|

市場調査レポート

商品コード

1910558

インシュアテック:市場シェア分析、業界動向と統計、成長予測(2026年~2031年)Insurtech - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2026 - 2031) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| インシュアテック:市場シェア分析、業界動向と統計、成長予測(2026年~2031年) |

|

出版日: 2026年01月12日

発行: Mordor Intelligence

ページ情報: 英文 150 Pages

納期: 2~3営業日

|

概要

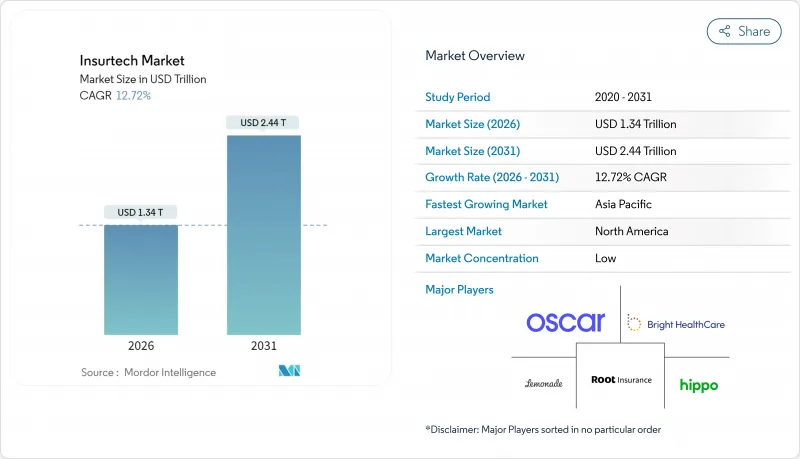

インシュアテック市場は2025年に1兆1,900億米ドルと評価され、2026年の1兆3,400億米ドルから2031年までに2兆4,400億米ドルに達すると予測されています。

予測期間(2026-2031年)におけるCAGRは12.72%と見込まれます。

この急成長は、デジタルファーストの体験が必須条件となる中、保険会社が保険契約の設計、販売、サービス提供を行う方法における構造的変化を反映しています。クラウドネイティブへの移行、AIを活用した引受業務、組み込み型保険は、試験的な取り組みから企業標準へと移行し、保険会社が運営コストを削減し、市場投入までのスピードを向上させ、新たな顧客層にリーチすることを可能にしています。10以上の管轄区域における政府主導のサンドボックスがソリューション展開を加速させると同時に、モビリティおよびIoTプラットフォームとの戦略的提携が自動車保険や損害保険分野におけるリスク評価の概念を再定義しています。競合上の差別化要因は、もはや貸借対照表上の規模のみではなく、データアクセス、プラットフォームの俊敏性、そして保険以外の購買プロセスにシームレスに補償範囲を組み込む能力に依存するようになりました。

世界の・インシュアテック市場の動向と洞察

引受・保険金請求業務におけるAI・機械学習の採用拡大

AI駆動型意思決定エンジンは、保険証券発行や保険金請求のトリアージ業務の大部分を自動化し、平均処理時間の短縮と予測精度の向上を実現しています。スイス・リーは、保険金請求分析をMicrosoft Azureに移行したことでインフラの大半を自動化し、査定時間を半減させたと報告しています。自社データセットを用いた教師あり学習を習得した保険会社は、競争優位性を確立し、競合他社にデータエンジニアリング計画の加速を迫っています。また、この技術により、使用量ベースのモビリティ保険など、新たなマイクロ期間商品が実現可能となります。これは、リスクをリアルタイムで価格設定できるためです。規制当局が説明可能なモデルに慣れるにつれ、AIの浸透は個人向け自動車保険、小規模商業保険、サイバー保険分野で最も急速に進むと予想されます。クラウドマーケットプレースで事前学習済みモデルを提供するベンダーエコシステムは、導入障壁をさらに低減します。

パーソナライズされたオンデマンド保険商品への需要拡大

消費者は保険がECサイトの決済フローを模倣することをますます期待しており、補償金額や期間を選択する作業がカートに商品を追加するのと同様に簡単になることを求めています。アリアンツとコスモコネクテッドの提携では、月額固定料金で事故補償をコネクテッドヘルメットに組み込んでおり、IoTデータが書類手続きなしに自動的な保険契約の有効化を可能にする実例を示しています。同様に、パラメトリック保険商品は、事前定義されたトリガー条件が満たされた時点で支払いが発生するため、長い保険金請求手続きを回避でき、旅行、農業、気候リスクにおける空白を埋めています。健康指導やサイバー監視といった付加価値サービスを組み合わせたマーケットプレースは、日常的なニーズに合致した提案により更新率が高まっています。この変化により、保険会社は従来の保険契約管理システムを再構築せざるを得ず、付帯条項や限度額を動的に調整できる仕組みへと移行し、固定的な年間契約から脱却しつつあります。

レガシー基幹システムの統合における複雑性

数十年前から運用されているメインフレームは、現代的なAPIを備えていない場合が多く、リアルタイムのデータ交換を高コストかつリスクの高いものにしています。そのため保険会社は、システム全体の刷新と、部分的なラップ&リニュー(既存システムを包み込む形で更新)アプローチとの間でトレードオフに直面しています。変換の失敗は保険証券の発行や保険金支払いを停滞させ、顧客の信頼を損ない、規制当局の監視を招く恐れがあります。また、コンプライアンス対応のためデータ系譜や監査証跡の保存が必要な場合、統合プロジェクトには隠れたコストが発生します。この結果、既存企業の中には基幹システムの改修ではなく新規事業体との提携を選択するケースもあり、親会社内のデジタル変革が遅れる要因となっています。

セグメント分析

損害保険は2025年にインシュアテック市場の58.73%を占め、収益を牽引しました。これは自動車保険や住宅保険の需要基盤が確立されていることを反映しています。しかしながら、サイバー保険、ペット保険、海上保険、旅行保険を含む特殊保険分野は、2031年までにCAGR18.63%で拡大し、最も速い保険料増加率をもたらすと予測されています。組み込み型IoTセンサーとパラメトリックトリガーにより、特殊保険商品は従来の損害査定遅延を回避し、高い利益率を実現する優れた顧客体験を提供します。AXA XLなどの保険会社は、企業向けAI導入に伴うデータ汚染リスクに対応するため、生成AIを活用したサイバー保険商品を既に導入しています。ニッチなリスクが増加する中、スペシャリティ分野の革新企業はウォレットシェアの大幅な拡大を捉えることができ、これらの分野におけるインシュアテック市場の規模は予測期間中に著しく拡大すると見込まれます。

一方、損害保険の既存企業はテレマティクスを活用して価格設定の精度を回復しつつありますが、膨大なレガシー契約が変更管理の障壁となっています。生命保険・医療保険会社はクラウドプラットフォーム上で迅速な引受業務の試験運用を行っていますが、死亡率・罹患率に関する規制が厳格なため、規制対象外の専門保険商品と比較するとスピードは抑制されています。再保険会社はサイバーMGA(管理総代理店)との提携を強化し、独自の保険金請求データセットを収集することで、ポートフォリオモデリングの精度向上を図っています。成長曲線の差異を踏まえ、投資家は堅牢なリスク管理と拡張可能な販売体制を実証する専門保険引受会社へ資本配分をシフトする可能性があります。

地域別分析

北米は2025年、豊富なベンチャーキャピタルと確立されたイノベーション拠点の恩恵を受け、インシュアテック市場シェア37.25%を維持しました。ケンタッキー州保険イノベーションサンドボックスに代表される州レベルの規制競争は、概念実証結果が支払能力基準を満たした後、全国展開されることが多いパイロット事業を加速させています。米国の自動車保険会社はテレマティクスの早期導入を維持する一方、カナダの保険会社は地理的なサービス分散を克服するためクラウドネイティブの保険契約管理システムを導入しています。既存企業が技術力を買収するM&A活動が活発化。ミュンヘン再保険によるNext Insuranceの26億米ドル買収は、2025年の米国一次保険分野への顕著な進出を示しました。市場成熟により表面的な成長は抑制されるもの、北米の保険会社は営業経費削減と付帯サービス(サイバー保険・個人情報保護パッケージ)のクロスセルにより収益を拡大しています。

アジア太平洋地域は2031年まで年率16.25%の成長が見込まれ、高いスマートフォン普及率、政府主導のフィンテック政策、レガシーシステムの制約が少ないことが追い風となっています。中国とインドは外資所有制限を緩和し、世界の保険会社が地域データセンターを備えたハイパースケールクラウド上でAI引受エンジンを現地化する動きを促進しています。シンガポール金融管理局は明確な規制サンドボックスを運用し、生命・損害・医療保険を包括するデジタル複合ライセンスを認可することで、地域展開を加速させております。日本の保険会社はAIを活用した年金商品価格設定で長寿リスクに対応し、韓国のプラットフォームはライドシェアリング・スーパーアプリに利用ベースのモビリティ保険を統合しております。保険普及率が低いことから新規顧客獲得の余地が大きく、電子商取引購入時に付帯販売される組み込み型マイクロ保険は、保険金額が控えめでも販売数量を牽引しております。

欧州ではGDPR準拠のデータガバナンス枠組みが基盤となり、一桁台の着実な成長を維持。これにより現地インシュアテック企業はプライバシー面で信頼性を獲得しています。今後施行予定のEUデータ法は車両データアクセスの標準化を義務付け、テレマティクス製品の革新をさらに促進する見込みです。英国はブレグジット後の規制柔軟性を追求し、製品承認を迅速化しつつ、クロスボーダー資本緩和のためのソルベンシーII相当基準を維持します。ドイツの産業基盤は高度な商業リスク・サイバーリスクソリューションの需要を喚起し、フランスでは大規模な個人保険市場が行動ベース価格設定の規模経済を支えます。ESG開示規制が強化される中、欧州保険会社は農業・再生可能エネルギープロジェクト向けパラメトリック気候リスク保険を革新し、他地域へ展開可能な枠組みを創出しています。

南米および中東・アフリカ地域は未成熟ながら有望です。ブラジル、ケニア、ナイジェリアのモバイルマネー環境では、従来の代理店網を飛び越え、微小事故保険や入院現金給付商品を組み合わせた商品が拡大しています。政府から個人への支払いプラットフォームは即時保険料徴収経路を提供し、小額商品のリスク軽減を実現しています。カリブ海地域および東アフリカのソブリンリスクプールでは、24時間以内に緊急資金を起動するパラメトリック型ハリケーン・干ばつソリューションを採用し、より広範な災害市場に向けた概念実証を確立しています。国際開発機関は初期ポートフォリオの共同引受を頻繁に行い、損失頻度モデルが成熟した段階で民間保険会社の参入を促進しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- アナリストによる3か月間のサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 引受業務および保険金請求処理におけるAI・機械学習の採用拡大

- パーソナライズされたオンデマンド保険商品への需要拡大

- クラウドネイティブ基幹システムへの移行増加

- 規制サンドボックスによる製品投入の加速

- モビリティ・IoTプラットフォームとのデータ連携

- 組み込み型流通モデルの急速な成長

- 市場抑制要因

- レガシー基幹システムの統合における複雑性

- 規制・コンプライアンスの断片化

- MGA向け再保険キャパシティの制約

- 投資家の姿勢転換:「成長至上主義」から収益性重視へ

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 買い手の交渉力

- 供給企業の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

- 投資・資金調達環境

- スタートアップ・エコシステム分析

第5章 市場規模と成長予測

- 製品ライン別(保険の種類)

- 生命保険

- 健康保険

- 損害保険(P&C;):自動車保険、住宅保険、商業保険、賠償責任保険など

- 専門分野(例:サイバー保険、ペット保険、海上保険、旅行保険)

- 流通チャネル別

- ダイレクト・トゥ・コンシューマー(D2C)デジタル

- アグリゲーター/マーケットプレース

- デジタルブローカー/MGA

- 組み込み保険プラットフォーム

- 従来型代理店・ブローカー(デジタル対応)

- バンカシュアランス(デジタル対応)

- その他のチャネル

- エンドユーザー別

- 小売/個人向け

- 中小企業/法人向け

- 大企業/法人

- 政府・公共部門

- 地域別(金額、10億米ドル)

- 北米

- カナダ

- 米国

- メキシコ

- 南米

- ブラジル

- ペルー

- チリ

- アルゼンチン

- その他南米

- 欧州

- 英国

- ドイツ

- フランス

- スペイン

- イタリア

- ベネルクス(ベルギー、オランダ、ルクセンブルク)

- 北欧諸国(デンマーク、フィンランド、アイスランド、ノルウェー、スウェーデン)

- その他欧州地域

- アジア太平洋地域

- インド

- 中国

- 日本

- オーストラリア

- 韓国

- 東南アジア(シンガポール、マレーシア、タイ、インドネシア、ベトナム、フィリピン)

- その他アジア太平洋地域

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- ナイジェリア

- その他中東・アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向と展開

- 市場シェア分析

- 企業プロファイル

- Lemonade

- Hippo Insurance

- Root Insurance

- Oscar Health

- Bright Health

- Clover Health

- Next Insurance

- ZhongAn

- Wefox

- Alan

- Devoted Health

- Coalition

- Slice Labs

- Metromile

- PolicyBazaar

- Digit Insurance

- ManyPets

- Pie Insurance

- Doma

- Kin Insurance