|

市場調査レポート

商品コード

1850385

舶用推進エンジン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Marine Propulsion Engine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 舶用推進エンジン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月26日

発行: Mordor Intelligence

ページ情報: 英文 100 Pages

納期: 2~3営業日

|

概要

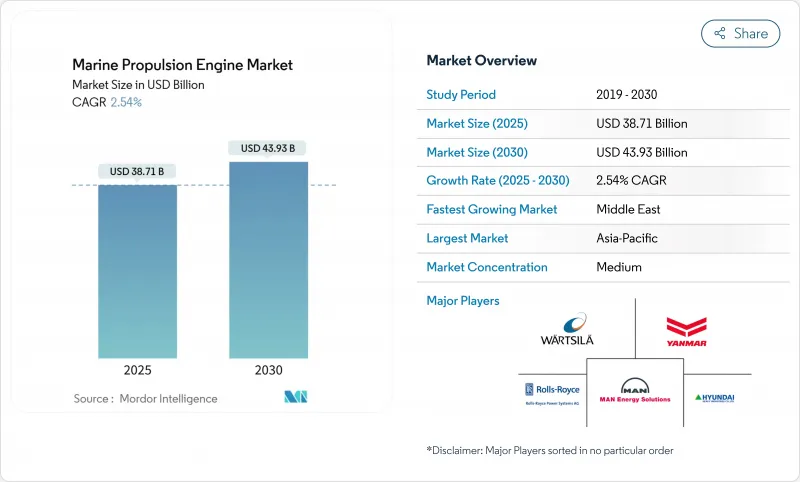

舶用推進エンジン市場規模は2025年に387億1,000万米ドル、2030年には439億3,000万米ドルに達すると推定・予測され、予測期間(2025-2030年)のCAGRは2.54%です。

需要は商業貨物船隊の能力更新サイクルに支えられているが、IMOのネット・ゼロ・フレームワークが2050年までに温室効果ガス強度を80%削減するよう船主を後押ししているため、その勢いは代替燃料へとますますシフトしています。LNGとメタノールのデュアルフューエルエンジンの早期採用は、アジア太平洋の堅調な受注と欧州の政策インセンティブに後押しされ、技術移行を後押ししています。

世界の舶用推進エンジン市場動向と洞察

IMO Tier IIIとEEXIコンプライアンスがレトロフィットを後押し

海運会社は、2025年5月から地中海に適用される、排出規制区域内での窒素酸化物75%削減の義務化に直面しています。新規則はEEXIのエネルギー効率基準値と交差しており、世界のトン数の約35%をカバーするレトロフィットの機会を誘発します。SCRとEGRのパッケージは、2026年の展開が予定されているMANのメタノール改造キットに代表されるように、近い将来の調達の大半を占める。適合エンジンがない船主は、港への入港が制限されるリスクがあるため、改造スケジュールが取締役会の優先事項となっています。したがって、資本配分は、純粋なメンテナンス予算よりもむしろアップグレードプログラムにますますシフトしており、アフターマーケットの収益構成を再構築しています。

アジア太平洋のコンテナ船とLNG船の新造船ブーム

中国、韓国、日本の造船所がコンテナ船とLNG船の契約を大量に獲得し、この地域の造船所の稼働率を数年ぶりの高水準に押し上げました。エバーグリーンは、LNGを燃料とする2万4,000TEU型船11隻を30億米ドルで受注したが、これは量の急増を象徴しています。2024年第1四半期のデータでは、78件のLNG新造船発注が記録され、前年同期比129%増となりました。そのため、エンジン・メーカーは、デュアル・フューエル・プラットフォームに対する需要の高まりと並行して、生産能力の制約を克服しています。このようなパイプラインは、アジア太平洋のヤードが2028年まで設計枠を引渡しに転換するにつれて、舶用推進エンジン市場の長期的な見通しを支えています。

燃料価格の変動がエンジン選択を複雑化

2024年のVLSFOはトン当たり平均630米ドルであったが、EU-ETS料金により、2025年までに欧州の航海コストはトン当たり実質795米ドルまで上昇する可能性があります。バイオブレンドの義務化は燃料予算をさらに膨らませ、eメタノールはトン当たり1,300米ドル以上で取引され、化石代替燃料との短期的な同等性を損なう。船主は、燃料の二重化によってリスクをヘッジし、操業の柔軟性を確保するため、より高い初期投資を受け入れます。しかし、ボラティリティの高さが、小規模な事業者の長期的な設備投資意欲を削ぎ、船隊の近代化が規模クラス間で不均一になる原因となっています。アナリストは、地域の規制の不一致が、2031年までに燃料費よりもコンプライアンス・コストを押し上げ、老朽船腹の競争力を低下させる可能性があると警告しています。

セグメント分析

ディーゼルエンジンは、2024年の舶用推進エンジン市場シェアの66.12%を維持し、その定着したサポート網とコスト競争力を裏付けています。LNG、メタノール、アンモニアを受け入れるデュアルフューエル設計が技術ギャップを埋めつつあり、船主はディーゼルのベースラインを放棄することなく新しい排出基準に準拠できます。燃料電池システムは、現時点ではニッチではあるが、CAGRが最も高く2.76%を記録し、フェリー、クルーズ・ヨット、補助動力モジュールのパイロットを引き付けています。デュアルフューエルユニットの市場規模は、特に北欧と東アジアにおけるバンカーインフラの整備と連動して拡大すると予測されます。

急速な技術革新がこのセグメントのプレミアム・エンドを定義します。TECO 2030の高速水素フェリーのプロトタイプは、沿岸旅客サービスのベンチマークである160海里の航続距離をサポートしながら、燃料電池が35ノットに達することができることを証明しています。高級ヨットメーカーは、ゼロ・カーボン・クルージングを拡大するため、極低温貯蔵とメタノール改質器を実験しています。しかし、水素の取り扱い規則はまだ流動的で、気体燃料貨物の保険料はまだ高いです。これらの障壁は、世界的な利用可能性、簡便性、数十年にわたる運航データが、環境上の罰則を上回り続けている深海航路におけるディーゼルの大半のシェアを守っています。

2024年の舶用推進エンジン市場規模の57.37%を商業貨物船が占め、パンデミックによる混乱後のコンテナおよびバルク需要の急増に後押しされました。船隊所有者は、アジアー欧州・ループでCIIに準拠した運航を確保するため、デュアル燃料エンジンを優先しました。クルーズ船とフェリーをカバーする旅客カテゴリーは、各国政府がフィヨルドや港湾の排ガス規制を課し、電気またはハイブリッド・パッケージが好まれるため、CAGR 2.41%で全体の成長を上回る。舶用推進エンジン業界は、静音走行と多燃料対応が運用上の必須条件である防衛分野での波及注文からも利益を得ています。

クルーズ・ラインは、企業のESG目標を達成するため、新造船にバッテリー・モジュールとメタノール機能を標準装備しています。ノルウェーのフィヨルド・ルールは、電気フィヨルド・フェリーの受注に拍車をかけ、カリフォルニアのアットバース拡張は、北米の運航会社をショアパワー対応に向かわせた。これらの開発は、船体あたりのエンジン数が減少しても、補助動力要件を引き上げ、市場価値を上昇させる。これとは対照的に、貨物船主は、価格と稼働率の両リスクをヘッジするために燃料の柔軟性に投資し、効率性を重視する貨物船と規制を重視する旅客船に市場を二分する2本立ての投資パターンを固めています。

地域分析

アジア太平洋は2024年の売上高の43.36%を占め、中国の大量商業造船のほぼ独占と韓国のLNG船特化によって支えられています。この地域の支援は、中国の輸出トン数に対する付加価値税払い戻しなどの政策的優遇措置から、鋳造所、クランクシャフト鍛造所、密集したベンダー・エコシステムを含むサプライチェーンの厚みにまで及んでいます。船主は、引き渡し前に低コストの船体製造と最新の推進パッケージを組み合わせることで、投資回収期間を短縮できるため、デュアルフューエル機能の採用が加速します。日本の先進的な研究開発クラスターは、直ちにバンカリングネットワークを一新することなく、段階的な排出削減を約束するアンモニア対応設計を推進しています。

欧州は依然として規制革新の坩堝であり、FuelEU Maritime、EU排出権取引制度、排出規制地域の拡大といった手段を通じて技術需要を形成しています。ノルウェーのフィヨルドのゼロエミッション義務化は、電気と水素ソリューションのための即座の改造と新造のパイプラインを作り出し、地中海のECA指定は、これまで北部の規則を避けてきたバルクとタンカーの輸送にコンプライアンス圧力を拡大します。エンジン・サプライヤーは、欧州のヤードの専門性を活用し、燃料電池と炭素捕獲のプロトタイプを商業航海条件下でテストし、その結果をアジア太平洋の大量配備に反映させています。

中東・アフリカは、2024年の収益貢献の10分の1程度に過ぎないが、カタールガスとADNOCがLNGとメタノール・インフラに投資して輸出チェーンを支えるため、CAGR最速の3.37%を記録します。ハンファ・フィリー造船所の年産10隻へのスケールアップなど、ソブリンが支援する造船拡張は、グローバルなベストプラクティスのノウハウをこの地域に引き込みます。北米の成長の中心は国防調達であり、ジョーンズ法の船員輸送規制が強化され、コスト高でも国内造船所の受注残が増加します。南米とアフリカは、港湾の近代化とオフショア・エネルギーへの投資によって急成長しているが、資金調達のハードルと限られた技術クラスターが、技術の導入を遅らせています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- IMO Tier IIIおよびEEXI規制によりエンジンの改造が加速

- アジア太平洋でコンテナ船とLNG船の新造受注が急増

- LNG/メタノールデュアル燃料設計の急速な普及

- 港湾入港ゼロエミッション補助推進区域

- デジタルツイン予測メンテナンスが総所有コストを削減

- 防衛CODAD/CODAG調達ブーム

- 市場抑制要因

- 燃料価格の変動がエンジン選択を複雑化

- SCR、EGR、後処理システムへの高額な設備投資

- 限定的なグリーンメタノール/アンモニアバンカーネットワーク

- 電気モーター向け希土類磁石の供給リスク

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- エンジンタイプ別

- ディーゼル

- デュアル燃料(LNG、メタノール、アンモニア対応)

- ガスタービン

- ハイブリッド電気

- 燃料電池

- 原子力(海軍)

- 用途別

- 乗客

- 商業貨物

- 防衛/沿岸警備隊

- 船種別

- コンテナ船

- タンカー

- バルクキャリア

- オフショア支援船

- 海軍艦艇

- 旅客/クルーズ

- 燃料タイプ別

- 重質燃料油(HFO)

- 船舶用ディーゼル/軽油

- LNG

- メタノール

- アンモニア/水素

- 出力範囲(kW)別

- 1000kW未満

- 1001kW~5000kW

- 5,001kW~10,000kW

- 10,001kW~20,000kW

- 20,000kW以上

- 地域別

- 北米

- 米国

- カナダ

- その他北米地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 欧州

- ドイツ

- 英国

- フランス

- スペイン

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- 韓国

- インド

- その他アジア太平洋地域

- 中東・アフリカ

- サウジアラビア

- アラブ首長国連邦

- トルコ

- 南アフリカ

- ナイジェリア

- その他中東・アフリカ地域

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- MAN Energy Solutions

- Rolls-Royce Power Systems

- Wartsila Corp.

- Caterpillar Inc.

- Hyundai Heavy Industries Engine & Machinery

- Cummins Inc.

- Mitsubishi Heavy Industries Marine Machinery

- Daihatsu Diesel

- Yanmar Co.

- GE Marine

- Kawasaki Heavy Industries

- Volvo Penta

- ABB Turbocharging & Motion

- Siemens Energy Marine

- Doosan Engine

- STX Engine

- Weichai Heavy-Duty Engine

- Jiangsu CSSC Diesel

- Honda Marine

- Scania AB