|

市場調査レポート

商品コード

1337769

ADASと自動運転のティア1調査レポート(2023年) 海外企業編ADAS and Autonomous Driving Tier 1 Research Report, 2023 - Foreign Companies |

||||||

|

|||||||

| ADASと自動運転のティア1調査レポート(2023年) 海外企業編 |

|

出版日: 2023年07月05日

発行: ResearchInChina

ページ情報: 英文 230 Pages

納期: 即日から翌営業日

|

- 全表示

- 概要

- 目次

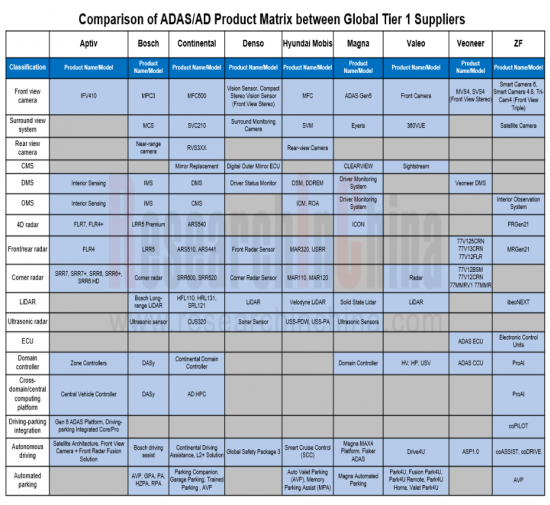

世界のADASと自動運転のティア1サプライヤーは完全なADAS/AD製品マトリクスを誇り、中国市場をつかむために継続的な努力を行っています。

ボッシュは、CMS以外のADAS/AD製品をフルラインナップしています。最新の製品としては、CES 2023で実物を展示した1550nmの長距離LiDARがあり、検出範囲は200m以上、消費電力は20W未満です。車内モニタリングシステム(IMS、OMS)は、OMSカメラをセンターコンソールのスクリーン上部に設置するか、車内ルームミラーと一体化した構成で、2024年に量産が開始される見込みです。

しかし、ソリューションの面では、現在、世界なティア1サプライヤーは、中国で注目されている運転駐車統合ソリューションをほとんど展開していません。その一例が、コンチネンタルのアンバレラCV3ベースのL2+ソリューションで、2021年1月に発表されましたが、生産が可能になるのは2026年です。

現在の受動的な立場に対処するため、世界のTier1サプライヤーも変化を模索しようとしています。例えば、ボッシュの運転駐車統合ソリューションであるWave3は、中国のXC部門とドイツの本社が同時に開発しており、そのうち中国のソリューションはデュアルOrin SoCを採用し、早ければ2023年に量産を開始する予定です。2023年6月、ZFは、意思決定時の部門間の内部摩擦を減らし、製品やソリューションの市場投入までの時間を短縮するため、乗用車シャシー技術とアクティブセーフティ技術の部門統合を発表しました。将来的には、アクティブセーフティがコックピットやシャシーなどすべての車両事業を統合した企業アーキテクチャを構築する可能性もあります。

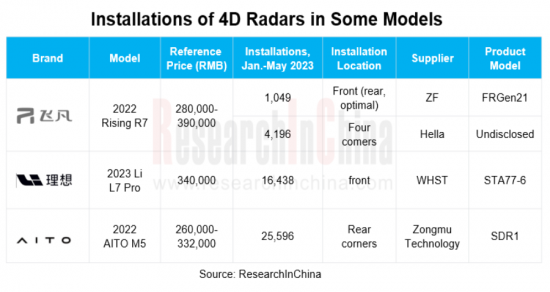

2023年1月から5月までに、中国の新車乗用車に搭載された4Dレーダーは全体で6万5,500台で、そのうちフロントビューおよびリアビューレーダーは3万5,700台、コーナーレーダーは2万9,800台だっています。4Dレーダーの搭載が確認されたモデルは、ライジングオートR7、リーオートL7プロ、AITO M5などです。

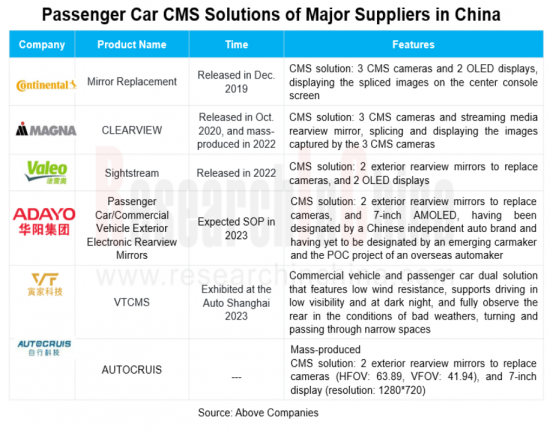

技術的な観点から見ると、現在世界のティア1サプライヤーが採用しているCMSソリューションの主流は、2台のCMSカメラ+2台のOLEDディスプレイ、つまり左右のバックミラーを2台のバックミラーCMSカメラ(一般に広角カメラ)に置き換えるものです。3台のCMSカメラ+2台のOLEDディスプレイ+ストリーミングバックカメラ/センターコンソール・スクリーンという別のソリューションは、画像のステッチング/補正などの追加技術を伴うため、比較的少数の企業が採用しています。典型的なケースはMagna CLEARVIEWで、3台のCMSカメラ+ストリーミング・メディア・バックミラー・タイル型ディスプレイのソリューションを採用しています。注目すべきことに、Magnaは2017年に2台のCMSカメラ+2台のOLEDディスプレイのソリューションも提案したが、Magnaが実際に量産している製品は依然として現行の3CMSソリューションです。

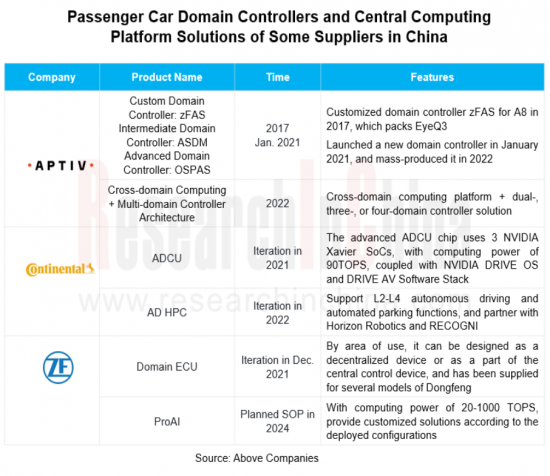

自動車アーキテクチャのアップグレードに伴い、車内電子機器の主制御ユニットも数百のECUから数個のドメインコントローラーへと進化しています。次のクロスドメインコンピューティングプラットフォーム(例:コックピット-パーキング統合ドメインコントローラー、運転駐車統合ドメインコントローラー)は、自動車のコンピューティングニーズを満たすために使用されます。将来的には、中央コンピューティングプラットフォームがすべてのコンピューティングタスクを完了し、集中E/Eアーキテクチャを可能にするために使用されます。

現段階では、いくつかの世界なティア1サプライヤーが、2022年にマルチドメイン/セントラルコンピューティングプラットフォームソリューションをリリース/発表しています。これらはドメインコントローラー製品に代わる次世代ソリューションです。

当レポートでは、世界のADASと自動運転のティア1について調査し、市場の概要とともに、世界の規制、各社の製品およびソリューションの開発動向、および主要サプライヤーのプロファイルなどを提供しています。

目次

第1章 道路における自動運転の適用に関する世界の規制と開発計画

- 道路上での自動運転の適用に関する世界の規制

- 道路上での自動運転の適用に関する欧州連合および欧州の規制

- 道路上での自動運転の適用に関する米国の規制

- 道路上での自動運転の適用に関する日本の規制

- 道路上での自動運転の適用に関する韓国の規制

第2章 世界のティア 1サプライヤーの製品およびソリューションの開発動向

- 新製品のSOP:4D Radarsの量産開始

- 規制の調整:中国は車両におけるCMSの使用を許可

- 製品アップグレード:ドメインコントローラーからセントラルコンピューティングプラットフォームへ

- ソリューション アップグレード:自動運転駐車から運転駐車統合へ

- 研究開発の方向性:製品マトリクスの改善と製品統合

第3章 主要な海外の自動運転ティア1サプライヤー

- Aptiv

- Bosch

- Continental

- Denso

- Hyundai Mobis

- Magna

- Valeo

- Veoneer

- ZF

Research on foreign ADAS Tier 1 suppliers: 4D radar starts volume production, and CMS becomes a new battlefield.

1. Global Tier 1 suppliers boast complete ADAS/AD product matrix, and make continuous efforts to grab the Chinese market.

From the ADAS/AD product matrix, it can be seen that some Tier 1 leaders have almost complete product matrix.

For example, Continental's latest products include: cockpit monitoring system (CMS, OMS), configured with an OMS camera and a cockpit radar and expected to be released in 2024; HRL131, a 1550nm long-range LiDAR with a detection range of more than 300m, 128° HFOV, 28° VFOV, expected to be mass-produced in 2024; and CUS320, a ultrasonic radar with a detection range of 0.1m-6m, expected to be spawned in 2024.

Bosch has a full range of ADAS/AD products except CMS. Its latest products include: a 1550nm long-range LiDAR, physically displayed at the CES 2023, with a detection range of over 200m and power consumption of less than 20W; an in-cabin monitoring system (IMS, OMS), configured with an OMS camera installed above the center console screen or integrated with the interior rearview mirror, and expected to come into mass production in 2024.

Yet in terms of solutions, currently few global Tier 1 suppliers deploy driving-parking integrated solutions that are hot in China, mainly because it takes them a period of about 2 or 3 years to launch the solutions after they put forward. One example is Continental's Ambarella CV3-based L2+ solution which was announced in January 2021 but will not be production-ready until 2026.

To cope with the current passive position, global Tier 1 suppliers are also trying to seek changes. For example, Wave3, Bosch's driving-parking integrated solution, is being developed simultaneously by the XC Division in China and the headquarters in Germany, of which the Chinese solution adopts dual Orin SoCs and is scheduled to be mass-produced in 2023 at the earliest; in June 2023, ZF announced the merger of the divisions for passenger car chassis technology and active safety technology to reduce the internal friction between divisions when making decisions and shorten the time-to-market of products and solutions. In the future, ZF may build a corporate architecture where the active safety integrates all the vehicle businesses such as cockpit and chassis.

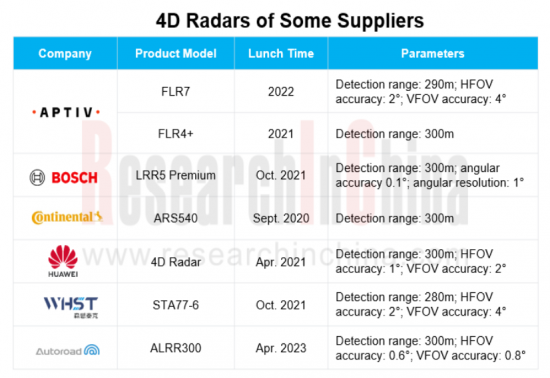

2. 4D radars begin to find mass adoption, and global Tier 1 suppliers grab first-mover advantages.

According to our data, from January to May 2023, the overall installations of 4D radars in new passenger cars in China were 65,500 units, of which 35,700 units were front view and rear view radars, and 29,800 units were corner radars. Models confirmed to pack 4D radars include Rising Auto R7, Li Auto L7 Pro and AITO M5.

4D radars have passed through three development phases: infancy, growth and SOP.

- Infancy: before 2022, foreign Tier 1 suppliers were the first to start upgrading from conventional 3D radar to 4D radar, for example, Continental went about developing ARS540 early in 2016.

- Growth: during 2022-2024, Chinese suppliers set about deploying 4D radar products. For example, in 2022 Nova Electronics introduced 4D-S front radar and corner radar products, as well as a new 6-cascade product; Freetech released FVR40 in 2022.

- SOP: beyond 2024, it is expected that 4D radars will begin to be spawned and mounted on vehicles.

Currently, 4D radars are still in the verification phase, and whether the installations will rise depends on the following:

- (1) Verify the cost performance of 4D radars (replacing ordinary radars) used in low-level driving assistance solutions (L2-L2+). Examples include Aptiv's satellite architecture-based sensing and computing system that supports L2 and L2+ with 5R5V12U.

- (2) Verify the feasibility of 4D radars replacing LiDAR in high-level intelligent driving solutions (L2.5-L2.9, that is, supporting ADAS in highway NOA and city NOA).

3. China's adjusted regulation allows CMS to be installed in vehicles, and the competition in the new market is fierce.

On July 1, 2023, the GB 15084-2022 Motor Vehicles - Devices for Indirect Vision - Requirements of Performance and Installation came into effect, specifying that Class M/N motor vehicles are allowed to carry electronic rearview mirrors to replace conventional optical exterior rearview mirrors.

At present, a number of global Tier 1 suppliers, Chinese suppliers and automakers have already made layout of CMS products. Wherein, the global Tier 1 suppliers that have unveiled/mass-produced CMS products include Continental, Magna and Valeo; Chinese suppliers include Autocruis, Voyager Technology, Foryou Group and Huawei.

On the whole, global Tier 1 suppliers start CMS layout a little earlier than Chinese companies, due to early introduction of regulations.

From a technical point of view, the mainstream CMS solution currently adopted by global Tier 1 suppliers is 2 CMS cameras + 2 OLED displays, that is, replace the left and right rearview mirrors with 2 rearview CMS cameras (generally wide-angle cameras). Another solution of 3 CMS cameras + 2 OLED displays + streaming rearview camera/center console screen is adopted by relatively few companies, as it involves additional technologies such as image stitching/correction. A typical case is Magna CLEARVIEW that adopts the solution of 3 CMS cameras + streaming media rearview mirror tiled display. Noticeably, Magna also proposed a solution of 2 CMS cameras + 2 OLED displays in 2017, but the product Magna actually produces in quantities is still the current 3CMS solution.

4. As decision products upgrade, a number of Tier 1 suppliers have launched cross-domain/central computing platforms.

As automotive architecture upgrades, the main control units of vehicle internal electronics have also evolved from hundreds of ECUs to several domain controllers. Next cross-domain computing platforms (e.g., cockpit-parking integrated domain controller and driving-parking integrated domain controller) will be used to meet the computing needs of vehicles. In the future, central computing platforms will be used to complete all the computing tasks and enable centralized E/E architecture.

In current stage, several global Tier 1 suppliers have released/iterated multi-domain/central computing platform solutions in 2022. In terms of time node, they are the next-generation alternative to domain controller products.

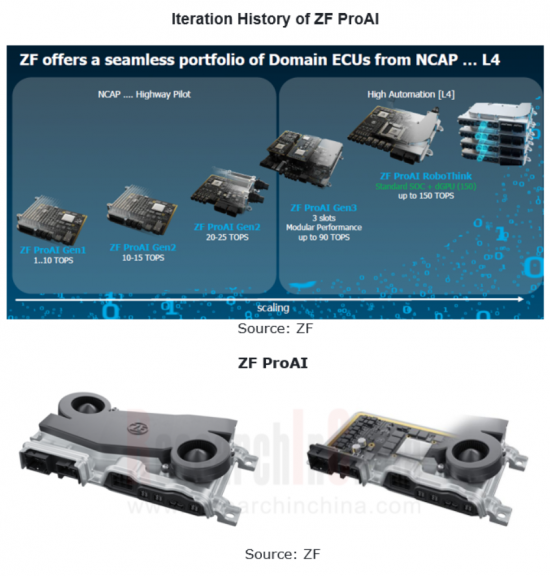

The early solutions include ZF ProAI, which has gone through several iterations, with the computing power increased from 1-10 TOPS to the current 20-1500 TOPS. The latest version of ProAI, scheduled to start volume production in 2024, enables cross-domain computing, packs ZF's domain control middleware, and is optimized for deep learning. Aptiv, on the other hand, puts forward three solutions based on a cross-domain computing platform: a cross-domain computing platform + dual domain controllers, a cross-domain computing platform + three domain controllers, and a cross-domain computing platform + four domain controllers.

Table of Contents

1 Global Regulations on Application of Autonomous Driving on Roads and Development Plans

- 1.1 Global Regulations on Application of Autonomous Driving on Roads

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - Main Test Items

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - System Safety and Failsafe Response

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - Human Machine Interface (HMI) / Operator information

- 1.1.1 UN Automated Lane Keeping Systems (ALKS) - Object Event Detection and Data Storage

- 1.1.2 Summary on Autonomous Driving Development Plans of Some Countries/Regions

- 1.2 European Union & Europe's Regulations on Application of Autonomous Driving on Roads

- 1.2.1 Germany's Law on Autonomous Driving

- 1.2.2 EU & Europe's Autonomous Driving Development Plan

- 1.2.3 EU Autonomous Driving Roadmap and 2040 Outlook

- 1.3 United Sates' Regulations on Application of Autonomous Driving on Roads

- 1.3.1 US Autonomous Driving Development Plan

- 1.4 Japan's Regulations on Application of Autonomous Driving on Roads

- 1.4.1 Japan's Action Plan for Realizing and Popularizing Autonomous Driving 4.0

- 1.4.2 Japan's Autonomous Driving Development Plan

- 1.4.3 Japan's "RoAD to the L4 Project" - 4 Major Themes

- 1.5 South Korea's Regulations on Application of Autonomous Driving on Roads

- 1.5.1 South Korea's Autonomous Driving Development Plan

2 Development Trends of Products and Solutions of Global Tier 1 Suppliers

- 2.1 SOP of New Products: the Volume Production of 4D Radars Starts

- 2.2 Regulation Adjustment: China Allows for Use of CMS in Vehicles

- 2.3 Product Upgrade: from Domain Controller to Central Computing Platform

- 2.4 Solution Upgrade: from Automated Driving/Parking to Driving-parking Integration

- 2.5 R&D Direction: Product Matrix Improvement + Product Iteration

3 Key Foreign Autonomous Driving Tier 1 Suppliers

- 3.1 Aptiv

- 3.1.1 Profile

- 3.1.2 Revenue

- 3.1.3 Competitors/Main Customers

- 3.1.4 Product Classification

- 3.1.5 Perception Products - Front View Camera

- 3.1.6 Perception Products - 4D Front Radar

- 3.1.7 Perception Products - Corner Radar

- 3.1.8 Decision Products - Domain Controller/Central Computing Platform

- 3.1.9 Solutions - Driving-parking Integration

- 3.1.10 Solutions - Autonomous Driving

- 3.1.11 Autonomous Driving Layout

- 3.1.12 Product/Market Planning

- 3.1.13 Summary

- 3.2 Bosch

- 3.2.1 Profile

- 3.2.2 Revenue

- 3.2.3 Product Classification

- 3.2.4 Perception Products - Front View Camera

- 3.2.5 Perception Products - Surround View System

- 3.2.6 Perception Products - 4D Front Radar

- 3.2.7 Perception Products - Front Radar

- 3.2.8 Perception Products - Corner Radar

- 3.2.9 Perception Products - LiDAR

- 3.2.10 Perception Products - DMS/OMS

- 3.2.11 Perception Products - Ultrasonic Radar

- 3.2.12 Decision Products - Domain Controller

- 3.2.13 Middleware

- 3.2.14 Solutions - Autonomous Driving

- 3.2.15 Solutions - Automated Parking

- 3.2.16 Recent Development Layout/Planning

- 3.2.17 Autonomous Driving Partners

- 3.2.18 Summary

- 3.3 Continental

- 3.3.1 Profile

- 3.3.2 Revenue

- 3.3.3 Product Classification

- 3.3.4 Perception Products - Front View Camera

- 3.3.5 Perception Products - Rear View Camera

- 3.3.6 Perception Products - Surround View System

- 3.3.7 Perception Products - CMS

- 3.3.8 Perception Products - DMS

- 3.3.9 Perception Products- OMS

- 3.3.10 Perception Products - Front Radar

- 3.3.11 Perception Products - Corner Radar

- 3.3.12 Perception Products - LiDAR

- 3.3.13 Perception Products - Ultrasonic Radar

- 3.3.14 Decision Products - Domain Controller

- 3.3.15 Decision Products - Central Computing Platform

- 3.3.16 Solutions - Autonomous Driving

- 3.3.17 Solutions - Automated Parking

- 3.3.18 Solutions - Road Data Solution

- 3.3.19 Engineering Solutions

- 3.3.20 Robotaxi

- 3.3.21 Autonomous Driving Roadmap

- 3.3.22 Continental China's Autonomous Driving Planning

- 3.3.23 Autonomous Driving Technologies

- 3.3.24 Summary

- 3.4 Denso

- 3.4.1 Profile

- 3.4.2 Revenue

- 3.4.3 Product Classification

- 3.4.4 Perception Products - Front View Camera

- 3.4.5 Perception Products - Surround View System

- 3.4.6 Perception Products - Front Radar

- 3.4.7 Perception Products - LiDAR

- 3.4.8 Perception Products - Ultrasonic Radar

- 3.4.9 Solutions - ADAS

- 3.4.10 Solutions - Autonomous Driving

- 3.4.11 Autonomous Driving Development Roadmap

- 3.4.12 Autonomous Driving Capabilities and R&D Layout

- 3.4.13 Summary

- 3.5 Hyundai Mobis

- 3.5.1 Profile

- 3.5.2 Revenue

- 3.5.3 Perception Products - Front View Camera

- 3.5.4 Perception Products - Surround View System

- 3.5.5 Perception Products - DMS

- 3.5.6 Perception Products - Radar

- 3.5.7 Perception Products - LiDAR & Ultrasonic Radar

- 3.5.8 Solutions - Automated Parking

- 3.5.9 Solutions - Autonomous Driving

- 3.5.10 Autonomous Concept Car

- 3.5.11 Autonomous Driving Development Planning

- 3.5.12 Summary

- 3.6 Magna

- 3.6.1 Profile

- 3.6.2 Revenue

- 3.6.3 Product Classification

- 3.6.4 Perception Products - Front View Camera

- 3.6.5 Perception Products - Surround View System

- 3.6.6 Perception Products - CMS

- 3.6.7 Perception Products - DMS/OMS

- 3.6.8 Perception Products - 4D Front/Corner Radar

- 3.6.9 Perception Products - LiDAR & Ultrasonic Radar

- 3.6.10 Decision Products - Domain Controller

- 3.6.11 Solutions - Autonomous Driving

- 3.6.12 Solutions - Automated Parking

- 3.6.13 Autonomous Driving & Intelligent Connectivity Planning

- 3.6.14 Summary

- 3.7 Valeo

- 3.7.1 Profile

- 3.7.2 Revenue

- 3.7.3 Autonomous Driving Product Layout

- 3.7.4 Automotive Product Layout

- 3.7.5 Distribution of R&D Bases in China

- 3.7.6 Autonomous Driving Products - Front View Camera

- 3.7.7 Autonomous Driving Products - Surround View System

- 3.7.8 Autonomous Driving Products - CMS

- 3.7.9 Autonomous Driving Products - Radar

- 3.7.10 Autonomous Driving Products - LiDAR

- 3.7.11 Autonomous Driving Products - Domain Controller

- 3.7.12 Autonomous Driving Products - Ultrasonic Radar

- 3.7.13 Solutions - Automated Parking

- 3.7.14 Solutions - Autonomous Driving

- 3.7.15 Autonomous Delivery Vehicles

- 3.7.16 Intent Prediction Technology

- 3.7.17 360-degree Autonomous Emergency Braking System

- 3.7.18 Autonomous Driving Product Partners

- 3.7.19 Summary

- 3.8 Veoneer

- 3.8.1 Profile

- 3.8.2 Revenue

- 3.8.3 Corporate Development Roadmap

- 3.8.4 Autonomous Driving Product Layout

- 3.8.5 Summary on Autonomous Driving Products

- 3.8.6 Perception Products - Camera

- 3.8.7 Perception Products - DMS

- 3.8.8 Perception Products - Radar

- 3.8.9 Perception Products - LiDAR

- 3.8.10 Decision Products - Domain Controller

- 3.8.11 Autonomous Driving Products - Positioning System

- 3.8.12 Autonomous Driving Products - V2X

- 3.8.13 Solutions - Autonomous Driving

- 3.8.14 Development History and Planning of Autonomous Driving Solutions

- 3.8.15 Main Partners

- 3.8.16 ADAS Technology Releases, 2021

- 3.8.17 Application of ADAS Products in Vehicles, 2021

- 3.8.18 Distribution of ADAS Product Customers, 2021

- 3.8.19 Summary

- 3.9 ZF

- 3.9.1 Profile

- 3.9.2 Recent Changes in Business Division Structure

- 3.9.3 Revenue

- 3.9.4 Product Classification

- 3.9.5 Perception Products - Front View Camera

- 3.9.6 Perception Products - Surround View System

- 3.9.7 Perception Products - OMS

- 3.9.8 Perception Products - 4D Front Radar

- 3.9.9 Perception Products - Front Radar

- 3.9.10 Perception Products - LiDAR & Sound Sensor

- 3.9.11 Decision Products - Vehicle Computing Platform

- 3.9.12 Decision Products - Domain Controller & Middleware

- 3.9.13 Solutions - Autonomous Driving & Driving-parking Integration

- 3.9.14 Solutions - Automated Parking

- 3.9.15 Development Trends & Layout

- 3.9.16 Summary