|

市場調査レポート

商品コード

1851207

バイオ医薬品受託製造:市場シェア分析、業界動向、成長予測(2025年~2030年)Biopharmaceuticals Contract Manufacturing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| バイオ医薬品受託製造:市場シェア分析、業界動向、成長予測(2025年~2030年) |

|

出版日: 2025年06月19日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

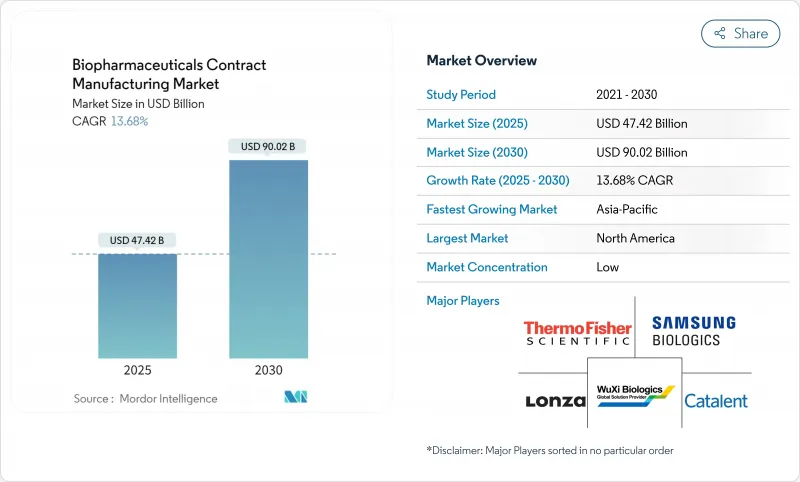

バイオ医薬品受託製造市場は、2025年に474億2,000万米ドルに達し、2030年には900億2,000万米ドルに達する見込みです。

大手スポンサーが資本を節約し、専門知識を活用するためにアウトソーシングを加速させているためです。生物学的製剤とバイオシミラー医薬品のパイプラインの絶え間ない拡大、シングルユース生産システムの急速な商業化、細胞・遺伝子治療用ベクターの生産能力格差の拡大により、成長は増幅されます。地理的需要は広範囲に及んでいるが、北米は強固なバイオテクノロジー・クラスターを擁し、アジア太平洋は多国籍企業がチャイナ・プラスワン・ソーシング戦略を実行する中で最も急速に成長しています。AI主導の予測制御、連続バイオプロセス、モジュラー設備への技術投資により、歩留まりが向上し、タイムラインが短縮され、デジタルファーストCDMOの競争力が研ぎ澄まされています。

世界のバイオ医薬品受託製造市場の動向と洞察

大手バイオファーマ・スポンサーにおけるアウトソーシングの急増

柔軟性と資本効率を追求する中、少なくとも1つの主要業務をアウトソーシングする開発企業の割合は2024年に86.9%に上昇。スポンサーは、抗体薬物複合体や自己細胞療法など、ニッチな専門知識と厳格な薬事管理が必要な複雑な治療法について、CDMOを利用する傾向が強まっています。アウトソーシングはまた、単一の品質システムの下でプロセス開発、分析、商業的スケールアップを提供する統合プロバイダーにより、臨床スケジュールを短縮します。複数年のマスターサービス契約に結びついたキャパシティ予約は、パイプラインの需要が急増した際に優先的なアクセスを確保するための標準となっています。これらの力が相まって、CDMOパートナーシップ・モデルは企業の製造戦略にしっかりと組み込まれ、バイオ医薬品受託製造市場の成長軌道を強化しています。

生物製剤/バイオシミラー・パイプラインの急速な拡大

2025年には、700を超える遺伝子ベースの治療薬と450を超えるバイオシミラー分子がグローバルな開発プログラムを通じて進展します。中小規模のイノベーターが工業的規模の能力を持つことは稀であるため、細胞培養のノウハウ、グローバルな薬事実績、各地域の申請間での機敏な対応をもたらす外部メーカーに依存しています。米国、欧州、アジア太平洋地域の主要な管轄区域で統一されたガイドラインは、多国籍の拠点網を持つCDMOをさらに優遇しています。生物製剤の複雑性が増すにつれて、差別化された精製、製剤化、送達技術が重要な価値ドライバーとなり、製品ライフサイクル全体にわたってCDMOを組み込む深い連携と技術移転の枠組みを促しています。

厳しいcGMPとデータ完全性コンプライアンス負担

EU GMP Annex 1の実施により、無菌製造要件が強化され、広範な汚染管理と品質モニタリングのアップグレードが余儀なくされます。2024年のFDAの警告状は、ガバナンスの欠如とソフトウェアのバリデーションギャップを浮き彫りにし、規制当局がALCOA+データ原則に焦点を当てることを強化しました。小規模のCDMOは、電子バッチ記録システム、トラック・アンド・トレース・プラットフォーム、高度な環境モニタリングの導入に際して、不釣り合いな財政的圧力に直面しています。コンプライアンスへの負荷は施設の利用を遅らせ、長期的な品質基準を業界全体で引き上げるとしても、短期的な収益の伸びを抑制する可能性があります。

セグメント分析

抗体セグメントは2024年に38.2%の市場シェアを獲得し、がん領域と自己免疫疾患領域における中心的なモダリティとしての役割を固めました。継続的な臨床活動により高いバッチ量が維持される一方、プロセスの強化により力価と経済性が向上しています。これと並行して、バイオシミラーモノクローナル抗体は、ラテンアメリカ、東欧、アジアの一部のコストに敏感な医療システムからの需要を刺激します。

細胞・遺伝子治療用ベクターは、GMPベクター生産能力の不足、特注の分析、厳格な規制監督により、CAGR18.4%で拡大しており、これらが相まって専門CDMOに高収益の機会を創出しています。次世代AAV血清型や非ウイルスデリバリー代替品を含むウイルスベクターの革新は、サービス範囲を拡大し、バイオ医薬品受託製造市場における開発と製造のスキルセットの融合を加速します。

CHO細胞を中心とする哺乳類発現プラットフォームは、細胞株工学、ベクター設計、培地最適化の進歩により特異的生産性が向上し、糖鎖修飾タンパク質や複合型mAbsにおけるこのプラットフォームの優位性が強化されたため、2024年の市場シェアの63.4%を占めました。

細菌と酵母のシステムは、単純な組換えタンパク質や酵素では依然としてコスト効率が高く、特に価格圧力が強い新興国ではその傾向が顕著です。植物や昆虫の細胞技術は、ニッチな用途で有望であるが、規制上の慣れがあるため、より広範な採用には限界があります。プロバイダーは、施設の利用率を最大化しつつ、顧客のニーズを満たすために、システム間のポートフォリオのバランスをとっています。これは、シングルユーススイートがプラットフォーム間の柔軟な切り替えを可能にするにつれて、ますます重要になってきています。

地域別分析

北米は2024年のバイオ医薬品受託製造市場シェア36.7%で引き続き最大の地域貢献国であり、豊富なベンチャー資金、先進的な規制エコシステム、ボストン・ケンブリッジとサンフランシスコ・ベイエリアの人材密集地によって支えられています。富士フイルムディオシンスの32億米ドルを投じたノースカロライナ・キャンパスやウーシー・バイオロジックスのマサチューセッツ・サイトなどの能力拡張により、サービスの幅が広がり、この地域は後期段階および商業プロジェクトの最前線にあり続ける。BIOSECURE法が制定される可能性があり、国内および関連サプライヤーが有利になることでベンダー選定が再編される可能性があるが、旺盛な需要と多様なパイプラインにより、モダリティを問わず堅調な見通しが維持されています。

アジア太平洋地域は最も急成長している地域で、2030年までのCAGRは11.6%です。中国の規制改革とインフラ整備は、地政学的緊張が二重調達の習慣に影響を与えるもの、初期段階の製造オプションとしての地位を高めています。韓国のサムスン・バイオロジクスは、2025年までに累計78万4,000Lの生産能力で世界的な注目を集め、この地域の台頭を強調しています。インドはコスト面の優位性と英語力を武器に、シンガポールは厳格な品質監督と政府のインセンティブを武器に、先端治療プロジェクトを獲得しています。

欧州は、ロンザ、ベーリンガーインゲルハイム、キャタレントといった既存企業が、スイス、ドイツ、オーストリアで10億米ドル規模の投資を行い、地域のエコシステムを強化しています。Vacavilleの買収は、ロンザのネットワークに33万Lの生産能力を追加するもので、Brexit関連のサプライチェーンの複雑さにもかかわらず、継続的なコミットメントを強調しています。EMAの調和された審査パスウェイと強固なIP保護は、規制の多様化を求める米国とアジアのクライアントを惹きつけています。成熟したインフラストラクチャー、自動化構想、グリーン製造のインセンティブを総合すると、欧州は、バイオ医薬品受託製造市場を評価する多国籍スポンサーの戦略計画にしっかりと位置づけられています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 大手バイオファーマ・スポンサーにおけるアウトソーシングの急増

- 生物製剤/バイオシミラーパイプラインの急速な拡大

- シングルユース&モジュール式バイオプロセススキッドの採用状況

- 細胞・遺伝子治療ベクターのキャパシティ・ギャップ

- 韓国・EUのCDMOに恩恵をもたらすチャイナ・プラス・ワン調達シフト

- AI主導の予測バイオプロセス制御が歩留まりと利益率を高める

- 市場抑制要因

- 厳しいcGMPとデータ整合性コンプライアンス負担

- 熟練バイオプロセスエンジニアの世界的不足

- 使い捨てプラスチックに対する持続可能性の圧力

- 過剰建設が遊休ステンレス&SU能力を生み出すリスク

- バリュー/サプライチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース

- 新規参入業者の脅威

- 買い手の交渉力

- 供給企業の交渉力

- 代替品の脅威

- ライバルの激しさ

第5章 市場規模と成長予測

- 製品タイプ別

- ペプチド/タンパク質

- 抗体(mAbs・ADCs)

- ワクチン

- バイオシミラー

- その他の生物製剤

- サービスタイプ別

- プロセス開発

- cGMP医薬品製造

- フィルフィニッシュ凍結乾燥

- 分析・QCサービス

- パッケージング&ロジスティクス

- 発現システム別

- 哺乳類

- 微生物

- 昆虫・植物

- 開発段階別

- 前臨床試験

- フェーズI

- フェーズII

- フェーズIII &商業

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 中東・アフリカ

- GCC

- 南アフリカ

- その他中東・アフリカ地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 北米

第6章 競合情勢

- 市場集中度

- 市場シェア分析

- 企業プロファイル

- Samsung Biologics

- Lonza Group

- WuXi Biologics

- Thermo Fisher Scientific(Patheon)

- Catalent Pharma Solutions

- Boehringer Ingelheim BioXcellence

- Fujifilm Diosynth Biotechnologies

- AGC Biologics

- Siegfried Holding

- Recipharm

- ProBioGen

- AbbVie Contract Manufacturing

- Novartis(Lek)

- INCOG BioPharma Services

- Lotte Biologics

- Thermex(Merck Life Science)

- Emergent BioSolutions