|

市場調査レポート

商品コード

1910913

ITアウトソーシング(ITO)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年)IT Outsourcing (ITO) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ITアウトソーシング(ITO)-市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

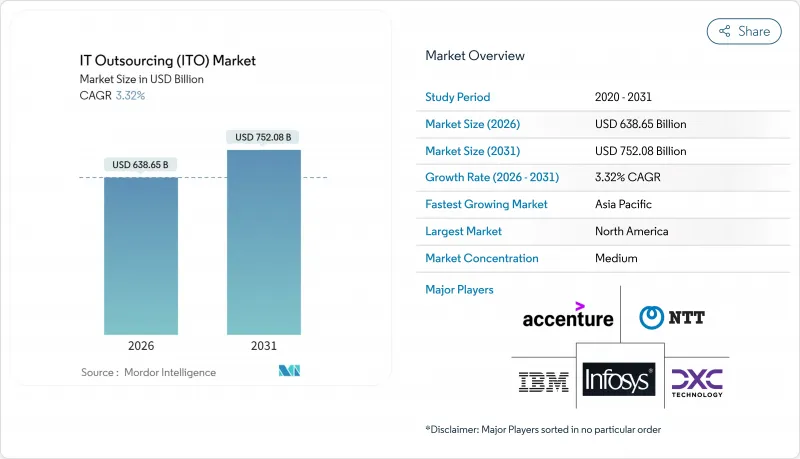

ITアウトソーシング(ITO)市場は、2025年に6,181億3,000万米ドルと評価され、2026年の6,386億5,000万米ドルから2031年までに7,520億8,000万米ドルに達すると予測されています。

予測期間(2026~2031年)におけるCAGRは3.32%と見込まれます。

この予測チャネルは、生成AIによる自動化が労働集約的な提供モデルを変革し、新たなAI対応サービスを促進する一方で、従来型人員依存型契約を縮小させることで、産業の成熟度を反映しています。地政学的緊張の高まりにより、企業は主権クラウド義務やデータ居住規則への対応として調達拠点の多様化を進めており、多くのバイヤーがリスク軽減のためオフショア、ニアショア、オンショアのセンターを組み合わせる傾向にあります。世界的に480万人に達するサイバーセキュリティ人材不足は、マネージド検知・対応サービスに対するプレミアム需要を生み出しています。産業再編が加速しています。コグニザントによるベルカン社13億米ドル買収やキャップジェミニのWNS買収交渉といった最近の事例は、大手企業がニッチな専門企業を吸収し、AI能力の深化とサービスポートフォリオの拡充を図る動きを示しています。企業がハイブリッド環境やマルチクラウド環境の管理に苦慮する中、クラウド管理サービスが重要性を増しており、測定可能なビジネス成果との連動性から成果連動型価格設定が支持を集めています。

世界のITアウトソーシング(ITO)市場の動向と洞察

クラウドネイティブアプリケーションの近代化需要

企業はモノリシックシステムをマイクロサービス、コンテナ、サーバーレス機能へと再構築しており、これによりプラットフォームエンジニアリング、Kubernetesオーケストレーション、イベント駆動型設計における大規模な案件が生まれています。プロバイダは、特に金融サービスや医療などコンプライアンスが複雑さを増す高度に規制された産業において、労力に対する課金ではなく、パフォーマンス、コスト目標、スケーラビリティを保証する成果ベース契約をますます提供するようになっています。技術的変革には文化変革の管理が伴い、社内のチームでは容易に導入できないアジャイルプロセスについては、外部パートナーが指導を行うケースが頻繁に見られます。

生成AIを活用したサービスデスク自動化

生成AIは、インテリジェントルーティングと自己修復スクリプトにより、レベル1チケットの量を最大40%削減し、平均解決時間を25%短縮しています。仮想アシスタントは現在、複数システムにわたる文脈を把握し、パーソナライズされた応答を推進し、ユーザーが障害に気付く前にインシデントを予測します。ただし、文脈による判断を必要とする複雑なセキュリティ問題については、プロバイダは自動化と人間のモニタリングを組み合わせる必要があります。

知的財産窃盗とランサムウェア保険費用の急増

サイバーインシデントの増加に伴い、保険料が上昇し補償範囲が狭まる中、企業はプロジェクトコストを押し上げる暗号化、アクセスモニタリング、分離開発ゾーンの追加を余儀なくされています(EY)。購入者は現在、ベンダーに対しより高い保険限度額の保持と定期的なペネトレーションテストの実施を要求しており、このハードルは中小ベンダーを不利にさせ、産業再編を加速させています。

セグメント分析

2025年、インフラアウトソーシングはITアウトソーシング(ITO)市場の45.05%を占めました。これは、継続的なモニタリングと規制順守を必要とする耐障害性の高いデータセンター運用への企業の依存度が高まっているためです。しかしながら、クラウド管理サービスは3.44%のCAGRで市場を牽引しています。これは、AWS、Azure、Google Cloud、プライベート環境を跨ぐハイブリッド環境の複雑さに組織が直面しているためです。プロバイダは現在、コスト、レイテンシー、コンプライアンス要件に基づきワークロードを順序付ける統合管理プラットフォームをバンドルしており、従来型インフラ管理と新興のマルチクラウドオーケストレーションの境界を曖昧にしています。

アプリケーション開発・保守の需要は、ローコードとAI支援開発によって再構築されつつあり、ベンダーはドメイン知識と統合専門性による差別化を迫られています。エッジコンピューティングとAIモデルライフサイクルサービスは「その他」カテゴリーに位置付けられ、まだ発展途上ながら高利益率の機会を象徴しています。クラウド導入が進む中、既存企業はAI駆動の自己修復機能により保証されたサービスレベル目標を達成する自動化されたサイト信頼性エンジニアリングサービスへ軸足を移し、価格圧縮からインフラ収益源を保護しています。

2025年においても、複雑なレガシー環境の維持には深いアーキテクチャ知識が求められるため、大企業は支出の67.25%を占め続けています。しかしながら、中小企業(SME)は3.96%のCAGRでより急速に拡大しています。成果連動型契約は、IT支出を従業員数ではなく具体的なビジネス成果に連動させるため、中小規模の企業に支持されています。クラウドネイティブベンダーは、セルフサービスポータルと自動プロビジョニングにより参入障壁を低減し、かつてフォーチュン500企業の予算でしか利用できなかったAI、分析、サイバーセキュリティ機能を中小企業にもオンデマンドで提供しています。この技術の民主化は、ITアウトソーシングの総潜在市場を拡大させると同時に、既存プロバイダに対し、利益率を損なうことなく経済的に縮小可能なモジュール化・標準化されたサービス創出を迫っています。

ITアウトソーシング(ITO)市場は、サービスタイプ(インフラアウトソーシング、アプリケーション開発・保守、その他)、組織規模(中小企業と大企業)、調達場所(オンショア、ニアショア、その他)、エンドユーザー産業(BFSI、ヘルスケア・ライフサイエンス、その他)、地域別に市場セグメンテーションされます。市場予測は金額(米ドル)ベースで提供されます。

地域別分析

北米の24.12%というシェアは、経験豊富なプロバイダを必要とするAIとクラウド近代化イニシアチブの主要導入地域としての地位を裏付けています。米国企業は、取引ごとのコストや収益向上指標を規定する成果ベース条件に向けてレガシー契約の再交渉を進めており、労働力アービトラージのリスクを低減しています。カナダの企業は、厳格なプライバシー法への準拠のため、ゼロトラストセキュリティフレームワークとソブリンクラウドインスタンスを優先しています。メキシコのニアショアセンターは、アジャイルポッドとDevOps能力を拡大し、プロジェクトの遅延を削減するとともに、米国クライアントとの文化的整合性を高めています。

アジア太平洋の3.66%というCAGRは、インドの継続的な優位性とASEANの貢献拡大に起因します。ベトナム、インドネシア、マレーシアは政府のインセンティブと学術連携を通じエンジニア人材の育成パイプラインを強化し、アプリケーション開発テストの二次拠点としての地位を確立しつつあります。日本と韓国は次世代ネットワーク運用とエッジクラウドオーケストレーションをアウトソーシングし、国内人材不足を補填。オーストラリアではマネージドサイバーセキュリティとクラウドFinOpsサービスの需要が増加しています。

欧州では、厳格なデータ保護規制とデジタル主権への強い関心が見られます。現地プロバイダはハイパースケーラーと提携し、地域固有の主権クラウドゾーンを展開しています。ドイツ、フランス、オランダは国内データ処理を堅持しつつ、セクタによるクラウド移行を推進。英国はブレグジット後も金融サービスアウトソーシングの拠点であり、レジリエンステストとオペレーショナルリスク管理を重視しています。東欧のソフトウェアエンジニアリングクラスターはハイエンドなR&Dアウトソーシングを提供しつつ、西欧クライアントとの多様化契約を通じて地政学的な不確実性を回避しています。

その他の特典

- エクセル形態の市場予測(ME)シート

- アナリストによる3ヶ月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- クラウドネイティブアプリケーションの近代化需要

- 生成AIを活用したサービスデスク自動化

- DevOpsアウトソーシングにおけるAIと自動化の統合

- サイバーセキュリティと可観測性セグメントにおける人材不足

- ソブリンクラウドとデータ居住義務の台頭

- ベンダーによる成果連動型価格モデルへの移行

- 市場抑制要因

- 知的財産権侵害とランサムウェア保険費用の急増

- 高まる地政学的緊張がオフショアデリバリーセンターに混乱をもたらす

- ハイパースケーラーのエグレス料金の変動性

- AIを活用したコード生成技術によるアウトソーシング範囲の縮小

- サプライチェーン分析

- 規制情勢

- 技術の展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争の激しさ

- 市場におけるマクロ経済的要因の評価

第5章 市場規模と成長予測

- サービスタイプ別

- インフラのアウトソーシング

- アプリケーション開発と保守

- クラウド管理サービス

- その他

- 組織規模別

- 中小企業

- 大企業

- 調達場所別

- オンショア

- ニアショア

- オフショア

- エンドユーザー産業別

- BFSI

- ヘルスケアとライフサイエンス

- メディア通信

- 小売と電子商取引

- 製造業

- その他

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- 韓国

- インド

- オーストラリア

- その他のアジア太平洋

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- トルコ

- その他の中東

- アフリカ

- 南アフリカ

- ナイジェリア

- エジプト

- その他アフリカ

- 中東

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- IBM Corporation

- Tata Consultancy Services

- Infosys Ltd

- Cognizant Technology Solutions

- Wipro Ltd

- HCLTech

- Capgemini SE

- DXC Technology

- NTT Data Corporation

- Atos SE

- CGI Inc.

- Tech Mahindra

- EPAM Systems

- LTI Mindtree

- Globant

- Endava plc

- Softtek

- Andela Inc.

- Persistent Systems

- Accenture plc