|

|

市場調査レポート

商品コード

1478683

水素生成市場、シェア、規模、動向、産業分析レポート:技術別、用途別、システム別、原料別、地域別、セグメント別予測、2024年~2032年Hydrogen Generation Market Share, Size, Trends, Industry Analysis Report, By Technology (Coal Gasification, Steam Methane Reforming and Others); By Application; By System; By Source; By Region; Segment Forecast, 2024 - 2032 |

||||||

カスタマイズ可能

|

|||||||

| 水素生成市場、シェア、規模、動向、産業分析レポート:技術別、用途別、システム別、原料別、地域別、セグメント別予測、2024年~2032年 |

|

出版日: 2024年04月24日

発行: Polaris Market Research

ページ情報: 英文 120 Pages

納期: 即日から翌営業日

|

全表示

- 概要

- 図表

- 目次

Polaris Market Research社の最新調査によると、世界の水素生成市場規模は2032年までに3,648億4,000万米ドルに達する見込みです。このレポートは、現在の市場力学を詳細に洞察し、将来の市場成長に関する分析を提供しています。

航空業界では、単位質量当たりのエネルギーに関して、ジェット機で使用される燃料と比較して大きな利点があるため、水素の需要が日々増加しています。水素は単位質量あたりのエネルギーに優れており、従来から使用されているジェット燃料よりもはるかに高いです。エアバスはそのように考えています。また、航空業界は、温室効果ガスを大量に排出する航空機のために大きな批判に直面しています。気候問題を解決するためには、航空産業が使用する燃料を変える必要があり、これは、炭素排出を50%近く削減できる水素の可能性を認識することで達成できます。これが水素生成市場の原動力です。

COVID-19パンデミックは、金融機関、インフラ企業、企業、一般家庭に影響を及ぼし、水素生成市場にとって否定的な意味で大きな影響を与えています。工業メーカーの操業停止、サプライチェーンや物流サポートの障害により、水素消費需要の減少が見られました。世界中の工業地帯で電力利用が減少し、水素生成市場の縮小を招いた。

水素は、信頼性が高く、容易に入手可能で、安全で、リーズナブルなエネルギー源として、21世紀の増大するエネルギー需要を満たしながら、気候変動や地球温暖化を解決できる、カーボンフリーの燃料オプションです。水素は地球上に広く分布しているが、様々な化合物に混在しているに過ぎず、様々な方法で製造することができます。しかし、熱化学水分解サイクル(TWSC)は、電気化学反応と熱化学反応を繰り返して水から水素を製造するために、電気と熱エネルギーを使用します。この方法は、市販の水電解システムよりもはるかに少ない電力しか使用しないです。したがって、商業的・技術的な障壁を解決するためには、水素生成技術を拡大する戦略や、より経済的・効率的でカーボンフリーの水素生成プロセスを構築することが不可欠です。

水素生成市場レポートハイライト

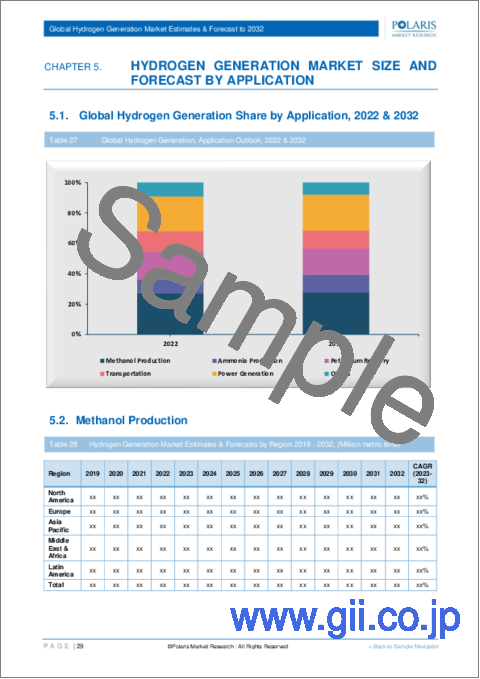

アンモニア製造セグメントは、再生可能水素の大規模製造に使用できる水素キャリアと炭素料金燃料の可能性により、2023年の市場を独占しました。

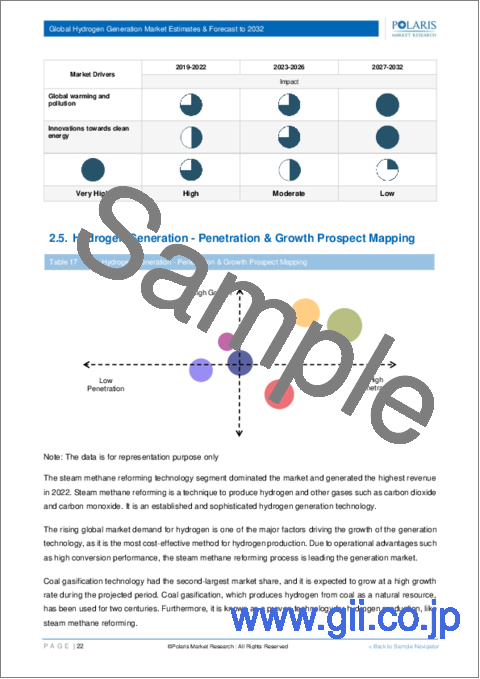

水蒸気メタン改質セグメントは2023年に市場をリードし、水素生成手順における技術革新の高まりにより優位性を維持すると予想されます。

アジア太平洋地域は、世界の水素生成市場において圧倒的な収益シェアを占めており、この地域諸国の政府によって実施される膨大な研究開発活動がその原動力となっています。

目次

第1章 イントロダクション

第2章 エグゼクティブサマリー

第3章 調査手法

第4章 世界の水素生成市場の洞察

- 水素生成- 業界スナップショット

- 水素生成市場力学

- 促進要因と機会

- 工業化の進展とインフラの発展が水素生成市場の需要を牽引している

- 持続可能なエネルギーへの重点のシフトが市場拡大を後押ししています。

- 抑制要因と課題

- 高価な貯蔵タンクは水素生成市場の成長を制限する可能性がある

- 促進要因と機会

- PESTLE分析

- 水素発電業界の動向

- バリューチェーン分析

- COVID-19の影響分析

第5章 世界の水素生成市場:技術別

- 主な調査結果

- イントロダクション

- 石炭ガス化

- 水蒸気メタン改質

- その他

第6章 世界の水素生成市場:用途別

- 主な調査結果

- イントロダクション

- 発電

- 輸送機関

- 石油精製

- アンモニア生産

- メタノール製造

- その他

第7章 世界の水素生成市場:システム別

- 主な調査結果

- イントロダクション

- キャプティブ

- マーチャント

第8章 世界の水素生成市場:原料別

- 主な調査結果

- イントロダクション

- 水

- バイオマス

- 石炭

- 天然ガス

第9章 世界の水素生成市場:地域別

- 主な調査結果

- イントロダクション

- 水素生成市場の評価:地域別、2019-2032年

- 北米

- 北米:技術別、2019-2032年

- 北米:原料別、2019-2032年

- 北米:用途別、2019-2032年

- 北米:システム別、2019-2032年

- 米国

- カナダ

- 欧州

- 欧州:技術別、2019-2032年

- 欧州:原料別、2019-2032年

- 欧州:用途別、2019-2032年

- 欧州:システム別、2019-2032

- 英国

- フランス

- ドイツ

- イタリア

- スペイン

- オランダ

- ロシア

- アジア太平洋地域

- アジア太平洋地域:技術別、2019-2032年

- アジア太平洋地域:原料別、2019-2032年

- アジア太平洋地域:用途別、2019-2032年

- アジア太平洋地域:システム別、2019-2032年

- 中国

- インド

- 日本

- マレーシア

- インドネシア

- 韓国

- 中東・アフリカ

- 中東・アフリカ:技術別、2019年~2032年

- 中東・アフリカ:原料別、2019-2032年

- 中東およびアフリカ:用途別、2019-2032年

- 中東・アフリカ:システム別、2019-2032年

- サウジアラビア

- 南アフリカ

- イスラエル

- アラブ首長国連邦

- ラテンアメリカ

- ラテンアメリカ:技術別、2019-2032年

- ラテンアメリカ:原料別、2019-2032年

- ラテンアメリカ:用途別、2019-2032年

- ラテンアメリカ:システム別、2019-2032年

- メキシコ

- ブラジル

- アルゼンチン

第10章 競合情勢

- 拡大と買収の分析

- 拡大

- 買収

- 提携/協業/合意/公開

第11章 企業プロファイル

- Air Liquide S.A

- Cummins Inc

- Total Energies

- ITM Power

- Air Products and Chemicals, Inc

- FuelCell Energy, Inc

- Iwatani Corporation

- The Messer Group GmbH

- Taiyo Nippon Sanso Corporation

- Linde Plc

- Uniper SE

- Green Hydrogen Systems

- Hydrogenics Corporation

- Tokyo Gas Chemical Co., Ltd

- INOX Air Products Ltd.

List of Tables

- Table 1 Global Hydrogen Generation Market, by Technology, by Region, 2019-2032 (USD Billion)

- Table 2 Global Hydrogen Generation Market, by Application, by Region, 2019-2032 (USD Billion)

- Table 3 Global Hydrogen Generation Market, by System, by Region, 2019-2032 (USD Billion)

- Table 4 Global Hydrogen Generation Market, by Source, by Region, 2019-2032 (USD Billion)

- Table 5 Hydrogen Generation Market Assessment, By Geography, 2019-2032 (USD Billion)

- Table 6 North America: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 7 North America: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 8 North America: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 9 North America: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 10 U.S.: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 11 U.S.: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 12 U.S.: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 13 U.S.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 14 Canada: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 15 Canada: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 16 Canada: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 17 Canada: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 18 Europe: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 19 Europe: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 20 Europe: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 21 Europe: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 22 Germany: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 23 Germany: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 24 Germany: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 25 Germany: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 26 France: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 27 France: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 28 France: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 29 France: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 30 UK: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 31 UK: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 32 UK: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 33 UK: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 34 Italy: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 35 Italy: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 36 Italy: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 37 Italy: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 38 Netherlands: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 39 Netherlands: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 40 Netherlands: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 41 Netherlands: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 42 Spain: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 43 Spain: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 44 Spain: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 45 Spain: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 46 Russia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 47 Russia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 48 Russia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 49 Russia: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 50 Asia Pacific: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 51 Asia Pacific: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 52 Asia Pacific: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 53 Asia Pacific: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 54 China: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 55 China: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 56 China: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 57 China: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 58 Japan: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 59 Japan: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 60 Japan: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 61 Japan: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 62 India: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 63 India: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 64 India: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 65 India: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 66 Indonesia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 67 Indonesia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 68 Indonesia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 69 Indonesia: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 70 Malaysia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 71 Malaysia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 72 Malaysia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 73 Malaysia: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 74 South Korea: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 75 South Korea: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 76 South Korea: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 77 South Korea: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 78 Latin America: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 79 Latin America: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 80 Latin America: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 81 Latin America: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 82 Brazil: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 83 Brazil: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 84 Brazil: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 85 Brazil: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 86 Mexico: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 87 Mexico: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 88 Mexico: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 89 Mexico: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 90 Argentina: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 91 Argentina: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 92 Argentina: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 93 Argentina: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 94 Middle East & Africa: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 95 Middle East & Africa: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 96 Middle East & Africa: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 97 Middle East & Africa: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 98 UAE: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 99 UAE: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 100 UAE: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 101 UAE: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 102 Saudi Arabia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 103 Saudi Arabia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 104 Saudi Arabia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 105 Saudi Arabia: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 106 South Africa: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 107 South Africa: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 108 South Africa: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 109 South Africa: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- Table 110 Israel: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- Table 111 Israel: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- Table 112 Israel: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- Table 113 Israel: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

List of Figures

- Figure 1. Global Hydrogen Generation Market, 2019-2032 (USD Billion)

- Figure 2. Integrated Ecosystem

- Figure 3. Research Methodology: Top-Down & Bottom-Up Source

- Figure 4. Market by Geography

- Figure 5. Porter's Five Forces

- Figure 6. Market by Technology

- Figure 7. Global Hydrogen Generation Market, by Technology, 2021 & 2030 (USD Billion)

- Figure 8. Market by Source

- Figure 9. Global Hydrogen Generation Market, by Source, 2021 & 2030 (USD Billion)

- Figure 10. Market by Application

- Figure 11. Global Hydrogen Generation Market, by Application, 2021 & 2030 (USD Billion)

- Figure 12. Market by System

- Figure 13. Global Hydrogen Generation Market, by System, 2021 & 2030 (USD Billion)

The global hydrogen generation market size is expected to reach USD 364.84 billion by 2032, according to a new study by Polaris Market Research. The report "Hydrogen Generation Market Share, Size, Trends, Industry Analysis Report, By Technology (Coal Gasification, Steam Methane Reforming and Others); By Application; By System; By Source; By Region; Segment Forecast, 2024- 2032" gives a detailed insight into current market dynamics and provides analysis on future market growth.

In the context of the aviation industry, the demand for hydrogen is increasing day by day due to huge advantages in comparison to the fuel used in jets regarding the energy per unit mass. Hydrogen has good energy per unit mass, which is greatly higher than jet fuel, which is used traditionally. Airbus makes such a consideration. Also, the aviation industry has faced huge levels of criticism due to its aircraft, which are greenhouse gas-intensive. To resolve the climatic issues, there must be a change in the fuel used by the aviation industry, and this can be achieved by recognizing the potential of hydrogen, which can also reduce carbon emissions by nearly 50%. This is the driving factor for the hydrogen generation market.

The COVID-19 pandemic has profoundly impacted in a negative sense for the hydrogen generation market, as this has affected financial institutions, infrastructure companies, businesses, and households. In such a way that fall in demand for hydrogen consumption was observed due to shutdown of industrial manufacturers and disturbance in the supply chain and logistics support. The power utilization was reduced in industrial areas all over the world, and this caused the shrinkage to the hydrogen generation market.

As a huge opportunity to be a dependable, easily available, safe, and reasonably priced energy source, hydrogen is a viable carbon-free fuel option that can solve climate change and global warming while meeting the 21st century's increasing energy demands. It is widely distributed on Earth, although only in mixed form in various compounds, and it can be made in a variety of ways. However, thermochemical water splitting cycles (TWSC) use electricity and heat energy to produce hydrogen from water through a series of electrochemical and thermochemical reactions; this method uses a lot less power than commercial water electrolysis systems. Thus, it is essential to create strategies to scale up hydrogen generation technologies as well as more economical, efficient, and carbon-free hydrogen generation processes to solve the commercial and technical barriers.

Hydrogen Generation Market Report Highlights

The ammonia production segment dominated the market in 2023, driven by the potential of hydrogen carriers and carbon-fee fuel, which can be used in the large-scale production of renewable hydrogen.

The steam methane reforming segment led the market in 2023 and is expected to maintain its dominance due to rising innovations in hydrogen-generating procedures.

Asia Pacific holds a dominant revenue share in the global Hydrogen Generation market, driven by the huge amounts of research and development activities conducted by the governments of regional countries.

The global key market players include Air Liquide S.A., Cummins Inc., Nel ASA, ITM Power, Linde plc, Air Products and Chemicals, Inc., FuelCell Energy, Inc., Iwatani Corporation, Showa Denko, The Messer Group GmbH, Taiyo Nippon Sanso Corporation, McPhy, Engie SA, Uniper SE,

Polaris Market Research has segmented the Hydrogen Generation market report based on technology, application, system, source and region:

Hydrogen Generation, Technology Outlook (Revenue - USD Million, 2019 - 2032)

- Coal Gasification

- Steam Methane Reforming

- Others

Hydrogen Generation, Application Outlook (Revenue - USD Million, 2019 - 2032)

- Power Generation

- Transportation

- Petroleum Refining

- Ammonia Production

- Methanol Production

- Others

Hydrogen Generation, System Outlook (Revenue - USD Million, 2019 - 2032)

- Captive

- Merchant

Hydrogen Generation, Source Outlook (Revenue - USD Million, 2019 - 2032)

- Water

- Biomass

- Coal

- Natural Gas

Hydrogen Generation, Regional Outlook (Revenue - USD Million, 2019 - 2032)

- North America

- U.S.

- Canada

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific

- China

- India

- Japan

- South Korea

- Indonesia

- Malaysia

- Australia

- Rest of Asia Pacific

- Latin America

- Argentina

- Brazil

- Mexico

- Rest of Latin America

- Middle East & Africa

- UAE

- Saudi Arabia

- Israel

- South Africa

- Rest of Middle East & Africa

Table of Contents

1. Introduction

- 1.1. Report Description

- 1.1.1. Objectives of the Study

- 1.1.2. Market Scope

- 1.1.3. Assumptions

- 1.2. Stakeholders

2. Executive Summary

- 2.1. Market Highlights

3. Research Methodology

- 3.1. Overview

- 3.1.1. Data Mining

- 3.2. Data Sources

- 3.2.1. Primary Sources

- 3.2.2. Secondary Sources

4. Global Hydrogen Generation Market Insights

- 4.1. Hydrogen Generation - Industry Snapshot

- 4.2. Hydrogen Generation Market Dynamics

- 4.2.1. Drivers and Opportunities

- 4.2.1.1. Rising industrialization and development of infrastructure is driving the demand for hydrogen generation market

- 4.2.1.2. Focusing shift on sustainable energy is boosting the market expansion.

- 4.2.2. Restraints and Challenges

- 4.2.2.1. The expensive storage tanks can limit the growth for hydrogen generation market

- 4.2.1. Drivers and Opportunities

- 4.3. Porter's Five Forces Analysis

- 4.3.1. Bargaining Power of Suppliers (Moderate)

- 4.3.2. Threats of New Entrants: (Low)

- 4.3.3. Bargaining Power of Buyers (Moderate)

- 4.3.4. Threat of Substitute (Moderate)

- 4.3.5. Rivalry among existing firms (High)

- 4.4. PESTLE Analysis

- 4.5. Hydrogen Generation Industry Trends

- 4.6. Value Chain Analysis

- 4.7. COVID-19 Impact Analysis

5. Global Hydrogen Generation Market, by Technology

- 5.1. Key Findings

- 5.2. Introduction

- 5.2.1. Global Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 5.3. Coal Gasification

- 5.3.1. Global Hydrogen Generation Market, by Coal Gasification, by Region, 2019-2032 (USD Billion)

- 5.4. Steam Methane Reforming

- 5.4.1. Global Hydrogen Generation Market, by Steam Methane Reforming, by Region, 2019-2032 (USD Billion)

- 5.5. Others

- 5.5.1. Global Hydrogen Generation Market, by Others, by Region, 2019-2032 (USD Billion)

6. Global Hydrogen Generation Market, by Application

- 6.1. Key Findings

- 6.2. Introduction

- 6.2.1. Global Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 6.3. Power Generation

- 6.3.1. Global Hydrogen Generation Market, by Power Generation, by Region, 2019-2032 (USD Billion)

- 6.4. Transportation

- 6.4.1. Global Hydrogen Generation Market, by Transportation, by Region, 2019-2032 (USD Billion)

- 6.5. Petroleum Refining

- 6.5.1. Global Hydrogen Generation Market, by Petroleum Refining, by Region, 2019-2032 (USD Billion)

- 6.6. Ammonia Production

- 6.6.1. Global Hydrogen Generation Market, by Ammonia Production, by Region, 2019-2032 (USD Billion)

- 6.7. Methanol Production

- 6.7.1. Global Hydrogen Generation Market, by Methanol Production, by Region, 2019-2032 (USD Billion)

- 6.8. Others

- 6.8.1. Global Hydrogen Generation Market, by Others, by Region, 2019-2032 (USD Billion)

7. Global Hydrogen Generation Market, by System

- 7.1. Key Findings

- 7.2. Introduction

- 7.2.1. Global Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 7.3. Captive

- 7.3.1. Global Hydrogen Generation Market, by Captive, by Region, 2019-2032 (USD Billion)

- 7.4. Merchant

- 7.4.1. Global Hydrogen Generation Market, by Merchant, by Region, 2019-2032 (USD Billion)

8. Global Hydrogen Generation Market, by Source

- 8.1. Key Findings

- 8.2. Introduction

- 8.2.1. Global Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 8.3. Water

- 8.3.1. Global Hydrogen Generation Market, by Water, by Region, 2019-2032 (USD Billion)

- 8.4. Biomass

- 8.4.1. Global Hydrogen Generation Market, by Biomass, by Region, 2019-2032 (USD Billion)

- 8.5. Coal

- 8.5.1. Global Hydrogen Generation Market, by Coal, by Region, 2019-2032 (USD Billion)

- 8.6. Natural Gas

- 8.6.1. Global Hydrogen Generation Market, by Natural Gas, by Region, 2019-2032 (USD Billion)

9. Global Hydrogen Generation Market, by Geography

- 9.1. Key findings

- 9.2. Introduction

- 9.2.1. Hydrogen Generation Market Assessment, By Geography, 2019-2032 (USD Billion)

- 9.3. Hydrogen Generation Market - North America

- 9.3.1. North America: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.3.2. North America: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.3.3. North America: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.3.4. North America: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.3.5. Hydrogen Generation Market - U.S.

- 9.3.5.1. U.S.: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.3.5.2. U.S.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.3.5.3. U.S.: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.3.5.4. U.S.: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.3.6. Hydrogen Generation Market - Canada

- 9.3.6.1. Canada: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.3.6.2. Canada: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.3.6.3. Canada: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.3.6.4. Canada: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4. Hydrogen Generation Market - Europe

- 9.4.1. Europe: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.2. Europe: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.3. Europe: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.4. Europe: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4.5. Hydrogen Generation Market - UK

- 9.4.5.1. UK: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.5.2. UK: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.5.3. UK: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.5.4. UK: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4.6. Hydrogen Generation Market - France

- 9.4.6.1. France: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.6.2. France: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.6.3. France: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.6.4. France: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4.7. Hydrogen Generation Market - Germany

- 9.4.7.1. Germany: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.7.2. Germany: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.7.3. Germany: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.7.4. Germany: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4.8. Hydrogen Generation Market - Italy

- 9.4.8.1. Italy: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.8.2. Italy: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.8.3. Italy: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.8.4. Italy: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4.9. Hydrogen Generation Market - Spain

- 9.4.9.1. Spain: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.9.2. Spain: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.9.3. Spain: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.9.4. Spain: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4.10. Hydrogen Generation Market - Netherlands

- 9.4.10.1. Netherlands: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.10.2. Netherlands: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.10.3. Netherlands: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.10.4. Netherlands: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.4.11. Hydrogen Generation Market - Russia

- 9.4.11.1. Russia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.4.11.2. Russia.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.4.11.3. Russia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.4.11.4. Russia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.5. Hydrogen Generation Market - Asia Pacific

- 9.5.1. Asia Pacific: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.5.2. Asia Pacific: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.5.3. Asia Pacific: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.5.4. Asia Pacific: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.5.5. Hydrogen Generation Market - China

- 9.5.5.1. China: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.5.5.2. China.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.5.5.3. China: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.5.5.4. China: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.5.6. Hydrogen Generation Market - India

- 9.5.6.1. India: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.5.6.2. India.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.5.6.3. India: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.5.6.4. India: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.5.7. Hydrogen Generation Market - Japan

- 9.5.7.1. Japan: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.5.7.2. Japan.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.5.7.3. Japan: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.5.7.4. Japan: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.5.8. Hydrogen Generation Market - Malaysia

- 9.5.8.1. Malaysia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.5.8.2. Malaysia.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.5.8.3. Malaysia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.5.8.4. Malaysia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.5.9. Hydrogen Generation Market - Indonesia

- 9.5.9.1. Indonesia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.5.9.2. Indonesia.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.5.9.3. Indonesia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.5.9.4. Indonesia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.5.10. Hydrogen Generation Market - South Korea

- 9.5.10.1. South Korea: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.5.10.2. South Korea.: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.5.10.3. South Korea: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.5.10.4. South Korea: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.6. Hydrogen Generation Market - Middle East & Africa

- 9.6.1. Middle East & Africa: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.6.2. Middle East & Africa: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.6.3. Middle East & Africa: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.6.4. Middle East & Africa: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.6.5. Hydrogen Generation Market - Saudi Arabia

- 9.6.5.1. Saudi Arabia: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.6.5.2. Saudi Arabia: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.6.5.3. Saudi Arabia: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.6.5.4. Saudi Arabia: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.6.6. Hydrogen Generation Market - South Africa

- 9.6.6.1. South Africa: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.6.6.2. South Africa: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.6.6.3. South Africa: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.6.6.4. South Africa: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.6.7. Hydrogen Generation Market - Israel

- 9.6.7.1. Israel: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.6.7.2. Israel: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.6.7.3. Israel: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.6.7.4. Israel: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.6.8. Hydrogen Generation Market - UAE

- 9.6.8.1. UAE: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.6.8.2. UAE: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.6.8.3. UAE: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.6.8.4. UAE: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.7. Hydrogen Generation Market - Latin America

- 9.7.1. Latin America: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.7.2. Latin America: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.7.3. Latin America: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.7.4. Latin America: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.7.5. Hydrogen Generation Market - Mexico

- 9.7.5.1. Mexico: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.7.5.2. Mexico: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.7.5.3. Mexico: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.7.5.4. Mexico: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.7.6. Hydrogen Generation Market - Brazil

- 9.7.6.1. Brazil: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.7.6.2. Brazil: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.7.6.3. Brazil: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.7.6.4. Brazil: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

- 9.7.7. Hydrogen Generation Market - Argentina

- 9.7.7.1. Argentina: Hydrogen Generation Market, by Technology, 2019-2032 (USD Billion)

- 9.7.7.2. Argentina: Hydrogen Generation Market, by Source, 2019-2032 (USD Billion)

- 9.7.7.3. Argentina: Hydrogen Generation Market, by Application, 2019-2032 (USD Billion)

- 9.7.7.4. Argentina: Hydrogen Generation Market, by System, 2019-2032 (USD Billion)

10. Competitive Landscape

- 10.1. Expansion and Acquisition Analysis

- 10.1.1. Expansion

- 10.1.2. Acquisitions

- 10.2. Partnerships/Collaborations/Agreements/Exhibitions

11. Company Profiles

- 11.1. Air Liquide S.A

- 11.1.1. Company Overview

- 11.1.2. Financial Performance

- 11.1.3. Product Benchmarking

- 11.1.4. Recent Development

- 11.2. Cummins Inc

- 11.2.1. Company Overview

- 11.2.2. Financial Performance

- 11.2.3. Product Benchmarking

- 11.2.4. Recent Development

- 11.3. Total Energies

- 11.3.1. Company Overview

- 11.3.2. Financial Performance

- 11.3.3. Product Benchmarking

- 11.3.4. Recent Development

- 11.4. ITM Power

- 11.4.1. Company Overview

- 11.4.2. Financial Performance

- 11.4.3. Product Benchmarking

- 11.4.4. Recent Development

- 11.5. Air Products and Chemicals, Inc

- 11.5.1. Company Overview

- 11.5.2. Financial Performance

- 11.5.3. Product Benchmarking

- 11.5.4. Recent Development

- 11.6. FuelCell Energy, Inc

- 11.6.1. Company Overview

- 11.6.2. Financial Performance

- 11.6.3. Product Benchmarking

- 11.6.4. Recent Development

- 11.7. Iwatani Corporation

- 11.7.1. Company Overview

- 11.7.2. Financial Performance

- 11.7.3. Product Benchmarking

- 11.7.4. Recent Development

- 11.8. The Messer Group GmbH

- 11.8.1. Company Overview

- 11.8.2. Financial Performance

- 11.8.3. Product Benchmarking

- 11.8.4. Recent Development

- 11.9. Taiyo Nippon Sanso Corporation

- 11.9.1. Company Overview

- 11.9.2. Financial Performance

- 11.9.3. Product Benchmarking

- 11.9.4. Recent Development

- 11.10. Linde Plc

- 11.10.1. Company Overview

- 11.10.2. Financial Performance

- 11.10.3. Product Benchmarking

- 11.10.4. Recent Development

- 11.11. Uniper SE

- 11.11.1. Company Overview

- 11.11.2. Financial Performance

- 11.11.3. Product Benchmarking

- 11.11.4. Recent Development

- 11.12. Green Hydrogen Systems

- 11.12.1. Company Overview

- 11.12.2. Financial Performance

- 11.12.3. Product Benchmarking

- 11.12.4. Recent Development

- 11.13. Hydrogenics Corporation

- 11.13.1. Company Overview

- 11.13.2. Financial Performance

- 11.13.3. Product Benchmarking

- 11.13.4. Recent Development

- 11.14. Tokyo Gas Chemical Co., Ltd

- 11.14.1. Company Overview

- 11.14.2. Financial Performance

- 11.14.3. Product Benchmarking

- 11.14.4. Recent Development

- 11.15. INOX Air Products Ltd.

- 11.15.1. Company Overview

- 11.15.2. Financial Performance

- 11.15.3. Product Benchmarking

- 11.15.4. Recent Development