|

市場調査レポート

商品コード

1405721

UAV推進システム:市場シェア分析、産業動向・統計、成長予測、2024年~2029年UAV Propulsion Systems - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| UAV推進システム:市場シェア分析、産業動向・統計、成長予測、2024年~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

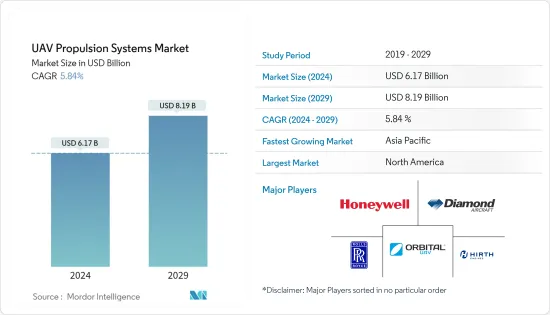

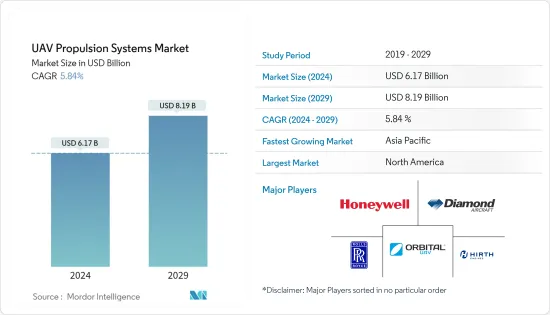

UAV推進システム市場規模は2024年に61億7,000万米ドルと推定され、2029年には81億9,000万米ドルに達し、予測期間中(2024-2029年)にCAGR 5.84%で成長すると予測されています。

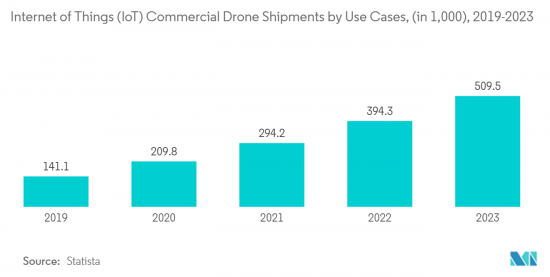

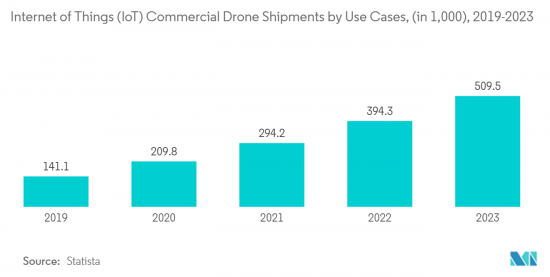

長年にわたり、ドローンの使用は、空撮、速達輸送と配達、災害管理のための情報収集や必需品の供給、アクセスできない地形や場所の地理的マッピング、建物の安全検査、精密作物モニタリング、無人貨物輸送、法執行と国境管理の監視、嵐の追跡、ハリケーンや竜巻の予測など、商業分野におけるいくつかのアプリケーションに浸透しています。商業用UAVのカスタマイズは非常に安価であるため、幅広いニッチな分野で新たな機能性への道が開かれます。例えば、作物畑の自動施肥、交通事故の監視、手の届きにくい場所の調査などに高度なUAVが導入されています。

さまざまなUAVプラットフォームに電気推進システムを統合する固有の利点も、他の同種の技術よりもはるかに速いペースで電気推進技術の採用を促進しています。例えば、電気推進システムはコンパクトであるため機械の設置に柔軟性があり、ドライブトレインの複数の可動部品がないため重量が軽く、したがって特定のUAVモデルの軽量化と耐久性向上に貢献します。加えて、世界のグリーン・エミッションへの取り組みも、電気推進などの環境に優しい推進技術の採用を後押ししています。UAVは、多種多様な用途に展開される、ますます高性能なプラットフォームへと進化しています。都市部で広範囲に分散した部隊と効果的に戦いながら、巻き添え被害を最小限に抑え、情報の優位性を達成する能力により、UAVは重要な任務でより大きな役割を果たすことができるようになった。UAVの耐久性は、使用する推進技術に影響され、空力設計と搭載する燃料の量に左右されます。多種多様なUAVのエネルギー要件を満たすために、ピストンエンジンや電気モーターのいくつかのバリエーションが市場関係者によって設計されています。推進システムの潜在的な利点は、UAV全体のコストに与える影響によって測られます。軽量で燃料効率の高いエンジンは、UAVのサイズやコストに大きな影響を与えることなく、与えられたミッションに高価なペイロードを使用することを可能にします。近年、小型UAVやミニUAVでは、静かな動作、取り扱いや保管が簡単で安全、正確な電力管理、制御といった明らかな利点がある電気推進システムの人気が高まっています。

UAV推進システムの市場動向

予測期間中、商用セグメントが市場をリードする見込み

ドローン技術はもはや軍事・国土防衛用途に限定されるものではないです。UAVはさまざまな商業産業で膨大な数の用途を見出しています。様々な商業用途でUAVの採用が急増しています。UAVは、屋根の検査、電話会社や無線タワーの検査、石油・ガスプラントの検査など、さまざまな資産の詳細な目視検査に使用されています。UAVは、廃棄物管理、道路安全、交通監視、高速道路インフラ管理、自然災害と災害救援、港湾・水路などの監視・管理用途に利用されています。商業用UAVメーカーは、UAVの代替推進技術の採用をめぐって長い間戦略を練ってきました。いくつかのベンダーがこのような革新的な技術を試していることで、UAVの化石燃料への依存度は大幅に低下しています。最近では、水素燃料電池がマイクロ無人機のリチウムイオンバッテリーに代わる実行可能な代替燃料として登場し、重量/出力比の面でその効率は急速に高まっています。マイクロ内燃機関よりも信頼性が向上し、安全で低メンテナンスの運用が可能になるため、UAVにとって魅力的な価値を提供します。燃料電池を動力源とするUAVシステムは、熱や騒音が少ないという同じ利点を持ちながら、バッテリーを動力源とするシステムよりも長く作動します。例えば、2023年8月、米連邦航空局(FAA)は、米国での農作物保護作業用としてPyka社のPelican Sprayドローンを承認しました。

予測期間中、アジア太平洋地域が最も高い需要を生み出す見込み

アジア太平洋地域は、予測期間中にUAV推進システムの最も高い需要を生み出すと予想されています。この需要の増加は主に、多数の軍事および商業用途向けにさまざまなUAV構成の注文が増加しているためです。この地域のいくつかの国では、ドローンの新興企業への投資が拡大すると予測されており、明確な規制政策の実施が必要となっています。アジア太平洋地域では、商業および軍事エンドユーザーの現在の能力を強化するために、いくつかの近代化プログラムが進行中です。例えば、2023年6月、インドの国防調達評議会(DAC)は、ゼネラル・ダイナミクス・アトミクス・システムズ社製のMQ-98プレデター無人機31機の調達を発表しました。調達額は30億米ドルで、これらの無人機の獲得により、インドの国境を越えた監視能力が向上します。

さらに2023年7月、インド軍は97機の中型・長耐久の「インド製」無人機を購入するよう通達を出しました。さらに、2022年10月、ガルーダ・エアロスペースとエルビット・システムズは、ディフェンス・エキスポで、ガルーダ・エアロスペースとエルビット・システムズは、スカイラーク3UASドローンを民間および政府機関に提供する契約を締結しました。スカイラーク3ドローンは、政府の村落プロジェクトの大規模な測量やマッピングを実施するために使用されます。

UAV推進システム産業概要

UAV推進システム市場は適度に統合されています。UAV推進システム市場の有力企業は、Orbital Corporation Limited、Diamond Aircraft Industries GmbH、Hirth Engines GmbH、Rolls-Royce plc、Honeywell International Inc.などです。これらの企業は、互換性のあるUAVモデル用の完全な推進システムの設計、製造、統合を主な業務としています。市場競争は激しく、各社は相互互換性のある製品をリリースしています。先進的なUAV推進システムを開発し、現在の能力を強化するために、三菱自動車のような著名な市場参入業者が継続的に研究開発を行っていることは、新規参入業者の脅威となっています。

さらに、推進ドライブに3D印刷技術を使用することで、相対的な性能に妥協することなく、サイズと質量を低減した高度な電気推進システムの需要に対応するための新しいシステムコンポーネントと設計の需要も同時に発生すると予想されます。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3か月間のアナリストサポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手・消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- エンジンタイプ

- 従来型

- ハイブリッド

- フル電動

- 用途

- 民間・商業

- 軍事

- UAVタイプ

- マイクロUAV

- ミニUAV

- タクティカルUAV

- 中高度長時間耐久型UAV(MALE UAV)

- 高高度長時間耐久型UAV(HALE UAV)

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- フランス

- ドイツ

- その他欧州

- アジア太平洋

- 中国

- インド

- 日本

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- カタール

- 南アフリカ

- その他中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- Diamond Aircraft Industries GmbH

- Honeywell International Inc.

- Rolls-Royce plc

- Orbital Corporation Limited

- Hirth Engines GmbH

- 3W International GmbH

- General Electric Company

- Pratt & Whitney(RTX Corporation)

- BRP-Rotax GmbH & Co KG

- UAV Engines Limited

- Ballard Power Systems Inc.

- MMC

- H3 Dynamics Holdings Pte. Ltd.

- Intelligent Energy Limited

第7章 市場機会と今後の動向

The UAV Propulsion Systems Market size is estimated at USD 6.17 billion in 2024, and is expected to reach USD 8.19 billion by 2029, growing at a CAGR of 5.84% during the forecast period (2024-2029).

Over the years, the usage of drones has penetrated several applications in the commercial sector, such as aerial photography, express shipping and delivery, gathering information or supplying essentials for disaster management, geographical mapping of inaccessible terrain and locations, building safety inspections, precision crop monitoring, unmanned cargo transport, law enforcement and border control surveillance, storm tracking, and forecasting hurricanes and tornadoes. As the customization of commercial UAVs is quite cheap, it paves the way for new functionalities in a wide array of niche spaces. For instance, sophisticated UAVs are being deployed to fertilize crop fields on an automated basis, monitor traffic incidents, and survey hard-to-reach places.

The inherent benefits of integrating an electric-propulsion system to different UAV platforms are also driving the adoption of electric propulsion technologies at a much faster pace than their other counterparts. For instance, an electrical propulsion system provides more flexibility in the installation of machinery as they are compact, and due to the absence of several moving components of the drivetrain, they weigh less and, hence, contribute toward weight savings and endurance enhancement of a particular UAV model. Besides, the emergence of global green emission initiatives has encouraged the adoption of eco-friendly propulsion technologies, such as electric propulsion. UAVs have evolved into increasingly capable platforms deployed for a wide variety of applications. The capability to fight effectively in urban areas against widely dispersed forces while minimizing collateral damage and achieving information superiority has enabled UAVs to play a greater role in critical missions. The endurance of a UAV is influenced by the propulsion technology used and is dependent on the aerodynamic design and amount of fuel carried. To fulfill the energy requirements of a large variety of UAVs, several variants of piston engines and electric motors have been designed by the market players. The potential benefits of a propulsion system are measured by their impact on the costs of the whole UAV. Lightweight, more fuel-efficient engines permit the usage of expensive payloads for a given mission without significantly affecting the size and cost of the UAV. In recent years, the electric propulsion system has gained more popularity among small or mini-UAVs for its apparent advantages: quiet operation, easy and safe to handle and store, precise power management, and control.

UAV Propulsion Systems Market Trends

Commercial Segment is Expected to Lead the Market During the Forecast Period

Drone technology is no longer limited to military and homeland uses. UAVs have found a vast number of applications in different commercial industries. There is a rapid rise in the adoption of UAVs for various commercial applications. UAVs are used for close visual inspection of different assets like roof inspection, telco and radio towers inspection, and oil & gas plant inspections. UAVs are utilized for monitoring and management applications such as waste management, road safety, traffic monitoring, highway infrastructure management, natural hazards and disaster relief, and port & waterways. Commercial UAV manufacturers have long been strategizing over the adoption of alternative propulsion technologies for UAVs. With several vendors experimenting with such innovative technologies, the dependence of UAVs on fossil fuels has been reduced significantly. Recently, hydrogen fuel cells have emerged as a viable alternative fuel to replace Li-ion batteries in smaller drones, and their efficiency in terms of weight/power ratios is increasing rapidly. They offer compelling value for UAVs due to improved reliability over small internal combustion engines, enhancing safe and low maintenance operation. UAV systems powered by fuel cells operate longer than their battery counterparts, with the same benefits of low thermal and noise. For instance, in August 2023, the Federal Aviation Administration (FAA) granted approval to the Pelican Spray drone from Pyka for crop protection operations in the US.

Asia-Pacific is Expected to Generate the Highest Demand During the Forecast Period

The Asia-Pacific region is expected to generate the highest demand for UAV propulsion systems during the forecast period. This increasing demand is mainly due to the increasing orders for different UAV configurations for a plethora of military and commercial applications. Investments in drone start-ups are projected to grow in several countries in the region, necessitating the implementation of well-defined regulatory policies. In the Asia-Pacific, several modernization programs are underway to enhance the current capabilities of the commercial and military end-users in the region. For instance, in June 2023, India's Defense Acquisition Council (DAC) announced the procurement of 31 MQ-98 Predator drones manufactured by General Dynamics Atomics Systems Inc. The procurement cost is USD 3 billion, and the acquisition of these drones will improve India's surveillance capabilities beyond its borders.

Additionally, in July 2023, the Indian Armed Forces issued out notice to purchase 97 medium-category and long-endurance 'Made-in-India' drones. Moreover, in October 2022, Garuda Aerospace and Elbit Systems signed an agreement at the Defense Expo for Garuda Aerospace; Elbit Systems signed an agreement to provide Skylark 3 UAS drones to commercial and government agencies. Skylark 3 drones are used to implement large-scale surveying and mapping of government village projects. Such developments are envisioned to drive the growth prospects of the market in focus during the forecast period.

UAV Propulsion Systems Industry Overview

The UAV propulsion systems market is moderately consolidated. The prominent players in the UAV propulsion systems market are Orbital Corporation Limited, Diamond Aircraft Industries GmbH, Hirth Engines GmbH, Rolls-Royce plc, and Honeywell International Inc., amongst others. These companies are majorly into the design, manufacturing, and integration of complete propulsion systems for compatible UAV models. The market is highly competitive, and players are releasing products with cross-compatibility. The continuous R&D of prominent market players, such as MMC, to develop advanced UAV propulsion systems and enhance their current capabilities poses a threat to new market entrants.

Additionally, the use of 3D printing technology in propulsion drives is anticipated to simultaneously generate demand for new system components and designs to cater to the demand for sophisticated electric propulsion systems with reduced size and mass without compromising on relative performance. For instance, in June 2023, Firestorm Labs partnered with Greenjets to build the first-of-its-kind additively manufactured unmanned aerial Vehicle airframe and engine solution. Similarly, in December 2022, Vertiq won a research grant from the U.S. Air Force to develop its Underactuated Propulsion System for use in UAVs. Vertiq's Underactuated Propulsion System was to offer UAVs longer flight time and increased maneuverability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Engine Type

- 5.1.1 Conventional

- 5.1.2 Hybrid

- 5.1.3 Full-electric

- 5.2 Application

- 5.2.1 Civil and Commercial

- 5.2.2 Military

- 5.3 UAV Type

- 5.3.1 Micro UAV

- 5.3.2 Mini UAV

- 5.3.3 Tactical UAV

- 5.3.4 MALE UAV

- 5.3.5 HALE UAV

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 France

- 5.4.2.3 Germany

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 South Korea

- 5.4.3.5 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Brazil

- 5.4.4.2 Mexico

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East and Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Qatar

- 5.4.5.4 South Africa

- 5.4.5.5 Rest of Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 Diamond Aircraft Industries GmbH

- 6.2.2 Honeywell International Inc.

- 6.2.3 Rolls-Royce plc

- 6.2.4 Orbital Corporation Limited

- 6.2.5 Hirth Engines GmbH

- 6.2.6 3W International GmbH

- 6.2.7 General Electric Company

- 6.2.8 Pratt & Whitney (RTX Corporation)

- 6.2.9 BRP-Rotax GmbH & Co KG

- 6.2.10 UAV Engines Limited

- 6.2.11 Ballard Power Systems Inc.

- 6.2.12 MMC

- 6.2.13 H3 Dynamics Holdings Pte. Ltd.

- 6.2.14 Intelligent Energy Limited