|

市場調査レポート

商品コード

1405342

航空機用断熱材:市場シェア分析、産業動向・統計、成長予測、2024~2029年Aircraft Insulation - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts 2024 - 2029 |

||||||

カスタマイズ可能

適宜更新あり

|

|||||||

| 航空機用断熱材:市場シェア分析、産業動向・統計、成長予測、2024~2029年 |

|

出版日: 2024年01月04日

発行: Mordor Intelligence

ページ情報: 英文 110 Pages

納期: 2~3営業日

|

全表示

- 概要

- 目次

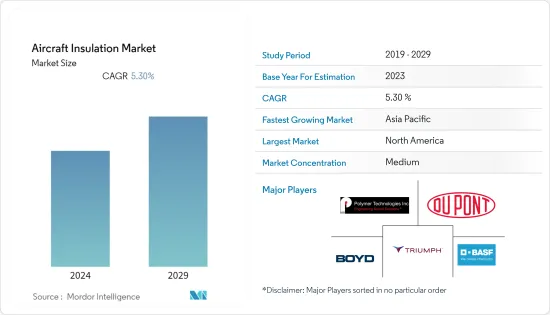

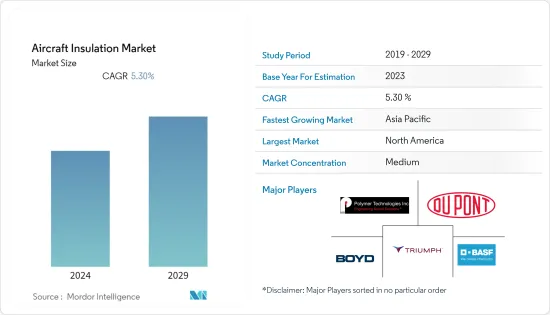

航空機用断熱材市場は、2024年に77億6,000万米ドルと評価され、2029年には100億5,000万米ドルに達すると予測され、予測期間中のCAGRは5.30%を記録すると予想されます。

乗客により高い安全性と快適性を提供するため、航空機OEMや航空会社は航空機にさまざまな航空機用断熱材を使用しており、これが市場成長の原動力となっています。断熱材の使用は、飛行時間中の振動や騒音の低減といった利点により急速に増加しています。商用航空機における複合材料の使用拡大により、さまざまな航空構造が開発されることが予想され、これらは大きな産業的可能性を秘めていると思われます。商用航空機やビジネス航空機では、機内騒音の低減を視野に入れた軽量断熱材や複合材への需要が増加しており、市場は刺激される可能性が高いです。

航空機の販売と生産、特に商用部門の成長が航空機用断熱システムの需要を生み出し、市場収益の成長を促進しています。さらに、FAAのような規制機関からの厳しい規制は、様々な環境における材料の生存性と能力の観点から、市場のプレーヤーの成長に課題しています。米国連邦航空局(FAA)の定義によれば、すべての商用航空機には断熱材と防音材を装備しなければなりません。これらの断熱材は、乗客の快適性が外気温の変化に左右されないこと、また航空機から発生する騒音に通信が影響されないことを保証するものです。このような厳しい規則により、航空機メーカーは航空機に断熱材を使用しやすくなっており、航空機用断熱材の市場が拡大しています。

航空機用断熱材の市場動向

商用航空機セグメントが最も高い市場シェアを記録

現在、商用航空機セグメントの市場規模が大きくなっていますが、これは主に航空機モデルの販売台数が多いためです。航空輸送部門は急速に拡大しており、今後数年間はこの傾向が続くと予想されています。国際航空運送協会は、2036年まで航空輸送需要は年率4.3%で増加すると予測しています。2036年までにこの成長が達成されれば、航空輸送部門は予測期間中、世界経済に1,520万人の直接雇用と1兆5,000億米ドルのGDPをもたらすことになります。平均して、商用航空機の断熱材の使用量は、他のタイプの航空機に比べて一般的に高いです。乗客の快適性を高めることが重視されるようになり、新世代の航空機には、旧型の航空機に比べてより優れた熱・振動・音響絶縁材料が使用されるようになっています。EASAとFAAによる耐火性熱音響断熱材に関する義務付けが、商用航空機用断熱材市場の成長を後押ししています。新しい機種の航空機が最初に更新された義務付けを実施するもの、古い商用航空機もこれらの規制のために過去2年間にいくつかの改修活動が見られました。航空輸送需要の増加に伴い、航空会社は新型航空機を大規模に発注・調達しています。同時に、航空機OEMへの膨大な発注残があるため、生産率が上昇し、航空機用断熱材の需要が増加します。この点に関して、2022年9月、エチオピアン・スカイ・テクノロジーズは、ボーイング社、ゲベン・スカイテクノ社、エチオピア航空間のボーイング契約(BSCA)の一環として、ボーイングB737 MAX航空機用の断熱ブランケットを生産する製造施設をアディスアベバに開設しました。従って、商業セグメントの航空機用断熱材市場は、将来的に市場を独占すると予想されます。

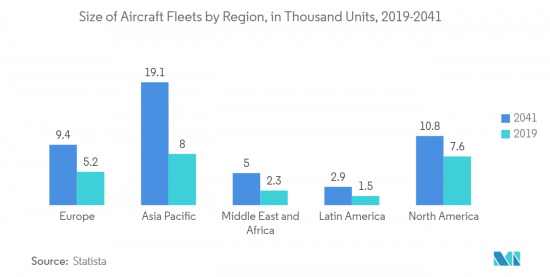

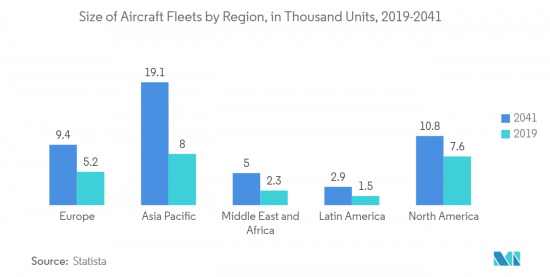

アジア太平洋地域が予測期間で最も急成長する市場

この地域の旅客輸送量は継続的に増加しており、航空会社はさまざまな成長戦略を採用しています。2025年までに、中国は航空輸送量で世界最大の航空市場になると予測され、インドは世界第3位の航空市場に発展すると予測され、インドネシアやタイなどの他の国々は世界市場のトップ10に入ると予測されています。航空会社の中には、新しい航空機を調達し、成長の原動力がある場所に路線を拡大しているところもあります。例えば、2023年6月、インディゴ(インド)はパリ航空ショーでエアバスA320neoファミリー500機を発注しました。同様に、エア・インディアはエアバス機250機とボーイング機220機(700億米ドル相当)の購入契約を締結しています。エア・インディアの発注には、エアバスから34機のA350-1000と6機のA350-900、ボーイングから20機のB787ドリームライナー、10機のB777Xを含む70機のワイドボディ機が含まれます。また、エアバスA320neo型機140機、エアバスA321neo型機70機、ボーイングB737 MAX型ナローボディ機190機も含まれています。また、50機のB737 MAXと20機のB787ドリームライナーを含む70機をボーイングから追加購入するオプションにも署名しています。例えば、エアバスA320、A330、A350型機には、アライド・インターナショナル社、トライアンフ・エアロスペース・ストラクチャーズ社、ダハー社製の防音材が使用されています。トライアンフ・エアロスペース・ストラクチャーズは、エアバスA330、A350、ボーイングB737、B767、B777、ドリームライナーB787型機に搭載されている遮音システムのメーカーです。DuPont Aerospace, Hi-Temp Insulation, Inc.が防火断熱材を提供する一方、3M CanadaはボーイングB787ドリームライナーおよびCOMAC ARJ21航空機用の断熱材を提供しています。このような調達受注は、予測期間中の市場プレイヤーの事業見通しを促進すると思われます。乗客にアピールする機内温度を経済的に作り出す空調/暖房システムに必要な断熱材は、航空機のタイプや運航場所によって異なります。同地域の大半は高温の熱帯地域にあるため、同地域の一般旅客機の運航会社でさえ、乗客が快適に旅行できるようにさまざまな断熱材を使用しています。そのため、アジア太平洋地域では、他の地域に比べて市場の成長が早まると予想されます。

航空機用断熱材産業の概要

DuPont de Nemours, Inc.、BASF SE、Triumph Group Inc.、Boyd Corporation、Polymer Technologies Inc.などは、航空機用断熱材市場の主要企業です。新しい断熱材という点での革新は、プレーヤーが新たな契約を獲得するのに役立つと思われます。さらに、航空業界では軽量部品が重視されるようになっているため、プレーヤーは主に熱/音響断熱材などの高度な断熱材の開発に注力しています。断熱材の安全性に関する規制が厳しくなるにつれ、中小企業が市場に参入するのは難しくなっています。米連邦航空局(FAA)は、航空機の火災安全性を高める結果となる、航空機用断熱材の新しい燃焼性試験要件を策定しています。このため、断熱材メーカーの製品は、規制当局の要求に合わせてアップグレードされなければなりません。

その他の特典:

- エクセル形式の市場予測(ME)シート

- 3ヶ月間のアナリスト・サポート

目次

第1章 イントロダクション

- 調査の前提条件

- 調査範囲

第2章 調査手法

第3章 エグゼクティブサマリー

第4章 市場力学

- 市場概要

- 市場促進要因

- 市場抑制要因

- 業界の魅力- ポーターのファイブフォース分析

- 供給企業の交渉力

- 買い手/消費者の交渉力

- 新規参入業者の脅威

- 代替品の脅威

- 競争企業間の敵対関係の強さ

第5章 市場セグメンテーション

- 絶縁タイプ

- 電気絶縁

- 断熱材

- 防音・防振

- 用途

- 商用航空機

- 軍用機

- 一般航空機

- 地域

- 北米

- 米国

- カナダ

- 欧州

- 英国

- ドイツ

- フランス

- イタリア

- その他欧州

- アジア太平洋

- 中国

- 日本

- インド

- 韓国

- その他アジア太平洋地域

- ラテンアメリカ

- ブラジル

- メキシコ

- その他ラテンアメリカ

- 中東・アフリカ

- アラブ首長国連邦

- サウジアラビア

- トルコ

- 南アフリカ

- その他中東・アフリカ

- 北米

第6章 競合情勢

- ベンダー市場シェア

- 企業プロファイル

- DuPont de Nemours, Inc.

- BASF SE

- HUTCHINSON SA

- Triumph Group, Inc.

- Boyd Corporation

- Duracote Corporation

- Hi-Temp Insulation, Inc.

- Polymer Technologies, Inc.

- Evonik Industries AG

- Zotefoams plc

- DUNMORE Europe GmbH

第7章 市場機会と今後の動向

The aircraft insulation market is valued at USD 7.76 billion in 2024 and is forecasted to reach USD 10.05 billion by 2029, registering a CAGR of 5.30% during the forecast period.

To provide more safety and comfort to the passengers, the aircraft OEMs, and airlines are using different aircraft insulation materials on the aircraft, which is driving the market growth. The use of insulation materials is rapidly increasing due to advantages such as reduced vibration and noise during flying hours. The growing use of composite materials in commercial aircraft is forecast to result in the development of a wide range of aerostructures, which are likely to have significant industrial potential. The market is likely to be stimulated by increasing demand for lightweight insulating and composite materials in commercial airplanes and business aircraft, with a view to reducing cabin noise.

Growth in aircraft sales and production, especially from the commercial segment, is generating demand for insulation systems for aircraft, thereby propelling growth in the market revenue. Moreover, stringent regulations from regulatory bodies, like the FAA, in terms of survivability and capability of the materials in various environments, are challenging the growth of the players in the market. In accordance with the US FAA's definition, all commercial aircraft must be fitted with thermal and acoustic insulation. These insulations ensure the comfort of passengers does not depend on external temperature variations and that communications are unaffected by noise generated by an aircraft. Such strict rules are making it easier for airplane manufacturers to use insulation materials in airplanes, increasing the market for aircraft insulation.

Aircraft Insulation Market Trends

The Commercial Aircraft Segment Registered the Highest Market Share

The market for the commercial aircraft segment is currently larger, which is mainly due to the high sales of the aircraft models. The air transport sector is expanding fast and is expected to continue like this over the next few years. The International Air Transport Association estimates that, until 2036, demand for air transport will increase at an annual rate of 4.3%. If that growth is achieved by 2036, the air transport sector will likely contribute 15.2 million directly employed jobs and USD 1.5 trillion of GDP to the global economy over the forecast period. On average, the usage of insulation in commercial aircraft is generally higher as compared to the other aircraft types. With the growing emphasis on increasing the passenger experience, better thermal/vibration/acoustic insulating materials are being used on the newer generation aircraft compared to the older aircraft types. The mandates imposed by EASA and FAA regarding fire-resistant thermal-acoustic insulation have propelled the growth of the insulation market for commercial aircraft. Though the newer aircraft models are the first to implement the updated mandates, older commercial aircraft have also seen some retrofitting activity in the last two years due to these regulations. With the increasing air transport demand, airlines are ordering and procuring new aircraft on a large scale. Simultaneously, with a huge order backlog with the aircraft OEMs, production rates are increasing, which will increase the demand for aircraft insulation materials. On this note, in September 2022, Ethiopian Sky Technologies inaugurated a manufacturing facility in Addis Ababa to produce insulation blankets for Boeing B737 MAX aircraft as part of a Boeing agreement (BSCA) between The Boeing Company, Geven-Skytecno and Ethiopian Airlines. Hence, the market for aircraft insulation in the commercial segment is expected to dominate the market in the future.

Asia-Pacific to be the Fastest-growing Market in the Forecast Period

As passenger traffic in the region is continuously growing, airlines are adopting various growth strategies. By 2025, China is forecasted to become the world's largest aviation market in terms of air traffic; India is forecasted to develop into the world's third-largest aviation market, while other countries, such as Indonesia and Thailand, are forecasted to enter the top 10 global markets. Some of the airlines are procuring new aircraft and are expanding their routes to places where there is a growth impetus. For instance, in June 2023, Indigo (India) ordered 500 Airbus A320neo family planes at the Paris Air Show. Similarly, Air India (India) has signed purchase agreements for 250 Airbus aircraft and 220 new Boeing jets worth USD 70 billion. Air India's orders include 70 widebody planes, comprising 34 A350-1000s and six A350-900s from Airbus, 20 B787 Dreamliners, and 10 B777Xs from Boeing. It also includes 140 Airbus A320neo, 70 Airbus A321neo, and 190 Boeing B737 MAX narrowbody aircraft. The airline has also signed options to buy an additional 70 aircraft from Boeing, including 50 B737 MAXs and 20 B787 Dreamliners. For instance, Airbus A320, A330, and A350 aircraft are provided with acoustic insulation by Allied International, Triumph Aerospace Structures, and Daher. Triumph Aerospace Structures is the manufacturer of the thermal acoustic insulation systems installed onboard the Airbus A330, A350, Boeing B737, B767, B777, and Dreamliner B787 aircraft families. While DuPont Aerospace, Hi-Temp Insulation, Inc. provides fire insulation, 3M Canada provides thermal insulation for the Boeing B787 Dreamliner and the COMAC ARJ21 aircraft. Such procurement orders would drive the business prospects of the market players during the forecast period. The insulation needed for the air conditioning/heating system to economically produce cabin temperatures that appeal to the passengers varies with the airplane type and location where the aircraft operates. With most of the region lying in the hot, tropical zone, even the operators of general aviation aircraft in the region use different materials for thermal insulation to make travel comfortable for the passengers. Hence, the market is expected to grow faster in the Asia Pacific compared to the other regions.

Aircraft Insulation Industry Overview

DuPont de Nemours, Inc., BASF SE, Triumph Group Inc., Boyd Corporation, and Polymer Technologies Inc. are some of the major players in the aircraft insulation market. Innovations, in terms of new insulation materials, will help the players gain new contracts. Moreover, due to the increasing emphasis on lightweight components in the aviation industry, the players are focusing on developing advanced insulation materials, mainly thermal/acoustic insulations. With the stringency of the regulations in terms of insulation safety increasing, it is becoming difficult for smaller players to penetrate into the market. The Federal Aviation Administration (FAA) is developing new flammability test requirements for aircraft insulation that will result in increased fire safety on aircraft. On this note, the product offerings of the insulation suppliers must be upgraded to suit the regulatory requirements of the governing bodies. Frequent upgrades to the product offerings based on the trends and requirements will help the players sustain the market competition in the long run. For instance, in August 2023, Ethiopian Airlines Group erected an aircraft component manufacturing plant at Kilinto Industrial Park in a joint venture with Boeing. The plant will likely manufacture various aerospace internal parts, including aircraft thermo-acoustic insulation blankets, electrical wire harnesses, and more. These internal components will be supplied to Boeing, Airbus, and an Italian aircraft manufacturing company, according to the IPDC.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Insulation Type

- 5.1.1 Electric Insulation

- 5.1.2 Thermal Insulation

- 5.1.3 Acoustic and Vibration Insulation

- 5.2 Application

- 5.2.1 Commercial Aircraft

- 5.2.2 Military Aircraft

- 5.2.3 General Aviation Aircraft

- 5.3 Geography

- 5.3.1 North America

- 5.3.1.1 United States

- 5.3.1.2 Canada

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 France

- 5.3.2.4 Italy

- 5.3.2.5 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 China

- 5.3.3.2 Japan

- 5.3.3.3 India

- 5.3.3.4 South Korea

- 5.3.3.5 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle East and Africa

- 5.3.5.1 United Arab Emirates

- 5.3.5.2 Saudi Arabia

- 5.3.5.3 Turkey

- 5.3.5.4 South Africa

- 5.3.5.5 Rest of Middle East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Vendor Market Share

- 6.2 Company Profiles

- 6.2.1 DuPont de Nemours, Inc.

- 6.2.2 BASF SE

- 6.2.3 HUTCHINSON SA

- 6.2.4 Triumph Group, Inc.

- 6.2.5 Boyd Corporation

- 6.2.6 Duracote Corporation

- 6.2.7 Hi-Temp Insulation, Inc.

- 6.2.8 Polymer Technologies, Inc.

- 6.2.9 Evonik Industries AG

- 6.2.10 Zotefoams plc

- 6.2.11 DUNMORE Europe GmbH