|

|

市場調査レポート

商品コード

1697901

自動車用燃料フィルターの世界市場の評価:車両タイプ別、燃料タイプ別、フィルターメディア別、販売チャネル別、地域別、機会、予測(2018年~2032年)Automotive Fuel Filter Market Assessment, By Vehicle Type, By Fuel Type, By Filter Media, By Sales Channel, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 自動車用燃料フィルターの世界市場の評価:車両タイプ別、燃料タイプ別、フィルターメディア別、販売チャネル別、地域別、機会、予測(2018年~2032年) |

|

出版日: 2025年04月08日

発行: Markets & Data

ページ情報: 英文 236 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動車用燃料フィルターの市場規模は、2024年の25億2,000万米ドルから2032年に39億5,000万米ドルに達すると予測され、CAGRで5.78%の成長が見込まれます。自動車用燃料フィルター市場は、自動車部品産業の主要セグメントであり、エンジン効率と寿命の延長に大きく寄与しています。

燃料フィルターは、燃料がエンジンに入る前に不純物を浄化し、エンジンにダメージを与えることなく最適な性能を発揮するのに役立ちます。先進の自動車が市販されるようになり、排ガス規制の強化やエンジンのスムーズな動作の必要性から、良質な燃料ろ過システムの需要は伸び続けています。ガソリンエンジンを搭載した従来式エンジンやハイブリッド車の乗用車の世界生産台数が多いことも、需要を促進しています。燃費と低排出ガスが消費者とメーカーの関心を集め、高品質なろ過技術への移行に拍車をかけています。また、アフターマーケットも堅調で、フィルター交換は自動車整備の日常的な要素となっています。アジア太平洋市場は地理的に多様で、インド、中国、東南アジア諸国など、自動車の保有台数と生産台数の多い地域から莫大な需要が発生しています。合成メディアや小型設計などのフィルターメディアと設計の発展は、性能と耐久性を高めています。自動車市場が電化へと進化する中、燃料フィルターはハイブリッド車や従来の燃料システムにとって依然として重要であり、市場で地歩を固めています。全体として、自動車用燃料フィルター産業は、技術開発と燃料のクリーントランスミッションに対する継続的な需要に後押しされ、着実に増加します。

例えば2023年9月、UFI FILTERS S.p.A.は、特にFPT Industrial Cursor XC13エンジン用に設計され、Euro VIIの厳しい排ガス基準に適合する次世代燃料ろ過システムを発売しました。この完全なソリューションは、超微細な汚染物質を捕捉し、効率的な燃料フローを確保する多段ろ過技術を組み込んだ先進の燃料フィルターモジュールを備えています。また、UFIのブローバイフィルターは、オイル蒸気の排出を最大限に低減し、クランクケース内圧の上昇を回避します。

当レポートでは、世界の自動車用燃料フィルター市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢などを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- 回答者の人口統計

- ブランド認知度

- 購入決定において考慮される要素

- 優先の流通チャネル

第5章 世界の自動車用燃料フィルター市場の見通し(2018年~2032年)

- 市場規模分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 車両タイプ別

- 燃料タイプ別

- フィルターメディア別

- 販売チャネル別

- 地域別

- 市場シェア分析:企業別(金額)(上位5社とその他 - 2024年)

- 市場マップ分析(2024年)

- 車両タイプ別

- 燃料タイプ別

- フィルターメディア別

- 販売チャネル別

- 地域別

第6章 北米の自動車用燃料フィルター市場の見通し(2018年~2032年)

- 市場規模分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 車両タイプ別

- 燃料タイプ別

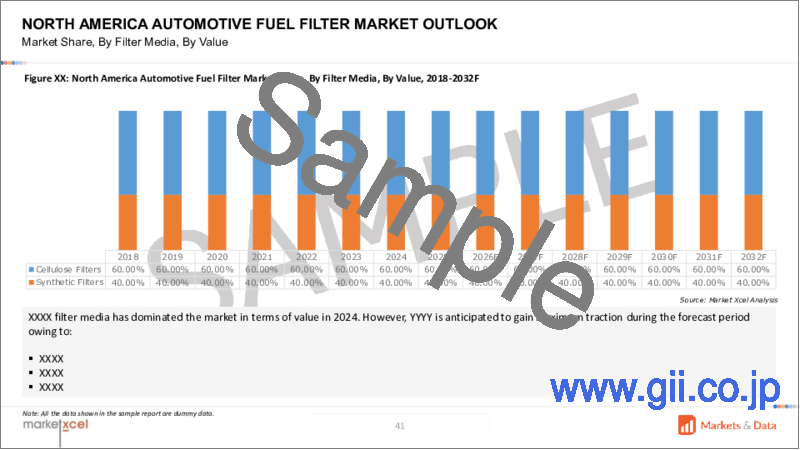

- フィルターメディア別

- 販売チャネル別

- シェア:国別

- 各国の市場の評価

- 米国の自動車用燃料フィルター市場の見通し(2018年~2032年)

- カナダ

- メキシコ

第7章 欧州の自動車用燃料フィルター市場の見通し(2018年~2032年)

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋の自動車用燃料フィルター市場の見通し(2018年~2032年)

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米の自動車用燃料フィルター市場の見通し(2018年~2032年)

- ブラジル

- アルゼンチン

第10章 中東・アフリカの自動車用燃料フィルター市場の見通し(2018年~2032年)

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第11章 ポーターのファイブフォース分析

第12章 PESTLE分析

第13章 価格分析

第14章 市場力学

- 市場促進要因

- 市場の課題

第15章 市場動向と発展

第16章 政策と規制情勢

第17章 ケーススタディ

第18章 競合情勢

- マーケットリーダー上位5社の競合マトリクス

- 上位5社のSWOT分析

- 主要企業上位10社の情勢

- Donaldson Company, Inc.

- MAHLE GmbH

- DENSO Corporation

- K&N Engineering, Inc

- Champion Laboratories, Inc.

- UFI FILTERS Spa

- Robert Bosch GmbH

- Hengst SE

- MANN+HUMMEL International GmbH & Co. KG

- Cummins Inc.

第19章 戦略的提言

第20章 調査会社について・免責事項

List of Tables

- Table 1. Competition Matrix of Top 5 Market Leaders

- Table 2. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 3. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 3. Global Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 4. Global Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 5. Global Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 6. Global Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 7. Global Automotive Fuel Filter Market Share (%), By Region, 2018-2032F

- Figure 8. North America Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 9. North America Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 10. North America Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 11. North America Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 12. North America Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 13. North America Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 14. North America Automotive Fuel Filter Market Share (%), By Country, 2018-2032F

- Figure 15. United States Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 16. United States Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 17. United States Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 18. United States Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 19. United States Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 20. United States Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 21. Canada Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 22. Canada Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 23. Canada Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 24. Canada Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 25. Canada Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 26. Canada Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 27. Mexico Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 28. Mexico Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 29. Mexico Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 30. Mexico Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 31. Mexico Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 32. Mexico Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 33. Europe Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 34. Europe Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 35. Europe Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 36. Europe Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 37. Europe Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 38. Europe Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 39. Europe Automotive Fuel Filter Market Share (%), By Country, 2018-2032F

- Figure 40. Germany Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 41. Germany Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 42. Germany Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 43. Germany Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 44. Germany Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 45. Germany Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 46. France Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 47. France Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 48. France Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 49. France Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 50. France Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 51. France Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 52. Italy Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 53. Italy Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 54. Italy Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 55. Italy Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 56. Italy Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 57. Italy Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 58. United Kingdom Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 59. United Kingdom Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 60. United Kingdom Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 61. United Kingdom Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 62. United Kingdom Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 63. United Kingdom Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 64. Russia Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 65. Russia Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 66. Russia Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 67. Russia Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 68. Russia Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 69. Russia Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 70. Netherlands Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 71. Netherlands Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 72. Netherlands Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 73. Netherlands Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 74. Netherlands Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 75. Netherlands Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 76. Spain Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 77. Spain Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 78. Spain Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 79. Spain Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 80. Spain Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 81. Spain Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 82. Turkey Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 83. Turkey Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 84. Turkey Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 85. Turkey Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 86. Turkey Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 87. Turkey Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 88. Poland Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 89. Poland Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 90. Poland Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 91. Poland Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 92. Poland Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 93. Poland Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 94. South America Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 95. South America Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 96. South America Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 97. South America Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 98. South America Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 99. South America Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 100. South America Automotive Fuel Filter Market Share (%), By Country, 2018-2032F

- Figure 101. Brazil Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 102. Brazil Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 103. Brazil Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 104. Brazil Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 105. Brazil Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 106. Brazil Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 107. Argentina Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 108. Argentina Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 109. Argentina Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 110. Argentina Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 111. Argentina Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 112. Argentina Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 113. Asia-Pacific Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 114. Asia-Pacific Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 115. Asia-Pacific Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 116. Asia-Pacific Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 117. Asia-Pacific Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 118. Asia-Pacific Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 119. Asia-Pacific Automotive Fuel Filter Market Share (%), By Country, 2018-2032F

- Figure 120. India Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 121. India Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 122. India Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 123. India Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 124. India Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 125. India Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 126. China Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 127. China Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 128. China Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 129. China Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 130. China Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 131. China Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 132. Japan Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 133. Japan Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 134. Japan Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 135. Japan Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 136. Japan Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 137. Japan Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 138. Australia Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 139. Australia Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 140. Australia Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 141. Australia Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 142. Australia Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 143. Australia Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 144. Vietnam Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 145. Vietnam Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 146. Vietnam Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 147. Vietnam Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 148. Vietnam Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 149. Vietnam Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 150. South Korea Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 151. South Korea Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 152. South Korea Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 153. South Korea Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 154. South Korea Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 155. South Korea Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 156. Indonesia Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 157. Indonesia Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 158. Indonesia Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 159. Indonesia Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 160. Indonesia Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 161. Indonesia Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 162. Philippines Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 163. Philippines Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 164. Philippines Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 165. Philippines Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 166. Philippines Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 167. Philippines Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 168. Middle East & Africa Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 169. Middle East & Africa Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 170. Middle East & Africa Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 171. Middle East & Africa Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 172. Middle East & Africa Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 173. Middle East & Africa Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 174. Middle East & Africa Automotive Fuel Filter Market Share (%), By Country, 2018-2032F

- Figure 175. Saudi Arabia Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 176. Saudi Arabia Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 177. Saudi Arabia Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 178. Saudi Arabia Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 179. Saudi Arabia Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 180. Saudi Arabia Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 181. UAE Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 182. UAE Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 183. UAE Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 184. UAE Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 185. UAE Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 186. UAE Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 187. South Africa Automotive Fuel Filter Market, By Value, In USD Billion, 2018-2032F

- Figure 188. South Africa Automotive Fuel Filter Market, By Volume, In Thousand Units, 2018-2032F

- Figure 189. South Africa Automotive Fuel Filter Market Share (%), By Vehicle Type, 2018-2032F

- Figure 190. South Africa Automotive Fuel Filter Market Share (%), By Fuel Type, 2018-2032F

- Figure 191. South Africa Automotive Fuel Filter Market Share (%), By Filter Media, 2018-2032F

- Figure 192. South Africa Automotive Fuel Filter Market Share (%), By Sales Channel, 2018-2032F

- Figure 193. By Vehicle Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 194. By Fuel Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 195. By Filter Media Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 196. By Sales Channel Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 197. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global automotive fuel filter market is projected to witness a CAGR of 5.78% during the forecast period 2025-2032, growing from USD 2.52 billion in 2024 to USD 3.95 billion in 2032F, propelled by a growing trend of customization and demand for passenger and commercial vehicles. The automotive fuel filter market is a prominent segment of the automotive components industry, contributing notably to extending engine efficiency and life.

Fuel filters help purify impurities from fuel before it enters the engine without any damage and at optimal performance. With more advanced vehicles available in the marketplace, the demand for good quality fuel filtration systems continues to grow with tighter emission controls and the need for smooth engine operation. Demand is further fueled by high global production levels of passenger cars, both gasoline-powered conventional engines and hybrid. Fuel economy and low emissions concern consumers and manufacturers alike, fueling the migration to high-quality filtration technology. The aftermarket is also robust with replacement filters as a routine element of vehicle service. Geographically, the Asia-Pacific market is diverse, and huge demand originates from high vehicle ownership and production areas such as India, China, and Southeast Asian Nations. Filter media and design developments, such as synthetic media and miniaturized designs, are enhancing performance and durability. As the automobile market evolves to electrification, fuel filters will continue to be relevant for hybrid vehicles and traditional fuel systems, still holding their ground in the market. In general, the automotive fuel filter industry will increase at a consistent rate, spurred by technological development and ongoing demand for clean transmission of the fuel.

For instance, in September 2023, UFI FILTERS S.p.A. launched a next-generation fuel filtration system that was particularly designed for the FPT Industrial Cursor XC13 engine to comply with Euro VII stringent emissions standards. The complete solution has an advanced fuel filter module that incorporates multi-stage filtration technology that traps ultra-fine contaminants and ensures efficient fuel flow. The UFI's blow-by filter also maximally reduces oil vapor emissions and averts crankcase pressure build-up.

New Products Bolster the Automotive Fuel Filter Market Demand

New product introductions are significantly boosting demand in the market for automotive fuel filters. Developments such as nanofiber filters, which provide even higher filtration efficiency through capture of finer particles, enhance reliability and performance. Multistage filters with several technologies integrated are also gaining popularity for maximizing engine protection with low pressure loss.

Self-cleaning filters are also on the horizon, offering convenience in the form of less manual upkeep. These technologies not only increase fuel system efficiency but also satisfy increasing consumer needs for high-quality automotive components. As manufacturers keep pushing the envelope and introducing these advanced solutions, overall market demand for automotive fuel filters should become increasingly stronger, reflecting a focus on cleaner and more efficient vehicle operation.

In March 2024, MAHLE GmbH Aftermarket launched its new KX 581 fuel filter, the higher-performance successor of the successful KX 400 for commercial applications. The latest filter offers superior separation efficiency for even greater protection against contamination by diesel engines. This innovation indicates MAHLE's ongoing aim to advance the performance of filters and the operating life of the engine, as well as cutting maintenance costs for fleet operators.

Stringent Emissions Standards Drive Market Growth

Strict pollution regulations constitute one of the key drivers in the automobile fuel filter industry because they compel firms to implement sophisticated filter systems. The legislation is implemented in regulating nitrogen oxides and particulate matter emissions that require quality fuel filters to clean fuel from impurities. As governments implement tighter emissions control, like ultra-low sulfur diesel requirements, the need for effective filtration technology has never been more acute. Technology helps manufacturers comply with the requirements, but it also improves engine efficiency and fuel efficiency. The companies in the auto industry are thus quickly heading toward developing sophisticated state-of-the-art fuel filter technologies that can keep up with such strict standards in a bid to drive market demand and facilitate sustainability in the environment.

In February 2024, Cummins Inc. launched its 2027 X15 diesel engine, a core component of its fuel-agnostic HELM platform, with rigorous emissions compliance and enhanced efficiency. The engine incorporates new cartridge-style filters, lowering maintenance costs and enhancing the total cost of ownership (TCO). A new fuel system with reduced parasitic losses also uses this filter design, with enhanced durability and performance.

Aftermarket Dominates the Global Automotive Fuel Filter Market

The aftermarket segment is growing at an exponential level in the automotive fuel filter industry with rising demand globally. The prime driving factors for the demand include the need to replace fresh fuel filters to maintain engine performance and fuel efficiency. Modern demand is also backed by improved consumer consciousness and awareness regarding vehicle maintenance. Additionally, the competitive market climate in the aftermarket allows the buyer to choose and select from an array of extremely effective filter items appropriate to respective needs. Product choice thus drives higher consumer satisfaction and confidence levels, further feeding the growth in the segment. The trend is being utilized by producers as they supply sophisticated filtration items that respond to evolving market demand, which turns the aftermarket into an essential segment of the automotive fuel filter market.

For instance, in December 2024, Cummins Inc. unveiled its advanced range of aftermarket solutions for back-up power gensets, construction, and mining segments at the 7th edition of baumaCONEXPO India 2024. The newly unveiled solutions include DATUM S, an extension of Cummins India's innovative fuel management solutions, OptiNAS+ Hydraulic Oil Filter, and DG Blue Diesel Exhaust Fluid for CPCBIV+ gensets. These solutions have been developed to help customers endure the tough and demanding conditions of construction and mining operations while fully complying with strict emission standards.

Asia-Pacific Acquires the Highest Market Share

Asia-Pacific market is endowed with the highest demand in the automobile fuel filter market on a global scale, driven by strong growth in the automobile industry. The region is witnessing high car production and sales growth, especially in nations such as China and India. Fast urbanization and industrialization have also fueled car ownership, triggering increasing demand for automobile components, such as fuel filters. Stringent emissions standards in China and other countries have driven the demand for high-grade filtration technology, raising environmental regulation adherence. Economic growth within regions has also fostered higher spending on automobile maintenance and aftermarket technologies. It is this combined effect that guarantees Asia-Pacific's leading market share of the international automotive fuel filter market, in line with its facilitative role in cleaner and more efficient motor vehicle technologies.

For instance, in December 2023, Uno Minda Limited broadened its auto product portfolio with the introduction of a new range of aftermarket filters for commercial vehicles in India. The range features air, oil, and fuel filters that have been engineered to provide high-quality performance in heavy-duty applications and to provide extended life. The move enhances Uno Minda's standing in the commercial vehicle aftermarket business by giving fleet operators value-for-money filtration products that help extend engine life and improve engine performance.

Future Market Scenario (2025 - 2032F)

The market will witness significant advancements in filtration technologies, such as nanofiber materials and self-cleaning filters, enhancing efficiency and performance. These innovations will align with evolving regulatory standards, ensuring sustained demand for high-quality filters.

The rise of electric vehicles will pose challenges to the traditional fuel filter market, as EVs do not require conventional fuel filters. However, hybrid vehicles will continue to drive demand for advanced filtration systems.

Asia-Pacific will remain a dominant region due to rapid urbanization and increased vehicle production in countries such as China and India. This growth will be fueled by investments in new automotive technologies and stringent emissions regulations.

Stringent emissions standards will continue to drive market growth as manufacturers invest in advanced filtration technologies to meet these regulations. This focus on compliance will enhance the demand for efficient and reliable fuel filters globally.

Key Players Landscape and Outlook

The competitive landscape of the automotive fuel filter market is characterized by a diverse array of key players striving to enhance their market positions through innovation and strategic initiatives. Major companies dominate the sector, leveraging their extensive experience and technological capabilities to deliver high-quality filtration solutions. These companies are actively investing in research and development to introduce advanced filtration technologies, such as nanofiber materials and self-cleaning systems, which improve efficiency and performance. Additionally, partnerships and collaborations with automakers are essential for aligning product offerings with evolving regulatory standards and consumer demands. The aftermarket segment is also witnessing heightened competition, with numerous suppliers aiming to capture a share of the growing demand for replacement filters. As environmental regulations become more stringent globally, companies are focusing on developing products that not only meet compliance requirements but also enhance fuel efficiency. This dynamic environment necessitates continuous innovation and adaptability among industry participants to maintain competitiveness in the automotive fuel filter market.

For instance, in October 2024, Donaldson Company, Inc. acquired Western Filter Corp., an air and liquid filtration product manufacturer for industrial and transportation markets. The acquisition strengthens Donaldson's capabilities in critical filtration technologies, including those used in heavy-duty vehicles and emerging applications like alternative fuel systems.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customers

- 4.1. Respondent Demographics

- 4.2. Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.4. Preferred Distribution Channel

5. Global Automotive Fuel Filter Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Vehicle Type

- 5.2.1.1. Passenger Cars

- 5.2.1.2. Commercial Vehicles

- 5.2.2. By Fuel Type

- 5.2.2.1. Petrol

- 5.2.2.2. Diesel

- 5.2.2.3. Alternative Fuels

- 5.2.3. By Filter Media

- 5.2.3.1. Cellulose Filters

- 5.2.3.2. Synthetic Filters

- 5.2.4. By Sales Channel

- 5.2.4.1. Original Equipment Manufacturer

- 5.2.4.2. Aftermarket

- 5.2.5. By Region

- 5.2.5.1. North America

- 5.2.5.2. Europe

- 5.2.5.3. Asia-Pacific

- 5.2.5.4. South America

- 5.2.5.5. Middle East and Africa

- 5.2.6. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Vehicle Type

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Vehicle Type

- 5.3.2. By Fuel Type

- 5.3.3. By Filter Media

- 5.3.4. Sales Channel

- 5.3.5. By Region

6. North America Automotive Fuel Filter Market Outlook, 2018-2032F

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Vehicle Type

- 6.2.1.1. Passenger Cars

- 6.2.1.2. Commercial Vehicles

- 6.2.2. By Fuel Type

- 6.2.2.1. Petrol

- 6.2.2.2. Diesel

- 6.2.2.3. Alternative Fuels

- 6.2.3. By Filter Media

- 6.2.3.1. Cellulose Filters

- 6.2.3.2. Synthetic Filters

- 6.2.4. By Sales Channel

- 6.2.4.1. Original Equipment Manufacturer

- 6.2.4.2. Aftermarket

- 6.2.5. By Country Share

- 6.2.5.1. United States

- 6.2.5.2. Canada

- 6.2.5.3. Mexico

- 6.2.1. By Vehicle Type

- 6.3. Country Market Assessment

- 6.3.1. United States Automotive Fuel Filter Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Vehicle Type

- 6.3.1.2.1.1. Passenger Cars

- 6.3.1.2.1.2. Commercial Vehicles

- 6.3.1.2.2. By Fuel Type

- 6.3.1.2.2.1. Petrol

- 6.3.1.2.2.2. Diesel

- 6.3.1.2.2.3. Alternative Fuels

- 6.3.1.2.3. By Filter Media

- 6.3.1.2.3.1. Cellulose Filters

- 6.3.1.2.3.2. Synthetic Filters

- 6.3.1.2.4. By Sales Channel

- 6.3.1.2.4.1. Original Equipment Manufacturer

- 6.3.1.2.4.2. Aftermarket

- 6.3.1.2.1. By Vehicle Type

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Automotive Fuel Filter Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Automotive Fuel Filter Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Automotive Fuel Filter Market Outlook, 2018-2032F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Automotive Fuel Filter Market Outlook, 2018-2032F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Automotive Fuel Filter Market Outlook, 2018-2032F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Porter's Five Forces Analysis

12. PESTLE Analysis

13. Pricing Analysis

14. Market Dynamics

- 14.1. Market Drivers

- 14.2. Market Challenges

15. Market Trends and Developments

16. Policy and Regulatory Landscape

17. Case Studies

18. Competitive Landscape

- 18.1. Competition Matrix of Top 5 Market Leaders

- 18.2. SWOT Analysis for Top 5 Players

- 18.3. Key Players Landscape for Top 10 Market Players

- 18.3.1. Donaldson Company, Inc.

- 18.3.1.1. Company Details

- 18.3.1.2. Key Management Personnel

- 18.3.1.3. Products and Services

- 18.3.1.4. Financials (As Reported)

- 18.3.1.5. Key Market Focus and Geographical Presence

- 18.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 18.3.2. MAHLE GmbH

- 18.3.3. DENSO Corporation

- 18.3.4. K&N Engineering, Inc

- 18.3.5. Champion Laboratories, Inc.

- 18.3.6. UFI FILTERS Spa

- 18.3.7. Robert Bosch GmbH

- 18.3.8. Hengst SE

- 18.3.9. MANN+HUMMEL International GmbH & Co. KG

- 18.3.10. Cummins Inc.

- 18.3.1. Donaldson Company, Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.