|

|

市場調査レポート

商品コード

1660089

自動車用DMS/OMS(ドライバー/乗員モニタリングシステム)(2024年~2025年)Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report,2024-2025 |

||||||

|

|||||||

| 自動車用DMS/OMS(ドライバー/乗員モニタリングシステム)(2024年~2025年) |

|

出版日: 2025年02月08日

発行: ResearchInChina

ページ情報: 英文 296 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 目次

1. 車内モニタリングシステムの搭載率は16.3%、搭載数は328万8,000台に達する

2024年1月~11月、中国の乗用車市場の総売上は2,012万5,000台でした。このうち、DMS/OMSを標準搭載したのは328万8,000台で、前年同期比39.4%増、搭載率は16.3%で、前年同期比3.6ポイント増となりました。

2024年1月~11月、中国の乗用車市場におけるDMS標準搭載数は318万台、搭載率は15.8%、前年同期比82.7%増となっています。

2024年1月~11月、中国の乗用車市場におけるOMS標準搭載数は減少し、75万5,000台、前年同期比18.1%減、搭載率は3.7%にとどまっています。

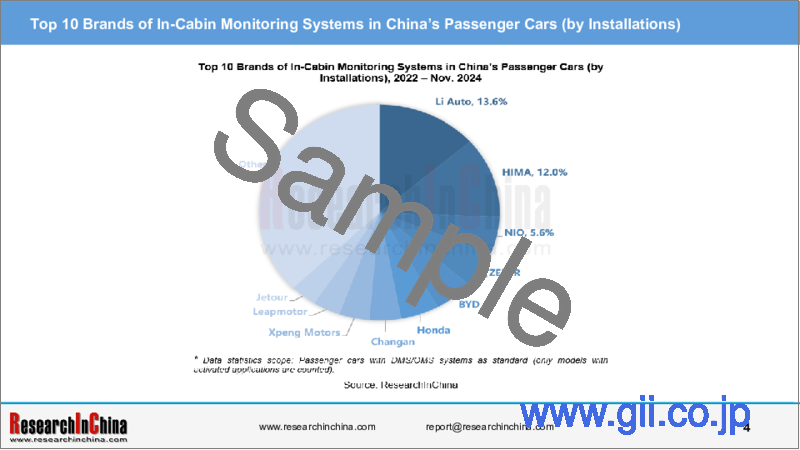

ブランド分布では、2024年1月~11月の車内モニタリングシステム搭載数で上位のブランドは、Li Auto、Harmony lntelligent Mobility Alliance(HIMA)、NIO、Zeekr、BYDなどで、上位10ブランドが総搭載数の62.7%を占めました。

2. ドライバーモニタリングが業界の変曲点に到達:DMSのプリインストール標準化と車載アルコール検出が安全運転に革命をもたらす

1. 規制と政策がDMSの標準搭載を後押し、市場規模は2027年までに70億元に達する

車内モニタリングの中核機能として、DMSはドライバーの疲労、注意散漫、危険な運転行動をリアルタイムでモニタリングし、タイムリーな警告を提供することで、交通事故率を効果的に低減することができます。

EUのGSR II規制では、2024年7月以降、新しい乗用車にはADDW(Advanced Driver Distraction Warning)システムを、すべての新車にはDDAW(Driver Drowsiness and Attention Warning)システムを搭載しなければならないと明記されています。2026年7月までに、すべての新しい乗用車にADDWシステムを搭載しなければなりません。中国では、2024年7月から適用されるC-NCAP管理規則の最新版で、DMSが初めてアクティブセーフティの評価枠組みに含まれ、2ポイントのスコアが割り当てられました。

国内外の政策規制が強化され、乗用車のインテリジェント開発が継続的に進む中、DMS市場は持続的かつ安定的な成長を見せ、新車の標準装備になる可能性があると予測されます。楽観的な見方をすれば、2027年までに中国乗用車市場におけるDMSの搭載数は947万3,000台に達し、カメラ式DMSの市場規模は71億1,000万元に達すると予測されます。

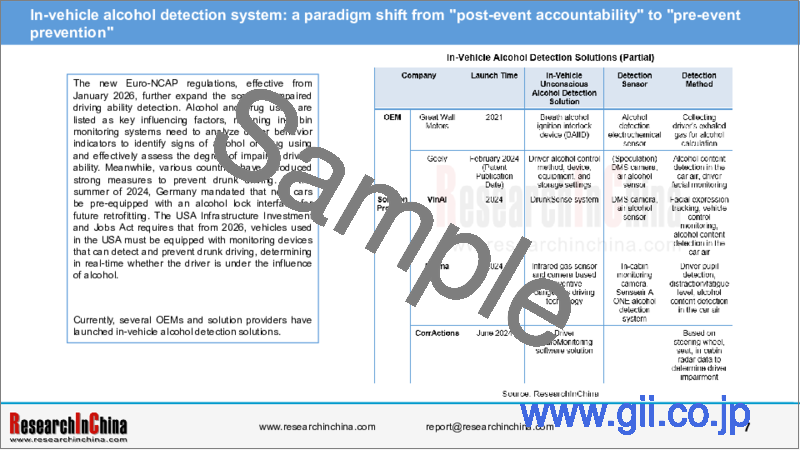

2. 車載アルコール検知システム:「事後の説明責任」から「事前の予防」へのパラダイムシフト

2026年1月から適用される新しいEuro-NCAP規制は、運転能力低下検知の範囲をさらに拡大します。アルコールと薬物の使用が重要な影響要因として挙げられており、車内モニタリングシステムはドライバーの行動指標を分析してアルコールや薬物使用の兆候を特定し、運転能力低下の程度を効果的に評価する必要があります。一方、各国は飲酒運転防止に向けた強力な対策を搭載しています。2024年夏、ドイツは新車に将来的な後付けのためにアルコールロックインターフェースをあらかじめ搭載することを義務付けました。米国のインフラ投資雇用法は、2026年から米国で使用される自動車に、ドライバーがアルコールの影響下にあるかどうかをリアルタイムで判断し、飲酒運転を検知・防止できるモニタリングデバイスを搭載することを義務付けています。

現在、複数のOEMやソリューションプロバイダーが車載アルコール検知ソリューションを発表しています。

当レポートでは、中国の自動車産業について調査し、車内モニタリングのサプライチェーンの詳細な分析や、主流技術の詳細なレビュー、国内外のサプライヤーの車内モニタリングシステムレイアウトの比較、将来の開発動向の評価などを提供しています。

目次

第1章 車内モニタリングシステムの概要

- 車内モニタリングの開発史

- 車内モニタリングシステムのイントロダクション

- 車内モニタリングのビジネスモデル

- 車内モニタリングの産業チェーン分析

- 車内モニタリングの政策環境

- 車内モニタリングシステムサプライヤーの資金調達状況

- 車内モニタリングシステム特許の概要

第2章 車内モニタリングシステムの搭載数と市場規模

- 車内モニタリングシステムの搭載数と搭載率

- DMS(ドライバーモニタリングシステム)の市場情勢

- OMS(乗員モニタリングシステム)の市場情勢

- 車内モニタリングシステムの市場規模

第3章 車内モニタリングシステムを支える技術と応用事例

- サポート技術1:視覚認識(カメラシステム)

- サポート技術2:レーダーセンサー

- サポート技術3:車載無意識アルコール検知センサー

- サポート技術4:車載CO2検知器

- 車内モニタリングシステムを支えるその他の技術

第4章 OEMの車内モニタリングシステムの応用事例

- 代表的なモデルにおける車内モニタリングシステムの用途のサマリー

- 老舗ブランドのモデルケース

- 新興ブランドのモデルケース

- 国外/合弁ブランドのモデルケース

第5章 中国の車内モニタリングシステムサプライヤー

- 中国の車内モニタリングシステムサプライヤーのソリューションのサマリー

- Jingwei HiRain

- Baolong Automotive

- MINIEYE

- OFILM

- Hikvision

- WHST

- Longhorn Auto

- SenseTime

- ArcSoft

- OmniVision

- Entron Technology

- oToBrite Electronics

第6章 国際的な車内モニタリングシステムサプライヤー

- 国際的な車内モニタリングシステムサプライヤーのソリューションのサマリー

- Continental

- Magna

- Cipia Vision

- Valeo

- Emotion3D

- Smart Eye

- LG Electronics

- Melexis

- ams OSRAM

第7章 車内モニタリングシステムの動向

- 動向1

- 動向2

- 動向3(1)

- 動向3(2)

- 動向4:UWB/レーダーなどの直接検知技術が主流のCPDソリューションになる

- 動向5

- 動向6

In-cabin monitoring research: unconscious alcohol detection expands DMS functions, UWB and other direct sensing technologies enter mass production

ResearchInChina released "Automotive DMS/OMS (Driver/Occupant Monitoring System) Research Report,2024-2025", which focuses on in-cabin monitoring systems such as DMS (Driver Monitoring System) and OMS (Occupant Monitoring System), providing an in-depth analysis of in-cabin monitoring supply chain, detailed review of mainstream in-cabin monitoring technologies, breakdown of key vehicle application solutions, comparison of in-cabin monitoring layouts between Chinese and international suppliers, and the assessment of future development trends in in-cabin monitoring.

1. In-cabin monitoring system installation rate reaches 16.3%, with 3.288 million units installed

From January to November 2024, the total sales volume in China's passenger car market was 20.125 million units. Among these, 3.288 million units were equipped with DMS/OMS as standard, a year-on-year increase of 39.4%; the installation rate reached 16.3%, an increase of 3.6 percentage points compared to the same period last year.

From January to November 2024, the installation volume of DMSs as standard in China's passenger car market reached 3.18 million units, with an installation rate of 15.8%, a year-on-year increase of 82.7%.

From January to November 2024, the installation volume of OMS systems as standard in China's passenger car market showed a decline, totaling 755,000 units, a year-on-year decrease of 18.1%; the installation rate was only 3.7%.

In terms of brand distribution, from January to November 2024, the top brands in terms of in-cabin monitoring system installation volume included Li Auto, Harmony lntelligent Mobility Alliance (HIMA), NIO, Zeekr, and BYD, with top 10 brands accounting for 62.7% of the total installation volume.

2. Driver monitoring reaches an industry inflection point: DMS pre-installation standardization & in-vehicle alcohol detection revolutionizes driving safety

1. Policies and regulations drive pre-installation of DMSs as standard, market size to reach 7 billion yuan by 2027

As a core function of in-cabin monitoring, DMS can monitor driver fatigue, distraction, and dangerous driving behaviors in real-time, providing timely warnings and effectively reducing traffic accident rates.

The EU GSR II regulation clearly states that from July 2024, new passenger car models must be equipped with the Advanced Driver Distraction Warning (ADDW) system, while all new cars must be equipped with the Driver Drowsiness and Attention Warning (DDAW) system. By July 2026, all new passenger cars must be equipped with the ADDW system. In China, the latest version of C-NCAP management rules, effective from July 2024, includes DMS in the active safety evaluation framework for the first time, assigning it a score of 2 points.

With the strengthening of domestic and international policy regulations and continuous advancement of intelligent development in passenger cars, the DMS market is expected to show sustained and stable growth, potentially becoming a standard feature in new vehicles. Optimistically, by 2027, the installation volume of DMS in China's passenger car market will reach 9.473 million units, and the market size of camera-based DMSs is expected to reach 7.11 billion yuan.

2. In-vehicle alcohol detection system: a paradigm shift from "post-event accountability" to "pre-event prevention"

The new Euro-NCAP regulations, effective from January 2026, further expand the scope of impaired driving ability detection. Alcohol and drug using are listed as key influencing factors, meaning in-cabin monitoring systems need to analyze driver behavior indicators to identify signs of alcohol or drug using and effectively assess the degree of impaired driving ability. Meanwhile, various countries have introduced strong measures to prevent drunk driving. In the summer of 2024, Germany mandated that new cars be pre-equipped with an alcohol lock interface for future retrofitting. The USA Infrastructure Investment and Jobs Act requires that from 2026, vehicles used in the USA must be equipped with monitoring devices that can detect and prevent drunk driving, determining in real-time whether the driver is under the influence of alcohol.

Currently, several OEMs and solution providers have launched in-vehicle alcohol detection solutions.

3. Child Presence Detection (CPD) technology leap: UWB/ radar and other direct sensing technologies become mainstream solutions

In-car Child Presence Detection (CPD) consists of a detection system and a reminder system. The detection system can be divided into indirect sensing systems (based on logic, using information such as door opening, seat pressure, or capacitive sensing to infer the possibility of human or object presence in the vehicle. Indirect sensing does not distinguish between living beings and objects) and direct sensing systems (which detect the presence of a person in the vehicle by sensing heartbeat, breathing, movement, or other life signs. Technical solutions include cameras, radar, UWB radar, Wi-Fi, etc.).

With the upgrade of C-NCAP and E-NCAP safety assessment protocols, CPD functions without direct sensing systems will find it difficult to achieve high scores or will not score at all in new car assessments. The application of indirect sensing technology in CPD detection will gradually become marginalized.

Table of Contents

1 Overview of In-Cabin Monitoring Systems

- 1.1 Development History of In-Cabin Monitoring

- 1.2 Introduction to In-Cabin Monitoring Systems

- 1.3 Business Models of In-Cabin Monitoring

- 1.4 In-Cabin Monitoring Industry Chain Analysis

- 1.4.1 In-Cabin Monitoring Industry Chain Map

- 1.4.2 Cost Composition

- 1.4.3 Suppliers' Cost Reduction Solutions

- 1.4.4 Summary of Chip Suppliers

- 1.4.5 Summary of Algorithm Suppliers

- 1.4.6 Summary of Image Sensor Manufacturers

- 1.5 Policy Environment of In-Cabin Monitoring

- 1.5.1 Summary of In-Cabin Monitoring Regulations and Policies

- 1.5.2 International Policy Interpretation (1): E-NCAP Assessment Protocol

- 1.5.2 International Policy Interpretation (2): EU GSR II - EU General Safety Regulation

- 1.5.3 Chinese Policy Interpretation: "C-NCAP Management Rules (2024 Edition)"

- 1.6 Financing Status of In-Cabin Monitoring System Suppliers

- 1.7 Summary of In-Cabin Monitoring System Patents

- 1.7.1 Summary of In-Cabin Monitoring System Patents - OEMs' Patents

- 1.7.2 Summary of In-Cabin Monitoring System Patents - Suppliers'/Other Enterprises' Patents

- 1.7.3 Summary of In-Cabin Monitoring System Patents - University/Individual Patents

- 2: Installations and Market Size of In-Cabin Monitoring Systems

- 2.1 Installations and Installation Rate of In-Cabin Monitoring Systems

- 2.2 Market Status of DMS (Driver Monitoring System)

- 2.2.1 Installations and Installation Rate of DMS

- 2.2.2 Installations of DMS by Price

- 2.2.3 Installations Share of DMS by Price

- 2.2.4 Installations and Installation Rate of DMS by Brand

- 2.2.5 Installations and Installation Rate of DMS by Model

- 2.3 Market Status of OMS (Occupant Monitoring System)

- 2.3.1 Installations and Installation Rate of OMS

- 2.3.2 Installations of OMS by Price

- 2.3.3 Installations Share of OMS by Price

- 2.3.4 Installations and Installation Rate of OMS by Brand

- 2.3.5 Installations and Installation Rate of OMS by Model

- 2.4 Market Size of In-Cabin Monitoring Systems

- 2.4.1 Installation Rate of DMS, 2023-2027E

- 2.4.2 Installation Rate of OMS, 2023-2027E

- 2.4.3 Market Size of In-Cabin Monitoring Systems, 2023-2027E

3 Supporting Technologies and Application Cases of In-Cabin Monitoring Systems

- 3.1 Supporting Technology 1: Visual Perception (Camera System)

- 3.1.1 Case (1)

- 3.1.1 Case (2)

- 3.1.1 Case (3)

- 3.1.1 Case (4)

- 3.2 Supporting Technology 2: Radar Sensors

- 3.2.1 Radar Case (1)

- 3.2.1 Radar Case (2)

- 3.2.1 Radar Case (3)

- 3.2.1 Radar Case (4)

- 3.2.1 Radar Case (5)

- 3.2.2 UWB Radar Case (1)

- 3.2.2 UWB Radar Case (2)

- 3.3 Supporting Technology 3: In-Vehicle Unconscious Alcohol Detection Sensors

- 3.3.1 Case (1)

- 3.3.1 Case (2)

- 3.4 Supporting Technology 4: In-Vehicle CO2 Detectors

- 3.4.1 Case (1)

- 3.4.1 Case (2)

- 3.5 Other Supporting Technologies for In-Cabin Monitoring Systems

- 3.5.1 Case (1)

- 3.5.1 Case (2)

4 In-Cabin Monitoring System Application Cases of OEMs

- 4.1 Summary of In-Cabin Monitoring System Applications in Typical Models

- 4.2 Traditional Brand Model Cases

- 4.2.1 Yangwang U9

- 4.2.2 Geely Galaxy E8

- 4.2.3 Zeekr 7X

- 4.2.4 Changan UNI-Z

- 4.2.5 Changan Deepal G318

- 4.2.6 Avatr 07

- 4.2.7 Dongfeng eπ007

- 4.2.8 ARCFOX Alpha S5

- 4.2.9 Exeed STERRA ET

- 4.3 Emerging Brand Model Cases

- 4.3.1 Xiaomi SU7

- 4.3.2 Luxeed R7

- 4.3.3 Stelato S9

- 4.3.4 Li MEGA Ultra

- 4.3.5 Xpeng MONA M03

- 4.3.6 ONVO L60

- 4.3.7 Leapmotor C16

- 4.4 Foreign/Joint Venture Brand Model Cases

- 4.4.1 Volvo EX30

- 4.4.2 Lotus EMEYA

- 4.4.3 2024 Buick E5

- 4.4.4 2025 BMW i4

- 4.4.5 2025 Mercedes-Benz EQE

- 4.4.6 2025 Genesis GV70

5 Chinese In-Cabin Monitoring System Suppliers

- 5.1 Summary of Chinese In-Cabin Monitoring System Supplier Solutions

- 5.2 Jingwei HiRain

- 5.2.1 Profile

- 5.2.2 SCSS Supports Full-Cabin Personnel Visual Detection Function

- 5.2.3 DMS

- 5.2.4 DMS Integrated All-in-one Solution

- 5.2.5 UWB Technology Supports In-Cabin Living Body Detection

- 5.2.6 DMS/OMS Camera Products

- 5.3 Baolong Automotive

- 5.3.1 Profile

- 5.3.2 IMS

- 5.3.3 DMS

- 5.3.4 OMS

- 5.3.5 In-Cabin Radar Detection

- 5.3.6 FACE ID Product

- 5.3.7 In-Cabin FACE ID

- 5.3.8 In-Cabin Monitoring Products (1)

- 5.3.8 In-Cabin Monitoring Products (2)

- 5.3.8 In-Cabin Monitoring Products (3)

- 5.4 MINIEYE

- 5.4.1 Profile

- 5.4.2 I-CS (In-Cabin Sensing) Intelligent Cockpit Perception and Interaction Solution (1)

- 5.4.2 I-CS (In-Cabin Sensing) Intelligent Cockpit Perception and Interaction Solution (2)

- 5.4.3 Intelligent Cockpit Solution: Provides Proactive Services for Six Application Scenarios

- 5.4.4 Advantages of I-CS (In-Cabin Sensing) Intelligent Cockpit Perception and Interaction Solution

- 5.4.5 iCabin OMS

- 5.4.6 In-Cabin Monitoring Products

- 5.4.7 Intelligent Cockpit Cooperation Dynamics, 2023-2024

- 5.5 OFILM

- 5.5.1 Profile

- 5.5.2 Intelligent Vehicle Layout

- 5.5.3 Cabin Monitoring Perception Products

- 5.5.4 DMS+OMS Integrated Solution

- 5.6 Hikvision

- 5.6.1 Profile

- 5.6.2 HikAuto Vehicle Intelligent Monitoring System VIMS

- 5.6.3 HikAuto In-Cabin Monitoring Products (1)

- 5.6.3 HikAuto In-Cabin Monitoring Products (2)

- 5.6.3 HikAuto In-Cabin Monitoring Products (3)

- 5.7 WHST

- 5.7.1 Profile

- 5.7.2 New Generation DMS Integrated All-in-one Solution

- 5.7.3 In-Cabin Monitoring Products (1)

- 5.7.3 In-Cabin Monitoring Products (2)

- 5.7.3 In-Cabin Monitoring Products (3)

- 5.7.3 In-Cabin Monitoring Products (4)

- 5.7.3 In-Cabin Monitoring Products (5)

- 5.7.3 In-Cabin Monitoring Products (6)

- 5.8 Longhorn Auto

- 5.8.1 Profile

- 5.8.2 In-Cabin Monitoring System

- 5.8.3 Some In-Cabin Monitoring Project Designations, 2024

- 5.9 SenseTime

- 5.9.1 Profile

- 5.9.2 SenseAuto In-Cabin Monitoring Products

- 5.9.3 SenseAuto In-Cabin Monitoring System Application Cases

- 5.10 ArcSoft

- 5.10.1 Profile

- 5.10.2 VisDrive Software Solution Iteration Enhances In-Cabin Driver and Passenger Monitoring Capabilities, Introduces Health Monitoring System

- 5.10.3 Tahoe Integrated Hardware and Software Solution Focuses on DMS/OMS In-Cabin Functions

- 5.10.4 Intelligent Cockpit Visual Solution (DMS)

- 5.10.5 In-Cabin Monitoring Core Technologies (1)

- 5.10.5 In-Cabin Monitoring Core Technologies (2)

- 5.11 OmniVision

- 5.11.1 Profile

- 5.11.2 In-Cabin Monitoring Development History

- 5.11.3 In-Cabin Monitoring Solutions

- 5.11.4 In-Cabin Monitoring Products

- 5.12 Entron Technology

- 5.12.1 Profile

- 5.12.2 Electronic Rearview Mirror System Supports In-Cabin Monitoring Function

- 5.12.3 In-Cabin Monitoring Products (1)

- 5.12.3 In-Cabin Monitoring Products (2)

- 5.12.3 In-Cabin Monitoring Products (3)

- 5.13 oToBrite Electronics

- 5.13.1 Profile

- 5.13.2 In-Cabin Monitoring Solutions

6 International In-Cabin Monitoring System Suppliers

- 6.1 Summary of International In-Cabin Monitoring System Supplier Solutions

- 6.2 Continental

- 6.2.1 Profile

- 6.2.2 Driver Monitoring System

- 6.2.3 In-Cabin Driver and Passenger Monitoring System

- 6.2.4 In-Cabin Monitoring Solutions (1)

- 6.2.4 In-Cabin Monitoring Systems (2)

- 6.2.4 In-Cabin Monitoring Solutions (3)

- 6.3 Magna

- 6.3.1 Profile

- 6.3.2 Driver Monitoring System (1)

- 6.3.2 Driver Monitoring System (2)

- 6.3.3 Occupant Monitoring System

- 6.3.4 Integrated DMS and OMS Solution

- 6.3.5 Magna-Veoneer In-Cabin Monitoring Product Layout

- 6.3.6 Development Plan of DMS and OMS

- 6.4 Cipia Vision

- 6.4.1 Profile

- 6.4.2 Driver Monitoring System

- 6.4.3 In-Car Monitoring System

- 6.4.4 Fleet Solutions

- 6.4.5 Latest In-Cabin Monitoring System R&D Dynamics

- 6.4.6 In-Cabin Monitoring Cooperation Dynamics

- 6.5 Valeo

- 6.5.1 Profile

- 6.5.2 Driver Monitoring System

- 6.5.3 In-Cabin Occupant Monitoring System (1)

- 6.5.3 In-Cabin Occupant Monitoring System (2)

- 6.5.4 In-Cabin Monitoring System: Camera-Based

- 6.6 Emotion3D

- 6.6.1 Profile

- 6.6.2 CABIN EYE Software Stack Supported DMS Functions

- 6.6.3 CABIN EYE Software Stack Supported OMS Functions

- 6.6.4 CABIN EYE Software Stack Supported Autonomous Shuttle Occupant Monitoring Functions

- 6.6.5 Latest In-Cabin Monitoring System R&D Dynamics

- 6.7 Smart Eye

- 6.7.1 Profile

- 6.7.2 Smart Eye Driver Monitoring System (DMS)

- 6.7.3 In-Cabin Monitoring System (IMS)

- 6.7.4 Integrated Hardware and Software Driver Monitoring System AIS

- 6.7.5 Integrated Hardware and Software Driver Monitoring System AIS+

- 6.7.6 Eye-Tracking Technology and System Solutions

- 6.7.7 Launches AI Driving Assistant Sheila

- 6.7.8 Cooperation Dynamics

- 6.8 LG Electronics

- 6.8.1 Profile

- 6.8.2 In-Cabin Monitoring System Development History and Plan

- 6.8.3 VisionWare Visual Processing Software Platform Provides High-Precision In-Cabin Monitoring System

- 6.8.4 In-Cabin Monitoring Solutions (1)

- 6.8.4 In-Cabin Monitoring Solutions (2)

- 6.8.5 Latest In-Cabin Monitoring System R&D Dynamics

- 6.9 Melexis

- 6.9.1 Profile

- 6.9.2 In-Cabin ToF Sensor Iteration

- 6.9.3 In-Cabin DMS/OMS Sensor Chips

- 6.9.4 In-Cabin ToF Sensor Function

- 6.10 ams OSRAM

- 6.10.1 Profile

- 6.10.2 In-Cabin Sensing Application Overview

- 6.10.3 In-Cabin Sensing Application Products (1)

- 6.10.3 In-Cabin Sensing Application Products (2)

7 Trends in In-Cabin Monitoring Systems

- 7.1 Trend 1

- 7.2 Trend 2

- 7.3 Trend 3 (1)

- 7.3 Trend 3 (2)

- 7.4 Trend 4: UWB/ Radar and Other Direct Sensing Technologies Become Mainstream CPD Solutions

- 7.4.1 CPD Technology Case Summary (1)

- 7.4.1 CPD Technology Case Summary (2)

- 7.4.2 CPD Technology Case (1)

- 7.4.2 CPD Technology Case (2)

- 7.5 Trend 5

- 7.5.1 Case Summary

- 7.5.2 Case

- 7.6 Trend 6