|

市場調査レポート

商品コード

1644359

シングルユースプラスチック包装:世界の市場シェア分析、産業動向と統計、成長予測(2025~2030年)Global Single Use Plastic Packaging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| シングルユースプラスチック包装:世界の市場シェア分析、産業動向と統計、成長予測(2025~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

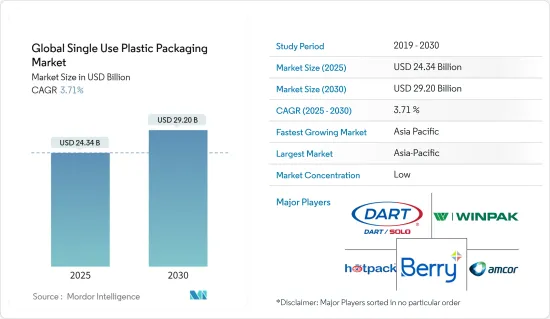

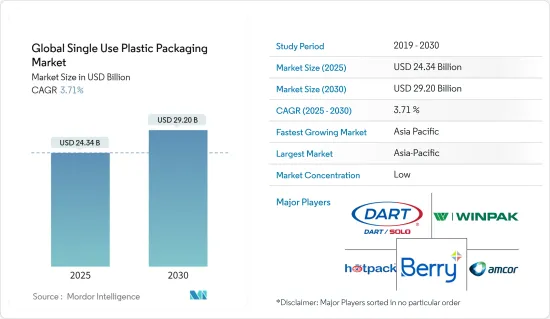

シングルユースプラスチック包装の世界市場規模は2025年に243億4,000万米ドルと推定され、予測期間(2025-2030年)のCAGRは3.71%で、2030年には292億米ドルに達すると予測されます。

主なハイライト

- 都市人口の拡大が調理済み食品やすぐに食べられる食品の需要を牽引し、外食産業の包装動向に大きな影響を与えています。この動向は予測期間中にシングルユースプラスチック包装ソリューションの需要を増加させると予想されます。都市部の消費者は多忙なライフスタイルを送ることが多く、食事の準備をする時間が少ないため、効率的な包装を必要とする簡便食品への依存度が高まっています。

- 都市部における食品宅配サービスや持ち帰りオプションの台頭がこの需要をさらに高めています。主要地域では、都市化、ライフスタイルの変化、ペースの速い職場環境への適応、オンライン食品プラットフォームへの依存の高まりが外食産業のダイナミクスを急速に変化させ、シングルユースプラスチック包装ソリューションの需要をさらに押し上げています。これらの要因は総体的に、利便性、携帯性、食品保存性を優先する包装の市場拡大に寄与しており、これは外食産業におけるシングルユースプラスチック包装にしばしば関連する特徴です。

- クイックサービス・レストラン、フルサービス・レストラン、コーヒーショップ、スナック・アウトレット、施設などのエンドユーザーの増加が、利便性の高いパッケージング・ソリューションの需要を後押ししています。この動向は、シングルユース包装フォーマットの生産を増加させると予想されます。消費者が利便性を求め、特に少人数世帯のライフスタイルの変化に適応していく中で、硬質包装から軟質包装へのシフトが勢いを増しています。その結果、シングルユースプラスチック包装は様々なフードサービス分野で人気が高まっています。

- ファーストフード・フランチャイズとクイックサービス・レストランの急速な拡大は、人口統計、雇用形態、ライフスタイルの変化に対応し、市場の成長を牽引しています。ファストフードの手頃な価格と迅速な調理時間は、便利な食事の選択肢を求める消費者の需要に合致しています。このようなファーストフード消費の世界の増加は、外食産業におけるシングルユースプラスチック包装の成長を直接支えています。

- 消費者の利便性に対する需要の高まりは、シングルユースプラスチック包装市場を牽引する重要な要因です。メーカーはこうしたニーズの変化に対応した包装ソリューションを提供することで、進化する顧客の嗜好に適応しています。社会人の多忙なライフスタイルは、便利な食品包装オプションへの需要を高めています。さらに、生産者は使用後の廃棄を考慮するようになり、簡単に廃棄できる包装アイテムの開発につながっています。

- シングルユースプラスチックに関する規制と、繊維や紙をベースとした製品など持続可能な代替包装への嗜好の高まりが、市場の成長を阻む課題となっています。これらの規制はプラスチック廃棄物を減らし、環境に優しいパッケージング・ソリューションを促進することを目的としています。持続可能な代替品へのシフトは、消費者の需要と政府の政策の両方によって推進されています。

- シングルユースプラスチックや持続不可能な慣行が環境に与える影響に対する消費者の意識の高まりは、生態学的に好ましい結果をもたらすより高い開発基準への要求につながっています。このような認識により、多くの消費者が環境に優しい包装を施した製品を積極的に求めるようになり、企業は包装戦略を適応させる必要に迫られています。その結果、さまざまな業界の企業が、こうした消費者の期待の変化に対応し、規制要件を遵守するために、革新的で持続可能な包装ソリューションの研究開発に投資しています。

シングルユースプラスチック包装市場の動向

クイックサービスレストラン部門が大きなシェアを占める

- クイックサービスレストラン(QSR)は、迅速なサービスに重点を置いた手頃な価格の食事オプションを提供しています。QSRは、テーブルサービスを制限し、セルフサービスに重点を置いているのが特徴で、従来のレストランとは一線を画しています。QSRは通常、ハンバーガー、サンドイッチ、揚げ物など、調理が簡単で、素早く組み立てて提供できる合理的なメニューを提供します。QSRは効率的なオペレーションにより、大量の顧客に素早くサービスを提供できるため、手早く食事を済ませたい人に人気があります。

- QSRで利用されるシングルユースプラスチック製フードサービス製品の大半は、発泡ポリスチレン(EPS)、ポリプロピレン(PP)、ポリエチレンテレフタレート(PET)、ポリ乳酸(PLA)から作られています。これらの素材は、耐久性、費用対効果、食品の温度を維持する能力から選ばれ、クイックサービスにおける全体的な効率と顧客体験に貢献しています。

- クイックサービス・レストラン(QSR)のメニューは通常、包装から直接消費されます。消費者がファーストフードを選ぶ理由は、その利便性、迅速な調理、価値、手頃な価格です。従って、包装は不可欠な食品構成要素であり、消費者のファーストフードに対する動機と期待に沿うものでなければならないです。包装は、食品の温度を維持し、鮮度を保ち、消費を容易にするなど、複数の目的を果たします。また、ブランド・アイデンティティや顧客の認知においても重要な役割を果たしています。

- 持続可能性への関心が高まるにつれ、多くのQSRは、ファストフードの顧客が期待する利便性と機能性を維持しつつ、消費者の環境に対する責任の要求に応えるため、環境に優しいパッケージング・オプションを模索しています。ファストフードのパッケージに使用されるデザインと素材は、消費者の食事体験全体を向上させながら、実用性、費用対効果、環境への影響のバランスを取る必要があります。

- 今日のペースの速い環境では、シングルユースプラスチック包装はクイック・サービス・レストラン(QSR)に不可欠なものとなっています。消費者は家庭での食事の準備により多くの時間を必要とするため、ますますファーストフードに頼るようになっています。このような消費者行動の変化により、便利で持ち運びに便利な食事ソリューションへの需要が高まっています。シングルユースプラスチック包装は、効率的、安全かつコスト効率よく食品を包装することで、QSRがこの需要に応えることを可能にします。これらの包装ソリューションは、様々な温度に耐え、輸送中の食品の品質を維持するように設計されています。また、漏れにくい、取り扱いが簡単といった実用的な利点もあり、通勤中や職場で食事を摂ることの多い顧客にとって極めて重要です。

- レストランの人気の高まりが、ファーストフード・クイックサービス・レストラン(QSR)市場の拡大を後押ししています。大手QSRブランドが店舗を増やすにつれ、シングルユースプラスチック包装の需要が生まれます。この拡大は様々な地域や料理で見られ、便利で手ごろな食事オプションに対する消費者の嗜好の変化を反映しています。

- この動向は特に都市部や新興市場で顕著で、急速な都市化と多忙なライフスタイルがQSRの利用者増加に寄与しています。例えば、世界のQSRブランドであるマクドナルドは、クイックミールへの需要の高まりを受けて、世界中で店舗数を着実に増やしています。同社の世界の店舗数は2017年の37,241店から2023年には41,822店に増加しており、この動向を物語っています。この成長はマクドナルドだけにとどまらず、他の大手QSRチェーンも店舗数を拡大し、シングルユース包装の需要をさらに押し上げました。

アジア太平洋が市場で大きなシェアを占める見込み

- アジア太平洋では、中国やインドなど人口密度の高い国や新興国が多く、外食需要が高いです。その結果、シングルユースプラスチック包装のニーズが高まっており、予測期間中もその傾向は続くと思われます。プラスチックは、消費者の利便性文化の中心である包装分野の重要な構成要素となっています。プラスチックの多用途性と耐久性は、持ち帰り容器から飲料ボトルまで、様々な食品包装用途にとって魅力的な選択肢となっています。

- プラスチック包装は他の素材に比べてコストパフォーマンスが良いため、多くの外食・包装用途が段ボール、ガラス、金属といった従来の包装素材からプラスチックへと移行しています。この移行は、フードデリバリーやクイックサービス・レストラン部門が急速に拡大している都市部で特に顕著です。プラスチック包装は軽量であるため、輸送コストの削減やサプライチェーンにおける二酸化炭素排出量の削減にも貢献し、アジア全域の外食産業での採用をさらに後押ししています。

- この地域は、大量に注文されることの多い家庭内および店外の飲食品用の包装製品の生産という点で成長が見込まれています。この増加は、消費者の習慣の変化と、便利で持ち運び可能な食品オプションに対する需要の高まりが原動力となっています。単回使用プラスチック包装はこの地域で、特にファーストフード店で、クラムシェル、ボトル、トレイ、カップ、蓋など様々な用途に広く使用されています。こうした包装ソリューションの多用途性と費用対効果の高さは、外食産業の企業にとって人気の高い選択肢となっています。しかし、この動向は環境の持続可能性についての懸念も引き起こし、この地域では代替包装材料とリサイクルの取り組みについての議論を促しています。

- 数多くのエンドユーザー産業があるため、この地域はシングルユースプラスチック包装の重要な投資国であり採用国でもあります。この採用は、飲食品、ヘルスケア、消費財など様々な分野で顕著です。この地域の市場成長を後押ししている要因はいくつかあります。第一に、特に利便性が高く評価される都市部では、包装された食事に対する需要が増加しています。次に、レストランやスーパーマーケットの拡大により、食品の鮮度と安全性を維持するための包装ソリューションに対するニーズが高まっています。最後に、消費者の嗜好や生活習慣の変化に後押しされたボトル入りの水や飲料の消費の増加が、この地域におけるシングルユースプラスチック包装の需要をさらに押し上げています。これらの動向は総体的に、この地域のシングルユースプラスチック包装市場の持続的成長と開拓に寄与しています。

- インドは人口が多く経済が新興諸国であるため、ボトル入り飲料水の消費量が大幅に増加しており、この地域の堅調な市場として際立っています。Indian Railway Catering and Tourism Corporation Limited(IRCTC)は、独自のボトル入り飲料水ブランド "Rail Neer "を導入し、主に列車内や駅で販売しています。ボトル入り飲料水の需要の高まりと鉄道部門の拡大に伴い、IRCTCは生産量を大幅に増やしました。2021年には7,530万本を生産し、2023年には3億5,770万本に増加しました。

- インドと中国の包装産業は近年著しい成長を遂げています。この拡大は、新しい製造ユニットの設立、環境に優しい素材の採用、研究開発への注力の増加など、いくつかの要因によるものです。こうした開発により、革新的で見た目にも魅力的な製品が、競争力のあるコストで現地生産されるようになった。さらに、インドの「メイク・イン・インディア」プログラムなどの政府のイニシアティブは、パッケージング業界におけるこうしたさらなる進歩を加速させると予想されます。

- 中国におけるボトル入り飲料水の生産と消費の増加は、市場にプラスの影響を与えています。中国の消費者はますます活動的で健康的なライフスタイルを採用するようになっており、これがボトル入り飲料水の需要急増につながっています。この動向は、国内の水道水供給における水質汚染に対する懸念の高まりによってさらに拍車がかかっています。その結果、中国ではさまざまな層でボトル入り飲料水の需要が大幅に増加しています。

- 消費者の健康意識の高まりは、より安全で便利な水分補給の選択肢を求めるようにし、ボトル入り飲料水を魅力的な選択肢にしています。Eastmoney.comによると、この消費者行動の変化は、中国におけるボトル入り飲料水の小売販売予測値にも反映されています。同市場は大幅な成長が見込まれており、小売売上高は2020年の2,002億人民元(281億2,000万米ドル)から顕著に増加し、2025年には3,536億人民元(496億7,000万米ドル)に達すると予測されています。この成長軌道は、市場の可能性の拡大と、ボトル入り飲料水製品に対する中国消費者の嗜好の変化を裏付けています。

シングルユースプラスチック包装業界の概要

シングルユースプラスチック包装市場は断片化されています。Berry Global Inc.、Amcor Group GmbH、Huhtamaki Oyj、Hotpack Packaging Industries LLCなど、いくつかの世界的・地域的プレーヤーが、この競争の激しい市場で注目を集めようと争っています。この市場の特徴は、製品の差別化が低いこと、製品の普及が進んでいること、競合が多いことです。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査想定と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 産業バリューチェーン分析

第5章 市場力学

- 市場促進要因

- クイックサービスレストランや飲食店の増加が市場の需要を牽引

- 市場抑制要因

- 包装におけるプラスチック使用に関する環境問題と政府規制

第6章 市場セグメンテーション

- 材料別

- ポリ乳酸(PLA)

- ポリエチレンテレフタレート(PET)

- ポリエチレン(PE)

- その他の材料タイプ

- 製品タイプ別

- ボトル

- バッグ&パウチ

- クラムシェル

- トレイ、カップ、蓋

- その他の製品タイプ

- エンドユーザー別

- クイックサービスレストラン

- フルサービス・レストラン

- インスティテューショナル

- 小売

- その他エンドユーザー

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア・ニュージーランド

- ラテンアメリカ

- ブラジル

- メキシコ

- コロンビア

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Novolex

- Pactiv LLC

- Dart Container Corporation

- Winpak Ltd

- Berry Global Inc.

- Amcor Group

- Huhtamaki Oyj

- Hotpack Packaging Industries LLC

- Graphic Packaging International LLC

- Pactiv Evergreen Inc.

第8章 投資分析

第9章 市場の将来

The Global Single Use Plastic Packaging Market size is estimated at USD 24.34 billion in 2025, and is expected to reach USD 29.20 billion by 2030, at a CAGR of 3.71% during the forecast period (2025-2030).

Key Highlights

- The expanding urban population drives the demand for prepared and ready-to-eat food products, significantly influencing food service packaging trends. This trend is expected to increase the demand for single-use plastic packaging solutions during the forecast period. Consumers in urban areas often have busier lifestyles and less time for meal preparation, leading to a greater reliance on convenience foods that require efficient packaging.

- The rise of food delivery services and takeaway options in cities has further amplified this demand. In key regions, urbanization, lifestyle changes, adaptation to fast-paced work environments, and increased reliance on online food platforms rapidly transform the foodservice industry dynamics, further boosting the demand for single-use plastic packaging solutions. These factors collectively contribute to a growing market for packaging that prioritizes convenience, portability, and food preservation, characteristics often associated with single-use plastic packaging in the foodservice industry.

- The growth of end users, including quick-service restaurants, full-service restaurants, coffee shops, snack outlets, and institutional facilities, drives the demand for convenient packaging solutions. This trend is expected to increase the production of single-use packaging formats. The shift from rigid to flexible packaging is gaining momentum as consumers seek convenience and adapt to changing lifestyles, particularly in smaller households. Consequently, single-use plastic packaging is experiencing increased popularity across various food service segments.

- The rapid expansion of fast-food franchises and quick-service restaurants drives the market's growth, responding to changing demographics, employment patterns, and lifestyles. Fast food's affordability and quick preparation times align with consumers' demand for convenient meal options. This global increase in fast food consumption directly supports the growth of single-use plastic packaging in the food service industry.

- The growing demand for consumer convenience is a crucial factor driving the single-use plastic packaging market. Manufacturers adapt to evolving customer preferences by offering packaging solutions catering to these changing needs. The busy lifestyles of working professionals have increased the demand for convenient food packaging options. Additionally, producers are now considering post-use disposal, leading to the development of packaging items that can be easily discarded.

- Regulations on single-use plastics and the growing preference for sustainable packaging alternatives, such as fiber and paper-based products, challenge the market's growth. These regulations aim to reduce plastic waste and promote environment-friendly packaging solutions. The shift towards sustainable alternatives is driven by both consumer demand and governmental policies.

- Increasing consumer awareness about the environmental impact of single-use plastics and unsustainable practices has led to demands for higher development standards with positive ecological outcomes. This awareness has prompted many consumers to actively seek out products with eco-friendly packaging, putting pressure on companies to adapt their packaging strategies. As a result, businesses across various industries are investing in research and development of innovative, sustainable packaging solutions to meet these evolving consumer expectations and comply with regulatory requirements.

Single Use Plastic Packaging Market Trends

Quick Service Restaurants Segment to Hold a Significant Share

- Quick-service restaurants (QSRs) provide affordable food options focusing on rapid service. These establishments are characterized by limited table service and a strong emphasis on self-service, setting them apart from traditional restaurants. QSRs typically offer a streamlined menu of easily prepared items, such as burgers, sandwiches, and fried foods, which can be quickly assembled and served. The efficiency of their operations allows them to serve a high volume of customers quickly, making them popular for those seeking quick meals.

- The majority of single-use plastic food service products utilized in QSRs are made from expanded polystyrene (EPS), polypropylene (PP), polyethylene terephthalate (PET), and polylactic acid (PLA). These materials are chosen for their durability, cost-effectiveness, and ability to maintain food temperature, contributing to the overall efficiency and customer experience in quick-service settings.

- Quick-service restaurant (QSR) menu items are typically consumed directly from their packaging. Consumers opt for fast food due to its convenience, rapid preparation, value, and affordability. Consequently, packaging is an essential food product component and must align with consumers' motivations and expectations for fast food. The packaging serves multiple purposes, including maintaining food temperature, preserving freshness, and facilitating easy consumption. It also plays a crucial role in brand identity and customer perception.

- As sustainability concerns grow, many QSRs are exploring eco-friendly packaging options to meet consumer demands for environmental responsibility while maintaining the convenience and functionality that fast food customers expect. The design and materials used in fast food packaging must balance practicality, cost-effectiveness, and environmental impact, all while enhancing the overall dining experience for consumers.

- In today's fast-paced environment, single-use plastic packaging has become integral to Quick Service Restaurants (QSRs). Consumers need more time for meal preparation at home, so they increasingly rely on fast food options. This shift in consumer behavior has led to a greater demand for convenient, on-the-go meal solutions. Single-use plastic packaging allows QSRs to meet this demand by packaging food efficiently, safely, and cost-effectively. These packaging solutions are designed to withstand various temperatures and maintain food quality during transportation. They also offer practical benefits such as leak resistance and easy handling, which are crucial for customers who often consume their meals while commuting or at their workplaces.

- The growing popularity of restaurants drives the expansion of the fast-food and quick-service restaurant (QSR) market. As major QSR brands increase their outlets, they create demand for single-use plastic packaging. This expansion is evident across various regions and cuisines, reflecting changing consumer preferences for convenient and affordable dining options.

- The trend is particularly noticeable in urban areas and emerging markets, where rapid urbanization and busier lifestyles contribute to the increased patronage of QSRs. For example, McDonald's, a global QSR brand, has been steadily growing its store count worldwide in response to the rising demand for quick meals. The company's global store count grew from 37,241 in 2017 to 41,822 in 2023, illustrating this trend. This growth was not limited to McDonald's alone; other major QSR chains expanded their footprints, further driving the demand for single-use packaging.

Asia-Pacific Expected to Hold Significant Share in the Market

- In Asia-Pacific, many densely populated countries and emerging economies, such as China and India, have a high demand for food services. Consequently, the need for single-use plastic packaging is increasing and will remain elevated during the forecast period. Plastic has been a crucial component of the packaging sector, which is central to consumer convenience culture. The versatility and durability of plastic make it an attractive option for various food packaging applications, from takeaway containers to beverage bottles.

- Due to plastic packaging's favorable cost-performance ratio compared to other materials, many food service and packaging applications have transitioned from traditional packaging materials like corrugated paper boards, glass, and metal to plastics. This shift is particularly noticeable in urban areas where the food delivery and quick-service restaurant sectors are rapidly expanding. The lightweight nature of plastic packaging also contributes to reduced transportation costs and lower carbon emissions in the supply chain, further driving its adoption in the food service industry across Asia.

- The region is expected to grow in terms of producing packaging products for domestic and off-premise food and beverage items, often ordered in bulk. This increase is driven by changing consumer habits and the growing demand for convenient, portable food options. Single-use plastic packaging is widely used in the region for various applications, including clamshells, bottles, trays, cups, and lids, particularly in fast-food establishments. The versatility and cost-effectiveness of these packaging solutions make them popular choices for businesses in the food service industry. However, this trend also raises concerns about environmental sustainability, prompting discussions about alternative packaging materials and recycling initiatives in the region.

- Due to its numerous end-user industries, the region is a significant investor and adopter of single-use plastic packaging. This adoption is evident across various sectors, including food and beverage, healthcare, and consumer goods. Several factors drive the regional market growth. Firstly, there is an increasing demand for packaged meals, particularly in urban areas where convenience is highly valued. Secondly, the expansion of restaurants and supermarkets has created a need for more packaging solutions to maintain food freshness and safety. Lastly, the rising consumption of bottled water and beverages, fueled by changing consumer preferences and lifestyle habits, has further boosted the demand for single-use plastic packaging in the region. These trends collectively contribute to the sustained growth and development of this area's single-use plastic packaging market.

- India stands out as a robust market in the region due to its large population and developing economy, leading to a significant increase in bottled water consumption. The Indian Railway Catering and Tourism Corporation Limited (IRCTC) has introduced its own bottled water brand, "Rail Neer," primarily sold on trains and at railway stations. With the rising demand for bottled water and the expanding railway sector, IRCTC has substantially increased production. In 2021, the corporation produced 75.30 million bottles, which grew to 357.70 million bottles in 2023.

- The packaging industry in India and China has experienced significant growth in recent years. This expansion is attributed to several factors, including establishing new manufacturing units, adopting eco-friendly materials, and increasing focus on research and development. These developments have led to the creation of innovative and visually appealing products, all manufactured locally at competitive costs. Additionally, government initiatives such as India's 'Make in India' program are expected to accelerate these further advancements in the packaging industry.

- The increasing production and consumption of bottled water in China have positively influenced the market. Chinese consumers are increasingly adopting more active and healthier lifestyles, which has led to a surge in demand for bottled water. This trend is further fueled by rising concerns about water contamination in the country's tap water supply. As a result, China has experienced a significant increase in demand for bottled water across various demographics.

- The growing health consciousness among consumers has prompted them to seek safer and more convenient hydration options, making bottled water an attractive choice. According to Eastmoney.com, this shift in consumer behavior is reflected in the projected retail sales figures for bottled water in China. The market is expected to show substantial growth, with retail sales projected to reach CNY 353.6 billion (USD 49.67 billion) in 2025, a notable increase from CNY 200.2 billion (USD 28.12 billion) in 2020. This growth trajectory underscores the expanding market potential and the changing preferences of Chinese consumers toward bottled water products.

Single Use Plastic Packaging Industry Overview

The single-use plastic packaging market is fragmented. Several global and regional players, such as Berry Global Inc., Amcor Group GmbH, Huhtamaki Oyj, and Hotpack Packaging Industries LLC, are vying for attention in this contested space. This market is characterized by low product differentiation, growing product penetration, and high competition.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industrial Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The Increasing Number of Quick-Service Restaurants and Food Establishments has Driven Market Demand

- 5.2 Market Restraints

- 5.2.1 Environmental Concerns and Government Regulations Regarding Use of Plastic in Packaging

6 MARKET SEGMENTATION

- 6.1 By Material

- 6.1.1 Polylactic Acid (PLA)

- 6.1.2 Polyethylene Terephthalate (PET)

- 6.1.3 Polyethylene (PE)

- 6.1.4 Other Material Types

- 6.2 By Product Type

- 6.2.1 Bottles

- 6.2.2 Bags and Pouches

- 6.2.3 Clamshells

- 6.2.4 Trays, Cups, and Lids

- 6.2.5 Other Product Types

- 6.3 By End User

- 6.3.1 Quick Service Restaurants

- 6.3.2 Full Service Restaurants

- 6.3.3 Institutional

- 6.3.4 Retail

- 6.3.5 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 Germany

- 6.4.2.2 United Kingdom

- 6.4.2.3 France

- 6.4.2.4 Italy

- 6.4.3 Asia-Pacific

- 6.4.3.1 China

- 6.4.3.2 Japan

- 6.4.3.3 India

- 6.4.3.4 Australia and New Zealand

- 6.4.4 Latin America

- 6.4.4.1 Brazil

- 6.4.4.2 Mexico

- 6.4.4.3 Columbia

- 6.4.5 Middle East and Africa

- 6.4.5.1 United Arab Emirates

- 6.4.5.2 Saudi Arabia

- 6.4.5.3 South Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Novolex

- 7.1.2 Pactiv LLC

- 7.1.3 Dart Container Corporation

- 7.1.4 Winpak Ltd

- 7.1.5 Berry Global Inc.

- 7.1.6 Amcor Group

- 7.1.7 Huhtamaki Oyj

- 7.1.8 Hotpack Packaging Industries LLC

- 7.1.9 Graphic Packaging International LLC

- 7.1.10 Pactiv Evergreen Inc.