|

|

市場調査レポート

商品コード

1746466

スマート倉庫の世界市場:提供別、技術別 - 予測(~2030年)Smart Warehousing Market by Offering (AGVs, AMRs, AS/RS, AIDC, Palletizing & Depalletizing Systems, Conveyors & Sorters, TMS, WMS, Order Management), Technology (AI, IoT, Blockchain, Big Data & Analytics, Robotics & Automation) - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| スマート倉庫の世界市場:提供別、技術別 - 予測(~2030年) |

|

出版日: 2025年06月05日

発行: MarketsandMarkets

ページ情報: 英文 338 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

世界のスマート倉庫市場は急速に拡大しており、市場規模は2025年の312億1,000万米ドルから2030年までに464億2,000万米ドルに拡大すると予測され、予測期間にCAGRで8.3%の成長が見込まれます。

eコマースの急増、IoTやオートメーションの進行、非接触の業務への需要、効率的な在庫管理へのニーズ、政府の支援策などが市場を牽引しています。しかし、高い初期費用、レガシーシステム統合の問題、熟練労働者の不足、データセキュリティ上の懸念、不透明なROIが成長を抑制しています。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2020年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 単位 | 10億米ドル |

| セグメント | 提供、倉庫規模、技術、業界 |

| 対象地域 | 北米、欧州、アジア太平洋、中東・アフリカ、ラテンアメリカ |

「自律走行搬送ロボットセグメントが予測期間にもっとも速い成長率となります。」

自律走行搬送ロボット(AMR)は、その柔軟性と拡張性、そして固定式のインフラなしに動的な倉庫環境で動作する能力により、スマート倉庫市場でもっとも速く成長すると予測されています。従来の自動システムとは異なり、AMRは先進のセンサーとAIを使用してリアルタイムのナビゲーションを行い、人間の作業員とのシームレスな連携とレイアウト変更への迅速な適応を可能にします。AMRの展開により、手作業が大幅に削減され、ピッキングや仕分けの効率が向上し、安全性が高まります。eコマースとオンデマンドロジスティクスが拡大するにつれ、高速で費用対効果が高く、容易に展開できるオートメーションソリューションへのニーズが高まり、世界の倉庫でAMRの採用がさらに加速するとみられます。

「倉庫管理システムセグメントが予測期間に最大の市場シェアを占めます。」

倉庫管理システム(WMS)ソフトウェアは、倉庫業務の最適化と指揮において中心的な役割を果たすため、スマート倉庫市場で最大の市場シェアを占めると予測されています。WMSは、リアルタイムの在庫追跡、効率的な注文処理、労務管理、ロボットやIoTデバイスなどの他のデジタルツールとの統合を可能にします。サプライチェーンが複雑化し、スピードと正確性に対する顧客の期待が高まるにつれて、企業は可視性の向上、運用コストの削減、意思決定の向上を実現するWMSへの依存度を高めています。その拡張性と業界を超えた適応性により、WMSはスマート倉庫エコシステムの基盤技術となっています。

「北米が早期採用とインフラで優位に立つ一方、アジア太平洋はイノベーションとeコマースブームでリードしています。」

北米は、先進技術の早期採用、ロジスティクス・eコマースの主要企業の強いプレゼンス、オートメーションとデジタルトランスフォーメーションへの多額の投資により、スマート倉庫市場で最大の市場シェアを占めると予測されます。同地域は確立されたインフラと高度に熟練した労働力からも恩恵を受けています。一方、アジア太平洋はeコマースの急速な拡大、効率的なサプライチェーン経営に対する需要の高まり、スマートインフラを支援する政府の取り組みの増加などにより、もっとも高い成長率が見込まれています。中国やインドなどの新興経済国は、競争力を強化し、労働力への依存を減らし、消費者の需要の増加に対応するため、スマート倉庫を積極的に採用しています。

当レポートでは、世界のスマート倉庫市場について調査分析し、主な促進要因と抑制要因、競合情勢、将来の動向などの情報を提供しています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 主な調査結果

- スマート倉庫市場の企業にとって魅力的な機会

- スマート倉庫市場:自動システム別

- 北米のスマート倉庫市場:提供別、倉庫規模別

- スマート倉庫市場:地域別

第5章 市場の概要と産業動向

- イントロダクション

- 市場力学

- イントロダクション

- 促進要因

- 抑制要因

- 機会

- 課題

- スマート倉庫の進化

- スマート倉庫市場:エコシステム分析

- ケーススタディ分析

- サプライチェーン分析

- 規制情勢

- 価格分析

- 主要企業の平均販売価格の動向:製品別(2025年)

- 平均販売価格:ソフトウェア別(2025年)

- 技術分析

- 主要技術

- 隣接技術

- 補完技術

- 特許分析

- ポーターのファイブフォース分析

- 主なステークホルダーと購入基準

- 顧客ビジネスに影響を与える動向/混乱

- 主な会議とイベント(2025年~2026年)

- 貿易分析

- 輸出シナリオ

- 輸入シナリオ

- 投資と資金調達のシナリオ

- スマート倉庫市場における生成AIの影響

- 主なユースケースと市場の可能性

- ベストプラクティス

- 生成AI実装のケーススタディ

- クライアントの準備度と影響の評価

- 2025年の米国関税の影響 - スマート倉庫市場

- イントロダクション

- 主な関税率

- 価格の影響の分析

- 国/地域に対する影響

- 最終用途産業に対する影響

第6章 スマート倉庫市場:提供別

- イントロダクション

- 自動システム

- ロボットシステム

- 自動保管・回収システム

- 自動識別・データ収集

- コンベア・ソーター

- ソフトウェア

- 輸送管理システム

- 倉庫管理システム

- 注文管理ソフトウェア

第7章 スマート倉庫ソフトウェア市場:展開方式別

- イントロダクション

- クラウド

- オンプレミス

第8章 スマート倉庫ソフトウェア市場、サービス

- イントロダクション

- プロフェッショナルサービス

- トレーニング・コンサルティング

- システム統合・実装

- サポート・メンテナンス

- マネージドサービス

第9章 スマート倉庫市場:技術別

- イントロダクション

- IoT

- ロボティクス・オートメーション

- AI

- ブロックチェーン

- ビッグデータ・アナリティクス

第10章 スマート倉庫市場:倉庫規模別

- イントロダクション

- 小

- 中

- 大

第11章 スマート倉庫市場:業界別

- イントロダクション

- 輸送・ロジスティクス

- サードパーティロジスティクス

- 貨物運送業者

- ラストマイル配送業者

- 製造

- 医療・ライフサイエンス

- 食品・飲料

- 小売・eコマース

- その他の業界

第12章 スマート倉庫市場:地域別

- イントロダクション

- 北米

- 北米のスマート倉庫市場の促進要因

- 北米のマクロ経済の見通し

- 米国

- カナダ

- 欧州

- 欧州のスマート倉庫市場の促進要因

- 欧州のマクロ経済の見通し

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- アジア太平洋のスマート倉庫市場の促進要因

- アジア太平洋のマクロ経済の見通し

- 中国

- 日本

- インド

- 韓国

- オーストラリア・ニュージーランド

- ASEAN

- その他のアジア太平洋

- 中東・アフリカ

- 中東・アフリカのスマート倉庫市場の促進要因

- 中東・アフリカのマクロ経済の見通し

- 中東

- アフリカ

- ラテンアメリカ

- ラテンアメリカのスマート倉庫市場の促進要因

- ラテンアメリカのマクロ経済の見通し

- ブラジル

- メキシコ

- アルゼンチン

- その他のラテンアメリカ

第13章 競合情勢

- 概要

- 主要参入企業の戦略/強み(2022年~2025年)

- 収益分析(2020年~2024年)

- 市場シェア分析(2024年)

- ブランド/製品の比較分析

- 製品の比較分析:ソフトウェアベンダー別

- ブランドの比較分析:自動システムベンダー別

- 企業の評価と財務指標

- 企業の評価マトリクス:主要企業(2024年)

- 企業の評価マトリクス:スタートアップ/中小企業(2024年)

- 競合シナリオ

第14章 企業プロファイル

- イントロダクション

- 主要企業

- MANHATTAN ASSOCIATES

- KORBER

- ORACLE

- SAP

- DEMATIC (KION GROUP)

- PSI GROUP

- SAMSUNG SDS

- REPLY

- INFOR

- IBM

- BLUE YONDER

- TECSYS

- GENERIX GROUP

- MICROLISTICS

- ABB

- MICROSOFT

- EPICOR

- MADE4NET

- MANTIS

- SOFTEON

- SYNERGY LOGISTICS

- E2OPEN

- VINCULUM

- MECALUX

- SSI SCHAEFER

- HONEYWELL

- SWISSLOG (KUKA)

- DAIFUKU

- その他の主要企業

- WAREIQ

- FOYSONIS

- INCREFF

- LOCUS ROBOTICS

- SHIPHERO

- CIN7 ORDERHIVE

- EASYECOM

- UNICOMMERCE

- ONWARD ROBOTICS

- LOGIWA

- GREYORANGE

- RIGHTHAND ROBOTICS

- MAGAZINO

- COVARIANT

- ATTABOTICS

- GEEK+

- NOMAGIC

- PLUS ONE ROBOTICS

第15章 隣接市場と関連市場

- イントロダクション

- ロジスティクスオートメーション市場 - 世界の予測(~2029年)

- 市場の定義

- 市場の概要

- サプライチェーンアナリティクス市場 - 世界の予測(~2027年)

- 市場の定義

- 市場の概要

第16章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2020-2024

- TABLE 2 LIST OF PRIMARY PARTICIPANTS

- TABLE 3 GLOBAL SMART WAREHOUSING MARKET SIZE AND GROWTH RATE, 2020-2024 (USD MILLION, Y-O-Y %)

- TABLE 4 GLOBAL SMART WAREHOUSING MARKET SIZE AND GROWTH RATE, 2025-2030 (USD MILLION, Y-O-Y %)

- TABLE 5 SMART WAREHOUSING MARKET: ROLE OF PLAYERS IN ECOSYSTEM

- TABLE 6 NORTH AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 7 EUROPE: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 8 ASIA PACIFIC: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 9 MIDDLE EAST & AFRICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 10 LATIN AMERICA: LIST OF REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING, 2025

- TABLE 12 AVERAGE SELLING PRICE, BY SOFTWARE, 2025

- TABLE 13 LIST OF KEY PATENTS

- TABLE 14 PORTER FIVE FORCES' IMPACT ON SMART WAREHOUSING MARKET

- TABLE 15 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- TABLE 16 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- TABLE 17 SMART WAREHOUSING MARKET: DETAILED LIST OF KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 18 EXPORT DATA FOR HS CODE 8428, BY KEY COUNTRY, 2017-2024

- TABLE 19 IMPORT DATA FOR HS CODE 8428, BY KEY COUNTRY, 2017-2024

- TABLE 20 TABLE 1: US ADJUSTED RECIPROCAL TARIFF RATES

- TABLE 21 SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 22 SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 23 AUTOMATED SYSTEMS: SMART WAREHOUSING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 24 AUTOMATED SYSTEMS: SMART WAREHOUSING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 25 AUTOMATED SYSTEMS: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 26 AUTOMATED SYSTEMS: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 27 ROBOTICS SYSTEMS: SMART WAREHOUSING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 28 ROBOTICS SYSTEMS: SMART WAREHOUSING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 29 SOFTWARE: SMART WAREHOUSING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 30 SOFTWARE: SMART WAREHOUSING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 31 TMS: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 32 TMS: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 33 WMS: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 34 WMS: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 35 OMS: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 36 OMS: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 37 SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 38 SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 39 CLOUD: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 40 CLOUD: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 41 ON-PREMISES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 42 ON-PREMISES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 43 SERVICES: SMART WAREHOUSING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 44 SERVICES: SMART WAREHOUSING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 45 SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 46 SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 47 PROFESSIONAL SERVICES: SMART WAREHOUSING MARKET, BY TYPE, 2020-2024 (USD MILLION)

- TABLE 48 PROFESSIONAL SERVICES: SMART WAREHOUSING MARKET, BY TYPE, 2025-2030 (USD MILLION)

- TABLE 49 PROFESSIONAL SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 50 PROFESSIONAL SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 51 TRAINING & CONSULTING SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 52 TRAINING & CONSULTING SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 53 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 54 SYSTEM INTEGRATION & IMPLEMENTATION SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 55 SUPPORT & MAINTENANCE SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 56 SUPPORT & MAINTENANCE SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 57 MANAGED SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 58 MANAGED SERVICES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 59 SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 60 SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 61 IOT: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 62 IOT: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 63 ROBOTICS AND AUTOMATION: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 64 ROBOTICS AND AUTOMATION: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 65 AI TECHNOLOGY: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 66 AI TECHNOLOGY: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 67 BLOCKCHAIN: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 68 BLOCKCHAIN: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 69 BIG DATA & ANALYTICS: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 70 BIG DATA & ANALYTICS: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 71 SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2020-2024 (USD MILLION)

- TABLE 72 SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2025-2030 (USD MILLION)

- TABLE 73 SMALL: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 74 SMALL: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 75 MEDIUM: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 76 MEDIUM: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 77 LARGE: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 78 LARGE: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 79 SMART WAREHOUSING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 80 SMART WAREHOUSING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 81 SMART WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 82 SMART WAREHOUSING MARKET, BY TRANSPORTATION & LOGISTICS, 2025-2030 (USD MILLION)

- TABLE 83 TRANSPORTATION & LOGISTICS: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 84 TRANSPORTATION & LOGISTICS: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 85 MANUFACTURING: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 86 MANUFACTURING: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 87 HEALTHCARE & LIFE SCIENCES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 88 HEALTHCARE & LIFE SCIENCES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 89 FOOD AND BEVERAGES: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 90 FOOD AND BEVERAGES: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 91 RETAIL & E-COMMERCE: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 92 RETAIL & E-COMMERCE: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 93 OTHER VERTICALS: SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 94 OTHER VERTICALS: SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 95 SMART WAREHOUSING MARKET, BY REGION, 2020-2024 (USD MILLION)

- TABLE 96 SMART WAREHOUSING MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 97 NORTH AMERICA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 98 NORTH AMERICA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 99 NORTH AMERICA: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2020-2024 (USD MILLION)

- TABLE 100 NORTH AMERICA: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 101 NORTH AMERICA: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2020-2024 USD MILLION)

- TABLE 102 NORTH AMERICA: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 103 NORTH AMERICA: SMART WAREHOUSING MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 104 NORTH AMERICA: SMART WAREHOUSING MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 105 NORTH AMERICA: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 106 NORTH AMERICA: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 107 NORTH AMERICA: SMART WAREHOUSING MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 108 NORTH AMERICA: SMART WAREHOUSING MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 109 NORTH AMERICA: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 110 NORTH AMERICA: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 111 NORTH AMERICA: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2020-2024 (USD MILLION)

- TABLE 112 NORTH AMERICA: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2025-2030 (USD MILLION)

- TABLE 113 NORTH AMERICA: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 114 NORTH AMERICA: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 115 NORTH AMERICA: SMART WAREHOUSING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 116 NORTH AMERICA: SMART WAREHOUSING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 117 NORTH AMERICA: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 118 NORTH AMERICA: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2025-2030 (USD MILLION)

- TABLE 119 NORTH AMERICA: SMART WAREHOUSING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 120 NORTH AMERICA: SMART WAREHOUSING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 121 US: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 122 US: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 123 CANADA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 124 CANADA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 125 EUROPE: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 126 EUROPE: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 127 EUROPE: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2020-2024 (USD MILLION)

- TABLE 128 EUROPE: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 129 EUROPE: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2020-2024 USD MILLION)

- TABLE 130 EUROPE: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 131 EUROPE: SMART WAREHOUSING MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 132 EUROPE: SMART WAREHOUSING MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 133 EUROPE: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 134 EUROPE: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 135 EUROPE: SMART WAREHOUSING MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 136 EUROPE: SMART WAREHOUSING MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 137 EUROPE: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 138 EUROPE: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 139 EUROPE: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2020-2024 (USD MILLION)

- TABLE 140 EUROPE: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2025-2030 (USD MILLION)

- TABLE 141 EUROPE: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 142 EUROPE: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 143 EUROPE: SMART WAREHOUSING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 144 EUROPE: SMART WAREHOUSING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 145 EUROPE: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 146 EUROPE: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2025-2030 (USD MILLION)

- TABLE 147 EUROPE: SMART WAREHOUSING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 148 EUROPE: SMART WAREHOUSING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 149 UK: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 150 UK: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 151 GERMANY: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 152 GERMANY: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 153 FRANCE: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 154 FRANCE: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 155 ITALY: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 156 ITALY: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 157 SPAIN: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 158 SPAIN: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 159 REST OF EUROPE: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 160 REST OF EUROPE: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 161 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 162 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 163 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2020-2024 (USD MILLION)

- TABLE 164 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 165 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2020-2024 USD MILLION)

- TABLE 166 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 167 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 168 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 169 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 170 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 171 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 172 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 173 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 174 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 175 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2020-2024 (USD MILLION)

- TABLE 176 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2025-2030 (USD MILLION)

- TABLE 177 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 178 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 179 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 180 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 181 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 182 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2025-2030 (USD MILLION)

- TABLE 183 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 184 ASIA PACIFIC: SMART WAREHOUSING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 185 CHINA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 186 CHINA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 187 JAPAN: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 188 JAPAN: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 189 INDIA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 190 INDIA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 191 SOUTH KOREA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 192 SOUTH KOREA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 193 AUSTRALIA & NEW ZEALAND: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 194 AUSTRALIA & NEW ZEALAND: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 195 ASEAN: SMART WAREHOUSING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 196 ASEAN: SMART WAREHOUSING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 197 ASEAN: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 198 ASEAN: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 199 REST OF ASIA PACIFIC: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 200 REST OF ASIA PACIFIC: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 201 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 202 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 203 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2020-2024 (USD MILLION)

- TABLE 204 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 205 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2020-2024 USD MILLION)

- TABLE 206 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 207 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 208 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 209 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 210 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 211 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 212 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 213 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 214 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 215 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2020-2024 (USD MILLION)

- TABLE 216 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2025-2030 (USD MILLION)

- TABLE 217 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 218 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 219 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 220 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 221 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 222 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2025-2030 (USD MILLION)

- TABLE 223 MIDDLE EAST: SMART WAREHOUSING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 224 MIDDLE EAST: SMART WAREHOUSING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 225 SAUDI ARABIA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 226 SAUDI ARABIA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 227 UAE: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 228 UAE: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 229 QATAR: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 230 QATAR: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 231 TURKEY: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 232 TURKEY: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 233 REST OF MIDDLE EAST: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 234 REST OF MIDDLE EAST: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 235 AFRICA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 236 AFRICA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 237 LATIN AMERICA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 238 LATIN AMERICA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 239 LATIN AMERICA: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2020-2024 (USD MILLION)

- TABLE 240 LATIN AMERICA: SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 241 LATIN AMERICA: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2020-2024 USD MILLION)

- TABLE 242 LATIN AMERICA: SMART WAREHOUSING MARKET, BY ROBOTIC SYSTEMS, 2025-2030 (USD MILLION)

- TABLE 243 LATIN AMERICA: SMART WAREHOUSING MARKET, BY SOFTWARE, 2020-2024 (USD MILLION)

- TABLE 244 LATIN AMERICA: SMART WAREHOUSING MARKET, BY SOFTWARE, 2025-2030 (USD MILLION)

- TABLE 245 LATIN AMERICA: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2020-2024 (USD MILLION)

- TABLE 246 LATIN AMERICA: SMART WAREHOUSING MARKET, BY DEPLOYMENT MODE, 2025-2030 (USD MILLION)

- TABLE 247 LATIN AMERICA: SMART WAREHOUSING MARKET, BY SERVICES, 2020-2024 (USD MILLION)

- TABLE 248 LATIN AMERICA: SMART WAREHOUSING MARKET, BY SERVICES, 2025-2030 (USD MILLION)

- TABLE 249 LATIN AMERICA: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2020-2024 (USD MILLION)

- TABLE 250 LATIN AMERICA: SMART WAREHOUSING MARKET, BY PROFESSIONAL SERVICES, 2025-2030 (USD MILLION)

- TABLE 251 LATIN AMERICA: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2020-2024 (USD MILLION)

- TABLE 252 LATIN AMERICA: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE, 2025-2030 (USD MILLION)

- TABLE 253 LATIN AMERICA: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2020-2024 (USD MILLION)

- TABLE 254 LATIN AMERICA: SMART WAREHOUSING MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 255 LATIN AMERICA: SMART WAREHOUSING MARKET, BY VERTICAL, 2020-2024 (USD MILLION)

- TABLE 256 LATIN AMERICA: SMART WAREHOUSING MARKET, BY VERTICAL, 2025-2030 (USD MILLION)

- TABLE 257 LATIN AMERICA: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2020-2024 (USD MILLION)

- TABLE 258 LATIN AMERICA: SMART WAREHOUSING MARKET, BY TRANSPORTATION AND LOGISTICS, 2025-2030 (USD MILLION)

- TABLE 259 LATIN AMERICA: SMART WAREHOUSING MARKET, BY COUNTRY, 2020-2024 (USD MILLION)

- TABLE 260 LATIN AMERICA: SMART WAREHOUSING MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 261 BRAZIL: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 262 BRAZIL: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 263 MEXICO: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 264 MEXICO: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 265 ARGENTINA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 266 ARGENTINA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 267 REST OF LATIN AMERICA: SMART WAREHOUSING MARKET, BY OFFERING, 2020-2024 (USD MILLION)

- TABLE 268 REST OF LATIN AMERICA: SMART WAREHOUSING MARKET, BY OFFERING, 2025-2030 (USD MILLION)

- TABLE 269 OVERVIEW OF STRATEGIES ADOPTED BY KEY SMART WAREHOUSING VENDORS, 2022-2025

- TABLE 270 SMART WAREHOUSING MARKET: DEGREE OF COMPETITION

- TABLE 271 SMART WAREHOUSING MARKET: REGION FOOTPRINT

- TABLE 272 SMART WAREHOUSING MARKET: OFFERING FOOTPRINT

- TABLE 273 SMART WAREHOUSING MARKET: TECHNOLOGY FOOTPRINT

- TABLE 274 SMART WAREHOUSING MARKET: VERTICAL FOOTPRINT

- TABLE 275 SMART WAREHOUSING MARKET: KEY STARTUPS/SMES, 2024

- TABLE 276 SMART WAREHOUSING MARKET: COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES, 2024

- TABLE 277 SMART WAREHOUSING MARKET: PRODUCT LAUNCHES AND ENHANCEMENTS, MARCH 2020-MAY 2025

- TABLE 278 SMART WAREHOUSING MARKET: DEALS, MARCH 2020-MAY 2025

- TABLE 279 MANHATTAN ASSOCIATES: BUSINESS OVERVIEW

- TABLE 280 MANHATTAN ASSOCIATES: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 281 MANHATTAN ASSOCIATES: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 282 MANHATTAN ASSOCIATES: DEALS

- TABLE 283 KORBER: BUSINESS OVERVIEW

- TABLE 284 KORBER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 285 KORBER: DEALS

- TABLE 286 ORACLE: BUSINESS OVERVIEW

- TABLE 287 ORACLE: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 288 ORACLE: DEALS

- TABLE 289 SAP: BUSINESS OVERVIEW

- TABLE 290 SAP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 291 SAP: DEALS

- TABLE 292 DEMATIC (KION GROUP): BUSINESS OVERVIEW

- TABLE 293 DEMATIC (KION GROUP): PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 294 DEMATIC (KION GROUP): DEALS

- TABLE 295 PSI GROUP: BUSINESS OVERVIEW

- TABLE 296 PSI GROUP: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 297 PSI GROUP: DEALS

- TABLE 298 SAMSUNG SDS: BUSINESS OVERVIEW

- TABLE 299 SAMSUNG SDS: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 300 SAMSUNG SDS: DEALS

- TABLE 301 REPLY: BUSINESS OVERVIEW

- TABLE 302 REPLY: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 303 REPLY: DEALS

- TABLE 304 INFOR: BUSINESS OVERVIEW

- TABLE 305 INFOR: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 306 INFOR: DEALS

- TABLE 307 IBM: BUSINESS OVERVIEW

- TABLE 308 IBM: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 309 IBM: PRODUCT LAUNCHES AND ENHANCEMENTS

- TABLE 310 IBM: DEALS

- TABLE 311 BLUE YONDER: BUSINESS OVERVIEW

- TABLE 312 BLUE YONDER: PRODUCTS/SOLUTIONS/SERVICES OFFERED

- TABLE 313 BLUE YONDER: DEALS

- TABLE 314 LOGISTICS AUTOMATION MARKET, BY OFFERING, 2019-2023 (USD MILLION)

- TABLE 315 LOGISTICS AUTOMATION MARKET, BY OFFERING, 2024-2029 (USD MILLION)

- TABLE 316 SOFTWARE: LOGISTICS AUTOMATION MARKET, BY DEPLOYMENT MODE, 2019-2023 (USD MILLION)

- TABLE 317 SOFTWARE: LOGISTICS AUTOMATION MARKET, BY DEPLOYMENT MODE, 2024-2029 (USD MILLION)

- TABLE 318 LOGISTICS AUTOMATION MARKET, BY LOGISTICS TYPE, 2019-2023 (USD MILLION)

- TABLE 319 LOGISTICS AUTOMATION MARKET, BY LOGISTICS TYPE, 2024-2029 (USD MILLION)

- TABLE 320 LOGISTICS AUTOMATION MARKET, BY TECHNOLOGY, 2019-2023 (USD MILLION)

- TABLE 321 LOGISTICS AUTOMATION MARKET, BY TECHNOLOGY, 2024-2029 (USD MILLION)

- TABLE 322 LOGISTICS AUTOMATION MARKET, BY ENTERPRISE TYPE, 2019-2023 (USD MILLION)

- TABLE 323 LOGISTICS AUTOMATION MARKET, BY ENTERPRISE TYPE, 2024-2029 (USD MILLION)

- TABLE 324 LOGISTICS AUTOMATION MARKET, BY REGION, 2019-2023 (USD MILLION)

- TABLE 325 LOGISTICS AUTOMATION MARKET, BY REGION, 2024-2029 (USD MILLION)

- TABLE 326 SUPPLY CHAIN ANALYTICS MARKET, BY OFFERING, 2016-2021 (USD BILLION)

- TABLE 327 SUPPLY CHAIN ANALYTICS MARKET, BY OFFERING, 2022-2027 (USD BILLION)

- TABLE 328 SUPPLY CHAIN ANALYTICS MARKET, BY TECHNOLOGY, 2016-2021 (USD BILLION)

- TABLE 329 SUPPLY CHAIN ANALYTICS MARKET, BY TECHNOLOGY, 2022-2027 (USD BILLION)

- TABLE 330 SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2016-2021 (USD BILLION)

- TABLE 331 SUPPLY CHAIN ANALYTICS MARKET, BY DEPLOYMENT MODE, 2022-2027 (USD BILLION)

- TABLE 332 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY ORGANIZATION, 2016-2021 (USD BILLION)

- TABLE 333 SUPPLY CHAIN ANALYTICS MARKET SIZE, BY ORGANIZATION, 2022-2027 (USD BILLION)

- TABLE 334 SUPPLY CHAIN ANALYTICS MARKET, BY BUSINESS FUNCTION, 2016-2021 (USD BILLION)

- TABLE 335 SUPPLY CHAIN ANALYTICS MARKET, BY BUSINESS FUNCTION, 2022-2027 (USD BILLION)

- TABLE 336 SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2016-2021 (USD BILLION)

- TABLE 337 SUPPLY CHAIN ANALYTICS MARKET, BY VERTICAL, 2022-2027 (USD BILLION)

- TABLE 338 SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2016-2021 (USD BILLION)

- TABLE 339 SUPPLY CHAIN ANALYTICS MARKET, BY REGION, 2022-2027 (USD BILLION)

List of Figures

- FIGURE 1 SMART WAREHOUSING MARKET: RESEARCH DESIGN

- FIGURE 2 BREAKDOWN OF PRIMARY INTERVIEWS, BY COMPANY TYPE, DESIGNATION, AND REGION

- FIGURE 3 SMART WAREHOUSING MARKET: TOP-DOWN AND BOTTOM-UP APPROACHES

- FIGURE 4 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 1 (SUPPLY SIDE): REVENUE OF VENDORS IN SMART WAREHOUSING MARKET

- FIGURE 5 MARKET SIZE ESTIMATION METHODOLOGY - APPROACH 2 (DEMAND SIDE): SMART WAREHOUSING MARKET

- FIGURE 6 MARKET SIZE ESTIMATION METHODOLOGY: DEMAND-SIDE ANALYSIS

- FIGURE 7 MARKET SIZE ESTIMATION USING BOTTOM-UP APPROACH

- FIGURE 8 SMART WAREHOUSING MARKET: DATA TRIANGULATION

- FIGURE 9 AUTOMATED SYSTEMS SEGMENT TO DOMINATE MARKET IN 2025

- FIGURE 10 ROBOTICS & AUTOMATION TO HOLD LARGEST MARKET SHARE IN 2025

- FIGURE 11 LARGE WAREHOUSE SIZE SEGMENT TO LEAD MARKET IN 2025

- FIGURE 12 HEALTHCARE & LIFE SCIENCES TO HOLD HIGHEST GROWTH RATE IN 2025

- FIGURE 13 ASIA PACIFIC TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 14 CONVERGENCE OF IOT AND 5G ACCELERATING WAREHOUSE INTELLIGENCE TO DRIVE MARKET

- FIGURE 15 AUTOMATIC IDENTIFICATION & DATA COLLECTION SEGMENT TO GROW AT HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 16 AUTOMATED SYSTEMS AND LARGE WAREHOUSE SIZE SEGMENTS TO DOMINATE MARKET IN NORTH AMERICA IN 2025

- FIGURE 17 NORTH AMERICA TO HOLD LARGEST MARKET SHARE IN 2025

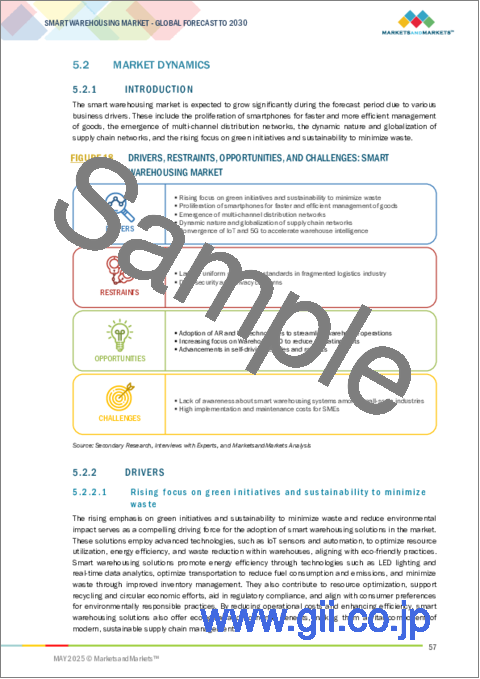

- FIGURE 18 DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES: SMART WAREHOUSING MARKET

- FIGURE 19 EVOLUTION: SMART WAREHOUSING

- FIGURE 20 SMART WAREHOUSING MARKET ECOSYSTEM

- FIGURE 21 SMART WAREHOUSING MARKET: SUPPLY CHAIN ANALYSIS

- FIGURE 22 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING, 2025

- FIGURE 23 LIST OF KEY PATENTS FOR SMART WAREHOUSING, 2015-2025

- FIGURE 24 SMART WAREHOUSING MARKET: PORTER'S FIVE FORCES ANALYSIS

- FIGURE 25 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS FOR TOP THREE VERTICALS

- FIGURE 26 KEY BUYING CRITERIA FOR TOP THREE VERTICALS

- FIGURE 27 SMART WAREHOUSING MARKET: TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 28 EXPORT SCENARIO FOR HS CODE 8428, BY KEY COUNTRY, 2017-2024

- FIGURE 29 IMPORT VALUE FOR HS CODE 8428IMPORT, BY KEY COUNTRY, 2017-2024

- FIGURE 30 INVESTMENT AND FUNDING SCENARIO, 2019-2024 (USD MILLION)

- FIGURE 31 MARKET POTENTIAL OF GENERATIVE AI IN ENHANCING SMART WAREHOUSING ACROSS VARIOUS TYPES OF SOLUTIONS

- FIGURE 32 GENERATIVE AI BEST PRACTICES ACROSS MAJOR INDUSTRIES

- FIGURE 33 SMART WAREHOUSING SERVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 34 AUTOMATIC IDENTIFICATION & DATA COLLECTION SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 35 AUTONOMOUS MOBILE ROBOTS SEGMENT TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 36 TRANSPORT MANAGEMENT SYSTEMS TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 37 3PL TO RECORD HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 38 CLOUD DEPLOYMENT SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 39 MANAGED SERVICES SEGMENT TO RECORD HIGHER CAGR DURING FORECAST PERIOD

- FIGURE 40 SUPPORT & MAINTENANCE SERVICES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 41 ROBOTICS & AUTOMATION SEGMENT TO HOLD LARGEST MARKET SHARE DURING FORECAST PERIOD

- FIGURE 42 SMALL WAREHOUSES TO REGISTER HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 43 HEALTHCARE AND LIFE SCIENCES VERTICAL TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 44 3PL VERTICAL TO WITNESS HIGHEST GROWTH DURING FORECAST PERIOD

- FIGURE 45 NORTH AMERICA TO BE LARGEST REGIONAL MARKET DURING FORECAST PERIOD

- FIGURE 46 INDIA TO WITNESS FASTEST GROWTH DURING FORECAST PERIOD

- FIGURE 47 NORTH AMERICA: SMART WAREHOUSING MARKET SNAPSHOT

- FIGURE 48 ASIA PACIFIC: SMART WAREHOUSING MARKET SNAPSHOT

- FIGURE 49 SMART WAREHOUSING MARKET: REVENUE ANALYSIS OF KEY PLAYERS, 2020-2024

- FIGURE 50 SMART WAREHOUSING MARKET SHARE ANALYSIS, 2024

- FIGURE 51 PRODUCT COMPARATIVE ANALYSIS, BY SOFTWARE VENDORS

- FIGURE 52 BRAND COMPARATIVE ANALYSIS, BY AUTOMATED SYSTEM VENDORS

- FIGURE 53 FINANCIAL METRICS OF KEY VENDORS

- FIGURE 54 YEAR-TO-DATE (YTD) PRICE TOTAL RETURN AND 5-YEAR STOCK BETA OF KEY VENDORS

- FIGURE 55 SMART WAREHOUSING MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 56 SMART WAREHOUSING MARKET: COMPANY FOOTPRINT

- FIGURE 57 SMART WAREHOUSING MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 58 MANHATTAN ASSOCIATES: COMPANY SNAPSHOT

- FIGURE 59 ORACLE: COMPANY SNAPSHOT

- FIGURE 60 SAP: COMPANY SNAPSHOT

- FIGURE 61 PSI GROUP: COMPANY SNAPSHOT

- FIGURE 62 SAMSUNG SDS: COMPANY SNAPSHOT

- FIGURE 63 REPLY: COMPANY SNAPSHOT

- FIGURE 64 IBM: COMPANY SNAPSHOT

The smart warehousing market is expanding rapidly, with a projected market size rising from USD 31.21 billion in 2025 to USD 46.42 billion by 2030, at a CAGR of 8.3% during the forecast period. The market is driven by the surge in e-commerce, advancements in IoT and automation, demand for contactless operations, need for efficient inventory management, and supportive government initiatives. However, high initial costs, legacy system integration issues, skilled labor shortages, data security concerns, and uncertain ROI restrain growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Billion) |

| Segments | Offering, Warehouse Size, Technology, and Vertical |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

"Autonomous mobile robots segment to account for the fastest growth rate during the forecast period"

Autonomous mobile robots (AMRs) are expected to witness the fastest growth in the smart warehousing market due to their flexibility, scalability, and ability to operate in dynamic warehouse environments without fixed infrastructure. Unlike traditional automated systems, AMRs use advanced sensors and AI for real-time navigation, enabling seamless collaboration with human workers and quick adaptation to layout changes. Their deployment significantly reduces manual labor, improves picking and sorting efficiency, and enhances safety. As e-commerce and on-demand logistics expand, the need for high-speed, cost-effective, and easily deployable automation solutions will further accelerate AMR adoption across global warehouses.

"Warehouse management system segment to hold the largest market share during the forecast period"

Warehouse management system (WMS) software is expected to hold the largest market share in the smart warehousing market due to its central role in optimizing and orchestrating warehouse operations. WMS enables real-time inventory tracking, efficient order fulfillment, labor management, and integration with other digital tools such as robotics and IoT devices. As supply chains become more complex and customer expectations for speed and accuracy rise, businesses increasingly rely on WMS to enhance visibility, reduce operational costs, and improve decision-making. Its scalability and adaptability across industries make it a foundational technology in smart warehousing ecosystems.

"North America dominates with early adoption and infrastructure, while Asia Pacific leads with innovation and e-commerce boom"

North America is projected to hold the largest market share in the smart warehousing market due to its early adoption of advanced technologies, strong presence of leading logistics and e-commerce companies, and significant investments in automation and digital transformation. The region also benefits from a well-established infrastructure and a highly skilled workforce. Conversely, the Asia Pacific region is expected to witness the fastest growth rate, driven by rapid e-commerce expansion, rising demand for efficient supply chain operations, and increasing government initiatives supporting smart infrastructure. Emerging economies such as China and India are aggressively adopting smart warehousing to enhance competitiveness, reduce labor dependency, and meet growing consumer demands.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, hardware providers, system integrators, and executives from various key organizations operating in the smart warehousing market.

- By Company: Tier I - 38%, Tier II - 50%, and Tier III - 12%

- By Designation: C-Level Executives - 35%, D-Level Executives - 40%, and others - 25%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, Middle East & Africa - 5%, and Latin America - 5%

The report includes key players offering smart warehousing. It profiles major vendors such as Manhattan Associates (US), Korber (Germany), Oracle (US), SAP (Germany), Tecsys (Canada), PSI Logistics (Germany), Samsung SDS (South Korea), Reply (Italy), Infor (US), IBM (US), Blue Yonder (US), Generix Group (France), Microlistics (Australia), ABB (Switzerland), Microsoft (US), Epicor (US), Made4net (US), Mantis (Greece), Softeon (US), Synergy Logistics (UK), E2open (US), Vinculum (India), Mecalux (Spain), SSI Schaefer (Germany), Dematic (US), Honeywell (US), Swisslog (Switzerland), Daifuku (Japan), WareIQ (India), Foysonis (US), Increff (India), Locus Robotics (US), ShipHero (US), Cin7 Orderhive (New Zealand), EasyEcom (India), Unicommerce (India), IAM Robotics (US), Logiwa (US), GreyOrange (India), RightHand Robotics (US), Magazino (Germany), Covariant (US), Attabotics (Canada), Geek+ (China), Nomagic (Poland), and Plus One Robotics (US).

Research Coverage

This research report categorizes the smart warehousing market based on offering (hardware, software, services), hardware (robotic systems, storage solutions, automatic identification & data collection, conveyors & sorters), robotic systems (AGVs, AMRs, robotic picking systems, palletizing & depalletizing systems), software (warehouse management systems, transport management systems, order management software), deployment mode (cloud, on-premise) services (professional services, managed services), professional services (training & consulting, system integration & implementation, support & maintenance), warehouse size (small, medium, large), technology (robotics & automation, AI, IoT, blockchain, big data analytics), vertical (transportation & logistics, retail & e-commerce, manufacturing, healthcare & life sciences, food & beverages, other verticals), transportation & logistics (3PL, freight forwarders, last-mile delivery providers), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the smart warehousing market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers and acquisitions; and recent developments associated with the smart warehousing market. This report also covers the competitive analysis of upcoming startups in the smart warehousing market ecosystem.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall smart warehousing market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising focus on green initiatives and sustainability to minimize waste, Proliferation of smartphones for faster and more efficient management of goods, emergence of multi-channel distribution networks, dynamic nature and globalization of supply chain networks), restraints (lack of uniform governance standards in the fragmented logistics industry, Data security and privacy concerns), opportunities (adoption of AR and VR technologies to streamline warehouse operations, rising focus on Warehouse 4.0 to reduce operating costs, advancements in self-driving vehicles and robotics), and challenges (lack of awareness among small-scale industries, high implementation and maintenance costs for SMEs).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the smart warehousing market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the smart warehousing market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the smart warehousing market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Manhattan Associates (US), Korber (Germany), Oracle (US), SAP (Germany), Tecsys (Canada), PSI Logistics (Germany), Samsung SDS (South Korea), Reply (Italy), Infor (US), IBM (US), Blue Yonder (US), Generix Group (France), Microlistics (Australia), ABB (Switzerland), Microsoft (US), Epicor (US), Made4net (US), Mantis (Greece), Softeon (US), Synergy Logistics (UK), E2open (US), Vinculum (India), Mecalux (Spain), SSI Schaefer (Germany), Dematic (US), Honeywell (US), Swisslog (Switzerland), Daifuku (Japan), WareIQ (India), Foysonis (US), Increff (India), Locus Robotics (US), ShipHero (US), Cin7 Orderhive (New Zealand), EasyEcom (India), Unicommerce (India), IAM Robotics (US), Logiwa (US), GreyOrange (India), RightHand Robotics (US), Magazino (Germany), Covariant (US), Attabotics (Canada), Geek+ (China), Nomagic (Poland), and Plus One Robotics (US), among others. The report also helps stakeholders understand the smart warehousing market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primary profiles

- 2.1.2.2 Key insights from industry experts

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 SMART WAREHOUSING MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SMART WAREHOUSING MARKET

- 4.2 SMART WAREHOUSING MARKET, BY AUTOMATED SYSTEMS

- 4.3 NORTH AMERICA: SMART WAREHOUSING MARKET, BY OFFERING AND WAREHOUSE SIZE

- 4.4 SMART WAREHOUSING MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 INTRODUCTION

- 5.2.2 DRIVERS

- 5.2.2.1 Rising focus on green initiatives and sustainability to minimize waste

- 5.2.2.2 Proliferation of smartphones for faster and efficient management of goods

- 5.2.2.3 Emergence of multi-channel distribution networks

- 5.2.2.4 Dynamic nature and globalization of supply chain networks

- 5.2.2.5 Convergence of IoT and 5G to accelerate warehouse intelligence

- 5.2.3 RESTRAINTS

- 5.2.3.1 Lack of uniform governance standards in fragmented logistics industry

- 5.2.3.2 Data security and privacy concerns

- 5.2.4 OPPORTUNITIES

- 5.2.4.1 Adoption of AR and VR technologies to streamline warehouse operations

- 5.2.4.2 Rising focus on Warehouse 4.0 to reduce operating costs

- 5.2.4.3 Advancements in self-driving vehicles and robotics

- 5.2.5 CHALLENGES

- 5.2.5.1 Lack of awareness about smart warehousing systems among small-scale industries

- 5.2.5.2 High implementation and maintenance costs for SMEs

- 5.3 EVOLUTION OF SMART WAREHOUSING

- 5.4 SMART WAREHOUSING MARKET: ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 COSTA LOGISTICS TRANSFORMS DISTRIBUTION EFFICIENCY WITH MANHATTAN ASSOCIATES' WAREHOUSE MANAGEMENT SOLUTION

- 5.5.2 NAGEL GROUP OPTIMIZES WAREHOUSE OPERATIONS USING PSIWMS AND AI-SUPPORTED LOGISTICS SOFTWARE FROM PSI GROUP

- 5.5.3 ENDRIES INTERNATIONAL AND INFOR ACHIEVE 40% WAREHOUSE-PRODUCTIVITY BOOST WITH CLOUD-BASED INFOR WMS ON AWS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 REGULATORY FRAMEWORKS

- 5.7.1.1 General Data Protection Regulation (GDPR)

- 5.7.1.2 Occupational Safety and Health Administration (OSHA)

- 5.7.1.3 Federal Motor Carrier Safety Administration (FMCSA)

- 5.7.1 REGULATORY FRAMEWORKS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY OFFERING, 2025

- 5.8.2 AVERAGE SELLING PRICE, BY SOFTWARE, 2025

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Voice recognition

- 5.9.1.2 Computer vision

- 5.9.1.3 Robotic process automation

- 5.9.1.4 Augmented Reality/Virtual Reality (AR/VR)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Cybersecurity

- 5.9.2.2 Digital twins

- 5.9.2.3 3D printing

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Cloud & edge computing

- 5.9.3.2 5G networks & connectivity

- 5.9.3.3 Predictive maintenance

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TRADE ANALYSIS

- 5.15.1 EXPORT SCENARIO

- 5.15.2 IMPORT SCENARIO

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 IMPACT OF GENERATIVE AI ON SMART WAREHOUSING MARKET

- 5.17.1 TOP USE CASES AND MARKET POTENTIAL

- 5.17.1.1 Key use cases

- 5.17.2 BEST PRACTICES

- 5.17.2.1 Retail industry

- 5.17.2.2 Automotive industry

- 5.17.2.3 Pharmaceutical infrastructure

- 5.17.3 CASE STUDIES OF GENERATIVE AI IMPLEMENTATION

- 5.17.3.1 Optimizing warehouse layouts for increased throughput

- 5.17.3.2 Real-time task scheduling for autonomous vehicles

- 5.17.3.3 Custom packaging solutions via generative AI

- 5.17.4 CLIENT READINESS AND IMPACT ASSESSMENT

- 5.17.4.1 Client A: An e-commerce enterprise

- 5.17.4.2 Client B: Healthcare supply chain enterprise

- 5.17.4.3 Client C: A global manufacturing enterprise

- 5.17.1 TOP USE CASES AND MARKET POTENTIAL

- 5.18 IMPACT OF 2025 US TARIFF - SMART WAREHOUSING MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.3.1 Strategic shifts and emerging trends

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.1.1 Strategic Shifts and Key Observations

- 5.18.4.2 China

- 5.18.4.2.1 Strategic Shifts and Key Observations

- 5.18.4.3 Europe

- 5.18.4.3.1 Strategic Shifts and Key Observations

- 5.18.4.4 Asia Pacific

- 5.18.4.4.1 Strategic Shifts and Key Observations

- 5.18.4.1 US

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Retail & eCommerce

- 5.18.5.2 Healthcare & Pharmaceuticals

- 5.18.5.3 3PL

- 5.18.5.4 Manufacturing

- 5.18.5.5 Food & Beverages

6 SMART WAREHOUSING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: SMART WAREHOUSING MARKET, BY OFFERING

- 6.2 AUTOMATED SYSTEMS

- 6.2.1 ROBOTICS SYSTEMS

- 6.2.1.1 Automated guided vehicles

- 6.2.1.1.1 Automating repetitive material transport, boosting efficiency and reducing labor dependency in warehouses

- 6.2.1.2 Automated mobile robots

- 6.2.1.2.1 Gaining prominence for flexible navigation in dynamic warehouse settings

- 6.2.1.3 Robotics picking systems

- 6.2.1.3.1 Critical for accelerating order fulfillment with improved accuracy and reduced human error

- 6.2.1.4 Palletizing & depalletizing systems

- 6.2.1.4.1 Essential for optimizing pallet handling, minimizing manual labor, and ensuring consistent load stability

- 6.2.1.1 Automated guided vehicles

- 6.2.2 AUTOMATED STORAGE & RETRIEVAL SYSTEMS

- 6.2.3 AUTOMATED IDENTIFICATION AND DATA COLLECTION

- 6.2.4 CONVEYORS AND SORTERS

- 6.2.1 ROBOTICS SYSTEMS

- 6.3 SOFTWARE

- 6.3.1 TRANSPORT MANAGEMENT SYSTEMS

- 6.3.1.1 Real-time visibility and tracking

- 6.3.1.1.1 Fundamental for supply chain transparency, enabling proactive inventory and shipment management

- 6.3.1.2 Route optimization & transportation management

- 6.3.1.2.1 Used to cut delivery times and transportation costs in complex logistics networks

- 6.3.1.3 Fleet management solutions

- 6.3.1.3.1 Maximizing vehicle utilization and improving overall transportation efficiency

- 6.3.1.4 Freight audits and payment solutions

- 6.3.1.4.1 Ensures accurate billing and reduces financial errors, saving significant operational costs

- 6.3.1.5 Load optimization

- 6.3.1.5.1 Vital for maximizing transport capacity, reducing shipping expenses, and lowering carbon footprint

- 6.3.1.1 Real-time visibility and tracking

- 6.3.2 WAREHOUSE MANAGEMENT SYSTEMS

- 6.3.2.1 Inventory management

- 6.3.2.1.1 Critical for balancing stock levels and preventing costly overstocking or shortages

- 6.3.2.2 Yard management

- 6.3.2.2.1 Increasingly important for smoothing inbound/outbound flows and reducing dock congestion

- 6.3.2.3 Shipping management

- 6.3.2.3.1 Accelerate dispatch processes and ensure timely deliveries

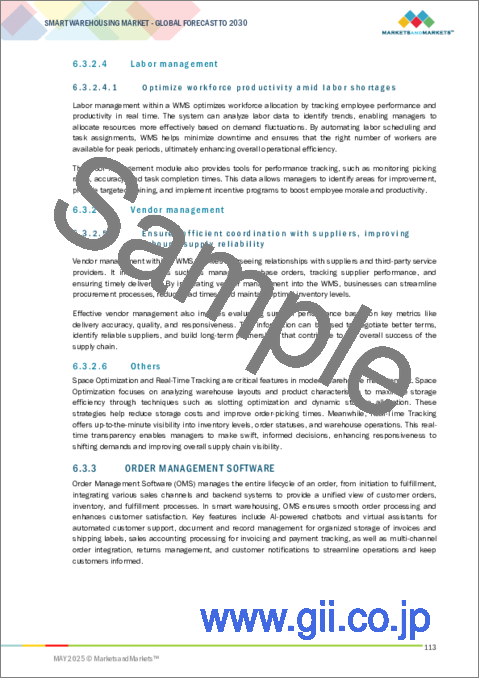

- 6.3.2.4 Labor management

- 6.3.2.4.1 Optimize workforce productivity amid labor shortages

- 6.3.2.5 Vendor management

- 6.3.2.5.1 Ensures efficient coordination with suppliers, improving inbound supply reliability

- 6.3.2.6 Others

- 6.3.2.1 Inventory management

- 6.3.3 ORDER MANAGEMENT SOFTWARE

- 6.3.3.1 Chatbots & virtual assistants

- 6.3.3.1.1 Enhance customer engagement and operational responsiveness through AI-driven automation

- 6.3.3.2 Documents & record management

- 6.3.3.2.1 Crucial for regulatory compliance and seamless warehouse operations

- 6.3.3.3 Sales accounting processing

- 6.3.3.3.1 Improves financial accuracy and expedites transaction processing in warehouse operations

- 6.3.3.4 Others

- 6.3.3.1 Chatbots & virtual assistants

- 6.3.1 TRANSPORT MANAGEMENT SYSTEMS

7 SMART WAREHOUSING SOFTWARE MARKET, BY DEPLOYMENT MODE

- 7.1 INTRODUCTION

- 7.2 CLOUD

- 7.2.1 OFFERS SCALABLE, FLEXIBLE WAREHOUSE MANAGEMENT FOR BUSINESSES SEEKING COST-EFFECTIVE AND EASILY UPDATABLE SOLUTIONS

- 7.3 ON-PREMISES

- 7.3.1 PROVIDES FULL CONTROL AND CUSTOMIZATION OF WAREHOUSE OPERATIONS WITH ENHANCED SECURITY

8 SMART WAREHOUSING SOFTWARE MARKET, SERVICES

- 8.1 INTRODUCTION

- 8.2 PROFESSIONAL SERVICES

- 8.2.1 TRAINING & CONSULTING

- 8.2.1.1 Effectively adopt and scale automation and AI-driven software technologies

- 8.2.2 SYSTEM INTEGRATION & IMPLEMENTATION

- 8.2.2.1 Seamless connectivity across robotics, WMS, and IoT platforms for end-to-end smart warehouse operations

- 8.2.3 SUPPORT & MAINTENANCE

- 8.2.3.1 Optimize performance and extend life of smart warehousing systems and infrastructure

- 8.2.1 TRAINING & CONSULTING

- 8.3 MANAGED SERVICES

9 SMART WAREHOUSING MARKET, BY TECHNOLOGY

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: SMART WAREHOUSING MARKET, BY TECHNOLOGY

- 9.2 IOT

- 9.2.1 ENABLING REAL-TIME TRACKING, PREDICTIVE MAINTENANCE, AND SMART INVENTORY SYSTEMS THROUGH CONNECTED DEVICES

- 9.3 ROBOTICS AND AUTOMATION

- 9.3.1 WITNESSING ACCELERATED ADOPTION AS WAREHOUSES STRIVE FOR HIGHER THROUGHPUT AND REDUCED ERRORS

- 9.4 AI

- 9.4.1 GAINING MOMENTUM IN SMART WAREHOUSING BY DRIVING AUTONOMOUS DECISIONS

- 9.5 BLOCKCHAIN

- 9.5.1 ENHANCING DATA INTEGRITY AND TRACEABILITY IN WAREHOUSE TRANSACTIONS AND MULTI-PARTY LOGISTICS ENVIRONMENTS

- 9.6 BIG DATA & ANALYTICS

- 9.6.1 ESSENTIAL FOR DEMAND FORECASTING AND RESOURCE OPTIMIZATION ACROSS COMPLEX WAREHOUSE OPERATIONS

10 SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE

- 10.1 INTRODUCTION

- 10.1.1 DRIVERS: SMART WAREHOUSING MARKET, BY WAREHOUSE SIZE

- 10.2 SMALL

- 10.2.1 GROWING DEMAND FOR COST-EFFECTIVE, FLEXIBLE SOLUTIONS TO DRIVE ADOPTION OF SCALABLE SMART TECHNOLOGIES IN LIMITED SPACES

- 10.3 MEDIUM

- 10.3.1 INCREASING ORDER VOLUMES AND OPERATIONAL COMPLEXITY TO FUEL INTEGRATION OF AUTOMATION AND IOT FOR ENHANCED EFFICIENCY

- 10.4 LARGE

- 10.4.1 NEED TO MANAGE VAST INVENTORIES AND OPTIMIZE COMPLEX SUPPLY CHAINS TO DRIVE INVESTMENT IN ADVANCED AUTOMATION AND AI SYSTEMS

11 SMART WAREHOUSING MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.1.1 DRIVERS: SMART WAREHOUSING MARKET, BY VERTICAL

- 11.2 TRANSPORTATION AND LOGISTICS

- 11.2.1 THIRD-PARTY LOGISTICS

- 11.2.1.1 Empowering 3PL providers to offer faster, scalable, and value-added logistics services through automation and real-time visibility

- 11.2.2 FREIGHT FORWARDERS

- 11.2.2.1 Leveraging intelligent warehousing to streamline global cargo handling and reduce transit delays

- 11.2.3 LAST-MILE DELIVERY PROVIDERS

- 11.2.3.1 Enabling last-mile delivery firms to meet rapid fulfillment demands through micro-fulfillment and real-time inventory updates

- 11.2.1 THIRD-PARTY LOGISTICS

- 11.3 MANUFACTURING

- 11.4 HEALTHCARE AND LIFE SCIENCES

- 11.5 FOOD AND BEVERAGES

- 11.6 RETAIL AND E-COMMERCE

- 11.7 OTHER VERTICALS

12 SMART WAREHOUSING MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: SMART WAREHOUSING MARKET DRIVERS

- 12.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.3 US

- 12.2.3.1 Need for faster and more efficient supply chain operations to drive market

- 12.2.4 CANADA

- 12.2.4.1 E-commerce growth and digital innovation to propel warehousing expansion

- 12.3 EUROPE

- 12.3.1 EUROPE: SMART WAREHOUSING MARKET DRIVERS

- 12.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.3 UK

- 12.3.3.1 Increasing need for efficient order fulfillment solutions to drive market

- 12.3.4 GERMANY

- 12.3.4.1 Rising focus on automation in manufacturing and logistics to fuel market

- 12.3.5 FRANCE

- 12.3.5.1 Growth in logistics and retail sectors to boost demand

- 12.3.6 ITALY

- 12.3.6.1 Leveraging strategic location to enhance logistics efficiency and technology adoption

- 12.3.7 SPAIN

- 12.3.7.1 Capitalizing on strategic location to become a logistics and tech innovation hub

- 12.3.8 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: SMART WAREHOUSING MARKET DRIVERS

- 12.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.3 CHINA

- 12.4.3.1 E-Commerce expansion to drive demand for automated and efficient warehousing

- 12.4.4 JAPAN

- 12.4.4.1 Growing e-commerce industry to boost adoption of smart warehousing solutions

- 12.4.5 INDIA

- 12.4.5.1 Rapid e-commerce growth in Tier 2 and Tier 3 cities to drive market

- 12.4.6 SOUTH KOREA

- 12.4.6.1 Accelerating smart warehousing through advanced automation and government-backed innovation to drive market

- 12.4.7 AUSTRALIA & NEW ZEALAND

- 12.4.7.1 Commitment to sustainability to encourage adoption of eco-friendly warehousing solutions

- 12.4.8 ASEAN

- 12.4.8.1 Driving smart warehousing growth through rapid e-commerce expansion and urbanization

- 12.4.9 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: SMART WAREHOUSING MARKET DRIVERS

- 12.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.5.3 MIDDLE EAST

- 12.5.3.1 Saudi Arabia

- 12.5.3.1.1 Launching advanced robotics to boost efficiency in smart warehousing

- 12.5.3.2 UAE

- 12.5.3.2.1 Implementing 5G and AGVs to transform warehouse operations

- 12.5.3.3 Qatar

- 12.5.3.3.1 Digitizing warehouse Access through national warehousing marketplace platform to drive market

- 12.5.3.4 Turkey

- 12.5.3.4.1 Expanding licensed warehousing to boost agricultural efficiency and food security

- 12.5.3.5 Rest of Middle East

- 12.5.3.1 Saudi Arabia

- 12.5.4 AFRICA

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: SMART WAREHOUSING MARKET DRIVERS

- 12.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.6.3 BRAZIL

- 12.6.3.1 Harnessing AI and Blockchain to revolutionize smart warehousing efficiency

- 12.6.4 MEXICO

- 12.6.4.1 Expansion of e-commerce accelerates demand for automated and efficient warehouse solutions

- 12.6.5 ARGENTINA

- 12.6.5.1 Accelerating digital transformation and automation to boost warehousing efficiency

- 12.6.6 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 13.3 REVENUE ANALYSIS, 2020-2024

- 13.4 MARKET SHARE ANALYSIS, 2024

- 13.5 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 13.5.1 PRODUCT COMPARATIVE ANALYSIS, BY SOFTWARE VENDORS

- 13.5.1.1 Manhattan Associates (Manhattan Active WM)

- 13.5.1.2 Oracle (Oracle Warehouse Management Cloud)

- 13.5.1.3 SAP (SAP Extended Warehouse Management - SAP EWM)

- 13.5.1.4 Infor (Infor WMS)

- 13.5.1.5 IBM (IBM Sterling Supply Chain Suite)

- 13.5.2 BRAND COMPARATIVE ANALYSIS, BY AUTOMATED SYSTEM VENDORS

- 13.5.2.1 Korber

- 13.5.2.2 ABB

- 13.5.2.3 SSI Schaefer

- 13.5.2.4 Dematic

- 13.5.2.5 Honeywell

- 13.5.1 PRODUCT COMPARATIVE ANALYSIS, BY SOFTWARE VENDORS

- 13.6 COMPANY VALUATION AND FINANCIAL METRICS

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.2.1 Offering footprint

- 13.7.5.2.2 Technology footprint

- 13.7.5.2.3 Vertical footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 MANHATTAN ASSOCIATES

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.4 MnM view

- 14.2.1.4.1 Key strengths/Right to win

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 KORBER

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.4 MnM view

- 14.2.2.4.1 Key strengths/Right to win

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 ORACLE

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.4 MnM view

- 14.2.3.4.1 Key strengths/Right to win

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 SAP

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.4 MnM view

- 14.2.4.4.1 Key strengths/Right to win

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 DEMATIC (KION GROUP)

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.4 MnM view

- 14.2.5.4.1 Key strengths/Right to win

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 PSI GROUP

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.7 SAMSUNG SDS

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.8 REPLY

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.9 INFOR

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.10 IBM

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.11 BLUE YONDER

- 14.2.11.1 Business overview

- 14.2.11.2 Products/Solutions/Services offered

- 14.2.11.3 Recent developments

- 14.2.12 TECSYS

- 14.2.13 GENERIX GROUP

- 14.2.14 MICROLISTICS

- 14.2.15 ABB

- 14.2.16 MICROSOFT

- 14.2.17 EPICOR

- 14.2.18 MADE4NET

- 14.2.19 MANTIS

- 14.2.20 SOFTEON

- 14.2.21 SYNERGY LOGISTICS

- 14.2.22 E2OPEN

- 14.2.23 VINCULUM

- 14.2.24 MECALUX

- 14.2.25 SSI SCHAEFER

- 14.2.26 HONEYWELL

- 14.2.27 SWISSLOG (KUKA)

- 14.2.28 DAIFUKU

- 14.2.1 MANHATTAN ASSOCIATES

- 14.3 OTHER KEY PLAYERS

- 14.3.1 WAREIQ

- 14.3.2 FOYSONIS

- 14.3.3 INCREFF

- 14.3.4 LOCUS ROBOTICS

- 14.3.5 SHIPHERO

- 14.3.6 CIN7 ORDERHIVE

- 14.3.7 EASYECOM

- 14.3.8 UNICOMMERCE

- 14.3.9 ONWARD ROBOTICS

- 14.3.10 LOGIWA

- 14.3.11 GREYORANGE

- 14.3.12 RIGHTHAND ROBOTICS

- 14.3.13 MAGAZINO

- 14.3.14 COVARIANT

- 14.3.15 ATTABOTICS

- 14.3.16 GEEK+

- 14.3.17 NOMAGIC

- 14.3.18 PLUS ONE ROBOTICS

15 ADJACENT AND RELATED MARKETS

- 15.1 INTRODUCTION

- 15.2 LOGISTICS AUTOMATION MARKET - GLOBAL FORECAST TO 2029

- 15.2.1 MARKET DEFINITION

- 15.2.2 MARKET OVERVIEW

- 15.2.2.1 Logistics automation market, by offering

- 15.2.2.2 Logistics automation market, software by deployment mode

- 15.2.2.3 Logistics automation market, by logistics type

- 15.2.2.4 Logistics automation market, by technology

- 15.2.2.5 Logistics automation market, by end user

- 15.2.2.6 Logistics automation market, by region

- 15.3 SUPPLY CHAIN ANALYTICS MARKET - GLOBAL FORECAST TO 2027

- 15.3.1 MARKET DEFINITION

- 15.3.2 MARKET OVERVIEW

- 15.3.2.1 Supply chain analytics market, by offering

- 15.3.2.2 Supply chain analytics market, by technology

- 15.3.2.3 Supply chain analytics market, by deployment mode

- 15.3.2.4 Supply chain analytics market, by organization size

- 15.3.2.5 Supply chain analytics market, by business function

- 15.3.2.6 Supply chain analytics market, by vertical

- 15.3.2.7 Supply chain analytics market, by region

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 AVAILABLE CUSTOMIZATIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS