|

|

市場調査レポート

商品コード

1374894

アジア太平洋地域のUAV推進システム市場:2023-2033年Asia-Pacific UAV Propulsion System Market - Analysis and Forecast, 2023-2033 |

||||||

カスタマイズ可能

|

|||||||

| アジア太平洋地域のUAV推進システム市場:2023-2033年 |

|

出版日: 2023年11月02日

発行: BIS Research

ページ情報: 英文 129 Pages

納期: 1~5営業日

|

- 全表示

- 概要

- 図表

- 目次

アジア太平洋地域のUAV推進システムの市場規模は、2022年の16億7,210万米ドルから、予測期間中は2.35%のCAGRで推移し、2033年には21億5,700万米ドルの規模に成長すると予測されています。

同市場は主に防衛・政府分野での利用により、大幅な増加が見込まれています。一方で、予測期間中は商業部門も大きく成長すると予測されています。この成長は、多くの民間企業でUAVの需要が増加していることが原動力となっており、これが最先端の推進システムへの投資を促しています。

無人航空機 (UAV) は世界中で重要なR&Dの対象になってきました。UAVの市場は当初は軍事用途が中心でしたが、科学技術の進歩に伴い、センサー、カメラ、光検出、測距 (LiDAR) などのさまざまなモジュールを取り込みながら拡大し、商業および民生分野での有用性も高まっています。

当レポートでは、アジア太平洋地域のUAV推進システムの市場を調査し、市場概要、市場成長への各種影響因子の分析、法規制環境、市場規模の推移・予測、各種区分・主要国別の詳細分析、競合情勢、主要企業の分析などをまとめています。

アジア太平洋地域のUAV推進システム市場:イントロダクション

| 主要市場統計 | |

|---|---|

| 予測期間 | 2023-2033年 |

| 2023年評価 | 17億980万米ドル |

| 2033年予測 | 21億5,700万米ドル |

| CAGR | 2.35% |

市場区分:

セグメンテーション1:UAVタイプ別

- 小型UAV

- 小型UAV

- 超小型UAV

- 戦術UAV

- 中高度長期耐久型 (MALE)

- 高高度長期耐久型 (HALE)

- 垂直離着陸 (VTOL)

セグメンテーション2:エンドユーザー別

- 商用

- 軍事用

- 政府用

セグメンテーション3:エンジン馬力別

- 10~50 HP

- 51-100 HP

- 101-150 HP

- 151-200 HP

- 200 HP超

セグメンテーション4:エンジンタイプ別

- ピストンエンジン

- タービンエンジン

- ターボファンエンジン

- 電動エンジン

- ワンケルエンジン

- ソーラーエンジン

セグメンテーション5:地域別

- アジア太平洋地域:中国、インド、日本、その他

目次

第1章 市場

- 業界の展望

- UAV推進システム市場:概要

- UAV運用の電動ソリューションからICエンジンソリューションへの移行

- UAV用ICエンジンに関連する新興技術動向

- ICエンジンソリューションと互換性のある主要なUAVユースケース

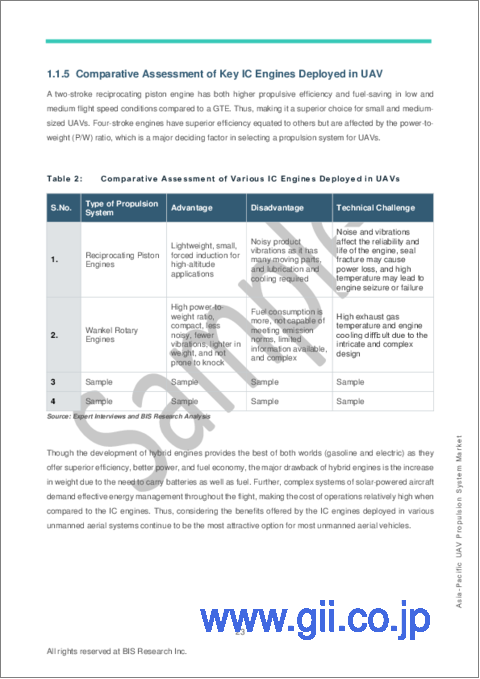

- UAVに搭載された主要なICエンジンの比較評価

- UAV推進システムの進行中および今後のプログラム

- UAV推進システムの主要サプライヤー

- スタートアップと投資の情勢

- サプライチェーン分析

第2章 地域

- 世界のUAV推進システム市場:地域別

- アジア太平洋

- 市場

- 用途

- 製品

- アジア太平洋:国別

第3章 市場:競合ベンチマーキングと企業プロファイル

- 市場シェア分析

- Gemini Diesel (Superior Aviation Group)

- PBS India (PBS Aerospace)

第4章 成長機会と推奨事項

- 成長機会

- 電気推進からICエンジン推進への移行

- コスト効率の高い製造技術の開発

第5章 調査手法

List of Figures

- Figure 1: Asia-Pacific (APAC) UAV Propulsion System Market, Units, 2022-2033

- Figure 2: Asia-Pacific (APAC) UAV Propulsion System Market, $Billion, 2022-2033

- Figure 3: Asia-Pacific (APAC) UAV Propulsion System Market (by UAV Type), Units, 2023 and 2033

- Figure 4: Asia-Pacific (APAC) UAV Propulsion System Market (by UAV Type), $Million, 2023 and 2033

- Figure 5: Asia-Pacific (APAC) UAV Propulsion System Market (by End User), Units, 2023 and 2033

- Figure 6: Asia-Pacific (APAC) UAV Propulsion System Market (by End User), $Million, 2023 and 2033

- Figure 7: Asia-Pacific (APAC) UAV Propulsion System Market (by Engine Horsepower), Units, 2023 and 2033

- Figure 8: Asia-Pacific (APAC) UAV Propulsion System Market (by Engine Horsepower), $Million, 2023 and 2033

- Figure 9: Asia-Pacific (APAC) UAV Propulsion System Market (by Engine Type), Units, 2023 and 2033

- Figure 10: Asia-Pacific (APAC) UAV Propulsion System Market (by Engine Type), $Million, 2023 and 2033

- Figure 11: UAV Propulsion System Market (by Region), $Billion, 2023

- Figure 12: Supply Chain Analysis of the Global UAV Propulsion System Market

- Figure 13: Supply Chain Analysis: Procurement of Raw Materials

- Figure 14: Supply Chain Analysis: End Users

- Figure 15: Global UAV Propulsion System Market Share (by Company), $Million, 2022

- Figure 16: Research Methodology

- Figure 17: Bottom-Up Approach

- Figure 18: Assumptions and Limitations

List of Tables

- Table 1: Illustrative Examples of Key UAV Use-Cases Compatible with IC Engine Solutions

- Table 2: Comparative Assessment of Various IC Engines Deployed in UAVs

- Table 3: Comparative Assessment of Various IC Engines deployed in UAVs on the Basis of Technical Parameters

- Table 4: Details on Ongoing and Upcoming Programs for UAV propulsion system- Contracts, Investments, and Other Developments

- Table 5: List of Key Suppliers Operating in the UAV Propulsion System Market

- Table 6: Start-ups and Investment Landscape: Investments, Collaborations, Agreements, and Other Developments

- Table 7: Global UAV Propulsion System Market (by Region), Units, 2022-2033

- Table 8: Global UAV Propulsion System Market (by Region), $Million, 2022-2033

- Table 9: Asia-Pacific UAV Propulsion System Market (by UAV Type), Units, 2022-2033

- Table 10: Asia-Pacific UAV Propulsion System Market (by UAV Type), $Million, 2022-2033

- Table 11: Asia-Pacific UAV Propulsion System Market (by End User), Units, 2022-2033

- Table 12: Asia-Pacific UAV Propulsion System Market (by End User), $Million, 2022-2033

- Table 13: Asia-Pacific UAV Propulsion System Market (by Commercial End User), Units, 2022-2033

- Table 14: Asia-Pacific UAV Propulsion System Market (by Commercial End User), $Million, 2022-2033

- Table 15: Asia-Pacific UAV Propulsion System Market (by Military End User), Units, 2022-2033

- Table 16: Asia-Pacific UAV Propulsion System Market (by Military End User), $Million, 2022-2033

- Table 17: Asia-Pacific UAV Propulsion System Market (by Civil Government End User), Units, 2022-2033

- Table 18: Asia-Pacific UAV Propulsion System Market (by Civil Government End User), $Million, 2022-2033

- Table 19: Asia-Pacific UAV Propulsion System Market (by Engine Horsepower), Units, 2022-2033

- Table 20: Asia-Pacific UAV Propulsion System Market (by Engine Horsepower), $Million, 2022-2033

- Table 21: Asia-Pacific UAV Propulsion System Market (by Engine Type), Units, 2022-2033

- Table 22: Asia-Pacific UAV Propulsion System Market (by Engine Type), $Million, 2022-2033

- Table 23: China UAV Propulsion System Market (by UAV Type), Units, 2022-2033

- Table 24: China UAV Propulsion System Market (by UAV Type), $Million, 2022-2033

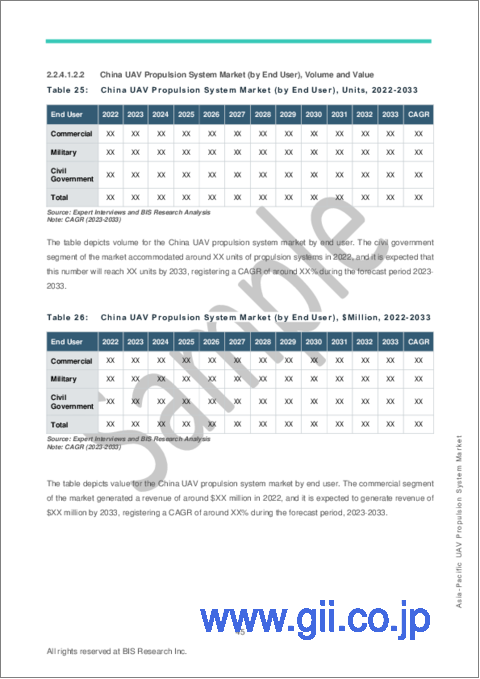

- Table 25: China UAV Propulsion System Market (by End User), Units, 2022-2033

- Table 26: China UAV Propulsion System Market (by End User), $Million, 2022-2033

- Table 27: China UAV Propulsion System Market (by Commercial End user), Units, 2022-2033

- Table 28: China UAV Propulsion System Market (by Commercial End User), $Million, 2022-2033

- Table 29: China UAV Propulsion System Market (by Military End User), Units, 2022-2033

- Table 30: China UAV Propulsion System Market (by Military End User), $Million, 2022-2033

- Table 31: China UAV Propulsion System Market (by Civil Government End User), Units, 2022-2033

- Table 32: China UAV Propulsion System Market (by Civil Government End User), $Million, 2022-2033

- Table 33: China UAV Propulsion System Market (by Engine Horsepower), Units, 2022-2033

- Table 34: China UAV Propulsion System Market (by Engine Horsepower), $Million, 2022-2033

- Table 35: China UAV Propulsion System Market (by Engine Type), Units, 2022-2033

- Table 36: China UAV Propulsion System Market (by Engine Type), $Million, 2022-2033

- Table 37: India UAV Propulsion System Market (by UAV Type), Units, 2022-2033

- Table 38: India UAV Propulsion System Market (by UAV Type), $Million, 2022-2033

- Table 39: India UAV Propulsion System Market (by End User), Units, 2022-2033

- Table 40: India UAV Propulsion System Market (by End User), $Million,2022-2033

- Table 41: India UAV Propulsion System Market (by Commercial End user), Units, 2022-2033

- Table 42: India UAV Propulsion System Market (by Commercial End User), $Million, 2022-2033

- Table 43: India UAV Propulsion System Market (by Military End User), Units, 2022-2033

- Table 44: India UAV Propulsion System Market (by Military End User), $Million, 2022-2033

- Table 45: India UAV Propulsion System Market (by Civil Government End User), Units, 2022-2033

- Table 46: India UAV Propulsion System Market (by Civil Government End User), $Million, 2022-2033

- Table 47: India UAV Propulsion System Market (by Engine Horsepower), Units, 2022-2033

- Table 48: India UAV Propulsion System Market (by Engine Horsepower), $Million, 2022-2033

- Table 49: India UAV Propulsion System Market (by Engine Type), Units, 2022-2033

- Table 50: India UAV Propulsion System Market (by Engine Type), $Million, 2022-2033

- Table 51: Japan UAV Propulsion System Market (by UAV Type), Units, 2022-2033

- Table 52: Japan UAV Propulsion System Market (by UAV Type), $Million, 2022-2033

- Table 53: Japan UAV Propulsion System Market (by End User), Units, 2022-2033

- Table 54: Japan UAV Propulsion System Market (by End User), $Million, 2022-2033

- Table 55: Japan UAV Propulsion System Market (by Commercial End User), Units, 2022-2033

- Table 56: Japan UAV Propulsion System Market (by Commercial End User), $Million, 2022-2033

- Table 57: Japan UAV Propulsion System Market (by Military End User), Units, 2022-2033

- Table 58: Japan UAV Propulsion System Market (by Military End User), $Million, 2022-2033

- Table 59: Japan UAV Propulsion System Market (by Civil Government End User), Units, 2022-2033

- Table 60: Japan UAV Propulsion System Market (by Civil Government End User), $Million, 2022-2033

- Table 61: Japan UAV Propulsion System Market (by Engine Horsepower), Units, 2022-2033

- Table 62: Japan UAV Propulsion System Market (by Engine Horsepower), $Million, 2022-2033

- Table 63: Japan UAV Propulsion System Market (by Engine Type), Units, 2022-2033

- Table 64: Japan UAV Propulsion System Market (by Engine Type), $Million, 2022-2033

- Table 65: Rest-of-Asia-Pacific UAV Propulsion System Market (by UAV Type), Units, 2022-2033

- Table 66: Rest-of-Asia-Pacific UAV Propulsion System Market (by UAV Type), $Million, 2022-2033

- Table 67: Rest-of-Asia-Pacific UAV Propulsion System Market (by End User), Units, 2022-2033

- Table 68: Rest-of-Asia-Pacific UAV Propulsion System Market (by End User), $Million, 2022-2033

- Table 69: Rest-of-Asia-Pacific UAV Propulsion System Market (by Commercial End User), Units, 2022-2033

- Table 70: Rest-of-Asia-Pacific UAV Propulsion System Market (by Commercial End User), $Million, 2022-2033

- Table 71: Rest-of-Asia-Pacific UAV Propulsion System Market (by Military End User), Units, 2022-2033

- Table 72: Rest-of-Asia-Pacific UAV Propulsion System Market (by Military End User), $Million, 2022-2033

- Table 73: Rest-of-Asia-Pacific UAV Propulsion System Market (by Civil Government End User), Units, 2022-2033

- Table 74: Rest-of-Asia-Pacific UAV Propulsion System Market (by Civil Government End User), $Million,2022-2033

- Table 75: Rest-of-Asia-Pacific UAV Propulsion System Market (by Engine Horsepower), Units, 2022-2033

- Table 76: Rest-of-Asia-Pacific UAV Propulsion System Market (by Engine Horsepower), $Million, 2022-2033

- Table 77: Rest-of-Asia-Pacific UAV Propulsion System Market (by Engine Type), Units, 2022-2033

- Table 78: Rest-of-Asia-Pacific UAV Propulsion System Market (by Engine Type), $Million, 2022-2033

- Table 79: Gemini Diesel (Superior Aviation Group): Product Portfolio

- Table 80: Gemini Diesel (Superior Aviation Group): Partnerships, Collaborations, Agreements, Contracts, Mergers and Acquisitions

- Table 81: PBS India (Part of PBS Aerospace): Product Portfolio

- Table 82: PBS India (Part of PBS Aerospace): New Product Developments and Fundings

“The APAC UAV Propulsion System Market expected to reach $2,157.0 million by 2033.”

Introduction to Asia-Pacific UAV Propulsion System Market

| KEY MARKET STATISTICS | |

|---|---|

| Forecast Period | 2023 - 2033 |

| 2023 Evaluation | $1,709.8 Million |

| 2033 Forecast | $2,157.0 Million |

| CAGR | 2.35% |

The Asia-Pacific UAV propulsion system market is projected to reach $2,157.0 million by 2033 from $1,672.1 million in 2022, growing at a CAGR of 2.35% during the forecast period 2023-2033.

The market for UAV propulsion systems in Asia-Pacific is anticipated to increase significantly, primarily due to applications in the defense and government sectors. The substantial financial investment required to develop propulsion systems explains this. Nonetheless, there is a significant chance for growth in commercial applications during the anticipated period of time. This expansion is driven by the increased demand for UAVs across many commercial businesses, which has prompted investments in state-of-the-art propulsion systems.

Market Introduction

Since its invention in the early 19th century, unmanned aerial vehicles (UAVs) have been the subject of significant worldwide research and development initiatives. The market for UAVs was first dominated by military uses. But as science and technology have progressed, UAVs have expanded to include a range of modules, such as sensors, cameras, and light detection and ranging (LiDAR), increasing their usefulness in both the commercial and civil sectors.

These developments have forced industry participants to emphasize UAV propulsion system development while also increasing UAV manufacturing. UAVs can benefit from conventional fuel propulsion systems' large cargo capacity, long flight times, wide operational range, and quick resupply. However, there are still issues facing the aviation industry due to the limited supply of fossil fuels and growing worries about their effects on the environment.

As a result of funding from UAV manufacturers, research and development efforts have increased dramatically, concentrating on solar-powered and hybrid/all-electric UAVs. For those involved in the market, these advances offer profitable prospects. The market's expansion is nevertheless constrained by things like governmental laws and the high cost of production.

A rise in commercial applications has also led to growth in the apac market for UAV propulsion systems. In an effort to attract more clients, private enterprises are expanding the range of UAV services they offer by implementing cutting-edge and effective propulsion technologies. Research institutes are a noteworthy user sector that contributes significantly to the growth of the market by actively participating in the design, development, and testing of the newest UAVs and related propulsion systems.

Because of these benefits, businesses are constantly trying to innovate their offerings. They are working with UAV makers and service providers to test and develop propulsion systems, which is creating a dynamic environment of advancement and potential in the industry.

Market Segmentation:

Segmentation 1: by UAV Type

- Small UAVs

- Mini UAVs

- Micro UAVs

- Tactical UAVs

- Medium-Altitude Long-Endurance (MALE)

- High-Altitude Long-Endurance (HALE)

- Vertical Take-off and Landing (VTOL)

Segmentation 2: by End User

- Commercial

- Military

- Civil government

Segmentation 3: by Engine Horsepower

- 10-50 HP

- 51-100 HP

- 101-150 HP

- 151-200 HP

- Above 200 HP

Segmentation 4: by Engine Type

- Piston Engine

- Turbine Engine

- Turbofan Engine

- Electrically Powered Engine

- Wankel Engine

- Solar-Powered Engine

Segmentation 5: by Region

- Asia-Pacific - China, India, Japan, and Rest-of-Asia-Pacific

Key Drivers for Asia Pacific UAV Propulsion System Market

The growing need for UAVs for military applications and the region's growing defense and security requirements are the main factors driving the Asia-Pacific (APAC) UAV propulsion system market. Simultaneously, the growing array of industrial uses, including aerial photography, infrastructure inspection, and agricultural, is encouraging the uptake of sophisticated propulsion systems. Innovation is being fueled by technological breakthroughs, especially in eco-friendly and more efficient engines, and the rise of the UAV sector is being supported by government programs and regulations. Research & development expenditures along with technology partnerships are driving the creation of innovative propulsion systems specifically suited to the APAC market. Moreover, the development of propulsion systems appropriate for a broad range of space-related applications is being aided by the APAC region's interest in satellite deployment and space exploration.

How can this report add value to an organization?

Product/Innovation Strategy: The service segment helps the reader understand the different end users that will generate the demand for UAV propulsion systems in APAC. Moreover, the study provides the reader with a detailed understanding of the different UAV propulsion systems based on UAV type (small UAVs, tactical UAVs, MALE, HALE, and VTOL), end user (commercial, military, and civil government), engine horsepower (10-50 HP, 51-100 HP, 101-150 HP, 151-200 HP, and Above 200 HP), and engine type (piston engine, turbine engine, turbofan, Wankel engine, electrically powered engine, and solar-powered engine).

Growth/Marketing Strategy: Key competitors in the market have made significant developments in the Asia-Pacific (APAC) UAV propulsion system market through company expansion initiatives, contracts, product launches, mergers, partnerships, collaborations, and joint ventures. The companies have committed to strengthen their position in the APAC UAV propulsion systems market, which is their preferred strategy.

Competitive Strategy: Key players in the Asia Pacific UAV propulsion systems market analyzed and profiled in the study involve UAV propulsion system manufacturers. Moreover, a detailed competitive benchmarking of the players operating in the Asia Pacific UAV propulsion system market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as contracts, partnerships, agreements, acquisitions, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Table of Contents

1 Markets

- 1.1 Industry Outlook

- 1.1.1 UAV Propulsion System Market: Overview

- 1.1.2 Migration of UAV Operations from Electric to IC Engine Solutions

- 1.1.3 Emerging Technology Trends Related to IC Engines for UAV

- 1.1.4 Key UAV Use-Cases Compatible with IC Engine Solutions

- 1.1.5 Comparative Assessment of Key IC Engines Deployed in UAV

- 1.1.6 Ongoing and Upcoming programs for UAV Propulsion Systems

- 1.1.7 Key Supplier for UAV Propulsion System

- 1.1.8 Start-Ups and Investment Landscape

- 1.1.9 Supply Chain Analysis

2 Region

- 2.1 Global UAV Propulsion System Market (by Region)

- 2.2 Asia-Pacific

- 2.2.1 Markets

- 2.2.1.1 Key Players in Asia-Pacific

- 2.2.1.2 Business Drivers

- 2.2.1.3 Business Challenges

- 2.2.2 Application

- 2.2.2.1 Asia-Pacific UAV Propulsion System Market (by UAV Type), Volume and Value

- 2.2.2.2 Asia-Pacific UAV Propulsion System Market (by End User), Volume and Value

- 2.2.3 Product

- 2.2.3.1 Asia-Pacific UAV Propulsion System Market (by Engine Horsepower), Volume and Value

- 2.2.3.2 Asia-Pacific UAV Propulsion System Market (by Engine Type), Volume and Value

- 2.2.4 Asia-Pacific (by Country)

- 2.2.4.1 China

- 2.2.4.1.1 Markets

- 2.2.4.1.1.1 Key Players in China

- 2.2.4.1.2 Application

- 2.2.4.1.2.1 China UAV Propulsion System Market (by UAV Type), Volume and Value

- 2.2.4.1.2.2 China UAV Propulsion System Market (by End User), Volume and Value

- 2.2.4.1.3 Product

- 2.2.4.1.3.1 China UAV Propulsion System Market (by Engine Horsepower), Volume and Value

- 2.2.4.1.3.2 China UAV Propulsion System Market (by Engine Type), Volume and Value

- 2.2.4.1.1 Markets

- 2.2.4.2 India

- 2.2.4.2.1 Markets

- 2.2.4.2.1.1 Key Players in India

- 2.2.4.2.2 Application

- 2.2.4.2.2.1 India UAV Propulsion System Market (by UAV Type), Volume and Value

- 2.2.4.2.2.2 India UAV Propulsion System Market (by End User), Volume and Value

- 2.2.4.2.3 Product

- 2.2.4.2.3.1 India UAV Propulsion System Market (by Engine Horsepower), Volume and Value

- 2.2.4.2.3.2 India UAV Propulsion System Market (by Engine Type), Volume and Value

- 2.2.4.2.1 Markets

- 2.2.4.3 Japan

- 2.2.4.3.1 Markets

- 2.2.4.3.1.1 Key Players in Japan

- 2.2.4.3.2 Application

- 2.2.4.3.2.1 Japan UAV Propulsion System Market (by UAV Type), Volume and Value

- 2.2.4.3.2.2 Japan UAV Propulsion System Market (by End User), Volume and Value

- 2.2.4.3.3 Product

- 2.2.4.3.3.1 Japan UAV Propulsion System Market (by Engine Horsepower), Volume and Value

- 2.2.4.3.3.2 Japan UAV Propulsion System Market (by Engine Type), Volume and Value

- 2.2.4.3.1 Markets

- 2.2.4.4 Rest-of-Asia-Pacific

- 2.2.4.4.1 Markets

- 2.2.4.4.1.1 Key Players in Rest-of-Asia-Pacific

- 2.2.4.4.2 Application

- 2.2.4.4.2.1 Rest-of-Asia-Pacific UAV Propulsion System Market (by UAV Type), Volume and Value

- 2.2.4.4.2.2 Rest-of-Asia-Pacific UAV Propulsion System Market (by End User), Volume and Value

- 2.2.4.4.3 Product

- 2.2.4.4.3.1 Rest-of-Asia-Pacific UAV Propulsion System Market (by Engine Horsepower), Volume and Value

- 2.2.4.4.3.2 Rest-of-Asia-Pacific UAV Propulsion System Market (by Engine Type), Volume and Value

- 2.2.4.4.1 Markets

- 2.2.4.1 China

- 2.2.1 Markets

3 Markets - Competitive Benchmarking & Company Profiles

- 3.1 Market Share Analysis

- 3.2 Gemini Diesel (Superior Aviation Group)

- 3.2.1 Company Overview

- 3.2.1.1 Role of Gemini Diesel (Superior Aviation Group) in the Global UAV Propulsion System Market

- 3.2.1.2 Product Portfolio

- 3.2.2 Corporate Strategies

- 3.2.2.1 Partnerships, Collaborations, Agreements, Contracts, Mergers and Acquisitions

- 3.2.3 Analyst View

- 3.2.1 Company Overview

- 3.3 PBS India (Part of PBS Aerospace)

- 3.3.1 Company Overview

- 3.3.1.1 Role of PBS India (Part of PBS Aerospace) in the Global UAV Propulsion System Market

- 3.3.1.2 Product Portfolio

- 3.3.2 Business Strategies

- 3.3.2.1 New Product Developments and Fundings

- 3.3.3 Analyst View

- 3.3.4 Sample Company

- 3.3.4.1 Overview

- 3.3.4.2 Top Products / Product Portfolio

- 3.3.4.3 Top Competitors

- 3.3.4.4 Target Customers

- 3.3.4.5 Key Personnel

- 3.3.4.6 Analyst View

- 3.3.4.7 Market Share

- 3.3.5 Sample Company

- 3.3.5.1 Overview

- 3.3.5.2 Top Products / Product Portfolio

- 3.3.5.3 Top Competitors

- 3.3.5.4 Target Customers

- 3.3.5.5 Key Personnel

- 3.3.5.6 Analyst View

- 3.3.5.7 Market Share

- 3.3.6 Sample Company

- 3.3.6.1 Overview

- 3.3.6.2 Top Products / Product Portfolio

- 3.3.6.3 Top Competitors

- 3.3.6.4 Target Customers

- 3.3.6.5 Key Personnel

- 3.3.6.6 Analyst View

- 3.3.6.7 Market Share

- 3.3.7 Sample Company

- 3.3.7.1 Overview

- 3.3.7.2 Top Products / Product Portfolio

- 3.3.7.3 Top Competitors

- 3.3.7.4 Target Customers

- 3.3.7.5 Key Personnel

- 3.3.7.6 Analyst View

- 3.3.7.7 Market Share

- 3.3.8 Sample Company

- 3.3.8.1 Overview

- 3.3.8.2 Top Products / Product Portfolio

- 3.3.8.3 Top Competitors

- 3.3.8.4 Target Customers

- 3.3.8.5 Key Personnel

- 3.3.8.6 Analyst View

- 3.3.8.7 Market Share

- 3.3.9 Sample Company

- 3.3.9.1 Overview

- 3.3.9.2 Top Products / Product Portfolio

- 3.3.9.3 Top Competitors

- 3.3.9.4 Target Customers

- 3.3.9.5 Key Personnel

- 3.3.9.6 Analyst View

- 3.3.9.7 Market Share

- 3.3.10 Sample Company

- 3.3.10.1 Overview

- 3.3.10.2 Top Products / Product Portfolio

- 3.3.10.3 Top Competitors

- 3.3.10.4 Target Customers

- 3.3.10.5 Key Personnel

- 3.3.10.6 Analyst View

- 3.3.10.7 Market Share

- 3.3.11 Sample Company

- 3.3.11.1 Overview

- 3.3.11.2 Top Products / Product Portfolio

- 3.3.11.3 Top Competitors

- 3.3.11.4 Target Customers

- 3.3.11.5 Key Personnel

- 3.3.11.6 Analyst View

- 3.3.11.7 Market Share

- 3.3.12 Sample Company

- 3.3.12.1 Overview

- 3.3.12.2 Top Products / Product Portfolio

- 3.3.12.3 Top Competitors

- 3.3.12.4 Target Customers

- 3.3.12.5 Key Personnel

- 3.3.12.6 Analyst View

- 3.3.12.7 Market Share

- 3.3.1 Company Overview

4 Growth Opportunities and Recommendation

- 4.1 Growth Opportunities

- 4.1.1 Transition from Electric to IC Engine Propulsion

- 4.1.1.1 Growth Opportunity 1: Development of Smaller IC Engines

- 4.1.1.2 Recommendations for UAV Propulsion System Manufacturers

- 4.1.1.3 Recommendations for UAV Manufacturers

- 4.1.2 Development of Cost-Effective Manufacturing Techniques

- 4.1.2.1 Growth Opportunity 2: Metal 3D Printing of Engine and Associated Components

- 4.1.2.2 Recommendations for UAV Propulsion System Manufacturers

- 4.1.2.3 Recommendations for UAV Manufacturers

- 4.1.1 Transition from Electric to IC Engine Propulsion

5 Research Methodology

- 5.1 Factors for Data Prediction and Modeling