|

|

市場調査レポート

商品コード

1757099

UAV推進の世界市場:技術別、コンポーネント別、プラットフォーム別、MTOW別、地域別 - 2030年までの予測UAV Propulsion Market by Technology, Component (IC Engine, Motor, Battery, Fuel Cell, Solar Panel, Propeller, Electronic Speed Controller), Platform, MTOW, Region - Global Forecast to 2030 |

||||||

カスタマイズ可能

|

|||||||

| UAV推進の世界市場:技術別、コンポーネント別、プラットフォーム別、MTOW別、地域別 - 2030年までの予測 |

|

出版日: 2025年06月24日

発行: MarketsandMarkets

ページ情報: 英文 244 Pages

納期: 即納可能

|

全表示

- 概要

- 図表

- 目次

UAV(ドローン)推進の市場規模は、2025年に70億米ドルと推定されています。

予測期間中のCAGRは10.0%で、2030年には113億米ドルに達すると予測されています。技術の進歩と市場環境の変化がUAV(ドローン)推進市場の主な促進要因です。

| 調査範囲 | |

|---|---|

| 調査対象年 | 2021年~2030年 |

| 基準年 | 2024年 |

| 予測期間 | 2025年~2030年 |

| 検討単位 | 金額(100万米ドル) |

| セグメント別 | 技術別、コンポーネント別、プラットフォーム別、MTOW別、地域別 |

| 対象地域 | 北米、欧州、アジア太平洋、その他の地域 |

コンポーネント別では、電源セグメントが予測期間中に最も高いCAGRで成長すると予測されます。電源は、性能、耐久性、ペイロード容量、ミッションの成功に直接影響します。このセグメントの成長は、特に商業市場で電動ドローンの人気が高まっており、洗練されたバッテリー管理システム(BMS)とオンボードエネルギー最適化技術の重要性が強調されていることに起因しています。モジュール式パワーパックの進化とクリーン推進への圧力の高まりも、電源ベンダーがUAVプラットフォーム全体でより高い価値を獲得するのに役立っています。このようにUAVの機能を決定する上で極めて重要な役割を担っているため、電源部門は推進力市場において依然として支配的な貢献をしています。

MTOW別では、150-600 KGセグメントが予測期間中最高のCAGRで成長すると予測されています。このセグメントの成長は、軍事および商業用途に採用される中型UAVの幅広い範囲によるものです。このカテゴリのUAVは、堅牢で効率的な推進技術を必要とし、一般的に高性能ICエンジンまたはハイブリッドセットを統合し、厳しい地形や空域条件で長時間のミッションを実行することができます。商業組織は、物流、パイプライン検査、地域配送のために中型ドローンを受け入れています。軍事および民間市場からのこの需要の増加は、このMTOWクラスに適した推進システムの開発を推進しています。さらに、推進力OEMは、UAVの力強い成長見通しと比較的標準化された認証要件により、このセグメントの研究開発に注力しており、市場シェア予測における優位性をさらに高めています。

北米は、2025年にUAV(ドローン)推進力市場で最大のシェアを占めると推定されます。米国は、確立された航空エコシステム、推進技術の早期導入、UAVイノベーションに対する強固な制度的支援により、この地域で優位を占めています。同国は、推進OEM、ティア1プロバイダー、部品専門家の幅広いクラスターに支えられており、次世代エンジンと電力システムの高速プロトタイピング、大量生産、統合を可能にしています。さらに、国境警備、国土安全保障、野火監視のためのUAVの国内での広範な展開により、長耐久性から高推力システムまで、さまざまな推進ニーズが発生しています。堅牢な試験インフラ、FAAのような機関からの有利な規制支援、ドローンの新興企業や防衛請負業者の活気あるネットワークにより、米国は推進システムの信頼性、性能、拡張性の基準を設定し続けています。

当レポートでは、世界のUAV推進市場について調査し、技術別、コンポーネント別、プラットフォーム別、MTOW別、地域別動向、および市場に参入する企業のプロファイルなどをまとめています。

目次

第1章 イントロダクション

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 重要考察

第5章 市場概要

- イントロダクション

- 市場力学

- 顧客のビジネスに影響を与える動向と混乱

- バリューチェーン分析

- エコシステム分析

- 価格分析

- 運用データ

- 規制状況

- HSコード

- 購買プロセスにおける主要な利害関係者

- 購入基準

- 技術分析

- ケーススタディ分析

- 2025年~2026年の主な会議とイベント

- 投資と資金調達のシナリオ

- 部品表(BOM)分析

- AI/生成AIがUAV(ドローン)推進市場に与える影響

- マクロ経済見通し

- ビジネスモデル

- テクノロジーロードマップ

- 米国の2025年関税

第6章 業界動向

- イントロダクション

- 技術動向

- メガ動向の影響

- 特許分析

第7章 UAV(ドローン)推進市場、技術別

- イントロダクション

- 電気

- 熱

- ハイブリッド

第8章 UAV(ドローン)推進市場、コンポーネント別

- イントロダクション

- ICエンジン

- 電動モーター

- 電源

- プロペラ

- 電子スピードコントローラー

第9章 UAV(ドローン)推進市場、プラットフォーム別

- イントロダクション

- 軍隊

- 商業

- 政府と法執行機関

- 消費者

第10章 UAV(ドローン)推進市場、MTOW別

- イントロダクション

- 2kg未満

- 2~25kg

- 25~150kg

- 150~600kg

- 600~2,000kg

- 2,000kg以上

第11章 UAV(ドローン)推進市場、地域別

- イントロダクション

- 北米

- PESTLE分析

- 米国

- カナダ

- アジア太平洋

- PESTLE分析

- インド

- オーストラリア

- 中国

- 日本

- 韓国

- その他

- 欧州

- PESTLE分析

- ドイツ

- 英国

- フランス

- イタリア

- ロシア

- スウェーデン

- その他

- 中東

- PESTLE分析

- GCC諸国

- イスラエル

- トルコ

- その他

- その他の地域

- PESTLE分析

- ラテンアメリカ

- アフリカ

第12章 競合情勢

- イントロダクション

- 主要参入企業の戦略/強み、2020年~2025年

- 収益分析、2020年~2024年

- 市場シェア分析、2024年

- 企業評価マトリックス:主要参入企業、2024年

- 企業評価マトリックス:スタートアップ/中小企業、2024年

- ブランド/製品比較

- 企業評価と財務指標

- 競合シナリオ

第13章 企業プロファイル

- 主要参入企業

- DJI

- RTX

- HONEYWELL INTERNATIONAL INC.

- ROLLS-ROYCE

- GENERAL ELECTRIC COMPANY

- T-MOTOR

- BRP-ROTAX GMBH & CO KG

- MAXON

- YUNEEC-ATL DRONE

- HOBBYWING TECHNOLOGY CO., LTD.

- EPSILOR-ELECTRIC FUEL LTD.

- EAGLEPICHER TECHNOLOGIES

- RRC POWER SOLUTIONS GMBH

- SHENZHEN GREPOW BATTERY CO., LTD.

- GENERAL ATOMICS

- その他の地域

- HIRTH ENGINES GMBH

- SKY POWER GMBH

- ORBITAL UAV

- KDE DIRECT

- ROTRON POWER LTD.

- DG PROPULSION

- H3 DYNAMICS

- ELECTROCRAFT, INC.

- AMPRIUS TECHNOLOGIES

- DENCHI GROUP

第14章 付録

List of Tables

- TABLE 1 USD EXCHANGE RATES, 2019-2024

- TABLE 2 UAV (DRONE) PROPULSION MARKET: MARKET SIZE ESTIMATION AND METHODOLOGY

- TABLE 3 RISK ASSESSMENT

- TABLE 4 LONG-ENDURANCE UAVS ADOPTED ACROSS COUNTRIES

- TABLE 5 KEY APPLICATIONS OF COMMERCIAL DRONES, BY INDUSTRY

- TABLE 6 ROLE OF COMPANIES IN ECOSYSTEM

- TABLE 7 AVERAGE SELLING PRICE OF DRONE PROPULSION SYSTEMS, BY PLATFORM, 2025 (USD)

- TABLE 8 AVERAGE SELLING PRICE OF DRONE PROPULSION SYSTEMS, BY REGION, 2025 (USD)

- TABLE 9 PROCUREMENT OF UNMANNED AERIAL VEHICLES, BY REGION, 2021-2024 (UNITS)

- TABLE 10 NORTH AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 11 EUROPE: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 12 ASIA PACIFIC: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 13 MIDDLE EAST & AFRICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 14 LATIN AMERICA: REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- TABLE 15 IMPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 16 EXPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- TABLE 17 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY PLATFORM (%)

- TABLE 18 KEY BUYING CRITERIA, BY KEY PLATFORM

- TABLE 19 KEY CONFERENCES AND EVENTS, 2025-2026

- TABLE 20 COMPARISON BETWEEN DIFFERENT BUSINESS MODELS

- TABLE 21 TIMELINE OF TRADE CHANGES

- TABLE 22 US TARIFF RATES FOR DRONES AND THEIR COMPONENTS

- TABLE 23 HS CODES AND THEIR CORRESPONDING TARIFF RATES FOR DRONES AND THEIR COMPONENTS

- TABLE 24 KEY MODEL-WISE PRICE IMPACT ANALYSIS

- TABLE 25 IMPACT OF US TARIFFS ON END-USE INDUSTRIES

- TABLE 26 LIST OF MAJOR PATENTS PUBLISHED, 2023-2024

- TABLE 27 UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 28 UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 29 UAV (DRONE) PROPULSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 30 UAV (DRONE) PROPULSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 31 UAV (DRONE) PROPULSION MARKET, BY IC ENGINE, 2021-2024 (USD MILLION)

- TABLE 32 UAV (DRONE) PROPULSION MARKET, BY IC ENGINE, 2025-2030 (USD MILLION)

- TABLE 33 UAV (DRONE) PROPULSION MARKET, BY ELECTRIC MOTOR, 2021-2024 (USD MILLION)

- TABLE 34 UAV (DRONE) PROPULSION MARKET, BY ELECTRIC MOTOR, 2025-2030 (USD MILLION)

- TABLE 35 UAV (DRONE) PROPULSION MARKET, BY POWER SOURCE, 2021-2024 (USD MILLION)

- TABLE 36 UAV (DRONE) PROPULSION MARKET, BY POWER SOURCE, 2025-2030 (USD MILLION)

- TABLE 37 UAV (DRONE) PROPULSION MARKET, BY PROPELLER, 2021-2024 (USD MILLION)

- TABLE 38 UAV (DRONE) PROPULSION MARKET, BY PROPELLER, 2025-2030 (USD MILLION)

- TABLE 39 UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 40 UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 41 UAV (DRONE) PROPULSION MARKET, BY MILITARY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 42 UAV (DRONE) PROPULSION MARKET, BY MILITARY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 43 UAV (DRONE) PROPULSION MARKET, BY COMMERCIAL PLATFORM, 2021-2024 (USD MILLION)

- TABLE 44 UAV (DRONE) PROPULSION MARKET, BY COMMERCIAL PLATFORM, 2025-2030 (USD MILLION)

- TABLE 45 UAV (DRONE) PROPULSION MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 46 UAV (DRONE) PROPULSION MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 47 UAV (DRONE) PROPULSION MARKET, BY REGION, 2021-2024(USD MILLION)

- TABLE 48 UAV (DRONE) PROPULSION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 49 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 50 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 51 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 52 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 53 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 54 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 55 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 56 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 57 US: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 58 US: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 59 US: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 60 US: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 61 CANADA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 62 CANADA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 63 CANADA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 64 CANADA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 65 ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY COUNTRY/REGION, 2021-2024 (USD MILLION)

- TABLE 66 ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY COUNTRY/REGION, 2025-2030 (USD MILLION)

- TABLE 67 ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 68 ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 69 ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 70 ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 71 INDIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 72 INDIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 73 INDIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 74 INDIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 75 AUSTRALIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 76 AUSTRALIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 77 AUSTRALIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 78 AUSTRALIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 79 CHINA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 80 CHINA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 81 CHINA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 82 CHINA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 83 JAPAN: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 84 JAPAN: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 85 JAPAN: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 86 JAPAN: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 87 SOUTH KOREA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 88 SOUTH KOREA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 89 SOUTH KOREA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 90 SOUTH KOREA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 91 REST OF ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 92 REST OF ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 93 REST OF ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 94 REST OF ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 95 EUROPE: UAV (DRONE) PROPULSION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 96 EUROPE: UAV (DRONE) PROPULSION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 97 EUROPE: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 98 EUROPE: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 99 EUROPE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 100 EUROPE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 101 EUROPE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 102 EUROPE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 103 GERMANY: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 104 GERMANY: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 105 GERMANY: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 106 GERMANY: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 107 UK: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 108 UK: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 109 UK: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 110 UK: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 111 FRANCE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 112 FRANCE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 113 FRANCE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 114 FRANCE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 115 ITALY: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 116 ITALY: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 117 ITALY: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 118 ITALY: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 119 RUSSIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 120 RUSSIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 121 RUSSIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 122 RUSSIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 123 SWEDEN: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 124 SWEDEN: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 125 SWEDEN: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 126 SWEDEN: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 127 REST OF EUROPE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 128 REST OF EUROPE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 129 REST OF EUROPE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 130 REST OF EUROPE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 131 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY COUNTRY, 2021-2024 (USD MILLION)

- TABLE 132 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY COUNTRY, 2025-2030 (USD MILLION)

- TABLE 133 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 134 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 135 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 136 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 137 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 138 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 139 SAUDI ARABIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 140 SAUDI ARABIA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 141 SAUDI ARABIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 142 SAUDI ARABIA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 143 UAE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 144 UAE: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 145 UAE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 146 UAE: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 147 ISRAEL: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 148 ISRAEL: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 149 ISRAEL: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 150 ISRAEL: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 151 TURKEY: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 152 TURKEY: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 153 TURKEY: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 154 TURKEY: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 155 REST OF MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 156 REST OF MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 157 REST OF MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 158 REST OF MIDDLE EAST: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 159 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY REGION, 2021-2024 (USD MILLION)

- TABLE 160 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY REGION, 2025-2030 (USD MILLION)

- TABLE 161 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY COMPONENT, 2021-2024 (USD MILLION)

- TABLE 162 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY COMPONENT, 2025-2030 (USD MILLION)

- TABLE 163 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2021-2024 (USD MILLION)

- TABLE 164 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY MTOW, 2025-2030 (USD MILLION)

- TABLE 165 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 166 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 167 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 168 REST OF WORLD: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 169 LATIN AMERICA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 170 LATIN AMERICA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 171 LATIN AMERICA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 172 LATIN AMERICA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 173 AFRICA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2021-2024 (USD MILLION)

- TABLE 174 AFRICA: UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY, 2025-2030 (USD MILLION)

- TABLE 175 AFRICA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2021-2024 (USD MILLION)

- TABLE 176 AFRICA: UAV (DRONE) PROPULSION MARKET, BY PLATFORM, 2025-2030 (USD MILLION)

- TABLE 177 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- TABLE 178 UAV (DRONE) PROPULSION MARKET: DEGREE OF COMPETITION

- TABLE 179 TECHNOLOGY FOOTPRINT

- TABLE 180 PLATFORM FOOTPRINT

- TABLE 181 COMPONENT FOOTPRINT

- TABLE 182 REGION FOOTPRINT

- TABLE 183 LIST OF STARTUPS/SMES

- TABLE 184 COMPETITIVE BENCHMARKING OF STARTUPS/SMES

- TABLE 185 UAV (DRONE) PROPULSION MARKET: PRODUCT LAUNCHES, NOVEMBER 2020-FEBRUARY 2025

- TABLE 186 UAV (DRONE) PROPULSION MARKET: DEALS, NOVEMBER 2020-FEBRUARY 2025

- TABLE 187 UAV (DRONE) PROPULSION MARKET: OTHER DEVELOPMENTS, NOVEMBER 2020-FEBRUARY 2025

- TABLE 188 DJI: COMPANY OVERVIEW

- TABLE 189 DJI: PRODUCTS OFFERED

- TABLE 190 DJI: DEALS

- TABLE 191 RTX: COMPANY OVERVIEW

- TABLE 192 RTX: PRODUCTS OFFERED

- TABLE 193 RTX: OTHER DEVELOPMENTS

- TABLE 194 HONEYWELL INTERNATIONAL INC.: COMPANY OVERVIEW

- TABLE 195 HONEYWELL INTERNATIONAL INC.: PRODUCTS OFFERED

- TABLE 196 HONEYWELL INTERNATIONAL INC.: DEALS

- TABLE 197 ROLLS-ROYCE PLC: COMPANY OVERVIEW

- TABLE 198 ROLLS-ROYCE PLC: PRODUCTS OFFERED

- TABLE 199 ROLLS-ROYCE PLC: DEALS

- TABLE 200 GENERAL ELECTRIC COMPANY: COMPANY OVERVIEW

- TABLE 201 GENERAL ELECTRIC COMPANY: PRODUCTS OFFERED

- TABLE 202 GENERAL ELECTRIC COMPANY: DEALS

- TABLE 203 T-MOTOR: COMPANY OVERVIEW

- TABLE 204 T-MOTOR: PRODUCTS OFFERED

- TABLE 205 BRP-ROTAX GMBH & CO KG: COMPANY OVERVIEW

- TABLE 206 BRP-ROTAX GMBH & CO KG: PRODUCTS OFFERED

- TABLE 207 MAXON: COMPANY OVERVIEW

- TABLE 208 MAXON: PRODUCTS OFFERED

- TABLE 209 MAXON: DEALS

- TABLE 210 YUNEEC - ATL DRONE: COMPANY OVERVIEW

- TABLE 211 YUNEEC - ATL DRONE: PRODUCTS OFFERED

- TABLE 212 HOBBYWING TECHNOLOGY CO., LTD.: COMPANY OVERVIEW

- TABLE 213 HOBBYWING TECHNOLOGY CO., LTD.: PRODUCTS OFFERED

- TABLE 214 EPSILOR-ELECTRIC FUEL LTD.: COMPANY OVERVIEW

- TABLE 215 EPSILOR-ELECTRIC FUEL LTD.: PRODUCTS OFFERED

- TABLE 216 EPSILOR-ELECTRIC FUEL LTD.: OTHER DEVELOPMENTS

- TABLE 217 EAGLEPICHER TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 218 EAGLEPICHER TECHNOLOGIES: PRODUCTS OFFERED

- TABLE 219 RRC POWER SOLUTIONS GMBH: COMPANY OVERVIEW

- TABLE 220 RRC POWER SOLUTIONS GMBH: PRODUCTS OFFERED

- TABLE 221 RRC POWER SOLUTIONS GMBH: PRODUCT LAUNCHES

- TABLE 222 SHENZHEN GREPOW BATTERY CO., LTD.: COMPANY OVERVIEW

- TABLE 223 SHENZHEN GREPOW BATTERY CO., LTD.: PRODUCTS OFFERED

- TABLE 224 SHENZHEN GREPOW BATTERY CO., LTD.: PRODUCT LAUNCHES

- TABLE 225 GENERAL ATOMICS: COMPANY OVERVIEW

- TABLE 226 GENERAL ATOMICS: PRODUCTS OFFERED

- TABLE 227 GENERAL ATOMICS: DEALS

- TABLE 228 HIRTH ENGINES GMBH: COMPANY OVERVIEW

- TABLE 229 SKY POWER GMBH: COMPANY OVERVIEW

- TABLE 230 ORBITAL UAV: COMPANY OVERVIEW

- TABLE 231 KDE DIRECT: COMPANY OVERVIEW

- TABLE 232 ROTRON POWER LTD.: COMPANY OVERVIEW

- TABLE 233 DG PROPULSION: COMPANY OVERVIEW

- TABLE 234 H3 DYNAMICS: COMPANY OVERVIEW

- TABLE 235 ELECTROCRAFT, INC.: COMPANY OVERVIEW

- TABLE 236 AMPRIUS TECHNOLOGIES: COMPANY OVERVIEW

- TABLE 237 DENCHI GROUP: COMPANY OVERVIEW

List of Figures

- FIGURE 1 RESEARCH PROCESS FLOW

- FIGURE 2 RESEARCH DESIGN

- FIGURE 3 BREAKDOWN OF PRIMARY INTERVIEWS

- FIGURE 4 BOTTOM-UP APPROACH

- FIGURE 5 TOP-DOWN APPROACH

- FIGURE 6 DATA TRIANGULATION

- FIGURE 7 MILITARY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

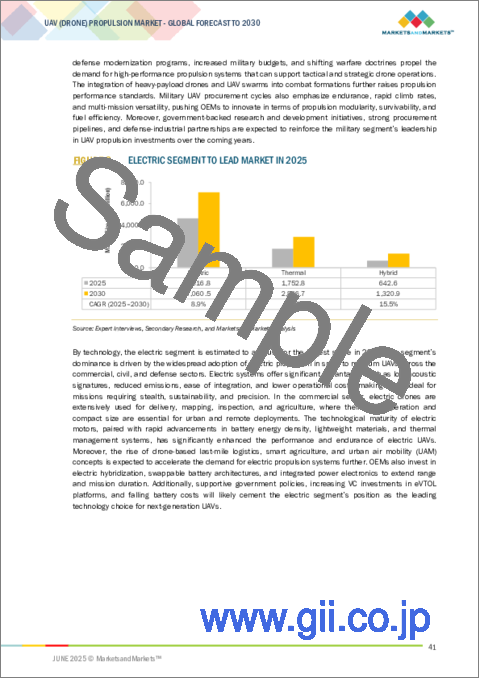

- FIGURE 8 ELECTRIC SEGMENT TO LEAD MARKET IN 2025

- FIGURE 9 IC ENGINE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 10 2-25 KG SEGMENT TO LEAD MARKET BY 2030

- FIGURE 11 NORTH AMERICA TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 12 NEED FOR ADVANCEMENTS IN UAV (DRONE) PROPULSION TECHNOLOGY TO DRIVE MARKET

- FIGURE 13 MILITARY SEGMENT TO LEAD MARKET IN 2025

- FIGURE 14 ELECTRIC SEGMENT TO LEAD MARKET IN 2025

- FIGURE 15 IC ENGINE SEGMENT TO ACCOUNT FOR LARGEST SHARE IN 2025

- FIGURE 16 2-25 KG SEGMENT TO LEAD MARKET IN 2025

- FIGURE 17 CANADA TO ACHIEVE HIGHEST CAGR DURING FORECAST PERIOD

- FIGURE 18 UAV (DRONE) PROPULSION MARKET: DRIVERS, RESTRAINTS, OPPORTUNITIES, AND CHALLENGES

- FIGURE 19 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- FIGURE 20 VALUE CHAIN ANALYSIS

- FIGURE 21 ECOSYSTEM ANALYSIS

- FIGURE 22 IMPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 23 EXPORT DATA FOR HS CODE 8806-COMPLIANT PRODUCTS, BY COUNTRY, 2022-2024 (USD THOUSAND)

- FIGURE 24 INFLUENCE OF STAKEHOLDERS ON BUYING PROCESS, BY KEY PLATFORM

- FIGURE 25 KEY BUYING CRITERIA, BY KEY PLATFORM

- FIGURE 26 INVESTMENT AND FUNDING SCENARIO, 2021-2024 (USD BILLION)

- FIGURE 27 BILL OF MATERIAL (BOM) ANALYSIS FOR UAV (DRONE) PROPULSION SYSTEMS

- FIGURE 28 IMPACT OF AI/GEN AI

- FIGURE 29 BUSINESS MODELS IN UAV (DRONE) PROPULSION MARKET

- FIGURE 30 EVOLUTION OF TECHNOLOGY

- FIGURE 31 TECHNOLOGY ROADMAP (2020-2025)

- FIGURE 32 VALUE OF DRONES IMPORTED TO AND EXPORTED FROM US, 2022-2024 (USD MILLION)

- FIGURE 33 US DRONE TRADE EXCHANGE VALUE, BY GEOGRAPHY, 2024 (USD MILLION)

- FIGURE 34 PATENTS GRANTED, 2014-2024

- FIGURE 35 ELECTRIC SEGMENT TO LEAD MARKET IN 2025

- FIGURE 36 IC ENGINE SEGMENT TO LEAD MARKET IN 2025

- FIGURE 37 MILITARY SEGMENT TO LEAD MARKET DURING FORECAST PERIOD

- FIGURE 38 2-25 KG SEGMENT TO LEAD MARKET IN 2025

- FIGURE 39 UAV (DRONE) PROPULSION MARKET, BY REGION, 2025-2030

- FIGURE 40 NORTH AMERICA: UAV (DRONE) PROPULSION MARKET SNAPSHOT

- FIGURE 41 ASIA PACIFIC: UAV (DRONE) PROPULSION MARKET SNAPSHOT

- FIGURE 42 EUROPE: UAV (DRONE) PROPULSION MARKET SNAPSHOT

- FIGURE 43 MIDDLE EAST: UAV (DRONE) PROPULSION MARKET SNAPSHOT

- FIGURE 44 REST OF WORLD: UAV (DRONE) PROPULSION MARKET SNAPSHOT

- FIGURE 45 REVENUE ANALYSIS OF TOP FIVE PLAYERS, 2020-2024 (USD MILLION)

- FIGURE 46 MARKET SHARE ANALYSIS OF KEY PLAYERS, 2024

- FIGURE 47 UAV (DRONE) PROPULSION MARKET: COMPANY EVALUATION MATRIX (KEY PLAYERS), 2024

- FIGURE 48 COMPANY FOOTPRINT

- FIGURE 49 UAV (DRONE) PROPULSION MARKET: COMPANY EVALUATION MATRIX (STARTUPS/SMES), 2024

- FIGURE 50 BRAND/PRODUCT COMPARISON

- FIGURE 51 FINANCIAL METRICS OF PROMINENT PLAYERS, 2025

- FIGURE 52 VALUATION OF PROMINENT PLAYERS, 2025

- FIGURE 53 RTX: COMPANY SNAPSHOT

- FIGURE 54 HONEYWELL INTERNATIONAL INC.: COMPANY SNAPSHOT

- FIGURE 55 ROLLS-ROYCE PLC: COMPANY SNAPSHOT

- FIGURE 56 GENERAL ELECTRIC COMPANY: COMPANY SNAPSHOT

The UAV (drone) propulsion market is estimated to be USD 7.0 billion in 2025. It is projected to reach USD 11.3 billion by 2030 at a CAGR of 10.0% during the forecast period. Technological advancements and changing market conditions are the key drivers of the UAV (drone) propulsion market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Component, Technology, MTOW, Platform and Region |

| Regions covered | North America, Europe, APAC, RoW |

"By component, the power source segment is projected to grow at the highest CAGR during the forecast period."

By component, the power source segment is projected to grow at the highest CAGR during the forecast period. Power source directly impacts the performance, endurance, payload capacity, and mission success. The segment's growth can be attributed to the increasing popularity of electric drones, particularly in the commercial market, highlighting the importance of sophisticated battery management systems (BMS) and onboard energy optimization technologies. The evolution of modular power packs and the increasing pressure for clean propulsion also assist power source vendors in capturing higher value across UAV platforms. This pivotal role in determining UAV functionality ensures that the power source segment remains a dominant contributor within the propulsion market.

"By MTOW, the 150-600 KG segment is projected to grow at the highest CAGR during the forecast period."

By MTOW, the 150-600 KG segment is projected to grow at the highest CAGR during the forecast period. The growth of the segment is due to the broad scope of medium-size UAVs employed for military and commercial applications. UAVs in this category need robust and efficient propulsion technologies, commonly integrating high-performance IC engines or hybrid sets that can run extended-duration missions in challenging terrain or airspace conditions. Commercial organizations are embracing medium-weight drones for logistics, pipeline inspection, and regional delivery. This increasing demand from the military and civil markets drives the development of propulsion systems suited to this MTOW class. Moreover, propulsion OEMs focus on R&D in this segment due to the UAVs strong growth outlook and relatively standardized certification requirements, further contributing to its dominant position in market share projections.

"US is estimated to account for the largest share of the North American UAV (drone) propulsion market in 2025."

North America is estimated to account for the largest share of the UAV (drone) propulsion market in 2025. The US is dominant in this region due to its established aviation ecosystem, early adoption of propulsion technologies, and robust institutional support for UAV innovation. The country is supported by a wide cluster of propulsion OEMs, tier-1 providers, and component experts, which allow for high-speed prototyping, mass production, and integration of next-generation engines and electric power systems. Additionally, the widespread deployment of UAVs in the country for border security, homeland security, and wildland fire monitoring generates varied propulsion needs from long endurance to high-thrust systems. With robust testing infrastructure, favorable regulatory support from bodies like the FAA, and a vibrant network of drone startups and defense contractors, the US continues to set the benchmark for propulsion system reliability, performance, and scalability.

Given below is the break-up of primary participants in the UAV (drone) propulsion market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Managers - 35%, Directors - 25%, Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 35%, Middle East- 10%, Rest of World-5%

DJI (China), RTX (US), Honeywell International Inc. (US), Rolls-Royce plc (UK), and General Electric Company (US) are some of the key players in the market. These key players offer connectivity applicable to various sectors and have well-equipped and strong distribution networks across North America, Europe, Asia Pacific, the Middle East, and the Rest of World.

Research Coverage

The study covers the UAV (drone) propulsion market across various segments and subsegments. It aims to estimate this market's size and growth potential across different segments based on platform, component, technology, and MTOW. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

This report segments the UAV (drone) propulsion market across five key regions: North America, Europe, Asia Pacific, the Middle East, and the Rest of World. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the UAV (Drone) propulsion market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, product launches, contracts, expansions, acquisitions, and partnerships associated with the UAV (drone) propulsion market.

Reasons to Buy this Report:

This report is a valuable resource for market leaders and newcomers in the UAV (drone) propulsion market. It offers data that closely approximates revenue figures for the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulating effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report also provides insights on the following aspects of the market:

- Analysis of key market drivers: Increasing military UAV procurement, growing demand for long-endurance UAVs, rising commercial drone applications, and technological advancements in electric propulsion

- Market Penetration: Comprehensive information on UAV (drone) propulsion solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the UAV (Drone) Propulsion market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about products & services, untapped geographies, recent developments, and investments in the UAV (drone) propulsion market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and service offerings of leading players in the UAV (drone) propulsion market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN UAV (DRONE) PROPULSION MARKET

- 4.2 UAV (DRONE) PROPULSION MARKET, BY PLATFORM

- 4.3 UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY

- 4.4 UAV (DRONE) PROPULSION MARKET, BY COMPONENT

- 4.5 UAV (DRONE) PROPULSION MARKET, BY MTOW

- 4.6 UAV (DRONE) PROPULSION MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing procurement of military UAVs

- 5.2.1.2 Growing demand for long-endurance UAVs

- 5.2.1.3 Rise in commercial drone applications

- 5.2.1.4 Technological advancements in electric propulsion

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited energy density in batteries

- 5.2.2.2 High development and manufacturing costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of AI with UAV propulsion systems

- 5.2.3.2 Increasing deployment of UAV Swarm and micro drones for defense and rescue operations

- 5.2.3.3 Emergence of hybrid-electric propulsion systems

- 5.2.4 CHALLENGES

- 5.2.4.1 Miniaturization without compromising performance

- 5.2.4.2 Inadequate infrastructure for propulsion testing in developing countries

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 RAW MATERIAL PRODUCERS

- 5.4.3 PRODUCT MANUFACTURING

- 5.4.4 TESTING & QUALITY ASSURANCE

- 5.4.5 APPROVALS

- 5.4.6 END USERS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 PRIVATE AND SMALL ENTERPRISES

- 5.5.3 END USERS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE OF DRONE PROPULSION SYSTEMS, BY PLATFORM

- 5.6.2 AVERAGE SELLING PRICE OF DRONE PROPULSION SYSTEMS, BY REGION, 2025

- 5.7 OPERATIONAL DATA

- 5.8 REGULATORY LANDSCAPE

- 5.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.2 REGULATORY FRAMEWORK

- 5.8.2.1 North America

- 5.8.2.2 Europe

- 5.8.2.3 Asia Pacific

- 5.8.2.4 Middle East

- 5.8.2.5 Rest of the World (Latin America & Africa)

- 5.9 HS CODES

- 5.9.1 IMPORT SCENARIO

- 5.9.2 EXPORT SCENARIO

- 5.10 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11 BUYING CRITERIA

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Contra-rotating propellers

- 5.12.1.2 Distributed Electric Propulsion (DEP)

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 Advanced electronic speed controllers

- 5.12.2.2 Battery Management Systems (BMSs)

- 5.12.3 ADJACENT TECHNOLOGIES

- 5.12.3.1 Thermal management systems

- 5.12.3.2 Propulsion diagnostics & predictive analytics software

- 5.12.1 KEY TECHNOLOGIES

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: HONEYWELL AEROSPACE AND HINDUSTAN AERONAUTICS LIMITED (HAL) SIGNED MOU TO MANUFACTURE HIGH-POWER TURBO GENERATORS IN INDIA

- 5.13.2 CASE STUDY 2: GE AEROSPACE (US) AND KRATOS DEFENSE & SECURITY SOLUTIONS (US) PARTNERED TO CO-DEVELOP AND MANUFACTURE SMALL, LOW-COST TURBOJET AND TURBOFAN ENGINES

- 5.13.3 CASE STUDY 3: PRATT & WHITNEY'S (US) F100 TURBOFAN ENGINE WAS CHOSEN AS PROPULSION SOLUTION FOR HYPERSONIC UAS PROTOTYPE

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 BILL OF MATERIALS (BOM) ANALYSIS

- 5.17 IMPACT OF AI/GENERATIVE AI ON UAV (DRONE) PROPULSION MARKET

- 5.17.1 GENERATIVE PROPULSION DESIGN

- 5.17.2 REAL-TIME PROPULSION OPTIMIZATION

- 5.17.3 PREDICTIVE MAINTENANCE AND FAULT DETECTION

- 5.17.4 SMART ENERGY MANAGEMENT

- 5.17.5 DIGITAL TWINS FOR PROPULSION SIMULATION

- 5.17.6 ENHANCED SWARM COORDINATION

- 5.17.7 ADAPTIVE CONTROL IN HYBRID PROPULSION

- 5.17.8 THERMAL LOAD BALANCING

- 5.18 MACROECONOMIC OUTLOOK

- 5.18.1 INTRODUCTION

- 5.18.2 NORTH AMERICA

- 5.18.3 EUROPE

- 5.18.4 ASIA PACIFIC

- 5.18.5 MIDDLE EAST

- 5.18.6 LATIN AMERICA

- 5.18.7 AFRICA

- 5.19 BUSINESS MODELS

- 5.20 TECHNOLOGY ROADMAP

- 5.21 US 2025 TARIFF

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 TECHNOLOGY TRENDS

- 6.2.1 HYBRID-ELECTRIC PROPULSION SYSTEMS

- 6.2.2 ADVANCED BATTERY TECHNOLOGIES

- 6.2.3 TURBOELECTRIC & MICRO GAS TURBINE PROPULSION

- 6.2.4 AI-OPTIMIZED POWER MANAGEMENT SYSTEMS

- 6.3 IMPACT OF MEGA TRENDS

- 6.3.1 ADDITIVE MANUFACTURING

- 6.3.2 ADVANCED MATERIAL INTEGRATION

- 6.3.3 BIG DATA ANALYTICS

- 6.4 PATENT ANALYSIS

7 UAV (DRONE) PROPULSION MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 ELECTRIC

- 7.2.1 NEED FOR LOW NOISE LEVELS AND HIGH EFFICIENCY IN DRONES TO DRIVE MARKET

- 7.3 THERMAL

- 7.3.1 THERMAL PROPULSION POWERS LONG-ENDURANCE UAVS FOR DEMANDING MISSIONS

- 7.3.2 CONVENTIONAL

- 7.3.3 MICROTURBINE

- 7.4 HYBRID

- 7.4.1 RAPID ADVANCEMENTS IN HYBRID UAV PROPULSION TO DRIVE MARKET

8 UAV (DRONE) PROPULSION MARKET, BY COMPONENT

- 8.1 INTRODUCTION

- 8.2 IC ENGINE

- 8.2.1 PISTON ENGINE

- 8.2.1.1 Rising demand for reliable and low-cost propulsion in small to mid-sized UAVs to drive market

- 8.2.2 WANKEL ENGINE

- 8.2.2.1 Increasing demand for compact and lightweight propulsion systems in UAVs to drive adoption of Wankel engines

- 8.2.3 TURBOPROP ENGINE

- 8.2.3.1 Rising demand for long-endurance, fuel-efficient UAVs to drive adoption of turboprop engines

- 8.2.4 TURBOFAN ENGINE

- 8.2.4.1 Rising demand for long-endurance UAVs to drive adoption of turbofan engines

- 8.2.5 TURBOJET ENGINE

- 8.2.5.1 Growing need for high-speed, compact, and cost-effective propulsion systems to drive use of turbojet engines

- 8.2.1 PISTON ENGINE

- 8.3 ELECTRIC MOTOR

- 8.3.1 BRUSHLESS MOTOR

- 8.3.1.1 Demand for drones with high efficiency, reliability, and performance to drive market

- 8.3.1.2 Up to 1,000 KV

- 8.3.1.3 1,001-2,000 KV

- 8.3.1.4 2,001-3,000 KV

- 8.3.1.5 Above 3,000 KV

- 8.3.2 BRUSHED MOTOR

- 8.3.2.1 Demand for drones for affordability, simplicity, and ease of maintenance to drive use of brushed motors

- 8.3.1 BRUSHLESS MOTOR

- 8.4 POWER SOURCE

- 8.4.1 BATTERY

- 8.4.1.1 Focus on batteries with high energy density, compactness, and ease of integration to drive market

- 8.4.1.2 Up to 5 Ah

- 8.4.1.3 5-20 Ah

- 8.4.1.4 21-50 Ah

- 8.4.1.5 Above 50 Ah

- 8.4.2 GENERATOR SET

- 8.4.2.1 Need for extended flight endurance and high payload capacity for demanding UAV missions to drive growth

- 8.4.3 FUEL CELL

- 8.4.3.1 Fuel cells to emerge as clean and efficient alternative for powering UAVs

- 8.4.4 SOLAR CELL

- 8.4.4.1 Rising need for ultra-long-endurance UAVs to boost demand for solar panels

- 8.4.1 BATTERY

- 8.5 PROPELLER

- 8.5.1 PLASTIC

- 8.5.1.1 Emphasis on affordability to drive widespread use of plastic propellers

- 8.5.2 COMPOSITE

- 8.5.2.1 High strength-to-weight ratio and performance reliability to fuel demand for composite propellers

- 8.5.3 WOOD

- 8.5.3.1 Wooden propellers are known for their excellent vibration-damping properties and balanced performance

- 8.5.1 PLASTIC

- 8.6 ELECTRONIC SPEED CONTROLLER

- 8.6.1 GROWING NEED FOR EFFICIENT, INTELLIGENT MOTOR CONTROL SYSTEMS TO DRIVE MARKET

9 UAV (DRONE) PROPULSION MARKET, BY PLATFORM

- 9.1 INTRODUCTION

- 9.2 MILITARY

- 9.2.1 SMALL

- 9.2.1.1 Demand for low-cost, portable, and stealthy ISR platforms to drive market

- 9.2.2 TACTICAL

- 9.2.2.1 Need for multi-role UAVs capable of operating independently to drive market

- 9.2.3 STRATEGIC

- 9.2.3.1 Demand for high-endurance, high-altitude performance in ISR and deep-strike missions to drive market

- 9.2.1 SMALL

- 9.3 COMMERCIAL

- 9.3.1 SMALL

- 9.3.1.1 Demand for small drones offering portability, regulatory flexibility, and ease of deployment to drive growth

- 9.3.2 MEDIUM

- 9.3.2.1 Demand for high payload capacity and mission endurance to drive advancements in medium-sized drones

- 9.3.3 LARGE

- 9.3.3.1 Expansion of long-range and BVLOS operations to drive innovation in large drone propulsion systems

- 9.3.1 SMALL

- 9.4 GOVERNMENT & LAW ENFORCEMENT

- 9.4.1 NEED FOR RAPID RESPONSE, STEALTH, AND VERSATILITY TO DRIVE DEMAND

- 9.5 CONSUMER

- 9.5.1 DEMAND FOR PROPULSION SYSTEMS OFFERING AFFORDABILITY, EASE OF USE, AND PORTABILITY TO FUEL GROWTH

10 UAV (DRONE) PROPULSION MARKET, BY MTOW

- 10.1 INTRODUCTION

- 10.1.1 < 2 KG

- 10.1.1.1 Demand for drones offering miniaturization, low cost, and regulatory ease to drive market

- 10.1.2 2-25 KG

- 10.1.2.1 Widespread commercial use and payload flexibility of 2-25 kg category drones to drive market

- 10.1.3 25-150 KG

- 10.1.3.1 Demand for propulsion systems offering endurance, power, and heavy-lift capabilities to fuel market

- 10.1.4 150-600 KG

- 10.1.4.1 Rising demand for heavy-duty drones for logistics, defense, and specialized commercial operations to drive market

- 10.1.5 600-2000 KG

- 10.1.5.1 Need for drones for persistent ISR, maritime surveillance, and regional military operations to drive market

- 10.1.6 > 2000 KG

- 10.1.6.1 Increase in strategic strike and high-altitude, persistent missions to fuel innovation in propulsion systems

- 10.1.1 < 2 KG

11 UAV (DRONE) PROPULSION MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 PESTLE ANALYSIS

- 11.2.2 US

- 11.2.2.1 Increase in defense investments to drive market

- 11.2.3 CANADA

- 11.2.3.1 Growing demand for energy-efficient and long-range propulsion technologies to drive market

- 11.3 ASIA PACIFIC

- 11.3.1 PESTLE ANALYSIS

- 11.3.2 INDIA

- 11.3.2.1 Increasing procurement of long-endurance and high-payload drones to drive growth

- 11.3.3 AUSTRALIA

- 11.3.3.1 Increasing investments in government & law enforcement to drive growth

- 11.3.4 CHINA

- 11.3.4.1 High research and development expenditure to drive growth

- 11.3.5 JAPAN

- 11.3.5.1 Technological advancements to drive growth

- 11.3.6 SOUTH KOREA

- 11.3.6.1 Focus on defense modernization and Indigenous UAV programs to drive growth

- 11.3.7 REST OF ASIA PACIFIC

- 11.4 EUROPE

- 11.4.1 PESTLE ANALYSIS

- 11.4.2 GERMANY

- 11.4.2.1 Increasing focus on adopting electric and hybrid-electric propulsion to drive growth

- 11.4.3 UK

- 11.4.3.1 Modernization of defense sector to drive growth

- 11.4.4 FRANCE

- 11.4.4.1 Expansion of dual-use drone technologies to drive growth

- 11.4.5 ITALY

- 11.4.5.1 Increasing use of drones by civil and industrial sectors to drive growth

- 11.4.6 RUSSIA

- 11.4.6.1 Increasing investments in propulsion advancements to drive growth

- 11.4.7 SWEDEN

- 11.4.7.1 Increased support from government for defense innovation to drive growth

- 11.4.8 REST OF EUROPE

- 11.5 MIDDLE EAST

- 11.5.1 PESTLE ANALYSIS

- 11.5.2 GCC COUNTRIES

- 11.5.2.1 Saudi Arabia

- 11.5.2.1.1 Focus on localization of UAV technologies to drive growth

- 11.5.2.2 UAE

- 11.5.2.2.1 Support from government and law enforcement sector for dual-use technology development to drive growth

- 11.5.2.1 Saudi Arabia

- 11.5.3 ISRAEL

- 11.5.3.1 Increasing investments in lightweight, low-noise, and fuel-efficient propulsion systems to drive growth

- 11.5.4 TURKEY

- 11.5.4.1 Integration of UAVs into multi-domain military operations to drive growth

- 11.5.5 REST OF MIDDLE EAST

- 11.6 REST OF WORLD

- 11.6.1 PESTLE ANALYSIS

- 11.6.2 LATIN AMERICA

- 11.6.2.1 Focus on strategic military surveillance to drive market

- 11.6.3 AFRICA

- 11.6.3.1 Increasing use of UAVs to drive growth

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT

- 12.5.5.1 Technology footprint

- 12.5.5.2 Platform footprint

- 12.5.5.3 Component footprint

- 12.5.5.4 Region footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING

- 12.6.5.1 List of startups/SMEs

- 12.6.5.2 Competitive benchmarking of startups/SMEs

- 12.7 BRAND/PRODUCT COMPARISON

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DJI

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 RTX

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Other developments

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 HONEYWELL INTERNATIONAL INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 ROLLS-ROYCE

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 GENERAL ELECTRIC COMPANY

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 T-MOTOR

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.7 BRP-ROTAX GMBH & CO KG

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.8 MAXON

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 YUNEEC - ATL DRONE

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.10 HOBBYWING TECHNOLOGY CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.11 EPSILOR-ELECTRIC FUEL LTD.

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Other developments

- 13.1.12 EAGLEPICHER TECHNOLOGIES

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.13 RRC POWER SOLUTIONS GMBH

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product launches

- 13.1.14 SHENZHEN GREPOW BATTERY CO., LTD.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Product launches

- 13.1.15 GENERAL ATOMICS

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.1 DJI

- 13.2 OTHER PLAYERS

- 13.2.1 HIRTH ENGINES GMBH

- 13.2.2 SKY POWER GMBH

- 13.2.3 ORBITAL UAV

- 13.2.4 KDE DIRECT

- 13.2.5 ROTRON POWER LTD.

- 13.2.6 DG PROPULSION

- 13.2.7 H3 DYNAMICS

- 13.2.8 ELECTROCRAFT, INC.

- 13.2.9 AMPRIUS TECHNOLOGIES

- 13.2.10 DENCHI GROUP

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS