|

|

市場調査レポート

商品コード

1462813

クレジットカードの世界市場の予測:~2030年Global Credit Cards Market Insights, Forecast to 2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| クレジットカードの世界市場の予測:~2030年 |

|

出版日: 2024年04月13日

発行: QYResearch

ページ情報: 英文 193 Pages

納期: 2~3営業日

|

全表示

- 概要

- 図表

- 目次

世界のクレジットカードの市場規模は、売上ベースで2023年の1兆3,172億5,400万米ドルから、予測期間中は4.47%のCAGRで推移し、2030年には1兆8,262億3,100万米ドルの規模に成長すると予測されています。

北米市場は、2023年の3,875億1,600万米ドルから、予測期間中は3.07%のCAGRで推移し、2030年には4,931億9,100万米ドルに達すると予測されています。欧州市場は、2023年の3,477億3,600万米ドルから、4.65%のCAGRで推移し、2030年には4,878億2,100万米ドルに達すると予測されています。アジア太平洋市場は、2023年の4,770億7,700万米ドルから、5.46%のCAGRで推移し、2030年には7,008億5,200万米ドルに達すると予測されちます。ラテンアメリカ市場は、2023年の564億4,000万米ドルから、4.51%のCAGRで推移し、2030年には791億1,000万米ドルに達すると予測されています。中東・アフリカ市場は、2023年の484億8,500万米ドルから、3.99%のCAGRで推移し、2030年には652億5,700万米ドルに達すると予測されています。

当レポートでは、世界のクレジットカードの市場を調査し、市場概要、競合情勢、市場規模の推移・予測、各種区分・地域/主要国別の詳細分析、市場成長への各種影響因子の分析、主要企業の分析などをまとめています。

目次

第1章 レポートの概要

- 調査範囲

- タイプ別市場分析

- 成長率:2019年 vs 2023年 vs 2030年

- 個人クレジットカード

- 法人クレジットカード

- 用途別市場

- 市場シェア:2019年 vs 2023年 vs 2030年

- 日々の利用

- 旅行

- エンターテインメント

- その他

- 前提と制限

- 調査目的

- 調査年数

第2章 世界の成長動向

- 世界のクレジットカード市場の展望

- 世界のクレジットカードの成長動向:地域別

- 世界市場の規模:地域別:2019年 vs 2023年 vs 2030年

- 市場規模の推移:地域別

- 市場規模の予測:地域別

- 市場力学

- 産業動向

- 市場促進要因

- 課題

- 市場抑制要因

第3章 競合情勢:主要企業別

- 収益・収益シェア:企業別

- 市場シェア:企業タイプ別

- 世界の主要企業:収益別ランキング

- 市場集中率

- 世界の主要企業:本社・営業エリア

- 世界の主要企業:製品・用途

- 世界の主要企業:業界参入日

- M&A・拡張計画

第4章 クレジットカード市場の内訳データ:タイプ別

- 市場規模の推移・予測

第5章 クレジットカード市場の内訳データ:用途別

- 市場規模の推移・予測

第6章 北米

第7章 欧州

第8章 アジア太平洋

第9章 ラテンアメリカ

第10章 中東・アフリカ

第11章 主要企業のプロファイル

- JPMorgan Chase &Co

- Citibank

- Bank of America

- Wells Fargo

- Capital One

- American Express

- HSBC

- Sumitomo Mitsui Banking Corporation

- BNP Paribas

- State Bank of India

- Sberbank

- MUFG Bank

- Itau Unibanco

- Commonwealth Bank

- Credit Agricole

- Deutsche Bank

- Hyundai Card

- Al-Rajhi Bank

- Standard Bank

- Hang Seng Bank

- Bank of East Asia

- China Merchants Bank

- ICBC

- China Construction Bank(CCB)

- Agricultural Bank of China(ABC)

- Ping An Bank

- Bank of China

第12章 産業チェーン分析

- 産業チェーン分析

- 製造プロセス

第13章 アナリストの見解・総論

第14章 付録

List of Tables

- Table 1. Global Credit Cards Market Size Growth Rate by Type (US$ Million): 2019 VS 2023 VS 2030

- Table 2. Global Credit Cards Market Size Growth by Application (US$ Million): 2019 VS 2023 VS 2030

- Table 3. Global Credit Cards Market Size Growth Rate (CAGR) by Region (US$ Million): 2019 VS 2023 VS 2030

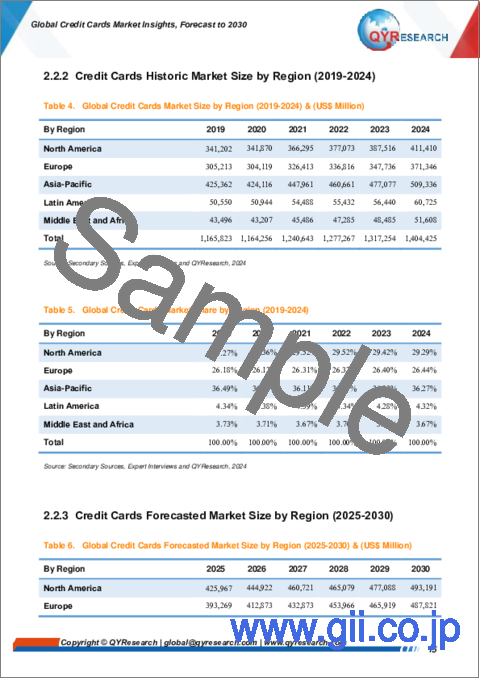

- Table 4. Global Credit Cards Market Size by Region (2019-2024) & (US$ Million)

- Table 5. Global Credit Cards Market Share by Region (2019-2024)

- Table 6. Global Credit Cards Forecasted Market Size by Region (2025-2030) & (US$ Million)

- Table 7. Global Credit Cards Market Share by Region (2025-2030)

- Table 8. Credit Cards Market Trends

- Table 9. Credit Cards Market Drivers

- Table 10. Credit Cards Market Challenges

- Table 11. Credit Cards Market Restraints

- Table 12. Global Credit Cards Revenue by Players (2019-2024) & (US$ Million)

- Table 13. Global Credit Cards Market Share by Players (2019-2024)

- Table 14. Global Top Credit Cards Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Credit Cards as of 2023)

- Table 15. Global Credit Cards Industry Ranking 2022 VS 2023

- Table 16. Global 5 Largest Players Market Share by Credit Cards Revenue (CR5 and HHI) & (2019-2024)

- Table 17. Global Key Players of Credit Cards, Headquarters and Area Served

- Table 18. Global Key Players of Credit Cards, Product and Application

- Table 19. Global Key Players of Credit Cards, Date of Enter into This Industry

- Table 20. Mergers & Acquisitions, Expansion Plans

- Table 21. Global Credit Cards Market Size by Type (2019-2024) & (US$ Million)

- Table 22. Global Credit Cards Revenue Market Share by Type (2019-2024)

- Table 23. Global Credit Cards Forecasted Market Size by Type (2025-2030) & (US$ Million)

- Table 24. Global Credit Cards Revenue Market Share by Type (2025-2030)

- Table 25. Global Credit Cards Market Size by Application (2019-2024) & (US$ Million)

- Table 26. Global Credit Cards Revenue Market Share by Application (2019-2024)

- Table 27. Global Credit Cards Forecasted Market Size by Application (2025-2030) & (US$ Million)

- Table 28. Global Credit Cards Revenue Market Share by Application (2025-2030)

- Table 29. North America Credit Cards Market Size by Type (2019-2024) & (US$ Million)

- Table 30. North America Credit Cards Market Size by Type (2025-2030) & (US$ Million)

- Table 31. North America Credit Cards Market Size by Application (2019-2024) & (US$ Million)

- Table 32. North America Credit Cards Market Size by Application (2025-2030) & (US$ Million)

- Table 33. North America Credit Cards Growth Rate (CAGR) by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 34. North America Credit Cards Market Size by Country (2019-2024) & (US$ Million)

- Table 35. North America Credit Cards Market Size by Country (2025-2030) & (US$ Million)

- Table 36. Europe Credit Cards Market Size by Type (2019-2024) & (US$ Million)

- Table 37. Europe Credit Cards Market Size by Type (2025-2030) & (US$ Million)

- Table 38. Europe Credit Cards Market Size by Application (2019-2024) & (US$ Million)

- Table 39. Europe Credit Cards Market Size by Application (2025-2030) & (US$ Million)

- Table 40. Europe Credit Cards Growth Rate (CAGR) by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 41. Europe Credit Cards Market Size by Country (2019-2024) & (US$ Million)

- Table 42. Europe Credit Cards Market Size by Country (2025-2030) & (US$ Million)

- Table 43. Asia-Pacific Credit Cards Market Size by Type (2019-2024) & (US$ Million)

- Table 44. Asia-Pacific Credit Cards Market Size by Type (2025-2030) & (US$ Million)

- Table 45. Asia-Pacific Credit Cards Market Size by Application (2019-2024) & (US$ Million)

- Table 46. Asia-Pacific Credit Cards Market Size by Application (2025-2030) & (US$ Million)

- Table 47. Asia-Pacific Credit Cards Growth Rate (CAGR) by Region (US$ Million): 2019 VS 2023 VS 2030

- Table 48. Asia-Pacific Credit Cards Market Size by Region (2019-2024) & (US$ Million)

- Table 49. Asia-Pacific Credit Cards Market Size by Region (2025-2030) & (US$ Million)

- Table 50. Latin America Credit Cards Market Size by Type (2019-2024) & (US$ Million)

- Table 51. Latin America Credit Cards Market Size by Type (2025-2030) & (US$ Million)

- Table 52. Latin America Credit Cards Market Size by Application (2019-2024) & (US$ Million)

- Table 53. Latin America Credit Cards Market Size by Application (2025-2030) & (US$ Million)

- Table 54. Latin America Credit Cards Growth Rate (CAGR) by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 55. Latin America Credit Cards Market Size by Country (2019-2024) & (US$ Million)

- Table 56. Latin America Credit Cards Market Size by Country (2025-2030) & (US$ Million)

- Table 57. Middle East and Africa Credit Cards Market Size by Type (2019-2024) & (US$ Million)

- Table 58. Middle East and Africa Credit Cards Market Size by Type (2025-2030) & (US$ Million)

- Table 59. Middle East and Africa Credit Cards Market Size by Application (2019-2024) & (US$ Million)

- Table 60. Middle East and Africa Credit Cards Market Size by Application (2025-2030) & (US$ Million)

- Table 61. Middle East and Africa Credit Cards Growth Rate (CAGR) by Country (US$ Million): 2019 VS 2023 VS 2030

- Table 62. Middle East and Africa Credit Cards Market Size by Country (2019-2024) & (US$ Million)

- Table 63. Middle East and Africa Credit Cards Market Size by Country (2025-2030) & (US$ Million)

- Table 64. JPMorgan Chase & Co Company Details

- Table 65. JPMorgan Chase & Co Business Overview

- Table 66. JPMorgan Chase & Co Credit Cards Product

- Table 67. JPMorgan Chase & Co Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 68. JPMorgan Chase & Co Recent Development

- Table 69. Citibank Company Details

- Table 70. Citibank Business Overview

- Table 71. Citibank Credit Cards Product

- Table 72. Citibank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 73. Citibank Recent Development

- Table 74. Bank of America Company Details

- Table 75. Bank of America Business Overview

- Table 76. Bank of America Credit Cards Product

- Table 77. Bank of America Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 78. Bank of America Recent Development

- Table 79. Wells Fargo Company Details

- Table 80. Wells Fargo Business Overview

- Table 81. Wells Fargo Credit Cards Product

- Table 82. Wells Fargo Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 83. Wells Fargo Recent Development

- Table 84. Capital One Company Details

- Table 85. Capital One Business Overview

- Table 86. Capital One Credit Cards Product

- Table 87. Capital One Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 88. Capital One Recent Development

- Table 89. American Express Company Details

- Table 90. American Express Business Overview

- Table 91. American Express Credit Cards Product

- Table 92. American Express Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 93. American Express Recent Development

- Table 94. HSBC Company Details

- Table 95. HSBC Business Overview

- Table 96. HSBC Credit Cards Product

- Table 97. HSBC Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 98. HSBC Recent Development

- Table 99. Sumitomo Mitsui Banking Corporation Company Details

- Table 100. Sumitomo Mitsui Banking Corporation Business Overview

- Table 101. Sumitomo Mitsui Banking Corporation Credit Cards Product

- Table 102. Sumitomo Mitsui Banking Corporation Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 103. Sumitomo Mitsui Banking Corporation Recent Development

- Table 104. BNP Paribas Company Details

- Table 105. BNP Paribas Business Overview

- Table 106. BNP Paribas Credit Cards Product

- Table 107. BNP Paribas Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 108. State Bank of India Company Details

- Table 109. State Bank of India Business Overview

- Table 110. State Bank of India Credit Cards Product

- Table 111. State Bank of India Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 112. State Bank of India Recent Development

- Table 113. Sberbank Company Details

- Table 114. Sberbank Business Overview

- Table 115. Sberbank Credit Cards Product

- Table 116. Sberbank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 117. MUFG Bank Company Details

- Table 118. MUFG Bank Business Overview

- Table 119. MUFG Bank Credit Cards Product

- Table 120. MUFG Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 121. MUFG Bank Recent Development

- Table 122. Itau Unibanco Company Details

- Table 123. Itau Unibanco Business Overview

- Table 124. Itau Unibanco Credit Cards Product

- Table 125. Itau Unibanco Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 126. Itau Unibanco Recent Development

- Table 127. Commonwealth Bank Company Details

- Table 128. Commonwealth Bank Business Overview

- Table 129. Commonwealth Bank Credit Cards Product

- Table 130. Commonwealth Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 131. Credit Agricole Company Details

- Table 132. Credit Agricole Business Overview

- Table 133. Credit Agricole Credit Cards Product

- Table 134. Credit Agricole Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 135. Deutsche Bank Company Details

- Table 136. Deutsche Bank Business Overview

- Table 137. Deutsche Bank Credit Cards Product

- Table 138. Deutsche Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 139. Deutsche Bank Recent Development

- Table 140. Hyundai Card Company Details

- Table 141. Hyundai Card Business Overview

- Table 142. Hyundai Card Credit Cards Product

- Table 143. Hyundai Card Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 144. Hyundai Card Recent Development

- Table 145. Al-Rajhi Bank Company Details

- Table 146. Al-Rajhi Bank Business Overview

- Table 147. Al-Rajhi Bank Credit Cards Product

- Table 148. Al-Rajhi Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 149. Standard Bank Company Details

- Table 150. Standard Bank Business Overview

- Table 151. Standard Bank Credit Cards Product

- Table 152. Standard Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 153. Standard Bank Recent Development

- Table 154. Hang Seng Bank Company Details

- Table 155. Hang Seng Bank Business Overview

- Table 156. Hang Seng Bank Credit Cards Product

- Table 157. Hang Seng Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 158. Hang Seng Bank Recent Development

- Table 159. Bank of East Asia Company Details

- Table 160. Bank of East Asia Business Overview

- Table 161. Bank of East Asia Credit Cards Product

- Table 162. Bank of East Asia Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 163. Bank of East Asia Recent Development

- Table 164. China Merchants Bank Company Details

- Table 165. China Merchants Bank Business Overview

- Table 166. China Merchants Bank Credit Cards Product

- Table 167. China Merchants Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 168. ICBC Company Details

- Table 169. ICBC Business Overview

- Table 170. ICBC Credit Cards Product

- Table 171. ICBC Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 172. ICBC Recent Development

- Table 173. China Construction Bank (CCB) Company Details

- Table 174. China Construction Bank (CCB) Business Overview

- Table 175. China Construction Bank (CCB) Credit Cards Product

- Table 176. China Construction Bank (CCB) Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 177. China Construction Bank (CCB) Recent Development

- Table 178. Agricultural Bank of China (ABC) Company Details

- Table 179. Agricultural Bank of China (ABC) Business Overview

- Table 180. Agricultural Bank of China (ABC) Credit Cards Product

- Table 181. Agricultural Bank of China (ABC) Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 182. Ping An Bank Company Details

- Table 183. Ping An Bank Business Overview

- Table 184. Ping An Bank Credit Cards Product

- Table 185. Ping An Bank Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 186. Ping An Bank Recent Development

- Table 187. Bank of China Company Details

- Table 188. Bank of China Business Overview

- Table 189. Bank of China Credit Cards Product

- Table 190. Bank of China Revenue in Credit Cards Business (2019-2024) & (US$ Million)

- Table 191. Bank of China Recent Development

- Table 192. Credit Card Manufacturer List

- Table 193. Research Programs/Design for This Report

- Table 194. Key Data Information from Secondary Sources

- Table 195. Key Data Information from Primary Sources

List of Figures

- Figure 1. Global Credit Cards Market Size Growth Rate by Type, 2019 VS 2023 VS 2030 (US$ Million)

- Figure 2. Global Credit Cards Market Share by Type: 2023 VS 2030

- Figure 3. Personal Credit Card Features

- Figure 4. Corporate Credit Card Features

- Figure 5. Global Credit Cards Market Size Growth Rate by Application, 2019 VS 2023 VS 2030 (US$ Million)

- Figure 6. Global Credit Cards Market Share by Application: 2023 VS 2030

- Figure 7. Daily Consumption Case Studies

- Figure 8. Travel Case Studies

- Figure 9. Entertainment Case Studies

- Figure 10. Medical Case Studies

- Figure 11. Credit Cards Report Years Considered

- Figure 12. Global Credit Cards Market Size (US$ Million), Year-over-Year: 2019-2030

- Figure 13. Global Credit Cards Market Size, (US$ Million), 2019 VS 2024 VS 2030

- Figure 14. Global Credit Cards Market Share by Region: 2023 VS 2030

- Figure 15. Global Credit Cards Market Share by Players in 2023

- Figure 16. Global Top Credit Cards Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Credit Cards as of 2023)

- Figure 17. The Top 10 and 5 Players Market Share by Credit Cards Revenue in 2023

- Figure 18. North America Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 19. North America Credit Cards Market Share by Type (2019-2030)

- Figure 20. North America Credit Cards Market Share by Application (2019-2030)

- Figure 21. North America Credit Cards Market Share by Country (2019-2030)

- Figure 22. United States Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 23. Canada Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 24. Europe Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 25. Europe Credit Cards Market Share by Type (2019-2030)

- Figure 26. Europe Credit Cards Market Share by Application (2019-2030)

- Figure 27. Europe Credit Cards Market Share by Country (2019-2030)

- Figure 28. Germany Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 29. France Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 30. U.K. Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 31. Italy Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 32. Russia Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 33. Asia-Pacific Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 34. Asia-Pacific Credit Cards Market Share by Type (2019-2030)

- Figure 35. Asia-Pacific Credit Cards Market Share by Application (2019-2030)

- Figure 36. Asia-Pacific Credit Cards Market Share by Region (2019-2030)

- Figure 37. China Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 38. Japan Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 39. South Korea Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 40. Southeast Asia Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 41. India Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 42. Australia Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 43. Latin America Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 44. Latin America Credit Cards Market Share by Type (2019-2030)

- Figure 45. Latin America Credit Cards Market Share by Application (2019-2030)

- Figure 46. Latin America Credit Cards Market Share by Country (2019-2030)

- Figure 47. Mexico Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 48. Brazil Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 49. Middle East and Africa Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 50. Middle East and Africa Credit Cards Market Share by Type (2019-2030)

- Figure 51. Middle East and Africa Credit Cards Market Share by Application (2019-2030)

- Figure 52. Middle East and Africa Credit Cards Market Share by Country (2019-2030)

- Figure 53. Saudi Arabia Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 54. UAE Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 55. Egypt Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 56. South Africa Credit Cards Market Size YoY Growth (2019-2030) & (US$ Million)

- Figure 57. Credit Card Industry Chain

- Figure 58. Bottom-up and Top-down Approaches for This Report

- Figure 59. Data Triangulation

- Figure 60. Key Executives Interviewed

Global Credit Cards market size in terms of revenue is projected to reach 1,826,231 Million USD by 2030 from 1,317,254 Million USD in 2023, with a CAGR 4.47% during 2024-2030.

North America market for Credit Cards is estimated to increase from 387,516 million USD in 2023 to reach 493,191 million USD by 2030, at a CAGR of 3.07% during the forecast period of 2024 through 2030.

Europe market for Credit Cards is estimated to increase from 347,736 million USD in 2023 to reach 487,821 million USD by 2030, at a CAGR of 4.65% during the forecast period of 2024 through 2030.

Asia-Pacific market for Credit Cards is estimated to increase from 477,077 million USD in 2023 to reach 700,852 million USD by 2030, at a CAGR of 5.46% during the forecast period of 2024 through 2030.

Latin America market for Credit Cards is estimated to increase from 56,440 million USD in 2023 to reach 79,110 million USD by 2030, at a CAGR of 4.51% during the forecast period of 2024 through 2030.

Middle East and Africa market for Credit Cards is estimated to increase from 48,485 million USD in 2023 to reach 65,257 million USD by 2030, at a CAGR of 3.99% during the forecast period of 2024 through 2030.

The major global manufacturers of Credit Cards include JPMorgan, Citibank, Bank of America, Wells Fargo, Capital One, American Express, HSBC, Sumitomo Mitsui Banking Corporation, BNP Paribas, State Bank of India, etc. In 2023, the world's top five vendors accounted for approximately 14.79% of the revenue.

Report Includes

This report presents an overview of global market for Credit Cards market size. Analyses of the global market trends, with historic market revenue data for 2019 - 2023, estimates for 2024, and projections of CAGR through 2030.

This report researches the key producers of Credit Cards, also provides the revenue of main regions and countries. Highlights of the upcoming market potential for Credit Cards, and key regions/countries of focus to forecast this market into various segments and sub-segments. Country specific data and market value analysis for the U.S., Canada, Mexico, Brazil, China, Japan, South Korea, Southeast Asia, India, Germany, the U.K., Italy, Middle East, Africa, and Other Countries.

This report focuses on the Credit Cards revenue, market share and industry ranking of main companies, data from 2019 to 2024. Identification of the major stakeholders in the global Credit Cards market, and analysis of their competitive landscape and market positioning based on recent developments and segmental revenues. This report will help stakeholders to understand the competitive landscape and gain more insights and position their businesses and market strategies in a better way.

This report analyzes the segments data by Type and by Application, revenue, and growth rate, from 2019 to 2030. Evaluation and forecast the market size for Credit Cards revenue, projected growth trends, production technology, application and end-user industry.

Descriptive company profiles of the major global players, including American Express, Banco Itau, Bank of America Merrill Lynch, Bank of Brazil, Bank of East Asia, Chase Commercial Banking, Diner's Club, Hang Seng Bank, Hyundai, JP Morgan, etc.

Market Segmentation

By Company

- JPMorgan

- Citibank

- Bank of America

- Wells Fargo

- Capital One

- American Express

- HSBC

- Sumitomo Mitsui Banking Corporation

- BNP Paribas

- State Bank of India

- Sberbank

- MUFG Bank

- Itau Unibanco

- Commonwealth Bank

- Credit Agricole

- Deutsche Bank

- Hyundai Card

- Al-Rajhi Bank

- Standard Bank

- Hang Seng Bank

- Bank of East Asia

- China Merchants Bank

- ICBC

- China Construction Bank (CCB)

- Agricultural Bank of China (ABC)

- Ping An Bank

- Bank of China

Segment by Type

- Personal Credit Card

- Corporate Credit Card

Segment by Application

- Daily Consumption

- Travel

- Entertainment

- Others

By Region

- North America

- United States

- Canada

- Asia-Pacific

- China

- Japan

- South Korea

- Southeast Asia

- India

- Australia

- Rest of Asia

- Europe

- Germany

- France

- U.K.

- Italy

- Russia

- Rest of Europe

- Latin America

- Mexico

- Brazil

- Rest of Latin America

- Middle East & Africa

- Saudi Arabia

- UAE

- Egypt

- South Africa

- Rest of MEA

Chapter Outline

Chapter 1: Introduces the report scope of the report, executive summary of different market segments (product type, application, etc), including the market size of each market segment, future development potential, and so on. It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

Chapter 2: Revenue of Credit Cards in global and regional level. It provides a quantitative analysis of the market size and development potential of each region and its main countries and introduces the market development, future development prospects, market space, and capacity of each country in the world. This section also introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by companies in the industry, and the analysis of relevant policies in the industry.

Chapter 3: Detailed analysis of Credit Cards companies' competitive landscape, revenue, market share and industry ranking, latest development plan, merger, and acquisition information, etc.

Chapter 4: Provides the analysis of various market segments by Type, covering the revenue, and development potential of each market segment, to help readers find the blue ocean market in different market segments.

Chapter 5: Provides the analysis of various market segments by Application, covering the revenue, and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

Chapter 6: North America (US & Canada) by Type, by Application and by country, revenue for each segment.

Chapter 7: Europe by Type, by Application and by country, revenue for each segment.

Chapter 8: Asia by Type, by Application and by region, revenue for each segment.

Chapter 9: Latin America by Type, by Application and by country, revenue for each segment.

Chapter 10: Middle East, Africa by Type, by Application and by country, revenue for each segment.

Chapter 11: Provides profiles of key companies, introducing the basic situation of the main companies in the market in detail, including product descriptions and specifications, Credit Cards revenue, gross margin, and recent development, etc.

Chapter 12: Analyst's Viewpoints/Conclusions

Table of Contents

1 Report Overview

- 1.1 Study Scope

- 1.2 Market Analysis by Type

- 1.2.1 Global Credit Cards Market Size Growth Rate by Type: 2019 VS 2023 VS 2030

- 1.2.2 Personal Credit Card

- 1.2.3 Corporate Credit Card

- 1.3 Market by Application

- 1.3.1 Global Credit Cards Market Share by Application: 2019 VS 2023 VS 2030

- 1.3.2 Daily Consumption

- 1.3.3 Travel

- 1.3.4 Entertainment

- 1.3.5 Others

- 1.4 Assumptions and Limitations

- 1.5 Study Objectives

- 1.6 Years Considered

2 Global Growth Trends

- 2.1 Global Credit Cards Market Perspective (2019-2030)

- 2.2 Global Credit Cards Growth Trends by Region

- 2.2.1 Global Credit Cards Market Size by Region: 2019 VS 2023 VS 2030

- 2.2.2 Credit Cards Historic Market Size by Region (2019-2024)

- 2.2.3 Credit Cards Forecasted Market Size by Region (2025-2030)

- 2.3 Credit Cards Market Dynamics

- 2.3.1 Credit Cards Industry Trends

- 2.3.2 Credit Cards Market Drivers

- 2.3.3 Credit Cards Market Challenges

- 2.3.4 Credit Cards Market Restraints

3 Competition Landscape by Key Players

- 3.1 Global Revenue Credit Cards by Players

- 3.1.1 Global Credit Cards Revenue by Players (2019-2024)

- 3.1.2 Global Credit Cards Revenue Market Share by Players (2019-2024)

- 3.2 Global Credit Cards Market Share by Company Type (Tier 1, Tier 2, and Tier 3)

- 3.3 Global Key Players of Credit Cards, Ranking by Revenue, 2022 VS 2023 VS 2024

- 3.4 Global Credit Cards Market Concentration Ratio

- 3.4.1 Global Credit Cards Market Concentration Ratio (CR5 and HHI)

- 3.4.2 Global Top 10 and Top 5 Companies by Credit Cards Revenue in 2023

- 3.5 Global Key Players of Credit Cards Head office and Area Served

- 3.6 Global Key Players of Credit Cards, Product and Application

- 3.7 Global Key Players of Credit Cards, Date of Enter into This Industry

- 3.8 Mergers & Acquisitions, Expansion Plans

4 Credit Cards Breakdown Data by Type

- 4.1 Global Credit Cards Historic Market Size by Type (2019-2024)

- 4.2 Global Credit Cards Forecasted Market Size by Type (2025-2030)

5 Credit Cards Breakdown Data by Application

- 5.1 Global Credit Cards Historic Market Size by Application (2019-2024)

- 5.2 Global Credit Cards Forecasted Market Size by Application (2025-2030)

6 North America

- 6.1 North America Credit Cards Market Size (2019-2030)

- 6.2 North America Credit Cards Market Size by Type

- 6.2.1 North America Credit Cards Market Size by Type (2019-2024)

- 6.2.2 North America Credit Cards Market Size by Type (2025-2030)

- 6.2.3 North America Credit Cards Market Share by Type (2019-2030)

- 6.3 North America Credit Cards Market Size by Application

- 6.3.1 North America Credit Cards Market Size by Application (2019-2024)

- 6.3.2 North America Credit Cards Market Size by Application (2025-2030)

- 6.3.3 North America Credit Cards Market Share by Application (2019-2030)

- 6.4 North America Credit Cards Market Size by Country

- 6.4.1 North America Credit Cards Market Size by Country: 2019 VS 2023 VS 2030

- 6.4.2 North America Credit Cards Market Size by Country (2019-2024)

- 6.4.3 North America Credit Cards Market Share by Country (2025-2030)

- 6.4.4 United States

- 6.4.5 Canada

7 Europe

- 7.1 Europe Credit Cards Market Size (2019-2030)

- 7.2 Europe Credit Cards Market Size by Type

- 7.2.1 Europe Credit Cards Market Size by Type (2019-2024)

- 7.2.2 Europe Credit Cards Market Size by Type (2025-2030)

- 7.2.3 Europe Credit Cards Market Share by Type (2019-2030)

- 7.3 Europe Credit Cards Market Size by Application

- 7.3.1 Europe Credit Cards Market Size by Application (2019-2024)

- 7.3.2 Europe Credit Cards Market Size by Application (2025-2030)

- 7.3.3 Europe Credit Cards Market Share by Application (2019-2030)

- 7.4 Europe Credit Cards Market Size by Country

- 7.4.1 Europe Credit Cards Market Size by Country: 2019 VS 2023 VS 2030

- 7.4.2 Europe Credit Cards Market Size by Country (2019-2024)

- 7.4.3 Europe Credit Cards Market Size by Country (2025-2030)

- 7.4.4 Germany

- 7.4.5 France

- 7.4.6 U.K.

- 7.4.7 Italy

- 7.4.8 Russia

8 Asia-Pacific-Pacific

- 8.1 Asia-Pacific Credit Cards Market Size (2019-2030)

- 8.2 Asia-Pacific Credit Cards Market Size by Type

- 8.2.1 Asia-Pacific Credit Cards Market Size by Type (2019-2024)

- 8.2.2 Asia-Pacific Credit Cards Market Size by Type (2025-2030)

- 8.2.3 Asia-Pacific Credit Cards Market Share by Type (2019-2030)

- 8.3 Asia-Pacific Credit Cards Market Size by Application

- 8.3.1 Asia-Pacific Credit Cards Market Size by Application (2019-2024)

- 8.3.2 Asia-Pacific Credit Cards Market Size by Application (2025-2030)

- 8.3.3 Asia-Pacific Credit Cards Market Share by Application (2019-2030)

- 8.4 Asia-Pacific Credit Cards Market Size by Region

- 8.4.1 Asia-Pacific Credit Cards Market Size by Region: 2019 VS 2023 VS 2030

- 8.4.2 Asia-Pacific Credit Cards Market Size by Region (2019-2024)

- 8.4.3 Asia-Pacific Credit Cards Market Size by Region (2025-2030)

- 8.4.4 China

- 8.4.5 Japan

- 8.4.6 South Korea

- 8.4.7 Southeast Asia

- 8.4.8 India

- 8.4.9 Australia

9 Latin America

- 9.1 Latin America Credit Cards Market Size (2019-2030)

- 9.2 Latin America Credit Cards Market Size by Type

- 9.2.1 Latin America Credit Cards Market Size by Type (2019-2024)

- 9.2.2 Latin America Credit Cards Market Size by Type (2025-2030)

- 9.2.3 Latin America Credit Cards Market Share by Type (2019-2030)

- 9.3 Latin America Credit Cards Market Size by Application

- 9.3.1 Latin America Credit Cards Market Size by Application (2019-2024)

- 9.3.2 Latin America Credit Cards Market Size by Application (2025-2030)

- 9.3.3 Latin America Credit Cards Market Share by Application (2019-2030)

- 9.4 Latin America Credit Cards Market Size by Country

- 9.4.1 Latin America Credit Cards Market Size by Country: 2019 VS 2023 VS 2030

- 9.4.2 Latin America Credit Cards Market Size by Country (2019-2024)

- 9.4.3 Latin America Credit Cards Market Size by Country (2025-2030)

- 9.4.4 Mexico

- 9.4.5 Brazil

10 Middle East and Africa

- 10.1 Middle East and Africa Credit Cards Market Size (2019-2030)

- 10.2 Middle East and Africa Credit Cards Market Size by Type

- 10.2.1 Middle East and Africa Credit Cards Market Size by Type (2019-2024)

- 10.2.2 Middle East and Africa Credit Cards Market Size by Type (2025-2030)

- 10.2.3 Middle East and Africa Credit Cards Market Share by Type (2019-2030)

- 10.3 Middle East and Africa Credit Cards Market Size by Application

- 10.3.1 Middle East and Africa Credit Cards Market Size by Application (2019-2024)

- 10.3.2 Middle East and Africa Credit Cards Market Size by Application (2025-2030)

- 10.3.3 Middle East and Africa Credit Cards Market Share by Application (2019-2030)

- 10.4 Middle East and Africa Credit Cards Market Size by Country

- 10.4.1 Middle East and Africa Credit Cards Market Size by Country: 2019 VS 2023 VS 2030

- 10.4.2 Middle East and Africa Credit Cards Market Size by Country (2019-2024)

- 10.4.3 Middle East and Africa Credit Cards Market Size by Country (2025-2030)

- 10.4.4 Saudi Arabia

- 10.4.5 UAE

- 10.4.6 Egypt

- 10.4.7 South Africa

11 Key Players Profiles

- 11.1 JPMorgan Chase & Co

- 11.1.1 JPMorgan Chase & Co Company Details

- 11.1.2 JPMorgan Chase & Co Business Overview

- 11.1.3 JPMorgan Chase & Co Credit Cards Introduction

- 11.1.4 JPMorgan Chase & Co Revenue in Credit Cards Business (2019-2024)

- 11.1.5 JPMorgan Chase & Co Recent Development

- 11.2 Citibank

- 11.2.1 Citibank Company Details

- 11.2.2 Citibank Business Overview

- 11.2.3 Citibank Credit Cards Introduction

- 11.2.4 Citibank Revenue in Credit Cards Business (2019-2024)

- 11.2.5 Citibank Recent Development

- 11.3 Bank of America

- 11.3.1 Bank of America Company Details

- 11.3.2 Bank of America Business Overview

- 11.3.3 Bank of America Credit Cards Introduction

- 11.3.4 Bank of America Revenue in Credit Cards Business (2019-2024)

- 11.3.5 Bank of America Recent Development

- 11.4 Wells Fargo

- 11.4.1 Wells Fargo Company Details

- 11.4.2 Wells Fargo Business Overview

- 11.4.3 Wells Fargo Credit Cards Introduction

- 11.4.4 Wells Fargo Revenue in Credit Cards Business (2019-2024)

- 11.4.5 Wells Fargo Recent Development

- 11.5 Capital One

- 11.5.1 Capital One Company Details

- 11.5.2 Capital One Business Overview

- 11.5.3 Capital One Credit Cards Introduction

- 11.5.4 Capital One Revenue in Credit Cards Business (2019-2024)

- 11.5.5 Capital One Recent Development

- 11.6 American Express

- 11.6.1 American Express Company Details

- 11.6.2 American Express Business Overview

- 11.6.3 American Express Credit Cards Introduction

- 11.6.4 American Express Revenue in Credit Cards Business (2019-2024)

- 11.6.5 American Express Recent Development

- 11.7 HSBC

- 11.7.1 HSBC Company Details

- 11.7.2 HSBC Business Overview

- 11.7.3 HSBC Credit Cards Introduction

- 11.7.4 HSBC Revenue in Credit Cards Business (2019-2024)

- 11.7.5 HSBC Recent Development

- 11.8 Sumitomo Mitsui Banking Corporation

- 11.8.1 Sumitomo Mitsui Banking Corporation Company Details

- 11.8.2 Sumitomo Mitsui Banking Corporation Business Overview

- 11.8.3 Sumitomo Mitsui Banking Corporation Credit Cards Introduction

- 11.8.4 Sumitomo Mitsui Banking Corporation Revenue in Credit Cards Business (2019-2024)

- 11.8.5 Sumitomo Mitsui Banking Corporation Recent Development

- 11.9 BNP Paribas

- 11.9.1 BNP Paribas Company Details

- 11.9.2 BNP Paribas Business Overview

- 11.9.3 BNP Paribas Credit Cards Introduction

- 11.9.4 BNP Paribas Revenue in Credit Cards Business (2019-2024)

- 11.10 State Bank of India

- 11.10.1 State Bank of India Company Details

- 11.10.2 State Bank of India Business Overview

- 11.10.3 State Bank of India Credit Cards Introduction

- 11.10.4 State Bank of India Revenue in Credit Cards Business (2019-2024)

- 11.10.5 State Bank of India Recent Development

- 11.11 Sberbank

- 11.11.1 Sberbank Company Details

- 11.11.2 Sberbank Business Overview

- 11.11.3 Sberbank Credit Cards Introduction

- 11.11.4 Sberbank Revenue in Credit Cards Business (2019-2024)

- 11.12 MUFG Bank

- 11.12.1 MUFG Bank Company Details

- 11.12.2 MUFG Bank Business Overview

- 11.12.3 MUFG Bank Credit Cards Introduction

- 11.12.4 MUFG Bank Revenue in Credit Cards Business (2019-2024)

- 11.12.5 MUFG Bank Recent Development

- 11.13 Itau Unibanco

- 11.13.1 Itau Unibanco Company Details

- 11.13.2 Itau Unibanco Business Overview

- 11.13.3 Itau Unibanco Credit Cards Introduction

- 11.13.4 Itau Unibanco Revenue in Credit Cards Business (2019-2024)

- 11.13.5 Itau Unibanco Recent Development

- 11.14 Commonwealth Bank

- 11.14.1 Commonwealth Bank Company Details

- 11.14.2 Commonwealth Bank Business Overview

- 11.14.3 Commonwealth Bank Credit Cards Introduction

- 11.14.4 Commonwealth Bank Revenue in Credit Cards Business (2019-2024)

- 11.15 Credit Agricole

- 11.15.1 Credit Agricole Company Details

- 11.15.2 Credit Agricole Business Overview

- 11.15.3 Credit Agricole Credit Cards Introduction

- 11.15.4 Credit Agricole Revenue in Credit Cards Business (2019-2024)

- 11.16 Deutsche Bank

- 11.16.1 Deutsche Bank Company Details

- 11.16.2 Deutsche Bank Business Overview

- 11.16.3 Deutsche Bank Credit Cards Introduction

- 11.16.4 Deutsche Bank Revenue in Credit Cards Business (2019-2024)

- 11.16.5 Deutsche Bank Recent Development

- 11.17 Hyundai Card

- 11.17.1 Hyundai Card Company Details

- 11.17.2 Hyundai Card Business Overview

- 11.17.3 Hyundai Card Credit Cards Introduction

- 11.17.4 Hyundai Card Revenue in Credit Cards Business (2019-2024)

- 11.17.5 Hyundai Card Recent Development

- 11.18 Al-Rajhi Bank

- 11.18.1 Al-Rajhi Bank Company Details

- 11.18.2 Al-Rajhi Bank Business Overview

- 11.18.3 Al-Rajhi Bank Credit Cards Introduction

- 11.18.4 Al-Rajhi Bank Revenue in Credit Cards Business (2019-2024)

- 11.19 Standard Bank

- 11.19.1 Standard Bank Company Details

- 11.19.2 Standard Bank Business Overview

- 11.19.3 Standard Bank Credit Cards Introduction

- 11.19.4 Standard Bank Revenue in Credit Cards Business (2019-2024)

- 11.19.5 Standard Bank Recent Development

- 11.20 Hang Seng Bank

- 11.20.1 Hang Seng Bank Company Details

- 11.20.2 Hang Seng Bank Business Overview

- 11.20.3 Hang Seng Bank Credit Cards Introduction

- 11.20.4 Hang Seng Bank Revenue in Credit Cards Business (2019-2024)

- 11.20.5 Hang Seng Bank Recent Development

- 11.21 Bank of East Asia

- 11.21.1 Bank of East Asia Company Details

- 11.21.2 Bank of East Asia Business Overview

- 11.21.3 Bank of East Asia Credit Cards Introduction

- 11.21.4 Bank of East Asia Revenue in Credit Cards Business (2019-2024)

- 11.21.5 Bank of East Asia Recent Development

- 11.22 China Merchants Bank

- 11.22.1 China Merchants Bank Company Details

- 11.22.2 China Merchants Bank Business Overview

- 11.22.3 China Merchants Bank Credit Cards Introduction

- 11.22.4 China Merchants Bank Revenue in Credit Cards Business (2019-2024)

- 11.23 ICBC

- 11.23.1 ICBC Company Details

- 11.23.2 ICBC Business Overview

- 11.23.3 ICBC Credit Cards Introduction

- 11.23.4 ICBC Revenue in Credit Cards Business (2019-2024)

- 11.23.5 ICBC Recent Development

- 11.24 China Construction Bank (CCB)

- 11.24.1 China Construction Bank (CCB) Company Details

- 11.24.2 China Construction Bank (CCB) Business Overview

- 11.24.3 China Construction Bank (CCB) Credit Cards Introduction

- 11.24.4 China Construction Bank (CCB) Revenue in Credit Cards Business (2019-2024)

- 11.24.5 China Construction Bank (CCB) Recent Development

- 11.25 Agricultural Bank of China (ABC)

- 11.25.1 Agricultural Bank of China (ABC) Company Details

- 11.25.2 Agricultural Bank of China (ABC) Business Overview

- 11.25.3 Agricultural Bank of China (ABC) Credit Cards Introduction

- 11.25.4 Agricultural Bank of China (ABC) Revenue in Credit Cards Business (2019-2024)

- 11.26 Ping An Bank

- 11.26.1 Ping An Bank Company Details

- 11.26.2 Ping An Bank Business Overview

- 11.26.3 Ping An Bank Credit Cards Introduction

- 11.26.4 Ping An Bank Revenue in Credit Cards Business (2019-2024)

- 11.26.5 Ping An Bank Recent Development

- 11.27 Bank of China

- 11.27.1 Bank of China Company Details

- 11.27.2 Bank of China Business Overview

- 11.27.3 Bank of China Credit Cards Introduction

- 11.27.4 Bank of China Revenue in Credit Cards Business (2019-2024)

- 11.27.5 Bank of China Recent Development

12 Industry Chain Analysis

- 12.1 Credit Card Industry Chain Analysis

- 12.2 Credit Card Manufacturing Process

13 Analyst's Viewpoints/Conclusions

14 Appendix

- 14.1 Research Methodology

- 14.1.1 Methodology/Research Approach

- 14.1.2 Data Source

- 14.2 Author Details

- 14.3 Disclaimer