|

|

市場調査レポート

商品コード

1238092

農産物倉庫サービスの世界市場:分析・実績・予測 (2018年~2029年)Global Agricultural Product Warehousing Service Market Report, History and Forecast 2018-2029 |

||||||

|

● お客様のご希望に応じて、既存データの加工や未掲載情報(例:国別セグメント)の追加などの対応が可能です。 詳細はお問い合わせください。 |

|||||||

| 農産物倉庫サービスの世界市場:分析・実績・予測 (2018年~2029年) |

|

出版日: 2023年03月16日

発行: QYResearch

ページ情報: 英文 105 Pages

納期: 2~3営業日

|

- 全表示

- 概要

- 図表

- 目次

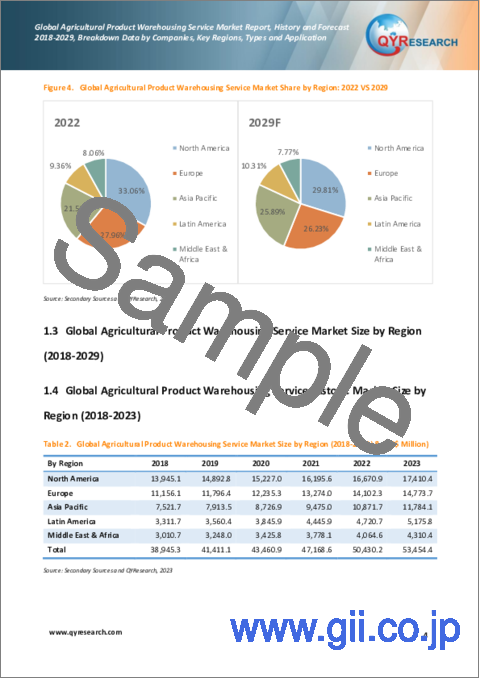

世界の農産物倉庫サービス市場の収益は、2022年に504億3,020万米ドル、2029年には738億9,900万米ドルに達する見通しです。

また、今後4年間に5.55%のCAGRで成長する、と予測されています。

消費者は現在、健康やウェルネスに対する意識が高まり、食品の栄養素、特にタンパク質が身体や精神の成長・発達全般に及ぼす影響について、より深く考えるようになってきています。その結果、乳製品、果物や野菜、高タンパク動物性食品 (肉、卵、魚介類など) といった生鮮食品の消費パターンが変化しています。

地域別に見ると、アジア太平洋やラテンアメリカの新興国で、生鮮食品に対する需要が高まっています。その背景には、これらの国々における急速な都市化、嗜好の変化、消費者の可処分所得の上昇といった要因があると考えられます。また、これらの国々では、加工食品や冷凍食品の普及率が低いため、将来性も高くなっています。これらの国々では、冷凍ピザ、デザート、スナックなどのインスタント食品の消費が順調に伸びています。

当レポートでは、世界の農産物倉庫サービスの市場について分析し、種類別・用途別・地域別 (国別) の市場動向の見通し (2018年~2029年)、主要企業のプロファイルなどについて調査しております。

目次

第1章 農産物倉庫サービス:市場概要

- 農産物倉庫サービス:市場概要

- 市場規模の概要:地域別 (2018年・2022年・2029年)

- 市場規模:地域別 (2018年~2029年)

- 過去の市場規模:地域別 (2018年~2023年)

- 市場規模の予測:地域別 (2024年~2029年)

- 主要地域の市場規模 (2018年~2029年)

- 北米の農産物倉庫サービスの市場規模 (2018年~2029年)

- 欧州の農産物倉庫サービスの市場規模 (2018年~2029年)

- アジア太平洋の農産物倉庫サービスの市場規模 (2018年~2029年)

- ラテンアメリカの農産物倉庫サービスの市場規模 (2018年~2029年)

- 中東・アフリカの農産物倉庫サービスの市場規模 (2018年~2029年)

第2章 農産物倉庫サービス市場の概要:種類別

- 市場規模の概要:種類別 (2018年・2022年・2029年)

- 過去の市場規模:種類別 (2018年~2023年)

- 市場規模の予測:種類別 (2024年~2029年)

- 物流倉庫

- 公共倉庫

- 民間倉庫

第3章 農産物倉庫サービス市場の概要:用途別

- 市場規模の概要:用途別 (2018年・2022年・2029年)

- 過去の市場規模:用途別 (2018年~2023年)

- 市場規模の予測:用途別 (2024年~2029年)

- 青果物

- 鶏肉・牛肉・豚肉

- 魚介類

- 乳製品

第4章 農産物倉庫サービス:企業別の競合分析

- 市場規模:企業別 (2018年~2023年)

- 世界の主要企業:企業の種類別 (ティア1、ティア2、ティア3) (収益別、2022年)

- 世界の農産物倉庫サービスの主要企業:本社・提供エリア

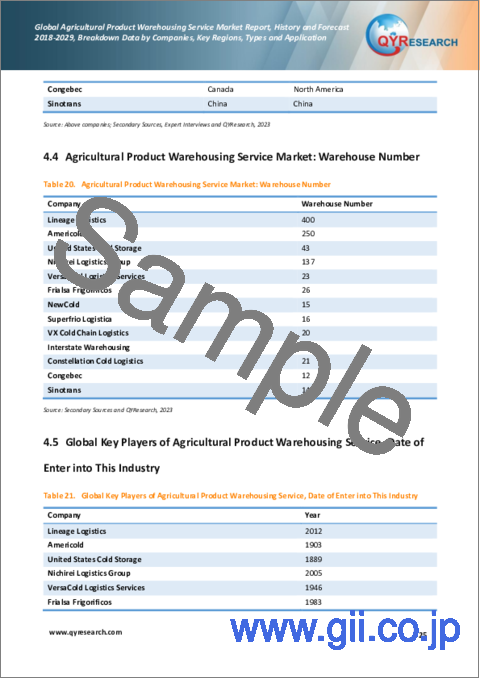

- 世界の農産物倉庫サービス市場:倉庫の件数

- 世界の農産物倉庫サービスの主要企業:市場参入時期

- 競合情勢

第5章 企業 (主要企業) のプロファイル

- Lineage Logistics

- 企業概略

- 主要事業

- 農産物倉庫サービス

- 収益・粗利益・市場シェア (2017年~2022年)

- Americold

- United States Cold Storage

- Nichirei Logistics Group

- VersaCold Logistics Services

- Frialsa Frigorificos

- NEWCOLD

- Superfrio Logistica

- VX Cold Chain Logistics

- Interstate Warehousing

- Constellation Cold Logistics

- Congebec

- Sinotrans

第6章 北米

- 北米の農産物倉庫サービスの市場規模:国別 (2018年~2029年)

- 米国

- カナダ

第7章 欧州

- 欧州の農産物倉庫サービスの市場規模:国別 (2018年~2029年)

- ドイツ

- フランス

- 英国

- イタリア

- スペイン

- ロシア

- 北欧諸国

第8章 アジア太平洋

- アジア太平洋の農産物倉庫サービスの市場規模:地域別 (2018年~2029年)

- 中国

- 日本

- 韓国

- 東南アジア

- インド

- オーストラリア

第9章 ラテンアメリカ

- ラテンアメリカの農産物倉庫サービスの市場規模:国別 (2018年~2029年)

- メキシコ

- ブラジル

第10章 中東とアフリカ

- 中東・アフリカの農産物倉庫サービスの市場規模:国別 (2018年~2029年)

- トルコ

- サウジアラビア

- エジプト

第11章 農産物倉庫サービスの市場力学

- 農産物倉庫サービス業界の動向

- 農産物倉庫サービス市場の促進要因

- 農産物倉庫サービス市場の抑制要因

- 競合要因

第12章 調査結果/結論

第13章 調査手法とデータソース

List of Tables

- Table 1. Global Market Agricultural Product Warehousing Service Market Size (US$ Million) Comparison by Region: 2018 VS 2022 VS 2029

- Table 2. Global Agricultural Product Warehousing Service Market Size by Region (2018-2023) & (US$ Million)

- Table 3. Global Agricultural Product Warehousing Service Market Size Share by Region (2018-2023)

- Table 4. Global Agricultural Product Warehousing Service Forecasted Market Size by Region (2024-2029) & (US$ Million)

- Table 5. Global Agricultural Product Warehousing Service Forecasted Market Size Share by Region (2024-2029)

- Table 6. Global Agricultural Product Warehousing Service Market Size (US$ Million) by Type: 2018 VS 2022 VS 2029

- Table 7. Global Agricultural Product Warehousing Service Market Size by Type (2018-2023) & (US$ Million)

- Table 8. Global Agricultural Product Warehousing Service Revenue Market Share by Type (2018-2023)

- Table 9. Global Agricultural Product Warehousing Service Forecasted Market Size by Type (2024-2029) & (US$ Million)

- Table 10. Global Agricultural Product Warehousing Service Revenue Market Share by Type (2024-2029)

- Table 11. Global Agricultural Product Warehousing Service Market Size by Application: (US$ Million) 2018 VS 2022 VS 2029

- Table 12. Global Agricultural Product Warehousing Service Market Size by Application (2018-2023) & (US$ Million)

- Table 13. Global Agricultural Product Warehousing Service Revenue Market Share by Application (2018-2023)

- Table 14. Global Agricultural Product Warehousing Service Forecasted Market Size by Application (2024-2029) & (US$ Million)

- Table 15. Global Agricultural Product Warehousing Service Revenue Market Share by Application (2024-2029)

- Table 16. Global Agricultural Product Warehousing Service Revenue by Players (2018-2023) & (US$ Million)

- Table 17. Global Agricultural Product Warehousing Service Revenue Market Share by Players (2018-2023)

- Table 18. Global Top Players Market Share by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Agricultural Product Warehousing Service as of 2022)

- Table 19. Global Key Players of Agricultural Product Warehousing Service, Headquarters and Area Served

- Table 20. Agricultural Product Warehousing Service Market: Warehouse Number

- Table 21. Global Key Players of Agricultural Product Warehousing Service, Date of Enter into This Industry

- Table 22. Global Agricultural Product Warehousing Service Players Market Concentration Ratio (CR5)

- Table 23. Mergers & Acquisitions, Expansion Plans

- Table 24. Lineage Logistics Basic Information, Warehouse Number and Service Regions

- Table 25. Lineage Logistics Major Business

- Table 26. Lineage Logistics Agricultural Product Warehousing Service

- Table 27. Lineage Logistics Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 28. Americold Basic Information, Warehouse Number and Service Regions

- Table 29. Americold Major Business

- Table 30. Americold Agricultural Product Warehousing Service

- Table 31. Americold Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 32. United States Cold Storage Basic Information, Warehouse Number and Service Regions

- Table 33. United States Cold Storage Major Business

- Table 34. United States Cold Storage Agricultural Product Warehousing Service

- Table 35. United States Cold Storage Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 36. Nichirei Logistics Group Basic Information, Warehouse Number and Service Regions

- Table 37. Nichirei Logistics Group Major Business

- Table 38. Nichirei Logistics Group Agricultural Product Warehousing Service

- Table 39. Nichirei Logistics Group Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 40. VersaCold Logistics Services Basic Information, Warehouse Number and Service Regions

- Table 41. VersaCold Logistics Services Major Business

- Table 42. VersaCold Logistics Services Agricultural Product Warehousing Service

- Table 43. VersaCold Logistics Services Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 44. Frialsa Frigorificos Basic Information, Warehouse Number and Service Regions

- Table 45. Frialsa Frigorificos Major Business

- Table 46. Frialsa Frigorificos Agricultural Product Warehousing Service

- Table 47. Frialsa Frigorificos Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 48. NEWCOLD Basic Information, Warehouse Number and Service Regions

- Table 49. NEWCOLD Major Business

- Table 50. NEWCOLD Agricultural Product Warehousing Service

- Table 51. NEWCOLD Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 52. Superfrio Logistica Basic Information, Warehouse Number and Service Regions

- Table 53. Superfrio Logistica Major Business

- Table 54. Superfrio Logistica Agricultural Product Warehousing Service

- Table 55. Superfrio Logistica Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 56. VX Cold Chain Logistics Basic Information, Warehouse Number and Service Regions

- Table 57. VX Cold Chain Logistics Major Business

- Table 58. VX Cold Chain Logistics Agricultural Product Warehousing Service

- Table 59. VX Cold Chain Logistics Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 60. Interstate Warehousing Basic Information, Warehouse Number and Service Regions

- Table 61. Interstate Warehousing Major Business

- Table 62. Interstate Warehousing Agricultural Product Warehousing Service

- Table 63. Interstate Warehousing Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 64. Constellation Cold Logistics Basic Information, Warehouse Number and Service Regions

- Table 65. Constellation Cold Logistics Major Business

- Table 66. Constellation Cold Logistics Agricultural Product Warehousing Service

- Table 67. Constellation Cold Logistics Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 68. Congebec Basic Information, Warehouse Number and Service Regions

- Table 69. Congebec Major Business

- Table 70. Congebec Agricultural Product Warehousing Service

- Table 71. Congebec Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 72. Sinotrans Basic Information, Warehouse Number and Service Regions

- Table 73. Sinotrans Major Business

- Table 74. Sinotrans Agricultural Product Warehousing Service

- Table 75. Sinotrans Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022) & (USD Million)

- Table 76. North America Agricultural Product Warehousing Service Market Size Growth Rate (CAGR) by Country (US$ Million): 2018 VS 2022 VS 2029

- Table 77. North America Agricultural Product Warehousing Service Market Size by Country (2018-2023) & (US$ Million)

- Table 78. North America Agricultural Product Warehousing Service Market Size by Country (2024-2029) & (US$ Million)

- Table 79. Europe Agricultural Product Warehousing Service Market Size Growth Rate (CAGR) by Country (US$ Million): 2018 VS 2022 VS 2029

- Table 80. Europe Agricultural Product Warehousing Service Market Size by Country (2018-2023) & (US$ Million)

- Table 81. Europe Agricultural Product Warehousing Service Market Size by Country (2024-2029) & (US$ Million)

- Table 82. Europe Agricultural Product Warehousing Service Market Share by Country (2018-2023)

- Table 83. Europe Agricultural Product Warehousing Service Market Share by Country (2024-2029)

- Table 84. Asia Pacific Agricultural Product Warehousing Service Market Size Growth Rate (CAGR) by Region (US$ Million): 2018 VS 2022 VS 2029

- Table 85. Asia Pacific Agricultural Product Warehousing Service Market Size by Region (2018-2023) & (US$ Million)

- Table 86. Asia Pacific Agricultural Product Warehousing Service Market Size by Region (2024-2029) & (US$ Million)

- Table 87. Asia Pacific Agricultural Product Warehousing Service Market Share by Region (2018-2023)

- Table 88. Asia Pacific Agricultural Product Warehousing Service Market Share by Region (2024-2029)

- Table 89. Latin America Agricultural Product Warehousing Service Market Size Growth Rate (CAGR) by Country (US$ Million): 2018 VS 2022 VS 2029

- Table 90. Latin America Agricultural Product Warehousing Service Market Size by Country (2018-2023) & (US$ Million)

- Table 91. Latin America Agricultural Product Warehousing Service Market Size by Country (2024-2029) & (US$ Million)

- Table 92. Middle East and Africa Agricultural Product Warehousing Service Market Size Growth Rate (CAGR) by Country (US$ Million): 2018 VS 2022 VS 2029

- Table 93. Middle East & Africa Agricultural Product Warehousing Service Market Size by Country (2018-2023) & (US$ Million)

- Table 94. Middle East & Africa Agricultural Product Warehousing Service Market Size by Country (2024-2029) & (US$ Million)

- Table 95. Agricultural Product Warehousing Service Market Trends

- Table 96. Agricultural Product Warehousing Service Market Drivers

- Table 97. Agricultural Product Warehousing Service Market Restraints

- Table 98. Research Programs/Design for This Report

- Table 99. Key Data Information from Secondary Sources

- Table 100. Key Data Information from Primary Sources

- Table 101. QYR Business Unit and Senior & Team Lead Analysts

List of Figures

- Figure 1. Agricultural Product Warehousing Service Product Picture

- Figure 2. Global Agricultural Product Warehousing Service Market Size Year-over-Year (2018-2029) & (US$ Million)

- Figure 3. Global Agricultural Product Warehousing Service Market Size, (US$ Million), 2018 VS 2022 VS 2029

- Figure 4. Global Agricultural Product Warehousing Service Market Share by Region: 2022 VS 2029

- Figure 5. Global Agricultural Product Warehousing Service Forecasted Market Size Share by Region (2018-2029)

- Figure 6. North America Agricultural Product Warehousing Service Market Size Growth Rate (2018-2029) & (US$ Million)

- Figure 7. Europe Agricultural Product Warehousing Service Market Size Growth Rate (2018-2029) & (US$ Million)

- Figure 8. Asia Pacific Agricultural Product Warehousing Service Market Size Growth Rate (2018-2029) & (US$ Million)

- Figure 9. Latin America Agricultural Product Warehousing Service Market Size Growth Rate (2018-2029) & (US$ Million)

- Figure 10. Middle East & Africa Agricultural Product Warehousing Service Market Size Growth Rate (2018-2029) & (US$ Million)

- Figure 11. Global Agricultural Product Warehousing Service Market Size Share by Type: 2022 & 2029

- Figure 12. Distribution Warehouse Market Size (US$ Million) & YoY Growth (2018-2029)

- Figure 13. Public Warehouse Market Size (US$ Million) & YoY Growth (2018-2029)

- Figure 14. Private Warehouse Market Size (US$ Million) & YoY Growth (2018-2029)

- Figure 15. Global Agricultural Product Warehousing Service Market Size Share by Application: 2022 & 2029

- Figure 16. Vegetables & Fruits

- Figure 17. Vegetables & Fruits Market Size (US$ Million) & YoY Growth (2018-2029)

- Figure 18. Poultry, Beef and Pork

- Figure 19. Poultry, Beef and Pork Market Size (US$ Million) & YoY Growth (2018-2029)

- Figure 20. Sea Food

- Figure 21. Seafood Market Size (US$ Million) & YoY Growth (2018-2029)

- Figure 22. Dairy

- Figure 23. Dairy Market Size (US$ Million) & YoY Growth (2018-2029)

- Figure 24. North America Agricultural Product Warehousing Service Market Share by Country (2018-2029)

- Figure 25. United States Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 26. Canada Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 27. Germany Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 28. France Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 29. U.K. Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 30. Italy Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 31. Spain Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 32. Russia Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 33. Nordic Countries Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 34. Asia Pacific Agricultural Product Warehousing Service Market Share by Region (2018-2029)

- Figure 35. China Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 36. Japan Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 37. South Korea Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 38. Southeast Asia Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 39. India Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 40. Australia Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 41. Latin America Agricultural Product Warehousing Service Market Share by Country (2018-2029)

- Figure 42. Mexico Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 43. Brazil Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 44. Middle East & Africa Agricultural Product Warehousing Service Market Share by Country (2018-2029)

- Figure 45. Turkey Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 46. Saudi Arabia Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 47. Egypt Agricultural Product Warehousing Service Market Size (2018-2029) & (US$ Million)

- Figure 48. Bottom-up and Top-down Approaches for This Report

- Figure 49. Data Triangulation

The global revenue of agricultural product warehousing service market was valued at 50,430.2 Million USD in 2022 and is expected to reach USD 73,899.0 Million USD in 2029. In the future four years, we predict the CAGR of global revenue is 5.55%.

The pandemic has created a positive impact on the agricultural logistic industry, resulting in fueling the demand for agricultural product warehousing service. The increasing adoption rate of fresh food is a promising take for the growth of the agricultural product warehousing service. The COVID-19 impacted the supply chain of every industry due to restricted trade during the pandemic, resulting in food manufactures to emphasize not only on the food products but also on their storage to increase their shelf-life, which is expected to propel the market for the warehousing service. The outbreak of COVID-19 has created a shift toward an organized retail market for preventing any further virus outbreaks. Consumers have stockpiled processed food products with a long shelf life to perishable foods and trade restricted trade movements between countries have resulted in surpassing of Temperature Controlled Logistics storage capacities in certain countries. These developments underscore the need for the food value chain to move from open-air markets to a cold-chain model that keeps perishable items for longer duration. These factors are expected to propel the demand for agricultural product warehousing service during the forecast period.

Consumers are now more aware of health and wellness, as well as the effect that food nutrients, especially protein, have on overall physical and mental growth and development. This has resulted in a change in the consumption pattern of perishable foods, such as dairy products, fruits and vegetables, and high-protein animal-based products (such as meat, eggs, and fish and seafood).

Emerging economies in the Asia Pacific and Latin America are witnessing a high demand for perishable food products. This can be attributed to the rapid urbanization, changing tastes and preferences, and the rising disposable income of consumers in these countries. The market potential for processed and frozen food products is also high in these countries due to their lower adoption rates. The consumption of ready-to-eat meals, such as frozen pizzas, desserts, and snacks, is rising steadily in these countries.

Report Scope

This report aims to provide a comprehensive presentation of the global market for Agricultural Product Warehousing Service, with both quantitative and qualitative analysis, to help readers develop business/growth strategies, assess the market competitive situation, analyze their position in the current marketplace, and make informed business decisions regarding Agricultural Product Warehousing Service.

The Agricultural Product Warehousing Service market size, estimations, and forecasts are provided in terms of revenue ($ millions), considering 2021 as the base year, with history and forecast data for the period from 2018 to 2029. This report segments the global Agricultural Product Warehousing Service market comprehensively. Regional market sizes, concerning products by Type, by Application, and by players, are also provided. The influence of COVID-19 and the Russia-Ukraine War were considered while estimating market sizes.

For a more in-depth understanding of the market, the report provides profiles of the competitive landscape, key competitors, and their respective market ranks. The report also discusses technological trends and new product developments.

This report will help the readers to understand the competition within the industries and strategies for the competitive environment to enhance the potential profit. The report also focuses on the competitive landscape of the global Agricultural Product Warehousing Service market, and introduces in detail the market share, industry ranking, competitor ecosystem, market performance, new product development, operation situation, expansion, and acquisition. etc. of the main players, which helps the readers to identify the main competitors and deeply understand the competition pattern of the market.

Market Segmentation

This report covers the Agricultural Product Warehousing Service segments by company, by Type, by Application, by region and country, and provides market size and CAGR for the history and forecast period (2018-2023, 2024-2029), considering 2022 as the base year. It elucidates potential revenue opportunities across different segments and explains attractive investment proposition matrices for this market.

By Company

- Lineage Logistics

- Americold

- United States Cold Storage

- Nichirei Logistics Group

- VersaCold Logistics Services

- Frialsa Frigorificos

- NewCold

- Superfrio Logistica

- VX Cold Chain Logistics

- Interstate Warehousing

- Constellation Cold Logistics

- Congebec

- Sinotrans

Segment by Type

- Distribution Warehouse

- Public Warehouse

- Private Warehouse

Segment by Application

- Vegetables & Fruits

- Poultry, Beef and Pork

- Seafood

- Dairy

- Others

By Region

- North America

- United States

- Canada

- Asia Pacific

- China

- Japan

- South Korea

- Southeast Asia

- India

- Australia

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Russia

- Nordic Countries

- Latin America

- Mexico

- Brazil

- Middle East & Africa

- Turkey

- Saudi Arabia

- Egypt

Core Chapters

- Chapter One: Introduces the report scope of the report, executive summary of global and regional market size and CAGR for the history and forecast period (2018-2023, 2024-2029). It offers a high-level view of the current state of the market and its likely evolution in the short to mid-term, and long term.

- Chapter Two: Provides the analysis of various market segments by Type, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different market segments.

- Chapter Three: Provides the analysis of various market segments by Application, covering the market size and development potential of each market segment, to help readers find the blue ocean market in different downstream markets.

- Chapter Four: Detailed analysis of Agricultural Product Warehousing Service companies competitive landscape, revenue, market share and ranking, latest development plan, merger, and acquisition information, etc.

- Chapter Five: Provides profiles of key players, introducing the basic situation of the main companies in the market in detail, including product introduction, revenue, recent development, etc.

- Chapter Six, Seven, Eight, Nine and Ten: North America, Europe, Asia Pacific, Latin America, Middle East & Africa, revenue by country.

- Chapter Eleven: this section also introduces the market dynamics, latest developments of the market, the driving factors and restrictive factors of the market, the challenges and risks faced by companies in the industry, and the analysis of relevant policies in the industry.

- Chapter Twelve: Research Finding/Conclusion

Table of Contents

1 Market Overview of Agricultural Product Warehousing Service

- 1.1 Agricultural Product Warehousing Service Market Overview

- 1.1.1 Agricultural Product Warehousing Service Product Scope

- 1.1.2 Agricultural Product Warehousing Service Market Status and Outlook

- 1.2 Global Agricultural Product Warehousing Service Market Size Overview by Region 2018 VS 2022 VS 2029

- 1.3 Global Agricultural Product Warehousing Service Market Size by Region (2018-2029)

- 1.4 Global Agricultural Product Warehousing Service Historic Market Size by Region (2018-2023)

- 1.5 Global Agricultural Product Warehousing Service Market Size Forecast by Region (2024-2029)

- 1.6 Key Regions Agricultural Product Warehousing Service Market Size (2018-2029)

- 1.6.1 North America Agricultural Product Warehousing Service Market Size (2018-2029)

- 1.6.2 Europe Agricultural Product Warehousing Service Market Size (2018-2029)

- 1.6.3 Asia Pacific Agricultural Product Warehousing Service Market Size (2018-2029)

- 1.6.4 Latin America Agricultural Product Warehousing Service Market Size (2018-2029)

- 1.6.5 Middle East & Africa Agricultural Product Warehousing Service Market Size (2018-2029)

2 Agricultural Product Warehousing Service Market Overview by Type

- 2.1 Global Agricultural Product Warehousing Service Market Size by Type: 2018 VS 2022 VS 2029

- 2.2 Global Agricultural Product Warehousing Service Historic Market Size by Type (2018-2023)

- 2.3 Global Agricultural Product Warehousing Service Forecasted Market Size by Type (2024-2029)

- 2.4 Distribution Warehouse

- 2.5 Public Warehouse

- 2.6 Private Warehouse

3 Agricultural Product Warehousing Service Market Overview by Application

- 3.1 Global Agricultural Product Warehousing Service Market Size by Application: 2018 VS 2022 VS 2029

- 3.2 Global Agricultural Product Warehousing Service Historic Market Size by Application (2018-2023)

- 3.3 Global Agricultural Product Warehousing Service Forecasted Market Size by Application (2024-2029)

- 3.4 Vegetables & Fruits

- 3.5 Poultry, Beef and Pork

- 3.6 Seafood

- 3.7 Dairy

4 Agricultural Product Warehousing Service Competition Analysis by Players

- 4.1 Global Agricultural Product Warehousing Service Market Size by Players (2018-2023)

- 4.2 Global Top Players by Company Type (Tier 1, Tier 2, and Tier 3) & (based on the Revenue in Agricultural Product Warehousing Service as of 2022)

- 4.3 Global Key Players of Agricultural Product Warehousing Service Head office and Area Served

- 4.4 Agricultural Product Warehousing Service Market: Warehouse Number

- 4.5 Global Key Players of Agricultural Product Warehousing Service, Date of Enter into This Industry

- 4.6 Competitive Status

- 4.6.1 Agricultural Product Warehousing Service Market Concentration Rate

- 4.6.2 Mergers & Acquisitions, Expansion Plans

5 Company (Top Player) Profiles

- 5.1 Lineage Logistics

- 5.1.1 Lineage Logistics Details

- 5.1.2 Lineage Logistics Major Business

- 5.1.3 Lineage Logistics Agricultural Product Warehousing Service

- 5.1.4 Lineage Logistics Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.2 Americold

- 5.2.1 Americold Details

- 5.2.2 Americold Major Business

- 5.2.3 Americold Agricultural Product Warehousing Service

- 5.2.4 Americold Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.3 United States Cold Storage

- 5.3.1 United States Cold Storage Details

- 5.3.2 United States Cold Storage Major Business

- 5.3.3 United States Cold Storage Agricultural Product Warehousing Service

- 5.3.4 United States Cold Storage Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.4 Nichirei Logistics Group

- 5.4.1 Nichirei Logistics Group Details

- 5.4.2 Nichirei Logistics Group Major Business

- 5.4.3 Nichirei Logistics Group Agricultural Product Warehousing Service

- 5.4.4 Nichirei Logistics Group Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.5 VersaCold Logistics Services

- 5.5.1 VersaCold Logistics Services Details

- 5.5.2 VersaCold Logistics Services Major Business

- 5.5.3 VersaCold Logistics Services Agricultural Product Warehousing Service

- 5.5.4 VersaCold Logistics Services Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.6 Frialsa Frigorificos

- 5.6.1 Frialsa Frigorificos Details

- 5.6.2 Frialsa Frigorificos Major Business

- 5.6.3 Frialsa Frigorificos Agricultural Product Warehousing Service

- 5.6.4 Frialsa Frigorificos Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.7 NEWCOLD

- 5.7.1 NEWCOLD Details

- 5.7.2 NEWCOLD Major Business

- 5.7.3 NEWCOLD Agricultural Product Warehousing Service

- 5.7.4 NEWCOLD Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.8 Superfrio Logistica

- 5.8.1 Superfrio Logistica Details

- 5.8.2 Superfrio Logistica Major Business

- 5.8.3 Superfrio Logistica Agricultural Product Warehousing Service

- 5.8.4 Superfrio Logistica Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.9 VX Cold Chain Logistics

- 5.9.1 VX Cold Chain Logistics Details

- 5.9.2 VX Cold Chain Logistics Major Business

- 5.9.3 VX Cold Chain Logistics Agricultural Product Warehousing Service

- 5.9.4 VX Cold Chain Logistics Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.10 Interstate Warehousing

- 5.10.1 Interstate Warehousing Details

- 5.10.2 Interstate Warehousing Major Business

- 5.10.3 Interstate Warehousing Agricultural Product Warehousing Service

- 5.10.4 Interstate Warehousing Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.11 Constellation Cold Logistics

- 5.11.1 Constellation Cold Logistics Details

- 5.11.2 Constellation Cold Logistics Major Business

- 5.11.3 Constellation Cold Logistics Agricultural Product Warehousing Service

- 5.11.4 Constellation Cold Logistics Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.12 Congebec

- 5.12.1 Congebec Details

- 5.12.2 Congebec Major Business

- 5.12.3 Congebec Agricultural Product Warehousing Service

- 5.12.4 Congebec Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

- 5.13 Sinotrans

- 5.13.1 Sinotrans Details

- 5.13.2 Sinotrans Major Business

- 5.13.3 Sinotrans Agricultural Product Warehousing Service

- 5.13.4 Sinotrans Agricultural Product Warehousing Service Revenue, Gross Margin and Market Share (2017-2022)

6 North America

- 6.1 North America Agricultural Product Warehousing Service Market Size by Country (2018-2029)

- 6.2 United States

- 6.3 Canada

7 Europe

- 7.1 Europe Agricultural Product Warehousing Service Market Size by Country (2018-2029)

- 7.2 Germany

- 7.3 France

- 7.4 U.K.

- 7.5 Italy

- 7.6 Spain

- 7.7 Russia

- 7.8 Nordic Countries

8 Asia Pacific

- 8.1 Asia Pacific Agricultural Product Warehousing Service Market Size by Region (2018-2029)

- 8.2 China

- 8.3 Japan

- 8.4 South Korea

- 8.5 Southeast Asia

- 8.6 India

- 8.7 Australia

9 Latin America

- 9.1 Latin America Agricultural Product Warehousing Service Market Size by Country (2018-2029)

- 9.2 Mexico

- 9.3 Brazil

10 Middle East & Africa

- 10.1 Middle East & Africa Agricultural Product Warehousing Service Market Size by Country

- 10.2 Turkey

- 10.3 Saudi Arabia

- 10.4 Egypt

11 Agricultural Product Warehousing Service Market Dynamics

- 11.1 Agricultural Product Warehousing Service Industry Trends

- 11.2 Agricultural Product Warehousing Service Market Drivers

- 11.3 Agricultural Product Warehousing Service Market Restraints

- 11.4 Factors of Competition

12 Research Finding/Conclusion

13 Methodology and Data Source

- 13.1 Methodology/Research Approach

- 13.1.1 Research Programs/Design

- 13.1.2 Market Size Estimation

- 13.1.3 Market Breakdown and Data Triangulation

- 13.2 Data Source

- 13.2.1 Secondary Sources

- 13.2.2 Primary Sources

- 13.3 Author List

- 13.4 Disclaimer