|

|

市場調査レポート

商品コード

1724947

醸造設備の世界市場:設備タイプ別、醸造所タイプ別、操業形態別、エンドユーザー別、地域別、機会、予測、2018年~2032年Global Brewery Equipment Market Assessment, By Equipment Type, By Brewery Type, By Mode of Operation, By End-user, By Region, Opportunities, and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 醸造設備の世界市場:設備タイプ別、醸造所タイプ別、操業形態別、エンドユーザー別、地域別、機会、予測、2018年~2032年 |

|

出版日: 2025年05月14日

発行: Markets & Data

ページ情報: 英文 234 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の醸造設備の市場規模は、ビール消費量の増加、クラフトビール醸造所の拡大、醸造プロセスの自動化の進展により、2025年~2032年の予測期間中に6.36%のCAGRで拡大し、2024年の209億3,000万米ドルから2032年には342億8,000万米ドルに成長すると予測されています。クラフトビールの需要の伸びと、世界中で地ビール醸造所とブルーパブの普及が進んでいることが主な要因です。地元で醸造される個性的なビールはカスタマイズされた風味で消費者を魅了し、専用の小規模醸造システムの需要につながっています。この動向は北米と欧州で非常に強く、アジア太平洋やラテンアメリカなどの開発途上地域でも加速しています。

技術革新も市場を促進する要因のひとつです。自動化、IoTベースの醸造システム、AIベースの発酵制御は、ビール製造の効率性、一貫性、拡張性を高めています。省エネでモジュール式の醸造設備も勢いを増しており、醸造所は変化する生産要件に対応しながら操業コストを下げることができます。さらに、持続可能性の問題は、消費者からの圧力と環境法の厳格化への反応として、水リサイクル装置、熱回収技術、廃棄物の最小化プロセスなど、環境に優しい手段を使用するよう醸造所に促しています。例えば、2022年10月、バドワイザーを擁するビール大手のAB InBevは、中国の普天に新しい醸造所を開設しました。この施設は、地域経済を活性化し、消費者の嗜好を向上させる一流のビールを製造することを目的としています。

低アルコール、ノンアルコール、トライアルビールへのニーズの高まりなど、顧客動向の変化も設備仕様に影響を与えており、脱アルコールや風味付けのための専用設計の機械が注目を集めています。これらの要因が組み合わさることで、変化がもたらされ、イノベーションと持続可能性を備えたダイナミックな市場が形成されつつあります。

当レポートでは、世界の醸造設備市場について調査し、市場の概要とともに、設備タイプ別、醸造所タイプ別、操業形態別、エンドユーザー別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 米国の関税の影響

第4章 エグゼクティブサマリー

第5章 お客様の声

第6章 世界の醸造設備市場の見通し、2018年~2032年

- 市場規模分析と予測

- 市場シェア分析と予測

- 設備タイプ別

- 醸造設備

- 発酵装置

- 冷却装置

- 製粉装置

- ろ過装置

- その他

- 醸造所タイプ別

- マクロ醸造所

- クラフトビール醸造所

- その他

- 操業形態別

- 自動

- 手動

- エンドユーザー別

- 産業

- 商業

- 地域別

- 北米

- 欧州

- アジア太平洋

- 南米

- 中東・アフリカ

- 企業別市場シェア分析(上位5社およびその他- 金額別、2024年)

- 設備タイプ別

- 2024年の市場マップ分析

第7章 北米の醸造設備市場の見通し、2018年~2032年

- 市場規模分析と予測

- 市場シェア分析と予測

- 国別市場評価

- 米国

第8章 欧州の醸造設備市場の見通し、2018年~2032年

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- ポーランド

第9章 アジア太平洋の醸造設備市場の見通し、2018年~2032年

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第10章 南米の醸造設備市場の見通し、2018年~2032年

- ブラジル

- アルゼンチン

第11章 中東・アフリカの醸造設備市場の見通し、2018年~2032年

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第12章 需要供給分析

第13章 輸出入の分析

第14章 バリューチェーン分析

第15章 ポーターのファイブフォース分析

第16章 PESTLE分析

第17章 市場力学

- 市場の促進要因

- 市場の課題

第18章 市場動向と発展

第19章 ケーススタディ

第20章 競合情勢

- 市場リーダートップ5の競合マトリックス

- 参入企業トップ5のSWOT分析

- 市場の主要企業トップ10の情勢

- Krones AG

- GEA Group Aktiengesellschaf

- Ziemann Holvrieka

- Alfa Laval

- BrauKon GmbH

- Brouwland

- Shandong Zunhuang Fermenting Equipment Co., Ltd

- DME Process Systems

- Della Toffola SPA

- Camerons Brewery Ltd.

第21章 戦略的提言

第22章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 3. Global Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 4. Global Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 5. Global Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 6. Global Brewery Equipment Market Share (%), By Region, 2018-2032F

- Figure 7. North America Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 8. North America Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 9. North America Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 10. North America Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

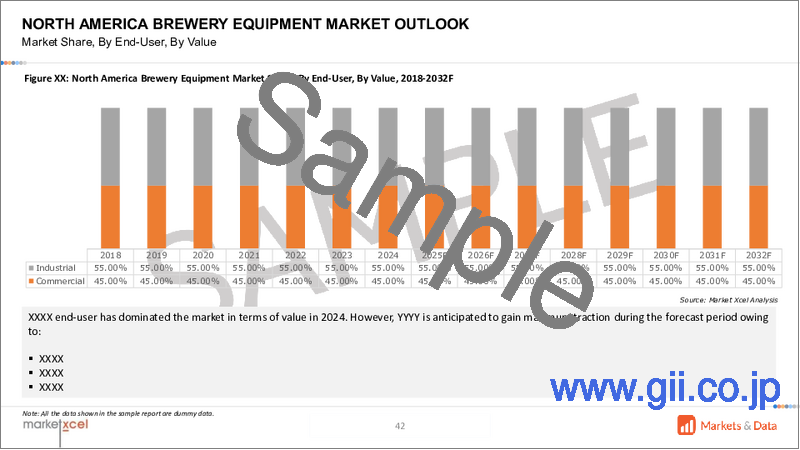

- Figure 11. North America Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 12. North America Brewery Equipment Market Share (%), By Country, 2018-2032F

- Figure 13. United States Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 14. United States Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 15. United States Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 16. United States Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 17. United States Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 18. Canada Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 19. Canada Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 20. Canada Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 21. Canada Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 22. Canada Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 23. Mexico Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 24. Mexico Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 25. Mexico Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 26. Mexico Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 27. Mexico Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 28. Europe Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 29. Europe Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 30. Europe Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 31. Europe Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 32. Europe Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 33. Europe Brewery Equipment Market Share (%), By Country, 2018-2032F

- Figure 34. Germany Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 35. Germany Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 36. Germany Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 37. Germany Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 38. Germany Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 39. France Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 40. France Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 41. France Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 42. France Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 43. France Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 44. Italy Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 45. Italy Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 46. Italy Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 47. Italy Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 48. Italy Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 49. United Kingdom Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 50. United Kingdom Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 51. United Kingdom Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 52. United Kingdom Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 53. United Kingdom Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 54. Russia Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 55. Russia Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 56. Russia Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 57. Russia Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 58. Russia Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 59. Netherlands Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 60. Netherlands Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 61. Netherlands Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 62. Netherlands Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 63. Netherlands Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 64. Spain Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 65. Spain Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 66. Spain Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 67. Spain Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 68. Spain Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 69. Turkey Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 70. Turkey Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 71. Turkey Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 72. Turkey Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 73. Turkey Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 74. Poland Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 75. Poland Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 76. Poland Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 77. Poland Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 78. Poland Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 79. South America Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 80. South America Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 81. South America Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 82. South America Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 83. South America Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 84. South America Brewery Equipment Market Share (%), By Country, 2018-2032F

- Figure 85. Brazil Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 86. Brazil Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 87. Brazil Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 88. Brazil Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 89. Brazil Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 90. Argentina Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 91. Argentina Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 92. Argentina Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 93. Argentina Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 94. Argentina Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 95. Asia-Pacific Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 96. Asia-Pacific Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 97. Asia-Pacific Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 98. Asia-Pacific Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 99. Asia-Pacific Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 100. Asia-Pacific Brewery Equipment Market Share (%), By Country, 2018-2032F

- Figure 101. India Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 102. India Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 103. India Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 104. India Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 105. India Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 106. China Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 107. China Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 108. China Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 109. China Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 110. China Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 111. Japan Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 112. Japan Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 113. Japan Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 114. Japan Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 115. Japan Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 116. Australia Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 117. Australia Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 118. Australia Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 119. Australia Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 120. Australia Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 121. Vietnam Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 122. Vietnam Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 123. Vietnam Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 124. Vietnam Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 125. Vietnam Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 126. South Korea Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 127. South Korea Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 128. South Korea Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 129. South Korea Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 130. South Korea Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 131. Indonesia Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 132. Indonesia Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 133. Indonesia Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 134. Indonesia Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 135. Indonesia Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 136. Philippines Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 137. Philippines Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 138. Philippines Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 139. Philippines Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 140. Philippines Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 141. Middle East & Africa Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 142. Middle East & Africa Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 143. Middle East & Africa Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 144. Middle East & Africa Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 145. Middle East & Africa Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 146. Middle East & Africa Brewery Equipment Market Share (%), By Country, 2018-2032F

- Figure 147. Saudi Arabia Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 148. Saudi Arabia Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 149. Saudi Arabia Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 150. Saudi Arabia Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 151. Saudi Arabia Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 152. UAE Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 153. UAE Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 154. UAE Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 155. UAE Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 156. UAE Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 157. South Africa Brewery Equipment Market, By Value, In USD Billion, 2018-2032F

- Figure 158. South Africa Brewery Equipment Market Share (%), By Equipment Type, 2018-2032F

- Figure 159. South Africa Brewery Equipment Market Share (%), By Brewery Type, 2018-2032F

- Figure 160. South Africa Brewery Equipment Market Share (%), By Mode of Operation, 2018-2032F

- Figure 161. South Africa Brewery Equipment Market Share (%), By End-user, 2018-2032F

- Figure 162. By Equipment Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 163. By Brewery Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 164. By Mode of Operation Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 165. By End-user Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 166. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global brewery equipment market is projected to witness a CAGR of 6.36% during the forecast period 2025-2032, growing from USD 20.93 billion in 2024 to USD 34.28 billion in 2032F, owing to rising beer consumption, the expansion of craft breweries, and increasing automation in brewing processes. The growth in the demand for craft beer and the increased proliferation of microbreweries and brewpubs across the globe are the main drivers. Unique, locally brewed beers with customized flavors attract consumers, leading to the demand for dedicated small-scale brewing systems. The trend is quite strong in North America and Europe, and is also gaining pace in developing regions such as Asia-Pacific and Latin America.

Technological innovation is another key driver driving the market. Automation, IoT-based brewing systems, and AI-based fermentation controls are enhancing efficiency, consistency, and scalability in beer making. Energy-saving and modular brewing equipment is also picking up steam, enabling breweries to lower their operational costs while responding to changing production requirements. In addition, sustainability issues are encouraging breweries to use environmentally friendly measures, such as water recycling units, heat recovery technology, and waste minimization processes, both as a reaction to consumer pressures and to stricter environmental laws. For instance, in October 2022, AB InBev, the beer powerhouse behind Budweiser, opened a new brewery in Putian, China. This facility is all about creating top-notch beers to boost the local economy and enhance consumers' taste.

Evolving customer trends, such as the greater need for low-alcohol, non-alcoholic, and trial beers, also influence equipment specifications, with purpose-designed machinery for dealcoholizing and flavorizing gaining prominence. Combined, these factors are introducing a change and making a dynamic marketplace with innovation and sustainability.

Rising Demand for Craft Beer and Microbreweries Driving the Global Market Demand

The global brewery equipment industry is observing strong growth, driven primarily by the growing popularity of craft beer and the spread of microbreweries at an increasing rate worldwide. With more consumers demanding specialty, premium, and locally produced beers that are unique and flavorful, small-scale breweries are growing fast to fulfill these needs. This movement is especially significant in Europe and North America, where craft brewing culture and craft brewing heritage are firmly rooted. This trend has created a significant demand for dedicated brewing equipment designed for smaller-scale production volumes. Homebrewers, brewpubs, and microbreweries are all purchasing more compact, efficient systems that allow them to try recipes while ensuring quality and consistency. As the craft brewing trend keeps building steam, the need for high-tech yet affordable brewery gear, ranging from mash tuns and fermenters to kegging and canning lines, is likely to increase steadily. Suppliers are meeting this demand with innovative, scalable solutions that range from startup microbreweries to growing craft beer brands, thereby promising continued growth in the worldwide brewery equipment market over the long term.

For instance, in September 2022, Probicient Pte Ltd. and Origgin Pte Ltd., experts in nurturing early-stage deep-tech start-ups and venture co-creation, teamed up with The Brewerkz Company, Singapore's oldest craft brewery, to introduce the world's very first probiotic beer.

Technological Advancements in Brewing Equipment Driving the Global Brewery Equipment Market

The global brewery equipment market is undergoing significant transformation, driven by innovative technologies that are transforming the process of beer making. With breweries seeking increased efficiency, consistency, and sustainability, sophisticated brewing systems are becoming the need of the hour, especially for craft brewers operating in a highly competitive market. Automation and intelligent brewing technologies are leading this revolution. New breweries are implementing IoT-based systems that track and regulate brewing parameters, including temperature, pressure, and fermentation, in real time. These networked systems minimize human intervention, maximize resource efficiency, and deliver batch-to-batch consistency, which is key to keeping brand quality consistent. For instance, in November 2022, AB InBev, is transforming the beer industry through innovation by unlocking unprecedented insight into the needs of consumers.

Energy efficiency has also gained prominence, with advancements such as heat recovery systems, smart glycol cooling, and energy-efficient boiling technologies minimizing costs while reducing the impact on the environment. With these technologies powering operational excellence, the brewery equipment sector is projected to experience consistent growth, providing brewers with the equipment they require to succeed in a competitive and changing environment.

Macro Brewery Type Dominating to Propel the Growth of the Market

The global brewery equipment market is driven by the dominance of macro breweries owing to its large production volumes and consolidated commercial operations. Although craft breweries have received significant focus in the past few years, big beer manufacturers are still the major drivers of equipment demand, using their broad distribution networks and economies of scale to lead the market. Macro breweries demand high-volume, industrial-level brewing systems that produce millions of barrels per year. These involve computerized brewhouses, enormous fermentation tanks, and high-rate packaging lines intended for efficiency and consistency. Even as craft brewing expands, macro brewery is the industry's bedrock, forcing innovation and dictating standards of efficiency, automation, and export penetration. As beer demand increases globally, the market for high-performance brewery equipment with high capacity will grow further, bolstering the leading position of macro breweries in the market.

Europe is Leading the Global Brewery Equipment Market

Europe remains the leader in the global brewery equipment industry, combining a deep brewing history with technological advances to continue leading the industry. As the homeland of numerous world-famous beer styles and brewing traditions, the continent enjoys a unique density of experience, with Germany, Belgium, and the UK being important manufacturing centers for premium brewing equipment. For instance, in December 2024, according to European beer trends, Germany consumes the highest amount of beer. Europe's dominance is due to a range of competitive strengths, its breweries produce about one-quarter of all beer globally, maintaining robust local demand for both large commercial-scale equipment and dedicated craft brewing systems. Europe's active craft brewing scene has additionally widened the market by creating demand for versatile, small-batch equipment, as well as the continent's rigorous environmental regulations, which fuel ongoing innovation in water recycling and carbon-neutral brewing technologies. With its special blend of brewing heritage, engineering prowess, and sustainability, Europe is still the world's leading provider of brewery equipment, shipping its top-quality systems to breweries worldwide. The continent is poised to keep its leadership as new trends in automation, digitalization, and environmentally friendly production continue to drive the future of the brewing sector.

Impact of the U.S. Tariff on Global Brewery Equipment Market

The imposition of U.S. tariffs on imported brewery equipment, particularly targeting steel and aluminum components from key manufacturing countries like China and Germany, has significantly disrupted the global brewery equipment market.

These tariffs, initially implemented as part of broader trade protection measures, have increased costs for American craft breweries and commercial beer producers who rely on imported systems.

Globally, the tariffs have forced manufacturers to restructure supply chains, with European and Chinese producers seeking alternative markets in Asia, Africa, and Latin America to offset reduced U.S. demand.

Key Players Landscape and Outlook

The global brewery equipment market is characterized by a competitive landscape dominated by several companies. These companies distinguish themselves through their global reach, comprehensive product portfolios, and ongoing investments in research and development. The market growth is fueled by rising demand for premium and craft beers, particularly among younger consumers, which is prompting breweries to invest in both large-scale and small-scale equipment. Automation and advanced process control are becoming standard requirements as breweries seek greater efficiency and consistency. However, the high capital and maintenance costs of advanced brewing equipment pose challenges, especially for smaller craft breweries and those in emerging markets. Regionally, Europe remains the largest market due to its established beer culture and concentration of equipment manufacturers, while North America is experiencing rapid growth driven by the craft beer movement. China is also emerging as a significant market, both as a consumer and as a producer of mid-range and automated brewery equipment. To maintain their competitive edge, leading companies are expanding their global presence, investing in automation, and offering tailored solutions for both macro breweries and the growing craft segment. Strategic partnerships, mergers, and acquisitions are common as firms seek to enhance their technological capabilities and broaden their market reach. Looking ahead, the competitive landscape is expected to remain dynamic, with ongoing consolidation among large players and increasing specialization among smaller, innovative firms.

For instance, in February 2025, Grupo Cuauhtemoc Moctezuma, SA de CV, also known as Heineken Guadalajara and ABB Ltd, has a long-running partnership keeping equipment safe and reliable while providing efficient and high-quality energy supply to Heineken Guadalajara.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Impact of the U.S. Tariff

4. Executive Summary

5. Voice of Customers

- 5.1. Respondent Demographics

- 5.2. Brand Awareness

- 5.3. Factors Considered in Purchase Decisions

- 5.4. Challenges Faced Post Purchase

6. Global Brewery Equipment Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Equipment Type

- 6.2.1.1. Brewhouse Equipment

- 6.2.1.2. Fermentation Equipment

- 6.2.1.3. Cooling Equipment

- 6.2.1.4. Milling Equipment

- 6.2.1.5. Filtration Equipment

- 6.2.1.6. Others

- 6.2.2. By Brewery Type

- 6.2.2.1. Macro Brewery

- 6.2.2.2. Craft Brewery

- 6.2.2.3. Others

- 6.2.3. By Mode of Operation

- 6.2.3.1. Automatic

- 6.2.3.2. Manual

- 6.2.4. By End-User

- 6.2.4.1. Industrial

- 6.2.4.2. Commercial

- 6.2.5. By Region

- 6.2.5.1. North America

- 6.2.5.2. Europe

- 6.2.5.3. Asia-Pacific

- 6.2.5.4. South America

- 6.2.5.5. Middle East and Africa

- 6.2.6. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 6.2.1. By Equipment Type

- 6.3. Market Map Analysis, 2024

- 6.3.1. By Equipment Type

- 6.3.2. By Brewery Type

- 6.3.3. By Mode of Operation

- 6.3.4. By End-User

- 6.3.5. By Region

7. North America Brewery Equipment Market Outlook, 2018-2032F

- 7.1. Market Size Analysis & Forecast

- 7.1.1. By Value

- 7.2. Market Share Analysis & Forecast

- 7.2.1. By Equipment Type

- 7.2.1.1. Brewhouse Equipment

- 7.2.1.2. Fermentation Equipment

- 7.2.1.3. Cooling Equipment

- 7.2.1.4. Milling Equipment

- 7.2.1.5. Filtration Equipment

- 7.2.1.6. Others

- 7.2.2. By Brewery Type

- 7.2.2.1. Macro Brewery

- 7.2.2.2. Craft Brewery

- 7.2.2.3. Others

- 7.2.3. By Mode of Operation

- 7.2.3.1. Automatic

- 7.2.3.2. Manual

- 7.2.4. By End-User

- 7.2.4.1. Industrial

- 7.2.4.2. Commercial

- 7.2.5. By Country

- 7.2.5.1. United States

- 7.2.5.2. Canada

- 7.2.5.3. Mexico

- 7.2.1. By Equipment Type

- 7.3. Country Market Assessment

- 7.3.1. United States Brewery Equipment Market Outlook, 2018-2032F*

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1.1.1. By Value

- 7.3.1.2. Market Share Analysis & Forecast

- 7.3.1.2.1. By Equipment Type

- 7.3.1.2.1.1. Brewhouse Equipment

- 7.3.1.2.1.2. Fermentation Equipment

- 7.3.1.2.1.3. Cooling Equipment

- 7.3.1.2.1.4. Milling Equipment

- 7.3.1.2.1.5. Filtration Equipment

- 7.3.1.2.1.6. Others

- 7.3.1.2.2. By Brewery Type

- 7.3.1.2.2.1. Macro Brewery

- 7.3.1.2.2.2. Craft Brewery

- 7.3.1.2.2.3. Others

- 7.3.1.2.3. By Mode of Operation

- 7.3.1.2.3.1. Automatic

- 7.3.1.2.3.2. Manual

- 7.3.1.2.4. By End-User

- 7.3.1.2.4.1. Industrial

- 7.3.1.2.4.2. Commercial

- 7.3.1.2.1. By Equipment Type

- 7.3.1.1. Market Size Analysis & Forecast

- 7.3.1. United States Brewery Equipment Market Outlook, 2018-2032F*

8. Europe Brewery Equipment Market Outlook, 2018-2032F

- 8.1. Germany

- 8.2. France

- 8.3. Italy

- 8.4. United Kingdom

- 8.5. Russia

- 8.6. Netherlands

- 8.7. Spain

- 8.8. Poland

9. Asia-Pacific Brewery Equipment Market Outlook, 2018-2032F

- 9.1. India

- 9.2. China

- 9.3. Japan

- 9.4. Australia

- 9.5. Vietnam

- 9.6. South Korea

- 9.7. Indonesia

- 9.8. Philippines

10. South America Brewery Equipment Market Outlook, 2018-2032F

- 10.1. Brazil

- 10.2. Argentina

11. Middle East and Africa Brewery Equipment Market Outlook, 2018-2032F

- 11.1. Saudi Arabia

- 11.2. UAE

- 11.3. South Africa

12. Demand Supply Analysis

13. Import and Export Analysis

14. Value Chain Analysis

15. Porter's Five Forces Analysis

16. PESTLE Analysis

17. Market Dynamics

- 17.1. Market Drivers

- 17.2. Market Challenges

18. Market Trends and Developments

19. Case Studies

20. Competitive Landscape

- 20.1. Competition Matrix of Top 5 Market Leaders

- 20.2. SWOT Analysis for Top 5 Players

- 20.3. Key Players Landscape for Top 10 Market Players

- 20.3.1. Krones AG

- 20.3.1.1. Company Details

- 20.3.1.2. Key Management Personnel

- 20.3.1.3. Key Products Offered

- 20.3.1.4. Key Financials (As Reported)

- 20.3.1.5. Key Market Focus and Geographical Presence

- 20.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 20.3.2. GEA Group Aktiengesellschaf

- 20.3.3. Ziemann Holvrieka

- 20.3.4. Alfa Laval

- 20.3.5. BrauKon GmbH

- 20.3.6. Brouwland

- 20.3.7. Shandong Zunhuang Fermenting Equipment Co., Ltd

- 20.3.8. DME Process Systems

- 20.3.9. Della Toffola SPA

- 20.3.10. Camerons Brewery Ltd.

- 20.3.1. Krones AG

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.