|

|

市場調査レポート

商品コード

1808614

UAV推進システム市場:推進タイプ、コンポーネント、UAVタイプ、航続距離、用途別- 世界予測2025-2030年UAV Propulsion System Market by Propulsion Type, Component, UAV Type, Range, Application - Global Forecast 2025-2030 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| UAV推進システム市場:推進タイプ、コンポーネント、UAVタイプ、航続距離、用途別- 世界予測2025-2030年 |

|

出版日: 2025年08月28日

発行: 360iResearch

ページ情報: 英文 183 Pages

納期: 即日から翌営業日

|

概要

UAV推進システム市場の2024年の市場規模は69億6,000万米ドルで、2025年にはCAGR 7.71%で74億7,000万米ドルに成長し、2030年には108億7,000万米ドルに達すると予測されています。

| 主な市場の統計 | |

|---|---|

| 基準年2024 | 69億6,000万米ドル |

| 推定年2025 | 74億7,000万米ドル |

| 予測年2030 | 108億7,000万米ドル |

| CAGR(%) | 7.71% |

UAV推進システムのダイナミックな出現を分析レンズで探り、技術の進歩とセクターの進化要因を明らかにします

無人航空機推進システムの急速な進化は、商業と防衛の両分野に変革をもたらし、運用能力と効率の新時代を切り開いた。飛行耐久時間の延長、排出ガスの削減、より静かな運用に対する新たな要求が、新しい推進アーキテクチャの研究開発を後押ししています。次世代バッテリーの化学的性質が成熟し、ハイブリッド構成が高度なパワーエレクトロニクスとシームレスに統合されるにつれて、業界は、技術的ブレークスルーが拡大するミッション・プロファイルと出会う極めて重要な変曲点に立っています。

無人航空機推進エコシステムをグローバルに再定義するパラダイムシフト的な技術的ブレークスルーと規制の流れを特定します

無人航空機推進セクターは、技術革新と規制状況の変化により、かつてない変革期を迎えています。電動化の取り組みは今や短距離用途にとどまらず、新たに登場したソリッドステート・バッテリーと高効率電力コンバーターによって、より長時間のミッションが可能になりました。一方、電気モーターと内燃機関を組み合わせたハイブリッド構成は、コンパクトな機体ではこれまで実現できなかった柔軟性と冗長性をもたらしています。これらの進歩は、軽量複合材における画期的な進歩と相まって、性能ベンチマークを再定義し、運用範囲を拡大しつつあります。

新たに実施される米国の関税措置がUAV推進コンポーネントのサプライチェーンと市場力学に与える多面的な影響の評価

2025年米国関税措置の実施により、世界のUAV推進部品サプライチェーンに大きな複雑性がもたらされました。従来は主要な海外サプライヤーから調達していたコンポーネントが輸入関税の引き上げに直面し、メーカーはコスト構造やベンダーとの関係を見直す必要に迫られています。調達チームが陸揚げコストの上昇に取り組む中、多くの企業は関税の影響を軽減し、重要部品の継続性を確保するために、ニアショアリングの機会を評価し、サプライヤーベースを多様化しています。

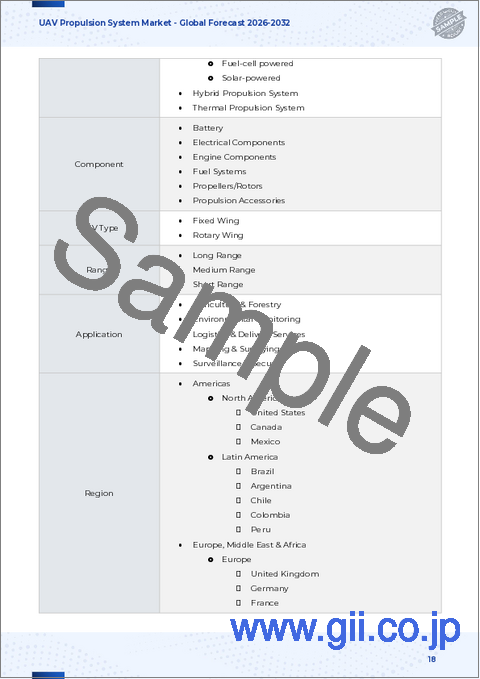

推進力タイプ、部品、UAVタイプ、運用範囲、用途ベースのセグメンテーション戦略から得られる深い洞察が市場を明確にする

市場セグメンテーションを詳細に調査することで、推進アーキテクチャ全体にわたる微妙な性能促進要因と戦略的必要性が明らかになります。推進力の種類を検討すると、電気システムはエネルギー密度と電力管理の画期的な進歩の恩恵を受けて急速に進歩しており、ハイブリッド推進構成は耐久性と環境への影響の最適なバランスを図っています。従来の内燃技術は、長時間のミッションで高出力を必要とするシナリオでは、引き続き重要な役割を果たしています。

UAV推進システムの採用と成長パターンに影響を与える、南北アメリカ、欧州・中東・アフリカ、アジア太平洋の地域別軌跡の解読

UAV推進システム分野の地域ダイナミクスは、南北アメリカ、中東・アフリカ、アジア太平洋の各地域で、市場促進要因と戦略的優先事項によって形成されています。南北アメリカでは、国防近代化努力の高まりと堅調な新興企業エコシステムが先進推進技術の採用を加速させています。研究機関と業界企業との共同イニシアチブにより、軍事偵察と商業配送の両方の用途向けに設計された次世代電気・ハイブリッド試作機が育成されています。

市場をリードする推進システム開発企業や共同開発企業が採用する極めて重要な戦略が、競争力のあるポジショニングとイノベーションを形成していることを明らかにします

UAV推進分野の主要企業は、差別化された戦略を展開して競争上の優位性を確保し、新たな市場機会を獲得しています。既存のエンジンメーカー数社は、戦略的買収や合弁事業を通じてポートフォリオを拡大し、デジタル制御モジュールを従来のパワープラントと統合して、進化する規制要件を満たすハイブリッド推進ソリューションを提供しています。

分析結果を的を絞った戦略的指令に変換することで、業界のリーダーが新たなUAV推進動向を効果的に活用できるようにします

競争が激化し、規制情勢が進化する中で成功するためには、業界リーダーは現在の市場力学に基づいた的を絞った戦略を実行する必要があります。第一に、組織はサプライチェーンの強靭性を高めるために戦略的垂直統合を追求すべきです。重要部品の内製化や、中核サプライヤーとの長期的パートナーシップの確立により、企業は関税の影響を緩和し、機動的な在庫管理を維持することができます。

UAV推進システム調査を支える厳密な調査フレームワーク、データ収集プロセス、分析手法の詳細

本調査は、包括的で信頼性の高い知見を提供するため、厳格な混合手法の枠組みを活用しています。1次調査手法には、大手航空宇宙・防衛企業の推進システムエンジニア、規制専門家、調達マネージャーとの詳細なインタビューが含まれます。これらの専門家による協議は、技術採用の課題、認証経路、サプライチェーン戦略に関する直接的な視点を提供します。

市場シフト、利害関係者の要請、UAV推進状況の将来の機会を総合した包括的な結論を導き出します

これらの洞察を総合すると、電動化、ハイブリッド化、先端材料の革新がUAV推進技術の変革の軌跡を浮き彫りにしています。規制改革、関税に対応したサプライチェーンの再構成、戦略的セグメンテーションの明確化の収束により、業界参加者は前例のない成長と技術的差別化の入り口に立っています。

目次

第1章 序文

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場の概要

第5章 市場力学

- モジュラー式電動モーター設計を採用し、UAVのパワートレイン構成を迅速にカスタマイズ

- ハイブリッド電気推進システムの統合により、無人航空機の飛行持続時間と航続距離を延長

- 次世代ドローンミッションを推進する高エネルギー密度固体電池の採用

- モジュラー式電気モーターアーキテクチャへの移行により、UAVパワートレインの迅速なカスタマイズが可能

- 長時間飛行可能なドローンの軽量化のための水素燃料電池技術の導入

- 過酷な環境におけるUAVモーターの効率を最適化する熱管理ソリューションの進歩

- リアルタイムUAV推進制御を強化するAI駆動型電力分配システムの出現

- 無人航空機の推力重量比を向上させる軽量複合プロペラ材料の開発

- 低騒音電気推進の規制強化により、都市部でのドローン配送の導入が増加

- 高エネルギー密度の固体電池統合を活用し、高耐久性ドローンミッションに電力を供給

第6章 市場洞察

- ポーターのファイブフォース分析

- PESTEL分析

第7章 米国の関税の累積的な影響2025

第8章 UAV推進システム市場推進タイプ別

- 電気推進

- 電池駆動

- 燃料電池駆動

- 太陽光発電

- ハイブリッド推進システム

- 内燃機関

第9章 UAV推進システム市場:コンポーネント別

- バッテリー

- 電気部品

- エンジン部品

- 燃料システム

- プロペラ/ローター

- 推進アクセサリ

第10章 UAV推進システム市場UAVの種類別

- 固定翼

- 回転翼

第11章 UAV推進システム市場:範囲別

- 長距離

- 中距離

- 短距離

第12章 UAV推進システム市場:用途別

- 農林業

- 環境モニタリング

- 物流・配送サービス

- マッピングと測量

- 監視とセキュリティ

第13章 南北アメリカのUAV推進システム市場

- 米国

- カナダ

- メキシコ

- ブラジル

- アルゼンチン

第14章 欧州・中東・アフリカのUAV推進システム市場

- 英国

- ドイツ

- フランス

- ロシア

- イタリア

- スペイン

- アラブ首長国連邦

- サウジアラビア

- 南アフリカ

- デンマーク

- オランダ

- カタール

- フィンランド

- スウェーデン

- ナイジェリア

- エジプト

- トルコ

- イスラエル

- ノルウェー

- ポーランド

- スイス

第15章 アジア太平洋地域のUAV推進システム市場

- 中国

- インド

- 日本

- オーストラリア

- 韓国

- インドネシア

- タイ

- フィリピン

- マレーシア

- シンガポール

- ベトナム

- 台湾

第16章 競合情勢

- 市場シェア分析, 2024

- FPNVポジショニングマトリックス, 2024

- 競合分析

- Advanced Innovative Engineering Ltd.

- BAE Systems PLC

- DJI Technology Co., Ltd.

- ePropelled Inc

- General Electric Company

- H3 Dynamics Holdings Pte. Ltd.

- Hanwha Corporation

- Hirth Engines GmbH

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- LaunchPoint Electric Propulsion Solutions, Inc.

- Mejzlik Propellers s.r.o.

- MT-Propeller Entwicklung GmbH

- Northwest UAV

- Orbital Corporation Limited

- Rotron Aerospace Ltd by AMETEK.Inc

- RTX Corporation

- SAAB AB

- Suter Industries AG

- Terra Drone Corporation

- Textron Inc

- UAV Engines Limited

- UAVOS INC

- Yuneec International Co. Ltd.