|

|

市場調査レポート

商品コード

1716754

バイオ酢酸市場の評価:原料・用途・エンドユーザー産業・地域別の機会および予測 (2018-2032年)Bio-acetic Acid Market Assessment, By Source, By Application, By End-user Industry, By Region, Opportunities and Forecast, 2018-2032F |

||||||

カスタマイズ可能

|

|||||||

| バイオ酢酸市場の評価:原料・用途・エンドユーザー産業・地域別の機会および予測 (2018-2032年) |

|

出版日: 2025年05月01日

発行: Markets & Data

ページ情報: 英文 225 Pages

納期: 3~5営業日

|

全表示

- 概要

- 図表

- 目次

世界のバイオ酢酸の市場規模は、2024年の2億7,470万米ドルから、予測期間中はCAGR 6.43%で推移し、2032年には4億6,125万米ドルに成長すると予測されています。

バイオ酢酸市場の主な原動力は、環境意識の高まりと、従来の石油化学製品に代わる持続可能な代替品への需要です。バイオマスや農業残渣などの再生可能な原料から得られるバイオ酢酸は、産業界が環境に配慮したソリューションを求めるようになるにつれて人気を集めています。さらに、二酸化炭素排出量の削減とバイオベース製品の促進を目的とした厳しい規制が、バイオ酢酸の採用をさらに後押ししています。食品・飲料、医薬品、繊維などさまざまな用途におけるバイオ酢酸の多用途性も世界中で人気が高まっている一因となっています。

2024年9月、モディ首相率いるインド連邦内閣は、バイオテクノロジー省の2つの既存スキームを統合し、「バイオテクノロジー研究・革新・起業開発 (Bio-RIDE) 」スキームとして継続することを承認しました。このスキームは、イノベーションの促進、バイオ起業家精神の育成、そしてバイオ製造とバイオテクノロジーにおける世界的リーダーとしてのインドの地位を強化することを目的としています。Bio-RIDEでは、バイオ起業家へのシード資金 (初期投資) の提供、インキュベーション支援、メンターシップ (指導・助言) 、助成金による技術革新の促進、産学連携の促進、持続可能なバイオ製造の奨励、学外資金による研究者支援などを行います。この計画には約10億8,000万米ドルが支出される予定です。

バイオ酢酸の需要増加には、他にもいくつかの要因が貢献しています。その一つが、酢酸の重要な誘導体である酢酸ビニルモノマー (VAM) 市場の拡大です。VAMは、接着剤、塗料、コーティング業界などで幅広く使用されており、この需要の増加がバイオ酢酸市場の成長を後押ししています。また、バイオVAMは、従来の石油化学由来VAMに代わるグリーンな選択肢として注目されており、特に包装業界で高い需要を誇っています。さらに、食品業界では、バイオ酢酸が天然の保存料および香味料として利用されており、特にオーガニック製品やクリーンラベル製品で重宝されています。加えて、バイオベース化学品に対する税制優遇や補助金といった政府の支援措置も、バイオ酢酸の導入を加速させる要因となっています。特に欧州や北米では、持続可能な生産を後押しする規制環境が整っており、これが市場におけるバイオ酢酸の成長をさらに促進しています。

当レポートでは、世界のバイオ酢酸の市場を調査し、市場の定義と概要、市場規模の推移・予測、各種区分別の詳細分析、産業構造、市場成長への影響因子の分析、競合情勢、主要企業のプロファイルなどをまとめています。

目次

第1章 プロジェクトの範囲と定義

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 顧客の声

- 回答者の人口統計

- 購入決定時に考慮される要素

- アンメットニーズ

第5章 世界のバイオ酢酸市場の展望

- 市場規模の分析・予測

- 市場シェアの分析・予測

- 原料別

- バイオマス

- コーンスターチ

- その他

- 用途別

- 酢酸ビニルモノマー

- 酢酸エステル

- 精製テレフタル酸

- 無水酢酸

- その他

- エンドユーザー業界別

- 食品・飲料

- 化学薬品

- 医薬品

- 繊維

- 化粧品

- その他

- 地域別

- 欧州

- アジア太平洋

- 北米

- 南米

- 中東・アフリカ

- 企業シェア分析 (上位5社およびその他-)

- 原料別

- 市場マップ分析

第6章 北米のバイオ酢酸市場の展望

- 市場規模の分析・予測

- 市場シェアの分析・予測

- 国別市場評価

- 米国

- カナダ

- メキシコ

第7章 欧州のバイオ酢酸市場の展望

- ドイツ

- スウェーデン

- フランス

- オーストリア

- チェコ共和国

- オランダ

- イタリア

- スペイン

- スイス

第8章 アジア太平洋のバイオ酢酸市場の展望

- 中国

- インド

- 日本

- 韓国

- インドネシア

- マレーシア

第9章 南米のバイオ酢酸市場の展望

- コロンビア

- アルゼンチン

第10章 中東・アフリカのバイオ酢酸市場の展望

- ケニア

- 南アフリカ

第11章 ポーターのファイブフォース分析

第12章 PESTLE分析

第13章 需給分析

第14章 輸出入分析

第15章 市場力学

- 市場促進要因

- 市場の課題

第16章 市場動向と発展

第17章 ケーススタディ

第18章 競合情勢

- 上位5社の競合マトリックス

- 上位10社の情勢

- SEKAB Biofuels & Chemicals AB

- Jubilant Ingrevia Limited

- Godavari Biorefineries Limited

- Lenzing AG

- Wacker Chemei AG

- AFYREN SAS

- Sucroal S.A.

- Biosimo AG

- Bio-Corn Products EPZ Ltd

- Again

第19章 戦略的提言

第20章 当社について・免責事項

List of Tables

- Table 1: Import Analysis, By Top 5 Countries, By Value (USD Million), By Volume (Kilotons), 2020-2024

- Table 2: Export Analysis, By Top 5 Countries, By Value (USD Million), By Volume (Kilotons), 2020-2024

- Table 3: : Global Bio-Acetic Acid Market - Competit

List of Figures

- Figure 1: Global Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 2: Global Bio-Acetic Acid Market Size, By Volume (Kilotons), 2018-2032F

- Figure 3: Global Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 4: Global Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 5: Global Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 6: Global Bio-Acetic Acid Market Share, By Region, By Value, 2018-2032F

- Figure 7: Global Bio-Acetic Acid Market Share, By Company, By Value, 2024

- Figure 8: Global Bio-Acetic Acid Market Map, By Source, By Value, 2024

- Figure 9: Global Bio-Acetic Acid Market Map, By Application, By Value, 2024

- Figure 10: Global Bio-Acetic Acid Market Map, By End-Use Industry, By Value, 2024

- Figure 11: Global Bio-Acetic Acid Market Map, By Region, By Value, 2024

- Figure 12: Europe Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 13: Europe Bio-Acetic Acid Market Size, By Volume (Kilotons), 2018-2032F

- Figure 14: Europe Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 15: Europe Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 16: Europe Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 17: Europe Bio-Acetic Acid Market Share, By Country, By Value, 2018-2032F

- Figure 18: Germany Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 19: Germany Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 20: Germany Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 21: Germany Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 22: Sweden Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 23: Sweden Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 24: Sweden Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 25: Sweden Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 26: France Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 27: France Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 28: France Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 29: France Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 30: Austria Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 31: Austria Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 32: Austria Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 33: Austria Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 34: Czech Republic Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 35: Czech Republic Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 36: Czech Republic Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 37: Czech Republic Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 38: Netherlands Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 39: Netherlands Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 40: Netherlands Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 41: Netherlands Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 42: Italy Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 43: Italy Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 44: Italy Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 45: Italy Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 46: Spain Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 47: Spain Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 48: Spain Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 49: Spain Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 50: Switzerland Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 51: Switzerland Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 52: Switzerland Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 53: Switzerland Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 54: Asia-Pacific Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 55: Asia-Pacific Bio-Acetic Acid Market Size, By Volume (Kilotons), 2018-2032F

- Figure 56: Asia-Pacific Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 57: Asia-Pacific Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 58: Asia-Pacific Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 59: Asia-Pacific Bio-Acetic Acid Market Share, By Country, By Value, 2018-2032F

- Figure 60: China Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 61: China Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 62: China Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 63: China Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 64: India Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 65: India Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 66: India Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 67: India Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 68: Japan Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 69: Japan Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 70: Japan Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 71: Japan Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 72: South Korea Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 73: South Korea Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 74: South Korea Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 75: South Korea Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 76: Indonesia Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 77: Indonesia Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 78: Indonesia Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 79: Indonesia Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 80: Malaysia Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

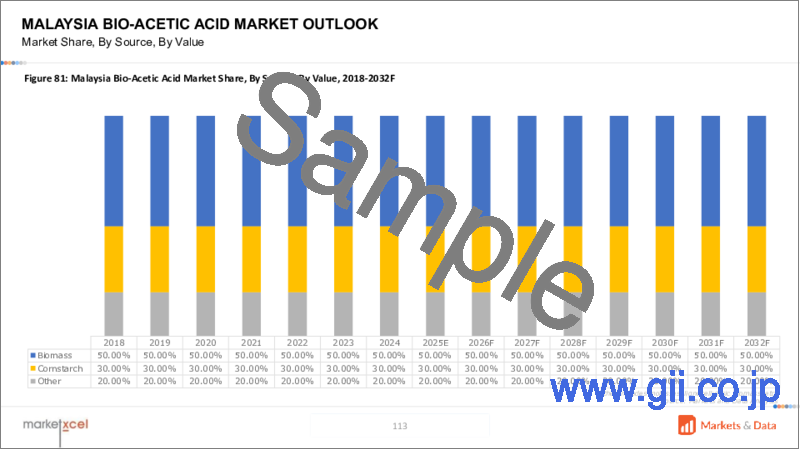

- Figure 81: Malaysia Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 82: Malaysia Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 83: Malaysia Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 84: North America Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 85: North America Bio-Acetic Acid Market Size, By Volume (Kilotons), 2018-2032F

- Figure 86: North America Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 87: North America Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 88: North America Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 89: North America Bio-Acetic Acid Market Share, By Country, By Value, 2018-2032F

- Figure 90: United States Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 91: United States Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 92: United States Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 93: United States Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 94: Canada Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 95: Canada Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 96: Canada Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 97: Canada Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 98: Mexico Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 99: Mexico Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 100: Mexico Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 101: Mexico Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 102: South America Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 103: South America Bio-Acetic Acid Market Size, By Volume (Kilotons), 2018-2032F

- Figure 104: South America Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 105: South America Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 106: South America Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 107: South America Bio-Acetic Acid Market Share, By Country, By Value, 2018-2032F

- Figure 108: Colombia Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 109: Colombia Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 110: Colombia Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 111: Colombia Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 112: Brazil Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 113: Brazil Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 114: Brazil Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 115: Brazil Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 116: Middle East and Africa Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 117: Middle East and Africa Bio-Acetic Acid Market Size, By Volume (Kilotons), 2018-2032F

- Figure 118: Middle East and Africa Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 119: Middle East and Africa Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 120: Middle East and Africa Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 121: Middle East and Africa Bio-Acetic Acid Market Share, By Country, By Value, 2018-2032F

- Figure 122: Kenya Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 123: Kenya Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 124: Kenya Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 125: Kenya Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

- Figure 126: South Africa Bio-Acetic Acid Market Size, By Value (USD Million), 2018-2032F

- Figure 127: South Africa Bio-Acetic Acid Market Share, By Source, By Value, 2018-2032F

- Figure 128: South Africa Bio-Acetic Acid Market Share, By Application, By Value, 2018-2032F

- Figure 129: South Africa Bio-Acetic Acid Market Share, By End-Use Industry, By Value, 2018-2032F

Global bio-acetic acid market is projected to witness a CAGR of 6.43% during the forecast period 2025-2032, growing from USD 274.70 million in 2024 to USD 461.25 million in 2032F. The bio-acetic acid market is primarily driven by heightened environmental awareness and the demand for sustainable alternatives to traditional petrochemical products. The bio-acetic acid derived from renewable feedstocks such as biomass and agricultural residues has been gaining popularity as industries increasingly seek eco-friendly solutions. Additionally, stringent regulations aimed at reducing carbon emissions and promoting bio-based products further support its adoption. The versatility of bio-acetic acid in various applications, including food and beverages, pharmaceuticals, and textiles, contributes to its growing popularity across the globe supplementarily.

In September 2024, the Union Cabinet in India, led by Prime Minister Narendra Modi, approved the continuation of the Department of Biotechnology's two schemes, merged into one 'Biotechnology Research Innovation and Entrepreneurship Development' (Bio-RIDE). The scheme aims to foster innovation, promote bio-entrepreneurship, and strengthen India's position as a global leader in biomanufacturing and biotechnology. It will provide seed funding, incubation support, and mentorship to bio-entrepreneurs, advance innovation through grants, facilitate industry-academia collaboration, encourage sustainable bio-manufacturing, and support researchers through extramural funding. The proposed outlay for the scheme is around USD 1080 million.

Several other factors contribute to the rise in demand for bio acetic acid, such as the expansion of the vinyl acetate monomer (VAM) market. VAM is becoming a critical derivative of acetic acid, which has several applications in adhesives, paints, and coatings industries, thereby boosting the bio acetic acid market size. Bio-VAM is gaining traction as a greener alternative to conventional petrochemical-based VAM is highly demanded in the packaging industry. Additionally, the food industry relies on bio-acetic acid as a natural preservative and flavoring agent, particularly in organic and clean-label products. Government incentives, such as tax benefits and subsidies for bio-based chemicals, further accelerate adoption, especially in Europe and North America, where regulatory frameworks favor sustainable production for bio acetic acid which drives its growth in the market.

Technological advancements in fermentation and enzymatic processes have improved the cost-efficiency and scalability of bio-acetic acid which makes the market more competitive. In addition, several companies are investing in bio-refineries to meet the rising demand for different applications. The increasing demand for bio-acetic acid in high-performance applications, such as bioplastics, pharmaceuticals, and specialty chemicals, is driving market growth. Industries are shifting towards bio-based alternatives to meet sustainability goals and reduce dependence on petrochemical-derived acetic acid. Innovations in fermentation technology and biomass processing are enhancing production efficiency, making bio-acetic acid a viable option for advanced industrial applications. As end-user industries seek greener solutions, the adoption of bio-acetic acid is expected to accelerate across multiple sectors. Furthermore, with the rising investment in waste-to-chemical innovations creating lucrative opportunities for bio-acetic acid in the forecast period.

Governmental Support for Bio-based Products to Promote Sustainability

Governmental support for bio-based products plays a pivotal role in driving the bio-acetic acid market. Influences worldwide are increasingly focusing on promoting sustainability by encouraging the adoption of renewable and eco-friendly alternatives to conventional petrochemical-based products. This includes providing incentives, subsidies, and funding for research and development in bio-based technologies, fostering innovation in the production of bio-acetic acid. Governments are also implementing stricter environmental regulations to reduce carbon emissions and combat climate change, further boosting the demand for bio-based solutions.

Furthermore, initiatives to establish biomanufacturing hubs and strengthen infrastructure for bio-based industries are accelerating the commercialization of bio-acetic acid. These measures aim to create a robust ecosystem for sustainable products, ensuring long-term environmental benefits while supporting economic growth. By prioritizing bio-based alternatives, governments are not only addressing ecological concerns but also encouraging industries to shift toward greener practices, making bio-acetic acid a key component in this transition.

In August 2024, the Union Cabinet approved India's first Biotechnology Policy, the 'BioE3 (Biotechnology for Economy, Environment and Employment) Policy for 'Fostering High Performance Biomanufacturing'. This policy aims to promote green growth by transforming the current manufacturing paradigm to regenerative principles. The initiative focuses on six key verticals: Bio-based Chemicals and Enzymes, Functional Food and Smart Proteins, Precision Biotherapeutics, Climate Resilient Agriculture, Biofuels and Carbon Capture, and Futuristic Marine and Space Research. The initiative will be accelerated through international collaboration and Public-Private Partnerships.

Rising Investment in Bio-Ethanol Production Driving the Market Growth of Bio-Acetic Acid

Rising investments in bioethanol production are significantly driving the growth of the bio-acetic acid market. As bioethanol serves as a key feedstock for producing bio-acetic acid, increased funding and technological advancements in bioethanol production enhance the availability and efficiency of bio-acetic acid manufacturing. This shift towards renewable sources is fueled by a growing awareness of environmental sustainability and the need to reduce reliance on fossil fuels. Furthermore, the expansion of bioethanol facilities often leads to improved production processes, resulting in higher yields and lower costs for bio-acetic acid. The synergy between bioethanol and bio-acetic acid production fosters innovation and encourages industries to adopt greener practices. Additionally, as consumers increasingly demand sustainable products, the focus on bio-based chemicals like bio-acetic acid becomes more pronounced, further incentivizing investments in bioethanol infrastructure and technology. This trend is expected to continue driving market growth as industries strive for eco-friendly alternatives in their operations.

For instance, in December 2024, Godavari Biorefineries Limited, a pioneer in renewable chemicals and biofuels, announce its plans for investing around USD 15 million in a new 200 KLPD corn/grain-based distillery to enhance its ethanol production capabilities. The investment will be part of existing operations, enhancing flexibility through dual-feedstock capability. The company reported a 25% Y-o-Y increase in revenue growth for the period April-June 2024, demonstrating its operational strength and focusing on sustainable growth. The investment is expected to be completed in January-March 2026.

Growing Efforts for Carbon Neutrality Driving the Bio-Acetic Acid Market Growth

Growing efforts toward carbon neutrality are driving the bio-acetic acid market as industries and governments increasingly focus on reducing greenhouse gas emissions and transitioning to sustainable practices. Bio-acetic acid, derived from renewable feedstocks such as biomass, offers an eco-friendly alternative to petrochemical-based acetic acid, aligning with global goals to minimize carbon footprints. Stricter environmental regulations and international commitments to combat climate change are encouraging companies to adopt greener production methods, further boosting the demand for bio-acetic acid. Additionally, businesses are leveraging bio-acetic acid to meet the rising consumer preference for environmentally friendly products, enhancing their sustainability credentials. The push for carbon neutrality has also led to increased investments in research and development, fostering innovation in bio-based production technologies. These advancements improve efficiency and scalability, making bio-acetic acid more accessible across industries such as food and beverages, textiles, and pharmaceuticals. Collectively, these efforts are creating a favorable environment for the growth of the bio-acetic acid market.

Food and Beverages Market is Dominating the Bio Acetic Acid Market

The food and beverages market is the dominant end-user segment in the global bio-acetic acid sector, particularly due to the compound's essential role as a preservative and flavor enhancer. The acid is widely employed into various food applications, including sauces, pickles, and condiments, where it serves as an acidity regulator and helps maintain product freshness. Its primary component, vinegar, is a staple in kitchens worldwide, further solidifying the demand for bio-acetic acid in this sector. The growing consumer preference for natural and organic ingredients has also spurred interest in bio-acetic acid derived from renewable sources, making it a healthier alternative to synthetic preservatives. Additionally, the versatility of bio-acetic acid in enhancing flavors and extending shelf life aligns with the food industry's ongoing efforts to improve product quality while adhering to sustainability goals. As manufacturers increasingly prioritize eco-friendly solutions, the food and beverages market continue to drive the growth of bio-acetic acid, reinforcing its significance within the broader bio-based chemicals landscape.

Jubilant Ingrevia Limited has commissioned a new Green Ethanol-based food-grade Acetic Acid plant in Gajraula, Uttar Pradesh, to meet global product certification standards. The plant, set to operate from natural bio-based feedstock, will produce 25,000 tons per annum of this high-demand product. The plant, was commissioned in 2022, offers a healthier alternative to petroleum-based Acetic Acid, addressing the growing demand in the global food preservative segment.

Europe Dominates the Global Bio-Acetic Acid Market

The region contributes with the largest market share due to increasing shift towards bio-based chemicals, driven by stringent environmental policies and carbon reduction initiatives. Countries like Germany, France, and the Netherlands are hubs for bio-acetic acid production which boosts its market size in the forecast period. The demand for sustainable alternatives in industries such as food & beverages, chemicals, and pharmaceuticals is accelerating market expansion. Additionally, advancements in fermentation technology and the availability of renewable feedstocks are supporting cost-effective production, further strengthening market growth. The region has a well-established bioeconomy, which is supported by government subsidies and R&D investments thereby accelerating adoption of bio-acetic acid in different industries. Furthermore, increasing investments in bio-refineries and partnerships among key industry players are also enhancing production efficiency and market penetration.

For instance, In June 2024, AFYREN SAS, a greentech company engaged in manufacturing bio-based, low-carbon ingredients produced using unique fermentation technology based on a completely circular model, provided an update on the recent activity of its AFYREN NEOXY plant during a visit organized for individual and institutional shareholders, and confirmed its target to start continuous production in 2024.

Future Market Scenario (2025 - 2032F)

As consumers become more environmentally conscious, the demand for sustainable and eco-friendly products is rising. Bio-acetic acid, sourced from renewable feedstocks, aligns with this trend, making it a preferred choice in various industries, particularly food and beverages. This shift towards sustainability is expected to fuel market growth as companies seek to enhance their product offerings with bio-based alternatives.

Innovations in biorefinery technologies and production processes are enhancing the efficiency and cost-effectiveness of bio-acetic acid manufacturing. These advancements enable producers to utilize a wider range of renewable feedstocks, improving yield and reducing production costs. As technology continues to evolve, it will likely lead to increased adoption of bio-acetic acid across various applications.

Governments worldwide are implementing stricter regulations aimed at reducing carbon emissions and promoting the use of bio-based chemicals. This regulatory environment encourages industries to transition from fossil fuel-derived products to sustainable alternatives like bio-acetic acid. Such policies create a favorable landscape for market growth as businesses strive to comply with environmental standards.

The versatility of bio-acetic acid in various applications, including pharmaceuticals, textiles, and industrial solvents, is driving its market growth. As industries increasingly recognize the benefits of bio-acetic acid in enhancing product quality and sustainability, its adoption across multiple sectors is expected to rise, further propelling market expansion.

Key Players Landscape and Outlook

The key players in global bio-acetic acid market are adopting strategic initiatives to strengthen their market presence and meet the growing demand for sustainable solutions. A major focus is on innovation in production technologies, with significant investments in research and development to improve efficiency, reduce costs, and utilize diverse bio-based feedstocks. Companies are also expanding their manufacturing capacities by establishing new facilities or upgrading existing ones to cater to increasing applications across industries such as food and beverages, pharmaceuticals, and textiles. Strategic partnerships and collaborations are another key approach, enabling players to leverage expertise, share resources, and accelerate advancements in bio-acetic acid production. Additionally, there is a strong emphasis on sustainability, with companies aligning their product portfolios to meet stringent environmental regulations and consumer preferences for eco-friendly products. By prioritizing green chemistry and renewable feedstocks, the key players in the market are investing to position themselves to lead in the transition toward environmentally conscious industrial practices.

In May 2023, SEKAB Biofuels & Chemicals AB expanded its production of bio-based Acetic Acid, a crucial raw material in various industries. The company's investment in new production capacity enables faster and larger deliveries, reducing the carbon footprint by up to 50%. The flagship product, Acetic Acid Pure, is 100% bio-based, reducing carbon dioxide emissions by 50% or more. It has undergone comprehensive certification and has a zero unplanned downtime record. Sekab's bio-based chemical expertise is renowned for its sustainability and traceability.

Table of Contents

1. Project Scope and Definitions

2. Research Methodology

3. Executive Summary

4. Voice of Customers

- 4.1. Respondent Demographics

- 4.2. Factors Considered in Purchase Decisions

- 4.2.1. Quality and Purity

- 4.2.2. Sustainability

- 4.2.3. Cost Friendliness

- 4.2.4. Supplier Reputation and Reliability

- 4.3. Unmet Needs

5. Global Bio-acetic Acid Market Outlook, 2018-2032F

- 5.1. Market Size Analysis & Forecast

- 5.1.1. By Value

- 5.1.2. By Volume

- 5.2. Market Share Analysis & Forecast

- 5.2.1. By Source

- 5.2.1.1. Biomass

- 5.2.1.2. Cornstarch

- 5.2.1.3. Others

- 5.2.2. By Application

- 5.2.2.1. Vinyl Acetate Monomer

- 5.2.2.2. Acetate Esters

- 5.2.2.3. Purified Terephthalic Acid

- 5.2.2.4. Acetic Anhydride

- 5.2.2.5. Others

- 5.2.3. By End-user Industry

- 5.2.3.1. Food and Beverages

- 5.2.3.2. Chemicals

- 5.2.3.3. Pharmaceutical

- 5.2.3.4. Textile

- 5.2.3.5. Cosmetics

- 5.2.3.6. Others

- 5.2.4. By Region

- 5.2.4.1. Europe

- 5.2.4.2. Asia-Pacific

- 5.2.4.3. North America

- 5.2.4.4. South America

- 5.2.4.5. Middle East and Africa

- 5.2.5. By Company Market Share Analysis (Top 5 Companies and Others - By Value, 2024)

- 5.2.1. By Source

- 5.3. Market Map Analysis, 2024

- 5.3.1. By Source

- 5.3.2. By Application

- 5.3.3. End-user Industry

- 5.3.4. By Region

6. North America Bio-acetic Acid Market Outlook, 2018-2032F*

- 6.1. Market Size Analysis & Forecast

- 6.1.1. By Value

- 6.1.2. By Volume

- 6.2. Market Share Analysis & Forecast

- 6.2.1. By Source

- 6.2.1.1. Biomass

- 6.2.1.2. Cornstarch

- 6.2.1.3. Others

- 6.2.2. By Application

- 6.2.2.1. Vinyl Acetate Monomer

- 6.2.2.2. Acetate Esters

- 6.2.2.3. Purified Terephthalic Acid

- 6.2.2.4. Acetic Anhydride

- 6.2.2.5. Others

- 6.2.3. By End-user Industry

- 6.2.3.1. Food and Beverages

- 6.2.3.2. Chemicals

- 6.2.3.3. Pharmaceutical

- 6.2.3.4. Textile

- 6.2.3.5. Cosmetics

- 6.2.3.6. Others

- 6.2.4. By Region

- 6.2.4.1. North America

- 6.2.4.2. Europe

- 6.2.4.3. Asia-Pacific

- 6.2.4.4. South America

- 6.2.5. Middle East and Africa

- 6.2.6. By Country Share

- 6.2.6.1. United States

- 6.2.6.2. Canada

- 6.2.6.3. Mexico

- 6.2.1. By Source

- 6.3. Country Market Assessment

- 6.3.1. United States Bio-acetic acid Market Outlook, 2018-2032F*

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.1.1.1. By Value

- 6.3.1.1.2. By Volume

- 6.3.1.2. Market Share Analysis & Forecast

- 6.3.1.2.1. By Source

- 6.3.1.2.1.1. Biomass

- 6.3.1.2.1.2. Cornstarch

- 6.3.1.2.1.3. Others

- 6.3.1.2.2. By Application

- 6.3.1.2.2.1. Vinyl Acetate Monomer

- 6.3.1.2.2.2. Acetate Esters

- 6.3.1.2.2.3. Purified Terephthalic Acid

- 6.3.1.2.2.4. Acetic Anhydride

- 6.3.1.2.2.5. Others

- 6.3.1.2.3. By End-user Industry

- 6.3.1.2.3.1. Food and Beverages

- 6.3.1.2.3.2. Chemicals

- 6.3.1.2.3.3. Pharmaceutical

- 6.3.1.2.3.4. Textile

- 6.3.1.2.3.5. Cosmetics

- 6.3.1.2.3.6. Others

- 6.3.1.2.1. By Source

- 6.3.1.3. By Region

- 6.3.1.3.1.1. North America

- 6.3.1.3.1.2. Europe

- 6.3.1.3.1.3. Asia-Pacific

- 6.3.1.3.1.4. South America

- 6.3.1.3.1.5. Middle East and Africa

- 6.3.1.1. Market Size Analysis & Forecast

- 6.3.2. Canada

- 6.3.3. Mexico

- 6.3.1. United States Bio-acetic acid Market Outlook, 2018-2032F*

All segments will be provided for all regions and countries covered

7. Europe Bio-acetic acid Market Outlook, 2018-2032F

- 7.1. Germany

- 7.2. Sweden

- 7.3. France

- 7.4. Austria

- 7.5. Czech Republic

- 7.6. Netherlands

- 7.7. Italy

- 7.8. Spain

- 7.9. Switzerland

8. Asia-Pacific Bio-acetic Acid Market Outlook, 2018-2032F

- 8.1. China

- 8.2. India

- 8.3. Japan

- 8.4. South Korea

- 8.5. Indonesia

- 8.6. Malaysia

9. South America Bio-acetic acid Market Outlook, 2018-2032F

- 9.1. Colombia

- 9.2. Argentina

10. Middle East and Africa Bio-acetic Acid Market Outlook, 2018-2032F

- 10.1. Kenya

- 10.2. South Africa

11. Porter's Five Forces Analysis

12. PESTLE Analysis

13. Demand Supply Analysis

14. Import Export Analysis

15. Market Dynamics

- 15.1. Market Drivers

- 15.2. Market Challenges

16. Market Trends and Developments

17. Case Studies

18. Competitive Landscape

- 18.1. Competition Matrix of Top 5 Market Leaders

- 18.2. Key Players Landscape for Top 10 Market Players

- 18.2.1. SEKAB Biofuels & Chemicals AB

- 18.2.1.1. Company Details

- 18.2.1.2. Key Management Personnel

- 18.2.1.3. Key Products Offered

- 18.2.1.4. Key Financials (As Reported)

- 18.2.1.5. Key Market Focus and Geographical Presence

- 18.2.1.6. Recent Developments/Collaborations/Partnerships/Mergers and Acquisition

- 18.2.1.7. SWOT Analysis for Top 5 Players

- 18.2.2. Jubilant Ingrevia Limited

- 18.2.3. Godavari Biorefineries Limited

- 18.2.4. Lenzing AG

- 18.2.5. Wacker Chemei AG

- 18.2.6. AFYREN SAS

- 18.2.7. Sucroal S.A.

- 18.2.8. Biosimo AG

- 18.2.9. Bio-Corn Products EPZ Ltd

- 18.2.10. Again

- 18.2.1. SEKAB Biofuels & Chemicals AB

Companies mentioned above DO NOT hold any order as per market share and can be changed as per information available during research work.