|

市場調査レポート

商品コード

1690155

売掛金自動化:市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Accounts Receivable Automation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 売掛金自動化:市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 157 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

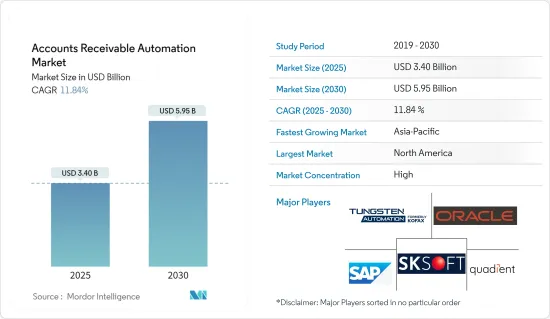

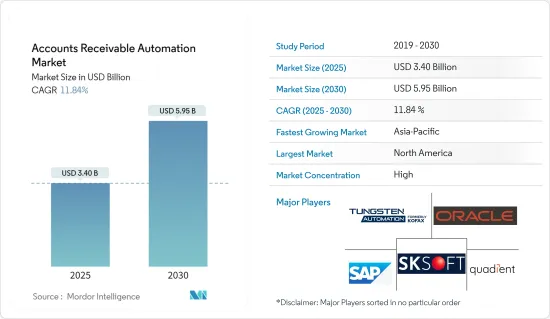

売掛金自動化市場規模は2025年に34億米ドルと推定され、予測期間(2025-2030年)のCAGRは11.84%で、2030年には59億5,000万米ドルに達すると予測されます。

主なハイライト

- 効率化が売掛金自動化の採用を促進する:売掛金自動化市場は、主に業務効率の改善、キャッシュフローの最適化、コスト削減のニーズによって急速な成長を遂げています。売掛金自動化ソフトウェアを利用する企業は、処理速度とチーム効率の両方において顕著な強化を報告しています。例えば、PYMNTSの調査によると、売掛金自動化ソリューションを採用している企業の87%が請求書処理をより迅速に行うことができ、79%がチームの生産性向上を実感しています。また、自動化された請求書発行システムでは、紙の請求書が最大25米ドルであるのに対し、電子請求書は2米ドル以下で作成できるため、コスト面でのメリットも明らかです。

- DSOの削減:ARの自動化により、売上残日数(DSO)が30%も減少し、キャッシュフローが大幅に改善されることが示されています。

- 処理能力の向上:自動化されたシステムでは、1ヶ月あたり最大19,000件の請求書を処理することができます。

- 迅速な投資回収:企業の65%がARワークフロー自動化への投資を12カ月以内に回収できたと報告しており、この数字は18カ月後には78%に上昇します。

- クラウドとAI技術がARプロセスに革命を起こす:クラウドベースのARプラットフォームと売掛金におけるAIの採用が増加しており、企業の売掛金管理方法に変革をもたらしています。クラウド技術は比類のない柔軟性、拡張性、コスト効率を提供し、あらゆる規模の企業を魅了しています。シスコのレポートでは、2021年までに全ワークロードの94%がクラウドデータセンターで処理され、その75%がSaaS(Software-as-a-Service)プラットフォームで処理されるようになると予測しています。

- クラウドの導入:90%の企業が何らかのクラウドサービスを導入しており、これはARにおけるデジタル決済処理に不可欠です。

- AIの導入:米国、英国、中国では34%の企業がすでにAIを使用しており、AR機能の自動化におけるAIの役割が高まっていることを示しています。

- スピードと正確性:AIを活用した支払照合の自動化は、請求書処理のスピードと精度を向上させ、財務成果の向上を促進します。

市場力学と将来展望:

市場では、大企業と中小企業の両方から売掛金管理ツールに対する需要が高まっています。手作業によるミスを減らし、キャッシュフローの予測可能性を確保し、顧客体験を向上させる必要性が、企業に売掛金自動化ソリューションの導入を促しています。BlueSnapのレポートによると、組織の93%が時代遅れのARプロセスに課題を抱えており、81%が支払遅延が事業継続のリスクになると考えています。

主なハイライト

- 支払い遅延の影響:平均して27%の顧客が支払期限を超過しており、月収の30%が売掛金に滞留しています。

- 中小企業の課題:中小企業も同様の問題に直面しており、月収の約24%が売掛金に滞留していることから、キャッシュフロー自動化の必要性が浮き彫りになっています。

- 業界特有の成長:ヘルスケア業界では、売掛金自動化導入のCAGRが15.51%になると予想されており、このテクノロジーが幅広い分野で採用されていることが明らかになっています。

革新的ソリューションと市場プレイヤー:

HighRadius、Sage、Eskerなど、市場の主要企業は、注文から現金化までのサイクル全体を合理化する財務自動化技術を提供するために革新を進めています。これらのプラットフォームは、請求書作成と支払照合を自動化するだけでなく、売掛金分析や行動予測モデルなどの機能も統合しています。

主なハイライト

- 戦略的パートナーシップHighRadiusはSageと提携し、RadiusOne A/R SuiteとSage Intacctを統合し、クラウドベースのAR業務を近代化します。

- 高度な機能:エスカーのキャッシュ・アプリケーション・ソリューションは、請求書と入金の照合を最適化し、照合プロセスの効率を高めます。

- AIの統合:ウェルズ・ファーゴは、AIと機械学習を活用した自動回収管理ツールを開発し、支払・送金データをより効率的に取得しています。

売掛金自動化市場の動向

市場成長を牽引するソリューションセグメント

売掛債権自動化市場はソリューションセグメントがリードしており、2021年の総市場シェアの84.78%を占めています。この優位性は今後も拡大すると予測され、同セグメントは2027年までにCAGR 12.70%で37億7,000万米ドルに達すると予測されます。

- AIとMLの変革:売掛金処理におけるAIの活用は、エラー検出の強化、支払照合におけるロジックの改善、請求自動化ソフトウェアにおける手入力の削減など、この分野に革命をもたらしています。

- クラウドベースの拡大:クラウドベースのARプラットフォームへのシフトは、特に中小企業においてソリューションセグメントの成長を加速させています。BlacklineによるAI主導の売掛金自動化企業Rimiliaの1億5,000万米ドルでの買収は、スケーラブルなクラウド製品への需要を浮き彫りにしています。

- 効率重視:キャッシュフローを最適化し、会計サイクルタイムを短縮するソリューションが優先されています。自動化ツールにより、ARチームは大量の請求書を迅速に処理できるようになり、手作業による支払照合のような価値の低い作業に費やす時間を削減できるようになりました。

- 統合機能:Eskerによるnumberzの買収やChargebee Receivablesの立ち上げに見られるように、売掛金自動化ツールは、既存のERPシステムとの統合能力がますます評価されています。

高成長地域として台頭するアジア太平洋地域

アジア太平洋地域は、2023年から2027年までのCAGRが14.74%と予測され、売掛金自動化における世界リーダーになる準備が整っています。この成長の原動力となるのは、各業界における急速なデジタルトランスフォーメーションです。

- 中小企業主導の成長:アジア太平洋地域の中小企業は、キャッシュフローを管理し、業務効率を改善するためにARオートメーションを導入しています。シンガポールの売掛金自動化プロバイダーであるAspireは、この動向を示しており、立ち上げからわずか1年で取引高10億米ドルを達成しました。

- 戦略的拡大:富士ゼロックスのような主要企業は、アジア太平洋地域で売掛金自動化サービスを拡大しており、世界市場におけるアジア太平洋地域の重要性を高めています。

- クラウドとモバイルの成長:Bill.comが6億2,500万米ドルを投じてInvoice2goを買収するなど、スマートフォンの高い普及率とクラウドインフラの成長がモバイルファーストのARソリューションの採用に拍車をかけています。

- 規制遵守:アジア全域で拡大するデジタル取引規制は、企業が効率性を向上させながらコンプライアンスを維持しようとしているため、売掛金自動化の導入を促進しています。

売掛金自動化産業の概要

世界企業が連結市場を独占

売掛金自動化市場は、世界なテクノロジー企業や金融サービス企業によって支配されています。SAP、Oracle、Workdayなどの大企業が牽引する一方、HighRadiusやBilltrustなどのフィンテック革新企業は、あらゆる規模の企業向けにカスタマイズされた最先端のARソリューションを導入しています。市場の統合は、戦略的パートナーシップとAI、機械学習、ロボティック・プロセス・オートメーションへの投資によって強化されています。

技術的リーダーシップ:新興国市場のプレーヤーは、優れた自動化機能と分析を提供する、堅牢でAI主導の売掛金管理ツールの開発に注力しています。

革新的なパートナーシップ:HighRadiusは、売掛金自動化プロセスを強化するためにCommerce Bankとの提携を拡大し、さまざまな部門におけるAR機能を近代化しています。

クラウドベースの優位性:SAP SEやオラクルなどの企業は、中小企業と大企業の両方向けに拡張性のあるAI強化プラットフォームに注力しており、市場のリーダーは引き続きクラウド統合を優先しています。

テクノロジー大手とフィンテック革新企業がリード:主要企業には、SAP SEやOracle Corporationのようなエンタープライズ・ソフトウェア・プロバイダーや、YayPayやBilltrustのようなフィンテック企業が含まれます。これらのリーダーに共通するテーマは、クラウド技術、売掛金プロセスの最適化、シームレスなERP統合に注力していることです。

新市場への進出:EskerやHighRadiusのような企業は、世界の需要、特にアジア太平洋のような新興市場での需要に対応するため、売掛金自動化ソリューションを展開しています。

AIと分析への注力:EskerのCash Applicationのような高度なAI駆動型プラットフォームが注目を集め、ARプロセスの最適化における予測分析の可能性を示しています。

法規制への対応:中国市場向けに設計されたApruveの多言語ローカライズされた請求書発行ツールに代表されるように、企業は現地の規制基準を満たすためにソリューションをカスタマイズしています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場洞察

- 市場概要

- 業界の魅力度-ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

- COVID-19の市場への影響評価

第5章 市場力学

- 市場促進要因

- キャッシュフローの改善、コストと会計サイクルタイムの削減による業務効率の向上

- クラウドコンピューティングやAIなどの技術導入の増加

- 市場抑制要因

- 請求書発行と支払管理の複雑な手続き

- プライバシーとセキュリティへの懸念

第6章 市場セグメンテーション

- コンポーネント別

- ソリューション

- サービス別

- 展開形態別

- オンプレミス

- クラウド

- 組織規模別

- 中小企業

- 大企業

- エンドユーザー業界別

- BFSI

- IT・通信

- 製造業

- ヘルスケア

- 運輸・物流

- その他エンドユーザー産業

- 地域別

- 北米

- 欧州

- アジア

- オーストラリア・ニュージーランド

- ラテンアメリカ

- 中東・アフリカ

第7章 競合情勢

- 企業プロファイル

- SAP SE

- Oracle Corporation

- SK Global Software

- Quadient(YayPay Inc.)

- Kofax Inc.

- Workday Inc.

- Corcentric LLC

- HighRadius Corporation

- Qvalia AB

- MHC Automation

- Bill.com Holdings Inc.

- Comarch SA

- Esker Inc.

第8章 投資分析

第9章 市場機会と今後の動向

The Accounts Receivable Automation Market size is estimated at USD 3.40 billion in 2025, and is expected to reach USD 5.95 billion by 2030, at a CAGR of 11.84% during the forecast period (2025-2030).

Key Highlights

- Efficiency Gains Drive Adoption of AR Automation: The Accounts Receivable Automation Market is witnessing rapid growth, primarily driven by the need for improved business efficiency, optimized cash flow, and cost reduction. Companies utilizing accounts receivable automation software have reported notable enhancements in both processing speed and team efficiency. For instance, a study by PYMNTS indicated that 87% of firms employing AR automation solutions can process invoices faster, while 79% experience increased team productivity. The cost advantage is also clear, as automated invoicing systems can generate electronic invoices for under USD 2, compared to up to USD 25 for paper invoices.

- Reduced DSO: AR automation has been shown to decrease Days Sales Outstanding (DSO) by as much as 30%, providing significant improvements in cash flow.

- Increased Processing Capacity: Automated systems can handle up to 19,000 invoices per month, compared to just 4,500 for manual processes.

- Quick Payback: 65% of companies report recouping their investment in AR workflow automation within 12 months, with this figure rising to 78% after 18 months.

- Cloud and AI Technologies Revolutionize AR Processes: The increasing adoption of cloud-based AR platforms and AI in accounts receivable is transforming the way businesses manage their accounts receivable functions. Cloud technology offers unmatched flexibility, scalability, and cost-efficiency, attracting businesses of all sizes. Cisco's report predicts that 94% of all workloads will be processed in cloud data centers, with 75% of these workloads expected to be on Software-as-a-Service (SaaS) platforms by 2021.

- Cloud Adoption: 90% of companies have integrated some form of cloud service, which is crucial for digital payment processing in AR.

- AI Deployment: 34% of firms in the US, UK, and China are already using AI, demonstrating its growing role in automating AR functions.

- Speed and Accuracy: AI-powered payment reconciliation automation improves invoice processing speeds and accuracy, driving enhanced financial outcomes.

Market Dynamics and Future Outlook:

The market is seeing growing demand for accounts receivable management tools from both large corporations and SMEs. The need to reduce manual errors, ensure cash flow predictability, and improve customer experiences is pushing companies to adopt AR automation solutions. According to BlueSnap's report, 93% of organizations face challenges with outdated AR processes, and 81% believe that late payments pose a risk to their business continuity.

Key Highlights

- Delayed Payments Impact: On average, 27% of customers exceed their payment terms, leading to 30% of monthly revenue being tied up in accounts receivable.

- SME Challenges: SMEs face similar issues, with about 24% of monthly revenue held up in AR, highlighting the need for cash flow automation.

- Industry-Specific Growth: The healthcare sector is expected to experience a compound annual growth rate (CAGR) of 15.51% in AR automation adoption, underscoring the technology's broad appeal.

Innovative Solutions and Market Players:

Key players in the market, such as HighRadius, Sage, and Esker, are innovating to provide financial automation technologies that streamline the entire order-to-cash cycle. These platforms not only automate invoice generation and payment matching but also integrate features such as accounts receivable analytics and predictive behavior models.

Key Highlights

- Strategic Partnerships: HighRadius has teamed up with Sage to integrate RadiusOne A/R Suite with Sage Intacct, modernizing cloud-based AR operations.

- Advanced Features: Esker's Cash Application solution optimizes the matching of invoices with received payments, boosting efficiency in the reconciliation process.

- AI Integration: Wells Fargo has developed automated collections management tools that leverage AI and machine learning for capturing payment and remittance data more effectively.

AR Automation Market Trends

Solutions Segment Driving Market Growth

The Solutions segment leads the accounts receivable automation market, capturing 84.78% of the total market share in 2021. This dominance is projected to grow, with the segment expected to reach USD 3.77 billion by 2027, at a CAGR of 12.70%.

- AI and ML Transformation: The use of AI in accounts receivable processes is revolutionizing the field, enhancing error detection, improving logic in payment matching, and reducing manual input in billing automation software.

- Cloud-Based Expansion: The shift to cloud-based AR platforms is accelerating the growth of the Solutions segment, especially among SMEs. The acquisition of Rimilia, an AI-driven AR automation firm, by Blackline for USD150 million highlights the demand for scalable cloud offerings.

- Efficiency Focus: Solutions that optimize cash flow and shorten accounting cycle times are a priority. Automation tools now enable AR teams to process large volumes of invoices faster, reducing the time spent on lower-value tasks like manual payment matching.

- Integration Capabilities: AR automation tools are increasingly valued for their ability to integrate with existing ERP systems, as seen in Esker's acquisition of numberz and the launch of Chargebee Receivables.

Asia-Pacific Emerging as a High-Growth Region

The Asia-Pacific region is poised to become a global leader in AR automation, with a projected CAGR of 14.74% from 2023 to 2027. This growth is driven by rapid digital transformation across industries.

- SME-Led Growth: SMEs in Asia-Pacific are adopting AR automation to manage cash flow and improve operational efficiency. Aspire, a Singaporean AR automation provider, illustrates this trend, reaching USD 1 billion in transaction volume just one year after its launch.

- Strategic Expansions: Key players like Fuji Xerox are expanding their AR automation offerings in Asia-Pacific, reinforcing the region's importance in the global market.

- Cloud and Mobile Growth: High smartphone penetration and a growing cloud infrastructure are fueling the adoption of mobile-first AR solutions, such as Bill.com's $625 million acquisition of Invoice2go, aimed at expanding its presence in the region.

- Regulatory Compliance: Growing digital transaction regulations across Asia are driving AR automation adoption, as businesses seek to remain compliant while improving efficiency.

AR Automation Industry Overview

Global Players Dominate Consolidated Market

The Accounts Receivable Automation Market is dominated by global technology and financial service firms. Large enterprises such as SAP, Oracle, and Workday are leading the charge, while fintech innovators like HighRadius and Billtrust are introducing cutting-edge AR solutions tailored for businesses of all sizes. Consolidation in the market is reinforced by strategic partnerships and investments in AI, machine learning, and robotic process automation.

Technological Leadership: Established market players are focusing on developing robust, AI-driven accounts receivable management tools that offer superior automation capabilities and analytics.

Innovative Partnerships: HighRadius has expanded its collaboration with Commerce Bank to enhance AR automation processes, modernizing AR functions across different sectors.

Cloud-Based Dominance: Leaders in the market continue to prioritize cloud integration, with companies like SAP SE and Oracle focusing on scalable, AI-enhanced platforms for both SMEs and large enterprises.

Technology Giants and Fintech Innovators Lead: Major players include enterprise software providers like SAP SE and Oracle Corporation, alongside fintech companies like YayPay and Billtrust. The common theme among these leaders is their focus on cloud technology, accounts receivable process optimization, and seamless ERP integration.

Expansion into New Markets: Companies like Esker and HighRadius are rolling out AR automation solutions to address global demand, particularly in emerging markets like Asia-Pacific.

AI and Analytics Focus: Advanced AI-driven platforms like Esker's Cash Application are gaining prominence, demonstrating the potential of predictive analytics in optimizing AR processes.

Adapting to Regulatory Demands: Companies are also tailoring solutions to meet local regulatory standards, exemplified by Apruve's multilingual, localized invoicing tools designed for the Chinese market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Improve Business Efficiency by Improving Cash Flow and Reducing Costs and Accounting Cycle Time

- 5.1.2 Increasing Adoption of Technologies like Cloud Computing and AI

- 5.2 Market Restraints

- 5.2.1 Complex Procedure of Invoicing and Payment Management

- 5.2.2 Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 By Deployment Mode

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Size of the Organization

- 6.3.1 Small and Medium Enterprises

- 6.3.2 Large Enterprises

- 6.4 By End-user Industry

- 6.4.1 BFSI

- 6.4.2 IT and Telecom

- 6.4.3 Manufacturing

- 6.4.4 Healthcare

- 6.4.5 Transportation and Logistics

- 6.4.6 Other End-user Industries

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia

- 6.5.4 Australia and New Zealand

- 6.5.5 Latin America

- 6.5.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 Oracle Corporation

- 7.1.3 SK Global Software

- 7.1.4 Quadient (YayPay Inc.)

- 7.1.5 Kofax Inc.

- 7.1.6 Workday Inc.

- 7.1.7 Corcentric LLC

- 7.1.8 HighRadius Corporation

- 7.1.9 Qvalia AB

- 7.1.10 MHC Automation

- 7.1.11 Bill.com Holdings Inc.

- 7.1.12 Comarch SA

- 7.1.13 Esker Inc.