|

市場調査レポート

商品コード

1821508

生物製剤受託製造市場:2035年までの業界動向と世界の予測 - 提供するサービスタイプ別、製造する生物製剤別、使用する発現システム別、事業規模別、企業規模別、主要地域別Biologics Contract Manufacturing Market: Industry Trends and Global Forecasts, Till 2035 - Distribution by Type of Service(s) Offered, Biologic Manufactured, Expression System Used, Scale of Operation, Company Size, and Key Geographical Regions |

||||||

カスタマイズ可能

|

|||||||

| 生物製剤受託製造市場:2035年までの業界動向と世界の予測 - 提供するサービスタイプ別、製造する生物製剤別、使用する発現システム別、事業規模別、企業規模別、主要地域別 |

|

出版日: 2025年09月24日

発行: Roots Analysis

ページ情報: 英文 799 Pages

納期: 即日から翌営業日

|

概要

生物製剤受託製造市場:概要

世界の生物製剤受託製造の市場規模は、2035年までの予測期間中に8.8%のCAGRで拡大し、現在の238億米ドルから2035年までに550億米ドルに成長すると予測されています。

市場セグメンテーションでは、市場規模および機会分析を以下のパラメータで区分しています。

提供するサービスタイプ別

- API製造

- FDF製造

製造する生物製剤別

- 抗体

- 細胞治療薬

- ワクチン

- その他

使用する発現システム別

- 哺乳類

- 微生物

- その他

事業規模別

- 前臨床/臨床

- 商業

企業規模別

- 小規模

- 中規模

- 大手および超大手

地域別

- 北米

- 欧州

- アジア太平洋

- 中東・北アフリカ

- ラテンアメリカ

生物製剤受託製造市場成長と動向

生物製剤の受託製造分野は、特異性、有効性、安全性など、生物製剤が提供するいくつかの利点により、近年著しい成長を遂げています。生物製剤業界は、低分子医薬品からモノクローナル抗体、ワクチン、細胞・遺伝子治療、バイオシミラーなどの複雑な生物学的製剤へのシフトを目の当たりにしてきたことは特筆に値します。実際、USFDAは2024年に50以上の生物学的製剤(モノクローナル抗体や組み換えタンパク質を含む)を承認しています。このような新しい治療法のパイプラインの増加と生物学的製剤の承認数の増加が相まって、外部製造能力の需要が高まっています。

生物製剤の成功にもかかわらず、生物製剤の製造は技術的に困難であり、長い開発期間、規制やコンプライアンスに関連する問題、最終製品の品質属性に関連する不整合など、専門施設、設備、専門知識への多額の資本投資が必要です。その結果、生物製剤開発企業の多くが、バイオプロセス開発と最適化を含む包括的なソリューションを求めて、受託製造業者に頼るようになっています。この分野でアウトソーシングが実用的で有利なビジネスモデルとして認知されつつあることから、生物製剤受託製造市場は予測期間を通じて大幅な成長が見込まれます。

生物製剤受託製造市場主な洞察

当レポートでは、生物製剤受託製造市場の現状を掘り下げ、業界内の潜在的な成長機会を特定しています。主な調査結果は以下の通りです。

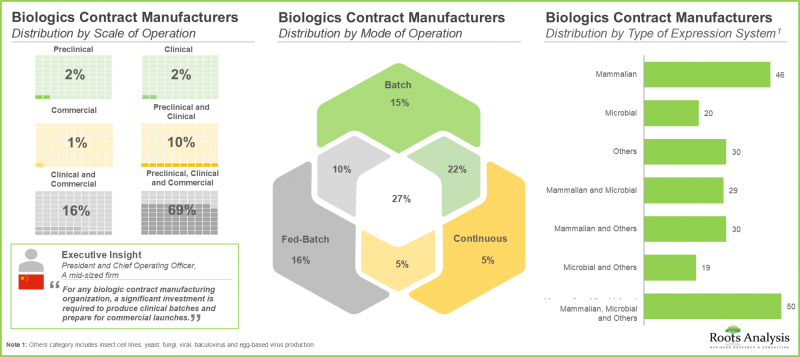

- 現在、305以上の受託製造機関(CMO)が生物製剤の製造に従事しており、その90%以上がFDF製造サービスを提供しています。

- 利害関係者の約70%は、顧客の多様なニーズに応えるため、あらゆる規模の事業を展開しています。特に、哺乳類細胞ベースの発現システムは、CMOの間で人気の選択肢として浮上しています。

- ニッチな新薬クラス別を標榜するサービス・プロバイダー間の競争は熾烈で、その主な要因は、過去にいくつかのブロックバスター治療が成功したことです。

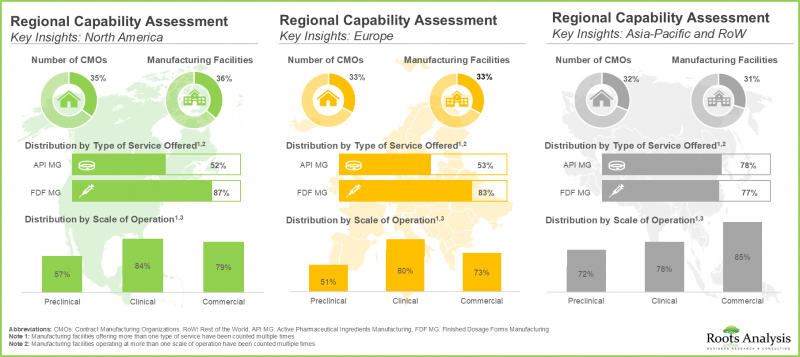

- 過去10年間、生物製剤受託製造業界では、アジア太平洋の発展途上地域に製造施設を設置する企業が増え、動向に変化が見られました。

- 過去5年間で、生物製剤受託製造は695件以上の契約を結んでおり、そのほとんどがワクチン、抗体、細胞療法の製造のために結ばれています。

- 競争力を維持し、ワンストップ・ショップとしての地位を確立するため、参入企業は既存の能力とサービス・ポートフォリオを拡大しています。

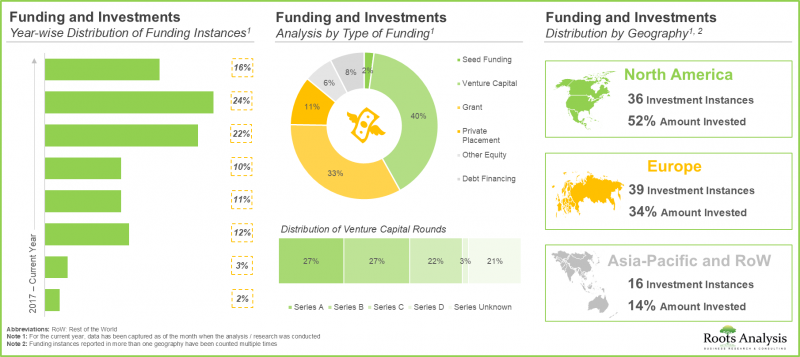

- 生物製剤の受託製造に関連する巨大な機会を考慮し、投資家は過去8年間に90件以上の資金調達で75億米ドルの資金を積極的に提供してきました。

- 需要の高まりに後押しされ、CMOは、主にニッチな生物製剤を対象に、既存の能力や能力を拡大するために入念な投資を行ってきました。この動向は、米国と中国で最も顕著です。

- この傾向は米国と中国で最も顕著です。大手製薬企業別実施されたイニシアチブは215件以上あり、その80%以上は提携と拡張に重点を置いたものでした。

- 既存の設備能力は現在の生物製剤の年間需要を満たすのに十分であるが、CMOは長期的な需要を満たすために、設備能力の増強に投資する可能性が高いと予想されます。

- 世界の生物製剤製造受託能力は様々な地域に分散しており、特に大手企業が全体の80%を占めています。

- 生物製剤のパイプラインの増加とアウトソーシング志向の高まりにより、生物製剤受託製造サービス市場は今後も安定した成長が見込まれます。

- より多くの開発企業がそれぞれの製造業務の様々な側面をアウトソーシングするにつれて、生物製剤受託製造市場は今後10年間に年率8.8%で成長すると予想されます。

生物製剤受託製造市場主要セグメント

提供するサービスタイプ別では、市場はAPIとFDFに区分されます。現在の生物製剤受託製造市場の大半がAPIによって占められていることは注目に値します。これは、生物製剤原薬の製造には多額の設備投資が必要であり、設備費用(開発とメンテナンス)、材料費、人件費、その他多くの付帯費用が含まれるという事実に起因しています。そのため、利害関係者はAPI製造においてCMOの専門知識に依存しています。

製造される生物製剤タイプ別では、市場は抗体、細胞療法、ワクチン、その他の生物製剤に区分されます。生物製剤受託製造市場において、抗体が最大のシェアを占めていることは注目に値します。これは、世界中で100を超える抗体が承認され、抗体関連の臨床試験が増加していることに起因しています。

使用する発現システム別では、市場は哺乳類、微生物、その他に区分されます。現在のところ、市場は哺乳類発現系を採用した生物製剤プロジェクトから得られる収益によって牽引される可能性が高いことは注目に値します。これは、高いタンパク質収量能力、強化されたフォールディングと翻訳後修飾、改善されたバッチ間均一性により、このようなシステムの使用率が高いことに起因しています。

事業規模別では、市場は前臨床/臨床スケールと商業スケールに区分されます。商業規模の製造セグメントが市場全体の主要な牽引役になると予測されます。さらに、前臨床/臨床スケールの生物製剤製造市場は、相対的に高いCAGRで成長する可能性が高いことは注目に値します。

企業規模別では、市場は小規模企業、中規模企業、大企業および超大企業に区分されます。大企業および超大企業が相対的に高い市場シェアを占めているが、小規模企業向けの生物製剤受託製造市場が今後数年間で大幅な市場成長を遂げる可能性が高いことは注目に値します。

主要地域別に見ると、市場は北米、欧州、アジア太平洋、中東・北アフリカ、ラテンアメリカに区分されます。特筆すべきは、アジア太平洋の市場が今後数年間、より高いCAGRで成長すると予想されることです。

生物製剤受託製造市場の参入企業例

- AGC Biologics

- Boehringer Ingelheim

- Catalent

- Cell Therapies

- Charles River Laboratories

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Kemwell Biopharma

- Lonza

- Miltenyi Biotec

- Minaris Regenerative Medicine

- Samsung Biologics

- Sandoz

- Vetter Pharma

- Wuxi Biologics

1次調査の概要

- 本調査で提示した意見や洞察は、複数の利害関係者とのディスカッション別影響を受けたものです。本調査報告書では、以下の業界利害関係者とのインタビューの詳細な記録を掲載している:

- A社最高経営責任者

- B社最高経営責任者兼共同創業者

- C社細胞・遺伝子治療部門最高技術責任者

- D社社長

- E社グローバル戦略マーケティング担当シニア・ディレクター

- F社商業戦略・市場洞察担当シニアディレクター

- G社セールス&マーケティング・グローバルヘッド兼市場開拓(ドイツ)ヘッド

- H社ビジネス開発マネージャー

- I社マーケティング&セールスマネージャー

生物製剤の受託製造市場調査対象

- 市場規模と機会分析:当レポートでは、世界の生物製剤受託製造市場を、[A]提供するサービスタイプ別、[B]製造する生物製剤別、[C]使用する発現システム別、[D]事業規模別、[E]企業規模別、[F]主要地域別の主要市場セグメントごとに徹底分析しています。

- 市場情勢:[A]設立年、[B]企業規模、[C]本社所在地、[D]提供するサービスの種類、[E]製造する生物製剤の種類、[F]事業規模、[G]使用する発現システムの種類、[H]使用するバイオリアクターの種類、[I]バイオリアクターの運転モードなど、いくつかの関連パラメータに基づき、生物製剤受託製造市場に関わる企業を詳細に評価します。

- 地域能力分析:[A]北米、[B]欧州、[C]アジア太平洋、[D]その他アジア太平洋など、主要な地域にわたって設立された生物製剤製造施設の包括的分析。

- 企業プロファイル:[A]企業概要、[B]財務情報(入手可能な場合)、[C]サービス・ポートフォリオ、[D]製造施設、[E]最近の動向と将来展望などのパラメータに焦点を当てた、生物製剤受託製造市場に従事する北米、欧州、アジア太平洋の主要サービス・プロバイダーの詳細な企業プロファイル。

- ケーススタディ- ニッチ製薬セクター:[A]抗体薬物複合体(ADC)、[B]二重特異性抗体、[C]細胞治療、[D]遺伝子治療、[E]ウイルスベクターなどの特定のニッチ製品に焦点を当て、この業界における主要なイネーブラーを包括的に評価します。

- ケーススタディ- 自社製造:生物製剤開発者が、それぞれの製品を自社で製造するか、生物製剤CMOのサービスを利用するかを決定する際に考慮する必要がある様々な要因の詳細なレビュー。

- 製造と購入のフレームワーク主要製薬企業が実施した生物製剤に特化した様々な製造イニシアチブに関する詳細な調査で、[A]イニシアチブの数、[B]イニシアチブの年、[C]イニシアチブの目的、[D]イニシアチブのタイプ、[E]事業規模、[F]製造する生物学的製剤のタイプなど、様々なパラメータにおける動向を明らかにします。

- パートナーシップとコラボレーション:[A]提携年、[B]提携のタイプ、[C]製造する生物製剤のタイプ、[D]治療領域、[E]最も活発な参入企業、[F]この業界で行われた提携活動の地域分布など、いくつかの関連パラメータに基づいて、生物製剤受託製造市場における最近の提携を詳細に分析。

- M&A:[A]合意年、[B]取引のタイプ、[C]企業の地域分析、[D]買収のタイプ、[E]製造された生物学的製剤のタイプ、[F]主要な価値ドライバーなど、いくつかの関連パラメーターに基づいて、この業界で行われた様々なM&Aを詳細に分析。

- 最近の事業拡大:[A]拡張年、[B]拡張の目的、[C]製造する生物製剤のタイプ、[D]拡張施設の所在地など、いくつかの関連パラメータに関する情報とともに、期間中に生物製剤受託製造が実施した拡張イニシアチブの詳細分析。

- 最近の動向:生物製剤の受託製造市場における最近の動向を分析し、[A]行われた資金投資に関する情報、[B]生物製剤製造に関連する技術の進歩に関する情報を強調します。

- 生産能力の分析:[A]メーカーの規模、[B]使用される発現システムのタイプ、[C]地域に基づいて、利用可能な能力の分布に焦点を当て、生物製剤の製造のための全体的な設置能力の推定。

- 需要分析:[A]対象患者集団、[B]投与頻度、[C]投与強度などの様々な関連パラメータに基づく、生物製剤の年間需要の情報に基づく推定。

- 総所有コスト(Total Cost of Ownership):生物製剤受託製造の総所有コストの詳細分析。

- SWOT分析:精緻なSWOT分析のもと、業界の進化に影響を与えるであろう関連動向、主要な促進要因、課題について考察。

- ケーススタディ- バーチャル製薬会社生物製剤業界全体における仮想ビジネスモデルのコンセプトとその役割に関するケーススタディ。

目次

第1章 序文

第1章 生物製剤受託製造市場概要

第2章 調査手法

第3章 経済的およびその他のプロジェクト特有の考慮事項

第4章 エグゼクティブサマリー

第5章 イントロダクション

- 章の概要

- 生物製剤の概要

- 生物製剤のための発現システム

- 生物製剤の製造プロセス

- 契約製造の概要

- 生物製剤製造業務のアウトソーシングの必要性

- 契約製造パートナーを選択する際に考慮すべき重要な点

- 将来の展望

第6章 市場情勢

- 章の概要

- 生物製剤受託製造業者:市場情勢

第7章 地域能力分析

- 章の概要

- 主要な前提とパラメータ

- 生物製剤受託製造施設の概要

- 地域別能力分析:北米の生物製剤受託製造施設

- 地域別能力分析:欧州の生物製剤受託製造施設

- 地域別能力分析:アジア太平洋の生物製剤受託製造施設

- 地域別能力分析:その他の地域における生物製剤受託製造施設

第8章 北米における生物製剤の受託製造

- 章の概要

- 米国における生物製剤の契約製造:規制のシナリオ

- 北米の大手生物製剤CMO

- AGC Biologics

- Catalent

- FUJIFILM Diosynth Biotechnologies

- KBI Biopharma

- Charles River Laboratories

- 北米のその他の主要生物製剤CMO

- Cytiva

- Patheon

- Piramal Pharma Solutions

第9章 欧州における生物製剤の受託製造

- 章の概要

- 欧州における生物製剤の契約製造:規制のシナリオ

- EMAのcGMP規制

- 欧州の主要生物製剤CMO

- Boehringer Ingelheim (BioXcellence)

- Lonza

- Sandoz

- Vetter Pharma

- Miltenyi Biotec

- 欧州のその他の主要生物製剤CMO

- Novasep

- Olon

- Rentschler Biopharma

第10章 アジア太平洋および世界のその他の地域の生物製剤の受託製造

- 章の概要

- 中国における生物製剤の受託製造

- 中国における生物製剤の受託製造:規制のシナリオ

- 中国の主要な生物製剤CMO

- WuXi Biologics

- インドにおける生物製剤の契約製造

- インドにおける生物製剤の契約製造:規制のシナリオ

- インドの主要な生物製剤CMO

- Kemwell Biopharma

- 日本における生物製剤の受託製造

- 日本における生物製剤受託製造:規制のシナリオ

- 日本の主要な生物製剤CMO

- Minaris Regenerative Medicine

- 韓国における生物製剤の受託製造

- 韓国における生物製剤の受託製造:規制のシナリオ

- 韓国の主要な生物製剤CMO

- Samsung Biologics

- オーストラリアにおける生物製剤の契約製造

- オーストラリアにおける生物製剤の契約製造:規制のシナリオ

- オーストラリアの大手生物製剤CMO

- 細胞治療

- アジア太平洋およびその他の地域の主要生物製剤CMO

- AcuraBio(旧称:Luina Bio)

- Celltrion

- Takara Bio

第11章 ニッチな生物製剤セクター

- 章の概要

- 二重特異性抗体

- 抗体薬物複合体(ADC)

- 細胞治療

- 遺伝子治療

- ウイルスベクター

- プラスミドDNA

第12章 ケーススタディ:バイオシミラーのアウトソーシング

- 章の概要

- バイオシミラーの概要

- バイオシミラーの開発段階

- バイオシミラーのライセンシングに関する規制要件

- 製造業務のアウトソーシングの必要性

- バイオシミラーが世界の契約製造市場に与える影響

- バイオシミラー契約製造サービスプロバイダー

- バイオシミラー製造業務のアウトソーシングに伴う課題

第13章 ケーススタディ:低分子薬と高分子薬/治療法の比較

- 章の概要

- 低分子および高分子医薬品/治療法