|

市場調査レポート

商品コード

1851210

配送ドローン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Delivery Drones - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 配送ドローン:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年06月24日

発行: Mordor Intelligence

ページ情報: 英文 120 Pages

納期: 2~3営業日

|

概要

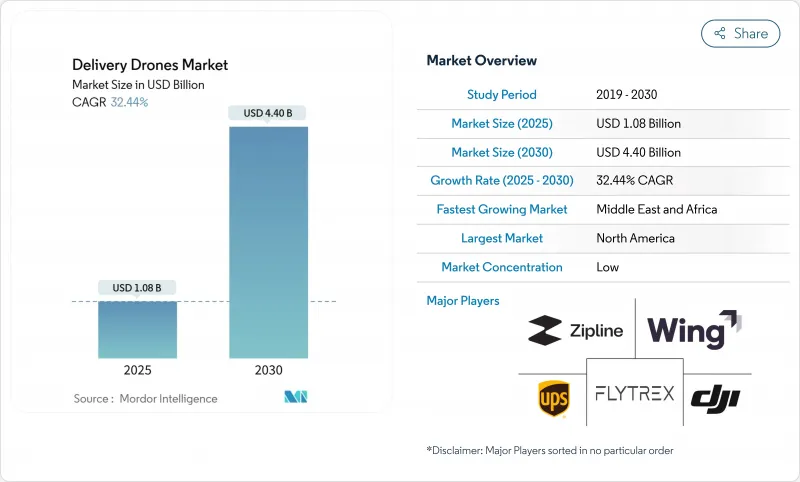

配送ドローンの市場規模は2025年に10億8,000万米ドル、2030年には44億米ドルに達し、CAGR 32.44%で成長すると予測されています。

この成長は、急速な規制の自由化、目視外境界線(BVLOS)認可の拡大、従来の宅配業者では対応困難な30分以内の配達を求める消費者の需要の高まりを反映しています。FAAとカナダ運輸省によるルール作りの加速化と米国における行政措置により、承認サイクルが短縮され、商用事業者のコンプライアンス・リスクが低下しています。ハイブリッド垂直離着陸(VTOL)設計、AIベースの飛行制御、トリプルドロップペイロードシステムにおけるブレークスルーは、実用的な航続距離とペイロードの限界を引き上げると同時に、ディーゼルバンと比較して配送あたりのエネルギー使用量を94%削減しています。小売企業はドローンフリートを使って「忘れ去られた商品」の需要を新たな売上に転換し、ヘルスケアネットワークは無人航空機を活用して貧弱な道路インフラや一貫性のないコールドチェーン能力を回避しています。投資の勢いは依然として強く、ウイングコプター、デルタクアッド、そして米国と欧州の初期段階の企業数社が2024年から2025年にかけて大規模なラウンドを終了しています。

世界の配送ドローン市場の動向と洞察

加速する都市部での即日フルフィルメント需要

密集した都市部では、30分以内の配達に対する消費者の期待が集中しており、小売業者は現在、ドローンをサービスの差別化に不可欠なものとして捉えています。WalmartとWingは、米国100店舗から平均19分のフルフィルメントを実証し、スケールでの商業スループットを検証しました。ラストワンマイルは総配送コストの最大50%を占める。マルチローターフリートは、高頻度の「忘れ物」注文を中心にルートを最適化することで、この負担を93%軽減します。中国のMeituanは2025年の春節に食品配達フライトを記録し、アジアの巨大都市の密度の優位性を強調しました。5Gと自律的な交通管理レイヤーを統合することで、何十もの同時飛行をリアルタイムで調整することが可能になります。これらの要因が相まって、ドローン・サービスはトラック・ルートを共食いするのではなく、むしろ増加する輸送量を獲得することができます。

遠隔地における信頼性の高いヘルスケア物流へのニーズの高まり

ライフクリティカルなペイロードは、プレミアム価格と迅速な規制免除を正当化します。ジップラインのネットワークは、ルワンダとガーナで血液とワクチンを30分以内に配達し、米国郊外の処方箋配達市場にも進出しています。日本航空は地方自治体と提携し、台風襲来後の島嶼地域へ救援物資をシャトル輸送し、災害対応コリドーの先例を作りました。インドでは20の事業者がBVLOS医療試験を許可され、公共セクターの受け入れが加速しています。このような使用事例は、地域社会の信頼を築き、恒久的な飛行回廊を作り、人道的目的が達成されれば、より広範な商業貨物のためのテンプレートを確立します。

レガシーATCとの複雑な空域統合

従来の航空機、緊急ヘリコプター、レクリエーション用ドローンが同じ空を争うため、交通量の多いコリドーは帯域幅の限界に直面しています。FAAが間もなく実施するeVTOL統合パイロット・プログラムでは、自動化されたデコンフリクション・プラットフォームがテストされます。しかし、都市部での展開には、レーダー、ADS-B、携帯電話から衛星通信へのバックホールなど、数十億米ドル規模のUスペースのアップグレードが必要になるかもしれないです。オーストラリアの郊外での試験で明らかになったのは、多くの苦情がまだ複数の省庁による審査の引き金になり得るということで、地域社会の騒音やプライバシーに関する懸念の敏感さが浮き彫りになりました。

セグメント分析

ロータリー・プラットフォームは、都市環境における垂直離陸の利便性により、2024年の売上の71.32%を占めました。この優位性が現在の配送ドローン市場を支えているが、運航会社がより長いルートとより重い積荷を追い求める中、固定翼モデルのCAGRは35.21%を記録しています。

ウイングコプターのティルトローター・システムが94km離れた場所に届けるなど、飛行効率の向上がヘルスケアや地方のeコマース・プロジェクトを誘致しています。ハイブリッドVTOLコンセプトは、両方のモードを融合させるもので、将来のリーダーたちが、単一アーキテクチャに賭けるのではなく、フレキシブルなフリートで飛行することを示唆しています。

5kg未満クラスは2024年の配送ドローン市場規模の55.67%を占め、規制の保守性とバッテリーの制約を反映しています。10kgを超えるプラットフォームは、概念実証パイロットがより利益率の高い貨物に移行するにつれて、CAGR最速の36.78%を示します。

カナダの新しい25kgから150kgまでの規則が、より重い医療品や工業品の輸送を可能にする一方、バッテリー密度の向上により、10年後までには飛行時間が2倍になることが期待されています。信頼性の高い重量物輸送サービスを提供できる事業者は、タービンのスペアから人道的パレットまで、従来のクーリエが遥かに高いコストで提供していたプレミアム・セクターを解放すると思われます。

地域分析

北米は、有利なFAAガイダンス、200万人をカバーするWalmart-Wingの展開、アマゾンの自社プライム・エア・ネットワークに支えられ、2024年の売上の36.95%を確保します。米国は2025年12月までにBVLOSルールが確定する見込みで、これによりこの地域で唯一最大の規模の障壁が取り除かれることになります。カナダの2025年11月のBVLOS枠組みは、中型クラスの航空機の飛行コリドーをさらに拡大します。ベンチャー投資家は、最初のFAAタイプ証明書によって商業的安全ベースラインが検証された後、Matternetやその他のカリフォルニア州の新興企業に記録的な資本を注入しました。

アジア太平洋が配送ドローン市場の技術エンジンとして稼働。中国は世界初のパイロットレスeVTOLタクシーのライセンスを取得し、2025年までに低高度空域レーンを建設するために1兆5,000億人民元(2,089億3,000万米ドル)を計上しました。また、インドのスカイ・エアは、ベンガルールの交通渋滞を7分で薬局に配達することを達成しました。日本航空と楽天は災害救援と島嶼部ロジスティクスのパイロットをリードし、アプリケーションの焦点における地域の多様性を明らかにしています。

欧州は航空法の調和を強みに前進しています。2024年4月のVTOLパッケージは認証を明確化し、EASAのUスペースルールブックは加盟国が現在実施しているデジタルコリドーを定義しました。ウイングコプターは、ドイツの食料品プロジェクトで3区画ドローンを拡大するため、欧州投資銀行から4,000万ユーロ(4,601万米ドル)を獲得しました。企業のフリートは、EUのグリーン・ロジスティクス・スキームの下で、ラストワンマイルの排出量を94%削減し、税制上の優遇措置を受けることができます。

中東とアフリカはCAGR37.39%で最も急成長している地域です。疎らな道路、広い砂漠の距離、ヘルスケアへのアクセス格差により、ドローンフリートは必要不可欠となっています。サウジアラビアはMatternetの商業運営を認可し、複数の湾岸諸国は低高度経済圏に資金を提供しています。ルワンダとガーナは全国的な血液配送ネットワークを拡大し続けており、ドローン物流が従来のインフラ制約を克服できることを証明しています。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 人口密度の高い都心部でのeコマース・フルフィルメントに対する需要の加速

- 地理的に隔離され、十分なサービスを受けていない地域で、信頼性の高いヘルスケア・デリバリー・ソリューションに対するニーズが高まっています。

- 商業用ドローンによる配送事業を可能にする規制枠組みの世界的拡大

- 交通量の多い環境における、より効率的なラスト・マイル・デリバリーによる運行コストの削減。

- 企業や政府の排出量目標に後押しされ、持続可能なロジスティクス慣行の採用が増加。

- ハイブリッドVTOLシステムの技術的進歩により、より長距離で柔軟な配達ミッションが可能になります。

- 市場抑制要因

- 運用の拡張性を制限する、既存の民間航空システムとの複雑な空域統合

- ペイロード容量の低さが、大量輸送セグメントにおける収益の可能性を制限しています。

- 住宅密集地におけるプライバシーや騒音に対する社会的懸念が根強いです。

- 中小企業にとって障壁となる高い初期投資要件

- バリューチェーン分析

- 規制の見通しと技術の見通し

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- ドローンタイプ別

- 回転翼

- 固定翼

- ペイロード容量別

- 5kg未満

- 5~10kg

- 10kg以上

- 配送範囲別

- 25km未満

- 25~50 km

- 50km以上

- エンドユーザー業界別

- 小売とeコマース

- 食品および食料雑貨

- ヘルスケアと医薬品ロジスティクス

- 郵便・エクスプレス小包

- 産業・建設

- 地域別

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- ドイツ

- 英国

- フランス

- イタリア

- スペイン

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- アラブ首長国連邦

- サウジアラビア

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- Prime Air(Amazon.com, Inc.)

- Wing Aviation LLC(Alphabet Inc.)

- United Parcel Service of America, Inc.

- FedEx Corporation

- Airbus SE

- Zipline International Inc.

- SZ DJI Technology Co., Ltd.

- Wingcopter GmbH

- Guangzhou EHang Intelligent Technology Co. Ltd.

- Drone Delivery Canada Corp.

- Flytrex Inc.

- Matternet Inc.

- Kite Aero

- Manna Drone Delivery

- Skyports Drone Services

- Speedbird Aero

- Rakuten Group, Inc.

- JDLogistics, Inc

- DroneUp, LLC