|

市場調査レポート

商品コード

1690119

ひまわり油- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年)Sunflower Oil - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| ひまわり油- 市場シェア分析、産業動向・統計、成長予測(2025年~2030年) |

|

出版日: 2025年03月18日

発行: Mordor Intelligence

ページ情報: 英文 139 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

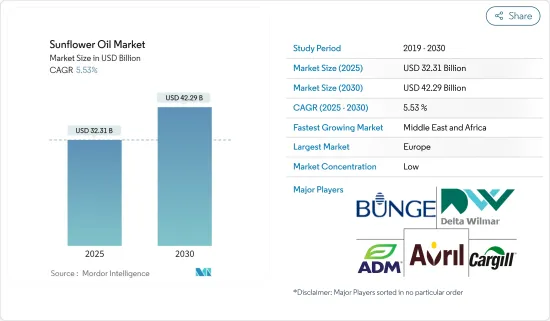

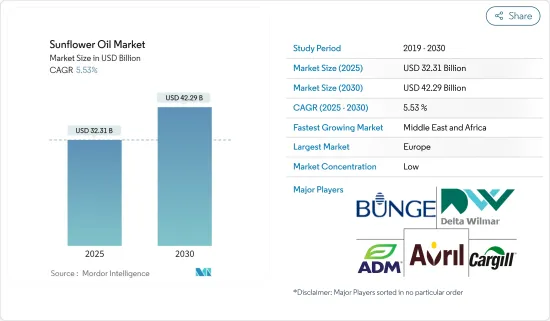

ひまわり油市場規模は2025年に323億1,000万米ドルと推定され、予測期間(2025~2030年)のCAGRは5.53%で、2030年には422億9,000万米ドルに達すると予測されます。

より健康的な食習慣への世界のシフトがあり、より健康的な食用油のひとつとされるひまわり油の需要増に拍車をかけています。この需要急増により、ひまわりの栽培面積が拡大し、それに伴い播種種子価格も上昇しています。近年、特に播種用のひまわり種子市場はかつてない成長を遂げています。ひまわり油は健康的であり、多くの代替品よりも手頃であるため、開発途上国で旺盛な需要が見られます。このひまわり油の消費増加は、パーム油、綿実油、菜種油の世界の低迷を打ち消しています。ひまわり油の主要用途は食品セグメントだが、化粧品メーカーや医療産業も関心を高めており、その魅力は拡大しています。日焼け止め、フェイシャルマスク、アイトリートメントのような製品に対する需要の急増は、予測期間中の世界市場の成長を後押しするものと考えられます。さらに、化粧品ユーザーの間では、化学品を含まないパーソナルケア製品を求める傾向が高まっており、世界のひまわり油市場をさらに後押ししています。これに対応するため、メーカー各社は化学品を含まない製品を求めるこの需要に応える新製品を展開しています。その顕著な例が、米国のシンガーソングライター、アリシア・キーズが立ち上げたブランド、キーズ・ソウルケアです。同社は2022年4月、認定皮膚科医レニー・スナイダー博士との共同開発別、肌に栄養を与える製品シリーズを発表しました。アボカド油、ツバキ種子油、ひまわり油などの天然成分で作られたティンテッドリップバーム、チークティント、ブロウジェル、コンプレックスブラシなどがラインナップされています。

ひまわり油市場の動向

食品セグメントがひまわり油の主要消費者に浮上

世界的に、消費者は飽和脂肪の少ない非遺伝子組み換え食品を優先し、ヴィーガン、コーシャ、ハラルといった食の嗜好に対応し、多様な健康効果を求めるようになっています。この変化は、特に非遺伝子組み換え製品を好む人々の間で、ひまわり油の消費量の急増につながっています。非遺伝子組み換えであるひまわり油は、伝統的育種方法で栽培されたひまわりの種から得られます。食品製造において、非遺伝子組み換えのステータスを維持している数少ない油のひとつです。さらに、その優れた酸化安定性により、通常のひまわり油は食品産業で広く利用されています。英国やドイツなどの開発途上国では、サラダ油や食用油として主に使用されています。工業的には、ひまわり油は炒め媒体の役割を果たし、マヨネーズやオイルベースのドレッシングの製造に不可欠です。需要の高まりを受けて、新興諸国ではひまわり油の新ブランドが台頭しています。例えば、2022年4月、ベンガルールのカルナタカ油糧種子生産者協同組合(KOF)は、新ブランドのダーラ・ひまわり油を発売しました。この取り組みを支援するため、国家酪農開発局(NDDB)はKOFに163億2,000万インドルピー(190万米ドル)を認可し、油糧種子と食用油の購入を促進しました。その結果、食品メーカーは、オリーブ油と比較した場合の費用対効果やパーム油と比較した場合の優位性を評価し、ひまわり油を選択するようになってきています。凝固点が高く、余分な加熱が必要なパーム油とは異なり、ひまわり油の特性により、そのようなシステムが不要となり、大幅なコスト削減につながります。

欧州がひまわり油市場を独占

欧州はひまわり油市場をリードしており、消費量の増加に後押しされて最大のシェアを誇っています。同大陸でひまわり油が急速に受け入れられているのは、その豊富な不飽和脂肪酸含有量と高い発煙点によるものです。欧州のライフスタイルが加速するにつれて、より健康的な食用油へのシフトが顕著になり、家庭と外食産業の両方での消費を押し上げています。世界的には、ロシアとウクライナがひまわり種子油の主要生産国として浮上しています。ロシア国内では、油脂産業が食品加工セグメントで重要なニッチを切り開いており、ひまわり油の生産量は過去10年間で急増しています。米国農務省(USDA)のデータによると、2023/24年シーズンのロシアのひまわり油生産量は682万トンで世界生産量の31%を占め、世界トップのひまわり油生産国としての地位を固めています。一方、英国は独自のひまわり油市場動向を目の当たりにしています。健康志向の高まりにより、消費者は栄養価の高い油を好むようになりました。飽和脂肪酸の含有量が低いことで知られるひまわり油は、この動向にぴったり合致しています。不飽和脂肪に関する消費者の知識が深まるにつれ、ひまわり油は心臓に良い選択肢として注目されています。このような嗜好の高まりにより、英国へのひまわり油の輸入が大幅に増加しています。ITC Trade Mapのデータによると、2023年に英国は約10万9,647トンのひまわり油を輸入しました。

ひまわり油産業概要

ひまわり油市場は競争が激しく、世界と国内の参入企業が覇権を争っています。主要参入企業は、Archer Daniels Midland Company、Delta Wilmar Ukraine LLC、Cargill Incorporated、Avril Group、Bunge Limitedです。

その他の特典

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件と市場定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場の促進要因

- ひまわり油の健康効果に対する消費者の認識

- ひまわり油の料理用途以外への採用の増加

- 市場抑制要因

- 代替油の存在

- サプライチェーンと生産の不安定性

- ポーターのファイブフォース分析

- 新規参入業者の脅威

- 買い手・消費者の交渉力

- 供給企業の交渉力

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- タイプ

- リノール油

- 中オレイン酸油

- 高オレイン酸油

- 用途

- 食品

- バイオ燃料

- パーソナルケア

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- その他の北米地域

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- スペイン

- その他の欧州

- アジア太平洋

- 中国

- 日本

- インド

- オーストラリア

- その他のアジア太平洋

- 南米

- ブラジル

- アルゼンチン

- その他の南米

- 中東・アフリカ

- サウジアラビア

- 南アフリカ

- その他の中東・アフリカ

- 北米

第6章 競合情勢

- 最も採用されている戦略

- 参入企業の市場ポジショニング

- 企業プロファイル

- Archer-daniels-midland Company

- Bunge Limited

- Cargill Incorporated

- Avril Group

- Kaissa Oil

- Optimusagro Trade Llc

- Risoil Sa

- Gustav Heess Oleochemische Erzeugnisse Gmbh

- Mwc Oil

- Delta Wilmar

第7章 市場機会と今後の動向

The Sunflower Oil Market size is estimated at USD 32.31 billion in 2025, and is expected to reach USD 42.29 billion by 2030, at a CAGR of 5.53% during the forecast period (2025-2030).

There has been a global shift towards healthier eating habits, spurring a heightened demand for sunflower oil, which is regarded as one of the healthier edible oils. This surge in demand has resulted in an expanded cultivation area for sunflowers and a corresponding rise in sowing seed prices. Recently, the sunflower seed market, particularly for sowing purposes, has experienced unprecedented growth. Sunflower oil, being both healthy and more affordable than many alternatives, sees robust demand in developing nations. This rising consumption of sunflower oil has counterbalanced the global downturn in palm, cottonseed, and rapeseed oils. The food sector predominantly utilizes sunflower oil, but its appeal is expanding, with cosmetic manufacturers and the healthcare industry showing increasing interest. The surging demand for products like sunscreens, facial masks, and eye treatments is poised to bolster the global market growth during the forecast period. Additionally, there is a rising trend among cosmetic users for chemical-free personal care products, further propelling the global sunflower oil market. In response, manufacturers are rolling out new products to cater to this demand for chemical-free offerings. A notable example is Keys Soulcare, a brand launched by US singer-songwriter Alicia Keys. In April 2022, they introduced a range of skin-nourishing products, developed in collaboration with board-certified dermatologist Dr. Renee Snyder. The lineup features tinted lip balms, cheek tints, brow gels, and complexion brushes, all crafted with natural ingredients like avocado oil, camellia seed oil, and sunflower oil.

Sunflower Oil Market Trends

Food Sector Emerges as the Dominant Consumer of Sunflower Oil

Globally, consumers are increasingly prioritizing non-GMO foods with lower saturated fats, catering to dietary preferences like vegan, kosher, or halal, and seeking diverse health benefits. This shift has led to a surge in sunflower oil consumption, especially among those favoring non-GMO products. Sunflower oil, being non-GMO, is derived from sunflower seeds cultivated through traditional breeding methods. It is one of the few oils in food manufacturing that maintains this non-GMO status. Moreover, due to its commendable oxidative stability, regular sunflower oil is widely utilized in the food industry. Developed nations, including the UK and Germany, predominantly use it as a salad and cooking oil. Industrially, sunflower oil serves as a frying medium and is integral in producing mayonnaise and oil-based dressings. Responding to the growing demand, new brands of sunflower oil are emerging in developing countries. For example, in April 2022, Bengaluru's Karnataka Cooperative Oilseeds Growers' Federation (KOF) introduced a new brand of Dhara sunflower oil. To support this initiative, the National Dairy Development Board (NDDB) sanctioned INR 16.32 crore (USD 1.9 million) to KOF, facilitating the purchase of oilseeds and edible oils. Consequently, food manufacturers are increasingly choosing sunflower oil, appreciating its cost-effectiveness compared to olive oil and its advantages over palm oil. Unlike palm oil, which has a higher freezing point and necessitates extra heating, sunflower oil's properties eliminate the need for such systems, resulting in significant cost savings.

Europe Dominates the Sunflower Oil Market

Europe leads the sunflower oil market, boasting the largest share, fueled by rising consumption. The continent's swift embrace of sunflower oil is due to its rich unsaturated fatty acid content and high smoke point. As European lifestyles accelerate, there is a marked shift towards healthier cooking oils, boosting consumption in both homes and the food service industry. On the global stage, Russia and Ukraine emerge as the dominant producers of sunflower seed oil. Within Russia, the oil and fat industry has carved out a significant niche in the food processing realm, with sunflower oil production skyrocketing over the last ten years. Data from the United States Department of Agriculture (USDA) highlights Russia's sunflower oil production for the 2023/24 season at 6.82 million metric tons, accounting for 31% of the global output, solidifying its position as the world's top sunflower oil producer. Meanwhile, the UK has been witnessing its own sunflower oil market trends. Heightened health awareness has led consumers to favor oils with touted nutritional benefits. Sunflower oil, celebrated for its low saturated fat content, perfectly aligns with this trend. As consumer knowledge about unsaturated fats grows, sunflower oil stands out as a heart-healthy option. This surge in preference has driven substantial sunflower oil imports into the UK. For context, data from ITC Trade Map reveals that in 2023, the UK imported around 109,647 tons of sunflower oil.

Sunflower Oil Industry Overview

The sunflower oil market is competitive, with both global and domestic players vying for dominance. Major players such as Archer Daniels Midland Company, Delta Wilmar Ukraine LLC, Cargill Incorporated, Avril Group, and Bunge Limited, leverage their extensive geographical reach and varied product portfolios to meet diverse consumer demands. This expansive approach not only strengthens their market presence but also underscores their commitment to high-quality, preservative-free ingredients, ensuring the global delivery of entirely natural products. Furthermore, in response to the surging demand for sunflower oil, producers are fine-tuning their sourcing strategies to better resonate with consumer preferences. These strategic moves aim to satisfy growing demand while navigating a landscape largely influenced by global giants.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Drivers

- 4.1.1 Consumer Awareness of the Health Benefits of Sunflower Oil

- 4.1.2 Rising Adoption of Sunflower Oil Beyond Culinary Uses

- 4.2 Market Restraints

- 4.2.1 Presence of Substitute Oils

- 4.2.2 Supply Chain and Production Volatility

- 4.3 Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Linoleic Oil

- 5.1.2 Mid-oleic Oil

- 5.1.3 High-oleic Oil

- 5.2 Application

- 5.2.1 Food

- 5.2.2 Biofuels

- 5.2.3 Personal Care

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.1.3 Mexico

- 5.3.1.4 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 Germany

- 5.3.2.2 United Kingdom

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Russia

- 5.3.2.6 Spain

- 5.3.2.7 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 Australia

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Most Adopted Strategies

- 6.2 Market Positioning of the Players

- 6.3 Company Profiles

- 6.3.1 Archer-daniels-midland Company

- 6.3.2 Bunge Limited

- 6.3.3 Cargill Incorporated

- 6.3.4 Avril Group

- 6.3.5 Kaissa Oil

- 6.3.6 Optimusagro Trade Llc

- 6.3.7 Risoil Sa

- 6.3.8 Gustav Heess Oleochemische Erzeugnisse Gmbh

- 6.3.9 Mwc Oil

- 6.3.10 Delta Wilmar