|

市場調査レポート

商品コード

1851842

航空機用アンテナ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年)Aircraft Antenna - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機用アンテナ:市場シェア分析、産業動向、統計、成長予測(2025年~2030年) |

|

出版日: 2025年07月01日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

概要

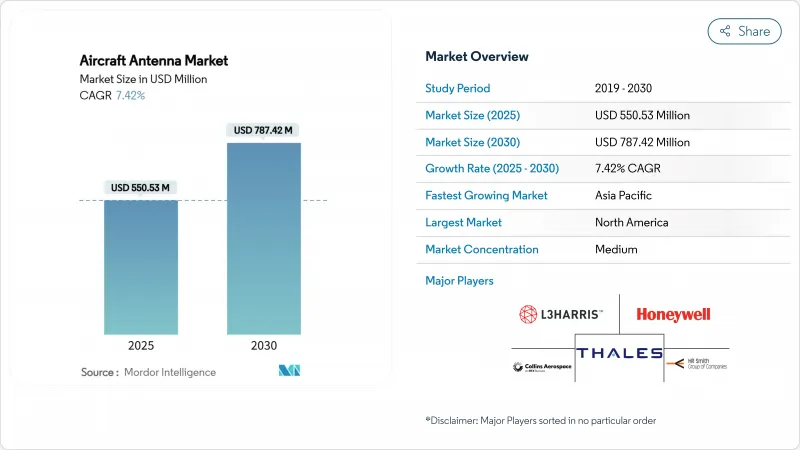

航空機用アンテナ市場規模は、2025年には5億5,053万米ドルとなり、2030年には7億8,742万米ドルに達すると予測されています。

現在の成長は、マルチ軌道接続に対する航空会社のコミットメント、規制当局主導の監視システムのアップグレード、視線外操作のための常時接続リンクを必要とする無人航空機システム需要の高まりに起因しています。セグメントリーダーは現在、設計図の段階でデジタルフライトデッキにアンテナを設計し、航空機のライフサイクルの早い段階での調達にシフトしています。通信事業者は、静止軌道、中軌道、低軌道、そして新たな5Gの空対地リンクを1つの端末でサポートする機器を優先し、レガシーフリート全体で買い替えを促進します。ガリウムと特殊RF基板におけるサプライチェーンの混乱は、価格設定に影響を与え続けています。これは、ティアワン・サプライヤー間の垂直統合と、低重量コンフォーマルアレイのアディティブ・マニュファクチャリングの採用を促進します。

世界の航空機用アンテナ市場の動向と洞察

世界の航空機納入数の増加

ボーイングの2024年見通しでは、20年間で43,975機の新型航空機の需要が見込まれており、コックピットと乗客の接続に重量最適化アンテナを使用する単通路ジェット機がその大半を占めています。航空会社は、初期設計の見直しにおいて、マルチバンド、ソフトウエア定義アレイを採用する傾向にあり、これは、アンテナの選択が、後付けではなく、30年にわたる戦略的決定とみなされるようになったためです。このような設計から完成までの移行は、サプライヤーにとっては収益認識を前倒しすることになり、アフターマーケットにおいては改修サイクルを短縮することになります。年率4.8%の交通量増加に牽引されるアジア太平洋地域の高い旅客数増加予測は、ファーストフィットアンテナの数量と定期的なスペア需要に直接反映されます。生産される各機体のベースライン注文を確保し、耐用年数半ばに差し掛かった機体の交換ニーズを加速させることで、差し迫った納入規模が航空機用アンテナ市場を押し上げます。

次世代衛星通信と5G空中接続の展開

多軌道衛星コンステレーションと地上5G空対地ネットワークが融合し、アンテナベンダーは異種スペクトルをシームレスにローミングする電子制御ステアラブルシステムの開発を迫られています。チャイナテレコムとパートナーOEMは、タワーとLEOリンク間のネットワークハンドオフを実証し、従来のGEOのみの構成よりも高いスループットと低遅延を証明しました。ViaSat-3の打ち上げと2024年の最初の商用サービス開始は、機敏なフラットパネル開口部と組み合わせることで、GEOクラフトが依然として提供できる帯域幅の飛躍を強調しています。航空会社は、マルチ軌道の俊敏性をカバレッジギャップに対する保険とリアルタイム分析の基盤として見ており、アンテナのアップグレードをデジタル変革戦略の中核にしています。積極的なロールアウトは、客室と運用データパイプのプレミアムサービス収益を引き出すことで、予測CAGRに2.1%ポイントを追加します。

複合材機体におけるアンテナ・レドーム統合の複雑さ

アルミニウムから炭素繊維への機体の移行は、導電性メッシュ層が新たな減衰経路を導入するため、RF伝搬を複雑にします。ACASIASコンソーシアムは、Kuバンドアレイを1.2m×3mのパネルに直接組み込み、実現可能性を証明しましたが、認定と結合の検証ステップに時間がかかることを強調しました。構造的な完全性は放射効率と対にならなければならないが、そのためにはコストのかかる電磁気シミュレーション、プロトタイプ・クーポン、破壊試験が必要になります。ブロードバンドアンテナアダプタプレートの腐食に関する最近のFAA指令は、新しい複合材はもちろんのこと、金属製の機体でさえも信頼性のハードルが続いていることを示しています。このようなエンジニアリングの負担は市場投入までの時間を延ばし、社内に材料研究所を持たない小規模なサプライヤーを躊躇させるため、認定された設計ツールチェーンが成熟するまでの潜在的なCAGRから1.4%ポイント減算されます。

セグメント分析

民間航空会社は、標準化された認証パスウェイとナローボディ・ジェットの大量導入により、2024年には航空機用アンテナ市場の39.45%を占める。航空会社は、Wi-Fiポータルやリアルタイム・テレメトリを追加する客室改装と並行して、マルチ軌道や5G対応のアンテナを調達しており、予測可能な交換サイクルを保証しています。ビジネス航空や一般航空のバイヤーは、チャーター便の顧客が一貫した接続性を求めているため、航空会社グレードのブロードバンド回線に移行し始めているが、キャビンのフットプリントが小さいため、マルチアンテナアーキテクチャにはまだ限界があります。軍用航空は、暗号化、アンチジャム、電子戦仕様のため、納入数は少ないながらも高いマージンを得ています。F-16 Viper Shieldのアップグレードのようなプログラムは、統合されたブロードバンドアパーチャの価値を示しています。

無人航空機は最も急成長している分野であり、CAGR 9.09%で成長しています。かつてはドローンを目視できる範囲に限定していた規制も、現在ではより長い航路を可能にし、荷物物流、パイプライン検査、精密農業などを可能にしています。NASAが実地試験した軽量エアロゲルアンテナは、Kaバンドリンクを維持しながらシステム質量を削減し、電動マルチコプターの厳しいサイズ、重量、電力目標を達成しました。防衛分野のバイヤーはまた、協調飛行のための位相整列ネットワークに依存する群遊プラットフォームの規模を拡大しています。このようなクロスオーバーにより、生産者は民生用と軍事用のチャネルにまたがって研究開発を償却することができ、UAVの勢いは航空機用アンテナ市場の持続的な成長レバーとして定着します。

ADS-B、交通衝突回避システム、宇宙ベースのレーダーは、位置データを収集するために専用の開口部に依存しているため、監視と偵察は2024年の収益の41.25%を占めました。商業用やビジネス用の航空機には搭載が義務付けられているため、毎年安定した交換が行われ、国境警備機関では高ゲインの合成開口レーダーポッドの注文が増えます。乗客のブロードバンド利用が急増し、航空会社が業務上のメッセージングをIPリンクに移行しているため、通信アプリケーションは後塵を拝しています。ナビゲーションアンテナは、スプーフィングやジャミングへの耐性を向上させるマルチコンステレーションのアップグレードにより、安定した需要を享受しています。

電子戦はCAGR 8.43%と最も高い上昇率を示しています。既存の戦闘機のブロック・アップグレードには、アクティブ・プロテクション・スイート用の送受信エレメントを内蔵するモジュール式アンテナ・ユニットが必要です。電子戦の航空機用アンテナ市場規模は、プログラムがリアルタイムのビームフォーミングが可能なデジタルアレイに移行し、検索、追跡、妨害機能を同時に実現できるようになるにつれて上昇します。また、民間プラットフォームは、進化する安全保障指令に準拠するために脅威監視ハードウェアを統合し、商業と防衛の支出の流れを融合させています。このような動向は、地域ジェット機のレドームからドローンのパイロンまで拡張可能な共通コアチップセットの構築をサプライヤーに促し、コスト効率を高めています。

地域分析

北米は、ボーイングのラインフィットプログラムと国防総省の持続的な支出によって生産ラインが忙しくなり、2024年の世界売上高の35.65%を占めました。同地域の航空会社は、地球低軌道コンステレーションの早期採用を主導し、旅客Wi-Fiとフライトクリティカル通信用に認定されたフェーズドアレイパネルをリージョナルジェットに装備し始めました。ユナイテッド航空は、300機以上の航空機にスターリンク端末を後付けする計画で、技術革新を迅速に進める意欲を強調しています。C5ISRハードウェアのための5億6,800万米ドルのViasatフレームワークを含む政府契約は、ボリュームを追加し、次世代アパーチャコンセプトを検証します。カナダでは宇宙ベースのADS-Bが義務付けられ、ビジネスやヘリコプターのフリート全体にダイバーシティアンテナが設置されるようになり、買い替え需要が高まる。

アジア太平洋地域は、航空機の構造的な成長と技術的野心の高まりを反映して、CAGR 8.12%で最も急成長すると予測されます。中国は、2043年までに航空機保有数を2倍以上の9,740機に増やすと予測されており、コックピット、キャビン、ドローン用アンテナに数十億米ドルのパイプラインが見込まれます。地域のサプライヤーは国内の5Gの進歩を活用して、タワーと衛星のハイブリッド・アーキテクチャに直接飛躍し、製品サイクルを圧縮します。2026年までにアドホック空中通信基地局を立ち上げるという日本の目標は、従来の衛星を超える空中ネットワーク層への政策的支持を示しています。インドと東南アジアも、急増する中産階級の旅行に対応するために新しいナローボディ機体を発注しており、標準化された接続キットの需要基盤を拡大しています。

欧州はエアバスの生産により大規模な設置基盤を維持しているが、成長は持続可能性と都市モビリティに軸足を移しています。炭素への影響に関する規制の後押しもあり、空気抵抗を減らす軽量なフラッシュマウントアンテナの採用が進んでいます。欧州衛星サービス・プロバイダー・コンソーシアムは、宇宙ベースの交通監視に向けた動きを進めており、軌道上と地上リンクの多様性のニーズを満たすために、新しい2周波アレイを必要としています。Lilium社がeVTOLプログラムで単一サプライヤー戦略を選択したことは、欧州が統合アンテナスキンに重点を置いていることを示すものです。中東とアフリカは、現在ではまだ規模は小さいが、ブロードバンド対応の旅客体験に依存する主要なハブ空港の拡張を受け入れており、インフラの成熟に伴ってアンテナの利用が増加する立場にあります。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリストサポート

よくあるご質問

目次

第1章 イントロダクション

- 調査の前提条件と市場の定義

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場情勢

- 市場概要

- 市場促進要因

- 世界の航空機納入数の増加

- 次世代SATCOMと5G空中接続の展開

- フリート全体のADS-B/Mode-Sトランスポンダ義務化

- BVLOSミッションプロファイルに対するUAV需要の急増

- eVTOLプラットフォーム用超軽量コンフォーマルアンテナ

- SWaPを低下させる積層造形プリントアンテナ

- 市場抑制要因

- 複合材機体におけるアンテナとレドームの統合の複雑さ

- LバンドとCバンドにおけるスペクトル混雑

- 航空宇宙ハードウェアの長い認定サイクル

- 特殊RF材料のサプライチェーン不足

- バリューチェーン分析

- 規制情勢

- テクノロジーの展望

- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係

第5章 市場規模と成長予測

- エンドユーザー別

- 商用航空

- 軍事航空

- ビジネスおよび一般航空

- 無人航空機(UAV)

- 用途別

- コミュニケーション

- ナビゲーション

- 監視・偵察

- 電子戦

- 旅客コネクティビティ/IFE

- アンテナタイプ別

- VHF/UHF通信

- SATCOM

- ナビゲーション(VOR/ILS/MB)

- トランスポンダとADS-B

- GNSS/GPSアンテナ

- マルチバンド・コンフォーマル

- 5Gエアボーン

- 周波数帯別

- HF

- VHF

- UHF

- Lバンド

- Cバンド

- Xバンド

- Ku/Kaバンド

- 地域

- 北米

- 米国

- カナダ

- メキシコ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- ロシア

- その他欧州地域

- アジア太平洋地域

- 中国

- 日本

- インド

- 韓国

- オーストラリア

- その他アジア太平洋地域

- 南米

- ブラジル

- アルゼンチン

- その他南米

- 中東・アフリカ

- 中東

- サウジアラビア

- アラブ首長国連邦

- カタール

- その他中東

- アフリカ

- 南アフリカ

- その他アフリカ

- 北米

第6章 競合情勢

- 市場集中度

- 戦略的動向

- 市場シェア分析

- 企業プロファイル

- L3Harris Technologies, Inc.

- Honeywell International Inc.

- Collins Aerospace(RTX Corporation)

- CMC Electronics Inc.

- Thales Group

- RAMI(R.A. Miller Industries, Inc.)

- PIDSO GmbH(Riedel Communications GmbH)

- Hexagon AB

- Tallysman Wireless(Calian Ltd.)

- General Dynamics Mission Systems(General Dynamics Corporation)

- Viasat, Inc.

- HR Smith Group of Companies

- AeroVironment, Inc.