|

市場調査レポート

商品コード

1771294

抗ウイルス薬市場:業界動向と世界の予測 - 作用機序別、適応症別、薬剤標的別、治療タイプ別、主要地域別Antiviral Drugs Market: Industry Trends and Global Forecasts - Distribution by Mechanism of Action, Target Indication, Drug Target, Type of Therapy and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| 抗ウイルス薬市場:業界動向と世界の予測 - 作用機序別、適応症別、薬剤標的別、治療タイプ別、主要地域別 |

|

出版日: 2025年07月15日

発行: Roots Analysis

ページ情報: 英文 245 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

世界の抗ウイルス薬市場:概要

世界の抗ウイルス薬の市場規模は、2035年までの予測期間中に6.2%のCAGRで拡大し、現在の650億米ドルから2035年までに1,270億米ドルに成長すると予測されています。

市場セグメンテーションでは、市場規模および市場機会を以下のパラメータで区分しています:

作用機序

- 融合阻害剤

- DNAポリメラーゼ

- プロテアーゼ阻害剤

- 逆転写酵素

- その他

適応症

- ヒト免疫不全ウイルス感染症

- コロナウイルス感染症

- 肝炎

- 単純ヘルペスウイルス感染症

- サイトメガロウイルス感染症

- インフルエンザ

- その他

薬剤標的

- ウイルス標的

- 宿主標的

治療タイプ

- 単剤療法

- 併用療法

主要地域

- 北米

- 欧州

- アジア太平洋

- ラテンアメリカ

- 中東・北アフリカ

世界の抗ウイルス薬市場:成長と動向

感染症は、世界の主要な死因トップ10の1つであることが知られています。実際、年間4,000万人以上が様々な種類の感染症に罹患しています。さらに、COVID-19のパンデミック発生から5年が経過したが、ウイルスは完全な根絶の兆しが見えないまま存続し続けています。ランセット』誌に掲載された論文によると、COVID-19パンデミックは2020年だけで1,800万人以上の死者を出しました。さらに、代表的なウイルス性疾患のひとつであるヒト免疫不全ウイルス(HIV)は、2030年までに世界で650万人が死亡すると予測されています。そのため、いくつかの製薬会社は、抗ウイルス薬を開発することで感染症のリスクを軽減する研究開発プロセスを強化しています。

抗ウイルス薬とは、ヒト免疫不全ウイルス感染症、サイトメガロウイルス(CMV)感染症、コロナウイルス感染症(COVID-19)、インフルエンザなどのウイルス感染症を治療する可能性を示した薬剤クラス別を指します。ここで注目すべきは、既知の220種類のウイルスのうち10種類を標的とし、ヒトに複数の感染症を引き起こす80種類近くの抗ウイルス薬がUSFDAから承認を受けていることです。注目すべきは、現在いくつかの抗ウイルス薬がさまざまな臨床試験で評価されていることです。この分野における研究の増加と、効果的な抗ウイルス薬に対する需要の高まりにより、市場は予測期間中に安定した成長を遂げると予想されています。

抗ウイルス薬の世界市場:主要インサイト

当レポートでは、世界の抗ウイルス薬市場の現状を調査し、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです。

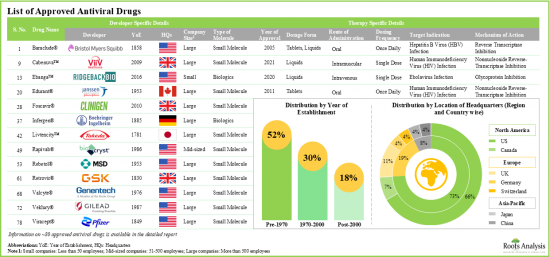

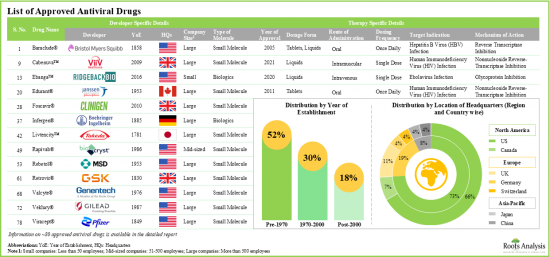

- 現在までに80種類近くの抗ウイルス薬が様々な感染症の治療薬として承認されており、その75%近くが経口投与です。

- 承認された抗ウイルス薬の約90%は錠剤と液剤で入手可能です。薬剤のほとんどは低分子であり、様々な感染症に対して異なる投与レジメンで使用できるように設計されています。

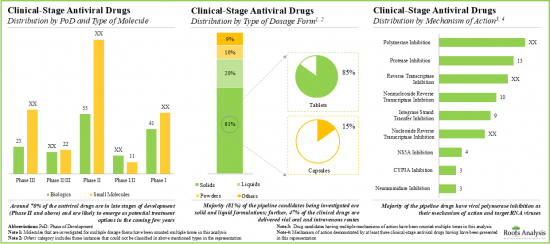

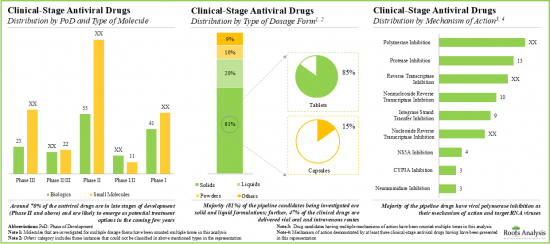

- 現在、約430の薬剤候補が複数の感染症の治療のために様々な段階の臨床試験で研究されており、薬剤分子の大部分は単剤療法として評価されています。

- ポリメラーゼ阻害とプロテアーゼ阻害が最も人気のある作用機序です。

- 利害関係者の関心が高まっていることは、提携活動の活発化からも明らかです。事実、抗ウイルス薬に関連する提携は、過去2年間で最も多く結ばれています。

- この分野の機会に気づいた複数の投資家が、過去4年間にさまざまな資金調達ラウンドで55億米ドル以上を投資しています。

- COVID-19のパンデミックは、製薬業界における効果的な抗ウイルス薬に対する需要の急増につながっています。

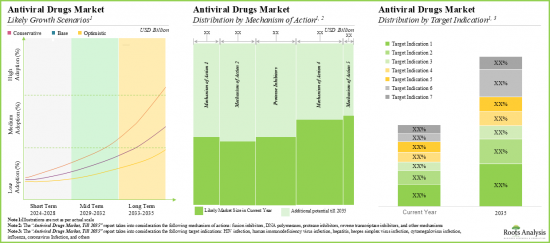

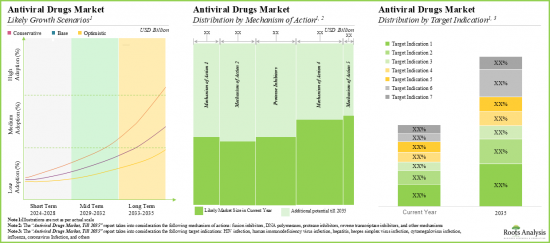

- 抗ウイルス剤市場はCAGR 6.2%で成長すると予想されており、現在、市場の大半のシェア(44%)はHIV感染をターゲットとする薬剤が占めています。

- 抗ウイルス薬市場に関連する機会は、さまざまな種類の薬剤標的、治療法、主要な地理的地域にうまく分散している可能性が高いです。

抗ウイルス薬の世界市場:主要セグメント

作用機序別では、市場は融合阻害剤、DNAポリメラーゼ阻害剤、プロテアーゼ阻害剤、逆転写酵素、その他に区分されます。現在、逆転写酵素セグメントは、HIVおよびC型肝炎の治療に有効であることから、世界の抗ウイルス薬市場で最大シェアを占めています。

適応症別では、市場はヒト免疫不全ウイルス感染症(HIV)、コロナウイルス感染症、肝炎、単純ヘルペスウイルス感染症、サイトメガロウイルス感染症、インフルエンザ、その他に区分されます。現在、世界の抗ウイルス薬市場で最も高い割合を占めているのはヒト免疫不全ウイルス感染症です。コロナウイルス感染セグメントの抗ウイルス薬市場は、比較的高いCAGRで成長する可能性が高いことは注目に値します。

薬剤標的別では、市場はウイルスと宿主に区分されます。現在、抗ウイルス薬市場ではウイルス標的薬が最大シェアを占めています。しかし、幅広い宿主を示す可能性があるため、宿主標的セグメントは相対的に高いCAGRで成長する可能性が高いです。

治療タイプ別では、市場は単剤療法と併用療法に区分されます。現在、単剤療法が抗ウイルス薬市場で最も高い割合を占めています。さらに、費用対効果や効率の高さといった利点から、併用療法市場が比較的高いCAGRで成長する可能性が高いことは注目に値します。

主要地域別に見ると、市場は北米、欧州、アジア太平洋、ラテンアメリカ、中東・北アフリカに区分されます。現在、北米が抗ウイルス薬市場を独占し、最大の収益シェアを占めています。これは、同地域の製薬産業が堅調であること、研究機関の数が増加し、同地域で感染症に関する研究プログラムが活発に行われていることに起因しています。

世界の抗ウイルス薬市場における参入企業例

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline(GSK)

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

当レポートでは、世界の抗ウイルス薬市場について調査し、市場の概要とともに、作用機序別、適応症別、薬剤標的別、治療タイプ別動向、地域別の動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 序文

第2章 エグゼクティブサマリー

第3章 イントロダクション

- 抗ウイルス薬の概要

- ウイルスの種類とウイルス性疾患

- 抗ウイルス薬の作用機序

- 抗ウイルス薬の特徴

- 抗ウイルス薬の利点

- 抗ウイルス薬開発に伴う課題

- 抗ウイルス薬の重要な事実と将来の展望

第4章 市場情勢:承認された抗ウイルス薬

- 承認された抗ウイルス薬:市場情勢

- 承認された抗ウイルス薬:開発情勢

第5章 市場情勢:臨床抗ウイルス薬

- 臨床段階の抗ウイルス薬:市場情勢

- 臨床段階の抗ウイルス薬:開発情勢

第6章 企業プロファイル

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline(GSK)

- Johnson &Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

第7章 パートナーシップとコラボレーション

第8章 資金調達と投資

- 抗ウイルス薬:資金調達と投資

第9章 ポーターのファイブフォース分析

第10章 市場予測と機会分析

- 予測調査手法と主要な前提条件

- 世界の抗ウイルス薬市場(2035年まで)

- 抗ウイルス薬市場:作用機序別

- 抗ウイルス薬市場:対適応症別

- 抗ウイルス薬市場:薬剤標的別

- 抗ウイルス薬市場:治療タイプ別

- 抗ウイルス薬市場:地域別

第11章 エグゼクティブ洞察

第12章 付録1:表形式データ

第13章 付録2:企業・団体一覧

List of Tables

- Table 4.1 List of Approved Antiviral Drugs

- Table 4.2 List of Approved Antiviral Drug Developers

- Table 5.1 List of Clinical-Stage Antiviral Drugs

- Table 5.2 List of Clinical-Stage Antiviral Drug Developers

- Table 6.1 AbbVie: Product Portfolio

- Table 6.2 AbbVie: Recent Developments and Future Outlook

- Table 6.3 AstraZeneca: Product Portfolio

- Table 6.4 AstraZeneca: Recent Developments and Future Outlook

- Table 6.5 Bristol-Myers Squibb: Product Portfolio

- Table 6.6 Bristol-Myers Squibb: Recent Developments and Future Outlook

- Table 6.7 Genentech: Product Portfolio

- Table 6.8 Genentech: Recent Developments and Future Outlook

- Table 6.9 Gilead Sciences: Product Portfolio

- Table 6.10 Gilead Sciences: Recent Developments and Future Outlook

- Table 6.11 GlaxoSmithKline: Product Portfolio

- Table 6.12 GlaxoSmithKline: Recent Developments and Future Outlook

- Table 6.13 Johnson & Johnson: Product Portfolio

- Table 6.14 Johnson & Johnson: Recent Developments and Future Outlook

- Table 6.15 Merck: Product Portfolio

- Table 6.16 Merck: Recent Developments and Future Outlook

- Table 6.17 Novartis: Product Portfolio

- Table 6.18 Novartis: Recent Developments and Future Outlook

- Table 6.19 Pfizer: Product Portfolio

- Table 6.20 Pfizer: Recent Developments and Future Outlook

- Table 6.21 Roche: Product Portfolio

- Table 6.22 Roche: Recent Developments and Future Outlook

- Table 6.23 ViiV Healthcare: Product Portfolio

- Table 6.24 ViiV Healthcare: Recent Developments and Future Outlook

- Table 7.1 Antiviral Drugs: List of Partnerships and Collaborations

- Table 8.1 Antiviral Drugs: List of Funding and Investments

- Table 12.1 Approved Antiviral Drugs: Distribution by Year of Approval

- Table 12.2 Approved Antiviral Drugs: Distribution by Type of Dosage Form

- Table 12.3 Approved Antiviral Drugs: Distribution by Type of Molecule

- Table 12.4 Approved Antiviral Drugs: Distribution by Type of Target Virus

- Table 12.5 Approved Antiviral Drugs: Distribution by Route of Administration

- Table 12.6 Approved Antiviral Drugs: Distribution by Dosing Frequency

- Table 12.7 Approved Antiviral Drugs: Distribution by Target Indication

- Table 12.8 Approved Antiviral Drugs: Distribution by Mechanism of Action

- Table 12.9 Approved Antiviral Drugs Developers: Distribution by Year of Establishment

- Table 12.10 Approved Antiviral Drugs Developers: Distribution by Company Size

- Table 12.11 Approved Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Table 12.12 Approved Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Table 12.13 Most Active Players: Distribution by Number of Approved Drugs

- Table 12.14 Clinical Antiviral Drugs: Distribution by Phase of Development

- Table 12.15 Clinical Antiviral Drugs: Distribution by Type of Molecule

- Table 12.16 Clinical Antiviral Drugs: Distribution by Phase of Development and Type of Molecule

- Table 12.17 Clinical Antiviral Drugs: Distribution by Type of Dosage Form

- Table 12.18 Clinical Antiviral Drugs: Distribution by Route of Administration

- Table 12.19 Clinical Antiviral Drugs: Distribution by Target Indication

- Table 12.20 Clinical Antiviral Drugs: Distribution by Phase of Development and Target Indication

- Table 12.21 Clinical Antiviral Drugs: Distribution by Type of Developer

- Table 12.22 Clinical Antiviral Drugs: Distribution by Type of Therapy

- Table 12.23 Clinical Antiviral Drugs: Distribution by Target Patient Segment

- Table 12.24 Clinical Antiviral Drugs: Distribution by Mechanism of Action

- Table 12.25 Clinical Antiviral Drugs: Distribution by Type of Target Virus

- Table 12.26 Clinical Antiviral Drugs: Distribution by Number of Doses

- Table 12.27 Clinical Antiviral Drugs Developers: Distribution by Year of Establishment

- Table 12.28 Clinical Antiviral Drugs Developers: Distribution by Company Size

- Table 12.29 Clinical Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Table 12.30 Clinical Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Table 12.31 Clinical Antiviral Drugs Developers: Distribution by Company Size and Location of Headquarters

- Table 12.32 Most Active Players: Distribution by Number of Clinical-stage Drugs

- Table 12.33 Partnerships and Collaborations: Distribution by Year of Partnership

- Table 12.34 Partnerships and Collaborations: Distribution by Type of Partnership

- Table 12.35 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Table 12.36 Partnerships and Collaborations: Distribution by Target Indication

- Table 12.37 Partnerships and Collaborations: Distribution by Type of Target Virus

- Table 12.38 Partnerships and Collaborations: Distribution by Type of Partner

- Table 12.39 Most Active Players: Distribution by Number of Partnerships

- Table 12.40 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Table 12.41 Partnerships and Collaborations: International and Local Deals

- Table 12.42 Funding and Investments: Distribution by Year of Funding

- Table 12.43 Funding and Investments: Distribution of Amount Invested by Year

- Table 12.44 Funding and Investments: Distribution of by Type of Fundings

- Table 12.45 Funding and Investments: Distribution of Amount Invested by Type of Funding

- Table 12.46 Funding and Investments: Distribution by Target Indication

- Table 12.47 Funding and Investments: Distribution by Type of Target Virus

- Table 12.48 Funding and Investments: Distribution by Type of Investor

- Table 12.49 Most Active Players: Distribution by Number of Instances

- Table 12.50 Most Active Players: Distribution by Amount Invested

- Table 12.51 Most Active Investors: Distribution by Number of Instances

- Table 12.52 Funding and Investments: Distribution of Amount Invested by Region

- Table 12.53 Funding and Investments: Distribution of Amount Invested by Country

- Table 12.54 Global Antiviral Drugs Market, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.55 Antiviral Drugs Market: Distribution by Mechanism of Action (USD Billion)

- Table 12.56 Antiviral Drugs Market for Fusion Inhibitors, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.57 Antiviral Drugs Market for DNA Polymerases, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.58 Antiviral Drugs Market for Protease Inhibitors, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.59 Antiviral Drugs Market for Reverse Transcriptase Inhibitors, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.60 Antiviral Drugs Market for Other Mechanisms, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.61 Antiviral Drugs Market: Distribution by Target Indication (USD Billion)

- Table 12.62 Antiviral Drugs Market for Human Immunodeficiency Virus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.63 Antiviral Drugs Market for Hepatitis, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.64 Antiviral Drugs Market for Coronavirus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.65 Antiviral Drugs Market for Herpes Simplex Virus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.66 Antiviral Drugs Market for Cytomegalovirus Infection, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.67 Antiviral Drugs Market for Influenza, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.68 Antiviral Drugs Market for Other Target Indications, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.69 Antiviral Drugs Market: Distribution by Type of Drug Target (USD Billion)

- Table 12.70 Antiviral Drugs Market for Virus Target, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.71 Antiviral Drugs Market for Host Target, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.72 Antiviral Drugs Market: Distribution by Type of Therapy (USD Billion)

- Table 12.73 Antiviral Drugs Market for Monotherapy, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.74 Antiviral Drugs Market for Combination Therapy, Conservative, Base and Optimistic Scenarios, Till 2035 (USD Billion)

- Table 12.75 Antiviral Drugs Market: Distribution by Geography (USD Billion)

- Table 12.76 Antiviral Drugs Market in North America, Till 2035 (USD Billion)

- Table 12.77 Antiviral Drugs Market in Europe, Till 2035 (USD Billion)

- Table 12.78 Antiviral Drugs Market in Asia-Pacific, Till 2035 (USD Billion)

- Table 12.79 Antiviral Drugs Market in Latin America, Till 2035 (USD Billion)

- Table 12.80 Antiviral Drugs Market in MENA, Till 2035 (USD Billion)

- Table 12.81 Antiviral Drugs Market in Rest of the World, Till 2035 (USD Billion)

List of Figures

- Figure 2.1 Executive Summary: Overall Market Landscape of Approved Antiviral Drugs

- Figure 2.2 Executive Summary: Overall Market Landscape of Clinical-stage Antiviral Drugs

- Figure 2.3 Executive Summary: Partnerships and Collaborations

- Figure 2.4 Executive Summary: Funding and Investments

- Figure 2.5 Executive Summary: Market Forecast and Opportunity Analysis

- Figure 3.1 Types of Viruses

- Figure 3.2 Mechanism of Action of Antiviral Drugs

- Figure 4.1 Approved Antiviral Drugs: Distribution by Year of Approval

- Figure 4.2 Approved Antiviral Drugs: Distribution by Type of Dosage Form

- Figure 4.3 Approved Antiviral Drugs: Distribution by Type of Molecule

- Figure 4.4 Approved Antiviral Drugs: Distribution by Type of Target Virus

- Figure 4.5 Approved Antiviral Drugs: Distribution by Route of Administration

- Figure 4.6 Approved Antiviral Drugs: Distribution by Dosing Frequency

- Figure 4.7 Approved Antiviral Drugs: Distribution by Target Indication

- Figure 4.8 Approved Antiviral Drugs: Distribution by Mechanism of Action

- Figure 4.9 Approved Antiviral Drugs Developers: Distribution by Year of Establishment

- Figure 4.10 Approved Antiviral Drugs Developers: Distribution by Company Size

- Figure 4.11 Approved Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Figure 4.12 Approved Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Figure 4.13 Most Active Players: Distribution by Number of Approved Drugs

- Figure 5.1 Clinical Antiviral Drugs: Distribution by Phase of Development

- Figure 5.2 Clinical Antiviral Drugs: Distribution by Type of Molecule

- Figure 5.3 Clinical Antiviral Drugs: Distribution by Phase of Development and Type of Molecule

- Figure 5.4 Clinical Antiviral Drugs: Distribution by Type of Dosage Form

- Figure 5.5 Clinical Antiviral Drugs: Distribution by Route of Administration

- Figure 5.6 Clinical Antiviral Drugs: Distribution by Target Indication

- Figure 5.7 Clinical Antiviral Drugs: Distribution by Phase of Development and Target Indication

- Figure 5.8 Clinical Antiviral Drugs: Distribution by Type of Developer

- Figure 5.9 Clinical Antiviral Drugs: Distribution by Type of Therapy

- Figure 5.10 Clinical Antiviral Drugs: Distribution by Target Patient Segment

- Figure 5.11 Clinical Antiviral Drugs: Distribution by Mechanism of Action

- Figure 5.12 Clinical Antiviral Drugs: Distribution by Type of Target Virus

- Figure 5.13 Clinical Antiviral Drugs: Distribution by Number of Doses

- Figure 5.14 Clinical Antiviral Drugs Developers: Distribution by Year of Establishment

- Figure 5.15 Clinical Antiviral Drugs Developers: Distribution by Company Size

- Figure 5.16 Clinical Antiviral Drugs Developers: Distribution by Geography (Region-wise)

- Figure 5.17 Clinical Antiviral Drugs Developers: Distribution by Geography (Country-wise)

- Figure 5.18 Clinical Antiviral Drugs Developers: Distribution by Company Size and Location of Headquarters

- Figure 5.19 Most Active Players: Distribution by Number of Clinical-Stage Drugs

- Figure 7.1 Partnerships and Collaborations: Distribution by Year of Partnership

- Figure 7.2 Partnerships and Collaborations: Distribution by Type of Partnership

- Figure 7.3 Partnerships and Collaborations: Distribution by Year and Type of Partnership

- Figure 7.4 Partnerships and Collaborations: Distribution by Target Indication

- Figure 7.5 Partnerships and Collaborations: Distribution by Type of Target Virus

- Figure 7.6 Partnerships and Collaborations: Distribution by Type of Partner

- Figure 7.7 Most Active Players: Distribution by Number of Partnerships

- Figure 7.8 Partnerships and Collaborations: Intercontinental and Intracontinental Deals

- Figure 7.9 Partnerships and Collaborations: International and Local Deals

- Figure 8.1 Funding and Investments: Distribution by Year of Funding

- Figure 8.2 Funding and Investments: Distribution of Amount Invested by Year

- Figure 8.3 Funding and Investments: Distribution by Type of Funding

- Figure 8.4 Funding and Investments: Distribution of Amount Invested by Type of Funding

- Figure 8.5 Funding and Investments: Distribution by Target Indication

- Figure 8.6 Funding and Investments: Distribution by Type of Target Virus

- Figure 8.7 Funding and Investments: Distribution by Type of Investor

- Figure 8.8 Most Active Players: Distribution by Number of Instances

- Figure 8.9 Most Active Players: Distribution by Amount Invested

- Figure 8.10 Most Active Investors: Distribution by Number of Instances

- Figure 8.11 Funding and Investments: Distribution of Amount Invested by Region

- Figure 8.12 Funding and Investments: Distribution of Amount Invested by Country

- Figure 9.1 Antiviral Drugs: Porter's Five Forces Analysis

- Figure 10.1 Global Antiviral Drugs Market, Till 2035 (USD Billion)

- Figure 10.2 Antiviral Drugs Market: Distribution by Mechanism of Action (USD Billion)

- Figure 10.3 Antiviral Drugs Market for Fusion Inhibitors, Till 2035 (USD Billion)

- Figure 10.4 Antiviral Drugs Market for DNA Polymerases, Till 2035 (USD Billion)

- Figure 10.5 Antiviral Drugs Market for Protease Inhibitors, Till 2035 (USD Billion)

- Figure 10.6 Antiviral Drugs Market for Reverse Transcriptase Inhibitors, Till 2035 (USD Billion)

- Figure 10.7 Antiviral Drugs Market for Other Mechanisms, Till 2035 (USD Billion)

- Figure 10.8 Antiviral Drugs Market: Distribution by Target Indication (USD Billion)

- Figure 10.9 Antiviral Drugs Market for Human Immunodeficiency Virus Infection, Till 2035 (USD Billion)

- Figure 10.10 Antiviral Drugs Market for Hepatitis, Till 2035 (USD Billion)

- Figure 10.11 Antiviral Drugs Market for Coronavirus Infection, Till 2035 (USD Billion)

- Figure 10.12 Antiviral Drugs Market for Herpes Simplex Virus Infection, Till 2035 (USD Billion)

- Figure 10.13 Antiviral Drugs Market for Cytomegalovirus Infection, Till 2035 (USD Billion)

- Figure 10.14 Antiviral Drugs Market for Influenza, Till 2035 (USD Billion)

- Figure 10.15 Antiviral Drugs Market for Other Target Indications, Till 2035 (USD Billion)

- Figure 10.16 Antiviral Drugs Market: Distribution by Type of Drug Target (USD Billion)

- Figure 10.17 Antiviral Drugs Market for Virus Target, Till 2035 (USD Billion)

- Figure 10.18 Antiviral Drugs Market for Host Target, Till 2035 (USD Billion)

- Figure 10.19 Antiviral Drugs Market: Distribution by Type of Therapy (USD Billion)

- Figure 10.20 Antiviral Drugs Market for Monotherapy, Till 2035 (USD Billion)

- Figure 10.21 Antiviral Drugs Market for Combination Therapy, Till 2035 (USD Billion)

- Figure 10.22 Antiviral Drugs Market: Distribution by Geography (USD Billion)

- Figure 10.23 Antiviral Drugs Market in North America, Till 2035 (USD Billion)

- Figure 10.24 Antiviral Drugs Market in Europe, Till 2035 (USD Billion)

- Figure 10.25 Antiviral Drugs Market in Asia-Pacific, Till 2035 (USD Billion)

- Figure 10.26 Antiviral Drugs Market in Latin America, Till 2035 (USD Billion)

- Figure 10.27 Antiviral Drugs Market in MENA, Till 2035 (USD Billion)

- Figure 10.28 Antiviral Drugs Market in Rest of the World, Till 2035 (USD Billion)

GLOBAL ANTIVIRAL DRUGS MARKET: OVERVIEW

As per Roots Analysis, the global antiviral drugs market is estimated to grow from USD 65 billion in the current year to USD 127 billion by 2035, at a CAGR of 6.2% during the forecast period, till 2035.

The market sizing and opportunity analysis has been segmented across the following parameters:

Mechanism of Action

- Fusion Inhibitors

- DNA Polymerases

- Protease Inhibitors

- Reverse Transcriptase

- Others

Target Indication

- Human Immunodeficiency Virus Infection

- Coronavirus Infection

- Hepatitis

- Herpes Simplex Virus Infection

- Cytomegalovirus Infection

- Influenza

- Others

Drug Target

- Virus Target

- Host Target

Type of Therapy

- Monotherapy

- Combination Therapy

Key Geographical Regions

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and North Africa

GLOBAL ANTIVIRAL DRUGS MARKET: GROWTH AND TRENDS

Infectious diseases are known to be one of the top 10 leading causes of deaths, worldwide. In fact, more than 40 million people are affected by various types of infectious diseases annually. Further, it has been five years since the onset of COVID-19 pandemic, and the virus continues to persist with no indication of complete eradication. An article published in The Lancet journal reported that COVID-19 pandemic caused deaths of over 18 million people in 2020 alone. In addition, it has been reported that human immunodeficiency virus (HIV), one of the leading viral diseases is anticipated to be the cause for 6.5 million deaths globally, by 2030. Consequently, several pharmaceutical companies have increased their R&D processes to mitigate the risk of infectious diseases by developing antiviral drugs.

Antiviral drugs refer to the medication class that has shown potential to treat viral infection, including human immunodeficiency virus infection, cytomegalovirus (CMV) infection, Coronavirus infection (COVID-19), influenza, and others. It is worth highlighting here that close to 80 antiviral drugs that can target 10 out of 220 known viruses, resulting in multiple infections in humans, have received approval from the USFDA. Notably, several antiviral drugs are presently being evaluated under different clinical trials. Owing to the increasing research in this field and rising demand for effective antiviral drugs, the market is anticipated to witness steady growth during the forecast period.

GLOBAL ANTIVIRAL DRUGS MARKET: KEY INSIGHTS

The report delves into the current state of global antiviral drugs market and identifies potential growth opportunities within the industry. Some key findings from the report include:

- Close to 80 antiviral drugs have been approved, till date, for the treatment of an array of infectious diseases; nearly 75% of these drugs are administered via oral route.

- Around 90% of the approved antiviral drugs are available in tablet and liquid formulations; most of the drugs are small molecules, designed for use against various infectious diseases at different dosing regimens.

- Currently, around 430 drug candidates are being investigated in various phases of clinical trials for the treatment of multiple infectious diseases; majority of the drug molecules are being evaluated as monotherapies.

- More than 40% of the antiviral drug candidates are currently in phase II clinical trials; polymerase inhibition and protease inhibition are the most popular mechanisms of action.

- The growing interest of stakeholders is also evident from the rise in partnership activity; in fact, the maximum number of collaborations related to antiviral drugs were inked in the last two years.

- Several investors, having realized the opportunity within this segment, have invested over USD 5.5 billion across various funding rounds in the past four years.

- The COVID-19 pandemic led to surge in demand for effective antiviral drugs in the pharmaceutical industry; several stakeholders have entered to tap the opportunities within this domain.

- The antiviral drugs market is expected to grow at a CAGR of 6.2%; currently, the majority share of the market (44%) is captured by drugs targeting HIV infections.

- The opportunity associated with the antiviral drugs market is likely to be well distributed across various types of drug targets, therapies, and key geographical regions.

GLOBAL ANTIVIRAL DRUGS MARKET: KEY SEGMENTS

Reverse Transcriptase Segment Occupy the Largest Share of the Antiviral Drugs Market

Based on the mechanism of action, the market is segmented into fusion inhibitors, DNA polymerases, protease inhibitors, reverse transcriptase and others. At present, reverse transcriptase segment holds the maximum share of the global antiviral drugs market owing to its effectiveness in the treatment of HIV and hepatitis C. This trend is likely to remain same in the future.

By Target Indication, Coronavirus Infection is the Fastest Growing Segment of the Global Antiviral Drugs Market During the Forecast Period

Based on the target indication, the market is segmented into human immunodeficiency virus infection (HIV), coronavirus infection, hepatitis, herpes simplex virus infection, cytomegalovirus infection, influenza, and others. Currently, the human immunodeficiency virus segment captures the highest proportion of the global antiviral drugs market. It is worth highlighting that the antiviral drugs market for coronavirus infection segment is likely to grow at a relatively higher CAGR.

Virus Target Segment Occupy the Largest Share of the Antiviral Drugs Market by Drug Target

Based on the drug target, the market is segmented into virus target and host target. At present, the virus target segment holds the maximum share of the antiviral drugs market. However, owing to the potential to indicate a broad-spectrum host, host target segment is likely to grow at a relatively higher CAGR.

By Type of Therapy, the Combination Therapy Segment is the Fastest Growing Segment of the Antiviral Drugs Market During the Forecast Period

Based on the type of therapy, the market is segmented into monotherapy and combination therapy. Currently, monotherapy segment captures the highest proportion of the antiviral drugs market. Further, it is worth highlighting that the combination therapy market is likely to grow at a relatively higher CAGR owing to its benefits like cost-effectiveness and high efficiency.

North America Accounts for the Largest Share of the Market

Based on key geographical regions, the market is segmented into North America, Europe, Asia-Pacific, Latin America and Middle East and North Africa. Currently, North America dominates the antiviral drugs market and accounts for the largest revenue share. This can be attributed to the region's robust pharmaceutical industry and the rising number of research institutions and their active research programs in infectious diseases within the region.

Example Players in the Global Antiviral Drugs Market

- AbbVie

- AstraZeneca

- Bristol-Myers Squibb

- Genentech

- Gilead Sciences

- GlaxoSmithKline (GSK)

- Johnson & Johnson

- Merck

- Novartis

- Pfizer

- Roche

- ViiV Healthcare

GLOBAL ANTIVIRAL DRUGS MARKET: RESEARCH COVERAGE

- Market Sizing and Opportunity Analysis: The report features an in-depth analysis of the global antiviral drugs market, focusing on key market segments, including [A] mechanism of action, [B] target indication, [C] drug target, [D] type of therapy and [E] key geographical regions.

- Approved Antiviral Drug's Market Landscape: A comprehensive evaluation of commercially available antiviral drugs, considering various parameters, such as [A] year of approval, [B] type of dosage form, [C] type of molecule, [D] type of target virus, [E] route of administration, [F] dosing frequency, [G] mechanism of action and [H] target indication. Additionally, a comprehensive evaluation of antiviral drug developers, based on the parameters, such as [A] year of establishment, [B] company size, [C] geographical location and [D] leading players.

- Clinical Antiviral Drug's Market Landscape: A comprehensive evaluation of clinical-stage antiviral drugs, considering various parameters, such as [A] phase of development, [B] type of molecule, [C] type of dosage form, [C] route of administration, [D] target indication, [E] type of developer, [F] type of therapy, [G] target patient segment, [H] mechanism of action, [I] type of target virus and [J] number of doses. Additionally, a comprehensive evaluation of antiviral companies engaged in the development of clinical-stage antiviral drugs, based on the parameters, such as [A] year of establishment, [B] company size, [C] location of headquarters and [D] leading players.

- Partnerships and Collaborations: An insightful analysis of the deals inked by stakeholders in the global antiviral drugs market, based on several parameters, such as [A] year of partnership, [B] type of partnership, [C] type of partner, [D] target indication, [E] target virus, [F] most active players (in terms of the number of partnerships signed) and [G] geographical distribution of partnership activity.

- Funding and Investments: An in-depth analysis of the fundings received by players in antiviral drugs market, based on relevant parameters, such as [A] number of funding instances, [B] amount invested, [C] type of funding, [D] most active players, [E] most active investors and [F] geography.

- PORTER'S Five Forces Analysis: A detailed analysis of the five competitive forces prevalent in antiviral drugs market, including [A] threats for new entrants, [B] bargaining power of drug developers, [C] bargaining power of buyers, [D] threats of substitute products and [E] rivalry among existing competitors.

- Company Profiles: In-depth profiles of companies engaged in the development of antiviral drugs, focusing on [A] company overviews, [B] product portfolio and [C] recent developments and an informed future outlook.

KEY QUESTIONS ANSWERED IN THIS REPORT

- How many companies are currently engaged in this market?

- Which are the leading companies in this market?

- What factors are likely to influence the evolution of this market?

- What is the current and future market size?

- What is the CAGR of this market?

- How is the current and future market opportunity likely to be distributed across key market segments?

REASONS TO BUY THIS REPORT

- The report provides a comprehensive market analysis, offering detailed revenue projections of the overall market and its specific sub-segments. This information is valuable to both established market leaders and emerging entrants.

- Stakeholders can leverage the report to gain a deeper understanding of the competitive dynamics within the market. By analyzing the competitive landscape, businesses can make informed decisions to optimize their market positioning and develop effective go-to-market strategies.

- The report offers stakeholders a comprehensive overview of the market, including key drivers, barriers, opportunities, and challenges. This information empowers stakeholders to stay abreast of market trends and make data-driven decisions to capitalize on growth prospects.

ADDITIONAL BENEFITS

- Complimentary PPT Insights Packs

- Complimentary Excel Data Packs for all Analytical Modules in the Report

- 15% Free Content Customization

- Detailed Report Walkthrough Session with Research Team

- Free Updated report if the report is 6-12 months old or older

TABLE OF CONTENTS

1. PREFACE

- 1.1. Scope of the Report

- 1.2. Research Methodology

- 1.2.1. Research Assumptions

- 1.2.2. Project Methodology

- 1.2.3. Forecast Methodology

- 1.2.4. Robust Quality Control

- 1.2.5. Key Considerations

- 1.2.5.1. Demographics

- 1.2.5.2. Economic Factors

- 1.2.5.3. Government Regulations

- 1.2.5.4. Supply Chain

- 1.2.5.5. COVID Impact / Related Factors

- 1.2.5.6. Market Access

- 1.2.5.7. Healthcare Policies

- 1.2.5.8. Industry Consolidation

- 1.3 Key Questions Answered

- 1.4. Chapter Outlines

2. EXECUTIVE SUMMARY

3. INTRODUCTION

- 3.1. Overview of Antiviral Drugs

- 3.2. Types of Viruses and Viral Diseases

- 3.3. Mechanism of Action of Antiviral Drugs

- 3.4. Characteristics of Antiviral Drugs

- 3.5. Advantages of Antiviral Drugs

- 3.6. Challenges Associated with Development of Antiviral Drugs

- 3.7. Key Facts and Future Perspectives of Antiviral Drugs

4. MARKET LANDSCAPE: APPROVED ANTIVIRAL DRUGS

- 4.1. Approved Antiviral Drugs: Overall Market Landscape

- 4.1.1. Analysis by Year of Approval

- 4.1.2. Analysis by Type of Dosage Form

- 4.1.3. Analysis by Type of Molecule

- 4.1.4. Analysis by Type of Target Virus

- 4.1.5. Analysis by Route of Administration

- 4.1.6. Analysis by Dosing Frequency

- 4.1.7. Analysis by Target Indication

- 4.1.8. Analysis by Mechanism of Action

- 4.2. Approved Antiviral Drugs: Developer Landscape

- 4.2.1. Analysis by Year of Establishment

- 4.2.2. Analysis by Company Size

- 4.2.3. Analysis by Geography (Region-wise)

- 4.2.4. Analysis by Geography (Country-wise)

- 4.2.5. Most Active Players: Analysis by Number of Approved Drugs

5. MARKET LANDSCAPE: CLINICAL ANTIVIRAL DRUGS

- 5.1. Clinical-stage Antiviral Drugs: Overall Market Landscape

- 5.1.1. Analysis by Phase of Development

- 5.1.2. Analysis by Type of Molecule

- 5.1.3. Analysis by Phase of Development and Type of Molecule

- 5.1.4. Analysis by Type of Dosage Form

- 5.1.5. Analysis by Route of Administration

- 5.1.6. Analysis by Target Indication

- 5.1.7. Analysis by Phase of Development and Target Indication

- 5.1.8. Analysis by Type of Developer

- 5.1.9. Analysis by Type of Therapy

- 5.1.10. Analysis by Target Patient Segment

- 5.1.11. Analysis by Mechanism of Action

- 5.1.12. Analysis by Type of Target Virus

- 5.1.13. Analysis by Number of Doses

- 5.2. Clinical-Stage Antiviral Drugs: Developer Landscape

- 5.2.1. Analysis by Year of Establishment

- 5.2.2. Analysis by Company Size

- 5.2.3. Analysis by Geography (Region-wise)

- 5.2.4. Analysis by Geography (Country-wise)

- 5.2.5. Analysis by Company Size and Location of Headquarters

- 5.2.6. Most Active Players: Analysis by Number of Clinical-Stage Drugs

6. COMPANY PROFILES

- 6.1. AbbVie

- 6.1.1. Company Overview

- 6.1.2. Key Executives

- 6.1.3. Financial Information

- 6.1.4. Product Portfolio

- 6.1.5. Recent Developments and Future Outlook

- 6.2. AstraZeneca

- 6.2.1. Company Overview

- 6.2.2. Key Executives

- 6.2.3. Financial Information

- 6.2.4. Product Portfolio

- 6.2.5. Recent Developments and Future Outlook

- 6.3. Bristol-Myers Squibb

- 6.3.1. Company Overview

- 6.3.2. Key Executives

- 6.3.3. Financial Information

- 6.3.4. Product Portfolio

- 6.3.5. Recent Developments and Future Outlook

- 6.4. Genentech

- 6.4.1. Company Overview

- 6.4.2. Key Executives

- 6.4.3. Product Portfolio

- 6.4.4. Recent Developments and Future Outlook

- 6.5. Gilead Sciences

- 6.5.1. Company Overview

- 6.5.2. Key Executives

- 6.5.3. Financial Information

- 6.5.4. Product Portfolio

- 6.5.5. Recent Developments and Future Outlook

- 6.6. GlaxoSmithKline (GSK)

- 6.6.1. Company Overview

- 6.6.2. Key Executives

- 6.6.3. Financial Information

- 6.6.4. Product Portfolio

- 6.6.5. Recent Developments and Future Outlook

- 6.7. Johnson & Johnson

- 6.7.1. Company Overview

- 6.7.2. Key Executives

- 6.7.3. Financial Information

- 6.7.4. Product Portfolio

- 6.7.5. Recent Developments and Future Outlook

- 6.8. Merck

- 6.8.1. Company Overview

- 6.8.2. Key Executives

- 6.8.3. Financial Information

- 6.8.4. Product Portfolio

- 6.8.5. Recent Developments and Future Outlook

- 6.9. Novartis

- 6.9.1. Company Overview

- 6.9.2. Key Executives

- 6.9.3. Financial Information

- 6.9.4. Product Portfolio

- 6.9.5. Recent Developments and Future Outlook

- 6.10. Pfizer

- 6.10.1. Company Overview

- 6.10.2. Key Executives

- 6.10.3. Financial Information

- 6.10.4. Product Portfolio

- 6.10.5. Recent Developments and Future Outlook

- 6.11. Roche

- 6.11.1. Company Overview

- 6.11.2. Key Executives

- 6.11.3. Financial Information

- 6.11.4. Product Portfolio

- 6.11.5. Recent Developments and Future Outlook

- 6.12. ViiV Healthcare

- 6.12.1. Company Overview

- 6.12.2. Key Executives

- 6.12.3. Product Portfolio

- 6.12.4. Recent Developments and Future Outlook

7. PARTNERSHIPS AND COLLABORATIONS

- 7.1. Antiviral Drugs: Partnerships and Collaborations

- 7.1.1. Analysis by Year of Partnership

- 7.1.2. Analysis by Type of Partnership

- 7.1.3. Analysis by Year and Type of Partnership

- 7.1.4. Analysis by Target Indication

- 7.1.5. Analysis by Type of Target Virus

- 7.1.6. Analysis by Type of Partner

- 7.1.7. Most Active Players: Analysis by Number of Partnerships

- 7.1.8. Geographical Analysis

- 7.1.8.1. Intercontinental and Intracontinental Deals

- 7.1.8.2. International and Local Deals

8. FUNDING AND INVESTMENTS

- 8.1. Antiviral Drugs: Funding and Investments

- 8.1.1. Analysis by Year of Funding

- 8.1.2. Analysis of Amount Invested by Year

- 8.1.3. Analysis by Type of Funding

- 8.1.4. Analysis of Amount Invested by Type of Funding

- 8.1.5. Analysis by Target Indication

- 8.1.6. Analysis by Type of Target Virus

- 8.1.7. Analysis by Type of Investor

- 8.1.8. Most Active Players: Analysis by Number of Instances

- 8.1.9. Most Active Players: Analysis by Amount Invested

- 8.1.10. Most Active Investors: Analysis by Number of Instances

- 8.1.11. Geographical Analysis

- 8.1.11.1. Analysis of Amount Invested by Region

- 8.1.11.2. Analysis of Amount Invested by Country

9. PORTER'S FIVE FORCES ANALYSIS

- 9.1. Chapter Overview

- 9.2. Methodology and Key Parameters

- 9.3. Porter's Five Forces

- 9.3.1. Threat of New Entrants

- 9.3.2. Bargaining Power of End Users

- 9.3.3. Bargaining Power of Drug Developers

- 9.3.4. Threat of Substitute Products

- 9.3.5. Rivalry Among Existing Competitors

10. MARKET FORECAST AND OPPORTUNITY ANALYSIS

- 10.1. Forecast Methodology and Key Assumptions

- 10.2. Global Antiviral Drugs Market, Till 2035

- 10.2.1. Antiviral Drugs Market: Distribution by Mechanism of Action

- 10.2.1.1. Antiviral Drugs Market for Fusion Inhibitors, Till 2035

- 10.2.1.2. Antiviral Drugs Market for DNA Polymerases, Till 2035

- 10.2.1.3. Antiviral Drugs Market for Protease Inhibitors, Till 2035

- 10.2.1.4. Antiviral Drugs Market for Reverse Transcriptase Inhibitors, Till 2035

- 10.2.1.5. Antiviral Drugs Market for Other Mechanisms, Till 2035

- 10.2.2. Antiviral Drugs Market: Distribution by Target Indication

- 10.2.2.1. Antiviral Drugs Market for Human Immunodeficiency Virus Infection, Till 2035

- 10.2.2.2. Antiviral Drugs Market for Hepatitis, Till 2035

- 10.2.2.3. Antiviral Drugs Market for Coronaviruses Infection, Till 2035

- 10.2.2.4. Antiviral Drugs Market for Herpes Simplex Virus Infection, Till 2035

- 10.2.2.5. Antiviral Drugs Market for Cytomegalovirus Infection, Till 2035

- 10.2.2.6. Antiviral Drugs Market for Influenza, Till 2035

- 10.2.2.7. Antiviral Drugs Market for Other Target Indications, Till 2035

- 10.2.3. Antiviral Drugs Market: Distribution by Type of Drug Target

- 10.2.3.1. Antiviral Drugs Market for Virus Target, Till 2035

- 10.2.3.2. Antiviral Drugs Market for Host Target, Till 2035

- 10.2.4. Antiviral Drugs Market: Distribution by Type of Therapy

- 10.2.4.1. Antiviral Drugs Market for Monotherapy, Till 2035

- 10.2.4.2. Antiviral Drugs Market for Combination Therapy, Till 2035

- 10.2.5. Antiviral Drugs Market: Distribution by Geography

- 10.2.5.1. Antiviral Drugs Market in North America, Till 2035

- 10.2.5.2. Antiviral Drugs Market in Europe, Till 2035

- 10.2.5.3. Antiviral Drugs Market in Asia-Pacific, Till 2035

- 10.2.5.4. Antiviral Drugs Market in Latin America, Till 2035

- 10.2.5.5. Antiviral Drugs Market in MENA, Till 2035

- 10.2.5.6. Antiviral Drugs Market in Rest of the World, Till 2035

- 10.2.1. Antiviral Drugs Market: Distribution by Mechanism of Action

11. EXECUTIVE INSIGHTS

- 11.1. Chapter Overview

- 11.2. Company A

- 11.2.1. Company Snapshot

- 11.2.2. Interview Transcript: Chief Commercial Officer