|

|

市場調査レポート

商品コード

1532123

バイオディーゼルの世界市場の評価:原料別、用途別、地域別、機会、予測(2017年~2031年)Biodiesel Market Assessment, By Feed Stock [Vegetable Oil, Animal Fats, Others], By Application [Transportation, Power Generation, Others], By Region, Opportunities and Forecast, 2017-2031F |

||||||

カスタマイズ可能

|

|||||||

| バイオディーゼルの世界市場の評価:原料別、用途別、地域別、機会、予測(2017年~2031年) |

|

出版日: 2024年08月13日

発行: Markets & Data

ページ情報: 英文 230 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のバイオディーゼルの市場規模は、2023年の411億5,000万米ドルから2031年に763億4,000万米ドルに達し、2024年~2031年の予測期間にCAGRで8.03%の成長が見込まれます。2021年と比較して、2022年の世界のバイオ燃料需要は6%増加し、年間91億リットルに相当します。この成長は、米国と欧州の有利な規制によるものです。さらに、インドとブラジルでは、金融優遇措置と混合の要件に支えられ、バイオディーゼル需要が増加しています。インドネシアでは30%のバイオディーゼル混合が義務付けられているため、バイオディーゼルの使用の増加が見られます。

IEAによると、2023年に世界で年間482億リットルのバイオディーゼルが消費されました。バイオ燃料の需要の大半は発展途上国、特にブラジル、インドネシア、インドからもたらされています。この3ヶ国はそれぞれ強力な規制を持ち、輸送用燃料のニーズが高まっており、原料の供給も豊富で、バイオディーゼルの使用がもっとも多いです。米国、カナダ、日本、欧州連合などの先進国は輸送規制を強化しています。しかし、電気自動車の普及、自動車効率の向上、バイオ燃料コストの高騰、技術的制約などの要因により、売上の伸びは限られています。

GHG排出削減を目的とした規制は、GHG排出が少なく廃棄物や残渣から作られるバイオディーゼルの需要を促進しています。一方、バイオディーゼル利用の拡大の主な促進要因となっているのは新興経済国であり、外国産石油の輸入を最小限に抑え、国内資源を最大限に利用して地域経済を支えるという2つの目標を掲げています。さらに、バイオ燃料を使用することで、これらの国々では温室効果ガスの排出が削減されます。

バイオディーゼルは燃焼に伴う大気汚染の少ないディーゼル燃料に代わる再生可能な代替燃料であり、既存のディーゼルエンジンに利用することができます。バイオディーゼルは、動物性油脂、農産物原料、再生食用油などから作られます。発電や輸送用途で従来の化石燃料の代替としてバイオディーゼルの需要が高まっていることから、市場の拡大が見込まれています。

温室効果ガス(GHG)の排出を抑えつつ、環境にやさしく完全燃焼を保証する燃料へのニーズが高まっていることも、市場を後押しする主な要因の1つです。バイオディーゼルは現行のディーゼルエンジンとの優れた互換性を持つことから、その需要が後押しされています。バイオディーゼルを使用する自動車やその他の産業の数は、人口の増加とともに、バイオディーゼル市場の需要を増加させると予測されます。

市場を独占する輸送セグメント

二酸化炭素排出の削減に役立つバイオディーゼルのような環境にやさしい燃料への需要が高まっているため、輸送セグメントが世界のバイオディーゼル市場をリードすると予測されます。大気を汚染し、心臓病や呼吸困難の原因となる輸送産業の炭素排出により、人々は環境安全に対する意識を高めています。バイオディーゼルは再生可能なディーゼル代替燃料であり、既存のディーゼルエンジンを改造することなく利用できます。そのため、輸送部門におけるバイオディーゼルの需要が高まっています。

例えば、米国エネルギー省(DOE)は2023年1月、同国の産業と輸送のニーズに対応する持続可能なバイオ燃料の製作を急ぐため、17のプロジェクトに1億1,800万米ドルを投入すると宣言しました。化石燃料の排出を抑制する持続可能な燃料の供給に向けて、予備試験や実証試験からバイオリファイナリー開発を進めることで、選ばれたプロジェクトは、バイオ燃料およびバイオ製品の国内生産を増やすことになります。

インドネシアが生産において最大の市場を持つ

インドネシアでは800万キロリットルを超えるバイオディーゼルが生産されており、国内外からの需要に対応できる強力な産業であることが実証されています。インドネシアのバイオディーゼル生産能力は1,200万キロリットルを超えると報告されており、バイオディーゼル需要の増加を満たす準備が整っていることを示しています。

当レポートでは、世界のバイオディーゼル市場について調査分析し、市場規模と予測、市場力学、主要企業の情勢と見通しなどを提供しています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- ブランド認知度

- リードタイム

- サプライチェーン

- 品質

- 購入のしやすさ

第5章 世界のバイオディーゼル市場の見通し(2017年~2031年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 原料別

- 用途別

- 地域別

- 市場シェア分析:企業別(金額)(上位5社とその他 - 2023年)

- 市場マップ分析(2023年)

- 原料別

- 用途別

- 地域別

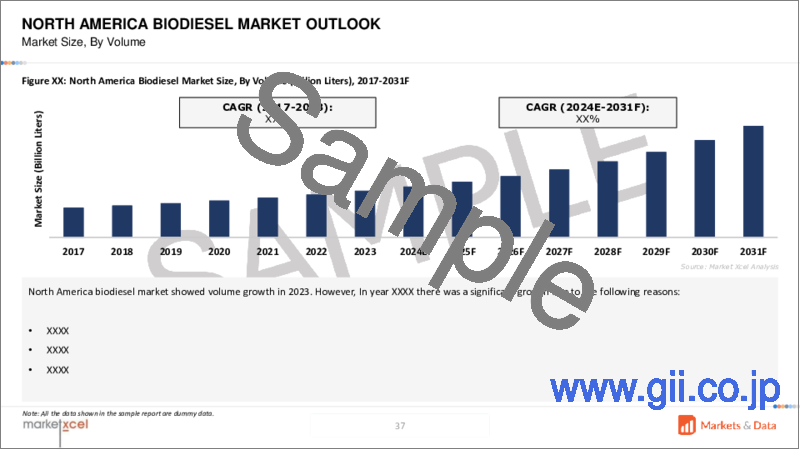

第6章 北米のバイオディーゼル市場の見通し(2017年~2031年)

- 市場規模の分析と予測

- 金額

- 数量

- 市場シェアの分析と予測

- 原料別

- 用途別

- シェア:国別

- 市場の評価:国別

- 米国のバイオディーゼルの見通し(2017年~2031年)

- カナダ

- メキシコ

第7章 欧州のバイオディーゼル市場の見通し(2017年~2031年)

- ドイツ

- フランス

- イタリア

- 英国

- ロシア

- オランダ

- スペイン

- トルコ

- ポーランド

第8章 アジア太平洋のバイオディーゼル市場の見通し(2017年~2031年)

- インド

- 中国

- 日本

- オーストラリア

- ベトナム

- 韓国

- インドネシア

- フィリピン

第9章 南米のバイオディーゼル市場の見通し(2017年~2031年)

- ブラジル

- アルゼンチン

第10章 中東・アフリカのバイオディーゼル市場の見通し(2017年~2031年)

- サウジアラビア

- アラブ首長国連邦

- 南アフリカ

第11章 ポーターのファイブフォース分析

第12章 PESTLE分析

第13章 市場力学

- 市場促進要因

- 市場の課題

第14章 市場の動向と発展

第15章 25の生産プラントの生産能力のリスト

第16章 競合情勢

- マーケットリーダー上位5社の競合マトリクス

- 上位5社のSWOT分析

- 主要企業上位10社の情勢

- Renewable Energy Group Inc.

- Wilmar International Ltd

- Archer Daniels Midland Company

- BIOX Corporation

- Bangchak Corporation Public Company Limited

- Neste Oyj

- Cargill Inc

- Ag Processing Inc.

- Bunge Ltd.

- Ecodiesel Colombia S.A.

- FutureFuel Corp.

- Manuelita S.A.

- Renewable Biofuels, Inc.

第17章 戦略的推奨

第18章 当社について、免責事項

List of Tables

- Table 1. Pricing Analysis of Products from Key Players

- Table 2. Competition Matrix of Top 5 Market Leaders

- Table 3. Mergers & Acquisitions/ Joint Ventures (If Applicable)

- Table 4. About Us - Regions and Countries Where We Have Executed Client Projects

List of Figures

- Figure 1. Global Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 2. Global Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 3. Global Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 4. Global Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 5. Global Biodiesel Market Share (%), By Region, 2017-2031F

- Figure 6. North America Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 7. North America Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 8. North America Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 9. North America Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 10. North America Biodiesel Market Share (%), By Country, 2017-2031F

- Figure 11. United States Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 12. United States Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 13. United States Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 14. United States Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 15. Canada Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 16. Canada Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 17. Canada Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 18. Canada Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 19. Mexico Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 20. Mexico Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 21. Mexico Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 22. Mexico Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 23. Europe Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 24. Europe Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 25. Europe Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 26. Europe Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 27. Europe Biodiesel Market Share (%), By Country, 2017-2031F

- Figure 28. Germany Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 29. Germany Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 30. Germany Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 31. Germany Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 32. France Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 33. France Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 34. France Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 35. France Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 36. Italy Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 37. Italy Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 38. Italy Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 39. Italy Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 40. United Kingdom Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 41. United Kingdom Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 42. United Kingdom Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 43. United Kingdom Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 44. Russia Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 45. Russia Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 46. Russia Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 47. Russia Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 48. Netherlands Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 49. Netherlands Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 50. Netherlands Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 51. Netherlands Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 52. Spain Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 53. Spain Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 54. Spain Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 55. Spain Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 56. Turkey Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 57. Turkey Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 58. Turkey Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 59. Turkey Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 60. Poland Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 61. Poland Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 62. Poland Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 63. Poland Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 64. South America Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 65. South America Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 66. South America Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 67. South America Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 68. South America Biodiesel Market Share (%), By Country, 2017-2031F

- Figure 69. Brazil Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 70. Brazil Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 71. Brazil Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 72. Brazil Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 73. Argentina Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 74. Argentina Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 75. Argentina Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 76. Argentina Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 77. Asia-Pacific Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 78. Asia-Pacific Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 79. Asia-Pacific Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 80. Asia-Pacific Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 81. Asia-Pacific Biodiesel Market Share (%), By Country, 2017-2031F

- Figure 82. India Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 83. India Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 84. India Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 85. India Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 86. China Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 87. China Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 88. China Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 89. China Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 90. Japan Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 91. Japan Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 92. Japan Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 93. Japan Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 94. Australia Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 95. Australia Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 96. Australia Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 97. Australia Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 98. Vietnam Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 99. Vietnam Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 100. Vietnam Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 101. Vietnam Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 102. South Korea Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 103. South Korea Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 104. South Korea Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 105. South Korea Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 106. Indonesia Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 107. Indonesia Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 108. Indonesia Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 109. Indonesia Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 110. Philippines Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 111. Philippines Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 112. Philippines Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 113. Philippines Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 114. Middle East & Africa Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 115. Middle East & Africa Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 116. Middle East & Africa Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 117. Middle East & Africa Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 118. Middle East & Africa Biodiesel Market Share (%), By Country, 2017-2031F

- Figure 119. Saudi Arabia Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 120. Saudi Arabia Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 121. Saudi Arabia Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 122. Saudi Arabia Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 123. UAE Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 124. UAE Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 125. UAE Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 126. UAE Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 127. South Africa Biodiesel Market, By Value, In USD Billion, 2017-2031F

- Figure 128. South Africa Biodiesel Market, By Volume, in Billion Liters, 2017-2031F

- Figure 129. South Africa Biodiesel Market Share (%), By Feed Stock, 2017-2031F

- Figure 130. South Africa Biodiesel Market Share (%), By Application, 2017-2031F

- Figure 131. By Feed Stock Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 132. By Application Map-Market Size (USD Billion) & Growth Rate (%), 2023

- Figure 133. By Region Map-Market Size (USD Billion) & Growth Rate (%), 2023

Global biodiesel market is expected to observe a CAGR of 8.03% during the forecast period 2024-2031, rising from USD 41.15 billion in 2023 to USD 76.34 billion in 2031. Compared to 2021, the global demand for biofuels increased by 6% in 2022, equivalent to 9,100 million liters per year. The growth is attributed to favorable regulations in the United States and Europe. Additionally, India and Brazil are experiencing rising demand for biodiesel, supported by financial incentives and blending requirements. Indonesia has seen increased biodiesel usage due to its 30% biodiesel blending mandate.

According to IEA, in 2023, 48.2 billion liters per year of biodiesel was consumed globally. Most of the demand for biofuels is coming from developing nations, especially Brazil, Indonesia, and India. Each of the three nations have strong regulations, a growing need for transportation fuel, and a plentiful supply of feedstock, with the highest usage of biodiesel. Advanced economies such as the United States, Canada, Japan, and European Union are tightening their transportation regulations. However, volume growth is limited due to factors such as the increasing popularity of electric vehicles, improvements in vehicle efficiency, high biofuel costs, and technological constraints.

Regulations intended to reduce GHG emissions are driving demand of biodiesel, as it has low GHG emissions and is made from wastes and residues. Meanwhile, emerging economies are the main drivers of the growing use of biodiesel, with the dual goals of minimizing the use of foreign oil imports and maximizing the use of domestic resources to support local economies. Additionally, using biofuels lowers greenhouse gas emissions in these nations.

Biodiesel is a clean-burning, renewable alternative to diesel that can be utilized in existing diesel engines. It is made from an increasing range of animal fats, agricultural feedstock, and recycled cooking oil. The market is expected to increase due to rising demand for biodiesel as an alternative to conventional fossil fuels in power generation and transportation applications.

One of the key elements propelling the market is the increasing need for fuels that are environmentally friendly and assure complete combustion while lowering greenhouse gas (GHG) emissions. Demand is being driven by biodiesel's excellent compatibility with current diesel engines. The number of cars and other industries using biodiesel, together with the population growth are predicted to increase demand for biodiesel in the market.

Transportation Segment to Dominate Market

Due to the rising demand for environmentally friendly fuels such as biodiesel, which help lower carbon emissions, the transportation segment is expected to lead the global biodiesel market. People are becoming more conscious of environmental safety due to the transportation industry's carbon emissions, which contaminate the air and contribute to heart disease and breathing difficulties. Biodiesel is a renewable diesel replacement utilized in existing diesel engines without modifications. It raises the demand for biodiesel in the transportation sector.

For instance, in January 2023, the US Department of Energy (DOE) declared that it would put USD 118 million into 17 projects to hasten the creation of sustainable biofuels for the country's industry and transportation needs. By advancing biorefinery development, from pre-pilot and demonstration to supply sustainable fuels that limit emissions associated with fossil fuels, the selected projects will increase domestic production of biofuels and bioproducts.

Indonesia Holds the Largest Market in Terms of Production

Over 8 million kiloliters of biodiesel have been produced in Indonesia, demonstrating a strong industry that can meet both local and international demand. With a reported capacity of over 12 million kiloliters, the nation has a sizable capability for producing biodiesel, indicating its readiness to satisfy rising biodiesel demand.

By blending diesel with Fatty Acid Methyl Ester (FAME) derived from palm oil, Indonesia intends to reduce fuel imports, increase domestic demand for palm oil, and lower emissions. The mandate, which has been expanded to include a nationwide B20 program in 2018, a B30 program in 2020, and a 35% blending rate by August 2023, is carried out by Pertamina in collaboration with private enterprises. Tests comparing the performance of two diesel fuel types with different degrees of bio components are part of the government's effort to surpass 35% of blending rates. The government started testing a 50% renewable diesel blend in May 2023, focusing on heavy equipment used in the mining industry. The successful implementation of the B30 program, mandating a 30% biodiesel blend in diesel fuel, demonstrates Indonesia's commitment to renewable energy and its leading role in the global biofuel initiatives.

Global Biofuels Alliance to Influence Market Growth

In September 2023, as the G20 Chair, India initiated the Global Biofuels Alliance (GBA), a multi-stakeholder collaboration of governments, international organizations, and industries that brings together largest producers and users of biofuels to promote the development and use of biofuels. The project seeks to establish biofuels as a vital component of energy transition and a driver of employment and economic expansion.

Through facilitating capacity-building exercises across the value chain, providing technical support for national programs and, encouraging the sharing of policy lessons technology advancements, and the increasing use of sustainable biofuels with the involvement of a wide range of stakeholders, the Alliance hopes to accelerate the global uptake of biofuels. To encourage the use and trading of biofuels, GBA seeks to create globally accepted standards, norms, and sustainability principles. The alliance will promote international cooperation for the promotion of biofuels by acting as a knowledge base and expert hub.

Rising Demand for Low-Carbon Emission Products

Biodiesel is devoid of sulfur compounds and aromatics, making it easy to use, biodegradable, and non-toxic. It is compatible with the majority of diesel engines, produces fewer greenhouse gases and air pollutants, and emits less harmful carbon-based emissions. The biodiesel business is expanding due to growing concerns about greenhouse gas emissions from the use of fossil fuels. In addition to a lower harmful and carcinogenic aromatic carbon content than petroleum diesel, biodiesel can cut greenhouse gas emissions by up to 50%.

For instance, Indonesia has submitted its latest commitment to the UNFCC, setting updated targets of a 31.89% reduction and a 43.2% reduction by 2030. The increase is conditional and shows that lowering emissions without help from abroad is a priority. To position biofuels as the main energy source for its transportation sector by 2050, Indonesia has devised the Long-Term Low Carbon Strategy (LTS-LCCR 2050). The transition entails gradually switching from gasoline to renewable diesel, bioethanol, and biodiesel derived from palm oil.

Future Market Scenario (2024 - 2031F)

Demand for biodiesel is expected to increase due to developments in transportation fleets, greater demand from consumers, and improvements in domestic policies. By 2031, global ethanol and biodiesel production is expected to rise to 140 billion liters and 55 billion liters, respectively, as a result of growth in Asian nations that support domestic production with tax breaks, subsidies, and low-interest loans for investments. Different nations use different feedstocks for biodiesel products, becoming more aware of the sustainability of biofuel production.

By 2031, ethanol mix rate in the United States will reach 11%. The European Union will continue to generate the most biodiesel globally, with a decline in production shares from 30.7% to 28% worldwide. By 2031, advanced biofuel sources are predicted to rise from 24% to 37% of total biofuel consumption in European Union, while overall biofuel usage is predicted to decline by 1.5% per annum. As it poses a high risk of ILUC, palm oil-based biodiesel is projected to see a decrease in consumption. Over the next ten years, Brazil is predicted to consume more fuel overall, underpinning the potential growth of blending biofuels into gasoline and diesel. By 2031, Indonesia is expected to produce 10.9 billion liters of biodiesel. European Union's environmental regulations and high-income countries' decreasing diesel use are expected to increase their exports during the forecast years.

In 2021, due to rising soybean oil prices and production expenses, the Argentina government lowered the biodiesel mix rate from 10% to 5%, which is estimated to increase to 8.5% in 2031. Tax exemptions will continue to boost the development of the country's biodiesel market. The Thailand government plans to gradually decrease its ethanol subsidy by 2022, with higher blends expected to be less affected. Blending is expected to reach 16%, and its production is projected to increase to 2 billion litter by 2031. Biodiesel demand will be supported by obligatory blending rates, with subsidies favoring B20 and B10. However, limited palm oil supply and high vegetable oil prices will constrain domestic supply.

Key Players Landscape and Outlook

The global biodiesel market is dominated due to their extensive production capacities and advanced technologies. The market outlook is expected to be positive, driven by increasing demand for cleaner transportation fuels and government policies. Regulations and incentives are encouraging biodiesel adoption, while advancements in production technology and feedstock diversification enhance efficiency and cost-effectiveness. Key players are expanding operations and forming strategic partnerships to improve biodiesel production and distribution. Innovations in feedstock and processing technologies are expected to further boost market growth.

For instance, in October 2023, Neste completed the merger of Neste Engineering Solutions Oy (NES) into Neste Corporation. As a result of the merger, NES is expected to provide a high-quality technology and engineering services for oil and gas, petrochemicals, and bio-based industries.

For instance, in June 2022, Chevron completed the acquisition of Renewable Energy Group. The acquisition aims to make Chevron one of the leading renewable fuel companies in the United States, offering cost-effective and lower carbon solutions to utilize in current fleets and infrastructure. The executive vice president of Downstream & Chemicals stated that the merger will enhance Chevron's offerings.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customer

- 4.1. Brand Awareness

- 4.2. Lead time

- 4.3. Supply Chain

- 4.4. Quality

- 4.5. Ease of Purchase

5. Global Biodiesel Market Outlook, 2017-2031F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Feed Stock

- 5.2.1.1. Vegetable Oil

- 5.2.1.2. Animal Fats

- 5.2.1.3. Others

- 5.2.2. By Application

- 5.2.2.1. Transportation

- 5.2.2.2. Power Generation

- 5.2.2.3. Others

- 5.2.3. By Region

- 5.2.3.1. North America

- 5.2.3.2. Europe

- 5.2.3.3. Asia-Pacific

- 5.2.3.4. South America

- 5.2.3.5. Middle East and Africa

- 5.2.4. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2023)

- 5.2.1. By Feed Stock

- 5.3. Market Map Analysis, 2023

- 5.3.1. By Feed Stock

- 5.3.2. By Application

- 5.3.3. By Region

6. North America Biodiesel Market Outlook, 2017-2031F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Feed Stock

- 6.2.1.1. Vegetable Oil

- 6.2.1.2. Animal Fats

- 6.2.1.3. Others

- 6.2.2. By Application

- 6.2.2.1. Transportation

- 6.2.2.2. Power Generation

- 6.2.2.3. Others

- 6.2.3. By Country Share

- 6.2.3.1. United States

- 6.2.3.2. Canada

- 6.2.3.3. Mexico

- 6.2.1. By Feed Stock

- 6.3. Country Market Assessment

- 6.3.1. United States Biodiesel Outlook, 2017-2031F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Feed Stock

- 6.3.1.2.1.1. Vegetable Oil

- 6.3.1.2.1.2. Animal Fats

- 6.3.1.2.1.3. Others

- 6.3.1.2.2. By Application

- 6.3.1.2.2.1. Transportation

- 6.3.1.2.2.2. Power Generation

- 6.3.1.2.2.3. Others

- 6.3.1.2.1. By Feed Stock

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Biodiesel Outlook, 2017-2031F*

All segments will be provided for all regions and countries covered

7. Europe Biodiesel Market Outlook, 2017-2031F

- 7.1. Germany

- 7.2. France

- 7.3. Italy

- 7.4. United Kingdom

- 7.5. Russia

- 7.6. Netherlands

- 7.7. Spain

- 7.8. Turkey

- 7.9. Poland

8. Asia-Pacific Biodiesel Market Outlook, 2017-2031F

- 8.1. India

- 8.2. China

- 8.3. Japan

- 8.4. Australia

- 8.5. Vietnam

- 8.6. South Korea

- 8.7. Indonesia

- 8.8. Philippines

9. South America Biodiesel Market Outlook, 2017-2031F

- 9.1. Brazil

- 9.2. Argentina

10. Middle East and Africa Biodiesel Market Outlook, 2017-2031F

- 10.1. Saudi Arabia

- 10.2. UAE

- 10.3. South Africa

11. Porter's Five Forces Analysis

12. PESTLE Analysis

13. Market Dynamics

- 13.1. Market Drivers

- 13.2. Market Challenges

14. Market Trends and Developments

15. List of 25 Production Plant Capacities

16. Competitive Landscape

- 16.1. Competition Matrix of Top 5 Market Leaders

- 16.2. SWOT Analysis for Top 5 Players

- 16.3. Key Players Landscape for Top 10 Market Players

- 16.3.1. Renewable Energy Group Inc.

- 16.3.1.1. Company Details

- 16.3.1.2. Key Management Personnel

- 16.3.1.3. Products and Services

- 16.3.1.4. Financials (As Reported)

- 16.3.1.5. Key Market Focus and Geographical Presence

- 16.3.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 16.3.2. Wilmar International Ltd

- 16.3.3. Archer Daniels Midland Company

- 16.3.4. BIOX Corporation

- 16.3.5. Bangchak Corporation Public Company Limited

- 16.3.6. Neste Oyj

- 16.3.7. Cargill Inc

- 16.3.8. Ag Processing Inc.

- 16.3.9. Bunge Ltd.

- 16.3.10. Ecodiesel Colombia S.A.

- 16.3.11. FutureFuel Corp.

- 16.3.12. Manuelita S.A.

- 16.3.13. Renewable Biofuels, Inc.

- 16.3.1. Renewable Energy Group Inc.

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.