|

市場調査レポート

商品コード

1644310

デジタルレンディング:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Digital Lending - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| デジタルレンディング:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年01月05日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

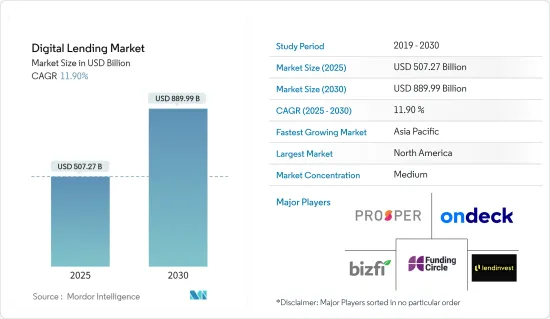

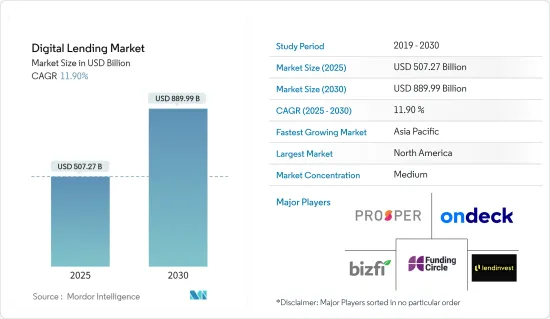

デジタルレンディングの市場規模は2025年に5,072億7,000万米ドルと推定され、2030年には8,899億9,000万米ドルに達すると予測され、予測期間中(2025-2030年)のCAGRは11.9%です。

主なハイライト

- フィンテック融資としても知られるデジタルレンディングは、オンラインプラットフォームを通じて融資を確保し、借入プロセスをより効率化します。借り手は物理的に銀行を訪れるのではなく、オンラインで融資を申し込むことができます。このデジタルアプローチにより、銀行などの従来の仲介業者が不要になり、事務処理の負担が大幅に軽減されます。

- BFSI業界におけるデジタル化の急速な導入により、融資の情勢はここ数年で劇的に変化しました。世界の多くの地域では伝統的な融資形態が依然として優勢ですが、デジタルソリューション・プロバイダーが提供するメリットにより、企業全体でデジタルレンディングソリューションやサービスの採用への道がますます開かれつつあります。

- 銀行・金融サービスのデジタル化がもたらすさまざまなメリットにより、消費者の期待や行動が変化していることも、市場の成長を促す大きな要因となっています。顧客は多様な背景を持ち、個人ローンから中小企業金融、住宅ローンに至るまで、さまざまな目的で融資を必要としています。

- さらに、スマートフォンの普及などの技術的進歩により、エンドユーザーの業種を問わずデジタルバンキングの導入が進んでいます。また、人工知能、機械学習、クラウド・コンピューティングなどの技術は、膨大な量の顧客情報を処理できるため、銀行やフィンテックに利益をもたらしています。これらのデータや情報は、顧客が望むタイムリーなサービスやソリューションに関する結果を得るために比較され、顧客関係の発展に役立っています。

- Aire、Kabbage、Kasistoは、AIに全面的に投資している最も著名な金融業界の新興企業です。例えば、Kabbageは、特定の顧客にお金を貸す際のあらゆるリスクを評価するAIアルゴリズムを使用しており、企業の管理者は最小限の時間で融資を行うことができます。フィンテック企業や銀行企業では、消費者のニーズをパーソナライズすることが求められており、AIの需要はさらに高まっています。

デジタルレンディング市場の動向

消費者セグメントが著しい成長を遂げる

- 金融サービス・テクノロジー・ソリューションのリーディング・世界・プロバイダであるFiserv Inc.が実施した最新の消費者動向調査「Expectations &Experiences」によると、過去2年間にローンを申し込んだ人の約3分の2が、一部または全部をオンラインで行っており、前年から大幅に増加しています。この成長の中心的な部分は、スマートフォンやタブレット端末の利用が増加していることによる。

- デジタルレンディングの新興企業も、教育や専門課程のための融資を開始し、個人向け融資が中心だったのが、消費者向け融資の分野にも拡大しています。例えば、ベンガルールを拠点とするゼスト・マネーは、専門教育目的の融資に大きく賭けています。同社は、Upgrade、NMIMS、Great Learning、Acadgild、Edurekaといった企業と提携し、新たなスキルを身につけたい新入社員や中堅管理職に資金を提供しています。

- 数年の職歴しかなく、信用履歴のないミレニアル世代(または、信用履歴の浅い層)は、ローンが承認されないか、高金利であることに気づく。さらに、伝統的な銀行では、中小企業や法人向け融資の決定までの期間は平均3~5週間、現金化までの期間は平均3カ月近くかかります。このような課題により、顧客のデジタル行動は、デジタルレンディングアプリケーションにアクセスするためのモバイル機器へと向かっています。

- 政府の規制も消費者のデジタル行動を強化しています。例えば、2023年12月、インド準備銀行(RBI)は、デジタルローン・アグリゲーターを規制の対象とし、業務の透明性を高める計画を発表しました。この動きは、RBIが規制対象団体や提携する融資サービス・プロバイダーを監督し、許容される信用円滑化サービスの円滑な提供を確保するというコミットメントを強調するものです。

大きな成長を遂げるアジア太平洋地域

- デジタルレンディングは、かなり以前から信用組合で利用可能でした。しかし、新たなテクノロジーと消費者金融の速いペースの性質に伴い、デジタルレンディングがペーパーレスプロセス以上のものを会員に提供することがこれまで以上に重要になっています。

- 2024年4月、全国農業農村開発銀行(NABARD)は、農業ローンの処理を合理化するため、準備銀行の子会社であるRBIHとの戦略的提携を発表しました。NABARDは、e-KCCの融資実行システムポータルと、準備銀行イノベーションハブ(RBIH)が開発したPublic Tech Platform for Frictionless Credit(PTPFC)を統合する予定です。

- インドでは、スマートフォンの急速な普及、インターネットへのアクセス、消費主義へのシフトが、デジタルレンディング企業の成長に拍車をかけた。現在、インドには338社のオンライン融資の新興企業があり、シームレスなプロセスを通じて貸し手と借り手の間のギャップを減らそうとしています。

- さらに、日本政府はキャッシュレス行動を国民に浸透させるためのプログラムを開始しています。政府は、2025年までにキャッシュレス決済を40%に増やすというイニシアチブを開始しました。2019年10月1日に消費税が8%から10%に引き上げられるのに伴い、いくつかの割引制度が実施されました。これらの制度は、加盟店にキャッシュレス決済端末の設置を補助し、登録された中小企業やフランチャイズ店から購入する場合、消費者に2%または5%の割引を提供しました。

デジタルレンディング業界の概要

デジタルレンディング市場は、複数のソリューション・プロバイダーが存在するため断片化されているが、いずれも過半数のシェアを占めていないです。Funding Circle Limited、On Deck Capital Inc.、Prosper Marketplace Inc.、LendInvest Limited、Bizfi LLCareなどの市場プレーヤーは、自社のサービスを改善し、市場の牽引力を最大限に高めるために、いくつかのイノベーションを行っています。市場の新興プレーヤーは、革新的で技術的に統合されたソリューションを提供するために戦略的に資金を調達しています。また、市場プレーヤーは戦略的提携も成長への有利な道と考えています。

- 2024年7月CRMの大手プロバイダーであるセールスフォースは、「インド向けデジタルレンディング」の立ち上げ計画を発表しました。このプラットフォームは、インドの銀行や貸金業者が消費者向け融資にデジタルアプローチを採用できるように設計されています。そうすることで、業務を合理化し、コストを削減し、時代遅れの異種システムを管理する課題を解消することができます。インド向けデジタルレンディング」はインド市場専用にカスタマイズされています。さらに、統合機能を提供しており、銀行は財務データとセールスフォースの顧客インサイトを統合することができます。

- 2024年5月PhonePeはアプリ内で安全なデジタルレンディング・プラットフォームを開始しました。このプラットフォームでは、5億3,500万人以上の登録ユーザーが、投資信託、金融、自動車ローンなど、6つのカテゴリーにわたるローンを利用できます。ローンは、銀行、非銀行金融会社(NBFC)、Tata Capital、L&T Finance、Hero FinCorp、Muthoot Fincorpなどのフィンテック企業のネットワークと提携して提供されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場動向

- 市場概要

- 業界の利害関係者分析

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 消費者の交渉力

- 新規参入業者の脅威

- 競争企業間の敵対関係

- 代替品の脅威

- 潜在的ローン購入者の重要なタッチポイント

- COVID-19がデジタルレンディングおよび関連市場に与える影響

第5章 市場力学

- 市場促進要因

- デジタル行動をとる潜在的ローン購入者の増加

- 市場の課題

- セキュリティへの懸念

第6章 市場セグメンテーション

- タイプ別

- ビジネス

- ビジネスデジタルレンディング市場力学

- ビジネスデジタルレンディングのエコシステム(新興企業と既存企業の両方を含む)

- 消費者別

- 消費者向けデジタルレンディング市場力学

- 消費者向けデジタルレンディングモデル(ペイデイレンダー、ピアツーピアローン、個人ローン、自動車ローン、学生ローン)

- 消費者向けデジタルレンディングのエコシステム(新興企業と既存企業の両方を含む)

- ビジネス

- 地域別

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- アジア

- 中国

- インド

- 日本

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

- 北米

第7章 競合情勢

- 企業プロファイル

- Funding Circle Limited(Funding Circle Holdings PLC)

- Bizfi LLC

- On Deck Capital Inc.

- Prosper Marketplace Inc.

- LendInvest Limited

- LendingClub Corp.

- Zopa Limited

- Social Finance Inc.

- Upstart Network Inc.

- Kiva Microfunds

- Kabbage Inc.

- CAN Capital Inc.

- Lendingtree Inc.

- Kaspi Bank JSC

- Klarna Bank AB

- Ferratum Oyj

- Provident Bank(Provident Financial Services Inc.)

- International Personal Finance PLC(IPF)

- Oriente

- Faircent

- LenDenClub

- CapFloat Financial Services Private Limited

- Transactree Technologies Private Limited(LendBox)

- Monexo

- i-LEND

- Decimal Technologies Pvt. Ltd

第8章 投資分析と市場機会

The Digital Lending Market size is estimated at USD 507.27 billion in 2025, and is expected to reach USD 889.99 billion by 2030, at a CAGR of 11.9% during the forecast period (2025-2030).

Key Highlights

- Digital lending, also known as fintech lending, involves securing loans through online platforms, making the borrowing process more efficient. Rather than physically visiting a bank, borrowers can apply for loans online. This digital approach removes the need for traditional intermediaries, such as banks, and significantly reduces the burden of paperwork.

- The lending landscape has changed drastically over the years due to the rapid adoption of digitization in the BFSI industry. While the traditional form of lending still prevails in many parts of the world, the benefits provided by digital solution providers are increasingly paving the way for the adoption of digital lending solutions and services across enterprises.

- Another major factor driving the market's growth is the changing consumer expectations and behavior due to the several benefits of digitizing banking and financial services. Customers may hail from diversified backgrounds and require loans for various purposes, ranging from personal loans to SME finance and home loans.

- Furthermore, technological advancements, such as the proliferation of smartphones, have led to an increase in the adoption of digital banking across several end-user verticals. Also, technologies like artificial intelligence, machine learning, and cloud computing benefit banks and fintech as they can process vast amounts of customer information. This data and information are then compared to obtain results about timely services/solutions that customers want, which has aided in developing customer relations.

- Aire, Kabbage, and Kasisto are some of the most prominent financial industry startups that are fully investing in AI. For instance, Kabbage uses AI algorithms that assess all risks of lending money to a particular customer, allowing company managers to give loans in minimal time. The demand for personalization of their needs among consumers in fintech and banking companies has further strengthened the demand for AI.

Digital Lending Market Trends

The Consumer Segment to Witness Significant Growth

- According to the latest Expectations & Experiences consumer trends survey from Fiserv Inc., a leading global provider of financial services technology solutions, almost two-thirds of people who have applied for loans in the past two years do so either partially or fully online, representing a significant increase from the previous year. A central portion of this growth is due to the increasing usage of smartphones and tablets.

- Digital lending startups have also started giving out loans for education and professional courses, expanding from mainly focusing on personal loans to consumer lending space. For instance, Bengaluru-based Zest Money is betting big on lending for professional education purposes. The company partnered with players like Upgrade, NMIMS, Great Learning, Acadgild, and Edureka to provide funds to entry-level- or mid-level executives wanting to acquire new skill sets.

- Millennials with a few years of work experience and no credit history (or the new-to-credit segment) find their loans either unapproved or at high interest rates. Moreover, in traditional banks, the time to decide for small businesses and corporate lending averages between three and five weeks, and the average time to cash is nearly three months. Such challenges are driving customers' digital behavior to mobile devices to access digital lending applications.

- Government regulations also augment digital behavior among consumers. For instance, in December 2023, the Reserve Bank of India (RBI) announced plans to subject digital loan aggregators to a regulatory framework to enhance transparency in operations. This move underscores the RBI's commitment to overseeing its regulated entities and the lending service providers it collaborates with, ensuring the smooth provision of permissible credit facilitation services.

Asia-Pacific to Register Major Growth

- Digital lending has been available to credit unions for quite some time. However, with emerging technologies and the fast-paced nature of consumer lending, it is more important than ever that digital lending offers members more than a paperless process.

- In April 2024, the National Bank for Agriculture and Rural Development (NABARD) announced a strategic partnership with the Reserve Bank's subsidiary, RBIH, to streamline the processing of agricultural loans. NABARD is projected to merge its e-KCC loan origination system portal with the Public Tech Platform for Frictionless Credit (PTPFC) developed by the Reserve Bank Innovation Hub (RBIH).

- The rapid adoption of smartphones, internet access, and a shift toward consumerism in India helped fuel the growth of digital lending enterprises. Currently, there are 338 online lending start-ups in India that are trying to reduce the gap between lenders and creditors through a seamless process.

- Moreover, the Government of Japan is launching programs to inculcate cashless behaviors in citizens. The government launched an initiative to increase cashless payments to 40% by 2025. With the consumption tax increase from 8% to 10% on October 1, 2019, several discount schemes were implemented. These schemes subsidized the installation of cashless payment terminals for merchants and provided 2% or 5% discounts for consumers when purchasing from registered SMEs or franchise stores.

Digital Lending Industry Overview

The digital lending market is fragmented owing to the presence of several solution providers, none of which holds a majority share. Market players, such as Funding Circle Limited, On Deck Capital Inc., Prosper Marketplace Inc., LendInvest Limited, and Bizfi LLCare, are making several innovations to improve their offerings and gain maximum market traction. The emerging players in the market are strategically raising funds to provide innovative and technologically integrated solutions. The market players also view strategic collaborations as a lucrative path toward growth.

- July 2024: Salesforce, a leading CRM provider, unveiled its plans to launch 'Digital Lending for India.' This platform is designed to enable banks and lenders in India to adopt digital approaches to consumer lending. By doing so, they can streamline operations, reduce costs, and eliminate the challenges of managing outdated, disparate systems. 'Digital Lending for India' is tailored exclusively for the Indian market. Furthermore, it offers integration capabilities, allowing banks to merge their financial data with Salesforce's customer insights.

- May 2024: PhonePe launched its secure digital lending platform within its app. This platform allows over 535 million registered users to access loans across six categories, including mutual fund, gold, and car loans. The loans are provided in partnership with a network of banks, non-banking financial companies (NBFCs), and other fintech companies, including Tata Capital, L&T Finance, Hero FinCorp, and Muthoot Fincorp.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKETDYNAMICS

- 4.1 Market Overview

- 4.2 Industry Stakeholder Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitute Products

- 4.4 Important Touchpoints of Potential Loan Purchasers

- 4.5 Impact of COVID-19 on the Digital Lending and Allied Markets

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Number of Potential Loan Purchasers with Digital Behavior

- 5.2 Market Challenges

- 5.2.1 Security concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Business

- 6.1.1.1 Business Digital Lending Market Dynamics

- 6.1.1.2 Business Digital Lending Ecosystem (Including both Startups and Incumbents)

- 6.1.2 By Consumer

- 6.1.2.1 Consumer Digital Lending Market Dynamics

- 6.1.2.2 Consumer Digital Lending Models (Payday Lenders, Peer-to-Peer Loans, Personal Loans, Auto Loans, and Student Loans)

- 6.1.2.3 Consumer Digital Lending Ecosystem (Including both Startups and Incumbents)

- 6.1.1 Business

- 6.2 By Geography

- 6.2.1 North America

- 6.2.1.1 United States

- 6.2.1.2 Canada

- 6.2.2 Europe

- 6.2.2.1 United Kingdom

- 6.2.2.2 Germany

- 6.2.2.3 France

- 6.2.3 Asia

- 6.2.3.1 China

- 6.2.3.2 India

- 6.2.3.3 Japan

- 6.2.4 Australia and New Zealand

- 6.2.5 Latin America

- 6.2.6 Middle East and Africa

- 6.2.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Funding Circle Limited (Funding Circle Holdings PLC)

- 7.1.2 Bizfi LLC

- 7.1.3 On Deck Capital Inc.

- 7.1.4 Prosper Marketplace Inc.

- 7.1.5 LendInvest Limited

- 7.1.6 LendingClub Corp.

- 7.1.7 Zopa Limited

- 7.1.8 Social Finance Inc.

- 7.1.9 Upstart Network Inc.

- 7.1.10 Kiva Microfunds

- 7.1.11 Kabbage Inc.

- 7.1.12 CAN Capital Inc.

- 7.1.13 Lendingtree Inc.

- 7.1.14 Kaspi Bank JSC

- 7.1.15 Klarna Bank AB

- 7.1.16 Ferratum Oyj

- 7.1.17 Provident Bank (Provident Financial Services Inc.)

- 7.1.18 International Personal Finance PLC (IPF)

- 7.1.19 Oriente

- 7.1.20 Faircent

- 7.1.21 LenDenClub

- 7.1.22 CapFloat Financial Services Private Limited

- 7.1.23 Transactree Technologies Private Limited (LendBox)

- 7.1.24 Monexo

- 7.1.25 i-LEND

- 7.1.26 Decimal Technologies Pvt. Ltd