. MARKET DYNAMICS

- 3.1. Forecast Methodology

- 3.1.1. Top-Down Approach

- 3.1.2. Bottom-Up Approach

- 3.1.3. Hybrid Approach

- 3.2. Market Assessment Framework

- 3.2.1. Total Addressable Market (TAM)

- 3.2.2. Serviceable Addressable Market (SAM)

- 3.2.3. Serviceable Obtainable Market (SOM)

- 3.2.4. Currently Acquired Market (CAM)

- 3.3. Forecasting Tools and Techniques

- 3.3.1. Qualitative Forecasting

- 3.3.2. Correlation

- 3.3.3. Regression

- 3.3.4. Time Series Analysis

- 3.3.5. Extrapolation

- 3.3.6. Convergence

- 3.3.7. Forecast Error Analysis

- 3.3.8. Data Visualization

- 3.3.9. Scenario Planning

- 3.3.10. Sensitivity Analysis

- 3.4. Key Considerations

- 3.4.1. Demographics

- 3.4.2. Market Access

- 3.4.3. Reimbursement Scenarios

- 3.4.4. Industry Consolidation

- 3.5. Robust Quality Control

- 3.6. Key Market Segmentations

- 3.7. Limitations

4. MACRO-ECONOMIC INDICATORS

- 4.1. Chapter Overview

- 4.2. Market Dynamics

- 4.2.1. Time Period

- 4.2.1.1. Historical Trends

- 4.2.1.2. Current and Forecasted Estimates

- 4.2.2. Currency Coverage

- 4.2.2.1. Overview of Major Currencies Affecting the Market

- 4.2.2.2. Impact of Currency Fluctuations on the Industry

- 4.2.3. Foreign Exchange Impact

- 4.2.3.1. Evaluation of Foreign Exchange Rates and Their Impact on Market

- 4.2.3.2. Strategies for Mitigating Foreign Exchange Risk

- 4.2.4. Recession

- 4.2.4.1. Historical Analysis of Past Recessions and Lessons Learnt

- 4.2.4.2. Assessment of Current Economic Conditions and Potential Impact on the Market

- 4.2.5. Inflation

- 4.2.5.1. Measurement and Analysis of Inflationary Pressures in the Economy

- 4.2.5.2. Potential Impact of Inflation on the Market Evolution

- 4.2.6. Interest Rates

- 4.2.6.1. Overview of Interest Rates and Their Impact on the Market

- 4.2.6.2. Strategies for Managing Interest Rate Risk

- 4.2.7. Commodity Flow Analysis

- 4.2.7.1. Type of Commodity

- 4.2.7.2. Origins and Destinations

- 4.2.7.3. Values and Weights

- 4.2.7.4. Modes of Transportation

- 4.2.8. Global Trade Dynamics

- 4.2.8.1. Import Scenario

- 4.2.8.2. Export Scenario

- 4.2.9. War Impact Analysis

- 4.2.9.1. Russian-Ukraine War

- 4.2.9.2. Israel-Hamas War

- 4.2.10. COVID Impact / Related Factors

- 4.2.10.1. Global Economic Impact

- 4.2.10.2. Industry-specific Impact

- 4.2.10.3. Government Response and Stimulus Measures

- 4.2.10.4. Future Outlook and Adaptation Strategies

- 4.2.11. Other Indicators

- 4.2.11.1. Fiscal Policy

- 4.2.11.2. Consumer Spending

- 4.2.11.3. Gross Domestic Product (GDP)

- 4.2.11.4. Employment

- 4.2.11.5. Taxes

- 4.2.11.6. R&D Innovation

- 4.2.11.7. Stock Market Performance

- 4.2.11.8. Supply Chain

- 4.2.11.9. Cross-Border Dynamics

- 4.2.1. Time Period

SECTION II: QUALITATIVE INSIGHTS

5. EXECUTIVE SUMMARY

6. INTRODUCTION

- 6.1. Chapter Overview

- 6.2. Overview of AI in Computer Vision Market

- 6.2.1. Type of Component

- 6.2.2. Type of Function

- 6.2.3. Type of Machine Learning Models

- 6.2.4. Type of Deployment

- 6.2.5. Areas of Application

- 6.2.6. Type of Product

- 6.2.7. Type of End Users

- 6.3. Future Perspective

7. REGULATORY SCENARIO

SECTION III: MARKET OVERVIEW

8. COMPREHENSIVE DATABASE OF LEADING PLAYERS

9. COMPETITIVE LANDSCAPE

- 9.1. Chapter Overview

- 9.2. Motion Control: Overall Market Landscape

- 9.2.1. Analysis by Year of Establishment

- 9.2.2. Analysis by Company Size

- 9.2.3. Analysis by Location of Headquarters

- 9.2.4. Analysis by Ownership Structure

10. WHITE SPACE ANALYSIS

11. COMPANY COMPETITIVENESS ANALYSIS

12. STARTUP ECOSYSTEM IN THE AI IN COMPUTER VISION MARKET

- 12.1. AI in Computer Vision Market: Market Landscape of Startups

- 12.1.1. Analysis by Year of Establishment

- 12.1.2. Analysis by Company Size

- 12.1.3. Analysis by Company Size and Year of Establishment

- 12.1.4. Analysis by Location of Headquarters

- 12.1.5. Analysis by Company Size and Location of Headquarters

- 12.1.6. Analysis by Ownership Structure

- 12.2. Key Findings

SECTION IV: COMPANY PROFILES

13. COMPANY PROFILES

- 13.1. Chapter Overview

- 13.2. Alphabet*

- 13.2.1. Company Overview

- 13.2.2. Company Mission

- 13.2.3. Company Footprint

- 13.2.4. Management Team

- 13.2.5. Contact Details

- 13.2.6. Financial Performance

- 13.2.7. Operating Business Segments

- 13.2.8. Service / Product Portfolio (project specific)

- 13.2.9. MOAT Analysis

- 13.2.10. Recent Developments and Future Outlook

- 13.3. Advanced Micro Devices

- 13.4. Amazon Web Services

- 13.5. Apple

- 13.6. Baumer Optronic

- 13.7. Basler

- 13.8. Baidu

- 13.9. Cognex

- 13.10. CEVA

- 13.11. Facebook

- 13.12. General Electric

- 13.13. Honeywell

- 13.14. Huawei

- 13.15. IBM

- 13.16. Intel

- 13.17. JAI A/S

- 13.18. KEYENCE

- 13.19. Matterport

SECTION V: MARKET TRENDS

14. MEGA TRENDS ANALYSIS

15. UNMEET NEED ANALYSIS

16. PATENT ANALYSIS

17. RECENT DEVELOPMENTS

- 17.1. Chapter Overview

- 17.2. Recent Funding

- 17.3. Recent Partnerships

- 17.4. Other Recent Initiatives

SECTION VI: MARKET OPPORTUNITY ANALYSIS

18. GLOBAL AI IN COMPUTER VISION MARKET

- 18.1. Chapter Overview

- 18.2. Key Assumptions and Methodology

- 18.3. Trends Disruption Impacting Market

- 18.4. Demand Side Trends

- 18.5. Supply Side Trends

- 18.6. Global AI in Computer Vision Market, Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 18.7. Multivariate Scenario Analysis

- 18.7.1. Conservative Scenario

- 18.7.2. Optimistic Scenario

- 18.8. Investment Feasibility Index

- 18.9. Key Market Segmentations

19. MARKET OPPORTUNITIES BASED ON TYPE OF COMPONENT

- 19.1. Chapter Overview

- 19.2. Key Assumptions and Methodology

- 19.3. Revenue Shift Analysis

- 19.4. Market Movement Analysis

- 19.5. Penetration-Growth (P-G) Matrix

- 19.6. AI in Computer Vision Market for Hardware: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.7. AI in Computer Vision Market for Software: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 19.8. Data Triangulation and Validation

- 19.8.1. Secondary Sources

- 19.8.2. Primary Sources

- 19.8.3. Statistical Modeling

20. MARKET OPPORTUNITIES BASED ON TYPE OF FUNCTION

- 20.1. Chapter Overview

- 20.2. Key Assumptions and Methodology

- 20.3. Revenue Shift Analysis

- 20.4. Market Movement Analysis

- 20.5. Penetration-Growth (P-G) Matrix

- 20.6. AI in Computer Vision Market for Training: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.7. AI in Computer Vision Market for Interference: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 20.8. Data Triangulation and Validation

- 20.8.1. Secondary Sources

- 20.8.2. Primary Sources

- 20.8.3. Statistical Modeling

21. MARKET OPPORTUNITIES BASED ON TYPE OF MACHINE LEARNING MODELS

- 21.1. Chapter Overview

- 21.2. Key Assumptions and Methodology

- 21.3. Revenue Shift Analysis

- 21.4. Market Movement Analysis

- 21.5. Penetration-Growth (P-G) Matrix

- 21.6. AI in Computer Vision Market for Supervised Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.7. AI in Computer Vision Market for Unsupervised Learning: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 21.8. Data Triangulation and Validation

- 21.8.1. Secondary Sources

- 21.8.2. Primary Sources

- 21.8.3. Statistical Modeling

22. MARKET OPPORTUNITIES BASED ON TYPE OF DEPLOYMENT

- 22.1. Chapter Overview

- 22.2. Key Assumptions and Methodology

- 22.3. Revenue Shift Analysis

- 22.4. Market Movement Analysis

- 22.5. Penetration-Growth (P-G) Matrix

- 22.6. AI in Computer Vision Market for Cloud-Based: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.7. AI in Computer Vision Market for On-Premises: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 22.8. Data Triangulation and Validation

- 22.8.1. Secondary Sources

- 22.8.2. Primary Sources

- 22.8.3. Statistical Modeling

23. MARKET OPPORTUNITIES BASED ON AREAS OF APPLICATIONS

- 23.1. Chapter Overview

- 23.2. Key Assumptions and Methodology

- 23.3. Revenue Shift Analysis

- 23.4. Market Movement Analysis

- 23.5. Penetration-Growth (P-G) Matrix

- 23.6. AI in Computer Vision Market for Facial Recognition: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.7. AI in Computer Vision Market for Image Classification: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.8. AI in Computer Vision Market for Object Detection: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.9. AI in Computer Vision Market for Object Tracking: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.10. AI in Computer Vision Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 23.11. Data Triangulation and Validation

- 23.11.1. Secondary Sources

- 23.11.2. Primary Sources

- 23.11.3. Statistical Modeling

24. MARKET OPPORTUNITIES BASED ON TYPE OF PRODUCT

- 24.1. Chapter Overview

- 24.2. Key Assumptions and Methodology

- 24.3. Revenue Shift Analysis

- 24.4. Market Movement Analysis

- 24.5. Penetration-Growth (P-G) Matrix

- 24.6. AI in Computer Vision Market for PC-Based Computer Vision System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.7. AI in Computer Vision Market for Smart Camera-Based Computer Vision System: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 24.8. Data Triangulation and Validation

- 24.8.1. Secondary Sources

- 24.8.2. Primary Sources

- 24.8.3. Statistical Modeling

25. MARKET OPPORTUNITIES BASED ON TYPE OF END-USERS

- 25.1. Chapter Overview

- 25.2. Key Assumptions and Methodology

- 25.3. Revenue Shift Analysis

- 25.4. Market Movement Analysis

- 25.5. Penetration-Growth (P-G) Matrix

- 25.6. AI in Computer Vision Market for Automotive: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.7. AI in Computer Vision Market for Consumer Electronics: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.8. AI in Computer Vision Market for Healthcare: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.9. AI in Computer Vision Market for Manufacturing: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.10. AI in Computer Vision Market for Retail: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.11. AI in Computer Vision Market for Security & Surveillance: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.12. AI in Computer Vision Market for Sports & Entertainment: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.13. AI in Computer Vision Market for Others: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 25.14. Data Triangulation and Validation

- 25.14.1. Secondary Sources

- 25.14.2. Primary Sources

- 25.14.3. Statistical Modeling

26. MARKET OPPORTUNITIES FOR AI IN COMPUTER VISION IN NORTH AMERICA

- 26.1. Chapter Overview

- 26.2. Key Assumptions and Methodology

- 26.3. Revenue Shift Analysis

- 26.4. Market Movement Analysis

- 26.5. Penetration-Growth (P-G) Matrix

- 26.6. AI in Computer Vision Market in North America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.1. AI in Computer Vision Market in the US: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.2. AI in Computer Vision Market in Canada: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.3. AI in Computer Vision Market in Mexico: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.6.4. AI in Computer Vision Market in Other North American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 26.7. Data Triangulation and Validation

27. MARKET OPPORTUNITIES FOR AI IN COMPUTER VISION IN EUROPE

- 27.1. Chapter Overview

- 27.2. Key Assumptions and Methodology

- 27.3. Revenue Shift Analysis

- 27.4. Market Movement Analysis

- 27.5. Penetration-Growth (P-G) Matrix

- 27.6. AI in Computer Vision Market in Europe: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.1. AI in Computer Vision Market in Austria: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.2. AI in Computer Vision Market in Belgium: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.3. AI in Computer Vision Market in Denmark: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.4. AI in Computer Vision Market in France: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.5. AI in Computer Vision Market in Germany: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.6. AI in Computer Vision Market in Ireland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.7. AI in Computer Vision Market in Italy: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.8. AI in Computer Vision Market in Netherlands: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.9. AI in Computer Vision Market in Norway: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.10. AI in Computer Vision Market in Russia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.11. AI in Computer Vision Market in Spain: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.12. AI in Computer Vision Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.13. AI in Computer Vision Market in Sweden: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.14. AI in Computer Vision Market in Switzerland: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.15. AI in Computer Vision Market in the UK: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.6.16. AI in Computer Vision Market in Other European Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 27.7. Data Triangulation and Validation

28. MARKET OPPORTUNITIES FOR AI IN COMPUTER VISION IN ASIA

- 28.1. Chapter Overview

- 28.2. Key Assumptions and Methodology

- 28.3. Revenue Shift Analysis

- 28.4. Market Movement Analysis

- 28.5. Penetration-Growth (P-G) Matrix

- 28.6. AI in Computer Vision Market in Asia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.1. AI in Computer Vision Market in China: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.2. AI in Computer Vision Market in India: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.3. AI in Computer Vision Market in Japan: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.4. AI in Computer Vision Market in Singapore: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.5. AI in Computer Vision Market in South Korea: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.6.6. AI in Computer Vision Market in Other Asian Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 28.7. Data Triangulation and Validation

29. MARKET OPPORTUNITIES FOR AI IN COMPUTER VISION IN MIDDLE EAST AND NORTH AFRICA (MENA)

- 29.1. Chapter Overview

- 29.2. Key Assumptions and Methodology

- 29.3. Revenue Shift Analysis

- 29.4. Market Movement Analysis

- 29.5. Penetration-Growth (P-G) Matrix

- 29.6. AI in Computer Vision Market in Middle East and North Africa (MENA): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.1. AI in Computer Vision Market in Egypt: Historical Trends (Since 2019) and Forecasted Estimates (Till 205)

- 29.6.2. AI in Computer Vision Market in Iran: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.3. AI in Computer Vision Market in Iraq: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.4. AI in Computer Vision Market in Israel: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.5. AI in Computer Vision Market in Kuwait: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.6. AI in Computer Vision Market in Saudi Arabia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.7. AI in Computer Vision Market in United Arab Emirates (UAE): Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.6.8. AI in Computer Vision Market in Other MENA Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 29.7. Data Triangulation and Validation

30. MARKET OPPORTUNITIES FOR AI IN COMPUTER VISION IN LATIN AMERICA

- 30.1. Chapter Overview

- 30.2. Key Assumptions and Methodology

- 30.3. Revenue Shift Analysis

- 30.4. Market Movement Analysis

- 30.5. Penetration-Growth (P-G) Matrix

- 30.6. AI in Computer Vision Market in Latin America: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.1. AI in Computer Vision Market in Argentina: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.2. AI in Computer Vision Market in Brazil: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.3. AI in Computer Vision Market in Chile: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.4. AI in Computer Vision Market in Colombia Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.5. AI in Computer Vision Market in Venezuela: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.6.6. AI in Computer Vision Market in Other Latin American Countries: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 30.7. Data Triangulation and Validation

31. MARKET OPPORTUNITIES FOR AI IN COMPUTER VISION IN REST OF THE WORLD

- 31.1. Chapter Overview

- 31.2. Key Assumptions and Methodology

- 31.3. Revenue Shift Analysis

- 31.4. Market Movement Analysis

- 31.5. Penetration-Growth (P-G) Matrix

- 31.6. AI in Computer Vision Market in Rest of the World: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 31.6.1. AI in Computer Vision Market in Australia: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 31.6.2. AI in Computer Vision Market in New Zealand: Historical Trends (Since 2019) and Forecasted Estimates (Till 2035)

- 31.6.3. AI in Computer Vision Market in Other Countries

- 31.7. Data Triangulation and Validation

32. MARKET CONCENTRATION ANALYSIS: DISTRIBUTION BY LEADING PLAYERS

- 32.1. Leading Player 1

- 32.2. Leading Player 2

- 32.3. Leading Player 3

- 32.4. Leading Player 4

- 32.5. Leading Player 5

- 32.6. Leading Player 6

- 32.7. Leading Player 7

- 32.8. Leading Player 8

33. ADJACENT MARKET ANALYSIS

SECTION VII: STRATEGIC TOOLS

34. KEY WINNING STRATEGIES

35. PORTER'S FIVE FORCES ANALYSIS

36. SWOT ANALYSIS

37. VALUE CHAIN ANALYSIS

38. ROOTS STRATEGIC RECOMMENDATIONS

- 38.1. Chapter Overview

- 38.2. Key Business-related Strategies

- 38.2.1. Research & Development

- 38.2.2. Product Manufacturing

- 38.2.3. Commercialization / Go-to-Market

- 38.2.4. Sales and Marketing

- 38.3. Key Operations-related Strategies

- 38.3.1. Risk Management

- 38.3.2. Workforce

- 38.3.3. Finance

- 38.3.4. Others