|

市場調査レポート

商品コード

1891244

RTU(レディトゥユース)医薬品包装市場(第3版):2035年までの業界動向と世界の予測 - 容器タイプ別、クロージャータイプ別、製造材料別、主要地域別Ready to Use Pharmaceutical Packaging Market (3rd Edition): Industry Trends and Global Forecasts, till 2035 - Distribution by Type of Container, Type of Closure, Material of Fabrication and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| RTU(レディトゥユース)医薬品包装市場(第3版):2035年までの業界動向と世界の予測 - 容器タイプ別、クロージャータイプ別、製造材料別、主要地域別 |

|

出版日: 2025年12月18日

発行: Roots Analysis

ページ情報: 英文 323 Pages

納期: 即日から翌営業日

|

概要

RTU医薬品包装市場:概要

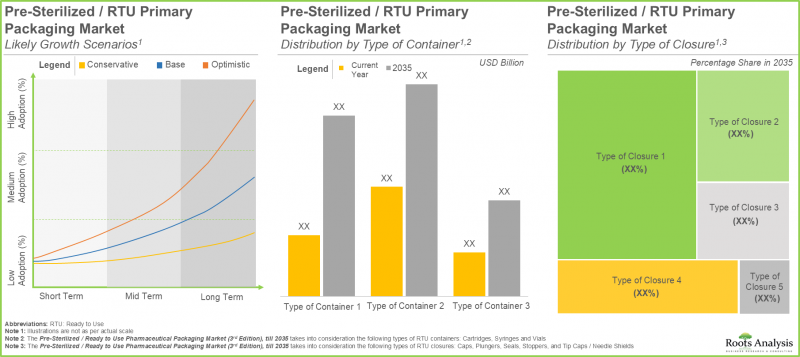

世界のRTU医薬品包装の市場規模は、2035年までの予測期間においてCAGR 9.7%で成長し、現在の95億米ドルから2035年までに251億米ドルに達すると推定されています。

市場規模および機会分析は、以下のパラメータに基づいてセグメント化されています:

容器タイプ

- 滅菌カートリッジ

- 滅菌シリンジ

- 滅菌バイアル

クロージャータイプ

- キャップ

- プランジャー

- シール

- ストッパー

- 先端キャップ/針シールド

製造材料

- アルミニウム

- ガラス

- プラスチック

- ゴム

主要地域

- 北米

- 欧州

- アジア

- ラテンアメリカ

- 中東・北アフリカ

- その他の地域

医薬品包装市場:成長と動向

医薬品業界において、ワクチンや医薬品の安全性と完全性は極めて重要です。これらの製品の第一次包装は、品質を維持し、汚染物質から保護するために不可欠です。したがって、製品の安全性を確保し、厳格な品質基準を遵守するため、医薬品製造における滅菌処理は必須となります。この結果、医薬品包装において、RTU/事前滅菌済み容器およびクロージャーが開発されました。RTUバイアル(RTUバイアル)は、内部滅菌工程の必要性を排除し、汚染リスクの低減と生産スケジュールの短縮を実現します。

医薬品製品のパイプライン拡大に伴い、関連する一次包装および二次包装ソリューションの需要が必然的に増加しております。しかしながら、従来の一次包装には、生産スケジュールの長期化や厳格な規制など、数多くの課題が存在します。このため、業界の利害関係者は滅菌済み/RTU一次包装ソリューションに注力するに至っております。医薬品一次包装の普及は、従来型一次包装に代わる有効な選択肢として台頭し、医薬品の充填・仕上げ工程を最適化する上で大きな利点をもたらします。これらの包装要素は、充填・仕上げ工程全体における複数の段階(主に洗浄、滅菌、容器の準備)を削減し、現行の規制要件を遵守しながら業務効率を向上させます。さらに、RTU包装システムは、発熱物質(体内に導入されると発熱を引き起こす可能性のある物質)を除去するための前処理を施されており、薬剤成分が規制基準に適合することを保証します。医療用ポリマーが提供する様々な追加的な利点により、RTU容器閉鎖システムは製薬業界内で着実に人気を高めています。

RTU医薬品包装市場:主要な知見

当レポートは、RTU医薬品包装市場の現状を詳細に分析し、業界内の潜在的な成長機会を特定します。レポートからの主な知見は以下の通りです:

- 現在、50社近いメーカー別95種類以上の滅菌済み/即使用可能容器が提供されているか、開発中です。これらの企業の比較的大きな割合は2000年以前に設立されました。

- RTU容器の約45%はバイアルとして提供されており、これらの製品の大半はエチレンオキサイド(EtO)を用いて滅菌されています。

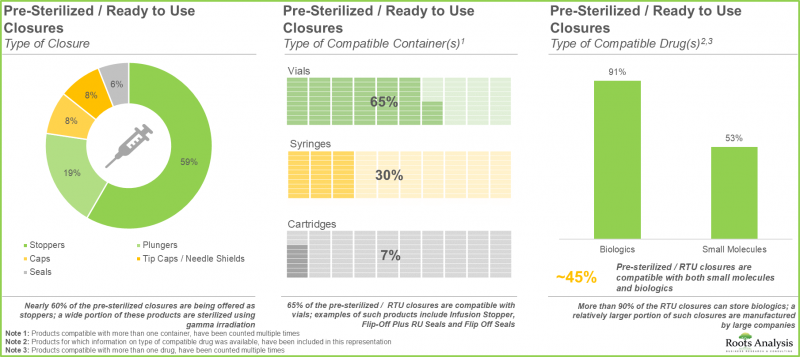

- 世界中で約85社のメーカーが滅菌済み/RTU(使用可能状態)の容器用キャップを製造しており、これらの企業の約60%はアジアに本社を置いています。

- バイアル、注射器、カートリッジなど、様々なタイプの容器に対応した幅広いRTUクロージャーが提供されており、生物学的製剤や低分子化合物に最適な包装ソリューションを実現しています。

- 競争優位性を獲得するため、RTU容器およびクロージャーの製造に携わる企業は現在、各社の製品ラインに先進的な機能を統合することに注力しております。

- 約40社が、様々な製薬工程の生産性と柔軟性を高めるため、異なる自由度を持つロボット機械を提供していると主張しています。

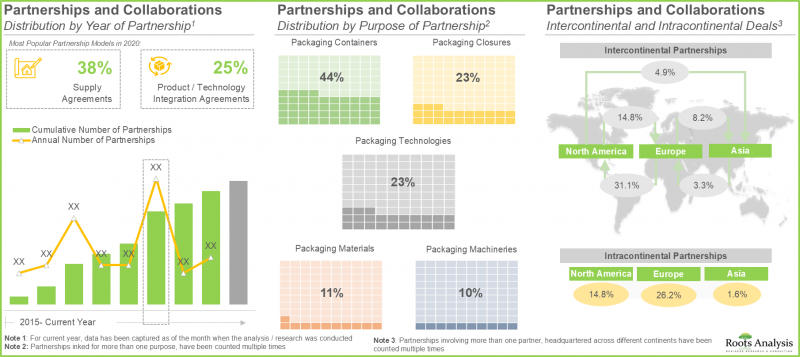

- RTU容器およびキャップ分野における利害関係者の関心の高まりは、提携活動からも明らかであり、実際、過去2年間で最多の提携が締結されました。

- 当社の知的資本に基づき、事前滅菌済み/RTU一次包装業界への参入可能性を評価できる独自のフレームワークを提案しております。利害関係者がこれを評価できます。

- バイアルは、近い将来、滅菌済み/RTU容器の需要の約55%を占めると予想されています。

- RTU一次包装市場は、主に滅菌済み/即使用可能容器からの収益に牽引され、今後数年間でCAGR 9.2%で成長すると予測されています。

- RTU医薬品包装の予測される機会は、様々なタイプの一次包装システム、製造材料、および主要な地理的地域に分散される見込みです。

- 複雑な医薬品製品の要件に対応できる先進的な包装材料および技術に対する需要の高まりにより、業界にはいくつかの成長機会が存在します。

即使用可能医薬品包装市場:主要セグメント

滅菌済み注射器セグメントが即使用可能医薬品包装市場で最大のシェアを占めています

容器タイプ別では、市場は無菌カートリッジ、無菌注射器、無菌バイアルに市場セグメンテーションされます。現在、無菌注射器カテゴリーが医薬品即用包装市場全体の最大のシェアを占めております。さらに、無菌バイアルセグメントにおける医薬品即用包装市場は、予測期間を通じて最大の成長可能性を示すと予測されております。

クロージャータイプ別では、キャップセグメントが予測期間中に急速な成長が見込まれます

クロージャータイプ別では、キャップ、プランジャー、シール、ストッパー、チップキャップ/ニードルシールドに分類されます。現在、プランジャーセグメントが世界のRTU医薬品包装市場で最大のシェアを占めております。しかしながら、キャップセグメントの市場は予測期間中に高いCAGRで成長することが見込まれております。

製造材料別では、プラスチックセグメントが世界のRTU医薬品包装市場で最大のシェアを占めています

製造材料別では、市場はアルミニウム、ガラス、プラスチック、ゴムに分類されます。現在、プラスチックセグメントが世界のRTU医薬品包装市場で最大の割合を占めております。これに続き、ガラスセグメントが予測期間中に高いCAGRで成長することが見込まれております。

アジアが市場で最大のシェアを占めています

主要地域別では、北米、欧州、アジア、ラテンアメリカ、中東・北アフリカ、世界のその他の地域に区分されます。現在、アジアが世界のRTU医薬品包装市場を主導し、最大の収益シェアを占めています。さらに、アジア市場は今後、より高いCAGRで成長する見込みです。

医薬品即用包装市場の代表的な企業例

- APG Pharma

- Aptar

- Daikyo Seiko

- Datwyler

- DWK Life Sciences

- Ningbo Zhengli Pharmaceutical Packaging

- SCHOTT

- Stevanto

- West Pharmaceutical Services

RTU医薬品包装市場:調査範囲

- 市場規模と機会分析:当レポートでは、[A]容器タイプ、[B]クロージャータイプ、[C]製造材料、[D]主要地域といった主要市場セグメンテーションに焦点を当て、世界のRTU医薬品包装市場の詳細な分析を特徴としています。

- 事前滅菌済み/即使用可能容器の市場情勢:事前滅菌済み/即使用可能容器について、[A]容器タイプ、[B]製造材料、[C]容器の色、[D]対応可能な薬剤タイプ、[E]事業規模、[F]包装形態、[G]使用される滅菌技術、[H]取得済みの品質認証、[I]対象市場、[J]追加コーティングおよびRTUキットの有無。さらに、[A]設立年、[B]企業規模(従業員数)、[C]本社所在地などのパラメータに基づき、滅菌済み/使用可能容器メーカーの包括的な評価を行います。

- 滅菌済み/使用可能状態のクロージャー市場情勢:滅菌済み/使用可能状態のクロージャーについて、以下の関連パラメータに基づく包括的な評価を行います:[A]クロージャータイプ、[B]製造材料、[C]対応可能な容器タイプ、[D]対応可能な薬剤タイプ[E]使用される滅菌技術、[F]提供可能な仕上げ形式、[G]取得済みの品質認証、[H]対象市場、[I]追加コーティングの有無といった複数の関連パラメータに基づきます。さらに、事前滅菌済み/使用可能状態のクロージャー製造業者について、[A]設立年、[B]企業規模(従業員数)、[C]本社所在地などのパラメータに基づく包括的な評価を行います。

- 主な知見:事前滅菌済み/使用可能状態の容器およびクロージャー品分野における市場動向の詳細な分析。関連するパラメータに基づき、[A]容器タイプと事業規模、[B]容器タイプと包装形式、[C]容器タイプと製造材料、[D]容器タイプと容器の色、[E]容器タイプと使用される滅菌技術[F]容器タイプと適合薬剤タイプ、[G]製造材料と使用される滅菌技術、[H]クロージャータイプと製造材料、[I]クロージャータイプと使用される滅菌技術、[J]クロージャータイプと利用可能な仕上げ形式、[K]クロージャータイプと適合薬剤タイプ。

- 事前滅菌済み/使用可能容器の製品競争力分析:各種事前滅菌済み/使用可能容器の包括的な競争力分析であり、[A]企業力および[B]製品競争力などの要素を検討します。

- 滅菌済み/使用可能状態のクロージャーの製品競争力分析:各種滅菌済み/使用可能状態のクロージャーに関する包括的な競合分析。具体的には、[A]企業力および[B]製品競争力などの要素を検討します。

- 企業プロファイル:滅菌済み/即使用可能容器およびキャップの提供に携わる主要企業の詳細なプロファイル。[A]企業の概要、[B]財務情報(入手可能な場合)、[C]製品ポートフォリオ、[D]最近の動向と将来展望に焦点を当てます。

- 提携・協業:医薬品即用包装市場における利害関係者の契約を、[A]提携年次、[B]提携形態、[C]提携先タイプ、[D]重点領域、[E]包装システム種別、[F]包装材料種別、[G]主要参入企業、[H]地域といった複数のパラメータに基づき、洞察に富んだ分析を行います。

- 市場参入意思決定の枠組み:アンメットニーズを特定し、事前滅菌済み/RTU一次包装分野への参入を支援する包括的フレームワーク。[A]製品到達範囲、[B]市場活動、[C]製品差別化、[D]競争力、[E]製造複雑性など、様々な要因に焦点を当てています。

- 需要分析:一次包装システムタイプや使用される製造材料など、様々な関連パラメータに基づき、滅菌済み/使用可能容器およびクロージャーに対する現在および将来の需要を詳細に評価します。

- 市場影響分析:市場成長に影響を与える可能性のある様々な要因、例えば促進要因、制約要因、機会、既存の課題などについての徹底的な分析。

- ケーススタディ:製薬製造および充填・仕上げ工程におけるロボット機械の使用に関する詳細な考察。これらのプロセスにおける自動化/自動化技術の採用別様々な利点を特徴として取り上げます。

目次

第1章 序文

第2章 調査手法

第3章 経済的およびその他のプロジェクト特有の考慮事項

第4章 エグゼクティブサマリー

第5章 イントロダクション

- 章の概要

- 医薬品の包装と充填

- RTU一次包装

- 結論

第6章 滅菌済み/RTU容器:市場情勢

- 章の概要

- 滅菌済み/RTU容器:市場情勢

- 滅菌済み/RTU容器:メーカー一覧

第7章 滅菌済み/RTUクロージャー:市場情勢

- 章の概要

- 滅菌済み/RTUクロージャー:市場情勢

- 滅菌済み/RTUクロージャー:メーカーの状況

第8章 重要な洞察

- 章の概要

- 滅菌済み/RTU容器:重要な洞察

- 滅菌済み/RTUクロージャー:重要な洞察

第9章 製品競争力分析:滅菌済み/RTU容器

- 章の概要

- 滅菌済み/RTU容器:製品競争力分析

第10章 製品競争力分析:滅菌済み/RTUキャップ

- 章の概要

- 滅菌済み/RTUクロージャー:製品競争力分析

第11章 企業プロファイル

- 章の概要

- APG Pharma Packaging

- Aptar

- Daikyo Seiko

- Datwyler

- DWK Life Sciences

- Ningbo Zhengli Pharmaceutical Packaging

- SCHOTT

- Stevanato

- West Pharmaceutical Services

第12章 パートナーシップとコラボレーション

- 章の概要

- パートナーシップモデル

- 滅菌済み/RTU医薬品包装:パートナーシップとコラボレーション

第13章 市場参入意思決定の枠組み

第14章 需要分析

- 章の概要

- 範囲と調査手法

- 滅菌済み/RTU医薬品包装の世界需要:容器タイプ別

- 滅菌済み/RTU医薬品包装の世界需要:クロージャータイプ別

- 滅菌済み/RTU医薬品包装の世界需要:製造材料別

- 滅菌済み/RTU医薬品包装の世界需要:主要地域別

第15章 市場影響分析:促進要因、抑制要因、機会、課題

第16章 世界の滅菌済み/RTU医薬品包装市場

第17章 滅菌済み/RTU医薬品包装市場(容器タイプ別)

第18章 滅菌済み/RTU医薬品包装市場(クロージャータイプ別)

第19章 滅菌済み/RTU医薬品包装市場(製造材料別)

第20章 滅菌済み/RTU医薬品包装市場(主要地域別)

第21章 医薬品包装の新たな動向

- 章の概要

- 新たな動向

- 結論

第22章 ケーススタディ:医薬品包装におけるロボット工学

- 章の概要

- 製薬業界におけるロボットの役割

- 製薬業界向けロボットを提供する企業

- 医薬品包装における機器統合型ロボットシステムを提供する企業

- Aseptic Technologies

- AST

- Bosch Packaging Technology

- Dara Pharma

- Fedegari

- IMA

- Steriline

- Vanrx Pharmasystems

- 結論