|

|

市場調査レポート

商品コード

1757417

格安航空会社の世界市場の評価、航空会社モデル別、航路タイプ別、収益源別、顧客層別、地域別、機会、予測、2018~2032年Global Low-Cost Carrier Market Assessment, By Carrier Model, By Route Type, By Revenue Stream, By Customer Segment, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 格安航空会社の世界市場の評価、航空会社モデル別、航路タイプ別、収益源別、顧客層別、地域別、機会、予測、2018~2032年 |

|

出版日: 2025年06月27日

発行: Markets & Data

ページ情報: 英文 240 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の格安航空会社(LCC)市場は、2025~2032年の予測期間中にCAGR 7.45%を記録し、2024年の2,314億3,000万米ドルから2032年には4,112億2,000万米ドルに成長すると予測されています。格安航空会社(LCC)は、手頃な価格と運航の効率性を重視することで世界中の航空旅行に変化をもたらし、世界の市場成長を牽引しています。LCCは、片道、直行便、ポイントツーポイントの航空券を販売するために(フルサービスではなく)アメニティや価格を下げ、運航頻度を増やすことで、あらゆるタイプの旅行者に手頃な価格で旅行を提供し、運航活動、ひいては航空機の稼働率を最大化しています。

さらに、LCC はデジタルプラットフォームを利用して航空券を予約し、二次空港まで飛行することで、諸経費とターンタイムを削減します。LCCは、付帯収入、手荷物料金、プレミアム座席、機内販売などに加え、旅客航空会社に典型的な基本運賃を超える追加の収益を生み出しました。アジアや南米だけでなく、新興市場における中間層の爆発的な増加により、需要はLCCを路線網の拡大へと駆り立て、より低運賃の旅行の選択肢としてダイナミックな価格設定モデルを追求するようになりました。パンデミック後の回復局面では、旅行者がより低価格の旅行オプションを求めるため、航空旅行の需要が大幅に増加し、予測期間中の市場成長を牽引しています。航空旅行は常に変化しており、LCCは航空業界の持続的な成長のために、より多くの超低運賃、ロイヤリティプログラム、ハイブリッドビジネスモデルを獲得し、余剰キャパシティを確保しています。

例えば、2025年1月、Tata Group傘下のインドの格安航空会社(LCC)、Air India Express (IX)は、2024年に22の国際都市ペア路線を追加しました。Air India Expressは、プーケット便の就航で東南アジアでの存在感の強化を計画していました。この拡大は、国際的な足跡を強化し、新興市場の機会を捉えるという航空会社の集中的な努力を反映しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国の関税の影響

第4章 エグゼクティブサマリー

第5章 お客様の声

- 回答者の人口統計

- ブランド認知度

- コスト効率

- 燃費

第6章 世界の格安航空会社(LCC)市場の展望、2018~2032年

- 市場規模分析と予測

- 金額別

- 市場シェア分析と予測

- 航空会社モデル別

- 超低価格(ULCC)

- 格安

- 地域航空

- 航路タイプ別

- 短距離(1,000マイル未満)

- 中距離(1,000~3,000マイル)

- 国際線

- 収益源別

- チケット料金

- 付属品(手荷物、座席、機内食)

- 顧客層別

- レジャー旅行者

- ビジネス旅行者

- 学生/青少年

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業別市場シェア分析(上位5社およびその他- 金額別、2024年)

- 航空会社モデル別

- 市場マップ分析、2024年

- 航空会社モデル別

- 航路タイプ別

- 収益源別

- 顧客層別

- 地域別

第7章 北米の格安航空会社(LCC)市場の展望、2018~2032年

- 市場規模分析と予測

- 金額別

- 市場シェア分析と予測

- 航空会社モデル別

- 超低価格(ULCC)

- 格安

- 地域航空

- 航路タイプ別

- 短距離(1,000マイル未満)

- 中距離(1,000~3,000マイル)

- 国際線

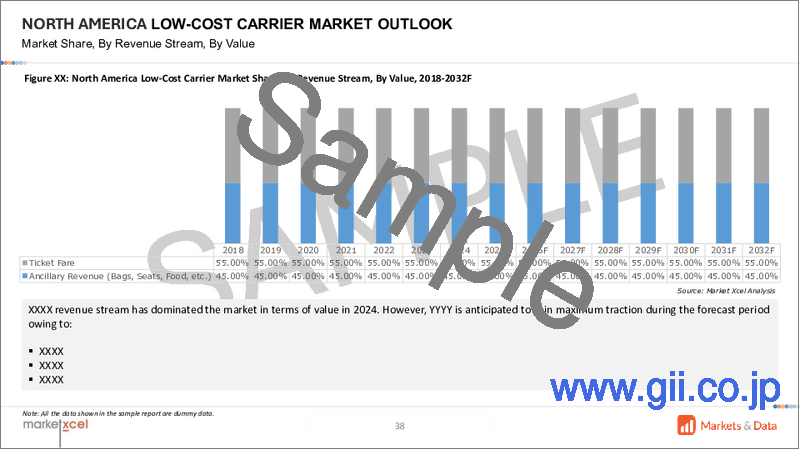

- 収益源別

- チケット料金

- 付属品(手荷物、座席、機内食)

- 顧客層別

- レジャー旅行者

- ビジネス旅行者

- 学生/青少年

- 国別シェア

- 米国

- カナダ

- メキシコ

- 航空会社モデル別

- 国別市場評価

- 米国の格安航空会社(LCC)市場展望、2018~2032年*

- 市場規模分析と予測

- 市場シェア分析と予測

- 米国の格安航空会社(LCC)市場展望、2018~2032年*

- カナダ

- メキシコ

すべてのセグメントは、対象となるすべての地域と国に提供されます。

第8章 欧州の格安航空会社(LCC)市場の展望、2018~2032年

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第9章 アジア太平洋の格安航空会社(LCC)市場の展望、2018~2032年

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第10章 南米の格安航空会社(LCC)市場の展望、2018~2032年

- ブラジル

- アルゼンチン

第11章 中東・アフリカの格安航空会社(LCC)市場の展望、2018~2032年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第12章 ポーターのファイブフォース分析

第13章 PESTLE分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場動向と発展

第16章 政策と規制状況

第17章 ケーススタディ

第18章 競合情勢

- 市場リーダー上位5社の競合マトリックス

- トップ5プレーヤーのSWOT分析

- 市場トップ10の主要企業の情勢

- AirAsia Berhad

- 会社概要

- 主要経営陣

- 製品

- 財務

- 主要市場への注力と地理的プレゼンス

- 最近の動向/コラボレーション/ パートナーシップ/合併と買収

- Ryanair DAC

- InterGlobe Aviation Ltd.

- Scoot Pte Ltd

- Southwest Airlines Co.

- Eurowings GmbH

- Dubai Aviation Corporation

- Virgin Australia Airlines Pty Ltd

- JetBlue Airways Corporation

- Spirit Airlines Inc.

上記の企業は市場シェアに応じて注文を保留するものではなく、調査作業中に入手可能な情報に応じて変更される可能性があります。

第19章 戦略的提言

第20章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 3. Global Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 4. Global Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 5. Global Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 6. Global Low-Cost Carrier (LCC) Market Share (%), By Region, 2018-2032F

- Figure 7. North America Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 8. North America Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 9. North America Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 10. North America Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 11. North America Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 12. North America Low-Cost Carrier (LCC) Market Share (%), By Country, 2018-2032F

- Figure 13. United States Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 14. United States Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 15. United States Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 16. United States Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 17. United States Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 18. Canada Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 19. Canada Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 20. Canada Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 21. Canada Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 22. Canada Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 23. Mexico Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 24. Mexico Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 25. Mexico Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 26. Mexico Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 27. Mexico Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 28. Europe Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 29. Europe Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 30. Europe Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 31. Europe Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 32. Europe Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 33. Europe Low-Cost Carrier (LCC) Market Share (%), By Country, 2018-2032F

- Figure 34. Germany Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 35. Germany Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 36. Germany Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 37. Germany Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 38. Germany Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 39. France Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 40. France Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 41. France Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 42. France Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 43. France Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 44. Italy Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 45. Italy Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 46. Italy Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 47. Italy Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 48. Italy Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 49. United Kingdom Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 50. United Kingdom Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 51. United Kingdom Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 52. United Kingdom Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 53. United Kingdom Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 54. Russia Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 55. Russia Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 56. Russia Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 57. Russia Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 58. Russia Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 59. Netherlands Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 60. Netherlands Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 61. Netherlands Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 62. Netherlands Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 63. Netherlands Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 64. Spain Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 65. Spain Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 66. Spain Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 67. Spain Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 68. Spain Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 69. Turkey Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 70. Turkey Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 71. Turkey Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 72. Turkey Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 73. Turkey Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 74. Poland Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 75. Poland Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 76. Poland Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 77. Poland Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 78. Poland Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 79. South America Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 80. South America Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 81. South America Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 82. South America Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 83. South America Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 84. South America Low-Cost Carrier (LCC) Market Share (%), By Country, 2018-2032F

- Figure 85. Brazil Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 86. Brazil Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 87. Brazil Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 88. Brazil Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 89. Brazil Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 90. Argentina Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 91. Argentina Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 92. Argentina Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 93. Argentina Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 94. Argentina Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 95. Asia-Pacific Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 96. Asia-Pacific Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 97. Asia-Pacific Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 98. Asia-Pacific Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 99. Asia-Pacific Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 100. Asia-Pacific Low-Cost Carrier (LCC) Market Share (%), By Country, 2018-2032F

- Figure 101. India Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 102. India Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 103. India Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 104. India Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 105. India Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 106. China Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 107. China Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 108. China Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 109. China Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 110. China Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 111. Japan Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 112. Japan Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 113. Japan Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 114. Japan Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 115. Japan Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 116. Australia Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 117. Australia Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 118. Australia Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 119. Australia Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 120. Australia Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 121. Vietnam Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 122. Vietnam Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 123. Vietnam Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 124. Vietnam Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 125. Vietnam Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 126. South Korea Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 127. South Korea Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 128. South Korea Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 129. South Korea Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 130. South Korea Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 131. Indonesia Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 132. Indonesia Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 133. Indonesia Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 134. Indonesia Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 135. Indonesia Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 136. Philippines Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 137. Philippines Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 138. Philippines Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 139. Philippines Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 140. Philippines Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 141. Middle East & Africa Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 142. Middle East & Africa Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 143. Middle East & Africa Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 144. Middle East & Africa Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 145. Middle East & Africa Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 146. Middle East & Africa Low-Cost Carrier (LCC) Market Share (%), By Country, 2018-2032F

- Figure 147. Saudi Arabia Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 148. Saudi Arabia Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 149. Saudi Arabia Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 150. Saudi Arabia Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 151. Saudi Arabia Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 152. UAE Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 153. UAE Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 154. UAE Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 155. UAE Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 156. UAE Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 157. South Africa Low-Cost Carrier (LCC) Market, By Value, In USD Billion, 2018-2032F

- Figure 158. South Africa Low-Cost Carrier (LCC) Market Share (%), By Carrier Model, 2018-2032F

- Figure 159. South Africa Low-Cost Carrier (LCC) Market Share (%), By Route Type, 2018-2032F

- Figure 160. South Africa Low-Cost Carrier (LCC) Market Share (%), By Revenue Stream, 2018-2032F

- Figure 161. South Africa Low-Cost Carrier (LCC) Market Share (%), By Customer Segment, 2018-2032F

- Figure 162. By Carrier Model Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 163. By Route Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 164. By Revenue Stream Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 165. By Customer Segment Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 166. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global low-cost carrier (LCC) market is projected to witness a CAGR of 7.45% during the forecast period 2025-2032, growing from USD 231.43 billion in 2024 to USD 411.22 billion in 2032. The low-cost carrier (LCC) is altering air travel around the world by emphasizing affordability and operational effectiveness, driving the market growth globally. The LCCs serve as affordable travel alternatives to all types of travelers by reducing amenities or price (rather than full service) to sell tickets on one-way, non-stop, point-to-point travel, and increasing flight frequency, LCCs maximize their operational activity and ultimately aircraft utilization.

In addition, by utilizing a digital platform to book a ticket and fly to secondary airports, LCC's eliminate overhead and turn time. In addition to ancillary revenues, baggage fees, premium seating, in-flight sales, etc., LCC's fueled additional profitability beyond the base fare typical of a passenger airline. With the explosive growth in the middle class in emerging markets, as well as Asia and Latin America, the demand has driven LCC's to expand their route networks and pursue dynamic pricing models conservatively as a lower fare travel option. Demand for air travel has increased significantly as travelers seek lower-priced travel options during the post-pandemic recovery phase, driving market growth in the forecast period. Air travel is ever changing, and LCC's are acquiring more ultra-low fares, loyalty programs, and hybrid business models to keep excess capacity for sustained growth in the aviation industry.

For instance, in January 2025, Tata Group-owned Indian low-cost carrier (LCC), Air India Express (IX), added 22 international city pair routes in 2024. Air India Express planned to strengthen its Southeast Asian presence with the launch of Phuket services. This expansion reflects the airline's concentrated efforts to enhance its international footprint and capture emerging market opportunities.

Global Business Expansions Drive the Global Low-Cost Carrier Market Growth

Low-Cost Carriers (LCCs) have transformed air travel globally and opened it up to widespread access for companies and individuals. By improving affordability through competitive pricing, optimized operating models and aircraft utilization, LCCs have helped companies enter new markets, increase international trade, and improve connectivity. The more affordable travel model provides economic benefits and growth in business travel, tourism and air/cargo movements and is enhanced by digitalization and sustainability efforts. As a growing number of travelers rely on low-cost, LCCs will continue to spearhead business expansion worldwide.

For instance, in January 2025, Daemyung Sono Group, a leading condominium and resort company in South Korea, acquired management control of low-cost carrier (LCC) T'way Air to improve the airline's financial health.

Strategic Industry Collaborations Fuel Market Expansion

The explosive growth of the low-cost carrier (LCC) model is sustained by the proliferation of innovative partnerships throughout the aviation ecosystem. Aircraft manufacturers are implementing partnerships with the LCCs to develop new fuel-efficient, high-density cabins and cabin configurations suitable for budget airlines. Also, the tech companies are partnering with airlines to offer dynamic AI-driven pricing systems and automated check-in to reduce operating costs. Airports in developing nations are now entering into exclusive partnerships with LCCs in exchange for establishing regional hubs and offering concessions on landing fees. Credit card companies and e-commerce sites are similarly creating co-branded loyalty programs to enhance their ancillary revenue stream for LCCs. All of this is allowing LCCs to penetrate new markets while also preserving their cost advantage, and joint ventures between both Asian and European carriers are now establishing global networks that contend with traditional airline alliances.

For instance, in April 2025, Kyte Tech Inc., a technology provider specializing in access to low-cost carrier (LCC) inventory, partnered with PKFARE to integrate and distribute LCC content via Kyte's application programming interface (API) to improve its travel retailing capability.

Ancillary Revenue Stream Dominates the Global Low-Cost Carrier Market Share

Ancillary revenue stream is the financial backbone for many low-cost carriers' (LCCs) growth strategy, as it allows air carriers to offer ridiculously low fares while still achieving profit. By implementing a systemic approach to monetize only baggage fees, seat upgrades, and in-flight services, LCCs have built multiple revenue streams that offset the volatility in operating costs. Digital platforms take this one step further, allowing LCCs to maximize revenue through dynamic pricing, best compared to retail, and personalized upselling of travel extras. The ancillary sales model has developed from additive sales to loyalty programs providing premium benefits, partnerships with insurance companies, and related retail ecosystems, making ancillary sales now a core component of airlines' revenue generation strategies. This revenue transformation allows airlines to commit to fare competitiveness but rely on other development activities for future growth. Ancillary sales have become critical to the global LCC market penetration strategy and for storing cash reserves against a potential economic downturn.

For instance, in May 2025, Airline Passenger Experience Association (APEX), Future Travel Experience (FTE), EMEA and Ancillary and Retailing events - help airports and airlines grow non-aeronautical revenue, build stronger passenger relationships, and boost operational efficiency through smart, easy-to-use digital solutions.

Asia-Pacific Dominates the Low-Cost Carriers (LCCs) Market Size

The Asia-Pacific is the undisputed global leader in low-cost aviation, with its unique market characteristics, fostering an environment where low-cost carriers (LCCs) thrive and dominate. Rapid urbanization, growing disposable incomes, and geography conducive to air travel have fueled the region's remarkable expansion. Local carriers have grown into masters of budget air travel, creating business models that are suited to a commercially aware consumer sector. The continued evolution of supportive government policy and the development of infrastructure to support growth at secondary airports factor in meeting travel needs and expectations. Also, the region continues to innovate by introducing new paths towards low-cost travel, from e-commerce omni-channel booking ecosystems to hybrid service models - companies are leading the charge to motivate each and all and are setting benchmarks for the global aviation industry.

For instance, in November 2024, AirAsia redefined global benchmarks for low-cost carriers, clinching two prestigious titles at the World Travel Awards Grand Final 2024: World's Leading Low-Cost Airline for an unprecedented 12th consecutive year and World's Leading Low-Cost Airline Cabin Crew for the eighth year in a row.

Impact of U.S. Tariffs on the Global Low-Cost Carriers Market

Increased Operational Costs - Tariff increases on aircraft parts and fuel imports have increased expenses for LCCs.

Supply Chain Disruptions - Airlines are unable to take delivery of aircraft as they will be impacted by restrictions on trade.

Inhibition of Fleet Expansion - Rising costs have caused difficulty in acquiring new aircraft, which will result in fewer new routes.

Increased Fares- Due to increased operational costs, the airline has increased all fares and consequently reduced affordability.

Key Players Landscape and Outlook

The low-cost carriers market is influenced by a combination of government defense agencies, aerospace advanced developers, and research organizations for emerging technologies. The market is changing with advances in scramjet engines, artificial intelligence targeting, and stealth technology as these components enhance military capabilities. The future illustrates increased attention and funding to hypersonic systems, and when combined with global defense strategies emphasizing rapid and precise responses, it requires disruptive change within the low-cost carriers market with heightened demand for high-speed and maneuverable strike weapons. Emerging global strategies for defense processes will increase transformation advances for operational tempo improvements regarding military space operations and defense deterrence strategies.

For instance, in June 2025, Sabre Corporation formalized a new agreement with SalamAir. This marks a pivotal step for both organizations, aims to harness Sabre's advanced marketplace capabilities to boost Salam Air's visibility on the international stage, diversify its customer base, and accelerate revenue growth amid an increasingly competitive regional aviation market.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of U.S. Tariffs

4. Executive Summary

5. Voice of Customers

- 5.1. Respondent Demographics

- 5.2. Brand Awareness

- 5.3. Cost Efficiency

- 5.4. Fuel Consumption

6. Global Low-Cost Carrier (LCC) Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Carrier Model

- 6.2.1.1. Ultra-Low-Cost (ULCC)

- 6.2.1.2. Budget

- 6.2.1.3. Regional

- 6.2.2. By Route Type

- 6.2.2.1. Short-Haul (< 1 k mile)

- 6.2.2.2. Regional (1-3 k mile)

- 6.2.2.3. International

- 6.2.3. By Revenue Stream

- 6.2.3.1. Ticket Fare

- 6.2.3.2. Ancillary (Bags, Seats, Food)

- 6.2.4. By Customer Segment

- 6.2.4.1. Leisure Travelers

- 6.2.4.2. Business Travelers

- 6.2.4.3. Students/Youth

- 6.2.5. By Region

- 6.2.5.1. North America

- 6.2.5.2. Europe

- 6.2.5.3. Asia-Pacific

- 6.2.5.4. South America

- 6.2.5.5. Middle East and Africa

- 6.2.6. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 6.2.1. By Carrier Model

- 6.3. Market Map Analysis, 2024

- 6.3.1. By Carrier Model

- 6.3.2. By Route Type

- 6.3.3. By Revenue Stream

- 6.3.4. By Customer Segment

- 6.3.5. By Region

7. North America Low-Cost Carrier (LCC) Market Outlook, 2018-2032F

- 7.1. Market Size Analysis & Forecast

- 7.1.1. By Value

- 7.2. Market Share Analysis & Forecast

- 7.2.1. By Carrier Model

- 7.2.1.1. Ultra-Low-Cost (ULCC)

- 7.2.1.2. Budget

- 7.2.1.3. Regional

- 7.2.2. By Route Type

- 7.2.2.1. Short-Haul (< 1 k mile)

- 7.2.2.2. Regional (1-3 k mile)

- 7.2.2.3. International

- 7.2.3. By Revenue Stream

- 7.2.3.1. Ticket Fare

- 7.2.3.2. Ancillary (Bags, Seats, Food)

- 7.2.4. By Customer Segment

- 7.2.4.1. Leisure Travelers

- 7.2.4.2. Business Travelers

- 7.2.4.3. Students/Youth

- 7.2.5. By Country Share

- 7.2.5.1. United States

- 7.2.5.2. Canada

- 7.2.5.3. Mexico

- 7.2.1. By Carrier Model

- 7.3. Country Market Assessment

- 7.3.1. United States Low-Cost Carrier (LCC) Market Outlook, 2018-2032F*

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share Analysis & Forecast

- 7.3.1.2.1. By Carrier Model

- 7.3.1.2.1.1. Ultra-Low-Cost (ULCC)

- 7.3.1.2.1.2. Budget

- 7.3.1.2.1.3. Regional

- 7.3.1.2.2. By Route Type

- 7.3.1.2.2.1. Short-Haul (< 1 k mile)

- 7.3.1.2.2.2. Regional (1-3 k mile)

- 7.3.1.2.2.3. International

- 7.3.1.2.3. By Revenue Stream

- 7.3.1.2.3.1. Ticket Fare

- 7.3.1.2.3.2. Ancillary (Bags, Seats, Food)

- 7.3.1.2.4. By Customer Segment

- 7.3.1.2.4.1. Leisure Travelers

- 7.3.1.2.4.2. Business Travelers

- 7.3.1.2.4.3. Students/Youth

- 7.3.1.2.1. By Carrier Model

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.2. Canada

- 7.3.3. Mexico

- 7.3.1. United States Low-Cost Carrier (LCC) Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

8. Europe Low-Cost Carrier (LCC) Market Outlook, 2018-2032F

- 8.1. Germany

- 8.2. France

- 8.3. Italy

- 8.4. United Kingdom

- 8.5. Russia

- 8.6. Netherlands

- 8.7. Spain

- 8.8. Turkey

- 8.9. Poland

9. Asia-Pacific Low-Cost Carrier (LCC) Market Outlook, 2018-2032F

- 9.1. India

- 9.2. China

- 9.3. Japan

- 9.4. Australia

- 9.5. Vietnam

- 9.6. South Korea

- 9.7. Indonesia

- 9.8. Philippines

10. South America Low-Cost Carrier (LCC) Market Outlook, 2018-2032F

- 10.1. Brazil

- 10.2. Argentina

11. Middle East and Africa Low-Cost Carrier (LCC) Market Outlook, 2018-2032F

- 11.1. Saudi Arabia

- 11.2. UAE

- 11.3. South Africa

12. Porter's Five Forces Analysis

13. PESTLE Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Policy and Regulatory Landscape

17. Case Studies

18. Competitive Landscape

- 18.1. Competition Matrix of Top 5 Market Leaders

- 18.2. SWOT Analysis for Top 5 Players

- 18.3. Key Players Landscape for Top 10 Market Players

- 18.3.1. AirAsia Berhad

- 18.3.1.1. Company Details

- 18.3.1.2. Key Management Personnel

- 18.3.1.3. Products

- 18.3.1.4. Financials

- 18.3.1.5. Key Market Focus and Geographical Presence

- 18.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 18.3.2. Ryanair DAC

- 18.3.3. InterGlobe Aviation Ltd.

- 18.3.4. Scoot Pte Ltd

- 18.3.5. Southwest Airlines Co.

- 18.3.6. Eurowings GmbH

- 18.3.7. Dubai Aviation Corporation

- 18.3.8. Virgin Australia Airlines Pty Ltd

- 18.3.9. JetBlue Airways Corporation

- 18.3.10. Spirit Airlines Inc.

- 18.3.1. AirAsia Berhad

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.