|

|

市場調査レポート

商品コード

1630539

自動車用塗料市場:コーティングタイプ別、樹脂タイプ別、ベースタイプ別、車両タイプ別、流通サービス別、地域別、機会、予測、2018年~2032年Automotive Paints Market Assessment, By Coating Type, By Resin Type, By Base Type, By Vehicle Type, By Distribution Service, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| 自動車用塗料市場:コーティングタイプ別、樹脂タイプ別、ベースタイプ別、車両タイプ別、流通サービス別、地域別、機会、予測、2018年~2032年 |

|

出版日: 2025年01月14日

発行: Markets & Data

ページ情報: 英文 223 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界の自動車用塗料の市場規模は、2025年~2032年の予測期間中に4.00%のCAGRで拡大し、2024年の94億6,000万米ドルから2032年には129億5,000万米ドルに成長すると予測されています。世界規模の自動車用塗料市場は、自動車生産台数の増加、技術の進歩、環境に優しい自動車用塗料に対する政府の厳しい規制など、いくつかの重要な要因によって著しい成長を示しています。自動車生産台数の増加は、美観と表面保護のための高品質塗料ソリューションの需要増加を支えています。技術の開発も重要な役割を果たしており、塗料の配合や塗布技術における革新が、優れた性能と低い揮発性有機化合物(VOC)排出量を提供するポリウレタン塗料を含む高度な塗料の開発につながっています。

さらに、健康や環境問題に対する消費者の関心の高まりは、環境に優しい製品に対する需要を生み出し、メーカーにVOC排出に関する政府の厳しい規制に準拠した水性塗料やバイオベース塗料の開発を促しています。例えば、2024年10月、PPG Industries, Inc.は、米国で開催される自動車製造業のフォーラムである2024 CARES Conferenceにおいて、自動車製造業向けの持続可能で有利なソリューションを発表すると発表しました。PPGは同社の塗膜ソリューションの利点を紹介します。これらのソリューションは、液状塗料に比べて自動車への塗布に必要なエネルギーが少なくて済むなど、さまざまな環境上のメリットをもたらすほか、新たな美観の選択肢も提供します。

さらに、高級車や高性能車への需要の高まりは、優れた仕上げと耐久性を提供する高級自動車用塗料の使用を後押ししています。可処分所得の増加やいくつかの開発地域における中流階級の人口増加といった経済的要因は、自動車所有の増加を引き起こし、独自のカスタマイズを施した自動車用塗料の需要を高めています。最後に、補修用塗料や保護塗料ソリューションを含む自動車アフターマーケットの成長は、消費者が自動車のメンテナンスに投資することで市場の拡大を促進します。これらの促進要因によって、自動車用塗料市場は将来的に力強い成長を遂げると予想されます。

当レポートでは、世界の自動車用塗料市場について調査し、市場の概要とともに、コーティングタイプ別、樹脂タイプ別、ベースタイプ別、車両タイプ別、流通サービス別、地域別動向、および市場に参入する企業のプロファイルなどを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

第5章 世界の自動車用塗料市場の見通し、2018年~2032年

- 市場規模の分析と予測

- 市場シェア分析と予測

- 市場マップ分析、2024年

- コーティングタイプ別

- 樹脂タイプ別

- ベースタイプ別

- 車両タイプ別

- 流通サービス別

- 地域別

第6章 北米の自動車用塗料市場の見通し、2018年~2032年

第7章 欧州の自動車用塗料市場の見通し、2018年~2032年

第8章 アジア太平洋の自動車用塗料市場の見通し、2018年~2032年

第9章 南米の自動車用塗料市場の見通し、2018年~2032年

第10章 中東・アフリカの自動車用塗料市場の見通し、2018年~2032年

第11章 需要供給分析

第12章 輸出入の分析

第13章 バリューチェーン分析

第14章 ポーターのファイブフォース分析

第15章 PESTLE分析

第16章 価格分析

第17章 市場力学

第18章 市場の動向と発展

第19章 ケーススタディ

第20章 競合情勢

- 市場リーダートップ5の競合マトリックス

- 参入企業トップ5のSWOT分析

- 市場の主要参入企業トップ10の情勢

- BASF SE

- Axalta Coating Systems, LLC

- Clariant Ltd.

- PPG Industries, Inc.

- Akzo Nobel N.V.

- Nippon Paint Holdings Co., Ltd.

- Kansai Paint Co., Ltd.

- Sherwin-Williams Company

- Solvay SA

- The Dow Chemical Company

第21章 戦略的提言

第22章 お問い合わせと免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 2. Global Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 3. Global Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 4. Global Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 5. Global Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 6. Global Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 7. Global Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 8. Global Automotive Paints Market Share (%), By Region, 2018-2032F

- Figure 9. North America Automotive Paints Market, By Value, In USD Billion, 2018-2032F

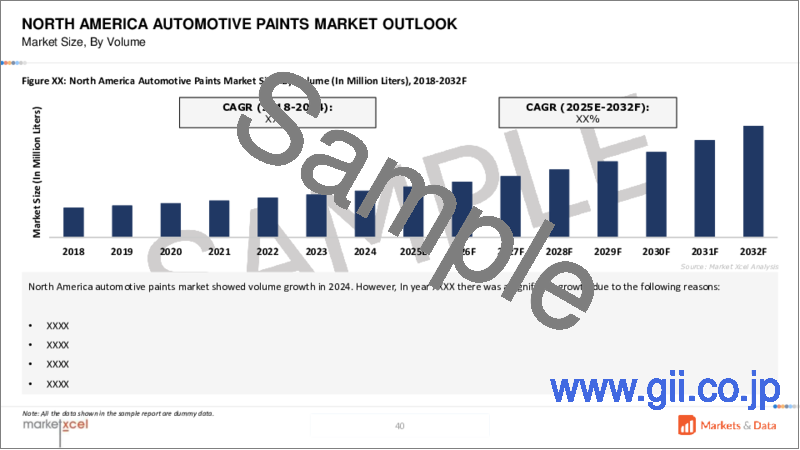

- Figure 10. North America Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 11. North America Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 12. North America Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 13. North America Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 14. North America Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 15. North America Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 16. North America Automotive Paints Market Share (%), By Country, 2018-2032F

- Figure 17. United States Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 18. United States Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 19. United States Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 20. United States Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 21. United States Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 22. United States Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 23. United States Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 24. Canada Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 25. Canada Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 26. Canada Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 27. Canada Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 28. Canada Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 29. Canada Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 30. Canada Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 31. Mexico Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 32. Mexico Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 33. Mexico Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 34. Mexico Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 35. Mexico Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 36. Mexico Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 37. Mexico Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 38. Europe Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 39. Europe Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 40. Europe Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 41. Europe Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 42. Europe Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 43. Europe Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 44. Europe Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 45. Europe Automotive Paints Market Share (%), By Country, 2018-2032F

- Figure 46. Germany Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 47. Germany Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 48. Germany Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 49. Germany Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 50. Germany Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 51. Germany Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 52. Germany Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 53. France Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 54. France Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 55. France Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 56. France Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 57. France Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 58. France Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 59. France Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 60. Italy Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 61. Italy Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 62. Italy Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 63. Italy Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 64. Italy Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 65. Italy Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 66. Italy Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 67. United Kingdom Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 68. United Kingdom Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 69. United Kingdom Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 70. United Kingdom Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 71. United Kingdom Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 72. United Kingdom Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 73. United Kingdom Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 74. Russia Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 75. Russia Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 76. Russia Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 77. Russia Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 78. Russia Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 79. Russia Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 80. Russia Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 81. Netherlands Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 82. Netherlands Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 83. Netherlands Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 84. Netherlands Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 85. Netherlands Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 86. Netherlands Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 87. Netherlands Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 88. Spain Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 89. Spain Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 90. Spain Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 91. Spain Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 92. Spain Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 93. Spain Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 94. Spain Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 95. Turkey Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 96. Turkey Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 97. Turkey Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 98. Turkey Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 99. Turkey Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 100. Turkey Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 101. Turkey Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 102. Poland Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 103. Poland Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 104. Poland Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 105. Poland Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 106. Poland Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 107. Poland Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 108. Poland Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 109. South America Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 110. South America Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 111. South America Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 112. South America Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 113. South America Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 114. South America Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 115. South America Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 116. South America Automotive Paints Market Share (%), By Country, 2018-2032F

- Figure 117. Brazil Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 118. Brazil Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 119. Brazil Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 120. Brazil Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 121. Brazil Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 122. Brazil Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 123. Brazil Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 124. Argentina Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 125. Argentina Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 126. Argentina Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 127. Argentina Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 128. Argentina Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 129. Argentina Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 130. Argentina Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 131. Asia-Pacific Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 132. Asia-Pacific Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 133. Asia-Pacific Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 134. Asia-Pacific Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 135. Asia-Pacific Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 136. Asia-Pacific Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 137. Asia- Pacific Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 138. Asia-Pacific Automotive Paints Market Share (%), By Country, 2018-2032F

- Figure 139. India Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 140. India Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 141. India Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 142. India Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 143. India Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 144. India Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 145. India Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 146. China Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 147. China Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 148. China Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 149. China Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 150. China Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 151. China Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 152. China Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 153. Japan Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 154. Japan Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 155. Japan Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 156. Japan Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 157. Japan Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 158. Japan Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 159. Japan Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 160. Australia Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 161. Australia Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 162. Australia Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 163. Australia Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 164. Australia Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 165. Australia Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 166. Australia Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 167. Vietnam Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 168. Vietnam Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 169. Vietnam Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 170. Vietnam Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 171. Vietnam Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 172. Vietnam Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 173. Vietnam Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 174. South Korea Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 175. South Korea Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 176. South Korea Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 177. South Korea Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 178. South Korea Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 179. South Korea Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 180. South Korea Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 181. Indonesia Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 182. Indonesia Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 183. Indonesia Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 184. Indonesia Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 185. Indonesia Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 186. Indonesia Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 187. Indonesia Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 188. Philippines Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 189. Philippines Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 190. Philippines Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 191. Philippines Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 192. Philippines Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 193. Philippines Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 194. Philippines Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 195. Middle East & Africa Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 196. Middle East & Africa Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 197. Middle East & Africa Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 198. Middle East & Africa Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 199. Middle East & Africa Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 200. Middle East & Africa Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 201. Middle East & Africa Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 202. Middle East & Africa Automotive Paints Market Share (%), By Country, 2018-2032F

- Figure 203. Saudi Arabia Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 204. Saudi Arabia Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 205. Saudi Arabia Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 206. Saudi Arabia Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 207. Saudi Arabia Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 208. Saudi Arabia Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 209. Saudi Arabia Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 210. UAE Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 211. UAE Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 212. UAE Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 213. UAE Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 214. UAE Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 215. UAE Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 216. UAE Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 217. South Africa Automotive Paints Market, By Value, In USD Billion, 2018-2032F

- Figure 218. South Africa Automotive Paints Market, By Volume, In Thousand Liter, 2018-2032F

- Figure 219. South Africa Automotive Paints Market Share (%), By Coating Type, 2018-2032F

- Figure 220. South Africa Automotive Paints Market Share (%), By Resin Type, 2018-2032F

- Figure 221. South Africa Automotive Paints Market Share (%), By Base Type, 2018-2032F

- Figure 222. South Africa Automotive Paints Market Share (%), By Vehicle Type, 2018-2032F

- Figure 223. South Africa Automotive Paints Market Share (%), By Distribution Service, 2018-2032F

- Figure 224. By Coating Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 225. By Resin Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 226. By Base Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 227. By Vehicle Type Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 228. By Distribution Service Map-Market Size (USD Billion) & Growth Rate (%), 2024

- Figure 229. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2024

Global automotive paints market is projected to witness a CAGR of 4.00% during the forecast period 2025-2032, growing from USD 9.46 billion in 2024 to USD 12.95 billion in 2032. The automotive paints market on a global scale is showcasing significant growth due to several key factors, comprising increased vehicle production, technological advancements, and stringent government regulations for eco-friendly automotive paints. Increased vehicle production supports the increase in demand for high-quality paint solutions for aesthetics and surface protection. Advancements in technology also play a crucial role, with innovations in paint formulations and application technologies leading to the development of advanced coatings comprising polyurethane paints that offer superior performance and lower volatile organic compound (VOC) emissions. In addition, growing concern from consumers about health and environmental issues is creating demand for eco-friendly products, prompting manufacturers to develop waterborne or bio-based coatings complying with stringent government regulations on VOC emissions. For instance, in October 2024, PPG Industries, Inc. announced that it would present its sustainably advantaged solutions for automotive manufacturing during the 2024 CARES Conference, an automotive manufacturing forum in the United States. PPG will present the benefits of its paint film solutions. These provide a range of environmental benefits, including lower energy required for application on vehicles compared to liquid paints, as well as new aesthetic options.

Furthermore, the increased demand for luxury and high-performance cars propels the use of high-end automotive paints that offer superior finishes and durability. Economic factors like increased disposable incomes and a growing middle-class population in several developing areas cause increased vehicle ownership, raising demand for automotive paint with unique customizations. Finally, the growth of the automotive aftermarket, including refinish coatings and protective paint solutions, enhances market expansion as consumers invest in maintaining their vehicles. It is expected that these drivers will project strong growth in the automotive paints market in the future.

Increased Vehicle Production is Expanding the Global Automotive Paints Market Scope

The global automotive paints market is expanding significantly due to increased vehicle production. For instance, in 2023, 93.5 million motor vehicles were produced worldwide, an increase of 10% compared to 2022. This surge in production is driving the demand for automotive paint, as each new vehicle requires a high-quality finish to meet consumer expectations. The rise in consumer preferences for customized and unique vehicle appearances further fuels this growth. Custom automotive paint accounted for a substantial portion of the industry, reflecting a trend among vehicle owners seeking personalized aesthetics. As manufacturers continue to innovate and respond to market demands, the automotive paints market is poised for sustained growth in tandem with rising vehicle production rates.

For instance, in December 2024, TOYOTA MOTOR CORPORATION, Kentucky, invested USD 922 million to build an advanced paint facility and further support electrification efforts. The facility is designed to improve operational efficiencies, reduce environmental impacts, and enhance the quality of vehicle finishes. The project further supports plant efforts to increase flexibility for future vehicle production and moves Toyota forward in its goal to achieve zero carbon emissions by 2050.

Technological Advancements Propel the Global Automotive Paints Market Growth

Technological advancements are significantly propelling the growth of the global automotive paints market by introducing innovative solutions that enhance performance, sustainability, and aesthetic appeal. Introducing waterborne paints is increasingly favored due to their lower volatile organic compound. This trend meets strict environmental regulations and responds to consumer demand for eco-friendly products. In addition, advancements in color-matching technology and the use of spectrophotometers have revolutionized the paint application process. These devices analyze light wavelengths reflected from painted surfaces, ensuring precise color matching that minimizes variations and enhances repair quality. This technology reduces human error and allows for more consistent results, which is crucially used in collision repair scenarios. The increasing interest in the market is for special effect paints and UV-curable paints, which provide unique finishes and much faster curing, respectively. These innovations cater to consumer preferences for customization and high-performance coatings. Furthermore, the integration of smart coatings comprising self-cleaning and self-healing paints demonstrates how technology can enhance the functionality of automotive finishes. Self-cleaning paint utilizes nanotechnology to prevent dirt accumulation, while self-healing wraps can mend scratches through heat activation. As these technologies continue to evolve, they improve the quality and durability of automotive paints and contribute to a more sustainable industry, positioning manufacturers to meet both regulatory requirements and consumer expectations effectively.

For instance, in August 2023, Axalta Coating Systems, LLC partnered with Xaar plc to introduce next-generation, sustainable digital paint technology for the transportation industry Axalta NextJet to the market. It is powered by Xaar plc's leading inkjet technology and paired with Axalta Coating Systems, LLC's proprietary paint designed for jetting. Digital paint, also referred to as an overspray-free application, is an advanced paint application that will allow for precise paint placement.

Dominance of Solvent-Borne Base in Global Automotive Paints Market

The dominance of solvent-borne base coatings in the global automotive paints market is a significant trend, driven by their established performance characteristics and versatility. Solvent-borne coatings have long been favored for their durability, ease of application, and excellent finish quality, making them a staple in automotive manufacturing and refinishing. This growth is attributed to the ongoing demand for high-performance coatings with smooth refinish that solvent-borne products provide, particularly in automotive refinishing. However, the automotive industry is experiencing a shift towards more sustainable practices driven by stringent regulations aimed at reducing volatile organic compound emissions and enhancing environmental responsibility. While solvent-borne base coatings continue to dominate the automotive paints market due to their established advantages, the future landscape will likely see increased competition from waterborne technologies as sustainability becomes a more pressing concern for manufacturers and consumers.

For instance, in January 2024, BYK-Chemie GmbH invested in the Deventer site in the Netherlands. The new production facility will manufacture solvent-based wax dispersions and replace the current facility with a state-of-the-art installation process. The dispersions are used by can and coil, automotive paint, printing inks, and wood- and industrial coatings producers.

Asia-Pacific Dominates the Global Automotive Paints Market Share

Asia-Pacific is poised to dominate the global automotive paints market and is expected to hold the largest share of the automotive paints market due to rising industrialization, urbanization, and a robust local automobile sector. China plays a pivotal role in this growth, emerging as a significant force in car manufacturing and consumption. For instance, China manufactured more than 67.13 million cars and 26.41 million commercial vehicles in 2023, producing about 93.54 million vehicles. The country tops in vehicle production and hosts many international and domestic automotive paint manufacturers. Moreover, the increasing demand for eco-friendly automotive paints is another major driver of this development in the region. As countries tighten environmental regulations and consumers grow keener on the environment, manufacturers shift toward technologies that produce much fewer VOC emissions compared to solvent-borne paints. This trend fits well within global sustainability trends, adding to the attractiveness of automotive paints within Asia-Pacific markets. Additionally, the expanding middle class and rising disposable incomes in countries like India contribute significantly to vehicle ownership rates, further boosting demand for automotive paints. The combination of these factors positions Asia-Pacific as the fastest-growing market for automotive paints globally.

For instance, in December 2022, BASF SE launched BASF's ColorBrite Airspace Blue ReSource basecoat, certified by REDcert. This is the first biomass-balance automotive coating in China using renewable raw materials according to a certified biomass-balance approach. This reduces the product's carbon footprint without altering its formulation and performance.

Future Market Scenario (2025-2032F)

Innovations in paint formulations, particularly the development of waterborne and UV-cured coatings, will gain traction due to their environmental impact and compliance with stringent regulations regarding VOC emissions.

Rising urbanization and industrialization contribute to increased vehicle ownership and demand for high-quality paint solutions.

Shift in consumer preferences towards sustainable transportation options will play a crucial role.

Key Players Landscape and Outlook

The global automotive paints market is characterized by a competitive landscape with several key players driving innovation and growth. Prominent players focus on expanding their product portfolios, particularly in eco-friendly and advanced coating technologies. The demand for sustainable solutions is becoming increasingly important as regulatory pressures mount and consumer preferences shift towards environmentally friendly products. As manufacturers continue to innovate, collaborate, acquire, and adapt to changing market dynamics, the outlook for the global automotive paints market remains positive, with significant opportunities for growth and expansion in emerging markets.

For instance, in May 2024, Axalta Coating Systems, LLC announced a strategic partnership with Solera Holdings, LLC. Through this strategic partnership, Axalta's conventional and Fast Cure Low Energy (FCLE) refinish paint systems will be integrated into Solera's Sustainable Estimatics platform, enabling Axalta Customers to analyze their CO2 emissions per repair, considering repair methods (repair versus replace), paint application process, and drying conditions.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Product and Market Intelligence

- 4.2. Brand Awareness

- 4.3. Factors Considered in Purchase Decisions

- 4.3.1. Quality Assurance

- 4.3.2. Price

- 4.3.3. Environmental Impact

- 4.3.4. Durability

- 4.4. Consideration of Regulations

5. Global Automotive Paints Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Coating Type

- 5.2.1.1. Primer

- 5.2.1.2. Base Coat

- 5.2.1.3. Clear Coat

- 5.2.1.4. Electrocoat

- 5.2.2. By Resin Type

- 5.2.2.1. Polyurethane

- 5.2.2.2. Epoxy

- 5.2.2.3. Acrylic

- 5.2.3. By Base Type

- 5.2.3.1. Powder Coating

- 5.2.3.2. Solvent-Borne

- 5.2.3.3. Water-Borne

- 5.2.4. By Vehicle Type

- 5.2.4.1. Passenger Vehicles

- 5.2.4.2. Commercial Vehicles

- 5.2.5. By Distribution Service

- 5.2.5.1. Direct

- 5.2.5.2. Indirect

- 5.2.6. By Region

- 5.2.6.1. North America

- 5.2.6.2. Europe

- 5.2.6.3. Asia-Pacific

- 5.2.6.4. South America

- 5.2.6.5. Middle East and Africa

- 5.2.7. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Coating Type

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Coating Type

- 5.3.2. By Resin Type

- 5.3.3. By Base Type

- 5.3.4. By Vehicle Type

- 5.3.5. By Distribution Service

- 5.3.6. By Region

6. North America Automotive Paints Market Outlook, 2018-2032F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Coating Type

- 6.2.1.1. Primer

- 6.2.1.2. Base Coat

- 6.2.1.3. Clear Coat

- 6.2.1.4. Electrocoat

- 6.2.2. By Resin Type

- 6.2.2.1. Polyurethane

- 6.2.2.2. Epoxy

- 6.2.2.3. Acrylic

- 6.2.3. By Base Type

- 6.2.3.1. Powder Coating

- 6.2.3.2. Solvent-Borne

- 6.2.3.3. Water-Borne

- 6.2.4. By Vehicle Type

- 6.2.4.1. Passenger Vehicles

- 6.2.4.2. Commercial Vehicles

- 6.2.5. By Distribution Service

- 6.2.5.1. Direct

- 6.2.5.2. Indirect

- 6.2.6. By Country Share

- 6.2.6.1. United States

- 6.2.6.2. Canada

- 6.2.6.3. Mexico

- 6.2.1. By Coating Type

- 6.3. Country Market Assessment

- 6.3.1. United States Automotive Paints Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Coating Type

- 6.3.1.2.1.1. Primer

- 6.3.1.2.1.2. Base Coat

- 6.3.1.2.1.3. Clear Coat

- 6.3.1.2.1.4. Electrocoat

- 6.3.1.2.2. By Resin Type

- 6.3.1.2.2.1. Polyurethane

- 6.3.1.2.2.2. Epoxy

- 6.3.1.2.2.3. Acrylic

- 6.3.1.2.3. By Base Type

- 6.3.1.2.3.1. Powder Coating

- 6.3.1.2.3.2. Solvent-Borne

- 6.3.1.2.3.3. Water-Borne

- 6.3.1.2.4. By Vehicle Type

- 6.3.1.2.4.1. Passenger Vehicles

- 6.3.1.2.4.2. Commercial Vehicles

- 6.3.1.2.5. By Distribution Service

- 6.3.1.2.5.1. Direct

- 6.3.1.2.5.2. Indirect

- 6.3.1.2.1. By Coating Type

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Automotive Paints Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Automotive Paints Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Automotive Paints Market Outlook, 2018-2032F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Automotive Paints Market Outlook, 2018-2032F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Automotive Paints Market Outlook, 2018-2032F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Demand Supply Analysis

12. Import and Export Analysis

13. Value Chain Analysis

14. Porter's Five Forces Analysis

15. PESTLE Analysis

16. Pricing Analysis

17. Market Dynamics

- 17.1. Market Drivers

- 17.2. Market Challenges

18. Market Trends and Developments

19. Case Studies

20. Competitive Landscape

- 20.1. Competition Matrix of Top 5 Market Leaders

- 20.2. SWOT Analysis for Top 5 Players

- 20.3. Key Players Landscape for Top 10 Market Players

- 20.3.1. BASF SE

- 20.3.1.1. Company Details

- 20.3.1.2. Key Management Personnel

- 20.3.1.3. Products and Services

- 20.3.1.4. Financials (As Reported)

- 20.3.1.5. Key Market Focus and Geographical Presence

- 20.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 20.3.2. Axalta Coating Systems, LLC

- 20.3.3. Clariant Ltd.

- 20.3.4. PPG Industries, Inc.

- 20.3.5. Akzo Nobel N.V.

- 20.3.6. Nippon Paint Holdings Co., Ltd.

- 20.3.7. Kansai Paint Co., Ltd.

- 20.3.8. Sherwin-Williams Company

- 20.3.9. Solvay SA

- 20.3.10. The Dow Chemical Company

- 20.3.1. BASF SE

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.